Finance

Why Did My Car Insurance Go Up?

Published: November 18, 2023

Discover the reasons behind the increase in your car insurance rates and learn how to better manage your finances to mitigate future hikes.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Car insurance is a necessary expense for every driver, but it can be frustrating when you receive a notice that your premiums are increasing. You may find yourself asking, “Why did my car insurance go up?” Understanding the factors that can impact your car insurance rates can help you make sense of these changes and potentially find ways to save money.

There are several reasons why your car insurance rates may have increased, ranging from changes in your personal information to shifts in the insurance industry. In this article, we will explore the common factors that can contribute to an increase in car insurance premiums. By gaining a deeper understanding of these factors, you can be better equipped to navigate the world of car insurance and find ways to potentially lower your rates.

It’s important to note that car insurance companies use various factors to determine insurance rates, and these factors can vary from one company to another. Additionally, insurance regulations can differ by state, leading to variations in premiums. Therefore, it’s essential to consider these factors as general guidelines rather than universal truths.

Whether you’re a new driver or a seasoned veteran on the road, it’s always helpful to stay informed about the factors that can impact your car insurance rates. So, let’s explore some of the key factors that can contribute to an increase in your car insurance premiums.

Changes in Personal Information

One of the main factors that can cause your car insurance rates to increase is changes in your personal information. When you apply for car insurance, insurers take into account various details about you, such as your age, marital status, and occupation. Any modifications to these factors can result in a change in your premiums.

For example, if you recently got married, you might notice an increase in your car insurance rates. Insurance companies generally consider married individuals to be more responsible, therefore, they may offer lower rates to married drivers. Conversely, if you recently went through a divorce or your marital status changed, your rates may go up as insurance companies perceive single individuals as having a higher risk of accidents.

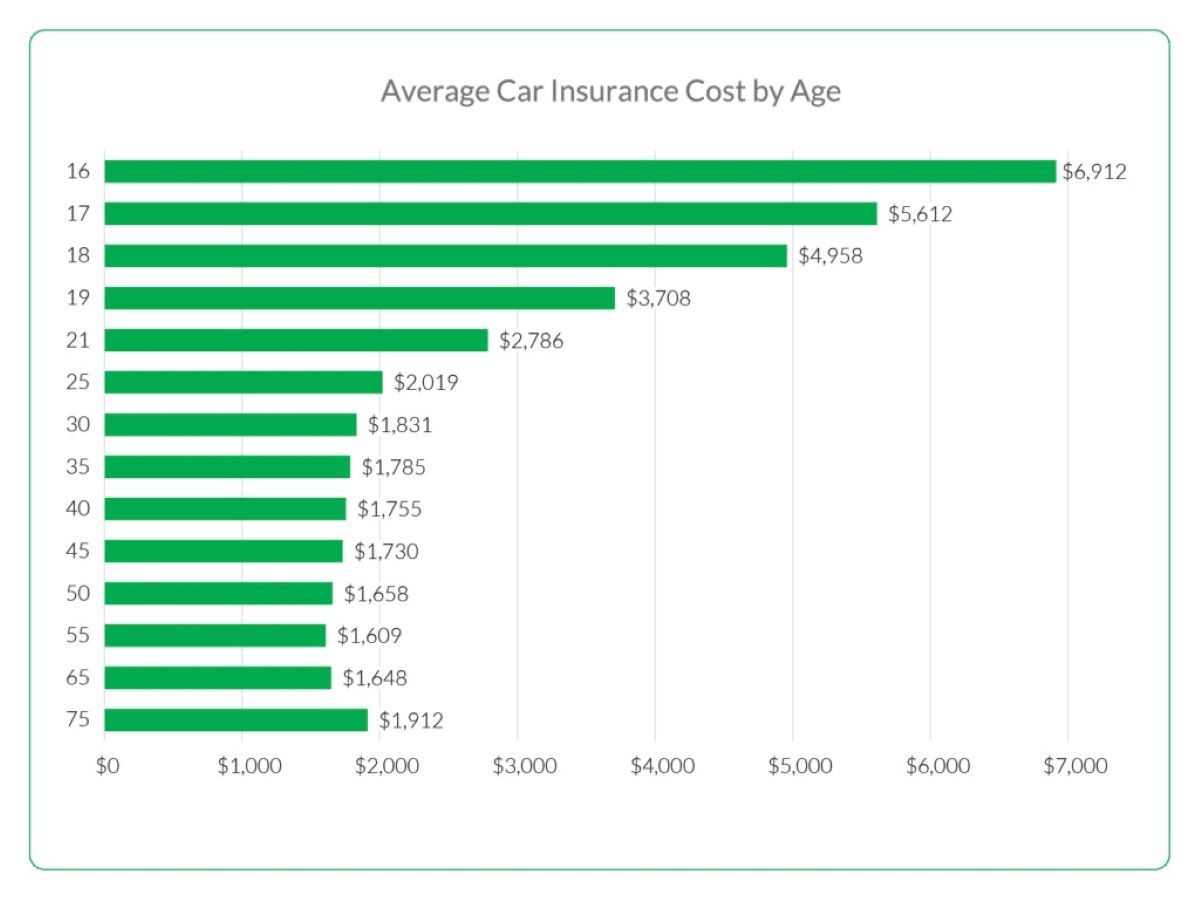

Another factor that can impact your car insurance rates is your age. Typically, younger drivers, especially teenagers, are considered higher risk due to their limited driving experience. As a result, they are more likely to face higher premiums. However, as you get older and gain more driving experience, your rates may decrease.

Your occupation also plays a role in determining your car insurance rates. Some occupations, such as doctors or lawyers, may be seen as less risky compared to professions that involve frequent driving or pose a higher risk of accidents. Changes in occupation could lead to adjustments in your premiums.

It’s important to inform your insurance provider about any changes in your personal information to ensure that your coverage remains accurate and up-to-date. Failure to do so could result in higher rates or even denial of coverage. Keep in mind that not all personal information changes will result in an increase in your premiums, but it’s always best to inform your insurance company to avoid any potential issues.

Driving Record

Your driving record is one of the most significant factors that can impact your car insurance rates. Insurance companies consider your driving history as a reflection of your risk as a driver. If you have a history of accidents, speeding tickets, or other traffic violations, your rates are likely to increase.

Insurance companies typically review your driving record when calculating your premiums, and they may do so periodically. If you have a clean driving record with no accidents or violations, you can expect to receive lower rates. However, if you have recent accidents or traffic tickets on your record, your rates may go up significantly.

Additionally, insurance companies commonly consider the severity of accidents when determining premiums. If you’ve been involved in a major accident that resulted in significant damages or injuries, your rates could be impacted even more. This is because insurance companies view drivers involved in high-cost accidents as higher risks to insure.

It’s important to note that not all accidents or violations will have the same effect on your car insurance rates. Some minor speeding tickets or non-fault accidents may have a minimal impact, while major violations or at-fault accidents can lead to substantial increases in premiums. Insurance companies typically assess risk based on various factors, including the number and severity of incidents, as well as the frequency of violations.

To maintain lower car insurance rates, it’s crucial to maintain a clean driving record by practicing safe driving habits, obeying traffic laws, and avoiding any actions that could result in traffic violations or accidents. If you do have violations or accidents on your record, it’s worth discussing with your insurance provider to understand how they affect your rates and if there are any steps you can take to mitigate the impact.

Insurance Claims

Another factor that can contribute to an increase in your car insurance rates is the number and frequency of insurance claims you have made. Insurance companies consider claims history as an indicator of risk and may adjust your premiums accordingly.

When you make an insurance claim, whether it’s for an accident, theft, or damage to your vehicle, it signals to the insurance company that you pose a higher risk of future claims. This increased risk can result in higher premiums to offset the potential cost of future claims.

If you have a history of multiple claims within a short period, insurance companies may view you as a higher-risk driver. The frequency and severity of the claims can significantly impact your rates. For example, frequent claims or claims involving substantial damages can lead to substantial increases in premiums.

It’s worth mentioning that not all claims will result in an immediate increase in premiums. Some insurance companies offer forgiveness programs for first-time accidents or have specific thresholds before they adjust rates. However, if you have a pattern of making claims or if your claim history reflects a high-risk driver, you are likely to experience an increase in your car insurance rates.

To avoid unnecessary rate increases, it’s important to evaluate whether filing a claim is absolutely necessary and if the cost of the claim outweighs potential premium increases. If the damage is minor and can be easily repaired out of pocket, it may be more cost-effective to handle it independently rather than filing a claim.

Additionally, practicing safe driving habits and avoiding situations that may lead to frequent insurance claims can help you maintain lower premiums. By being a cautious and responsible driver, you can minimize the need for filing claims and potentially save money on your car insurance.

Location

The location where you live plays a significant role in determining your car insurance rates. Insurance companies assess the risk associated with your location, considering factors such as population density, crime rates, and historical accident data in your area.

If you reside in an urban area with a high population density, your car insurance rates are likely to be higher than those in rural areas. This is because densely populated areas typically have more traffic congestion, a higher risk of accidents, and a greater likelihood of theft or vandalism.

Crime rates also impact car insurance rates. If you live in an area with high crime rates, your premiums may increase. Car thefts, break-ins, and vandalism can result in insurance claims, leading to higher costs for insurance companies, and consequently, higher premiums for residents of those areas.

Another factor that influences car insurance rates based on location is the prevalence of extreme weather conditions. If you live in an area prone to hurricanes, tornadoes, or other natural disasters, insurance companies may adjust rates to account for the potential risks associated with these events.

It’s important to note that while location does impact car insurance rates, the specific factors considered by insurance companies can vary. Therefore, rates can differ between cities, states, and even neighborhoods within the same city. It’s always advisable to shop around and compare rates from different insurance providers to find the best coverage options for your specific location.

If you’re considering a move, it’s worth researching the impact on your car insurance rates beforehand. This can help you anticipate potential changes and make informed decisions about your insurance coverage.

While you can’t control your location, you can still take steps to potentially lower your car insurance rates. Installing security devices such as car alarms or tracking systems, parking in well-lit areas, and practicing safe driving habits can help mitigate the risks associated with your location and potentially result in lower premiums.

Vehicle Type

The type of vehicle you drive can have a significant impact on your car insurance rates. Insurance companies consider various factors related to your vehicle, including its make, model, age, and safety features.

Generally, sports cars and luxury vehicles are more expensive to insure compared to sedans or minivans. This is because sports cars are typically associated with a higher risk of accidents due to their performance capabilities, while luxury vehicles tend to have higher repair costs.

The age of your vehicle can also affect your insurance rates. Newer vehicles often have higher premiums due to their higher market value and the costlier repairs or replacements that may be required in the event of an accident. On the other hand, older vehicles may have lower premiums, as they tend to have lower market value and potentially lower repair costs.

Safety features of your vehicle can also impact your insurance rates. Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and collision avoidance systems, are generally considered safer and may qualify for discounts on insurance premiums. Conversely, if your vehicle lacks these safety features or has a poor safety record, your rates may be higher.

Modifications made to your vehicle can also influence your insurance rates. Installing custom parts or aftermarket accessories, such as spoilers or performance enhancements, may increase the risk associated with your vehicle and result in higher premiums.

It’s important to provide accurate information about your vehicle to your insurance company, including its make, model, and any modifications, to ensure that your coverage is appropriate. Failure to disclose modifications or providing incorrect vehicle details could result in issues with your coverage in the event of a claim.

While you may not be able to change the inherent factors related to your vehicle, such as its make or model, you can still take steps to potentially lower your car insurance rates. Maintaining a good driving record, taking advantage of available vehicle safety discounts, and comparing insurance quotes from different providers can help you find the best rates for your specific vehicle.

Changes in Coverage

One of the factors that can cause your car insurance rates to go up is making changes to your coverage. When you modify your insurance coverage, it can impact your premiums, either increasing or decreasing them depending on the changes you make.

For example, if you decide to increase your coverage limits or add additional coverage options, such as comprehensive or collision coverage, your premiums are likely to increase. This is because providing increased coverage involves higher potential costs for the insurance company in the event of a claim.

Conversely, if you choose to decrease your coverage or remove certain coverage options, it can result in lower premiums. However, it’s essential to carefully consider the potential risks before making any significant changes to your coverage. Removing essential coverage options may leave you exposed to higher financial risks in the event of an accident or other covered incidents.

Another factor to consider when it comes to changes in coverage is the deductibles you choose. A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. Opting for a lower deductible typically leads to higher premiums, as the insurance company will be responsible for a larger portion of the overall claim cost.

It’s important to regularly review your insurance coverage and make adjustments based on your individual needs. However, it’s advisable to consult with your insurance provider or an experienced insurance agent to understand the potential impact of any coverage changes on your premiums. They can help you evaluate your options and find a balance between adequate coverage and affordable rates.

Remember that making changes to your coverage is a personal decision, and what works for one driver may not work for another. Assess your specific needs, evaluate the risks involved, and consult with professionals in the insurance industry to make an informed decision about your coverage.

Credit Score

Believe it or not, your credit score can also impact your car insurance rates. Insurance companies use credit-based insurance scores to assess the level of risk associated with insuring an individual. Your credit score is a reflection of your financial responsibility and reliability, and it can be an indicator of how likely you are to file insurance claims.

Studies have shown that individuals with lower credit scores are statistically more likely to file insurance claims compared to those with higher credit scores. As a result, insurance companies may view individuals with lower credit scores as higher-risk policyholders and may charge higher premiums to offset that perceived risk.

Insurers use complex algorithms that incorporate various factors from your credit history to calculate your credit-based insurance score. These factors may include your payment history, outstanding debt, length of credit history, and any recent credit inquiries or new accounts opened.

It’s important to note that not all states allow the use of credit scores as a factor in determining car insurance rates. Therefore, the impact of your credit score on your premiums may vary depending on your location.

To ensure you’re getting the most accurate and fair car insurance rates, it’s crucial to regularly monitor your credit score and take steps to improve it if necessary. Paying bills on time, keeping credit card balances low, and maintaining a healthy credit mix can all contribute to improving your credit score over time.

It’s also worth noting that some insurance companies offer discounts or lower rates for policyholders with good credit scores. Be sure to check with your insurance provider to see if they offer any credit-related discounts or incentives that you may qualify for.

Remember that maintaining a good credit score not only benefits your car insurance rates but also has a positive impact on other areas of your financial life. By being diligent with your finances, you can potentially enjoy lower insurance premiums and access to better credit opportunities.

Insurance Company Rate Changes

When it comes to car insurance rates, it’s important to understand that they can fluctuate based on changes made by the insurance company itself. Insurance companies regularly review and adjust their rates to reflect various factors such as claims experience, market conditions, and overall profitability.

Insurance companies consider their past loss experience and claims data to determine the premiums they charge. If an insurance company has experienced a higher number of claims or increased claim costs, they may need to adjust their rates accordingly to cover the higher potential costs.

Market conditions can also play a role in insurance rate changes. Factors such as inflation, trends in medical costs, and the overall cost of vehicle repairs can impact the expenses incurred by insurance companies. As these costs increase, insurance companies may need to adjust their rates to maintain profitability.

Additionally, regulatory changes or shifts in the competitive landscape can influence insurance companies’ rate adjustments. Changes in state insurance regulations, for example, may require companies to revise their rates to comply with new requirements or to adapt to changing market dynamics.

Insurance companies also consider their own financial performance when determining rate changes. If an insurer experiences lower profitability or increased expenses, they may need to raise their premiums to ensure they can meet their financial obligations and continue providing coverage to policyholders.

It’s important to keep in mind that insurance rate changes are not solely dependent on individual policyholders. While your personal factors, such as driving record and credit score, can influence your rates, external factors such as market conditions and the overall performance of the insurance company also play a significant role.

To ensure you’re getting the best rates, it’s advisable to periodically review your car insurance policy and compare quotes from different insurance providers. This allows you to assess if you’re still getting competitive rates or if it may be beneficial to switch to another insurer that offers more affordable coverage.

By staying informed about insurance company rate changes and monitoring the market, you can make informed decisions about your car insurance coverage and potentially find opportunities to save money on your premiums.

Conclusion

Understanding the various factors that can cause your car insurance rates to go up is crucial in navigating the world of car insurance. While it may be frustrating to see an increase in your premiums, knowing the reasons behind these changes can help you make informed decisions and potentially find ways to save money.

Changes in your personal information, such as marital status, age, and occupation, can impact your car insurance rates. Additionally, your driving record and claims history play a significant role in determining your premiums. Factors like location, vehicle type, and credit score also come into play when calculating insurance rates.

When changes are made to your coverage or when there are rate adjustments by the insurance company, it can lead to fluctuations in your premiums as well. By staying informed about these factors and periodically reviewing your policy, you can ensure you’re getting the coverage you need at the best possible rates.

Keep in mind that not all factors are within your control, such as changes in insurance company rates or market conditions. However, there are proactive steps you can take to potentially mitigate rate increases, such as maintaining a clean driving record, improving your credit score, and practicing safe driving habits.

Lastly, it’s important to shop around and compare quotes from different insurance providers to ensure you’re getting the most competitive rates and coverage options. Each company may have its own unique rating system and criteria, so it’s worth exploring different options to find the best fit for your needs.

By understanding the factors influencing your car insurance rates and taking proactive steps, you can better navigate the insurance landscape and find opportunities to save money on your premiums. Remember, insurance rates can vary, so it’s important to stay informed and regularly review your policy to ensure you’re getting the best value for your coverage.