Finance

Why Do You Want To Work In Banking

Published: November 2, 2023

Discover your passion for finance and explore exciting opportunities in banking. Join us and let your financial expertise shine in this dynamic field.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- The Appeal of the Banking Industry

- Opportunities for Career Growth

- Financial Stability and Compensation

- Prestige and Professionalism

- Learning and Development Opportunities

- Fast-Paced and Dynamic Work Environment

- Networking and Exposure to Different Industries

- Contributing to Economic Growth and Development

- Conclusion

Introduction

The banking industry is a vital component of the global economy, serving as the backbone of financial systems and providing essential services to individuals, businesses, and governments. Working in the banking sector offers a range of exciting opportunities for professionals seeking a challenging and rewarding career. Whether you have a passion for finance, a knack for numbers, or a desire to make a meaningful impact on the financial world, the banking industry has much to offer.

From investment banking and commercial banking to risk management and financial analysis, the vast array of roles and responsibilities within the banking sector allows individuals to specialize in areas that align with their skills and interests. Becoming a part of this industry not only provides a wide range of job opportunities but also offers several advantages that make it an appealing choice for professionals across various disciplines.

This article will explore the reasons why many individuals aspire to work in the banking industry. From the opportunities for career growth and financial stability to the prestige and professional development it offers, we will delve into the various aspects that make banking an enticing field for aspiring professionals.

The Appeal of the Banking Industry

There are several factors that contribute to the appeal of the banking industry as a career choice. One of the key attractions is the wide range of opportunities for career growth and advancement. Banks have multiple departments and specialized roles, allowing professionals to specialize in areas such as investment banking, retail banking, corporate finance, risk management, and more. This breadth of opportunities allows individuals to find their niche and develop expertise in their chosen field.

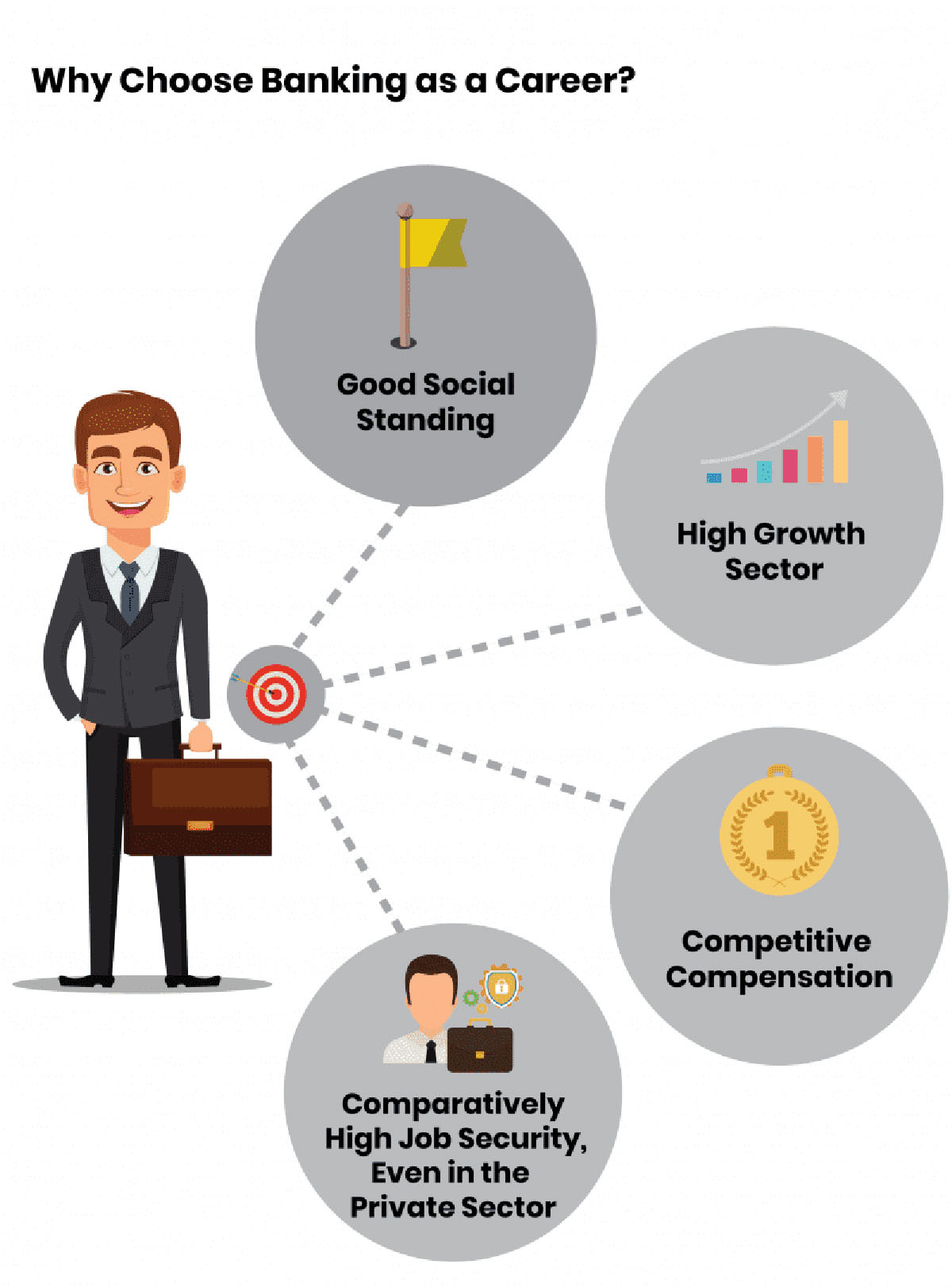

Another significant appeal of the banking industry lies in its financial stability and compensation. Banks are known for offering competitive salaries and comprehensive benefits packages, ensuring financial security for employees. Moreover, the banking industry is less susceptible to economic downturns compared to other sectors, providing a sense of stability even during challenging times.

Prestige and professionalism are also hallmark characteristics of the banking industry. Bankers are often seen as trusted advisors and experts in their field. The industry upholds high standards of professionalism, requiring employees to maintain integrity, ethical conduct, and compliance with regulatory frameworks. This focus on professionalism adds to the allure of working in the banking industry.

Furthermore, the banking industry offers ample opportunities for learning and development. Banks invest heavily in training and skill development programs to ensure that their employees stay up to date with industry trends and changes. These programs not only enhance knowledge and expertise but also pave the way for career advancement.

In addition, the banking industry provides a fast-paced and dynamic work environment. As financial markets are constantly evolving, employees are challenged to stay proactive and adapt to changing situations. This creates a stimulating work environment that keeps professionals engaged and motivated.

Networking and exposure to different industries are also significant advantages of working in the banking sector. Banks often collaborate with various businesses, governments, and organizations, providing employees with opportunities to interact and forge connections with professionals from diverse backgrounds. This exposure can help individuals develop a robust professional network, opening doors to new opportunities and collaborations.

Finally, working in the banking industry allows individuals to contribute to economic growth and development. Banks play a crucial role in financing businesses, providing loans, and supporting economic activities. By working in the industry, professionals directly contribute to fostering economic growth and stability.

With its diverse career options, financial stability, professional prestige, learning and development opportunities, dynamic work environment, networking possibilities, and contribution to economic growth, it’s no wonder that the banking industry remains an appealing choice for ambitious individuals.

Opportunities for Career Growth

The banking industry offers a plethora of opportunities for career growth, making it an attractive choice for ambitious professionals. One of the main advantages of working in banking is the possibility to climb the corporate ladder and reach high-level positions. Banks have hierarchical structures that allow employees to progress from entry-level positions to senior roles with increased responsibilities and leadership opportunities.

Within the banking industry, there are various career paths to explore. For instance, individuals interested in finance and investment may pursue a career in investment banking, where they can specialize in mergers and acquisitions, capital markets, or private equity. Those with a passion for retail banking can move up the ranks to become branch managers or regional directors, overseeing multiple branches and leading teams.

Moreover, the banking industry offers a wide range of specialized roles that cater to different skill sets and interests. Risk management, compliance, financial analysis, wealth management, and corporate finance are just a few examples of the diverse career paths available within the industry. This allows individuals to align their career growth with their specific areas of expertise, ensuring a fulfilling and rewarding journey.

Furthermore, banks often provide comprehensive training and development programs to nurture talent. These programs equip employees with the necessary skills and knowledge to excel in their roles and advance in their careers. From leadership development programs to technical training, these initiatives not only enhance professional skills but also contribute to personal growth and growth mindset.

In addition to vertical growth within a particular bank, the banking industry also offers opportunities for horizontal career moves. Employees can explore different departments or areas of specialization, allowing them to gain a broader understanding of the industry and diversify their skill set. This versatility opens doors to new challenges, experiences, and networking opportunities, fostering continuous growth and professional development.

Moreover, the global nature of the banking industry creates possibilities for international career growth. Many banks have a global presence, which means that employees can explore opportunities to work in different countries or regions. This not only provides exposure to different cultures and markets but also broadens perspectives and enhances cross-cultural communication skills.

Ultimately, the abundance of career growth opportunities in the banking industry makes it an attractive choice for individuals who are looking for long-term professional development. Whether it’s through climbing the corporate ladder, exploring different areas of specialization, or seeking international opportunities, banking offers a pathway for ambitious professionals to continually challenge themselves and reach new heights in their careers.

Financial Stability and Compensation

One of the significant appeals of working in the banking industry is the financial stability it offers. Banks are known for their resilience and ability to weather economic storms, making them a reliable source of employment even during turbulent times. This stability provides employees with a sense of security in their career choice and peace of mind regarding job stability and long-term prospects.

Additionally, the banking industry is known for its competitive compensation packages. Salaries in banking tend to be higher than average, reflecting the industry’s demands, responsibilities, and the specialized skill sets required. Employees in banking often receive bonuses and performance-based incentives, providing an opportunity to further boost their earnings.

Beyond base salaries and bonuses, banks typically provide comprehensive benefits packages that include health insurance, retirement plans, vacation time, and other perks. These benefits contribute to the overall financial well-being of employees and can make a significant difference in their quality of life.

The compensation and financial stability in banking go hand in hand with the considerable investment many banks make in their employees. Banks often provide ongoing training and professional development programs to enhance employees’ skills and knowledge. By investing in their workforce, banks create a culture of growth and advancement, ultimately leading to higher earning potential and career growth opportunities for their employees.

Furthermore, the banking industry offers ample opportunities for individuals to grow their wealth through various investment options. With their expertise and access to financial markets, employees in banking are well-positioned to make informed investment decisions and potentially build wealth over time. This potential for personal financial growth enhances the overall appeal of working in the industry.

It is important to note that while the financial stability and compensation in the banking industry are attractive, they often come with high demands and expectations. Employees may be required to work long hours, especially during peak periods or when dealing with high-profile clients. However, the rewards, both financially and professionally, can outweigh the challenges for those who are motivated and dedicated to success.

Overall, the banking industry offers a financially stable and rewarding career path. The potential for high compensation, comprehensive benefits, and opportunities for wealth accumulation cement banking as an attractive choice for professionals who value financial stability and being rewarded for their hard work and expertise.

Prestige and Professionalism

The banking industry is often associated with prestige and professionalism, making it an appealing career choice for many individuals. Banks are seen as pillars of the financial world, and working in this sector carries a certain level of respect and recognition.

Bankers are generally regarded as experts in their field, trusted advisors who possess in-depth knowledge of financial markets and the intricacies of the industry. This expertise gives them a level of credibility and prestige within the professional community. Being part of an industry that is highly regarded and respected adds a sense of pride and accomplishment to one’s career.

In addition to the external perception, the banking industry upholds high standards of professionalism. Integrity, ethical conduct, and adherence to regulatory frameworks are integral to the industry’s operations. Employees in banking are expected to maintain the utmost professionalism and exhibit a high level of personal and corporate accountability.

This emphasis on professionalism and ethical conduct creates a work environment that is founded on trust, integrity, and transparency. It fosters a culture of collaboration, respect, and excellence, where individuals are encouraged to perform at their best and make ethical decisions in the best interest of their clients and the organization.

Furthermore, the banking industry provides ample opportunities for personal growth and professional development. Banks invest in their employees by offering ongoing training programs, mentorship opportunities, and avenues for skill enhancement. This commitment to development ensures that employees stay up to date with industry trends and advancements, maintaining their professional edge.

Moreover, the banking industry provides opportunities for career progression and advancement based on merit and performance. Those who demonstrate exceptional skills and deliver outstanding results can rise to leadership positions and take on greater responsibilities. This recognition of talent further enhances the prestige associated with working in the industry.

Being part of the banking industry also opens doors to networking with professionals from various backgrounds and industries. Banks often collaborate with businesses, governments, and organizations, providing ample opportunities to build a robust professional network. This network can contribute to career growth, collaboration on projects, and exposure to different perspectives and industry trends.

Overall, the combination of external prestige, the industry’s focus on professionalism and ethical conduct, the commitment to personal and professional development, and the opportunities for growth and networking, make the banking industry an attractive choice for individuals seeking a career that values excellence, credibility, and professionalism.

Learning and Development Opportunities

The banking industry provides abundant learning and development opportunities, making it an appealing career choice for individuals who value continuous growth and skill enhancement. Banks recognize the importance of investing in their employees’ professional development to stay competitive in the ever-evolving financial landscape.

One of the key benefits of working in the banking industry is the access to comprehensive training programs. Banks offer a wide range of training initiatives that cover both technical skills and soft skills development. Employees have the opportunity to enhance their knowledge in areas such as financial analysis, risk management, compliance regulations, investment strategies, and more.

These training programs are often conducted by industry experts and professionals who bring real-world experience and insights into the classroom. This practical approach ensures that employees gain relevant skills and knowledge that can be directly applied to their roles and responsibilities.

Moreover, many banks offer mentorship and coaching programs to support employees’ professional growth. Mentors provide guidance and advice, sharing their expertise and helping individuals navigate their career paths. This mentorship not only helps employees develop new skills but also nurtures relationships within the organization.

Banks also encourage employees to pursue professional certifications and qualifications. They often provide financial support and study leave to employees looking to obtain credentials such as Chartered Financial Analyst (CFA), Certified Financial Planner (CFP), or Certified Risk Manager (CRM). These certifications not only enhance employees’ knowledge and credibility but also open doors to career advancement and new opportunities.

In addition to formal training programs, banks foster a culture of continuous learning. Employees are encouraged to stay up to date with industry trends, advancements, and regulatory changes. This can be achieved through participation in conferences, seminars, webinars, and industry events. Banks often sponsor employees to attend professional events, providing exposure to different perspectives and networking opportunities.

Furthermore, the banking industry offers diverse career paths and opportunities to expand one’s horizons. Employees can explore different departments and roles within the bank to gain a broader understanding of the industry. This exposure to different areas helps individuals develop a well-rounded skill set and a deeper knowledge of the banking ecosystem.

Overall, the learning and development opportunities in the banking industry ensure that employees have the resources and support to continually enhance their skills and knowledge. This commitment to professional growth not only benefits the individual employee but also strengthens the bank’s overall capabilities and competitiveness.

Fast-Paced and Dynamic Work Environment

The banking industry is renowned for its fast-paced and dynamic work environment, making it an attractive choice for individuals seeking excitement and challenges in their careers. The nature of the industry requires employees to be adaptable, dynamic, and quick thinkers, creating an energetic atmosphere that keeps professionals engaged and motivated.

Financial markets fluctuate rapidly, and the banking industry operates in real-time, demanding quick decision-making and the ability to handle high-pressure situations. This fast-paced environment provides individuals with constant opportunities to test their skills and problem-solving abilities.

Working in banking often involves handling complex transactions, analyzing financial data, and managing clients’ portfolios. These tasks require attention to detail, critical thinking, and the ability to synthesize information quickly. The dynamic nature of banking ensures that no two days are the same, allowing employees to constantly learn and grow.

Furthermore, technological advancements and innovation have greatly impacted the banking industry, creating an environment that is continuously evolving. Banks are at the forefront of utilizing cutting-edge technologies to improve efficiency, enhance security, and deliver better services to clients.

This dynamic landscape presents employees with the opportunity to stay at the forefront of technological advancements. They can develop skills in areas such as artificial intelligence, data analysis, blockchain technology, and cybersecurity. The constant integration of technology into banking operations keeps employees on their toes and encourages them to stay up to date with emerging trends and tools.

Moreover, the fast-paced nature of the industry fosters a sense of camaraderie and teamwork. Collaboration is essential in banking, as employees often work together to solve complex problems and deliver high-quality services to clients. This collaborative work environment is both stimulating and rewarding, enabling employees to learn from each other and build strong professional relationships.

The dynamic work environment in banking also provides individuals with ample opportunities for career advancement. As employees prove their ability to handle challenging situations and deliver results under pressure, they become eligible for higher-level roles with increased responsibilities and leadership opportunities.

However, it is important to note that the fast-paced nature of the industry can also present challenges. Tight deadlines, long working hours, and high-stakes decision-making can lead to stress and burnout if not managed properly. Effective time management, work-life balance, and self-care practices are essential to thrive in this environment.

Overall, the fast-paced and dynamic work environment in the banking industry offers an exciting and challenging career path. It pushes individuals to continually improve their skills, think on their feet, and adapt to changing market conditions, providing a stimulating and rewarding professional journey.

Networking and Exposure to Different Industries

Working in the banking industry provides individuals with valuable networking opportunities and exposure to different industries, making it an attractive choice for professionals looking to expand their horizons and build diverse connections.

As banks are involved in financing various businesses and sectors, employees often have the chance to interact with professionals from different industries. This exposure allows individuals to gain insights into various sectors, understand different business models, and develop a broader perspective on the overall economy.

Collaborating with businesses, governments, and organizations exposes banking professionals to a wide range of stakeholders. This exposure not only increases their knowledge and understanding of different industries but also provides them with the opportunity to build meaningful relationships and expand their professional network.

The networking opportunities in the banking industry are valuable for career growth and development. A strong professional network can open doors to new job opportunities, collaborations, and partnerships. It can also provide access to information, mentorship, and guidance from experienced professionals in the industry.

Networking within the banking industry itself is also highly beneficial. Banks often organize networking events, conferences, and seminars where employees can connect with colleagues from different departments and branches. This networking within the organization encourages cross-collaboration, knowledge sharing, and a better understanding of the bank’s operations as a whole.

Furthermore, the banking industry provides exposure to global markets and international opportunities. Many banks have a presence in multiple countries, giving employees the chance to work in different locations and experience different cultures. This exposure to international markets enhances employees’ global perspectives and cross-cultural communication skills.

Moreover, banks frequently work with external partners, such as legal firms, consulting companies, and technology providers. Interacting with professionals from these industries provides employees with insights into their operations and fosters valuable connections. This exposure to external partners can also lead to collaborative projects and opportunities to learn from experts in other fields.

Building a diverse professional network is crucial for personal and professional growth. It allows individuals to stay updated on industry trends, learn from others’ experiences, and gain visibility in the professional community. An extensive network can also support career advancements, as individuals are more likely to be considered for new opportunities and recommendations from trusted connections.

Overall, working in the banking industry provides ample networking opportunities and exposure to different industries. This exposure enhances employees’ knowledge, expands their professional network, and opens doors to new possibilities. It is a valuable aspect of a banking career, fostering continuous growth and development.

Contributing to Economic Growth and Development

The banking industry plays a crucial role in driving economic growth and development, making it an appealing choice for individuals who want to make a meaningful impact on the financial world and contribute to the advancement of society as a whole.

Banks are the primary institutions responsible for financing businesses, governments, and individuals. By providing loans, credit facilities, and financial services, they facilitate economic activities and help businesses expand and thrive. This support is vital for job creation, innovation, and overall economic growth.

Moreover, banks play a critical role in capital allocation. They assess investment opportunities, evaluate risks, and allocate funds to projects that have the potential to generate economic returns. By channelling investment capital to productive sectors, banks contribute to the efficient allocation of resources and stimulate economic development.

Additionally, banks provide financial services that enable individuals to achieve their financial goals. Whether it’s securing a mortgage to buy a home, obtaining a car loan, or managing personal finances, banks empower individuals to make significant life decisions and improve their overall financial well-being.

Banks also support the infrastructure development of communities and the nation as a whole. They finance infrastructure projects such as roads, bridges, power plants, and schools, which are essential for economic progress and social development. By investing in infrastructure, banks help create a more sustainable and prosperous future.

Furthermore, the banking industry fosters financial inclusion by providing access to financial services for underserved populations. Banks offer basic banking services, such as savings accounts, payment systems, and microfinance, to individuals who were previously excluded from formal financial systems. This inclusion helps boost economic participation and social empowerment.

In addition to direct contributions, the banking industry plays a vital role in stabilizing the financial system. Banks are subject to strict regulatory frameworks and oversight to ensure financial stability and consumer protection. This oversight helps foster trust and confidence in the financial system, which is essential for economic growth and investor confidence.

Banks also collaborate with governments and central banks in formulating monetary policies and implementing measures to manage economic cycles. By supporting monetary policy objectives, banks contribute to maintaining stable inflation levels, low interest rates, and overall economic stability.

Overall, the banking industry is a catalyst for economic growth and development. It provides the financial services and support necessary for businesses and individuals to prosper, facilitates infrastructure development, promotes financial inclusion, and contributes to financial stability. Choosing a career in banking allows individuals to directly impact economic progress and make a positive difference in society.

Conclusion

The banking industry offers a plethora of reasons for individuals to aspire to work in this sector. From the opportunities for career growth and financial stability to the prestige and professionalism it entails, the banking industry continues to attract ambitious professionals from diverse backgrounds.

The appeal of the banking industry lies in its wide range of career opportunities, allowing individuals to specialize in areas that align with their skills and interests. Moreover, the industry offers financial stability and competitive compensation packages, providing employees with a sense of security and a rewarding career path.

Prestige and professionalism are intrinsic to the banking industry, and employees are often regarded as trusted advisors and experts in their field. The industry upholds high standards of professionalism, ensuring ethical conduct, integrity, and compliance with regulatory frameworks.

Learning and development opportunities are abundant in banking, with banks investing in training programs, mentorship, and professional certifications. This commitment to growth enhances employees’ skills and knowledge, allowing them to stay at the forefront of the industry.

The fast-paced and dynamic work environment in banking offers excitement and challenges, pushing employees to continually learn and adapt in a rapidly evolving industry. Networking opportunities within and outside the banking sector provide exposure to different industries, fostering valuable connections and collaboration.

Lastly, the banking industry’s role in driving economic growth and development makes it a fulfilling career choice. By financing businesses, supporting infrastructure development, and promoting financial inclusion, banks directly contribute to the prosperity and advancement of society.

In conclusion, the banking industry offers an enticing blend of career opportunities, financial stability, professional prestige, learning and development, dynamic work environment, networking possibilities, and societal impact. It continues to be a top choice for individuals seeking a challenging and rewarding career that combines expertise in finance with the opportunity to make a meaningful impact on the financial world and contribute to the economic growth and stability of communities and nations.