Home>Finance>Why Is Money Management Important In Relationships?

Finance

Why Is Money Management Important In Relationships?

Published: February 28, 2024

Discover the significance of finance in relationships and the impact of effective money management. Learn how to navigate financial matters for a harmonious partnership.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Why Is Money Management Important in Relationships?

Money management is a crucial aspect of any relationship, playing a significant role in the overall well-being and stability of the partnership. While it may not be the most romantic topic, the way a couple navigates financial matters can profoundly impact the harmony and longevity of their relationship. This article delves into the reasons why money management is vital in relationships, shedding light on the various ways it influences the dynamics between partners.

Financial matters are often intertwined with emotions, values, and aspirations, making them a sensitive and potentially contentious subject within relationships. Understanding the significance of money management in this context can help couples navigate potential challenges and build a solid foundation for their future together.

Effective money management in a relationship involves open communication, trust, shared goals, and the ability to navigate financial stress and conflicts. By exploring these key elements, we can gain a deeper understanding of why money management holds such importance in relationships and how it contributes to the overall health and success of the partnership.

Communication and Trust

Communication and trust form the bedrock of a healthy relationship, and this holds true when it comes to money management. Open and honest communication about financial matters is essential for fostering trust and understanding between partners. It involves discussing income, expenses, savings, investments, and any debts in a transparent and non-judgmental manner.

When couples communicate effectively about their financial situations, they can work together to set realistic goals, make informed decisions, and allocate resources efficiently. This collaborative approach not only strengthens their financial position but also deepens the level of trust and mutual respect within the relationship.

Furthermore, transparent communication about money helps prevent misunderstandings and reduces the likelihood of financial secrets or surprises, which can strain trust and lead to conflicts. By openly addressing financial concerns and aspirations, couples can align their values and priorities, fostering a sense of unity and shared purpose.

Ultimately, effective communication and trust in money matters empower couples to navigate challenges, celebrate achievements, and weather financial ups and downs as a team. It lays the groundwork for a resilient and harmonious relationship, where both partners feel heard, understood, and supported in their financial journey together.

Shared Goals and Priorities

When it comes to money management in relationships, aligning on shared goals and priorities is paramount. Couples who openly discuss and establish common financial objectives are better equipped to make unified decisions and work towards a collective vision for their future.

By identifying and prioritizing shared financial goals, such as saving for a home, planning for retirement, or funding a vacation, partners can channel their resources and efforts in a cohesive manner. This not only fosters a sense of teamwork but also reinforces the notion that both individuals are equally invested in the relationship’s long-term prosperity.

Moreover, having shared financial priorities encourages accountability and mutual support. It allows couples to hold each other responsible for adhering to budgetary constraints, curbing unnecessary expenses, and staying committed to their joint objectives. This collaborative approach to money management promotes a sense of unity and reinforces the idea that both partners are working towards a common purpose.

Additionally, establishing shared financial priorities can serve as a source of motivation and inspiration, propelling couples to stay focused on their collective aspirations. It provides a sense of direction and purpose, instilling a shared sense of accomplishment as they progress towards their mutual financial milestones.

Ultimately, aligning on shared goals and priorities in money management not only strengthens the financial foundation of the relationship but also fosters a deeper sense of unity, purpose, and mutual investment in each other’s well-being and happiness.

Financial Stress and Conflict

Money is often cited as one of the leading causes of stress and conflict in relationships. Discrepancies in spending habits, differing attitudes towards saving, or unequal financial contributions can give rise to tension and discord between partners. Furthermore, financial stress can permeate various aspects of the relationship, impacting communication, emotional well-being, and overall satisfaction.

When couples experience financial strain, it can lead to heightened levels of anxiety, frustration, and even resentment. The pressure to meet financial obligations, coupled with the inability to align on budgetary decisions, can strain the emotional fabric of the relationship, potentially leading to arguments and misunderstandings.

Moreover, unresolved financial conflicts can erode trust and intimacy, creating a rift between partners. Feelings of being unsupported or misunderstood in money matters can exacerbate the strain on the relationship, potentially impacting other areas of mutual cooperation and emotional connection.

It is important for couples to recognize the potential impact of financial stress and conflict on their relationship and actively work towards mitigating these challenges. This can involve seeking professional guidance, implementing structured budgeting strategies, and fostering empathy and understanding towards each other’s financial perspectives.

By addressing financial stress and conflict head-on, couples can strengthen their resilience and fortify the relationship against the detrimental effects of monetary pressures. Building a supportive and communicative framework for navigating financial challenges can help alleviate tension and promote a more harmonious and understanding dynamic within the relationship.

Planning for the Future

Effective money management in relationships extends beyond addressing immediate financial needs; it also involves planning for the future. Couples who engage in proactive financial planning set the stage for long-term security and stability, laying a robust foundation for their shared journey ahead.

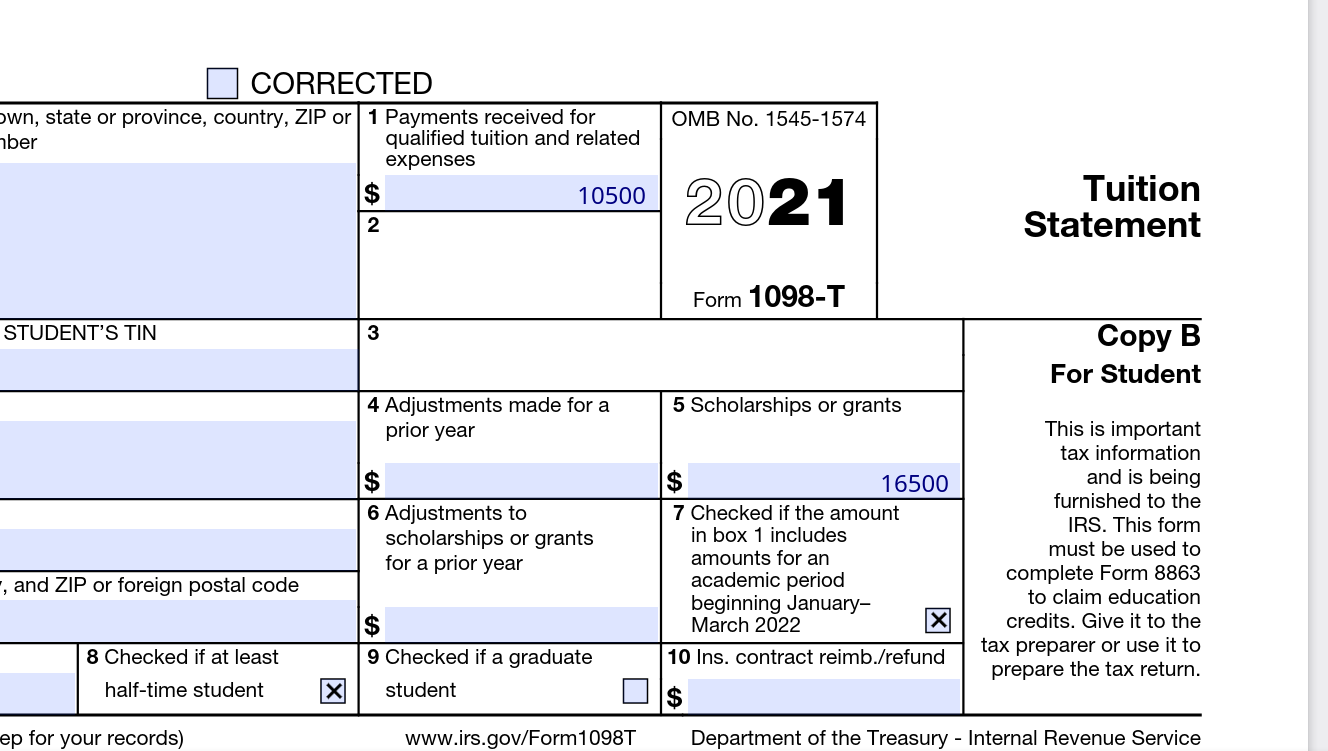

One key aspect of planning for the future involves setting aside funds for contingencies and unforeseen expenses. Establishing an emergency fund can provide a safety net during challenging times, offering peace of mind and financial resilience. Additionally, planning for major life events, such as purchasing a home, starting a family, or pursuing higher education, requires thoughtful financial foresight and strategic resource allocation.

Furthermore, couples need to consider retirement planning as an integral part of their future-focused money management. By discussing retirement goals, exploring investment opportunities, and considering pension options, partners can collaboratively work towards a secure and fulfilling post-work life.

Engaging in comprehensive estate planning is also crucial for couples, as it ensures that their assets and resources are managed and distributed according to their wishes. This may involve creating wills, establishing trusts, and designating beneficiaries, thereby safeguarding their legacy and providing clarity for their loved ones.

By actively engaging in financial planning for the future, couples demonstrate a commitment to each other’s long-term well-being and security. This proactive approach not only cultivates a sense of shared responsibility but also instills confidence in the relationship’s ability to navigate future challenges and opportunities.

Conclusion

Money management is a fundamental pillar of any successful relationship, influencing the dynamics between partners in profound ways. By prioritizing open communication, trust, shared goals, and proactive planning, couples can navigate the complexities of financial matters while strengthening their bond and fostering a resilient partnership.

Effective communication about money not only builds trust but also minimizes the potential for conflicts and misunderstandings. It allows couples to align their financial values and aspirations, creating a sense of unity and shared purpose.

Establishing shared financial goals and priorities provides a roadmap for couples to work together towards a common vision, fostering mutual accountability and support. This collaborative approach not only enhances the couple’s financial well-being but also deepens their sense of partnership and unity.

However, it is essential for couples to recognize the potential impact of financial stress and conflict on their relationship and actively work towards mitigating these challenges. By addressing financial challenges with empathy and understanding, couples can fortify their relationship against the detrimental effects of monetary pressures.

Looking ahead, proactive financial planning for the future demonstrates a commitment to long-term security and well-being. By engaging in thoughtful discussions about emergencies, retirement, and estate planning, couples can lay a solid foundation for their future, fostering confidence and assurance in their shared journey.

In essence, money management in relationships is not solely about dollars and cents; it is about building a foundation of trust, understanding, and shared aspirations. By navigating financial matters with transparency, collaboration, and foresight, couples can strengthen their bond and create a resilient framework for a fulfilling and prosperous future together.