Home>Finance>Why Is Cash Flow Management Important To A Business

Finance

Why Is Cash Flow Management Important To A Business

Published: December 20, 2023

Learn why effective cash flow management is crucial to the success of your business. Discover how finance plays a vital role in ensuring financial stability and growth.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Cash Flow Management

- Importance of Cash Flow Management

- Ensuring Sufficient Liquidity

- Managing Financial Obligations

- Making Informed Business Decisions

- Planning for Growth and Expansion

- Benefits of Effective Cash Flow Management

- Steps to Enhance Cash Flow Management

- Implementing a Cash Flow Management Strategy

- Conclusion

Introduction

Cash flow management is a crucial aspect of running a successful business. It involves monitoring, analyzing, and optimizing the inflow and outflow of financial resources within an organization. From ensuring sufficient liquidity to making informed business decisions, cash flow management plays a vital role in the financial health and sustainability of a company.

In simple terms, cash flow refers to the movement of money in and out of a business. It represents the net amount of cash generated or utilized during a given period. Cash flow management involves tracking and forecasting these cash movements to ensure that a business has enough funds to meet its financial obligations, invest in growth opportunities, and navigate unforeseen challenges.

Effective cash flow management allows business owners and managers to maintain control over their finances, mitigate the risk of cash shortages, and seize lucrative opportunities when they arise. By closely monitoring cash flow, companies can make informed decisions about managing expenses, negotiating favorable terms with suppliers, and allocating resources efficiently.

This article will explore the importance of cash flow management for businesses of all sizes and provide insights into the benefits of implementing effective cash flow management strategies. It will also outline practical steps that businesses can take to enhance their cash flow management practices.

Definition of Cash Flow Management

Cash flow management refers to the process of monitoring, analyzing, and optimizing the inflow and outflow of cash within a business. It involves keeping track of the money that comes into the business from various sources such as sales, investments, and bank loans, and monitoring the expenses and outgoing payments such as salaries, rent, utilities, and supplier payments.

The primary goal of cash flow management is to ensure that a business has enough cash on hand to cover its short-term obligations and operate smoothly on a day-to-day basis. It involves carefully managing the timing of cash inflows and outflows to maintain a positive cash flow and avoid cash shortages.

Cash flow management is essential for maintaining the financial health and stability of a business. By effectively managing cash flow, businesses can reduce the risk of running out of cash, make timely payments to suppliers and creditors, and seize growth opportunities.

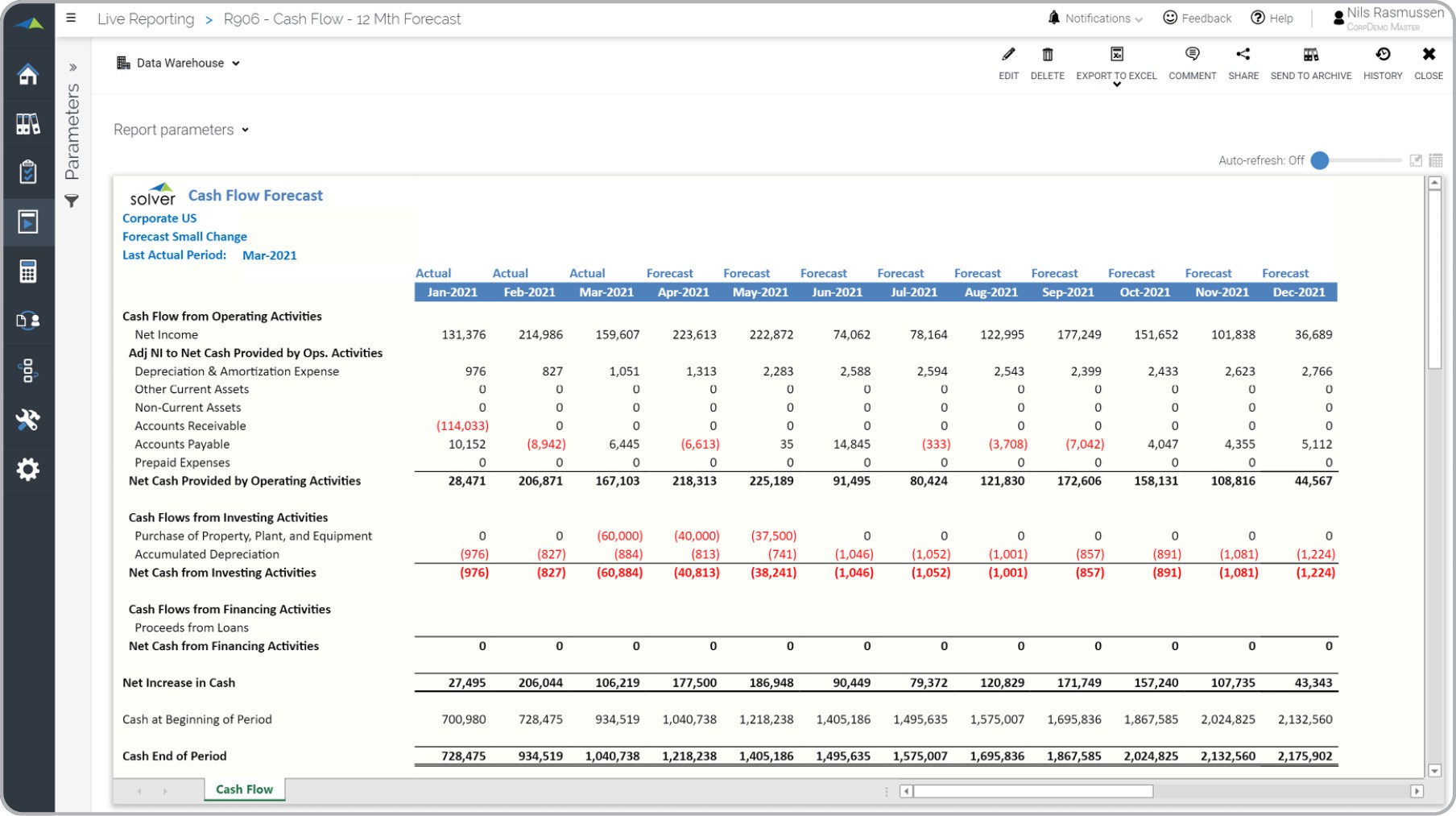

The process of cash flow management starts with creating a cash flow forecast, which is an estimate of future cash inflows and outflows over a specific period, usually a month, quarter, or year. This forecast allows businesses to project their future cash position and anticipate any cash shortfalls or surpluses.

Once the cash flow forecast is in place, businesses can then implement strategies to improve their cash flow. This may involve implementing cost-cutting measures, negotiating better payment terms with suppliers, accelerating receivables collections, or seeking additional financing options.

Overall, cash flow management is a critical financial management practice that allows businesses to maintain control over their finances, meet their financial obligations, plan for growth, and make informed business decisions.

Importance of Cash Flow Management

Cash flow management is of utmost importance to businesses for a variety of reasons. It plays a crucial role in maintaining financial stability, ensuring sufficient liquidity, managing financial obligations, making informed business decisions, and planning for growth and expansion.

One of the primary reasons cash flow management is essential is its role in ensuring sufficient liquidity. Liquidity refers to a company’s ability to meet its short-term financial obligations. By actively managing their cash flow, businesses can ensure that they have enough cash on hand to pay for expenses such as salaries, rent, utilities, inventory, and other operational costs. This helps prevent cash shortages and the potential disruption of business operations.

Cash flow management also allows businesses to effectively manage their financial obligations. It ensures that they can make timely payments to suppliers, lenders, and other creditors. This not only helps maintain good relationships with stakeholders but also avoids penalties or late fees that may be imposed for missed or delayed payments.

In addition to managing immediate financial obligations, cash flow management enables businesses to make informed business decisions. By having a clear understanding of their cash flow position, they can assess whether they have the financial resources to invest in new equipment, expand operations, or launch marketing campaigns. It also helps in evaluating the viability of projects, considering the potential impact on cash flow and the overall financial health of the business.

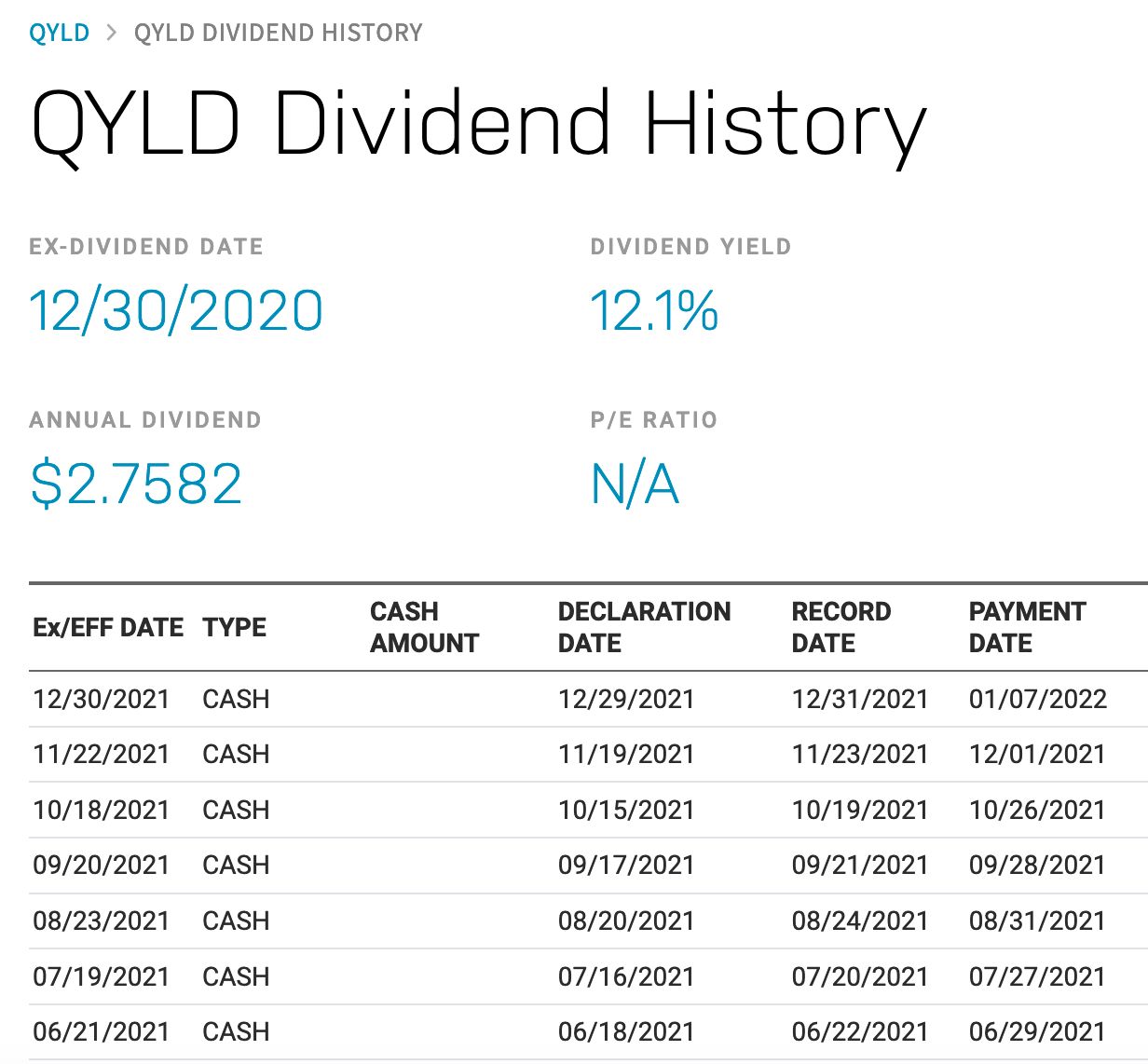

Furthermore, cash flow management plays a critical role in planning for growth and expansion. By accurately forecasting cash inflows and outflows, businesses can identify periods of cash surplus or shortage. This information allows them to make strategic decisions regarding when to reinvest profits, seek additional financing, or adjust business operations to align with cash flow patterns.

Overall, effective cash flow management provides businesses with financial stability, improved decision-making capabilities, and the ability to plan for both short-term and long-term growth. It is an essential practice that every business, regardless of size or industry, should prioritize to maintain financial health and achieve sustainable success.

Ensuring Sufficient Liquidity

One of the key reasons why cash flow management is important for businesses is to ensure sufficient liquidity. Liquidity refers to the ability of a company to meet its short-term financial obligations without incurring significant costs or disruptions to its operations.

Insufficient liquidity can be a major challenge for businesses, as it can lead to cash shortages and difficulties in paying employees, suppliers, and other essential expenses. This can result in damaged relationships with stakeholders, delayed or missed payments, and even potential legal consequences.

Effective cash flow management enables businesses to maintain sufficient liquidity by closely monitoring their cash inflows and outflows. By carefully tracking the timing and magnitude of cash inflows from sources such as sales, investments, and loans, and managing the timing of cash outflows for expenses such as salaries, rent, utilities, and supplier payments, businesses can ensure that they have enough cash on hand to cover their obligations.

This involves creating a cash flow forecast that estimates future inflows and outflows over a specific period, typically a month or a quarter, and comparing the projected cash position with the anticipated expenses. By analyzing the forecast, businesses can identify potential gaps or surpluses and take proactive measures to address them.

One strategy to ensure sufficient liquidity is by implementing effective account receivable management. This involves closely monitoring and managing the collection of outstanding payments from customers, ensuring that invoices are sent promptly and following up on late payments. By reducing the time it takes to collect receivables, businesses can accelerate cash inflows and improve their overall liquidity position.

On the other hand, effective cash flow management also involves carefully managing accounts payable. This includes negotiating favorable payment terms with suppliers, taking advantage of early payment discounts, and strategically prioritizing payments to optimize cash flow. By managing accounts payable efficiently, businesses can stretch their payment periods without negatively impacting relationships with suppliers.

Furthermore, businesses can improve liquidity by implementing strategies to generate additional cash inflows or reduce expenses during periods of cash shortages. This may involve exploring alternate financing options such as short-term loans or lines of credit, or implementing cost-cutting measures to reduce unnecessary expenses.

By focusing on ensuring sufficient liquidity through cash flow management, businesses can avoid cash shortages, maintain financial stability, and navigate unforeseen challenges with greater ease. It allows businesses to meet their obligations promptly, maintain positive relationships with stakeholders, and have the flexibility to seize growth opportunities when they arise.

Managing Financial Obligations

Cash flow management plays a crucial role in managing financial obligations for businesses. It involves ensuring that a company has the necessary funds to meet its financial commitments, including payments to suppliers, employees, lenders, and other creditors.

By effectively managing cash flow, businesses can meet their financial obligations in a timely manner. This helps maintain good relationships with suppliers and creditors, as well as avoid penalties or late fees that may be imposed for missed or delayed payments.

One way to manage financial obligations is by closely monitoring and managing accounts payable. This involves reviewing payment terms with suppliers and negotiating favorable terms that align with the company’s cash flow capabilities. By strategically prioritizing payments and taking advantage of early payment discounts, businesses can optimize their cash flow and ensure that critical payments are made on time.

Another aspect of managing financial obligations is efficiently managing accounts receivable. Businesses need to ensure that they have effective systems in place to track and collect payments from customers. By proactively following up on overdue invoices and implementing clear credit and collection policies, businesses can improve their cash flow position and reduce the risk of unpaid invoices impacting their ability to meet financial obligations.

Cash flow management also helps businesses address any cash shortfalls caused by unexpected events or fluctuations in demand. By having a clear understanding of their cash flow position, businesses can take proactive measures to secure additional financing, such as short-term loans or lines of credit, to bridge any temporary gaps in cash flow and meet their financial obligations.

Furthermore, effective cash flow management enables businesses to make informed decisions regarding major financial obligations, such as investments in equipment or expansion plans. By analyzing their cash flow projections and considering the impact of these obligations on their cash flow, businesses can ensure that they have the necessary funds to support these initiatives without jeopardizing their ability to meet ongoing financial obligations.

Overall, managing financial obligations through cash flow management helps businesses maintain financial stability, preserve positive relationships with suppliers and creditors, and navigate unforeseen challenges with greater ease. By proactively monitoring and optimizing cash inflows and outflows, businesses can stay on top of their financial commitments and ensure the smooth operation of their day-to-day financial activities.

Making Informed Business Decisions

Cash flow management is essential for businesses to make informed decisions that impact their long-term success. By having a clear understanding of their cash flow position, businesses can assess their financial capabilities, evaluate the viability of projects, and make informed choices regarding investments, expenses, and growth opportunities.

One way cash flow management enables informed decision-making is by providing businesses with a realistic view of their financial resources. By analyzing their cash flow projections, businesses can determine the amount of available cash that can be allocated towards various initiatives. This helps in prioritizing investments and expenses based on the financial capacity of the company.

Furthermore, cash flow management helps businesses evaluate the potential impact of business decisions on their cash flow position. By considering the expected inflows and outflows associated with a project or investment, businesses can assess whether the projected returns justify the cash outlay. This helps in avoiding overextending financially and making decisions that may strain cash flow in the long run.

Informed decision-making also involves assessing the timing of business decisions in relation to the cash flow cycle. Cash flow management allows businesses to identify periods of cash surplus or shortage and make strategic decisions accordingly. For example, businesses may choose to invest in growth initiatives during periods of positive cash flow or delay certain expenses during periods of cash scarcity. By aligning decisions with cash flow patterns, businesses can optimize their financial resources and minimize the potential impact on cash flow.

Cash flow management also helps businesses evaluate the financial feasibility of potential projects or expansion plans. By analyzing cash flow projections in relation to the anticipated returns, businesses can determine whether they have the necessary cash flow to support these initiatives. This prevents the risk of committing to projects that may strain cash flow and potentially jeopardize the overall financial health of the business.

Additionally, cash flow management allows businesses to make informed decisions when negotiating with suppliers, customers, or lenders. By understanding their cash flow capabilities, businesses can negotiate payment terms, credit extensions, or financing arrangements that align with their cash flow projections. This helps in managing cash flow effectively and ensuring that the business can meet its financial obligations without incurring unnecessary financial risk.

In summary, cash flow management provides businesses with the necessary information to make informed decisions that align with their financial capabilities and objectives. By analyzing cash flow projections, assessing the impact of decisions on cash flow, and considering the timing and feasibility of projects, businesses can optimize their financial resources, minimize risk, and set themselves up for long-term success.

Planning for Growth and Expansion

Cash flow management plays a critical role in planning for growth and expansion within a business. By effectively managing cash flow, businesses can ensure they have the necessary financial resources to support growth initiatives, seize opportunities, and expand their operations.

One way cash flow management aids in planning for growth is by providing businesses with a realistic view of their available cash. Cash flow projections enable businesses to assess their financial capacity to fund growth initiatives. By analyzing projected cash inflows and outflows, businesses can determine if they have sufficient cash reserves to invest in new equipment, hire additional staff, or explore new markets.

Moreover, cash flow management allows businesses to evaluate the financial feasibility of expansion plans or new business ventures. By assessing the projected cash flows associated with these initiatives, businesses can determine if the potential returns justify the costs. This helps in making informed decisions regarding the viability and timing of expansion projects.

Cash flow management also aids in identifying the need for additional financing to support growth and expansion. By analyzing cash flow projections, businesses can identify periods of cash shortages or gaps between cash inflows and outflows that may arise during the growth phase. This information allows businesses to explore financing options such as business loans, lines of credit, or equity investments to bridge the cash flow gaps and fund expansion plans.

Furthermore, effective cash flow management helps in strategic decision-making when it comes to setting growth targets and timelines. By analyzing historical cash flow data and projecting future cash flows, businesses can set realistic growth targets and establish a timeline for achieving those goals. This helps in establishing a clear roadmap for expansion and ensures that financial resources are allocated efficiently to support growth initiatives.

Additionally, cash flow management aids in identifying the need for adjustments in business operations to support growth. By closely monitoring cash flows, businesses can identify any inefficiencies or bottlenecks that may hinder growth. This allows businesses to make necessary adjustments to processes, systems, or allocation of resources to optimize cash flow and support sustained growth.

In summary, cash flow management is instrumental in planning for growth and expansion within a business. By accurately projecting cash flows, assessing the financial feasibility of expansion plans, identifying financing needs, setting growth targets, and making necessary adjustments to business operations, businesses can position themselves for successful and sustainable growth in the long run.

Benefits of Effective Cash Flow Management

Implementing effective cash flow management practices brings numerous benefits to businesses of all sizes. By actively monitoring and optimizing cash flows, businesses can experience improved financial stability, enhanced decision-making capabilities, reduced financial risk, and increased opportunities for growth.

One of the primary benefits of effective cash flow management is improved financial stability. By maintaining a positive cash flow and ensuring sufficient liquidity, businesses can better cope with unexpected expenses, economic downturns, or seasonal fluctuations. This allows them to withstand financial challenges without jeopardizing their operations or resorting to expensive financing options.

Effective cash flow management also provides businesses with greater control over their financial position. By having a clear understanding of their cash inflows and outflows, businesses can accurately predict their future financial position and make informed decisions about purchasing, expanding, or investing in new initiatives.

Furthermore, effective cash flow management reduces financial risk. By closely monitoring cash flows and identifying potential cash shortages or gaps, businesses can take proactive measures to address these issues. This may involve negotiating extended payment terms with suppliers, reducing non-essential expenses, or securing additional financing. By mitigating financial risks, businesses can avoid cash shortages, penalties, and potential damage to their reputation.

Moreover, effective cash flow management enhances decision-making capabilities. By having access to accurate and up-to-date cash flow information, businesses can make informed decisions about pricing, investments, and expenses. This helps in optimizing resource allocation, identifying cost-saving opportunities, and maximizing profitability. Additionally, businesses can evaluate the financial feasibility of new projects or opportunities based on their cash flow projections.

Effective cash flow management also offers businesses increased opportunities for growth and expansion. By understanding their cash flow position and planning ahead, businesses can allocate resources towards growth initiatives at the right time. This may include expanding into new markets, investing in research and development, or launching new products or services. By managing cash flow efficiently, businesses can seize growth opportunities and set themselves up for long-term success.

Overall, implementing effective cash flow management practices offers businesses a range of benefits, including improved financial stability, enhanced decision-making capabilities, reduced financial risk, and increased opportunities for growth. It is an essential practice that businesses should prioritize to ensure their long-term financial health and success.

Steps to Enhance Cash Flow Management

Enhancing cash flow management involves implementing strategies and adopting best practices to optimize cash flows within a business. By following these steps, businesses can improve their cash flow position, maintain financial stability, and make informed financial decisions:

- Create a Cash Flow Forecast: Develop a cash flow forecast that estimates future inflows and outflows based on historical data and anticipated business activities. This forecast serves as a roadmap for cash flow management.

- Monitor and Track Cash Flows: Regularly track and monitor cash inflows and outflows to assess the actual cash flow performance against the forecast. This helps identify any discrepancies or areas that need improvement.

- Accelerate Receivables Collection: Implement efficient billing and collection processes to shorten the time it takes to receive payments from customers. Offer incentives such as early payment discounts and establish clear credit and collection policies.

- Manage Accounts Payable: Negotiate favorable payment terms with suppliers to optimize cash flow. Prioritize payments based on due dates and available cash, taking advantage of any early payment discounts offered.

- Control and Reduce Expenses: Analyze expenses regularly and identify areas where costs can be reduced without sacrificing the quality of products or services. Look for ways to optimize processes and negotiate better deals with suppliers.

- Optimize Inventory Management: Avoid excess inventory that ties up cash by implementing just-in-time inventory management or using technologies to track and forecast inventory needs accurately.

- Explore Financing Options: Assess different financing options, such as lines of credit or short-term loans, to bridge any temporary cash flow gaps. Ensure that the cost of financing aligns with the anticipated returns on investments.

- Implement Cash Flow Improvement Initiatives: Identify specific initiatives to improve cash flow, such as renegotiating contracts, diversifying revenue streams, or implementing cost-cutting measures. Regularly measure the effectiveness of these initiatives.

- Prepare for Unforeseen Events: Build contingency plans and maintain cash reserves to handle unexpected events that may impact cash flow, such as economic downturns or natural disasters.

- Regularly Review and Adjust Cash Flow Strategies: Continuously monitor and review cash flow strategies to assess their effectiveness. Make adjustments as needed to adapt to changing market conditions or business circumstances.

By following these steps, businesses can enhance their cash flow management practices and achieve better control over their financial resources. This enables them to maintain sufficient liquidity, make informed financial decisions, and position themselves for long-term success.

Implementing a Cash Flow Management Strategy

Developing and implementing a cash flow management strategy is crucial for businesses to effectively manage their finances and ensure a healthy cash flow. The following steps outline the process of implementing an effective cash flow management strategy:

- Analyze Historical Cash Flow Data: Start by reviewing historical cash flow data to gain insights into your business’s cash flow patterns and identify potential areas of improvement. This analysis will help you identify trends, seasonality, and areas where cash flow can be optimized.

- Create a Cash Flow Forecast: Develop a cash flow forecast that projects your expected cash inflows and outflows over a specific period. This forecast should consider factors such as sales revenue, operating expenses, credit terms, loan repayments, and any other significant financial activities. Regularly update and monitor your cash flow forecast to ensure accuracy.

- Identify and Assess Key Cash Flow Drivers: Identify the key drivers that impact your cash flow, such as sales, accounts receivable, accounts payable, inventory management, and expense control. Conduct a thorough assessment of these drivers to understand their impact on cash flow and identify areas for improvement.

- Optimize Accounts Receivable: Implement strategies to improve the collection of accounts receivable. This may include sending timely and accurate invoices, offering discounts for early payment, and actively following up on overdue payments. Improving your accounts receivable turnover will enhance your cash inflows.

- Manage Accounts Payable: Take a strategic approach to managing your accounts payable. Negotiate favorable payment terms with suppliers, but ensure that you honor your commitments promptly. By optimizing your accounts payable, you can maintain positive business relationships while preserving your cash flow.

- Control and Reduce Expenses: Review your expenses regularly to identify areas where costs can be reduced. Consider renegotiating contracts with vendors, implementing cost-saving initiatives, and scrutinizing discretionary spending. Reducing unnecessary expenses will help conserve cash flow.

- Implement Inventory Management Techniques: Analyze your inventory management practices to avoid excessive inventory holdings. Implement just-in-time inventory management, track inventory turnover, and identify slow-moving or obsolete items to free up cash tied up in inventory.

- Diversify Revenue Streams: Explore opportunities to diversify your revenue streams and reduce dependence on a single source of income. By expanding into new markets or offering complementary products or services, you can mitigate the risk of revenue fluctuations and improve overall cash flow stability.

- Monitor and Review Cash Flow Performance: Regularly monitor and review your actual cash flow performance against your forecast. Make adjustments to your cash flow management strategy as needed based on changes in market conditions, business circumstances, or unexpected events.

- Seek Professional Assistance: If necessary, consider seeking the guidance of a financial advisor or accountant with expertise in cash flow management. They can provide valuable insights, help develop customized strategies, and offer guidance on financial best practices.

By implementing a well-defined cash flow management strategy, businesses can gain better control over their finances, optimize their cash flow, and make informed decisions that contribute to long-term financial success and stability.

Conclusion

Cash flow management is critical for the financial health and success of any business. By actively monitoring and optimizing cash flows, businesses can maintain sufficient liquidity, meet their financial obligations, make informed decisions, and plan for growth and expansion.

The benefits of effective cash flow management are numerous. It provides businesses with financial stability, reduces financial risk, enhances decision-making capabilities, and opens up opportunities for growth. By implementing strategies such as cash flow forecasting, accelerating receivables collection, and managing accounts payable, businesses can improve their cash flow position and ensure a healthy cash flow cycle.

Effective cash flow management also involves controlling and reducing expenses, optimizing inventory management, and exploring financing options when necessary. It requires regular monitoring, analysis, and adjustment to align with changing market conditions and business circumstances.

By implementing a comprehensive cash flow management strategy, businesses can gain better control over their finances, allocate resources efficiently, and navigate economic challenges with greater ease. Through effective cash flow management, businesses can position themselves for long-term success, make informed financial decisions, and drive sustainable growth.

In conclusion, cash flow management should be a top priority for businesses of all sizes. It is an ongoing process that requires attention and proactive measures. With a well-implemented cash flow management strategy in place, businesses can optimize their cash flow, maintain financial stability, and pave the way for a prosperous future.