Finance

Why Was My 401K Terminated

Published: October 15, 2023

Learn why your 401K was terminated and how it can affect your financial future. Get expert insights and advice on finance matters.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Retirement is a significant milestone in one’s life, and having a 401K account is a vital tool for building a secure financial future. It allows individuals to save and invest for their retirement by contributing a portion of their income on a pre-tax basis. However, there are instances when individuals may encounter the unfortunate event of their 401K being terminated.

401K termination can happen for various reasons, such as company mergers, acquisitions, bankruptcies, or even the decision of the employer to discontinue the retirement plan. It is essential to understand the implications of a terminated 401K and the steps to take to mitigate any potential losses.

In this article, we will delve into the different aspects of 401K termination, including the reasons behind it, the impact on employees, and the options available to handle a terminated 401K. We will also discuss the importance of regular account monitoring to ensure the security of your retirement savings.

Understanding the intricacies of 401K termination is crucial for employees who find themselves in such a situation. It helps to alleviate concerns and provides guidance on how to navigate through the challenges that arise when a 401K is terminated.

In the following sections, we will explore the reasons why a 401K may be terminated, the effects it has on employees, and the steps to take when faced with a terminated 401K. We will also discuss the various options for rolling over your funds and the importance of actively monitoring your retirement account to protect your savings.

Let’s dive into this topic further to gain a better understanding of 401K termination and how it can impact individuals planning for their retirement.

Understanding 401K Termination

401K termination refers to the discontinuation of a company’s 401K retirement plan. It can occur due to a variety of reasons, including company restructuring, mergers, acquisitions, or financial difficulties. When a 401K plan is terminated, it means that the employer will no longer offer the plan, and employees will need to make arrangements for their retirement savings.

Termination of a 401K plan can be both unexpected and unsettling for employees who have been diligently contributing to their retirement savings. It is important to understand the implications of a terminated 401K and the steps that need to be taken to protect and manage the accrued savings.

When a 401K plan is terminated, employees have a few options. They can either withdraw the funds, transfer them to an Individual Retirement Account (IRA), or roll them over into a new employer-sponsored retirement plan, if available. It is important to carefully consider these options to make the most suitable decision based on individual circumstances and long-term retirement goals.

Understanding the reasons behind 401K termination is crucial in comprehending the impact it can have on employees. While it is difficult to predict when a 401K plan will be terminated, certain events such as company bankruptcies or mergers may increase the likelihood of such occurrences. Employers must provide advance notice to employees about the termination of a 401K plan, giving them time to make informed decisions regarding their retirement savings.

In the next section, we will explore the various reasons behind 401K termination, shedding light on the factors that can lead to the discontinuation of a retirement plan. By understanding these reasons, employees can gain insights into the circumstances surrounding their terminated 401K plan and explore alternative solutions to protect their retirement savings.

Reasons for 401K Termination

There are several reasons why a company may choose to terminate its 401K retirement plan. It is important for employees to understand these reasons in order to navigate the implications and plan accordingly for their retirement savings.

Here are some common reasons for 401K termination:

- Company Restructuring: When a company goes through a reorganization or restructuring process, it may decide to terminate its existing 401K plan. This can happen when the company merges with another organization, undergoes a change in ownership, or experiences financial difficulties requiring cost-cutting measures.

- Financial Challenges: Companies facing financial challenges or significant losses may need to terminate their 401K plans as a method to alleviate financial strain. In these situations, the company’s priority may be to focus on core business operations and reduce expenses, including the administration and contributions associated with the retirement plan.

- Change in Business Priorities: Sometimes, a company may shift its business priorities or strategies, which may result in the termination of the 401K plan. This can occur if the company decides to focus on other employee benefits or restructure their overall compensation package.

- Compliance and Regulatory Issues: Compliance with various regulations and requirements is essential for maintaining a 401K plan. If a company fails to meet these compliance standards or faces persistent regulatory issues, it may result in the termination of the plan.

- Merger or Acquisition: When two companies merge or one company acquires another, there can be changes to employee benefit plans, including the termination of existing 401K plans. The acquiring company might choose to integrate the retirement benefits into its existing plan, or it may opt to establish a new plan for all employees.

It is worth noting that employers are required to provide advance notice to employees regarding the termination of a 401K plan. The notice period can vary depending on the circumstances and regulations governing the specific situation.

Understanding the reasons behind 401K termination is essential for employees to comprehend the factors that contributed to the discontinuation of their retirement plan. By understanding these reasons, individuals can make informed decisions about their retirement savings and explore alternative options to secure their financial future.

Impact on Employees

When a 401K plan is terminated, it can have several implications and consequences for the employees who have been contributing to the plan. Understanding these impacts is crucial for individuals to make informed decisions regarding their retirement savings.

Here are some of the key impacts that employees may experience when their 401K plan is terminated:

- Loss of Retirement Savings: The most significant impact of 401K termination is the potential loss of retirement savings. Employees who have been diligently contributing to their 401K plans may find themselves without a structured retirement savings vehicle. This loss can significantly impact their financial well-being in retirement.

- Disruption of Retirement Plans: Termination of a 401K plan can disrupt employees’ retirement plans and timelines. Individuals may need to reassess their retirement goals and make adjustments to compensate for the loss of their primary savings vehicle. This may involve working longer, increasing contributions to other retirement accounts, or exploring alternative investment options to make up for the shortfall.

- Limited Investment Options: Employer-sponsored 401K plans often provide a range of investment options that employees can choose from. When a 401K plan is terminated, employees may lose access to these investment options and the ability to manage and diversify their retirement savings as effectively. This limitation can impact long-term investment growth.

- Potential Tax Implications: Employees who withdraw funds from a terminated 401K plan may face tax implications. Depending on the age of the employee and the nature of the withdrawal, taxes and penalties may apply. It is important for individuals to consult with a tax advisor to understand the potential tax consequences of withdrawing or rolling over their retirement savings.

- Need for Decision-Making: 401K termination requires employees to make important decisions regarding the management of their retirement savings. They may need to choose between withdrawing the funds, transferring them to an IRA, or rolling them over into a new employer-sponsored retirement plan. These decisions can have long-term implications, and it is crucial for individuals to carefully evaluate their options and choose the best course of action based on their financial goals.

Employees faced with a terminated 401K plan should seek guidance from financial advisors or retirement experts to help navigate through the impacts and make informed decisions. It is essential to evaluate the available options and choose the most suitable path to secure retirement savings and minimize any potential losses.

In the next section, we will discuss the steps employees can take when they find themselves with a terminated 401K plan, providing guidance on how to handle this situation effectively.

Steps for Handling a Terminated 401K

Handling a terminated 401K requires careful consideration and proactive steps to protect and manage your retirement savings. Here are some important steps to take when faced with a terminated 401K:

- Evaluate the Notice: Review the notice provided by your employer regarding the termination of the 401K plan. Understand the timeline, specific details, and any available options for handling your retirement savings. This will help you in making informed decisions and planning your next steps.

- Consult a Financial Advisor: Seek professional guidance from a financial advisor specialized in retirement planning. They can assess your unique financial situation, understand your retirement goals, and provide advice tailored to your needs. A financial advisor can help you make the right decisions regarding the management of your terminated 401K.

- Assess Your Options: Consider the available options for your terminated 401K. You may have the choice to withdraw the funds, transfer them to an Individual Retirement Account (IRA), or roll them over into a new employer-sponsored retirement plan, if available. Evaluate the pros and cons of each option, taking into account factors such as taxes, investment options, and long-term retirement goals.

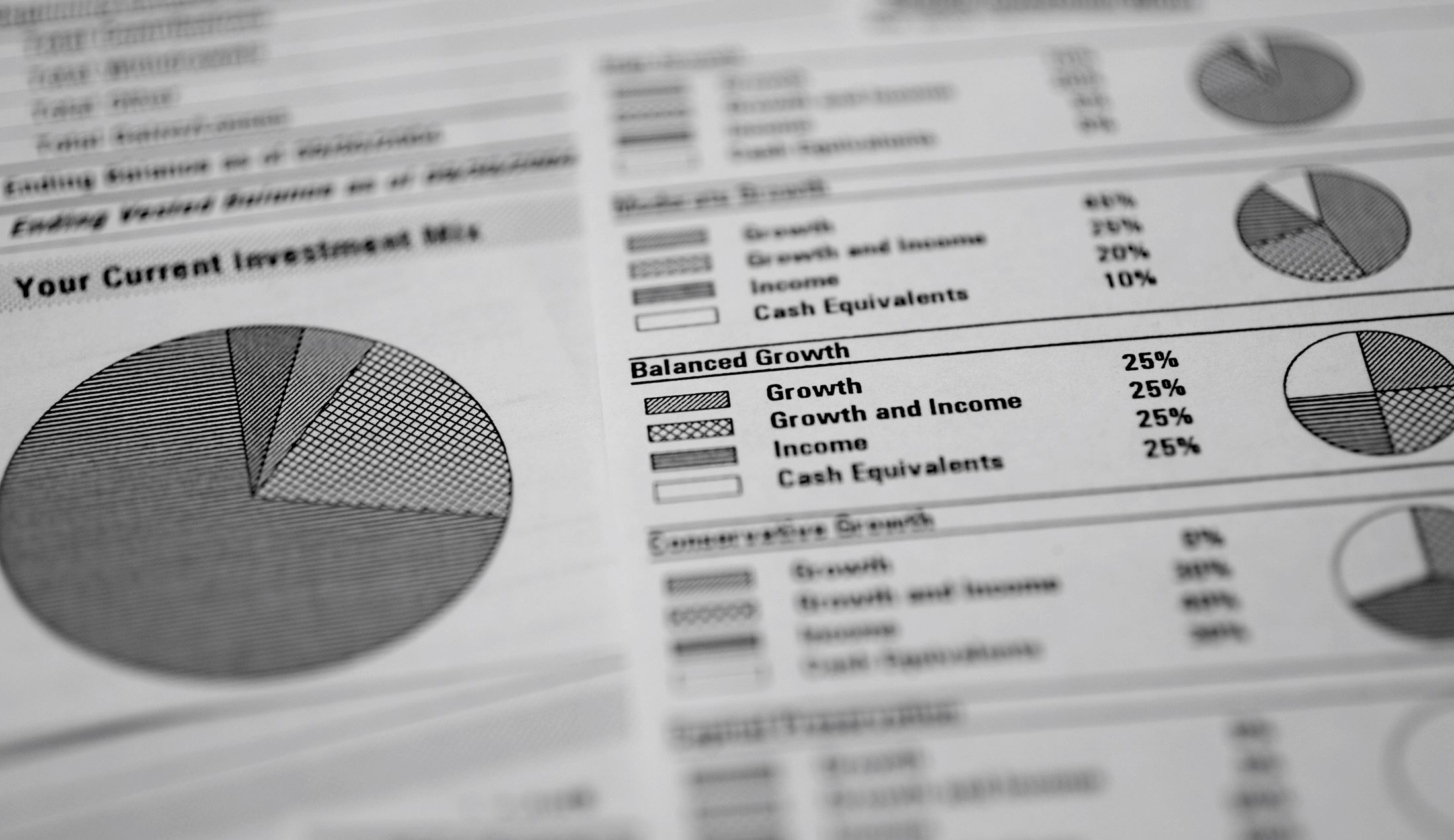

- Review Investment Strategy: If you decide to roll over your terminated 401K into an IRA or another retirement plan, take the opportunity to reassess your investment strategy. Evaluate the available investment options and determine the right allocation based on your risk tolerance, time horizon, and retirement objectives.

- Initiate the Rollover Process: If you choose to roll over your terminated 401K, initiate the process as soon as possible. Contact the financial institution where you want to establish your new retirement account and follow their procedures for transferring the funds. Ensure that the rollover is done correctly to avoid any tax or penalty implications.

- Consider Additional Contributions: To compensate for the loss of your terminated 401K, consider increasing contributions to other retirement accounts, such as an IRA or a new employer-sponsored plan. Maximize your allowable contributions to accelerate your retirement savings growth and ensure you are on track to meet your financial goals.

- Stay Informed: Keep yourself informed about any updates or changes related to your terminated 401K. It’s important to stay connected with your employer, financial advisor, and any relevant institutions to ensure you are up to date with any developments that may affect your retirement savings.

- Regular Account Monitoring: Once you have successfully rolled over your terminated 401K or established a new retirement account, make it a habit to regularly monitor and review your investments. Stay informed about market trends, make necessary adjustments to your portfolio, and keep track of your progress towards your retirement goals.

Remember, each individual’s financial situation is unique, and the steps for handling a terminated 401K may vary. It is advisable to consult with financial professionals and retirement experts to ensure you make decisions that align with your specific needs and objectives.

In the next section, we will discuss the various options for rolling over your terminated 401K and how to choose the most suitable one for your circumstances.

Options for Rollover

When faced with a terminated 401K, individuals have several options for rolling over their retirement savings. It is important to carefully consider these options and choose the most suitable one based on your financial goals and circumstances.

Here are the main options for rolling over a terminated 401K:

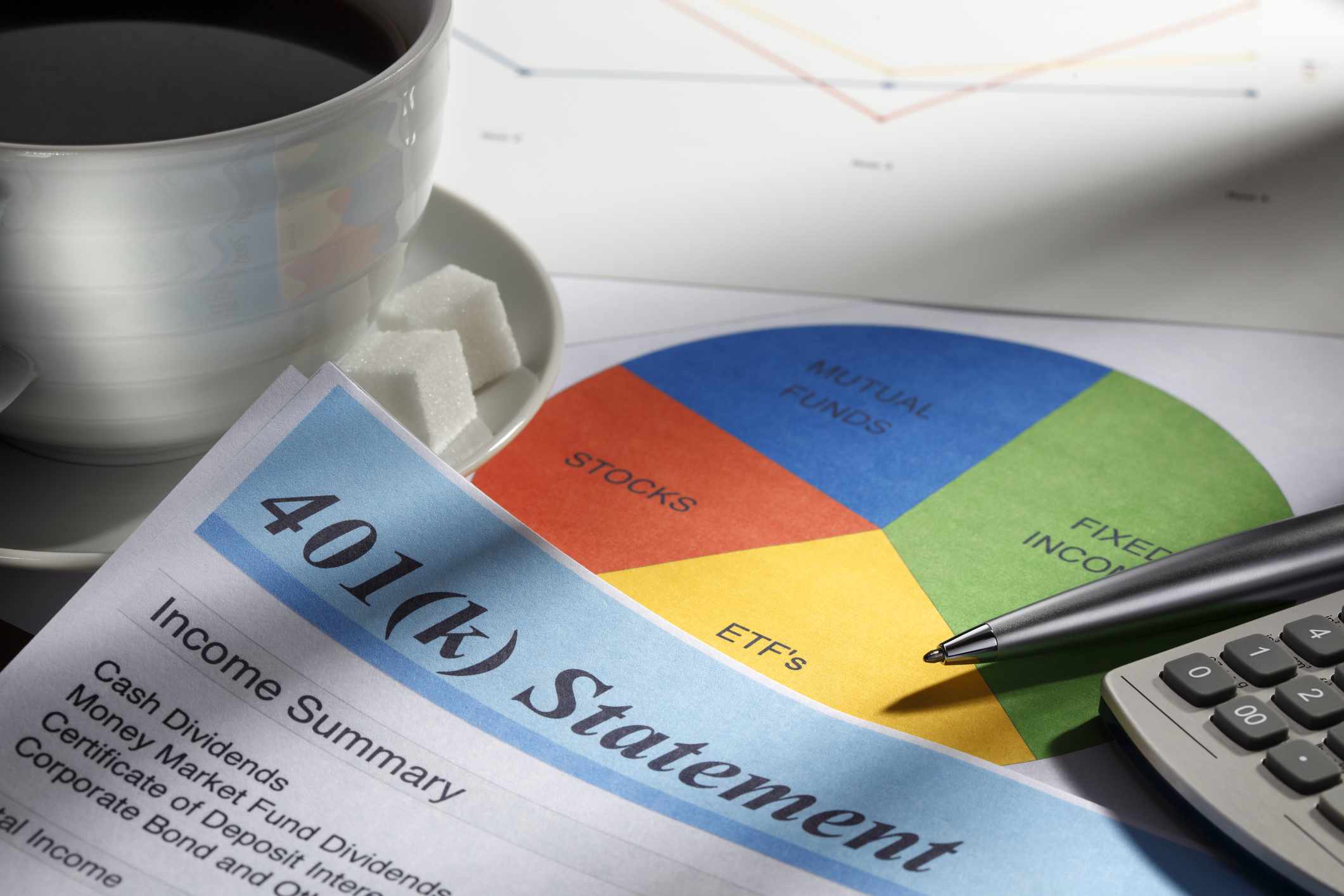

- Roll Over into an Individual Retirement Account (IRA): One of the most common options is to roll over the funds from your terminated 401K into an IRA. This allows you to maintain control over your retirement savings and gives you a wide range of investment options. IRAs offer flexibility in managing your investments and provide potential tax advantages, such as the ability to defer taxes on earnings until withdrawal.

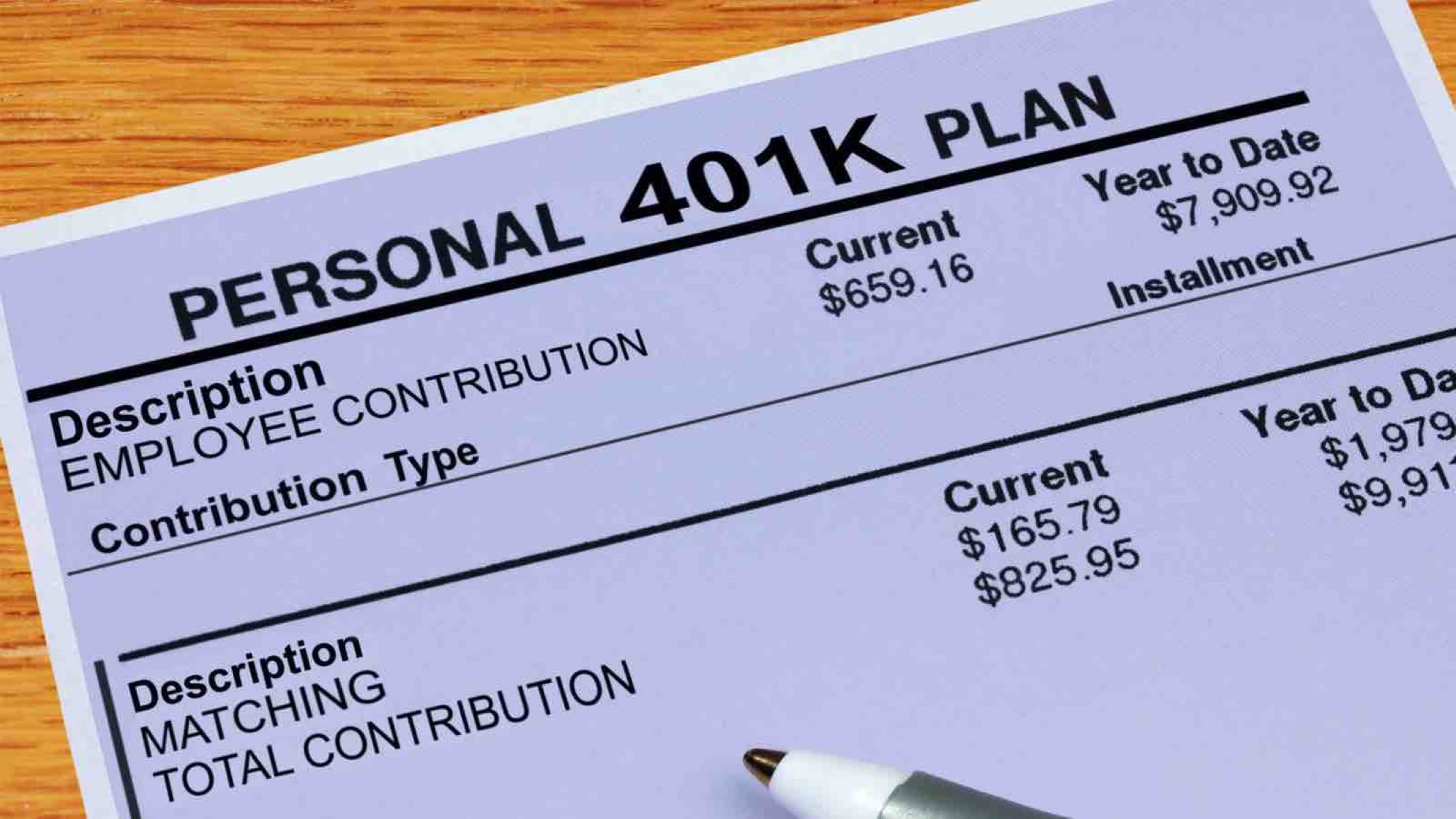

- Roll Over into a new Employer-Sponsored Retirement Plan: If you have a new employer who offers a retirement plan, you may have the option to roll over your terminated 401K into the new plan. This can be advantageous as it allows you to consolidate your retirement savings and continue making contributions to the new plan. It is essential to compare the investment options, fees, and any employer matching contributions offered by the new plan before making a decision.

- Leave Funds in the Terminated 401K (if permitted): In some cases, the terminated 401K plan may allow you to leave your funds in the account, though it may no longer be actively managed. Leaving your funds in the terminated plan can be an option if you are satisfied with the investment options and fees associated with it. However, it is important to carefully consider this option as you may not have access to the same level of support or the potential for future growth compared to other retirement account options.

- Withdraw the Funds: While it is generally not recommended, individuals also have the option to withdraw the funds from their terminated 401K. However, this option may have tax implications, such as early withdrawal penalties and potential income tax obligations. It is advisable to consult with a tax advisor before choosing this option to understand the potential financial impact.

Choosing the right rollover option depends on various factors, including your investment preferences, long-term retirement goals, tax considerations, and availability of new employer-sponsored retirement plans. It is important to carefully evaluate these factors and seek professional advice to make an informed decision.

Regardless of the option chosen, it is crucial to follow the necessary procedures and documentation required for a smooth rollover process. Be sure to contact the appropriate financial institutions involved to initiate the transfer and ensure compliance with any rollover requirements.

In the next section, we will emphasize the importance of regularly monitoring your retirement account, even after handling a terminated 401K, to protect and optimize your savings.

Importance of Regular Account Monitoring

When it comes to retirement savings, regular account monitoring is crucial, even after handling a terminated 401K. Monitoring your retirement account ensures that your investments align with your goals, helps protect your savings, and allows you to make informed decisions. Here are several reasons why regular account monitoring is important:

- Tracking Investment Performance: By consistently monitoring your retirement account, you can stay informed about the performance of your investments. This helps you assess whether your investments are meeting your expectations and make necessary adjustments if needed. Regular monitoring allows you to take advantage of market opportunities and avoid potential losses.

- Rebalancing and Diversification: Over time, the performance of different investment assets within your retirement account may vary. Regular monitoring allows you to assess the asset allocation and diversification of your investments. If your portfolio becomes imbalanced, you can rebalance it to stay aligned with your risk tolerance and long-term goals. Diversification helps to mitigate risk and maximize potential returns.

- Staying Informed about Market Trends: Keeping a close eye on market trends and economic developments is essential for effective retirement account management. Regular monitoring helps you to stay informed about changes that may impact your investments, such as interest rate shifts or industry-specific developments. With this knowledge, you can make informed decisions about adjusting your portfolio to optimize returns.

- Maximizing Contributions: Regularly monitoring your retirement account also reminds you to maximize your contributions within the allowable limits. This ensures that you take full advantage of the tax benefits and compound interest potential offered by retirement savings accounts. Consistent monitoring helps you plan and allocate funds to maximize your retirement savings over time.

- Protecting Against Fraud or Errors: Fraud and errors can occur in any financial account, and retirement accounts are no exception. Regularly monitoring your account allows you to spot any suspicious or unauthorized activity, helping you take immediate action to protect your savings. Promptly addressing any errors or discrepancies ensures that your retirement funds are safe and secure.

- Adapting to Life Changes: Regular account monitoring enables you to adapt to any significant life changes that may impact your retirement goals. Whether it’s a new job, a salary increase, or a change in personal circumstances, monitoring your retirement account allows you to adjust your contributions and investment strategies accordingly. This ensures that your retirement plan remains aligned with your evolving financial situation.

- Seeking Professional Advice: Monitoring your retirement account regularly also provides opportunities to seek professional advice. Financial advisors can review your account, assess your progress, and provide guidance to help you meet your retirement goals. They can assist with investment recommendations, tax planning, and overall retirement strategy as you navigate through different phases of life.

Taking the time to regularly monitor your retirement account is an essential aspect of responsible financial management. It allows you to stay in control of your investments, adapt to changing circumstances, and make informed decisions towards building a successful retirement nest egg.

In the final section, we will conclude the article by highlighting the key takeaways regarding handling a terminated 401K and the significance of proactive retirement planning.

Conclusion

Handling a terminated 401K requires careful consideration and proactive steps to protect and manage your retirement savings. Understanding the reasons behind 401K termination, the impact on employees, and the options available for rollover are essential for making informed decisions.

When faced with a terminated 401K, it is important to evaluate the notice, consult with financial advisors, assess your options, and initiate the rollover process in a timely manner. Whether you choose to roll over into an Individual Retirement Account (IRA), transfer to a new employer-sponsored retirement plan, or explore other alternatives, it is crucial to carefully weigh the factors that align with your long-term retirement goals and financial situation.

Regular account monitoring remains a cornerstone of responsible retirement planning, even after handling a terminated 401K. It allows you to track investment performance, rebalance and diversify your portfolio, stay informed about market trends, maximize contributions, protect against fraud, adapt to life changes, and seek professional advice when needed. By proactively monitoring your retirement account, you can optimize your savings, protect your investments, and make informed decisions to ensure a secure and comfortable future.

Remember, everyone’s financial situation is unique, and it is important to seek personalized advice from financial professionals to make the best decisions for your circumstances. With careful planning, proactive management, and regular monitoring, you can navigate through the challenges of a terminated 401K and build a strong foundation for a successful retirement.