Finance

Zero Basis Risk Swap (ZEBRA) Definition

Published: February 20, 2024

Learn the Definition of Zero Basis Risk Swap (ZEBRA) in Finance. Discover how ZEBRAs can help mitigate risks and enhance financial stability.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

What is a Zero Basis Risk Swap (ZEBRA)?

Welcome to our Finance category! In this blog post, we delve into the world of Zero Basis Risk Swaps, also known as ZEBRAs. If you’re wondering what a Zero Basis Risk Swap is and how it can benefit you, you’re in the right place. Keep reading to gain a clear understanding of this financial tool and its potential applications.

Key Takeaways:

- A Zero Basis Risk Swap (ZEBRA) is a derivative instrument used by financial institutions to hedge against interest rate risk.

- ZEBRAs involve exchanging fixed and floating interest rate payments between two parties without the exchange of notional principal.

So, what exactly is a Zero Basis Risk Swap (ZEBRA)? Put simply, it is a financial contract between two parties, typically financial institutions such as banks or investment firms. The purpose of a ZEBRA is to protect against interest rate risk, which can impact the profitability and value of investments.

In a ZEBRA, two parties agree to exchange interest rate payments based on a fixed rate and a floating rate. Unlike traditional interest rate swaps, ZEBRAs do not involve the exchange of notional principal. Instead, only the interest payment difference, or “basis,” between the fixed and floating rate is exchanged.

How Does a Zero Basis Risk Swap (ZEBRA) Work?

Let’s break down the mechanics of a ZEBRA:

- Agreement: Two parties enter into a legally binding agreement to exchange interest payments.

- Fixed Rate Payment: One party (typically referred to as the “fixed rate receiver”) agrees to receive a fixed interest rate payment.

- Floating Rate Payment: The other party (known as the “floating rate payer”) agrees to make a payment based on a floating interest rate, typically tied to a benchmark such as LIBOR.

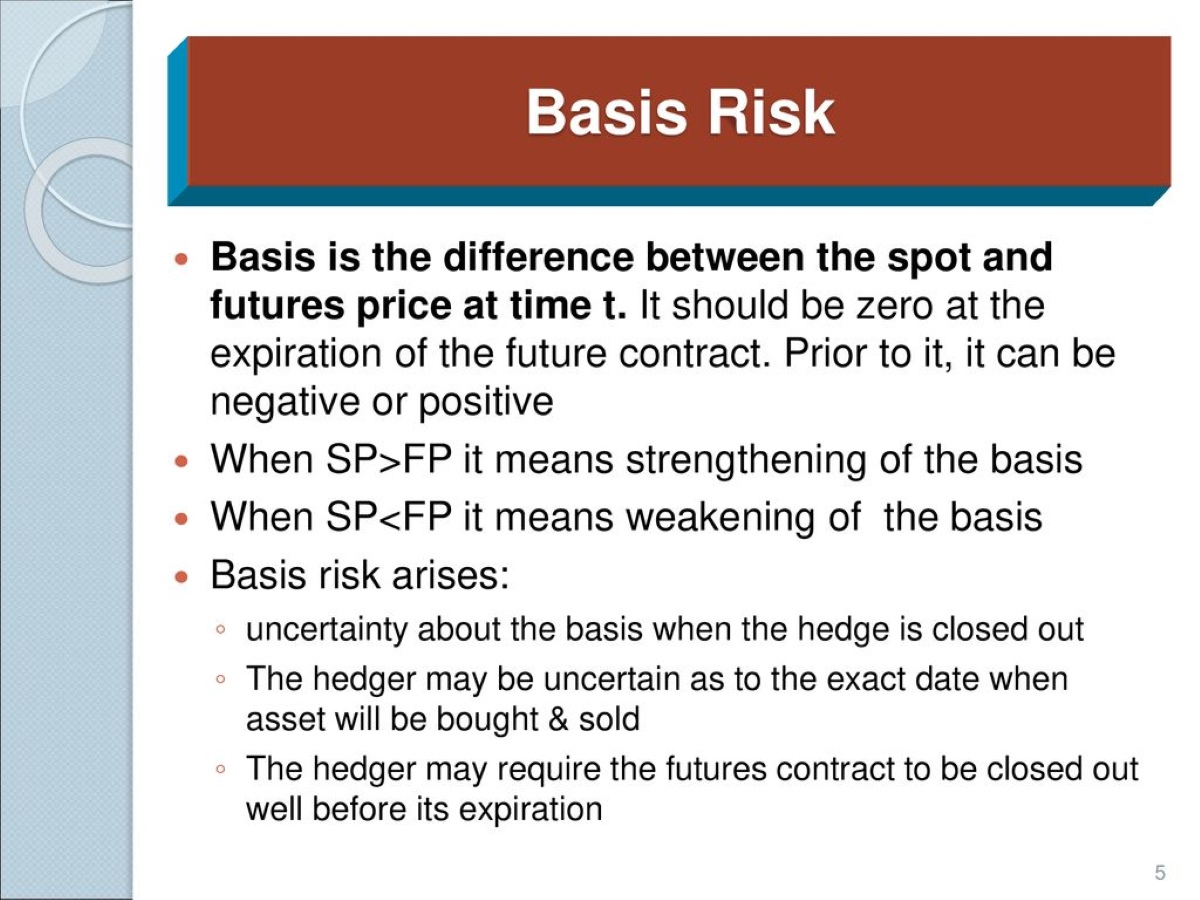

- Basis: The difference between the fixed and floating rate payments is referred to as the “basis.”

- Basis Payment: At regular intervals, the party receiving the fixed interest rate compensates the floating rate payer for the basis.

By engaging in a ZEBRA, financial institutions can mitigate their exposure to interest rate risk. The party receiving the fixed interest rate benefits if interest rates rise, as they continue to receive the higher fixed payments. Conversely, the party paying the floating rate fares better if interest rates decrease, as their payments are reduced.

Benefits of Zero Basis Risk Swaps (ZEBRAs)

ZEBRAs offer several key benefits to market participants:

- Risk Management: Financial institutions can use ZEBRAs to hedge against interest rate fluctuations, reducing their exposure to market risks.

- Liquidity Management: ZEBRAs enable institutions to manage their liquidity needs by matching fixed and floating rate obligations.

- Term Structure: ZEBRAs allow institutions to adjust the duration of their fixed or floating rate positions to align with their investment strategies or market expectations.

It’s important to note that ZEBRAs have gained popularity as a hedging tool for institutions. However, they are complex instruments that require a deep understanding of financial markets and derivatives. As such, ZEBRAs are typically utilized by sophisticated market participants.

Conclusion

Zero Basis Risk Swaps (ZEBRAs) are tools that financial institutions use to manage their exposure to interest rate risk. By exchanging fixed and floating interest rate payments, institutions can hedge against fluctuations in the market. These instruments offer risk management, liquidity management, and term structure benefits to market participants.

If you want to explore ZEBRAs further or consider incorporating them into your financial strategy, consult an experienced professional for guidance. By understanding the mechanics and potential benefits of ZEBRAs, you can make more informed decisions in your financial endeavors.