Home>Finance>Cash Flow-to-Debt Ratio: Definition, Formula, And Example

Finance

Cash Flow-to-Debt Ratio: Definition, Formula, And Example

Published: October 24, 2023

Learn about the Cash Flow-to-Debt Ratio, its definition, formula, and see an example. Enhance your understanding of finance with this essential ratio.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Cash Flow-to-Debt Ratio: Definition, Formula, and Example

Welcome to our Finance category, where we explore various financial topics to help you gain a better understanding of managing your money. Today, we will dive into the concept of the Cash Flow-to-Debt Ratio. Have you ever wondered how companies assess their ability to handle their debt obligations? This ratio is a valuable tool in analyzing a company’s financial health and its capacity to meet its debt payment obligations. Let’s break down what this ratio is, how to calculate it, and provide you with an example to illustrate its significance.

Key Takeaways:

- The Cash Flow-to-Debt Ratio helps measure a company’s ability to pay off its debt using operating cash flow.

- A higher ratio indicates a better ability to cover debt payments, while a lower ratio suggests potential financial difficulties.

What is Cash Flow-to-Debt Ratio?

The Cash Flow-to-Debt Ratio, also known as the Debt Service Coverage Ratio (DSCR), is a financial metric that highlights a company’s ability to cover its debt obligations using its operating cash flow. It is a critical tool for investors, lenders, and creditors because it provides insights into the company’s financial stability and repayment capacity.

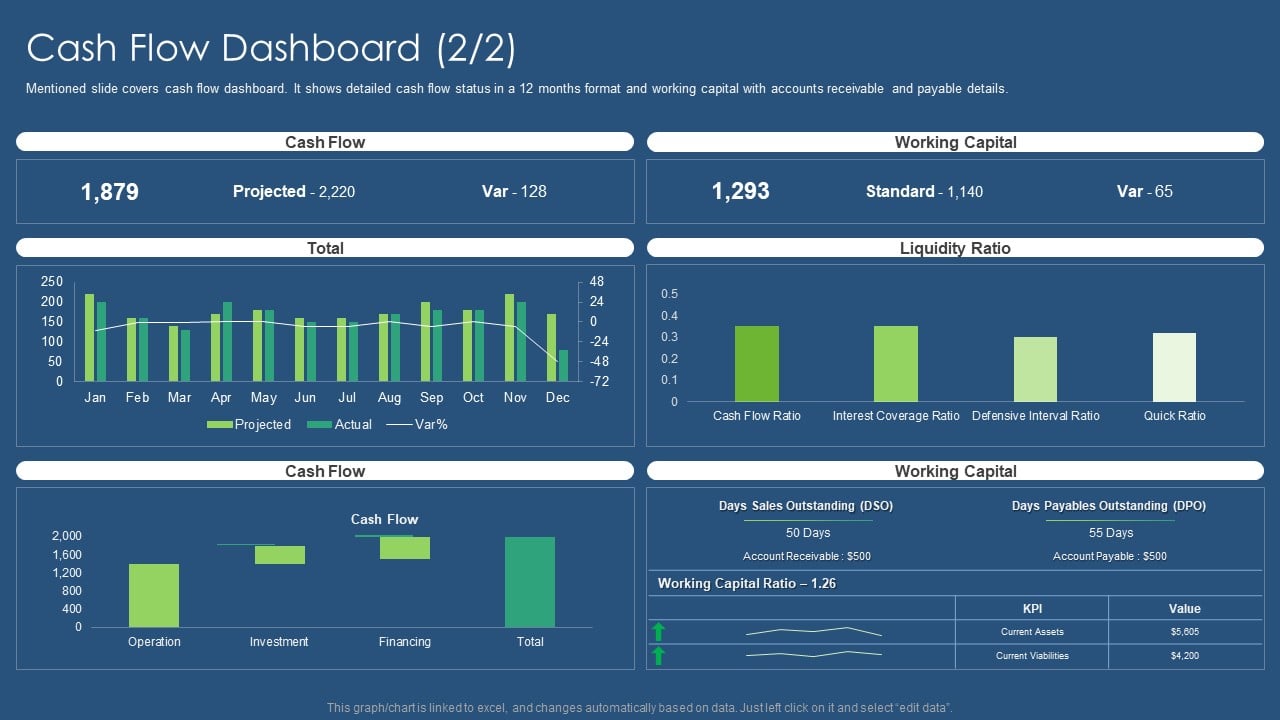

To calculate the Cash Flow-to-Debt Ratio, you need two essential financial figures: the company’s operating cash flow and its total debt. Operating cash flow refers to the amount of cash a company generates from its regular business operations, while total debt includes both short-term and long-term debt obligations.

The formula for calculating the Cash Flow-to-Debt Ratio is as follows:

Cash Flow-to-Debt Ratio = Operating Cash Flow / Total Debt

By dividing the operating cash flow by the total amount of debt, you get a ratio that indicates how many times the company’s annual operating cash flow can cover its debt obligations.

Example

Let’s say Company XYZ has an operating cash flow of $5 million and a total debt of $20 million. To determine its Cash Flow-to-Debt Ratio, we would divide the $5 million operating cash flow by the $20 million total debt:

Cash Flow-to-Debt Ratio = $5,000,000 / $20,000,000 = 0.25

In this example, Company XYZ has a Cash Flow-to-Debt Ratio of 0.25 or 25%. This means that the company’s operating cash flow is sufficient to cover only 25% of its total debt.

What does the Cash Flow-to-Debt Ratio indicate?

The Cash Flow-to-Debt Ratio serves as a financial indicator that helps assess a company’s ability to handle its debt obligations. Here’s what different values of the ratio signify:

- A ratio greater than 1 indicates that the company generates enough operating cash flow to cover its debt obligations. This is generally viewed as a positive sign, suggesting the company has a healthy financial position.

- A ratio less than 1 signifies that the company may struggle to meet its debt payments with its current cash flow. It suggests a potential risk of defaulting on debt obligations.

- Ideally, companies aim for a ratio higher than 1.2 to 1.5 to have a comfortable margin of safety when it comes to handling their debt obligations.

In conclusion

In summary, the Cash Flow-to-Debt Ratio is an essential tool for analyzing a company’s financial health and its ability to manage its debt. By calculating this ratio, investors, lenders, and creditors can make informed decisions regarding potential investments or extending credit. Remember, a higher ratio indicates a better ability to cover debt payments, while a lower ratio suggests potential financial difficulties. Employing this ratio in your analysis can provide valuable insights into a company’s financial stability and repayment capacity.

We hope this article has shed light on the Cash Flow-to-Debt Ratio and how it can be helpful in assessing a company’s financial position. Stay tuned for more informative posts on various finance-related topics!