Finance

What Is A Good Cash Flow Ratio

Published: December 20, 2023

Learn all about the cash flow ratio and its importance in finance. Find out how to calculate and interpret this key financial metric.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance, where numbers reign supreme and decisions are made based on careful analysis. One of the fundamental aspects of financial analysis is evaluating a company’s cash flow, as it provides crucial insights into its financial health and sustainability. A key tool used in this analysis is the cash flow ratio.

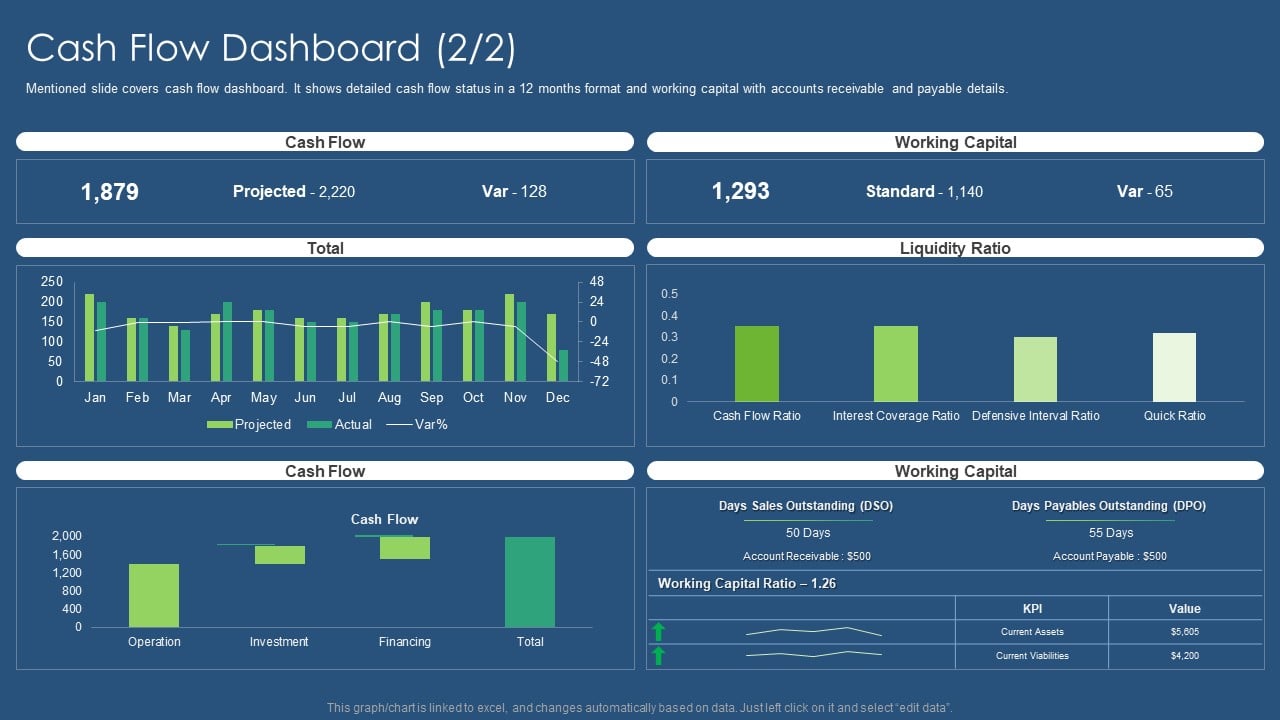

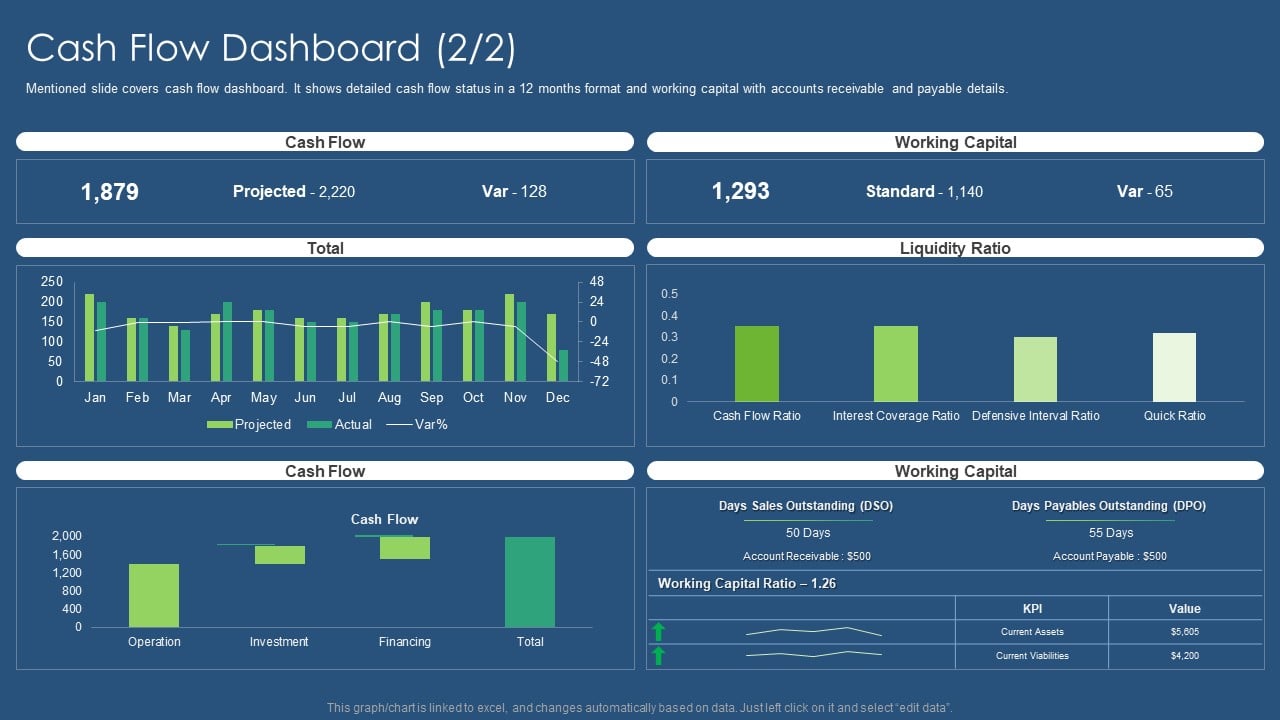

The cash flow ratio is a financial metric that measures a company’s ability to generate and manage its cash flow. It helps assess the company’s liquidity and its capacity to meet its financial obligations. By analyzing this ratio, investors, creditors, and financial analysts can gain a better understanding of a company’s financial well-being and its capacity for future growth.

Understanding cash flow ratios is essential for sound decision-making. It allows us to determine whether a company has enough cash reserves to cover its expenses, invest in growth opportunities, or sustain operations during challenging times. Investing in companies with positive cash flow ratios can provide financial stability and potential returns on investments.

In this article, we will delve into cash flow ratios, exploring their importance, calculation methods, interpretation, and examples of their application. We will also address the limitations and considerations when using cash flow ratios for analysis. So, let’s dive in and explore the world of cash flow ratios in finance.

Definition of Cash Flow Ratio

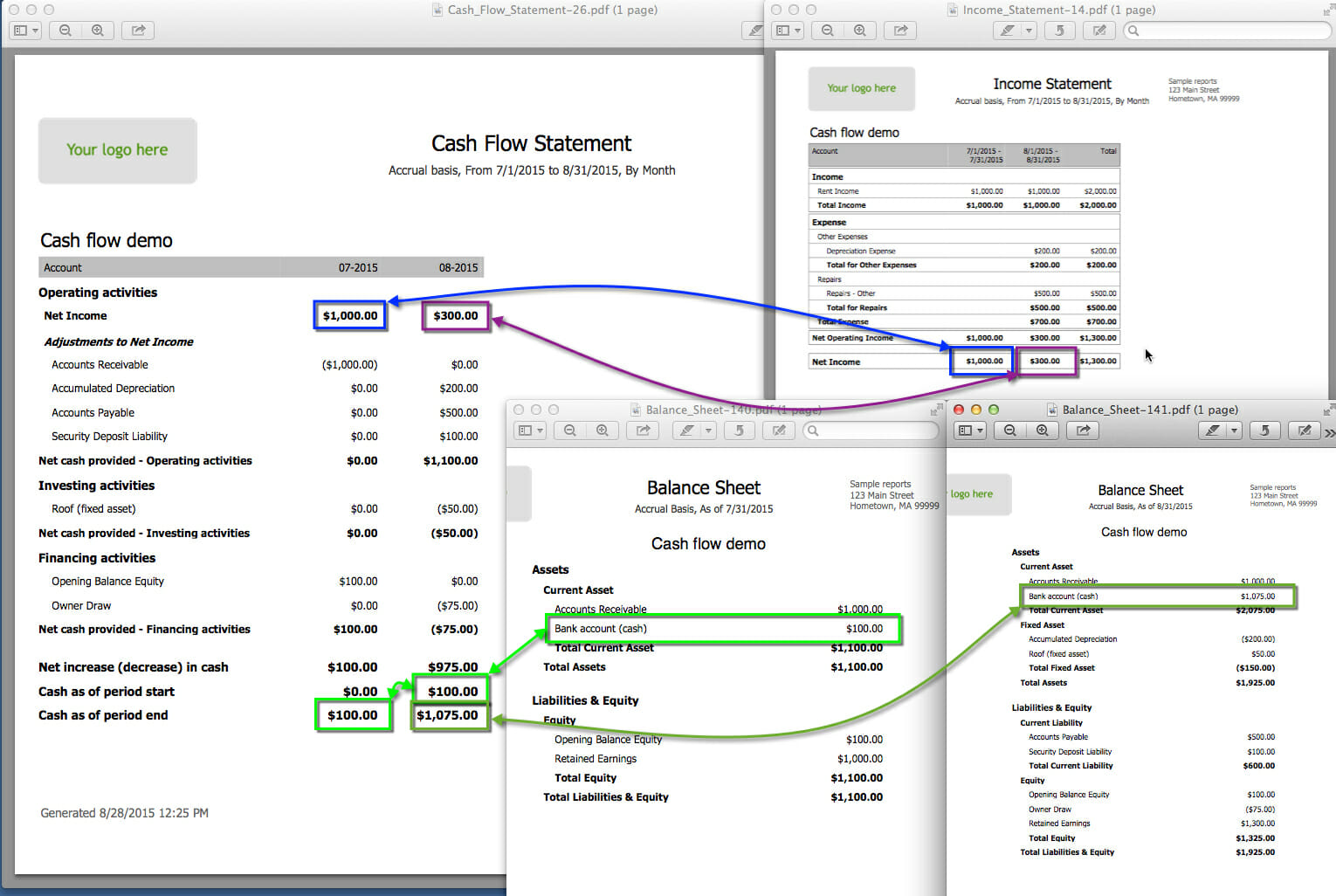

The cash flow ratio is a financial metric that provides insights into a company’s ability to generate and manage its cash flow. It measures the relationship between a company’s cash inflows and outflows, indicating its liquidity and sustainability. The ratio is calculated by dividing the company’s cash flow from operating activities by its total cash flow or its net income.

The cash flow ratio is an essential indicator of a company’s financial health. It highlights the company’s ability to generate cash through its core operations, which is crucial for meeting day-to-day expenses, debt obligations, and reinvesting in the business.

There are different types of cash flow ratios, including the operating cash flow ratio, free cash flow ratio, and cash flow coverage ratio. Each focuses on a specific aspect of a company’s cash flow and provides valuable insights into different areas of financial management.

The operating cash flow ratio measures the company’s ability to generate cash from its core operating activities. It compares the company’s cash flow from operations to its current liabilities, giving an indication of its ability to meet short-term obligations.

The free cash flow ratio, on the other hand, assesses the company’s ability to generate excess cash after accounting for capital expenditures. It compares the company’s free cash flow (operating cash flow minus capital expenditures) to its net income, indicating its capacity to invest in growth opportunities or distribute dividends.

The cash flow coverage ratio evaluates the company’s ability to cover its interest and debt obligations. It compares the company’s operating cash flow (before interest and taxes) to its interest and debt payments, providing insights into its solvency and debt management.

Overall, cash flow ratios provide a comprehensive view of a company’s cash flow position and its ability to manage financial obligations. By analyzing these ratios, investors and financial analysts can assess a company’s financial health, make informed investment decisions, and identify potential risks and opportunities.

Importance of Cash Flow Ratio

The cash flow ratio plays a vital role in financial analysis and decision-making for investors, creditors, and financial analysts. It provides valuable insights into a company’s financial health and management of cash resources. Here are some key reasons why the cash flow ratio is important:

1. Assessing Liquidity: The cash flow ratio helps determine a company’s liquidity and ability to meet its short-term obligations. It indicates whether the company has sufficient cash flow from operations to cover its current liabilities. A high cash flow ratio suggests that the company has strong liquidity and can easily meet its financial obligations, while a low ratio may indicate potential cash flow challenges.

2. Evaluating Cash Flow Management: By analyzing the cash flow ratio, investors and financial analysts can evaluate how effectively a company manages its cash flow. It provides insights into the company’s ability to generate cash from its core operations and highlights its cash flow management practices. A positive cash flow ratio indicates that the company is generating sufficient cash flow to support its operations and potential growth.

3. Financial Stability and Risk Assessment: The cash flow ratio helps assess a company’s financial stability and ability to withstand economic downturns or unexpected events. A company with a healthy cash flow ratio is more likely to have a stable financial position, making it attractive to investors and lenders. Conversely, a low cash flow ratio may raise concerns about the company’s financial stability and increase the risk of defaulting on its obligations.

4. Identifying Growth Potential: A strong cash flow ratio indicates that a company has the financial capacity to invest in growth opportunities. It shows that the company generates enough cash flow to support expansion, research and development, acquisitions, or other strategic initiatives. Evaluating the cash flow ratio can help investors identify companies with potential for long-term growth and value.

5. Comparing Performance: Cash flow ratios allow for benchmarking and comparison of a company’s performance within its industry or against its competitors. Investors and financial analysts can use these ratios to assess how a company’s cash flow performance stacks up against industry averages or similar companies. This provides valuable insights into the company’s competitive position and helps identify areas for improvement.

Overall, the cash flow ratio is a critical tool for assessing a company’s financial health, liquidity, cash flow management, and growth potential. It assists in making informed investment decisions, evaluating risk, and identifying companies with sustainable financial performance.

Calculation Methods of Cash Flow Ratio

There are several calculation methods used to determine cash flow ratios. Each method provides different insights into a company’s cash flow position and financial health. Here are some commonly used calculation methods:

1. Operating Cash Flow Ratio: This ratio measures the company’s ability to generate cash flow from its core operations. It is calculated by dividing the company’s cash flow from operations by its current liabilities. The formula is:

Operating Cash Flow Ratio = Cash Flow from Operations / Current Liabilities

2. Free Cash Flow Ratio: This ratio assesses the company’s ability to generate excess cash flow after accounting for capital expenditures. It is calculated by dividing the company’s free cash flow (operating cash flow minus capital expenditures) by its net income. The formula is:

Free Cash Flow Ratio = Free Cash Flow / Net Income

3. Cash Flow Coverage Ratio: This ratio evaluates the company’s ability to cover its interest and debt obligations. It is calculated by dividing the company’s operating cash flow (before interest and taxes) by its interest and debt payments. The formula is:

Cash Flow Coverage Ratio = Operating Cash Flow / Interest and Debt Payments

It’s important to note that these formulas can be adjusted or customized based on specific requirements and industry standards. Additionally, different variations of cash flow ratios, such as cash flow margin, cash flow per share, or cash flow return on investment, can also be calculated using different formulas.

The calculation of cash flow ratios requires accurate financial data from a company’s cash flow statement and other financial statements. These statements provide information on cash flow from operations, capital expenditures, net income, current liabilities, and interest and debt payments.

By calculating and analyzing cash flow ratios, investors and financial analysts can gain insights into a company’s cash flow position, liquidity, debt management, and growth potential. It facilitates better decision-making, risk assessment, and comparison of a company’s performance against industry benchmarks.

Interpretation of Cash Flow Ratio

Interpreting cash flow ratios is crucial in understanding a company’s financial health and making informed decisions. The interpretation of cash flow ratios involves comparing them to industry benchmarks, historical data, and the company’s own performance over time. Here are some key points to consider when interpreting cash flow ratios:

1. Operating Cash Flow Ratio: A high operating cash flow ratio indicates that the company generates sufficient cash flow from its core operations to cover its current liabilities. This suggests strong liquidity and the ability to meet short-term obligations. Conversely, a low operating cash flow ratio may indicate potential cash flow challenges and the need for closer scrutiny of the company’s revenue generation and cost management strategies.

2. Free Cash Flow Ratio: A high free cash flow ratio implies that the company has excess cash flow after accounting for capital expenditures. This suggests that the company has the ability to invest in growth opportunities, distribute dividends, or reduce debt. On the other hand, a low free cash flow ratio might indicate limited cash available for such activities or potential cash flow constraints.

3. Cash Flow Coverage Ratio: A high cash flow coverage ratio indicates that the company’s operating cash flow is sufficient to cover its interest and debt payments. This demonstrates a strong solvency position and the ability to meet financial obligations. Conversely, a low cash flow coverage ratio may signal potential difficulties in meeting debt payments and higher financial risk.

It’s important to note that interpretation of cash flow ratios should consider the company’s specific industry, business model, and growth stage. Comparing the ratios to industry benchmarks or similar companies can provide additional context for interpretation.

Furthermore, it’s essential to analyze the trend of cash flow ratios over time. Consistent improvement or stability in the ratios indicates positive financial management and sustained cash flow generation. In contrast, a declining trend may raise concerns and require further investigation into the company’s cash flow position and management practices.

Lastly, it’s crucial to consider other financial factors and metrics in conjunction with cash flow ratios. Cash flow ratios provide insights into a company’s liquidity and cash flow management, but they should be evaluated alongside profitability, growth prospects, debt levels, and other financial indicators to form a comprehensive assessment of the company’s overall financial health.

In summary, interpreting cash flow ratios involves comparing them to industry benchmarks, historical data, and considering the company’s financial context. It requires a holistic analysis of the company’s financial position and an understanding of the factors that can impact cash flow. This interpretation aids in making well-informed decisions regarding investments, lending, and evaluating a company’s overall financial health.

Examples of Cash Flow Ratio Analysis

Let’s take a look at a couple of examples to illustrate how cash flow ratio analysis can provide insights into a company’s financial health and aid in decision-making:

Example 1: Company A

- Operating Cash Flow: $500,000

- Current Liabilities: $300,000

- Net Income: $400,000

In this example, the operating cash flow ratio can be calculated as follows:

Operating Cash Flow Ratio = $500,000 / $300,000 = 1.67

The operating cash flow ratio of 1.67 indicates that Company A generates $1.67 of operating cash flow for every dollar of current liabilities. This suggests that the company has strong liquidity and is able to cover its short-term obligations adequately.

Example 2: Company B

- Free Cash Flow: $200,000

- Net Income: $300,000

The free cash flow ratio for Company B can be calculated as:

Free Cash Flow Ratio = $200,000 / $300,000 = 0.67

In this example, the free cash flow ratio of 0.67 indicates that Company B generates $0.67 of free cash flow for every dollar of net income. This implies that the company has limited cash flow available for investment in growth opportunities or distribution to shareholders.

These examples demonstrate how cash flow ratio analysis can provide meaningful insights into a company’s financial position. The ratios help investors and financial analysts assess a company’s liquidity, cash flow management, and potential for growth. By comparing the ratios to industry benchmarks or historical data, stakeholders can make informed decisions about investment opportunities, lending practices, and risk assessments.

It’s important to note that cash flow ratio analysis should be performed in conjunction with a comprehensive evaluation of other financial and non-financial factors. A holistic assessment, considering profitability, debt levels, industry trends, and management strategies, will provide a more accurate understanding of a company’s financial health and prospects.

Limitations of Cash Flow Ratio Analysis

While cash flow ratio analysis provides valuable insights into a company’s financial health, it is important to acknowledge its limitations. Here are some key limitations to consider:

1. Timing of Cash Flows: Cash flow ratios represent a snapshot of a company’s financial position at a specific point in time. They do not account for the timing of cash inflows and outflows, which can vary significantly throughout a company’s operating cycle. As a result, cash flow ratios may not provide a complete picture of a company’s cash flow management over a longer period.

2. Volatility of Cash Flows: Cash flow ratios can be influenced by fluctuations in cash flows, particularly for companies in volatile industries or with irregular cash flow patterns. Certain events, such as seasonality or one-time transactions, can distort the ratios temporarily and may not accurately reflect the company’s overall financial stability.

3. Industry Comparisons: While comparing cash flow ratios to industry benchmarks can provide useful insights, it is important to consider that different industries have different cash flow dynamics. Ratios that are considered healthy in one industry may not be appropriate for another. It is essential to take industry-specific factors into account when interpreting cash flow ratios.

4. Lack of Contextual Information: Cash flow ratios alone do not provide a comprehensive understanding of a company’s financial health. They need to be assessed alongside other financial indicators, such as profitability ratios, debt levels, and market trends. Contextual information about the company’s industry, competitive landscape, and strategic initiatives is crucial for a holistic analysis.

5. Manipulation Potential: Similar to other financial ratios, cash flow ratios can be subject to manipulation. Companies may engage in aggressive accounting practices or use non-operational activities to inflate their cash flow ratios temporarily. Therefore, it is important to conduct thorough due diligence and analyze cash flow ratios in conjunction with other financial statements.

6. Lack of Future Predictability: Cash flow ratios provide insights into past and present cash flow performance but do not guarantee future cash flows. Changes in market conditions, customer behavior, or macroeconomic factors can significantly impact a company’s cash flow position, even if its historical ratios are strong. It is crucial to incorporate forward-looking analysis and scenario planning when assessing a company’s future cash flow prospects.

Despite these limitations, cash flow ratio analysis remains a valuable tool for evaluating a company’s financial health and liquidity. By understanding these limitations and conducting a comprehensive analysis, investors, creditors, and financial analysts can make more informed decisions based on a holistic understanding of the company’s financial position.

Conclusion

Cash flow ratio analysis serves as a critical tool for evaluating a company’s financial health, liquidity, and cash flow management. By assessing the relationship between cash inflows and outflows, these ratios provide valuable insights into a company’s ability to meet short-term obligations, invest in growth opportunities, and sustain operations.

Throughout this article, we explored the definition of cash flow ratios, their importance, calculation methods, interpretation, examples, and limitations. We learned that the operating cash flow ratio, free cash flow ratio, and cash flow coverage ratio are commonly used metrics that provide different perspectives on a company’s cash flow performance.

We also discussed the significance of comparing these ratios to industry benchmarks, historical data, and considering the company’s specific context. By conducting a holistic analysis and incorporating other financial and non-financial factors, investors, creditors, and financial analysts can make well-informed decisions and assess a company’s overall financial health.

While cash flow ratio analysis has its limitations, such as the timing and volatility of cash flows, industry comparisons, and the lack of future predictability, it remains a valuable tool when used alongside other financial indicators. By understanding these limitations and conducting thorough due diligence, stakeholders can gain a deeper understanding of a company’s cash flow position and make more informed decisions.

In conclusion, cash flow ratio analysis is an integral part of financial analysis and decision-making processes. It aids in assessing a company’s liquidity, cash flow management, and potential for growth. By leveraging these insights, investors and financial analysts can identify opportunities, manage risks, and make informed choices to drive financial success.