Finance

How To Calculate Price To Cash Flow Ratio

Modified: December 29, 2023

Learn how to calculate the Price to Cash Flow ratio in finance. Gain insights into evaluating investment opportunities and making informed decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Price to Cash Flow Ratio

- Importance of Price to Cash Flow Ratio

- Calculation of Price to Cash Flow Ratio

- Interpreting the Price to Cash Flow Ratio

- Advantages of Using Price to Cash Flow Ratio

- Limitations of Price to Cash Flow Ratio

- Examples of Price to Cash Flow Ratio Calculation

- Conclusion

Introduction

When it comes to evaluating the financial health and investment potential of a company, there are numerous metrics and ratios to consider. One such ratio that is widely used by investors and analysts is the Price to Cash Flow (P/CF) ratio.

The Price to Cash Flow ratio is a valuation metric that helps investors assess the relationship between a company’s stock price and its cash flow. It provides insights into the market’s perception of a company’s cash-generating ability and can be a valuable tool for making informed investment decisions.

In simple terms, the P/CF ratio compares a company’s market capitalization (the total value of its outstanding shares) to its cash flow from operations. This ratio helps investors determine whether a stock is overvalued or undervalued based on its ability to generate cash.

Unlike the Price to Earnings (P/E) ratio, which uses earnings per share (EPS) as a measure of profitability, the P/CF ratio focuses on cash flow. This is because cash flow can be a more reliable indicator of a company’s financial strength as it reflects the actual cash generated by its operations.

Throughout this article, we will explore the definition, calculation, interpretation, advantages, and limitations of the Price to Cash Flow ratio. We will also provide examples of how it can be calculated and analyzed to aid in investment decisions.

If you’re ready to gain a solid understanding of this important valuation metric and how it can impact your investment strategy, let’s dive into the world of the Price to Cash Flow ratio.

Definition of Price to Cash Flow Ratio

The Price to Cash Flow (P/CF) ratio is a financial metric used to evaluate a company’s valuation by comparing its stock price to its cash flow from operations. It is calculated by dividing the market capitalization of a company by its cash flow from operations.

In simple terms, the P/CF ratio measures how much investors are willing to pay for each dollar of cash flow generated by a company. It provides insights into the market’s assessment of a company’s ability to generate cash and can be used to identify potentially undervalued or overvalued stocks.

Unlike the traditional Price to Earnings (P/E) ratio, which focuses on a company’s profitability, the P/CF ratio concentrates on cash flow. Cash flow is the cash generated or consumed by a company’s operating activities, providing a clearer picture of its financial health.

When the P/CF ratio is low, it suggests that investors are paying less for each dollar of cash flow, indicating a potentially undervalued stock. Conversely, a high P/CF ratio implies that investors are willing to pay a premium for each dollar of cash flow, which may indicate an overvalued stock.

It’s important to note that the interpretation of the P/CF ratio can vary depending on several factors such as industry norms, growth prospects, and economic conditions. A comprehensive analysis of other financial metrics and qualitative factors is essential to gain a complete understanding of a company’s financial position.

By incorporating the P/CF ratio into the investment analysis process, investors can gain insights into a company’s ability to generate cash and make more informed investment decisions.

Importance of Price to Cash Flow Ratio

The Price to Cash Flow (P/CF) ratio is an important valuation metric for investors and analysts. It provides valuable insights into a company’s ability to generate cash and its overall financial health. Here are some key reasons why the P/CF ratio is important:

1. Assessing Valuation: The P/CF ratio helps investors assess whether a stock is overvalued or undervalued by examining the relationship between the stock price and the company’s cash flow. A low P/CF ratio suggests that the stock may be undervalued, presenting a potential buying opportunity. Conversely, a high P/CF ratio may indicate an overvalued stock, signaling a potential selling opportunity.

2. Focusing on Cash Flow: Unlike other valuation ratios such as the Price to Earnings (P/E) ratio, which focuses on earnings, the P/CF ratio emphasizes cash flow. This is crucial because cash flow represents the actual cash generated by a company’s operations and is a more reliable indicator of its ability to sustain and grow its business.

3. Deterring Earnings Manipulation: Companies can manipulate their earnings through various accounting techniques, but it is more challenging to manipulate cash flow. By considering a company’s cash flow, the P/CF ratio provides a clearer picture of its financial performance, reducing the impact of potential earnings manipulation.

4. Comparing Companies: The P/CF ratio allows for the comparison of companies across different industries and sizes. Since cash flow is less influenced by accounting practices and industry-specific factors, the P/CF ratio enables investors to compare the relative attractiveness of companies in various sectors.

5. Identifying Growth Opportunities: A low P/CF ratio may indicate an undervalued stock with growth potential. In some cases, investors may identify companies with strong cash flow generation that are currently undervalued by the market, presenting an opportunity to invest in potential growth stocks.

6. Evaluating Investment Risks: The P/CF ratio can help investors evaluate the risk associated with a stock. A high P/CF ratio may suggest that investors are paying a premium for each dollar of cash flow, potentially increasing the risk if the projected cash flow does not materialize.

7. Long-Term Investment Perspective: The P/CF ratio is particularly useful for long-term investors who focus on the fundamental qualities of a company. By considering the cash flow generated by a company, long-term investors can make more informed decisions about the potential returns and stability of their investments.

Overall, the P/CF ratio provides a valuable perspective on a company’s financial health and valuation. By incorporating this ratio into their analysis, investors can gain insights that support more informed investment decisions.

Calculation of Price to Cash Flow Ratio

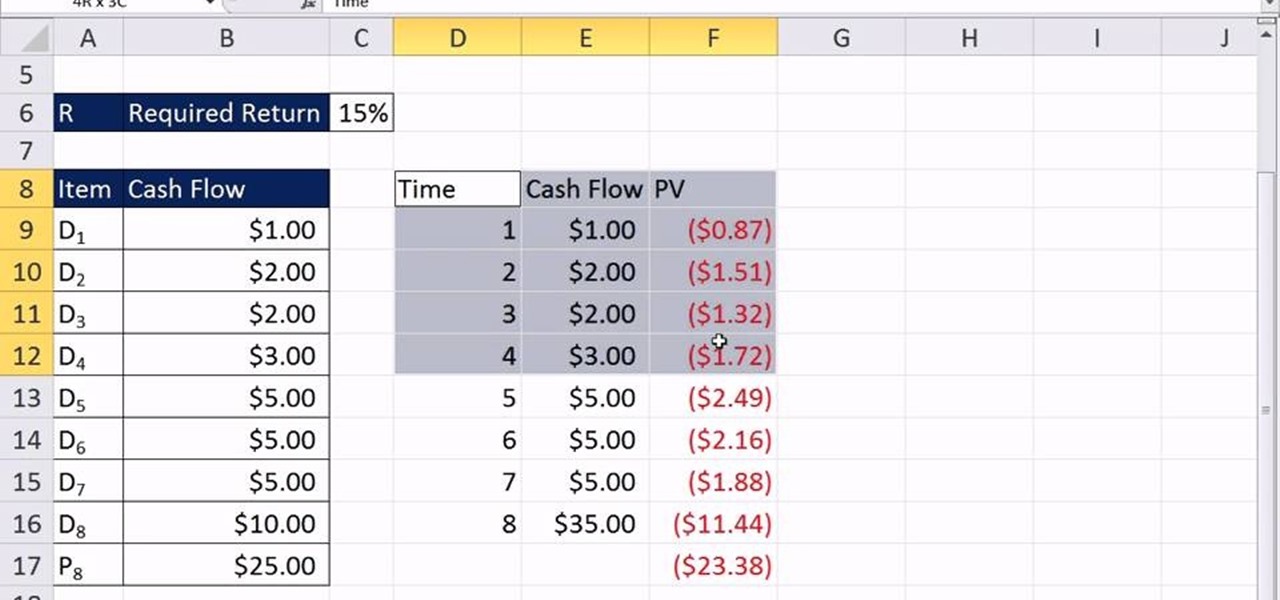

The Price to Cash Flow (P/CF) ratio is calculated by dividing a company’s market capitalization (the total value of its outstanding shares) by its cash flow from operations. The formula for calculating the P/CF ratio is as follows:

P/CF Ratio = Market Capitalization / Cash Flow from Operations

To calculate the P/CF ratio, follow these steps:

- Step 1: Obtain the market capitalization of the company. Market capitalization is calculated by multiplying the current stock price by the number of outstanding shares.

- Step 2: Determine the cash flow from operations for the specified period. The cash flow from operations can usually be found in the company’s financial statements, specifically in the statement of cash flows.

- Step 3: Divide the market capitalization by the cash flow from operations to get the P/CF ratio.

It’s important to note that the P/CF ratio can be calculated and analyzed on different time frames, such as annual or quarterly data, depending on the investor’s preference and the availability of financial statements.

Additionally, the P/CF ratio can be calculated on a per-share basis by dividing the market capitalization by the cash flow per share. This allows for a more precise comparison between companies with varying numbers of shares outstanding.

Keep in mind that the P/CF ratio should be used in conjunction with other financial metrics and qualitative factors to gain a comprehensive understanding of a company’s financial position and investment potential.

By utilizing the P/CF ratio in investment analysis, investors can evaluate a company’s valuation in relation to its cash flow generation, helping them make more informed decisions about potential investments.

Interpreting the Price to Cash Flow Ratio

The Price to Cash Flow (P/CF) ratio provides valuable insights into a company’s valuation and financial health. Interpreting the P/CF ratio involves considering the following factors:

1. Undervalued or Overvalued: A low P/CF ratio suggests the stock may be undervalued, indicating that investors are paying less for each dollar of cash flow generated by the company. Conversely, a high P/CF ratio may suggest that the stock is overvalued, indicating that investors are willing to pay a premium for each dollar of cash flow.

2. Industry Comparison: It’s important to compare the P/CF ratio to the average ratio within the industry. A lower P/CF ratio compared to its industry peers may indicate a potentially undervalued stock, while a higher ratio may suggest an overvalued stock.

3. Historical Trend: Analyzing the trend of a company’s P/CF ratio over time can provide insights into its financial performance and potential changes in valuation. Significant changes in the P/CF ratio may signify shifts in investor sentiment or changes in the company’s cash flow generation.

4. Growth Prospects: When evaluating the P/CF ratio, consider the company’s growth prospects. A low P/CF ratio combined with strong growth prospects may indicate an attractive investment opportunity, as the company has the potential to generate higher cash flows in the future.

5. Cash Flow Stability: Assess the stability and consistency of a company’s cash flow when interpreting the P/CF ratio. A company with stable and predictable cash flows typically receives a higher valuation and a higher P/CF ratio. On the other hand, a company with irregular or volatile cash flows may have a lower P/CF ratio.

6. Comparison to Other Valuation Ratios: Consider the P/CF ratio in conjunction with other valuation ratios, such as the Price to Earnings (P/E) ratio or the Price to Sales (P/S) ratio, to gain a more comprehensive view of the company’s valuation. Different ratios provide different perspectives on a company’s financial health.

It’s essential to remember that the interpretation of the P/CF ratio should be context-specific and consider other relevant factors. A comprehensive analysis of the company’s financial statements, industry dynamics, competitive position, and future prospects is crucial in making informed investment decisions.

Ultimately, the P/CF ratio is a tool to help investors assess the market’s perception of a company’s cash flow generation. Integration of the P/CF ratio within a broader investment analysis framework can provide valuable insights into a company’s valuation and support decision-making processes.

Advantages of Using Price to Cash Flow Ratio

The Price to Cash Flow (P/CF) ratio is a valuable metric that offers several advantages for investors and analysts. Let’s explore some of the key advantages of using the P/CF ratio:

1. Focuses on Cash Flow: The P/CF ratio emphasizes a company’s cash flow rather than its earnings. Cash flow represents the actual cash generated by a company and is less prone to manipulation than earnings. This focus on cash flow provides a more accurate measure of a company’s financial health and ability to generate sustainable cash flows.

2. Considers Operating Activities: The P/CF ratio considers cash flow from operations, which reflects the core business activities of a company. By focusing on operating cash flow, the P/CF ratio provides insights into the cash-generating capability of a company’s primary operations and helps assess its financial fundamentals.

3. Less Affected by Accounting Assumptions: Unlike other valuation metrics, such as the Price to Earnings (P/E) ratio, the P/CF ratio is less influenced by accounting assumptions and practices. Cash flow is a more objective measure and is less likely to be distorted by accounting techniques, providing a clearer view of a company’s financial performance.

4. Cross-Industry Comparisons: The P/CF ratio allows for meaningful comparisons of companies across different industries and sectors. Since cash flow is more universal and less influenced by industry-specific factors, the P/CF ratio enables investors to compare companies on a level playing field and identify potential investment opportunities across industries.

5. Indicates Relative Value: The P/CF ratio indicates the relative value of a stock compared to its cash flow generation. A low P/CF ratio suggests that a stock may be undervalued, as investors are paying less for each dollar of cash flow. Conversely, a high P/CF ratio may indicate an overvalued stock, as investors are willing to pay a premium for each unit of cash flow.

6. Highlights Cash Flow Stability: Analyzing the P/CF ratio can help identify companies with stable and consistent cash flow generation. A company with a steady cash flow history and a low P/CF ratio may be appealing to investors seeking stability and predictability in their investments.

7. Supplementary Tool for Investment Decisions: The P/CF ratio is a useful tool for investors to support their investment decisions. By incorporating the P/CF ratio alongside other financial metrics, qualitative analysis, and a comprehensive understanding of the company’s industry dynamics, investors can make more informed investment choices.

While the P/CF ratio provides valuable insights, it should not be the sole determinant of an investment decision. It is essential to consider other factors, such as a company’s growth prospects, competitive position, and overall market conditions, to gain a comprehensive view of its investment potential.

By leveraging the advantages of the P/CF ratio, investors can effectively evaluate companies, identify potential investment opportunities, and make informed decisions to achieve their financial goals.

Limitations of Price to Cash Flow Ratio

While the Price to Cash Flow (P/CF) ratio is a valuable metric for assessing a company’s valuation, it is important to be aware of certain limitations when utilizing this ratio. Here are some key limitations:

1. Excludes Non-Cash Items: The P/CF ratio only considers cash flow from operations, excluding non-cash items such as depreciation, amortization, and non-operating activities. As a result, the P/CF ratio may not provide a comprehensive picture of a company’s overall financial performance and potential cash flow sources.

2. Ignores Capital Expenditures: The P/CF ratio does not account for capital expenditures (CapEx) necessary for a company to maintain and grow its operations. CapEx can significantly impact a company’s ability to generate future cash flows and should be considered alongside the P/CF ratio.

3. Ignores Timing of Cash Flows: The P/CF ratio does not consider the timing of cash flows, making it difficult to assess the sustainability and predictability of a company’s cash flow generation. It’s important to examine a company’s historical cash flow trends and future cash flow projections to gain a better understanding of its cash flow stability.

4. Industry-Specific Variations: Different industries have varying capital structures, growth rates, and cash flow characteristics. Comparing P/CF ratios across industries may not provide accurate insights due to these industry-specific variations.

5. Limited by Interpretation: The interpretation of the P/CF ratio can be subjective and dependent on the investor’s perspective. A low P/CF ratio may indicate an undervalued stock to one investor, while another investor may view it as a sign of poor growth prospects or financial distress. It is critical to consider other financial metrics and qualitative factors when interpreting the P/CF ratio.

6. Does Not Account for Debt and Equity Structure: The P/CF ratio does not consider a company’s debt and equity structure. Companies with high debt levels may have significant interest expenses, which can impact their cash flow generation and sustainability. Analyzing a company’s debt-to-equity ratio in conjunction with the P/CF ratio can provide a more comprehensive assessment of its financial health.

7. Short-Term Focus: The P/CF ratio is primarily a short-term valuation metric and may not be suitable for evaluating long-term investments. Longer-term factors such as industry trends, competitive advantages, and growth prospects should also be considered alongside the P/CF ratio to make informed long-term investment decisions.

While the P/CF ratio has limitations, it is still a valuable tool when used in conjunction with other financial metrics and qualitative analysis. By considering these limitations, investors can make more well-rounded assessments of a company’s valuation and financial health.

Examples of Price to Cash Flow Ratio Calculation

Let’s explore a couple of examples to illustrate how the Price to Cash Flow (P/CF) ratio is calculated:

Example 1:

Company XYZ has a market capitalization of $500 million and a cash flow from operations of $100 million. To calculate the P/CF ratio:

P/CF Ratio = Market Capitalization / Cash Flow from Operations

P/CF Ratio = $500 million / $100 million

P/CF Ratio = 5x

In this example, the P/CF ratio is 5x, indicating that investors are willing to pay 5 times the company’s cash flow from operations for each unit of its stock.

Example 2:

Company ABC has a market capitalization of $1 billion and a cash flow from operations of $50 million. To calculate the P/CF ratio:

P/CF Ratio = Market Capitalization / Cash Flow from Operations

P/CF Ratio = $1 billion / $50 million

P/CF Ratio = 20x

In this example, the P/CF ratio is 20x, indicating that investors are willing to pay 20 times the company’s cash flow from operations for each unit of its stock.

These examples showcase how the P/CF ratio is calculated by dividing the market capitalization by the cash flow from operations. The resulting ratio indicates the number of times investors are willing to pay for each unit of cash flow generated by the company.

It’s important to note that the interpretation of these ratios is subjective and requires analysis in the context of industry benchmarks, historical trends, and other financial metrics. Additionally, different industries may have different average P/CF ratio ranges due to varying cash flow characteristics and growth prospects.

By calculating and analyzing the P/CF ratio, investors can gain insights into the market’s perception of a company’s cash flow generation and make informed decisions about its valuation.

Conclusion

The Price to Cash Flow (P/CF) ratio is a valuable tool for investors and analysts to assess a company’s valuation and financial health. By comparing a company’s market capitalization to its cash flow from operations, the P/CF ratio provides insights into the market’s perception of a company’s ability to generate cash.

Throughout this article, we discussed the definition of the P/CF ratio and its importance in evaluating investment opportunities. We explored the calculation of the ratio, its interpretation, and the advantages it offers in investment analysis. It is crucial to consider the limitations of the P/CF ratio and to complement its usage with other financial metrics and qualitative analysis.

The P/CF ratio allows investors to make meaningful comparisons between stocks, identify potentially undervalued or overvalued investments, and evaluate a company’s cash flow generating ability. By incorporating the P/CF ratio into their analysis, investors can gain insights into a company’s financial health and make more informed investment decisions.

However, it’s important to remember that the P/CF ratio is just one piece of the puzzle. A comprehensive investment analysis should consider other financial metrics, industry dynamics, competitive positioning, and qualitative factors to gain a complete understanding of a company’s investment potential.

In conclusion, the P/CF ratio provides a snapshot of a company’s valuation based on its cash flow generation. By utilizing this ratio alongside other investment tools, investors can build a more comprehensive view of a company’s financial position and make informed decisions to achieve their investment goals. The P/CF ratio serves as a guide in the complex world of investment, helping investors navigate the market with greater confidence.