Home>Finance>Price-to-Cash Flow (P/CF) Ratio? Definition, Formula, And Example

Finance

Price-to-Cash Flow (P/CF) Ratio? Definition, Formula, And Example

Published: January 11, 2024

Learn about the Price-to-Cash Flow (P/CF) ratio in finance. Understand its definition, formula, and example. Discover its importance in evaluating investment opportunities.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Price-to-Cash Flow (P/CF) Ratio – Definition, Formula, and Example

Welcome to our Finance category! Today, we’ll be diving into the fascinating world of financial analysis with a focus on the Price-to-Cash Flow (P/CF) ratio. If you’ve ever wondered how investors evaluate a company’s cash flow in relation to its stock price, you’re in the right place. In this blog post, we will explore the definition, formula, and provide an example of the P/CF ratio to help you better understand its significance in financial analysis.

Key Takeaways:

- The Price-to-Cash Flow (P/CF) ratio is a valuation metric used by investors to assess a company’s health and determine if its stock is overvalued or undervalued.

- The P/CF ratio compares a company’s market price per share to its cash flow per share, providing insights into the company’s ability to generate positive cash flows relative to its stock price.

What is the Price-to-Cash Flow (P/CF) Ratio?

The Price-to-Cash Flow (P/CF) ratio is a financial metric that measures the relationship between a company’s stock price and its cash flow. It provides investors with a snapshot of how much they are paying for each unit of the company’s cash flows.

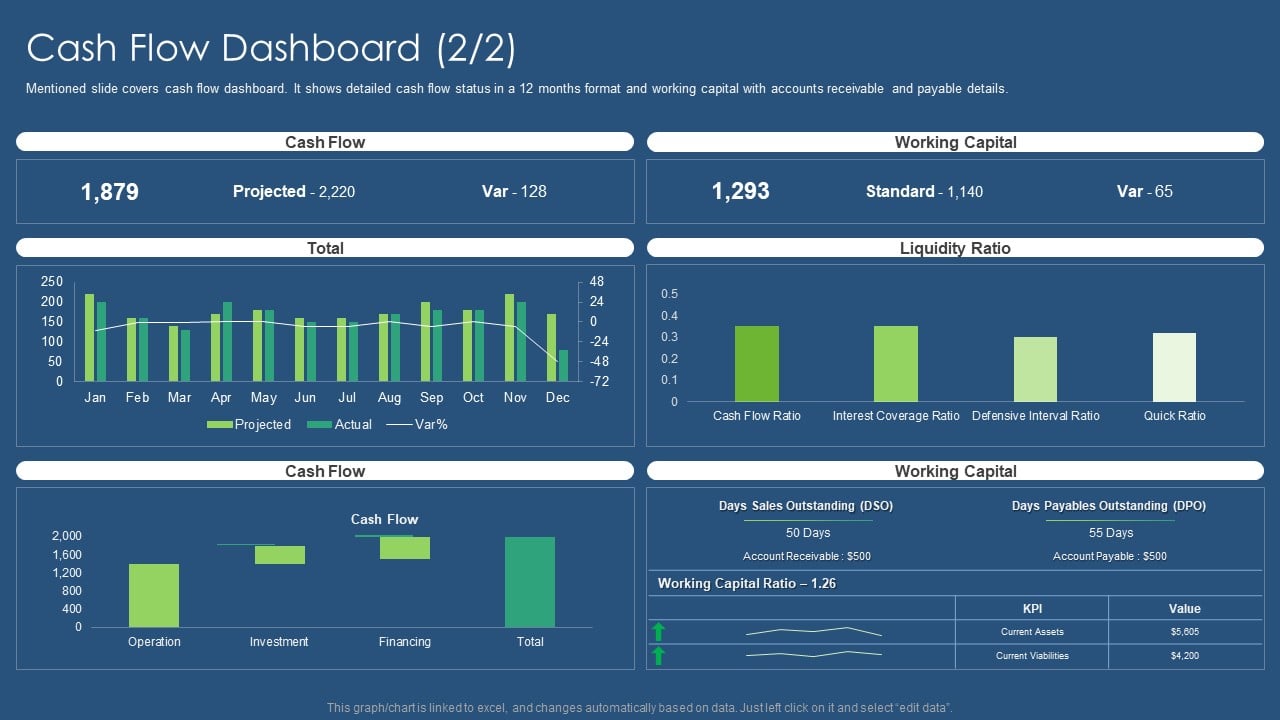

This ratio is often used in conjunction with other valuation metrics to evaluate a company’s financial performance and determine its investment potential. By comparing the P/CF ratio to historical data and industry benchmarks, investors can gain insights into a company’s profitability, operating efficiency, and overall financial health.

Calculating the Price-to-Cash Flow (P/CF) Ratio

To calculate the P/CF ratio, you will need two key pieces of information: the company’s market price per share and its cash flow per share. The formula for the P/CF ratio is as follows:

P/CF Ratio = Market Price per Share / Cash Flow per Share

It’s important to note that the cash flow per share can be calculated using the company’s net income plus non-cash expenses, such as depreciation and amortization.

Example of the Price-to-Cash Flow (P/CF) Ratio

Let’s consider a hypothetical company, ABC Inc., which has a market price per share of $50 and a cash flow per share of $5. Using the formula mentioned above, we can calculate ABC Inc.’s P/CF ratio as:

P/CF Ratio = $50 / $5 = 10

In this example, ABC Inc.’s P/CF ratio is 10, indicating that investors are paying 10 times the company’s cash flow per share to own its stock. By comparing this ratio to industry peers or historical data, investors can determine if ABC Inc.’s stock is trading at a relatively higher or lower valuation.

Conclusion

The Price-to-Cash Flow (P/CF) ratio is a valuable tool in financial analysis, offering insights into a company’s financial health and its stock’s valuation. By understanding how it is calculated and interpreting the ratio in the context of industry benchmarks, investors can make more informed decisions when evaluating potential investment opportunities.

Remember, the P/CF ratio is just one of many metrics used in financial analysis, and it should be considered alongside other important factors, such as a company’s revenue growth, profitability, and debt levels, to paint a comprehensive picture of its investment potential.

We hope this blog post has provided you with a solid understanding of the Price-to-Cash Flow (P/CF) ratio. Stay tuned for more insightful articles on finance and don’t forget to check out our other blog posts in the Finance category.