Finance

How To Cancel Express Credit Card

Published: November 4, 2023

Learn how to cancel your Express Credit Card and manage your finances effectively. Take control of your financial future with our step-by-step guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to our guide on how to cancel an Express credit card. Whether you have found a better credit card option or simply no longer need a credit card, cancelling your Express credit card is a straightforward process that can be done with just a few simple steps. In this article, we’ll walk you through the necessary steps to ensure a smooth cancellation process, while also providing you with some important information to keep in mind.

Express credit cards offer customers various benefits, including reward points for every purchase made with the card. However, if you have decided that it’s time to close your account, it’s essential to follow the proper procedures in order to avoid any potential issues or fees.

Before we delve into the specific steps of cancelling your Express credit card, it’s important to note that closing a credit card can have an impact on your credit score, especially if it’s one of your older accounts. However, if you have made up your mind and are certain about cancelling your Express credit card, follow the steps below to ensure a smooth and hassle-free process.

Please keep in mind that the specific steps may vary depending on the issuer of your Express credit card. Always refer to the terms and conditions provided by Express or contact their customer service for any additional information or requirements.

Step 1: Contact Customer Service

The first step in cancelling your Express credit card is to contact the customer service department. This is typically the most efficient and direct way to initiate the cancellation process. You can find the customer service contact information on the back of your credit card, on your monthly statements, or on the Express website.

When contacting customer service, be prepared to provide your account information, such as your credit card number and any relevant personal details. This will help expedite the process and ensure that you are speaking with the appropriate representative who can assist you with cancelling your Express credit card.

It is important to note that some credit card issuers may require you to provide a reason for cancelling your card. While this information is typically not mandatory, providing truthful feedback can help them improve their services and products.

Remember to stay calm and patient throughout the call, as the customer service representative may try to persuade you to keep your account open or provide alternative solutions. Politely but firmly reiterate your desire to cancel the card.

Lastly, keep track of the date and time of your call, as well as the name and ID of the representative you spoke with. This information may come in handy if you encounter any issues later on or need to follow up on the cancellation process.

Step 2: Prepare Necessary Information

Before proceeding with the cancellation of your Express credit card, it is essential to gather all the necessary information to ensure a smooth and efficient process. Having these details on hand will help expedite the cancellation and prevent any potential delays.

Here are the key pieces of information you should gather:

- Your Express credit card number: This is the unique identification number associated with your card. It can typically be found on the front of your card.

- Your personal information: This includes your full name, address, phone number, and any other details that the customer service representative may require to verify your identity.

- Your account balance: Make note of any outstanding balances on your credit card. It is important to ensure that you have settled all pending payments before cancelling your card.

- Rewards and benefits: If you have accumulated any rewards points or are entitled to any special benefits or discounts, take note of them. It’s important to inquire about the status of these rewards and benefits during the cancellation process.

By having all the necessary information readily available, you will be well-prepared to provide the customer service representative with the details they need to process your credit card cancellation smoothly.

Additionally, it is advisable to review the terms and conditions of your Express credit card. Pay attention to any potential cancellation fees, as some credit cards may impose charges for closing an account before a certain time period has elapsed. Being aware of these potential fees will help you make an informed decision about cancelling your Express credit card.

Step 3: Request Card Cancellation

Once you have contacted customer service and gathered all the necessary information, it’s time to formally request the cancellation of your Express credit card. During your conversation with the customer service representative, clearly state your intention to cancel the card and provide them with the required information.

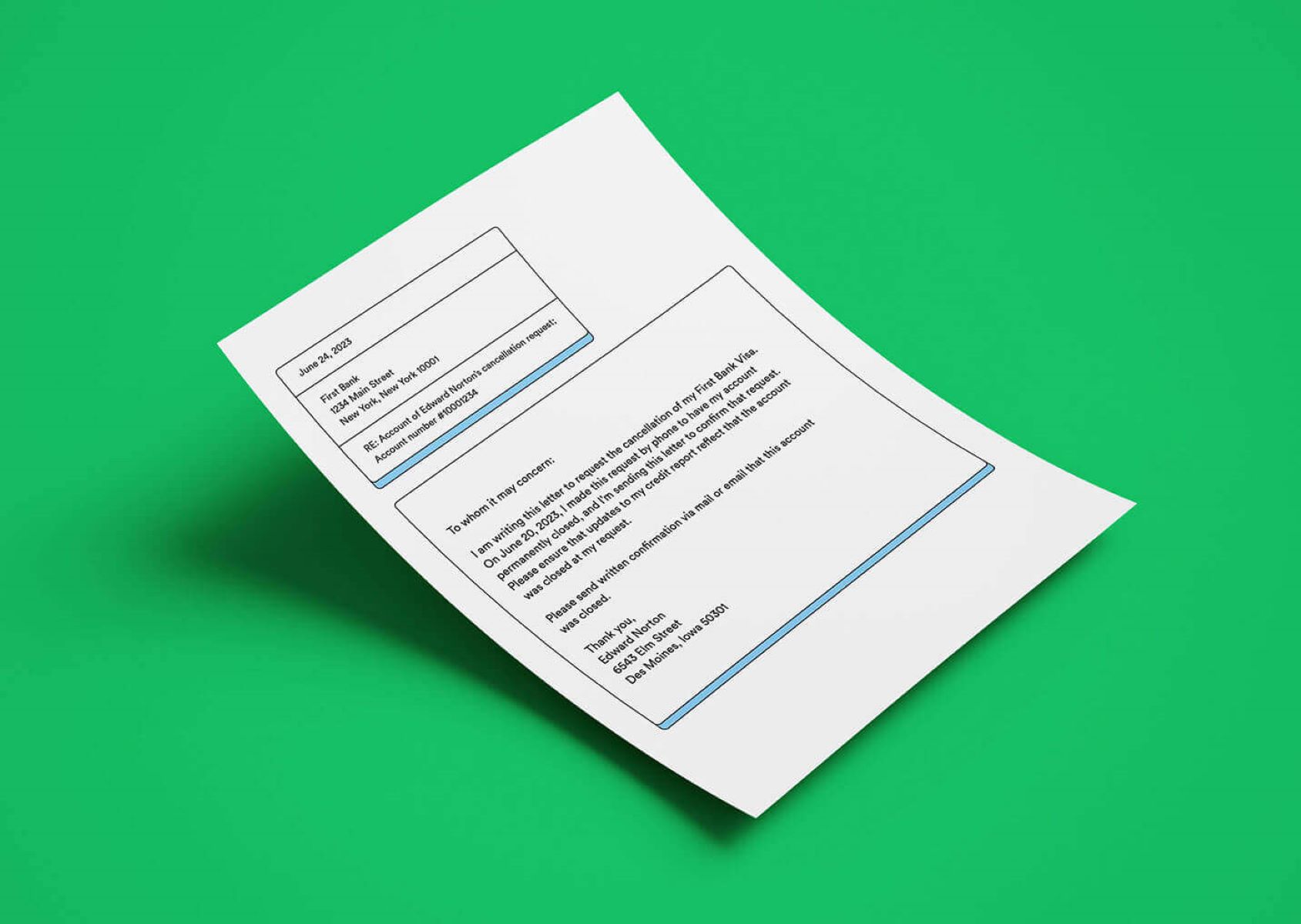

Express may have specific procedures in place for cancelling a credit card, so be prepared to follow their instructions. Some issuers may require you to submit a written request or fill out a cancellation form, in addition to the phone call. Ensure that you adhere to these requirements to complete the process accurately.

As part of the cancellation request, it’s important to ask for confirmation that your Express credit card has been successfully cancelled. The representative should provide you with a reference number or confirmation email to serve as proof of cancellation. Keep this documentation in a safe place for future reference.

During this step, it’s also a good idea to inquire about any additional actions you may need to take, such as returning or destroying the physical credit card. Some issuers may provide instructions on how to handle this, so be sure to clarify with the customer service representative.

Remember to be patient and understanding during this process, as it may take some time to complete the cancellation request. Having all the necessary information and following the instructions provided will help ensure a successful cancellation of your Express credit card.

Step 4: Confirm Cancellation

After requesting the cancellation of your Express credit card, it is crucial to follow up to confirm that the cancellation has been processed successfully. This step is important to ensure that your account has been closed and that you will no longer be responsible for any charges or fees.

Wait for a reasonable amount of time for the cancellation to be processed, as it may take a few business days for the changes to reflect in the system. During this waiting period, refrain from using your Express credit card to avoid any confusion or unwanted charges.

Once you have allowed sufficient time, contact Express customer service again to verify the cancellation status. Provide them with your reference number or confirmation email from the previous step and ask for confirmation that the cancellation has been completed.

It’s essential to double-check with the representative that your account has been closed and that no further charges will be applied to your Express credit card. If there are any outstanding balances, inquire about settling them to avoid any negative impact on your credit score.

If, during this step, you find out that the cancellation was not processed or there are any issues, remain calm and ask for guidance on how to resolve the situation. It may be necessary to provide additional information or to escalate the issue to a supervisor or higher level of support.

Ensure that you receive written confirmation of the cancellation, either through email or by mail. This documentation serves as proof that your Express credit card has been cancelled, which can be vital for your records and future credit reference.

By taking the time to confirm the cancellation, you can have peace of mind knowing that your Express credit card account has been closed correctly and that there will be no further charges or issues associated with it.

Step 5: Follow Up on Outstanding Balances

After confirming the cancellation of your Express credit card, it is crucial to take care of any outstanding balances to ensure that your account is fully settled. Failing to do so can result in negative consequences for your credit score and may lead to additional fees or issues in the future.

Review your recent statements or contact Express customer service to determine if there are any pending charges or balances on your credit card. It’s important to settle these amounts promptly to avoid any late fees or penalties.

If you have enrolled in automatic payments or have authorized any recurring charges on your Express credit card, make sure to notify the relevant parties about your cancellation. Update your payment information or provide an alternative credit card if necessary.

For any outstanding balances that you are unable to pay in full, contact Express customer service to discuss possible payment arrangements or to set up a payment plan. Clear communication with the issuer can help you manage your financial obligations responsibly.

Remember that settling your outstanding balances is crucial to maintaining a positive credit history and avoiding any future complications. Being proactive in handling these matters will ensure a smooth transition after cancelling your Express credit card.

Lastly, it is recommended to periodically check your credit report to verify that the cancellation of your Express credit card has been updated. This will help you ensure that there are no inaccuracies or unresolved issues related to the closed account.

By following up on outstanding balances and taking the necessary steps to settle any remaining obligations, you will conclude the cancellation process of your Express credit card responsibly and mitigate any potential negative impact on your credit history.

Conclusion

Cancelling your Express credit card is a straightforward process that requires careful attention to detail and proper communication with the customer service department. By following the steps outlined in this guide, you can navigate the cancellation process with ease and confidence.

Remember to begin by contacting customer service and providing them with all the necessary information. Be prepared to answer any questions or requests to verify your identity. Step 2 involves gathering the essential details, such as your credit card number and any outstanding balances, to ensure a smooth cancellation process.

Next, you will need to formally request the cancellation of your Express credit card. Clearly express your intention to cancel the card and follow any instructions given by the customer service representative. It’s important to obtain confirmation of the cancellation to serve as proof and to finalize the process.

Once you have confirmed the cancellation, take the time to follow up on any outstanding balances. Settle your account to avoid late fees or negative consequences on your credit score. It is also advisable to monitor your credit report to ensure that the cancellation is properly reflected.

While cancelling a credit card may have an impact on your credit score, it can also be a necessary step towards managing your finances or exploring better credit card options. By understanding the process and taking the appropriate steps, you can cancel your Express credit card smoothly and responsibly.

As a final reminder, always refer to the specific terms and conditions provided by Express or contact their customer service for any additional information or requirements specific to your credit card account.

Thank you for reading our guide on how to cancel an Express credit card. We hope you found it helpful and informative. Good luck with your financial endeavors!