Finance

Who Can Use Cash Method Of Accounting

Published: October 6, 2023

Find out who can use the cash method of accounting and its benefits for small businesses in the finance industry. Discover how this accounting method can simplify your financial transactions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

The cash method of accounting is a widely used method in financial management. It provides a straightforward way to track the flow of cash in and out of a business or individual’s finances. In this article, we will explore who can use the cash method of accounting, its advantages, disadvantages, as well as any exceptions or restrictions that may apply.

Managing finances effectively is crucial for individuals and businesses, as it ensures proper recording and reporting of income and expenses. The choice of accounting method plays a significant role in this process. The cash method is often contrasted with the accrual method, which records transactions when they occur, regardless of when the cash is exchanged.

Unlike the accrual method, the cash method focuses on actual cash transactions. It records income when it is received and expenses when they are paid, giving a real-time record of cash flow. This simplicity and directness make it particularly suitable for small businesses and individuals who do not have complex financial situations or substantial inventories of goods.

Next, we will delve into the eligibility criteria for using the cash method of accounting, exploring who can benefit from this approach.

Definition of Cash Method of Accounting

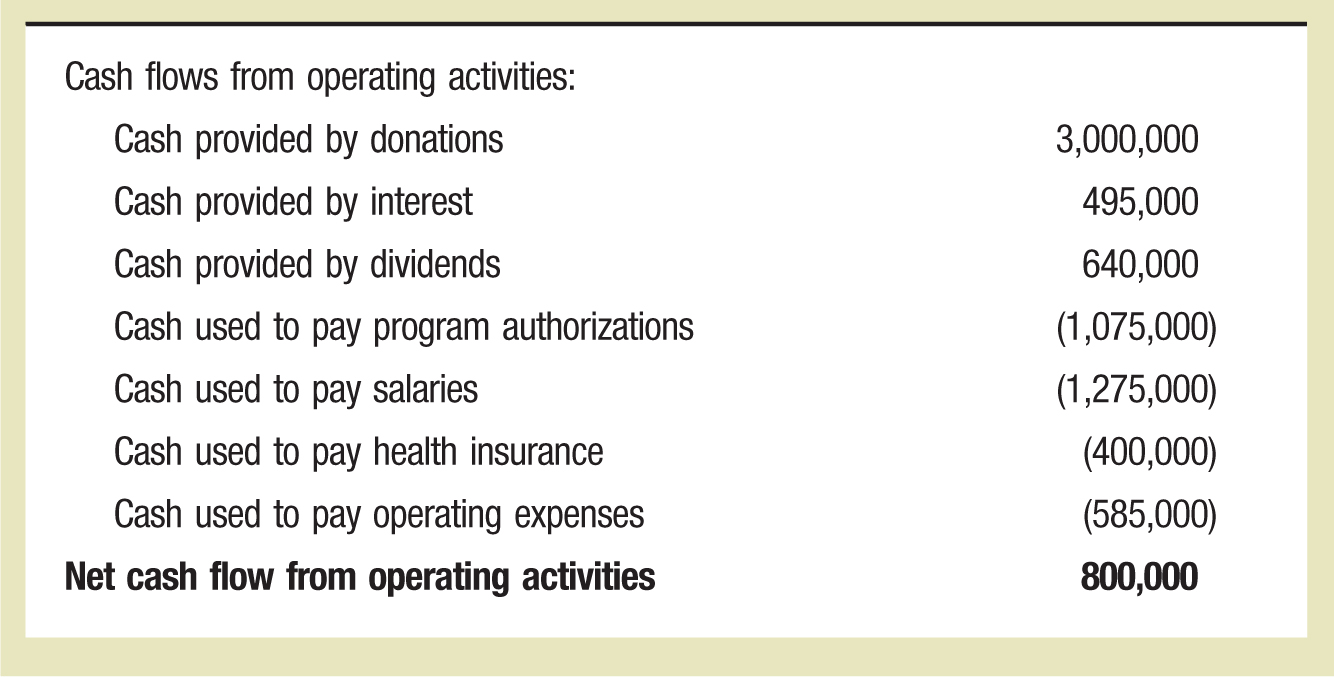

The cash method of accounting is a system wherein income is recognized when it is received and expenses are recorded when they are paid. In simpler terms, transactions are recorded based on the actual cash flow, regardless of when the sales or purchases occurred.

Under the cash method, revenue is recognized only when payment is received, whether in the form of cash, check, or electronic transfer. Similarly, expenses are recognized when the payment is made, such as when the bills are paid or the goods and services are purchased.

This method provides a clear and straightforward way to track the financial position of a business because it focuses on the actual inflow and outflow of cash. It is particularly beneficial for small businesses or individuals who have limited inventories or do not engage in complex financial transactions.

For example, suppose a small bakery sells a dozen pastries to a customer for $20. With the cash method, the business would record the revenue of $20 when the payment is received, whether it is in cash or through other means of payment. The expenses related to producing the pastries, such as the cost of ingredients, would be recorded when the payment is made to the supplier.

Alternatively, the accrual method of accounting records transactions when they occur, regardless of when the cash is exchanged. This method matches income and expenses to the period in which they are earned or incurred, providing a more comprehensive view of a business’s financial performance. However, it can be more complex and time-consuming to implement, making it less suitable for small businesses with limited resources.

Now that we understand the basic concept of the cash method of accounting, let’s explore the eligibility criteria for using this approach.

Eligible Individuals and Businesses

The cash method of accounting is available for use by both individuals and businesses. It is particularly popular among small businesses, self-employed individuals, and sole proprietors. Let’s take a closer look at the eligibility criteria for using the cash method:

1. Small Businesses and Self-Employed Individuals: Small businesses, including partnerships, limited liability companies (LLCs), and S-corporations, with average annual gross receipts of $25 million or less over the past three years, are eligible to use the cash method of accounting. This threshold was increased from $5 million under the Tax Cuts and Jobs Act of 2017, allowing more businesses to benefit from the simplicity of the cash method.

Self-employed individuals, such as freelancers and independent contractors, can also use the cash method if they meet the same gross receipts criteria. This is beneficial for individuals who receive payments irregularly throughout the year, as it allows them to recognize income when the payments are actually received.

2. Sole Proprietors: Sole proprietors are individuals who run their businesses as single owners and are not registered as separate legal entities. They have the flexibility to choose between the cash method and the accrual method of accounting, regardless of their annual gross receipts. However, once they select a method, they must continue to use it consistently unless they obtain permission from the Internal Revenue Service (IRS) to make a change.

3. Farming Businesses: Farming businesses, regardless of size, are eligible to use the cash method of accounting. This applies to both individuals and entities engaged in agricultural activities, such as cultivating land, raising livestock, or operating nurseries.

It’s important to note that while many businesses and individuals are eligible to use the cash method of accounting, they may still choose to use the accrual method if it better suits their financial reporting needs or if required by certain regulatory bodies.

Now that we have explored who can utilize the cash method of accounting, let’s look at its advantages and why it is popular among eligible individuals and businesses.

Advantages of Using the Cash Method

The cash method of accounting offers several advantages for eligible individuals and businesses. Let’s explore some of the key benefits:

1. Simplicity: The cash method is straightforward and easy to understand. It tracks the actual flow of cash, making it easier for small businesses and individuals to manage their finances without the need for complex accounting systems or professional expertise. It eliminates the need to track accounts receivable or accounts payable, as transactions are recorded when cash is exchanged.

2. Real-Time Cash Flow Tracking: By recognizing income and expenses at the time of cash transactions, the cash method provides a real-time view of the financial position of a business or individual. This allows for better monitoring of cash flow and helps in making informed financial decisions, such as budgeting and forecasting.

3. Tax Benefits: The cash method can offer tax advantages, especially for businesses with fluctuating income or expenses. By delaying the recognition of income until it is received, businesses can potentially lower their taxable income in a particular year. This can be particularly beneficial for businesses that experience seasonal fluctuations or rely on unpredictable client payments.

4. Reduced Administrative Burden: Compared to the accrual method, the cash method involves less record-keeping and administrative work. Businesses and individuals do not need to track outstanding invoices or unpaid bills, simplifying the financial management process. This can save time, reduce paperwork, and lower the cost of maintaining sophisticated accounting systems or hiring professional accountants.

5. Better Cash Flow Management: The cash method allows businesses to have a clearer understanding of their actual cash inflows and outflows, enabling effective cash flow management. It helps businesses avoid cash shortages, plan for future expenses, and make necessary adjustments to optimize cash reserves.

It’s important to note that while the cash method offers numerous advantages, it may not be suitable for all businesses or individuals. It is essential to consider the specific financial needs and reporting requirements before deciding to use the cash method of accounting.

Now, let’s explore some of the potential disadvantages associated with using the cash method of accounting.

Disadvantages of Using the Cash Method

While the cash method of accounting has its advantages, it also comes with certain drawbacks that may limit its suitability for certain businesses or individuals. Let’s discuss some of the disadvantages:

1. Limited Financial Insight: The cash method provides a simplified view of financial transactions by focusing only on cash inflows and outflows. This can limit the ability to generate comprehensive financial statements that accurately reflect the financial health of a business. This lack of detailed financial insight may make it challenging to analyze trends, make informed business decisions, or attract potential investors or lenders who require more comprehensive financial reporting.

2. Incomplete Picture of Accruals: The cash method disregards the concept of accruals, which can lead to a skewed representation of a business’s financial performance. For example, if a business sells products on credit or incurs expenses but has not received or paid for them yet, the cash method will not accurately reflect these transactions until the cash is exchanged. This can result in a distorted understanding of the business’s profitability or liabilities.

3. Tax Timing Challenges: While the cash method offers tax advantages by allowing businesses to delay the recognition of income, it can also create challenges. In some cases, the timing of cash inflows and outflows may result in inconsistent tax liabilities from year to year. This can complicate tax planning and forecasting, especially when there are large variances in cash flow between different periods.

4. Limited Use for Inventory-Based Businesses: Businesses that rely heavily on inventory management may find the cash method less suitable. The cash method does not account for inventory purchases as expenses until the actual cash is paid. This can distort the cost of goods sold calculation and make it difficult to accurately track inventory levels and evaluate profitability.

5. Less Compliance with Generally Accepted Accounting Principles (GAAP): The cash method may not comply with the industry standards outlined by GAAP, which serve as guidelines for accurate and consistent financial reporting. Certain regulatory bodies or lenders may require businesses to adhere to accrual accounting principles for better transparency and comparability.

Despite these disadvantages, the cash method of accounting continues to be a popular choice for businesses with straightforward financial operations and those seeking simplicity and real-time cash flow management. It is crucial for businesses and individuals to carefully consider their unique financial needs and reporting requirements before deciding to adopt the cash method of accounting.

Next, let’s explore some exceptions and restrictions that may apply when using the cash method.

Exceptions and Restrictions

While the cash method of accounting is accessible to many small businesses and individuals, there are certain exceptions and restrictions to be aware of. These exceptions and restrictions may limit the eligibility of certain entities or require businesses to follow specific guidelines. Let’s explore them:

1. Inventory-Based Businesses: Generally, businesses that carry an inventory are required to use the accrual method for recording their transactions. However, there is an exception for small businesses with average annual gross receipts of $25 million or less. These businesses can still use the cash method, despite their inventory-based operations. This exception provides flexibility for small businesses to manage their accounts without the additional complexities associated with the accrual method.

2. Tax Shelter Restrictions: The Internal Revenue Code imposes certain restrictions on the use of the cash method for tax shelter transactions. If a business or individual participates in a tax shelter, such as a syndicated conservation easement, they generally are not eligible to use the cash method. This restriction helps prevent abusive tax avoidance strategies and ensures proper reporting of income and expenses.

3. Exceptions for Certain Industries: Some industries have specific guidelines that require the use of the accrual method of accounting. For example, businesses engaged in the production and sale of merchandise designed primarily for use by the general public, such as retail stores, must use the accrual method if their average annual gross receipts exceed $1 million.

4. Changes in Accounting Method: Once a business or individual selects a method of accounting, they must generally obtain the consent of the Internal Revenue Service (IRS) to switch to a different method. This involves filing specific forms and meeting certain criteria outlined by the IRS. It’s important to consult with a tax professional or accountant before making any changes in the accounting method to ensure compliance with IRS regulations.

5. State and Local Regulations: While the IRS sets guidelines for federal tax purposes, state and local tax regulations may vary. It’s important to consider and comply with the specific reporting requirements and regulations of the state and local jurisdictions in which the business operates.

It’s crucial to consult with a tax professional or accountant who can provide guidance on the eligibility, exceptions, and restrictions related to using the cash method of accounting, considering the specific circumstances and applicable regulations.

Now, let’s conclude our exploration of the cash method of accounting.

Conclusion

The cash method of accounting offers a straightforward and real-time approach to tracking the flow of cash in and out of a business or individual’s finances. It is particularly beneficial for small businesses, self-employed individuals, sole proprietors, and farming businesses with limited financial complexity.

By recognizing income when it is received and expenses when they are paid, the cash method provides simplicity, real-time cash flow tracking, tax benefits, and reduced administrative burden. It allows businesses and individuals to better manage their cash flow, make informed financial decisions, and save time and resources on complex accounting tasks.

However, the cash method also has its limitations. It may not provide a comprehensive view of a business’s financial performance, especially for inventory-based businesses or those seeking to comply with generally accepted accounting principles (GAAP). It can also create challenges in tax planning and forecasting due to inconsistent tax liabilities from year to year.

There are exceptions and restrictions to be mindful of, such as the requirements for inventory-based businesses, restrictions on tax shelter transactions, and industry-specific guidelines for the accrual method. It’s essential to consult with tax professionals or accountants to determine eligibility and ensure compliance with applicable regulations.

In conclusion, the cash method of accounting is a valuable option for eligible individuals and businesses seeking simplicity, real-time cash flow tracking, and reduced administrative burden. However, it is crucial to evaluate specific financial needs, reporting requirements, and regulatory guidelines before deciding to adopt the cash method of accounting.

Remember, proper financial management is key to the success of any business or individual, and selecting the most suitable accounting method is an important aspect of this process.