Home>Finance>How To Prepare Cash Flow Statement Using The Indirect Method

Finance

How To Prepare Cash Flow Statement Using The Indirect Method

Published: December 21, 2023

Learn how to prepare a cash flow statement using the indirect method in finance. Gain valuable insights into analyzing your company's financial flows.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Overview of Cash Flow Statements

- Purpose of the Cash Flow Statement

- Understanding the Indirect Method

- Steps to Prepare a Cash Flow Statement Using the Indirect Method

- Start with Net Income

- Adjustments for Non-Cash Items

- Adjustments for Changes in Working Capital

- Adjustments for Investing and Financing Activities

- Calculate Net Cash Flow from Operating Activities

- Determine Cash Flows from Investing and Financing Activities

- Calculate Net Increase or Decrease in Cash

- Conclusion

Introduction

Welcome to the world of finance! Whether you are an aspiring investor, a business owner, or simply someone who wants to gain a better understanding of how money flows in and out of a company, understanding cash flow statements is crucial. In this article, we will explore the concept of cash flow statements, specifically focusing on how to prepare them using the indirect method.

A cash flow statement is a financial statement that provides insight into the cash inflows and outflows of a company during a specific period. It helps investors, creditors, and other stakeholders evaluate the financial health of a business by analyzing its ability to generate cash, pay debts, and fund operations. This statement is divided into three main sections: operating activities, investing activities, and financing activities.

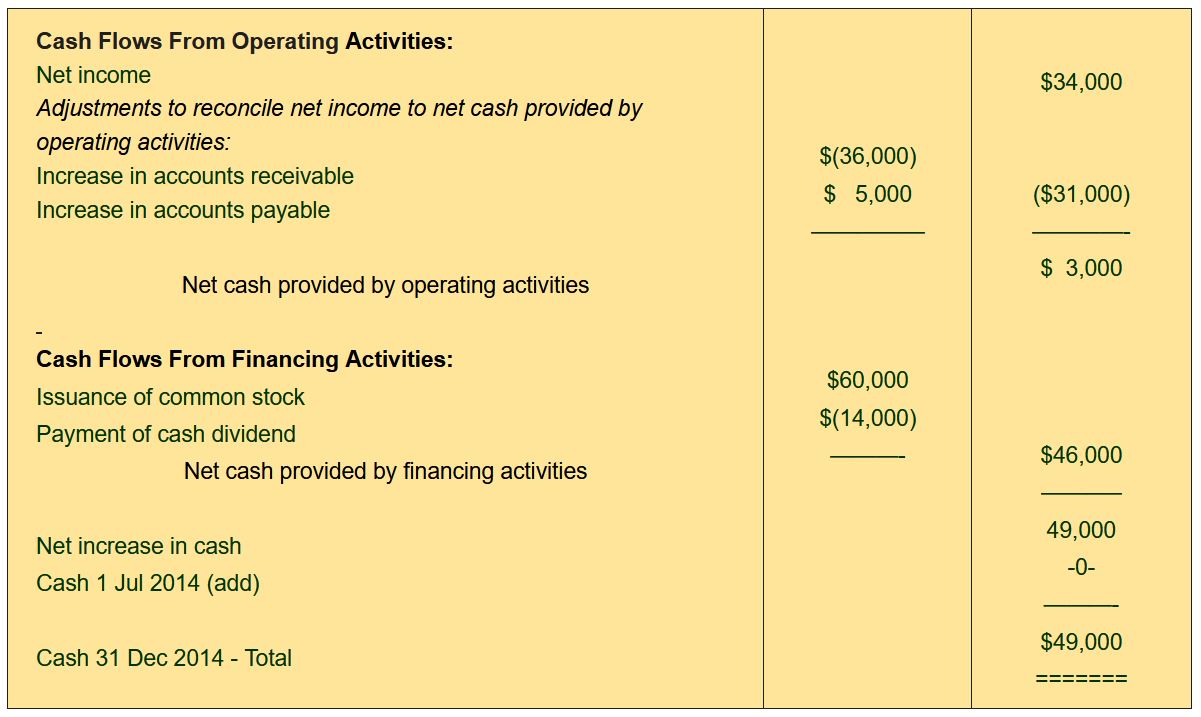

The indirect method is one of the two approaches used to prepare the cash flow statement. It starts with the company’s net income and adjusts for non-cash items and changes in working capital to calculate the cash flow from operating activities. Then, it separately presents the cash flows from investing and financing activities to provide a comprehensive view of how the company’s cash position has changed over time.

Preparing a cash flow statement using the indirect method may seem daunting at first, but with the right knowledge and guidance, it can be straightforward. In the following sections, we will break down the steps necessary to prepare a cash flow statement using the indirect method in a clear and concise manner. So, let’s dive in!

Overview of Cash Flow Statements

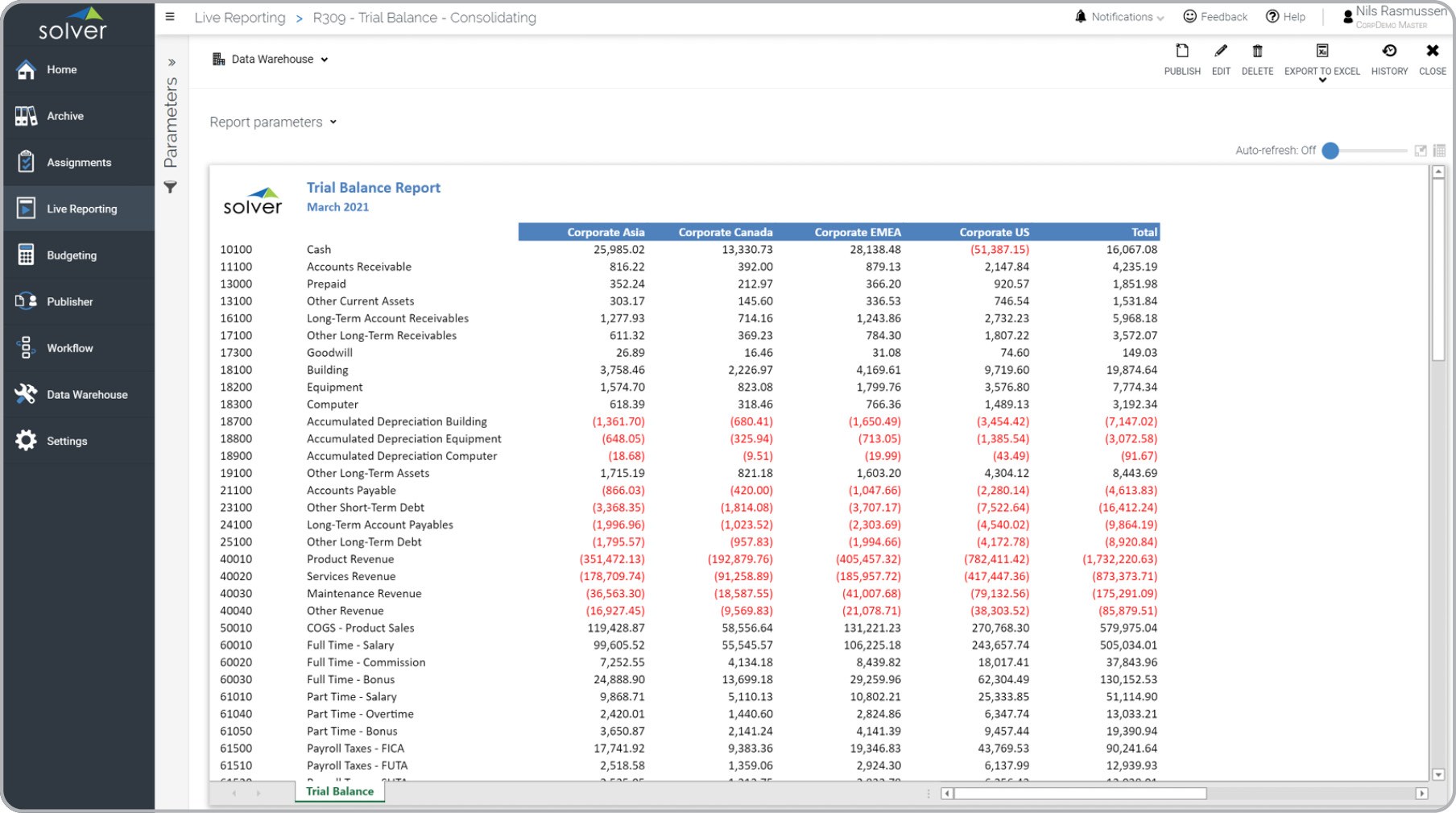

A cash flow statement is a financial statement that provides a snapshot of the cash inflows and outflows of a company during a specific period. It is an essential tool for investors, creditors, and other stakeholders to assess the financial health and liquidity of a business.

The cash flow statement is divided into three main sections: operating activities, investing activities, and financing activities. Each section provides valuable information about how cash is being generated or utilized within the company.

The operating activities section focuses on the cash flows that result from the primary operations of the business. This includes cash inflows from sales revenue, interest income, and dividends received, as well as cash outflows for operating expenses, supplier payments, and employee salaries. The operating activities section shows whether a company is generating enough cash from its core operations to sustain and grow its business.

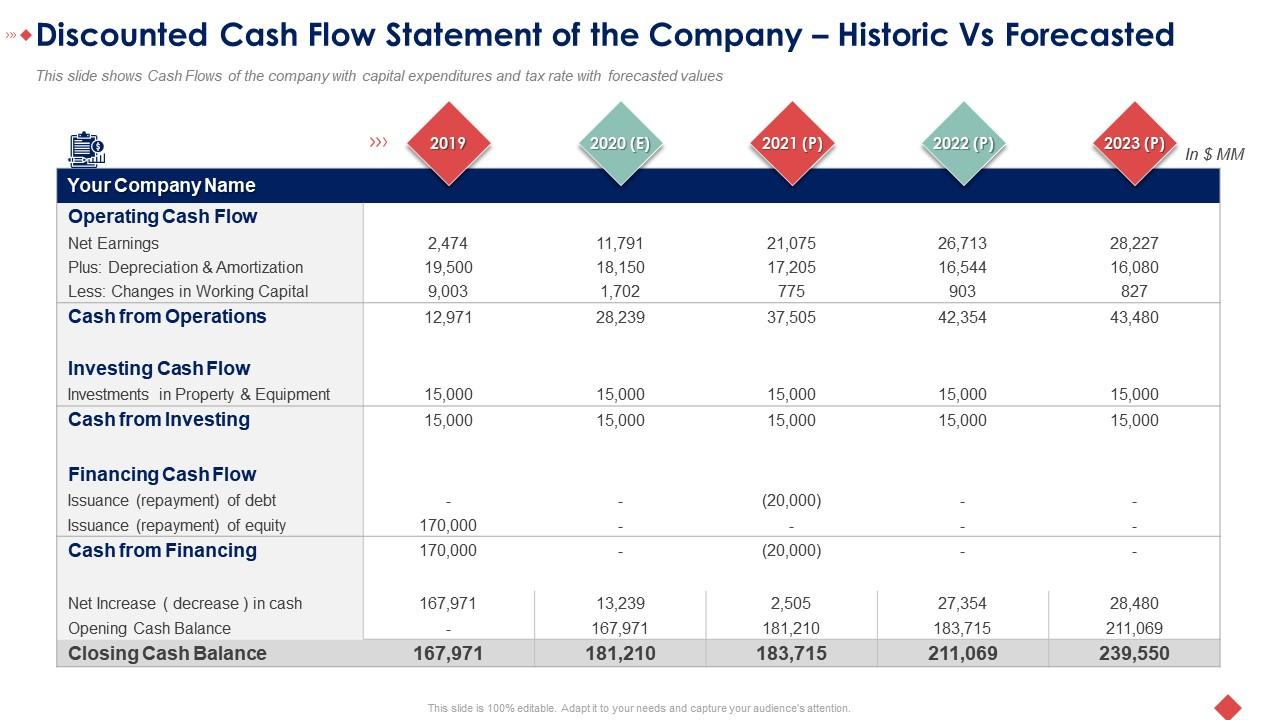

The investing activities section provides insights into how a company is deploying its cash for long-term investments. This includes cash inflows from the sale of assets, repayment of loans made to other entities, and proceeds from investments. On the other hand, cash outflows in this section typically include the purchase of property, plant, and equipment (PP&E), investments in securities, and loans made to other entities. The investing activities section helps evaluate the company’s capital expenditure decisions and its ability to generate future returns.

The financing activities section focuses on the cash flows related to the company’s capital structure and financing activities. Cash inflows in this section may come from issuing new debt or equity, receiving loans, or proceeds from the sale of company stocks. Cash outflows, on the other hand, can include dividend payments to shareholders, debt repayments, and repurchasing company stocks. The financing activities section provides insights into how a company is raising capital and managing its debt obligations.

In sum, the cash flow statement provides transparency into how a company is generating and utilizing its cash resources. It helps investors assess a company’s ability to generate cash, meet its financial obligations, and support its growth strategies. Understanding the cash flow statement is essential for making informed investment decisions and evaluating a company’s financial performance.

Purpose of the Cash Flow Statement

The cash flow statement serves several important purposes in the realm of financial reporting and analysis. It provides valuable insights into a company’s cash position and helps stakeholders assess its liquidity, operating performance, and financial health. Let’s explore the primary purposes of the cash flow statement:

- Evaluating Liquidity: One of the main purposes of the cash flow statement is to help stakeholders assess a company’s liquidity. By examining the cash inflows and outflows, investors and creditors can determine if a company has enough cash on hand to meet its short-term obligations, such as paying suppliers or servicing debt. The cash flow statement helps provide a clearer picture of a company’s ability to generate sufficient cash to cover its operational needs.

- Understanding Operating Performance: The cash flow statement aids in evaluating a company’s operating performance. By focusing on the cash flows from operating activities, stakeholders can assess how effectively a company is generating cash from its core operations. This section of the cash flow statement provides insights into the cash generated from day-to-day business activities, such as sales and expenses. It helps investors and analysts assess the quality of a company’s earnings and understand if the company’s profitability is sustainable over time.

- Assessing Financial Health: The cash flow statement provides a holistic view of a company’s financial health. By examining the cash flows from all three sections – operating, investing, and financing activities – stakeholders can identify any potential red flags or areas of concern. For example, if a company consistently has negative cash flows from operating activities, it may indicate underlying issues with its business model or profitability. Additionally, by analyzing the cash flows from investing and financing activities, stakeholders can assess the effectiveness of a company’s investment decisions and its ability to secure appropriate financing.

- Aiding in Decision-Making: The cash flow statement also serves as a valuable tool in decision-making processes. Investors and managers can utilize the information provided in the statement to assess the feasibility of specific projects, evaluate potential investments, or make strategic decisions about financing, such as issuing new debt or equity. The cash flow statement helps stakeholders understand the impact of various decisions on a company’s cash position and overall financial health.

In summary, the cash flow statement plays a vital role in financial analysis and decision-making. It provides insights into a company’s liquidity, operating performance, and financial health. By understanding the purpose and significance of the cash flow statement, stakeholders can make informed decisions and gain a deeper understanding of a company’s financial position.

Understanding the Indirect Method

The indirect method is one of the two approaches used to prepare the cash flow statement. It starts with the company’s net income and adjusts for non-cash items and changes in working capital to calculate the cash flow from operating activities. The indirect method is widely used because it is less time-consuming and requires fewer detailed calculations compared to the direct method.

When using the indirect method, the starting point is the net income, which is typically obtained from the income statement. However, it’s important to note that the net income is based on accrual accounting principles and includes non-cash items such as depreciation, amortization, and changes in inventory values. To arrive at the cash flow from operating activities, adjustments need to be made to remove these non-cash expenses or revenues.

In addition to adjusting for non-cash items, the indirect method also takes changes in working capital into account. Working capital represents the difference between current assets (such as cash, accounts receivable, and inventory) and current liabilities (such as accounts payable and accrued expenses). Changes in working capital can have a significant impact on a company’s cash flow, as they reflect changes in the timing of cash inflows and outflows associated with operating activities.

By using the indirect method, the cash flow statement provides a reconciliation between net income and cash flow from operating activities. This allows stakeholders to understand the sources and uses of cash that are not directly captured in the income statement. It provides insights into how the company’s net income is being converted into cash, which is crucial for assessing the company’s ability to generate and manage its cash flow.

It’s worth mentioning that while the indirect method is widely used, some companies may choose to use the direct method instead. The direct method presents the cash flows from operating activities by directly reporting cash receipts and payments, without considering the net income. The direct method provides a more detailed view of the company’s operating cash flows but requires more comprehensive and detailed information.

Understanding the indirect method is essential for preparing and interpreting the cash flow statement. It provides a framework for capturing the cash flow from operating activities while considering non-cash items and changes in working capital. By analyzing the cash flow statement prepared using the indirect method, stakeholders can gain valuable insights into a company’s cash flows and assess its financial performance and stability.

Steps to Prepare a Cash Flow Statement Using the Indirect Method

Preparing a cash flow statement using the indirect method involves several steps. While the process may vary depending on the specific financial information available, the following steps provide a general framework to guide you through the process:

- Start with Net Income: Begin by obtaining the net income figure from the income statement. This serves as the starting point for the cash flow statement.

- Adjustments for Non-Cash Items: Remove non-cash items from the net income. These can include depreciation, amortization, and other non-cash expenses or revenues. The goal is to adjust the net income to reflect the actual cash generated or utilized in operating activities.

- Adjustments for Changes in Working Capital: Consider changes in working capital, which is the difference between current assets and current liabilities. Analyze the changes in accounts receivable, accounts payable, inventory, and other current assets and liabilities, and adjust the net income accordingly. Changes in working capital can have a significant impact on cash flows from operating activities.

- Adjustments for Investing and Financing Activities: Account for cash flows related to investing and financing activities separately. This includes cash flows associated with the purchase or sale of property, plant, and equipment, investments in other companies, and borrowing and repayment of loans. Adjust the net income to reflect the cash flows from investing and financing activities.

- Calculate Net Cash Flow from Operating Activities: Sum up the adjustments made for non-cash items and changes in working capital. This will give you the net cash flow from operating activities, which represents the cash generated or utilized from the core operations of the business.

- Determine Cash Flows from Investing and Financing Activities: Combine the adjustments made for investing and financing activities to determine the net cash flows from these sections. This will provide insights into how the company is investing or financing its operations.

- Calculate Net Increase or Decrease in Cash: Sum up the net cash flow from operating, investing, and financing activities to determine the overall change in cash during the specified period. This will show whether the company has experienced a net increase or decrease in cash.

These steps serve as a general guide to prepare a cash flow statement using the indirect method. It’s important to carefully analyze the financial information and reconcile the changes to accurately reflect the cash flows. Additionally, it is recommended to refer to the applicable accounting standards and regulations to ensure compliance and accuracy in the preparation of the cash flow statement.

By following these steps, stakeholders can gain a comprehensive understanding of a company’s cash flows, assess its ability to generate cash, and evaluate its financial performance and stability.

Start with Net Income

When preparing a cash flow statement using the indirect method, the first step is to start with the company’s net income. Net income is the amount of profit or loss generated by the business during a specific period, as reported in the income statement.

Net income is calculated by subtracting all expenses, taxes, and other deductions from the total revenue generated by the company. It is an essential figure as it represents the bottom line of the income statement and indicates the overall profitability of the business.

However, it’s important to note that net income is based on accrual accounting principles, which means it includes non-cash items and timing differences. These non-cash items can include depreciation, amortization, and changes in inventory values, among others. Non-operating and non-recurring items, such as gains or losses from the sale of assets, are also reflected in net income.

While net income provides a measure of profitability, it does not directly reflect the actual cash generated or utilized by the company during the period. This is where the cash flow statement comes into play, as it helps reconcile the net income with the cash flows from operating, investing, and financing activities.

Starting with net income allows you to have a reference point from which to make adjustments and accurately reflect the cash flow from operating activities. By adjusting net income for non-cash items and changes in working capital, you can determine the cash generated or utilized by the core operations of the business.

By understanding and starting with net income, stakeholders can gain insights into the financial performance and profitability of the company. It serves as the foundation for preparing the cash flow statement and enables a comprehensive analysis of the cash flows of the business.

Adjustments for Non-Cash Items

After starting with net income, the next step in preparing a cash flow statement using the indirect method is to make adjustments for non-cash items. Non-cash items are expenses or revenues that are included in the calculation of net income but do not involve actual cash inflows or outflows.

Common examples of non-cash items include depreciation, amortization, and changes in inventory values. Depreciation represents the systematic allocation of the cost of an asset over its useful life, while amortization refers to the gradual reduction of the value of intangible assets such as patents or copyrights. These expenses are recognized in the income statement to reflect the consumption of assets but do not involve the outflow of cash.

By adjusting net income for non-cash items, you can arrive at a more accurate representation of the cash generated or utilized in operating activities. If net income includes non-cash expenses, the cash flow statement needs to remove these items to reflect the actual cash flows from the business.

For example, if the net income includes a depreciation expense of $10,000, you would add this amount back to the net income to remove the non-cash nature of the expense. Similarly, if there is a gain from the sale of an asset included in net income, you would subtract this amount to remove the non-cash nature of the revenue.

It’s important to note that adjustments for non-cash items do not affect the overall profitability of the business, as these items are already accounted for in the net income. Instead, these adjustments aim to provide a clearer picture of the actual cash flows generated or utilized by the business.

By making adjustments for non-cash items, stakeholders can get a better understanding of the cash flows directly related to the operating activities of the company. It helps to distinguish between profitability and cash generation and ensures the cash flow statement accurately reflects the cash flows associated with the company’s operations.

Adjustments for Changes in Working Capital

In the process of preparing a cash flow statement using the indirect method, the next crucial step is to make adjustments for changes in working capital. Working capital represents the difference between a company’s current assets and current liabilities and reflects the company’s short-term liquidity position.

Working capital adjustments are necessary because changes in working capital can have a significant impact on a company’s cash flows. The cash flow statement aims to capture the timing differences between when cash is received or paid and when related revenues or expenses are recognized.

Working capital adjustments involve analyzing changes in various current assets and current liabilities accounts, such as accounts receivable, accounts payable, inventory, and accrued expenses. These changes can be either positive (increases in assets or decreases in liabilities) or negative (decreases in assets or increases in liabilities).

When there is an increase in current assets, such as accounts receivable or inventory, the adjustment requires subtracting the increase from net income. This is because the increase in current assets represents cash that has been tied up in the business and is not available for immediate use. Conversely, when there is a decrease in current assets, such as a decrease in accounts receivable or inventory, the adjustment would involve adding the decrease to net income.

On the other hand, changes in current liabilities are adjusted in the opposite manner. When there is an increase in current liabilities, such as accounts payable or accrued expenses, the adjustment involves adding the increase to net income. This is because the increase in current liabilities represents a source of cash provided by suppliers or unpaid expenses. Conversely, when there is a decrease in current liabilities, the adjustment would involve subtracting the decrease from net income.

By making adjustments for changes in working capital, the cash flow statement captures the impact of timing differences and provides a more accurate portrayal of the actual cash flows from operating activities. It allows stakeholders to understand how changes in working capital affect the cash generated or utilized by the business and provides insights into the company’s ability to manage its short-term liquidity.

Adjustments for changes in working capital ensure that the cash flow statement aligns the recognition of cash inflows and outflows with the related revenues and expenses, giving stakeholders a clearer understanding of the cash flows associated with the company’s operating activities.

Adjustments for Investing and Financing Activities

After making adjustments for non-cash items and changes in working capital, the next step in preparing a cash flow statement using the indirect method is to account for the cash flows related to investing and financing activities. This involves adjusting the net income to accurately reflect the cash flows associated with these activities.

Investing activities include the purchase or sale of long-term assets, such as property, plant, and equipment (PP&E), investments in other companies, and loans made to other entities. Financing activities, on the other hand, involve the issuance or repayment of debt, as well as equity-related transactions like issuing or repurchasing company stocks.

When making adjustments for investing and financing activities, the focus is on capturing the actual cash inflows and outflows associated with these transactions. If the net income includes gains or losses from the sale of assets, these amounts need to be subtracted or added back to accurately reflect the cash flows from investing activities. Similarly, adjustments need to be made for cash flows associated with financing activities, such as dividends paid or received from equity investments.

For example, if the net income includes a gain of $20,000 from the sale of equipment, this amount would be subtracted from the net income to remove the non-cash nature of the gain. Likewise, if the company issued new debt and received $50,000 in cash, this amount would be added to the net income to reflect the cash flows from financing activities.

By adjusting the net income for investing and financing activities, the cash flow statement provides transparency into how the company is investing its resources and how it is obtaining financing. It helps stakeholders understand the cash flows associated with these activities, which can have a significant impact on the overall financial position and growth potential of the business.

Properly adjusting for investing and financing activities ensures that the cash flow statement accurately reflects the cash flows generated or utilized by the company, beyond just the operating activities. It allows stakeholders to analyze and evaluate how the company is allocating its capital and managing its financing needs.

By considering the cash flows from investing and financing activities, the cash flow statement offers a comprehensive view of the company’s cash flow position and helps stakeholders assess its overall financial performance and stability.

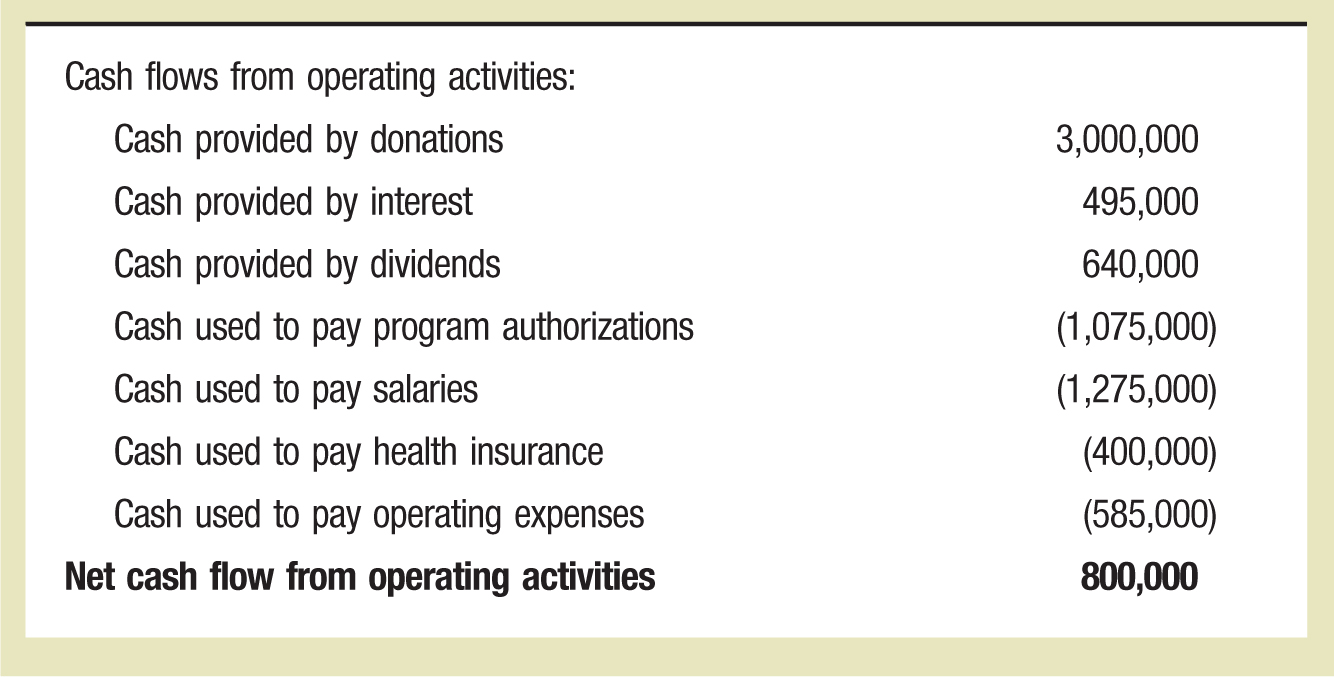

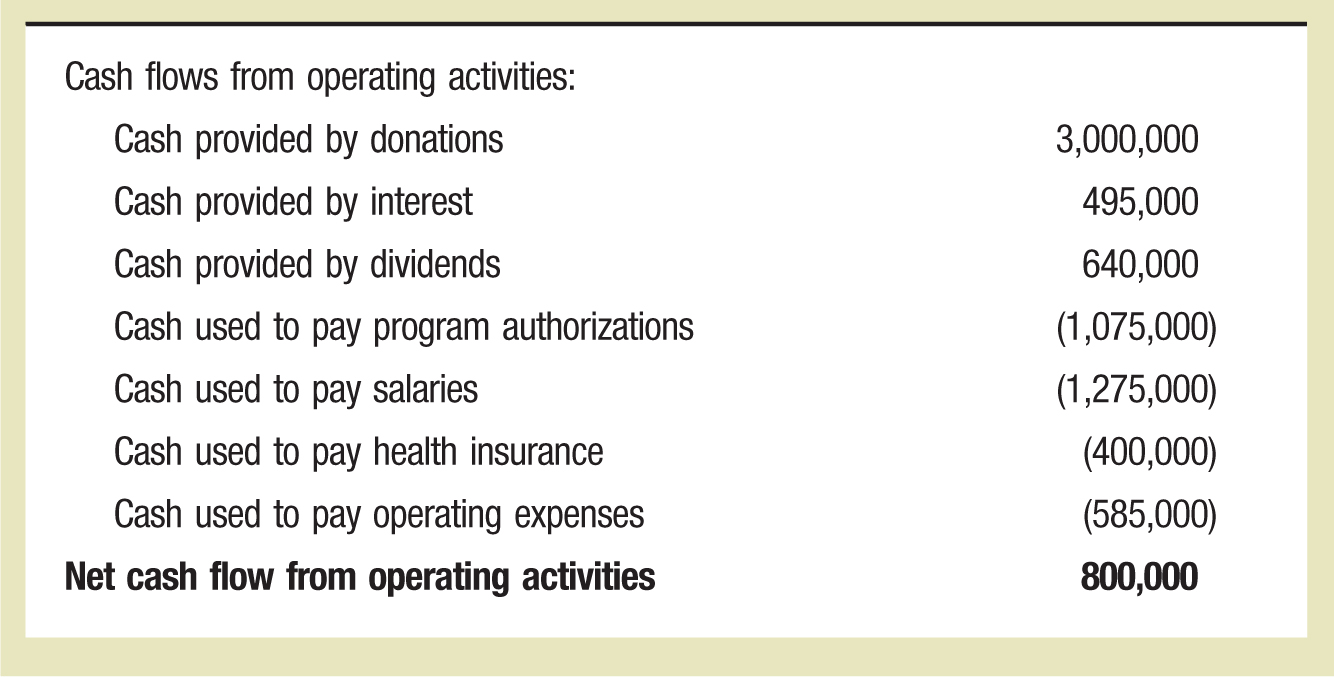

Calculate Net Cash Flow from Operating Activities

Once adjustments have been made for non-cash items, changes in working capital, and cash flows from investing and financing activities, the next step in preparing a cash flow statement using the indirect method is to calculate the net cash flow from operating activities. This section of the cash flow statement focuses on the cash generated or utilized by the core operations of the business.

To calculate the net cash flow from operating activities, you need to sum up all the adjustments made up to this point. These adjustments remove non-cash expenses or revenues and account for changes in working capital. The resulting figure represents the cash flow directly related to the company’s day-to-day operational activities.

If the adjustments made so far result in a positive value, it indicates that the company has generated cash from its operating activities. On the other hand, if the adjustments result in a negative value, it suggests that the company has utilized cash in its operating activities.

For example, if the adjustments for non-cash items and changes in working capital result in a positive value of $50,000, it means that the company has generated $50,000 in cash from its operating activities. This net cash flow figure highlights the cash inflows and outflows directly related to the company’s core business operations.

Calculating the net cash flow from operating activities is crucial for stakeholders to have a clear understanding of the actual cash generated or utilized by the company’s day-to-day operations. It provides insights into the company’s ability to generate cash from its core income-generating activities and indicates the cash flow sustainability.

Moreover, the net cash flow from operating activities helps evaluate the quality of a company’s earnings. It shows whether the reported net income is supported by actual cash flows and whether the company’s profitability is sustainable.

By accurately calculating the net cash flow from operating activities, the cash flow statement provides stakeholders with valuable information about the liquidity and performance of the company’s core operations.

Determine Cash Flows from Investing and Financing Activities

After calculating the net cash flow from operating activities, the next step in preparing a cash flow statement using the indirect method is to determine the cash flows from investing and financing activities. This step involves accounting for the cash flows related to these specific areas of the business.

Investing Activities: Investing activities involve the buying and selling of long-term assets, investments in other entities, and loans made to other parties. To determine the cash flows from investing activities, you need to consider the adjustments made earlier for investing activities and any subsequent investment or divestment events. Positive amounts indicate cash inflows, while negative amounts represent cash outflows from investing activities.

For example, if the adjustments made for investing activities resulted in a positive value of $30,000, it means that the company received $30,000 in cash from the sale of assets or investments. On the other hand, if the adjustments resulted in a negative value of $20,000, it suggests that the company made investments or purchased assets worth $20,000 during the period.

Financing Activities: Financing activities involve the issuance or repayment of debt, as well as equity-related transactions such as issuing or repurchasing company stocks. To determine the cash flows from financing activities, you need to consider the adjustments made earlier for financing activities and any subsequent financing events. Positive amounts indicate cash inflows, while negative amounts represent cash outflows from financing activities.

For instance, if the adjustments made for financing activities resulted in a positive value of $40,000, it means that the company received $40,000 in cash from issuing debt or equity during the period. Conversely, if the adjustments resulted in a negative value of $10,000, it indicates that the company made loan repayments or repurchased its own stocks, resulting in a cash outflow.

Determining the cash flows from investing and financing activities enables stakeholders to understand how the company is allocating its capital and obtaining financing. It provides insights into the company’s investment decisions, how it secures funds, and any changes in its capital structure.

By separately presenting the cash flows from investing and financing activities, the cash flow statement offers a comprehensive view of the company’s cash flows beyond just the operating activities. It helps stakeholders assess the company’s capital investment strategies, debt management, and capital raising activities.

Accurately determining the cash flows from investing and financing activities adds depth to the cash flow statement and allows stakeholders to gain a holistic understanding of the company’s overall cash flow position and financial stability.

Calculate Net Increase or Decrease in Cash

The final step in preparing a cash flow statement using the indirect method is to calculate the net increase or decrease in cash for the specified period. This step involves summing up the net cash flows from operating, investing, and financing activities to arrive at the overall change in cash during the period.

To calculate the net increase or decrease in cash, you simply add or subtract the net cash flows from operating, investing, and financing activities. A positive value indicates a net increase in cash, meaning that the company generated more cash than it utilized during the period. Conversely, a negative value indicates a net decrease in cash, suggesting that the company utilized more cash than it generated.

For example, if the net cash flow from operating activities is $50,000, the net cash flow from investing activities is $20,000 (negative), and the net cash flow from financing activities is $30,000 (positive), you would add these values together. In this case, the net increase or decrease in cash would be $100,000.

The net increase or decrease in cash reveals the change in the company’s cash position over the specified period. It provides crucial information about whether the company’s cash reserves have grown or diminished and helps stakeholders assess the company’s liquidity and financial health.

If the net increase in cash is positive, it suggests that the company has generated more cash inflows than outflows, indicating a healthy cash flow position. This surplus of cash can be used to invest in growth opportunities, repay debt, or build a cash reserve for future needs.

On the other hand, if the net increase in cash is negative, it implies that the company has experienced more cash outflows than inflows. This may raise concerns about the company’s ability to finance its operations, meet debt obligations, or invest in future growth endeavors.

Calculating the net increase or decrease in cash provides stakeholders with a clear understanding of how the company’s cash position has changed over the specified period and allows for better evaluation of its overall financial performance.

By determining the net increase or decrease in cash, the cash flow statement offers insight into the company’s cash flow sustainability, liquidity, and ability to meet financial obligations. It enables stakeholders to make informed decisions and assessments regarding the company’s cash management and financial viability.

Conclusion

Preparing a cash flow statement using the indirect method offers valuable insights into a company’s cash inflows and outflows, allowing stakeholders to assess its liquidity, operating performance, and financial health.

In this article, we explored the process of preparing a cash flow statement using the indirect method, which involves several key steps. Starting with net income, adjustments are made for non-cash items, changes in working capital, and cash flows from investing and financing activities. These adjustments provide a more accurate representation of the actual cash generated or utilized by the business.

By following these steps, stakeholders can gain a comprehensive understanding of a company’s cash flows and financial position. The cash flow statement helps evaluate a company’s ability to generate and manage its cash flow, ensuring the company maintains an optimal level of liquidity to meet its obligations and invest in future growth.

The cash flow statement also aids in evaluating the quality of a company’s earnings. It enables stakeholders to distinguish between profitability and cash generation, ensuring the reported net income is supported by actual cash flows from operating activities.

Additionally, the cash flow statement provides insights into the company’s investing and financing decisions. By separately presenting the cash flows from investing and financing activities, stakeholders can analyze how the company allocates its capital, manages its debt obligations, and raises funds.

In conclusion, understanding and preparing a cash flow statement using the indirect method is essential for assessing the financial health and performance of a company. By accurately reflecting the cash flows from operating, investing, and financing activities, stakeholders can make informed decisions, evaluate the company’s liquidity, and gain a deeper understanding of its overall financial position.

Ultimately, the cash flow statement serves as a critical tool for investors, creditors, and other stakeholders to evaluate the cash-generating capabilities and financial stability of a company, providing valuable insights for decision-making and financial analysis.