Finance

What Does It Mean When Your Credit Score Is 0

Modified: March 6, 2024

Find out the significance of having a credit score of 0 and how it impacts your finances. Learn why a credit score of 0 may pose challenges and how to improve it.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

A credit score is an important financial metric that reflects an individual’s creditworthiness. It is a numerical representation of a person’s credit history and plays a crucial role in various aspects of their financial life, from obtaining loans to renting an apartment. While most individuals typically have a credit score that falls within a certain range, there are circumstances where someone may find themselves with a credit score of 0.

In this article, we will delve into what it means to have a credit score of 0 and discuss the common reasons behind it. We will also explore the impact of having a credit score of 0 and provide steps to help individuals build credit from scratch and improve their score.

Understanding credit scores and the factors that influence them is essential for anyone navigating the world of personal finance. Whether you are a young adult just starting your financial journey or someone who has faced credit challenges in the past, gaining knowledge about credit scores and how they can affect your financial life is crucial.

So, if you have ever wondered about the implications of having a credit score of 0 and how to overcome it, read on to discover valuable insights and practical tips to help you build a strong credit profile.

Understanding Credit Scores

A credit score is a three-digit number that is used by lenders to assess an individual’s creditworthiness. It is a snapshot of a person’s credit history and is calculated based on various factors such as payment history, credit utilization, length of credit history, types of credit accounts, and new credit applications.

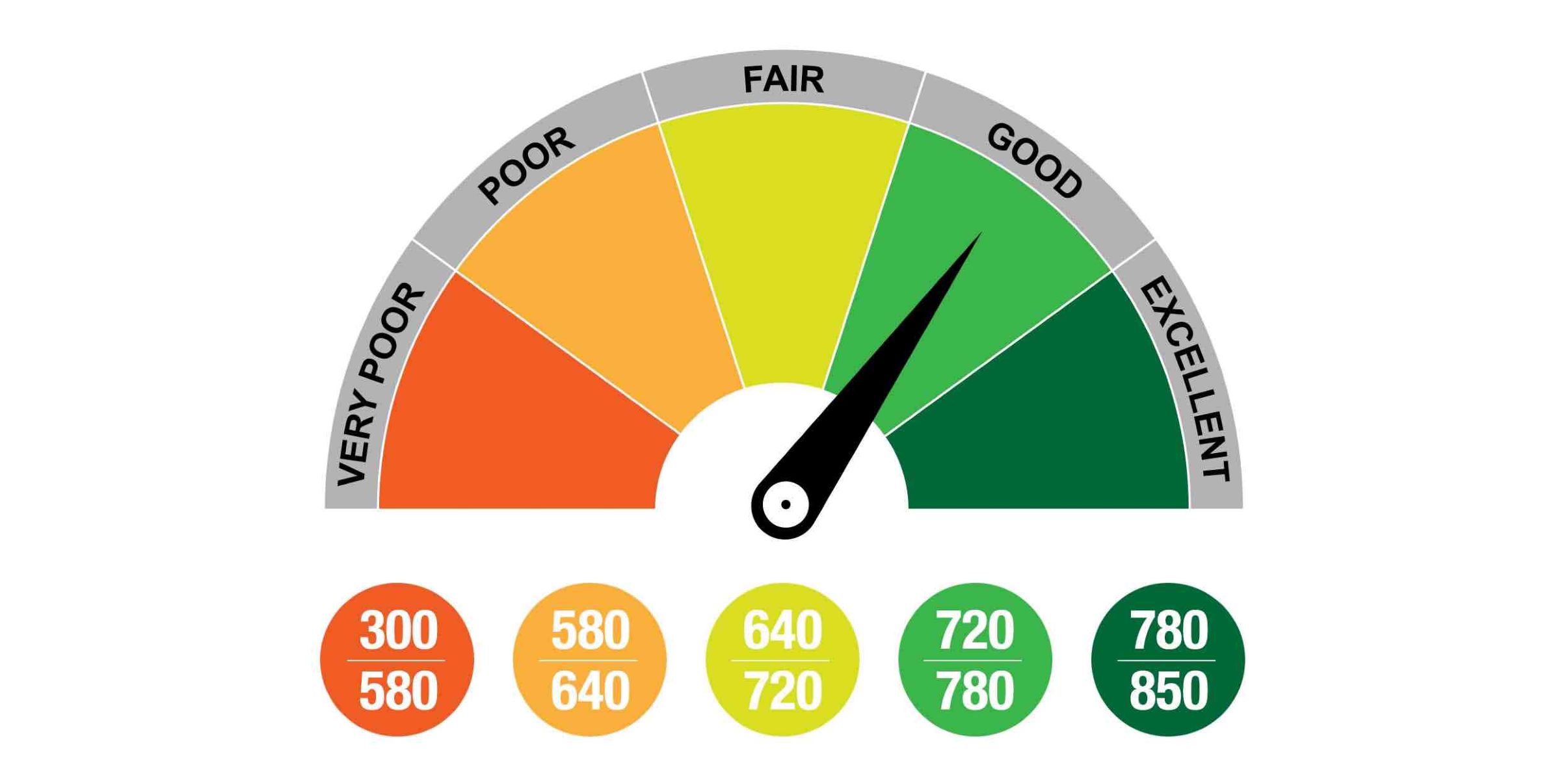

There are several credit scoring models, but the most widely used is the FICO score, which ranges from 300 to 850. A higher credit score indicates a lower credit risk and increases the likelihood of being approved for credit with favorable terms.

Credit scores are categorized into different ranges to make it easier for lenders to evaluate an applicant’s creditworthiness. While the specific ranges may vary slightly depending on the scoring model, a typical breakdown is as follows:

- Poor: 300-579

- Fair: 580-669

- Good: 670-739

- Very Good: 740-799

- Excellent: 800-850

It is important to note that credit scores are not fixed and can change over time as new information is added to a person’s credit report. Regularly monitoring your credit score and taking steps to improve it can have a significant impact on your financial well-being.

Now that we have a basic understanding of credit scores, let’s explore what it means to have a credit score of 0 and the factors that can lead to this situation.

What is a Credit Score of 0?

A credit score of 0 is a rare occurrence and is typically associated with individuals who have limited or no credit history. It signifies that there is not enough information available to calculate a traditional credit score for that person.

Having a credit score of 0 does not necessarily imply a negative credit history or financial irresponsibility. It simply means that there is not enough data to generate a credit score based on the usual scoring models.

There are various reasons why someone may have a credit score of 0:

- No Credit History: If you have never taken out a loan or credit card, or if you have not had any recent activity that is reported to the credit bureaus, you may not have enough credit history to generate a score.

- New to Credit: Young adults who are just starting their financial journey and have not yet established a credit history may have a credit score of 0.

- Recent Immigrants: Individuals who have recently moved to the country may not have a credit history in the United States, resulting in a credit score of 0.

- No Recent Borrowing Activity: If you haven’t taken out any new loans or lines of credit in the past few years, your credit score might drop to 0 due to inactivity.

- Identity Theft: In some cases, identity theft or fraud may lead to a credit score of 0 if the individual is not aware of the unauthorized accounts opened in their name.

It’s important to note that having a credit score of 0 can pose challenges when applying for credit or loans since lenders rely on credit scores to assess an individual’s creditworthiness. However, it is not a permanent situation, and there are steps you can take to start building your credit from scratch.

In the next section, we will explore the impact of having a credit score of 0 and the importance of building credit.

Common Reasons for a Credit Score of 0

Having a credit score of 0 is typically a result of limited or no credit history. Here are the common reasons why someone may have a credit score of 0:

- No Credit History: If you have never borrowed money or used credit cards, you may not have any credit history. Lenders rely on credit history to assess your creditworthiness, and without it, your credit score will be 0.

- New to Credit: Young adults who are just starting their financial journey may not have had enough time to establish a credit history. Since credit scores are based on past credit behavior, their score may be 0 until they build a credit history.

- Recent Immigrants: Individuals who have recently moved to a new country, such as immigrants, may not have a credit history in their new country. As a result, their credit score may initially be 0 until they start building credit.

- Inactive Accounts: If you have not used credit accounts for an extended period, they may become inactive. Inactive accounts do not contribute to your credit history, leading to a credit score of 0.

- Identity Theft or Fraud: If you have been a victim of identity theft or fraud, it’s possible that unauthorized accounts were opened in your name. Since you may not be aware of these accounts, they can negatively impact your credit score.

It’s important to remember that a credit score of 0 does not imply a poor credit history or financial irresponsibility. Instead, it reflects a lack of credit history. While this may make it challenging to obtain credit initially, there are steps you can take to start building your credit and improve your score.

In the next section, we will explore the impact of having a credit score of 0 and why it is essential to work towards improving your creditworthiness.

Impact of a Credit Score of 0

Having a credit score of 0 can have significant implications when it comes to your financial life. Since credit scores are used by lenders, landlords, and even potential employers to assess your creditworthiness and reliability, having a credit score of 0 may limit your options and opportunities.

Here are some potential impacts of having a credit score of 0:

1. Difficulty Obtaining Credit: With a credit score of 0, lenders may perceive you as a higher risk borrower, making it challenging to obtain credit cards, loans, or other forms of credit. You may be required to provide additional documentation or collateral, or you may only be eligible for higher interest rates or less favorable terms.

2. Limited Housing Options: Landlords often check credit scores when evaluating rental applications to assess an individual’s financial responsibility. A credit score of 0 may make it harder to secure a rental property, as landlords may be hesitant to lease to someone without an established credit history.

3. Higher Insurance Premiums: Insurance companies consider credit scores when determining premiums for auto, home, or renters insurance. Without a credit score or with a score of 0, you may face higher insurance rates, as insurers may consider you a higher risk.

4. Employment Concerns: Some employers perform credit checks as part of their hiring process, especially for positions that involve handling finances or sensitive information. A credit score of 0 may raise concerns about your financial responsibility and could potentially impact your chances of being hired.

5. Inability to Build Credit: Without existing credit history, it can be challenging to start building credit. This can create a Catch-22 situation, as having credit is often necessary to establish creditworthiness.

It’s important to note that while having a credit score of 0 may initially present challenges, it is not a permanent situation. There are steps you can take to build credit from scratch and improve your credit score over time, which we will explore in the following sections.

In the next section, we will provide practical steps you can take to start building your credit and improve your creditworthiness.

Building Credit from Scratch

If you have a credit score of 0, it’s essential to start building your credit history to improve your creditworthiness. While it may take time, patience, and responsible financial behavior, following these steps can help you establish a solid credit foundation:

1. Open a Secured Credit Card: A secured credit card requires a cash deposit as collateral, making them accessible even for individuals with little to no credit history. Use the secured card responsibly by making small purchases and paying off the balance in full each month.

2. Become an Authorized User: Ask a trusted family member or friend with good credit to add you as an authorized user on their credit card account. Their positive payment history will be reflected on your credit report, helping you build your credit history.

3. Apply for a Credit Builder Loan: Some financial institutions offer credit builder loans designed to help individuals establish credit. These loans typically have low limits and are repaid over a specific period. Timely payments on these loans can have a positive impact on your credit score.

4. Pay Bills on Time: Consistently making on-time payments for your rent, utilities, and other bills can contribute to building a positive credit history. While these payments may not be reported to credit bureaus by default, certain services allow you to opt-in for credit reporting.

5. Monitor Your Credit Report: Regularly review your credit report to ensure that the information is accurate and up to date. Look for errors, discrepancies, or signs of identity theft. Disputing any errors can help improve your credit score.

6. Keep Credit Utilization Low: Aim to keep your overall credit utilization ratio below 30%—the lower, the better. High credit utilization can indicate financial strain and negatively impact your credit score.

7. Avoid Opening Multiple Accounts Quickly: Opening too many credit accounts within a short period can be seen as a risk by lenders. Pace yourself and focus on responsibly managing the credit you have before seeking additional credit.

Remember, building credit takes time, and there are no quick fixes. Be patient and stay consistent with responsible financial habits. Over time, by demonstrating positive credit behavior, you will build a stronger credit history and improve your credit score.

In the next section, we will outline specific steps you can take to improve a credit score of 0 and move toward a healthier credit profile.

Steps to Improve a Credit Score of 0

If you have a credit score of 0, it’s important to take proactive steps to improve your creditworthiness. While it may take time to see significant improvements, following these steps can help you gradually build a stronger credit profile:

1. Establish Credit Accounts: Start by opening a credit card or a small loan to begin building credit. Consider secured credit cards or credit builder loans, which are designed for individuals with limited or no credit history.

2. Make Timely Payments: Pay all your bills on time, including credit card payments, loans, rent, and utilities. Late payments can have a negative impact on your credit score. Consider setting up automatic payments or reminders to ensure that you never miss a payment.

3. Reduce Credit Utilization: Aim to keep your credit utilization ratio—the amount of your credit limit that you are using—below 30%. Lower utilization shows responsible credit management and can positively impact your credit score.

4. Monitor Your Credit: Regularly check your credit report for any errors or discrepancies. If you find any inaccuracies, dispute them with the credit bureaus to have them corrected. Monitoring your credit can also help you identify any signs of potential identity theft.

5. Build a Positive Payment History: Consistently making on-time payments over an extended period can demonstrate your creditworthiness. The longer you maintain a positive payment history, the more it will beneficially impact your credit score.

6. Diversify Your Credit Mix: Having a mix of credit accounts, such as credit cards, student loans, auto loans, or mortgages, can positively contribute to your credit score. However, only apply for new credit accounts when necessary and avoid overextending yourself.

7. Keep Old Accounts Open: Closing old credit accounts can negatively impact your credit score. Instead, keep these accounts open and occasionally make small purchases to keep them active. This shows a longer credit history and responsible credit usage.

8. Be Patient and Persistent: Building credit takes time, and there are no quick fixes. Be consistent with your responsible credit habits and give it time to reflect positively on your credit score. Remember, the goal is to build a strong credit history over time.

Improving a credit score of 0 requires discipline, patience, and responsible financial behavior. By following these steps consistently, you can gradually build your creditworthiness and move towards a healthier credit profile.

In the final section, we will provide a summary and conclude the article by emphasizing the importance of credit management and making informed financial decisions.

Conclusion

A credit score of 0 indicates limited or no credit history, which can present challenges when it comes to obtaining credit and enjoying financial opportunities. However, having a credit score of 0 is not a permanent situation, and there are steps you can take to build credit from scratch and improve your creditworthiness.

Understanding credit scores and the factors that contribute to them is crucial for anyone looking to navigate the world of personal finance. By establishing credit accounts, making timely payments, and managing credit responsibly, you can gradually build a solid credit foundation.

Building credit takes time, patience, and persistence. It’s important to monitor your credit report for any errors, keep your credit utilization low, and maintain a positive payment history. Additionally, staying informed about your credit score and maintaining good financial habits can help you achieve your financial goals.

Remember, improving your credit score and building a strong credit history is not only about obtaining loans or credit cards—it’s about demonstrating financial responsibility and creating opportunities for a better financial future.

In conclusion, if you find yourself with a credit score of 0, don’t be discouraged. Take control of your financial journey, follow the steps outlined in this article, and stay committed to responsible credit practices. With time, patience, and informed decisions, you can build a solid credit profile and open doors to a world of financial possibilities.