Finance

How To Get A Credit Report On Another Person

Published: October 20, 2023

Learn how to obtain a comprehensive credit report on someone else. Ensure financial security and make informed decisions with our finance guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Step 1: Understand the Importance of Obtaining a Credit Report on Another Person

- Step 2: Verify Legal Permissibility

- Step 3: Gather Necessary Information

- Step 4: Choose a Credit Reporting Agency

- Step 5: Submit a Request for a Credit Report

- Step 6: Follow the Verification Process

- Step 7: Review the Credit Report

- Step 8: Handle Discrepancies or Errors

- Step 9: Respect Privacy and Legal Boundaries

- Conclusion

Introduction

Obtaining a credit report on another person can be a useful step in many situations. Whether you are considering hiring a new employee, entering into a business partnership, or getting into a serious relationship, having access to someone’s credit report can provide valuable insights into their financial behavior and responsibility.

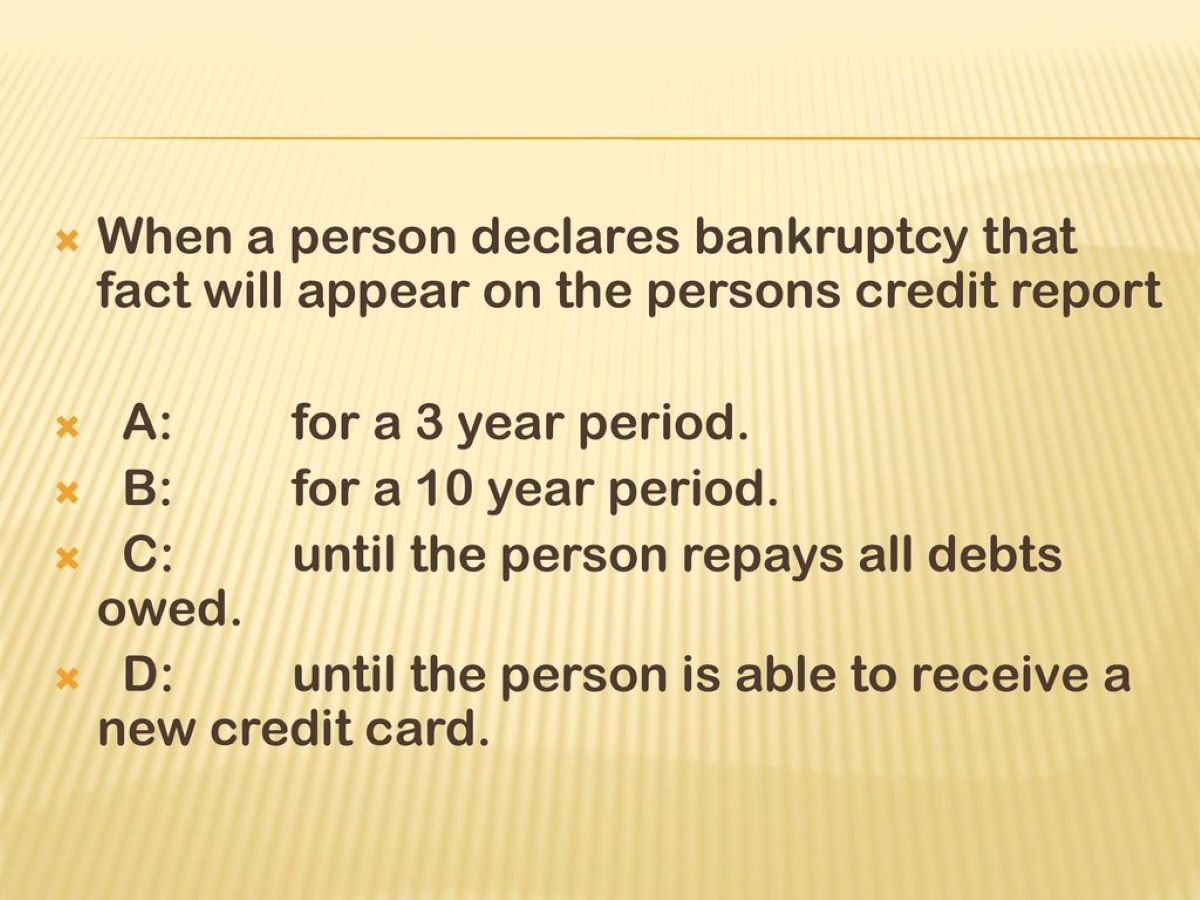

A credit report is a detailed summary of an individual’s financial history, including their credit accounts, payment history, outstanding debts, and public records such as bankruptcies or liens. It provides a comprehensive overview of their creditworthiness and helps determine their ability to manage financial obligations.

While it may seem intrusive to delve into someone else’s financial information, there are times when it becomes necessary to assess their financial stability and reliability. For example, if you are planning to co-sign a loan or rent a property with someone, you want to ensure that their creditworthiness aligns with your own financial goals and risk tolerance.

However, it’s important to approach the process of obtaining a credit report on another person with caution and respect for both legal boundaries and personal privacy. In this article, we will guide you through the steps involved in obtaining a credit report on another person legally and ethically.

Step 1: Understand the Importance of Obtaining a Credit Report on Another Person

Before delving into the process of obtaining a credit report on another person, it’s essential to understand the importance of why you would want to do so. A credit report provides a wealth of information that can help you make informed decisions regarding financial matters that involve the other person.

Here are a few key reasons why obtaining a credit report on another person is crucial:

- Evaluating Financial Responsibility: A credit report allows you to assess an individual’s financial habits and their ability to manage debt. By reviewing their payment history and outstanding debts, you can gauge their reliability in meeting financial obligations.

- Mitigating Risk: Whether you’re considering a business partnership or entering into a significant financial commitment, such as cosigning a loan or sharing a lease, understanding someone’s creditworthiness can help mitigate potential risks. A person with a poor credit history may pose a higher risk of defaulting on financial obligations, affecting your own financial well-being.

- Building Trust: Obtaining a credit report on another person can foster trust and transparency in various relationships. Sharing financial information can be a crucial step towards establishing trust, particularly when entering a joint venture or a long-term commitment.

- Guarding Against Fraud: In some cases, obtaining a credit report can help protect against fraud or identity theft. By reviewing the individual’s credit accounts and detecting any unusual activity, you can identify any suspicious behavior and take appropriate measures to safeguard your interests.

Understanding the importance of obtaining a credit report on another person can help you make informed decisions when it comes to financial partnerships, collaborations, or personal relationships. It provides a comprehensive view of an individual’s financial health, enabling you to assess their reliability and make sound judgments based on accurate information.

Step 2: Verify Legal Permissibility

Before proceeding with obtaining a credit report on another person, it is essential to ensure that you are legally permitted to do so. Privacy laws vary by jurisdiction, and accessing someone’s credit information without proper authorization can have serious legal consequences.

Here are some steps to verify the legal permissibility of obtaining a credit report on another person:

- Know the Laws: Familiarize yourself with the privacy laws and regulations governing credit reports in your jurisdiction. This may include the Fair Credit Reporting Act (FCRA) in the United States or similar legislation in other countries. These laws outline the permissible reasons for accessing someone’s credit information and the procedures for obtaining it.

- Determine Your Relationship: Consider the nature of your relationship with the person whose credit report you are seeking. In some cases, you may need to have a legally recognized reason for accessing their credit information, such as being an employer or a landlord. Make sure you understand your role and the legal requirements associated with it.

- Seek Consent: In many cases, obtaining written consent from the individual is a legal requirement. This consent should clearly outline the purpose for accessing their credit report and the period for which the authorization is valid. Keep a copy of the consent form for your records.

- Engage Legal Counsel: If you are unsure about the legal permissibility of accessing someone’s credit report or have specific concerns, consult with an attorney who specializes in privacy or consumer law. They can provide guidance based on your specific circumstances and ensure that you are operating within the bounds of the law.

It is crucial to understand and respect the legal restrictions and requirements surrounding accessing someone’s credit information. By taking the necessary steps to verify the legal permissibility, you can ensure that you are acting in compliance with the applicable laws and safeguarding the privacy rights of the individual in question.

Step 3: Gather Necessary Information

Before proceeding to obtain a credit report on another person, you will need to gather certain essential information about the individual. This information will be required when submitting a request to a credit reporting agency for the credit report.

Here are the key pieces of information you should gather:

- Full Name: Ensure that you have the person’s full legal name as it appears on their identification documents. This will help to avoid any confusion or discrepancies when accessing their credit report.

- Current Address: Obtain their current residential address. This information is necessary as credit reports are often associated with a specific address, and it helps in locating the correct report.

- Social Security Number (SSN) or National ID: In some cases, credit reporting agencies may require the individual’s SSN or national identification number to verify their identity. This information is crucial for accurate identification and retrieval of the correct credit report.

- Date of Birth: The person’s date of birth is used as an additional identifier for accessing their credit report. It helps ensure that the correct individual’s information is retrieved.

- Previous Addresses: If the person has recently moved or has lived at different addresses within the past few years, it may be necessary to provide their previous addresses. This helps credit reporting agencies compile a more comprehensive credit history.

- Employment Information: If applicable, gather information about the person’s current employer and their job position. Some credit reporting agencies may ask for this information to further verify the individual’s identity.

- Additional Identifiers: Depending on the country and credit reporting agency, there may be other identifiers required, such as passport numbers or driver’s license information. Be aware of any additional information needed based on the specific requirements of the credit reporting agency you choose.

By gathering all the necessary information beforehand, you will be well-prepared when submitting your request for a credit report. Ensure that the information you collect is accurate and up-to-date to avoid any complications or delays in the process.

Step 4: Choose a Credit Reporting Agency

Once you have gathered all the necessary information, the next step is to choose a reputable credit reporting agency from which to obtain the credit report on the individual. There are several credit reporting agencies available, each with their own procedures, fees, and level of detail provided in the credit reports.

Here are some factors to consider when choosing a credit reporting agency:

- Accreditation and Reputation: Look for credit reporting agencies that are accredited and have a positive reputation. Check for reviews or ratings from other users to ensure the agency provides accurate and reliable credit reports.

- Range of Information: Consider the level of detail provided in the credit reports. Some agencies may offer comprehensive reports that include information on credit accounts, payment history, public records, and credit scores, while others may provide more basic reports.

- Cost: Compare the fees charged by different credit reporting agencies. Consider factors such as the cost of obtaining a single report or any subscription plans offered by the agency.

- Customer Support: Look for agencies that provide excellent customer support, should you have any questions or need assistance during the process of obtaining the credit report.

- Legal Compliance: Ensure that the credit reporting agency operates in compliance with privacy laws and regulations. Check if they provide clear guidelines on obtaining credit reports and require proper authorization before releasing the information.

It’s important to choose a reputable and trustworthy credit reporting agency to ensure the accuracy and security of the credit report. Take the time to research and compare different agencies before making a final decision.

Once you have selected a credit reporting agency, proceed to the next step of submitting your request for a credit report on the individual.

Step 5: Submit a Request for a Credit Report

After choosing a credit reporting agency, it’s time to submit your request for a credit report on the individual. The process may vary slightly depending on the agency, but here are the general steps to follow:

- Visit the Credit Reporting Agency’s Website: Go to the website of the chosen credit reporting agency. Look for a section or page dedicated to requesting credit reports.

- Provide the Required Information: Fill out the necessary fields or forms on the website. This typically includes the individual’s full name, current and previous addresses, social security number or national ID, date of birth, and any additional identifiers as required.

- Attach Authorization: If you obtained written consent from the individual to access their credit report, make sure to attach a copy of the signed authorization form when submitting your request. This is crucial to comply with legal requirements and ensure the request is processed.

- Pay the Required Fee: Some credit reporting agencies charge a fee for accessing credit reports. Review the agency’s fee structure and make the necessary payment as instructed on their website. Keep in mind that fees may vary based on the level of detail provided in the credit report.

- Submit the Request: Once you have filled out the required information, attached any necessary documents, and made the payment, submit your request through the online submission process. The agency may provide a confirmation number or acknowledgment of the request.

It’s important to follow the instructions provided by the credit reporting agency carefully to ensure a smooth and accurate processing of your request. Double-check all the information you have entered to minimize any errors or delays.

After submitting the request, you will typically receive the credit report within a specified timeframe. This may vary depending on the agency and the volume of requests they receive. Be patient and monitor your email or account with the agency for any updates or notifications regarding the status of your request.

Once you receive the credit report, you can move on to the next step: reviewing the report and analyzing the information it contains.

Step 6: Follow the Verification Process

After submitting your request for a credit report, the credit reporting agency will initiate a verification process to ensure the accuracy and validity of the information provided. This step is crucial for protecting the individual’s privacy and preventing unauthorized access to their credit report.

Here’s what you can expect during the verification process:

- Confirmation of Identity: The credit reporting agency may reach out to you via email or phone to verify your identity as the requester. They may ask for additional information or documentation to ensure that the request is legitimate.

- Confirmation from the Individual: In some cases, the credit reporting agency may contact the individual whose credit report you are requesting to confirm that they have given consent for their information to be accessed. This adds an extra layer of verification and ensures that their privacy rights are protected.

- Documentation Review: The credit reporting agency will review the documentation you submitted, including the consent form if applicable, to ensure that all necessary requirements have been met. They may request additional documentation or information if needed.

- Processing Timeframe: The verification process can take some time, depending on the credit reporting agency’s workload and the complexity of the request. It is important to be patient and allow the agency sufficient time to process the request and complete the verification process.

- Updates and Notifications: The credit reporting agency may provide you with updates or notifications regarding the status of your request. This could include confirmation of successful verification, any additional information required, or delays in processing times.

It is essential to cooperate with the credit reporting agency throughout the verification process. Respond promptly to any requests for additional information and provide the necessary documentation to ensure a smooth and efficient process.

Remember that the verification process is in place to protect the privacy and confidentiality of individuals’ credit information. By following this step, you demonstrate respect for the legal and ethical boundaries surrounding credit report access.

Once the verification process is complete, you will be notified, and you can proceed to the next step of reviewing the credit report.

Step 7: Review the Credit Report

Once you receive the credit report from the credit reporting agency, it’s time to thoroughly review the information it contains. This step is crucial as it allows you to gain insights into the individual’s financial history and assess their creditworthiness.

Here are the key points to consider when reviewing the credit report:

- Personal Information: Start by verifying that the personal information, such as the individual’s name, address, and date of birth, is accurate. Ensure that it matches the information you provided during the request process.

- Credit Accounts: Evaluate the individual’s credit accounts, including credit cards, loans, and mortgages. Look for any missed or late payments, outstanding balances, or defaults. Pay attention to the payment history, as consistent on-time payments are a positive sign of financial responsibility.

- Public Records: Check for any public records, such as bankruptcies, tax liens, or judgments. These records indicate potential financial struggles or legal issues that could affect their creditworthiness.

- Credit Inquiries: Review the list of credit inquiries made on the individual’s credit report. Inquiries occur when someone has requested their credit information. This could include potential lenders, landlords, or employers. Multiple inquiries within a short period may signal a high level of credit-seeking behavior.

- Credit Scores: Some credit reports provide a credit score, which is a numerical representation of an individual’s creditworthiness. Take note of the credit score, as it helps assess the overall financial health and ability to manage credit.

- Discrepancies or Errors: Look for any discrepancies or errors in the credit report, such as accounts that don’t belong to the individual or incorrect payment information. Discrepancies can have a significant impact on the accuracy of the credit report and may require further investigation or correction.

It’s vital to understand that a credit report is a snapshot of an individual’s financial history at the time of its creation. It provides valuable information, but it should be used as part of a more comprehensive evaluation process. Consider the context of the information and any relevant circumstances that may have influenced the individual’s credit profile.

If you discover any discrepancies or errors in the credit report, it’s important to address them promptly. Notify the credit reporting agency and provide any necessary supporting documentation to initiate the dispute resolution process.

By carefully reviewing the credit report, you can gain a comprehensive understanding of the individual’s financial behavior and make informed decisions based on their creditworthiness.

Step 8: Handle Discrepancies or Errors

During the review of the credit report, it is possible to come across discrepancies or errors that require attention. It is vital to handle these issues promptly to ensure the accuracy of the credit report and protect the individual’s creditworthiness.

Here are the steps to handle discrepancies or errors in a credit report:

- Document the Discrepancies: Make a note of any specific discrepancies or errors that you have identified in the credit report. Include relevant details, such as the account name, account number, and the nature of the discrepancy.

- Contact the Credit Reporting Agency: Reach out to the credit reporting agency that provided the report. Inform them about the discrepancies or errors you have identified and provide supporting documentation or evidence, if available. This can be done through their customer service channels, such as phone, email, or online dispute forms.

- Dispute the Inaccurate Information: Submit a formal dispute with the credit reporting agency to challenge the accuracy of the disputed information. The agency is legally obligated to investigate and correct any errors or inaccuracies found in the credit report within a specific timeframe, according to local regulations.

- Gather Supporting Documents: Collect any relevant supporting documentation that can substantiate your dispute. This might include payment receipts, account statements, or correspondence with creditors or lenders. These documents can strengthen your case and support the correction of the erroneous information.

- Follow Up on the Dispute: Keep track of the progress of your dispute by maintaining regular communication with the credit reporting agency. They should provide updates on the investigation and any actions taken to resolve the dispute. If necessary, provide additional information or documents as requested during the investigation.

- Review the Updated Credit Report: Once the investigation is complete, review the updated credit report provided by the credit reporting agency. Verify that the corrections have been made and the inaccurate information has been removed or revised accordingly. Ensure that the credit report now accurately reflects the individual’s financial history.

Handling discrepancies or errors in a credit report is essential for maintaining the accuracy and reliability of the information. By addressing these issues promptly, you can help protect the individual’s creditworthiness and ensure the report is a true reflection of their financial history.

Remember to retain copies of all communication and documentation related to the dispute process for your records. This will be valuable in case further action is required in the future.

Step 9: Respect Privacy and Legal Boundaries

While obtaining a credit report on another person can provide valuable insights, it is crucial to always respect privacy and abide by legal boundaries. Respecting the privacy rights of individuals is not only ethically important but also essential for avoiding legal repercussions.

Here are key considerations to keep in mind:

- Obtain Proper Authorization: Always ensure you have proper authorization from the individual before accessing their credit report. This may include written consent or other legal requirements depending on your jurisdiction. Without proper authorization, accessing someone’s credit report can be a violation of privacy laws.

- Use the Information Responsibly: Use the credit report information only for the intended purpose and within the scope of your relationship with the individual. Avoid sharing the information with others who do not have a legitimate need to know, as this can be a breach of trust and potentially lead to legal consequences.

- Securely Store and Dispose of Information: Handle the credit report and any personal information obtained with care. Store the information securely to protect it from unauthorized access or misuse. When disposing of the information, use proper data destruction methods to ensure it cannot be retrieved or accessed by unauthorized individuals.

- Follow Applicable Laws and Regulations: Familiarize yourself with the privacy laws and regulations in your jurisdiction that govern the access and use of credit reports. Stay updated on any changes or updates to these laws, ensuring ongoing compliance with the legal requirements.

- Consider Professional Assistance: If you are unsure about the legal permissibility or requirements for accessing someone’s credit report, consider consulting with legal or privacy professionals. They can provide guidance based on your specific circumstances and ensure that you navigate the process within the bounds of the law.

Respecting privacy and legal boundaries is of utmost importance when obtaining a credit report on another person. By doing so, you demonstrate ethical conduct and maintain the trust and integrity of your relationships. It also helps protect the privacy and rights of individuals and ensures compliance with relevant laws and regulations.

Remember that a credit report contains sensitive and personal financial information, so it should be handled with care and discretion.

Conclusion

Obtaining a credit report on another person can provide valuable insights into their financial history and help you make informed decisions in various personal and professional situations. However, it is essential to approach this process with caution and respect for privacy and legal boundaries.

Throughout the steps outlined in this guide, it is crucial to prioritize the following key considerations:

- Legal Compliance: Ensure that you are legally permitted to access someone’s credit report and follow the proper procedures outlined by privacy laws and regulations in your jurisdiction.

- Authorization: Obtain proper authorization from the individual before accessing their credit report. This can help protect their privacy rights and ensure that you are acting within the boundaries of the law.

- Thorough Review: Take the time to carefully review the credit report and analyze the information it contains. Consider the individual’s payment history, outstanding debts, public records, and credit scores to truly understand their financial behavior and creditworthiness.

- Handling Discrepancies: Address any discrepancies or errors in the credit report promptly by following the appropriate dispute resolution process with the credit reporting agency. This ensures the accuracy of the credit report and protects the individual’s creditworthiness.

- Respect and Privacy: Always respect the privacy rights of individuals and use the obtained credit report information responsibly. Consider the confidentiality of the information and take the necessary steps to securely store and dispose of it as required.

Remember, a credit report provides valuable insights into an individual’s financial history, but it should be used as part of a comprehensive evaluation process. It is not the sole determinant of someone’s character or trustworthiness. Consider other factors and engage in open and transparent communication to build trust and make well-informed decisions.

Lastly, if you have any doubts or concerns about the legal permissibility or requirements of obtaining someone’s credit report, it is advisable to consult with legal professionals who specialize in privacy or consumer law. They can provide personalized guidance based on your specific situation.

By following these steps and conducting the process in an ethical and responsible manner, you can navigate the journey of obtaining a credit report on another person while upholding privacy, adhering to legal boundaries, and making informed decisions.