Finance

Why Is My Student Loan Not On My Credit Report

Published: October 20, 2023

Find out why your student loan is not appearing on your credit report and how it may impact your overall finance. Discover the steps to resolve this issue and ensure your financial status is accurately reflected.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding the Role of Credit Reports

- Student Loans and Credit Reports

- Reasons Why Your Student Loan May Not Appear on Your Credit Report

- Loan Status

- Repayment Status

- Reporting Delays

- Credit Bureau Errors

- Private Student Loan Reporting

- Loan Consolidation or Refinancing

- Reporting Frequency

- Inactive or Dormant Status

- Loan Discharge or Forgiveness

- How to Ensure Your Student Loan Appears on Your Credit Report

- Stay Informed and Keep Records

- Regularly Check Your Credit Report

- Contact Your Loan Servicer or Credit Bureau

- Establish Good Credit Habits

- Conclusion

Introduction

Having a clear understanding of your financial situation is crucial for making informed decisions and managing your credit effectively. One key aspect of financial health is your credit report, which provides a snapshot of your borrowing and repayment history. It allows potential lenders to assess your creditworthiness and determine whether to extend credit to you.

However, you may find yourself in a situation where your student loan, a significant financial obligation, is not appearing on your credit report. This can be puzzling and may raise concerns about how it could impact your credit score and future borrowing opportunities. In this article, we will explore some of the reasons why your student loan may not be visible on your credit report and provide insights on how to ensure its accurate reporting.

Understanding the relationship between student loans and credit reports is essential. A student loan is a type of debt incurred to finance education expenses, such as tuition, room and board, and textbooks. While on one hand, student loans can help you invest in your future, on the other hand, they can have a significant impact on your creditworthiness.

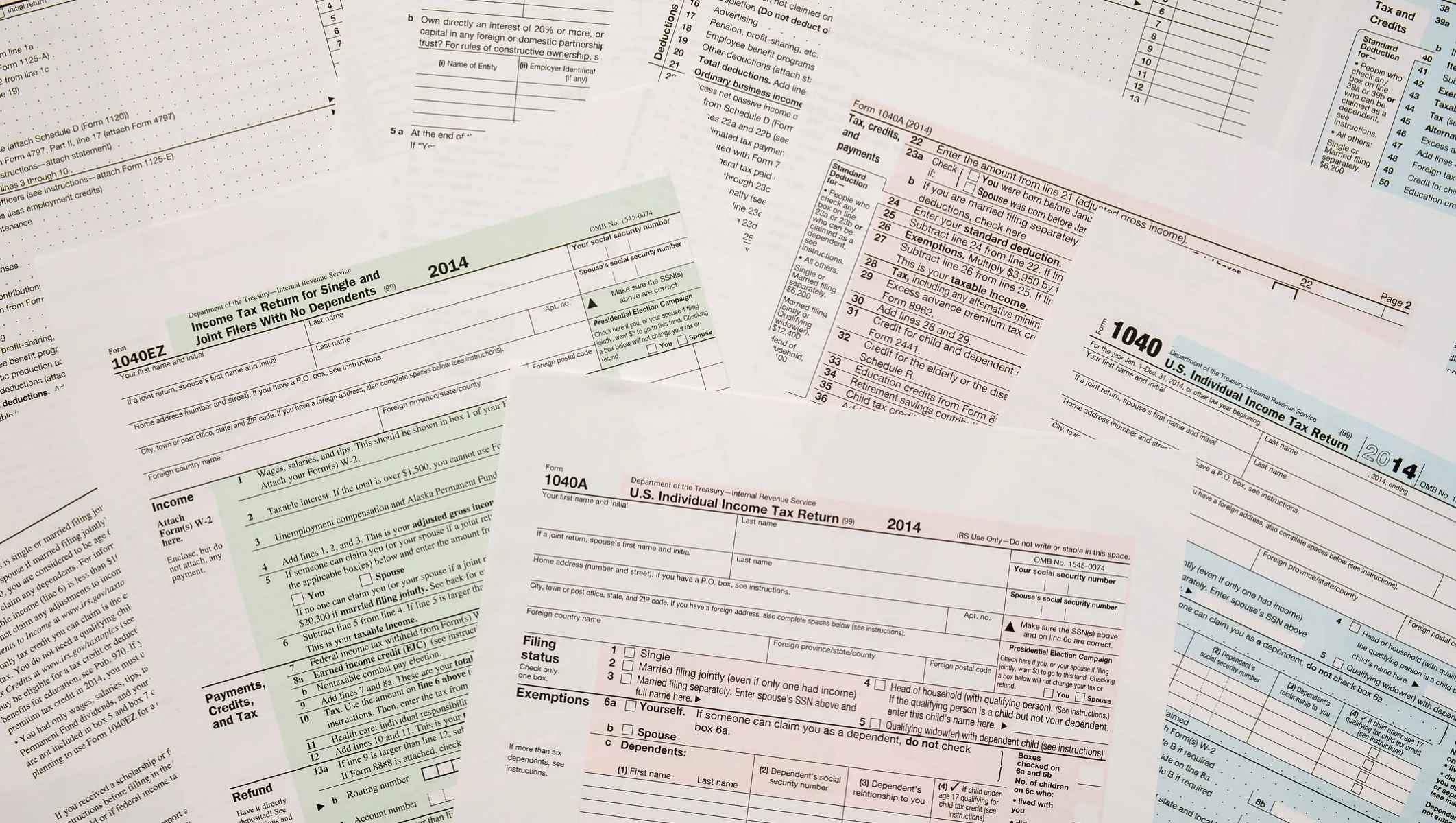

Your credit report is a compilation of information about your credit utilization, repayment history, and outstanding debts. It is maintained by credit reporting agencies, also known as credit bureaus, such as Experian, Equifax, and TransUnion. Lenders, landlords, and other entities rely on these reports to assess your creditworthiness and determine the terms of credit you may receive.

Understanding the Role of Credit Reports

Credit reports play a crucial role in financial transactions, helping lenders evaluate an individual’s creditworthiness and their ability to repay debt. These reports contain information about an individual’s credit history, including details about loans, credit cards, mortgages, and other lines of credit. It is important to recognize the significance of credit reports in determining your financial standing and potential borrowing opportunities.

When you apply for credit, such as a loan or a credit card, lenders use your credit report to assess the risk of lending to you. They examine your credit score, which is derived from the information in your credit report, to determine your creditworthiness. A higher credit score generally indicates a lower risk borrower and increases the likelihood of loan approval with favorable terms.

Aside from lenders, other entities also rely on credit reports. Landlords may check credit reports to assess the reliability of potential tenants, insurance providers may examine credit reports to determine premiums, and employers may use credit reports as part of background checks for certain positions.

Understanding the contents of your credit report is important for several reasons. Firstly, it allows you to verify the accuracy of the information being reported about your credit history. Mistakes or inaccuracies in your credit report can negatively impact your credit score and may lead to difficulties in obtaining credit.

Secondly, knowing your credit report can empower you to take steps to improve your creditworthiness. By identifying areas of concern, such as high credit card balances or late payments, you can take proactive measures to address them and work towards building a healthier credit profile.

Lastly, being aware of your credit report gives you the opportunity to dispute any inaccuracies and have them rectified. This is particularly important if you encounter any fraudulent activity or identity theft, as it can have a significant impact on your creditworthiness.

Overall, credit reports provide a comprehensive overview of your financial history and are instrumental in determining your creditworthiness. By understanding their role and ensuring their accuracy, you can have greater control over your financial future.

Student Loans and Credit Reports

Student loans are an important component of many individuals’ financial lives, especially for those pursuing higher education. These loans allow students to access funds to cover the costs of tuition, books, and other educational expenses. However, it is essential to understand how student loans are reported on credit reports and the potential impact they can have on your creditworthiness.

When you take out a student loan, whether it is a federal loan or a private loan, the lender will report the loan to the credit bureaus. This information will then appear on your credit report, providing a detailed record of your borrowing and repayment history.

Having a student loan on your credit report can impact your credit in several ways. First, it will increase your overall debt load, which can affect your debt-to-income ratio. This ratio is a significant factor that lenders consider when evaluating your creditworthiness. A high debt-to-income ratio may raise concerns about your ability to manage additional debt and can potentially result in higher interest rates or loan denials.

Second, the student loan repayment history will appear on your credit report. Timely payments can positively impact your credit score, demonstrating responsible borrowing behavior. Conversely, late payments or defaults can have a detrimental effect on your credit score and make it more challenging to secure credit in the future.

It’s important to note that there are different types of student loans, and their reporting on credit reports may differ. Federal student loans, which are backed by the government, are typically reported to the credit bureaus consistently and automatically. Private student loans, on the other hand, may not always be automatically reported, and the reporting practices may vary among lenders.

In addition to the overall student loan reporting, the individual accounts related to your student loans will also be listed on your credit report. Each loan account will indicate the loan amount, current balance, payment history, and status. This information provides lenders with a comprehensive view of your student loan obligations and your ability to manage them.

Understanding how your student loans are reported on your credit report is crucial for your financial well-being. It allows you to assess the impact on your creditworthiness and take appropriate steps to maintain good standing with your student loans.

Reasons Why Your Student Loan May Not Appear on Your Credit Report

While it is common for student loans to be reported on credit reports, there are instances where your student loan may not appear. Understanding the reasons behind this can help alleviate any concerns you may have about the visibility of your loan on your credit report. Below are some potential factors that may contribute to your student loan not appearing on your credit report:

- Loan Status: If your student loan is still in the grace period, meaning you are not yet required to make payments, it may not be reported until the repayment period begins.

- Repayment Status: If your student loan is in deferment or forbearance, it may not be reported during these periods when payments are temporarily paused or reduced.

- Reporting Delays: Sometimes, there can be delays in updating your credit report, especially if your loan was recently disbursed or you recently made changes to your repayment plan.

- Credit Bureau Errors: Credit bureaus can make errors or experience glitches that result in missing or incomplete reporting of your student loan. It’s important to regularly review your credit report to identify any possible errors.

- Private Student Loan Reporting: While federal student loans are typically reported consistently, private student loans may not have standardized reporting requirements. Some lenders may not report to all credit bureaus or may have different reporting schedules.

- Loan Consolidation or Refinancing: If you have consolidated or refinanced your student loans, the existing loans may no longer appear on your credit report. Instead, the consolidated or refinanced loan will be reported as a new loan.

- Reporting Frequency: Creditors may not report loan information to credit bureaus on a monthly basis. This can lead to temporary gaps in the reporting of your student loan on your credit report.

- Inactive or Dormant Status: If your student loan has been inactive or dormant for an extended period, it may not appear on your credit report. This typically occurs if you have not made any payments or engaged with the loan for an extended period of time.

- Loan Discharge or Forgiveness: In some cases, student loans may be discharged or forgiven due to specific circumstances, such as disability or public service. In these instances, the loan may no longer appear on your credit report.

If you are concerned about the visibility of your student loan on your credit report, it is important to take proactive steps. Regularly checking your credit report, contacting your loan servicer or credit bureau to inquire about the reporting status, and keeping thorough records of your loan payments and communication can help ensure accurate reporting of your student loan.

Loan Status

The status of your student loan can greatly impact whether it appears on your credit report or not. Different stages of your loan lifecycle may affect its reporting status. Here are a few scenarios that could explain why your loan status may cause it to not appear on your credit report:

Grace Period: Many student loans offer a grace period after graduation or leaving school, during which you are not required to make payments. If your loan is still within the grace period, it might not be reported on your credit report until the repayment period begins. During this time, your loan is still considered active, but no payment history is reported.

Deferment or Forbearance: If you have requested and received deferment or forbearance on your student loan, it means that your payments have been temporarily paused or reduced. In these cases, the lender may not report the loan to the credit bureaus during the deferment or forbearance period. It’s important to note that while your loan may not be reported, it should not have a negative impact on your credit score.

Default or Delinquency: If your student loan is in default or delinquency, meaning you have missed several payments, it will likely be reported on your credit report. This negative reporting can have a significant impact on your credit score and overall creditworthiness.

Active Repayment: It is during the active repayment stage that your student loan is most likely to appear on your credit report. Regular and on-time payments demonstrate responsible borrowing behavior and are reported to the credit bureaus. This reporting helps establish a positive payment history, which can improve your credit score over time.

If you suspect that the status of your student loan is preventing it from appearing on your credit report, it’s essential to review your loan documents and communicate with your loan servicer. They can clarify the reporting policies and help you understand why your loan may not be showing up on your credit report. Keeping track of your loan status and remaining proactive in managing your payments will ensure that your loan is accurately reflected on your credit report.

Repayment Status

The repayment status of your student loan is another crucial factor that can determine whether it appears on your credit report. The reporting of your loan is closely tied to your repayment activity and how you handle your loan obligations. Here are some scenarios related to repayment status that may impact the visibility of your student loan on your credit report:

On-Time Payments: If you consistently make your student loan payments on time, it is likely that your loan will be reported on your credit report. Timely payments demonstrate responsible borrowing behavior and positively contribute to your credit history. Lenders and credit bureaus view this as a positive indication of your ability to manage your debt.

Missed Payments: Failure to make loan payments on time can have a negative impact on your credit report. If you have missed payments or fallen behind on your student loan, the delinquency or default status may be reported, potentially lowering your credit score. It’s important to note that the longer the delinquency or default period, the more severe the impact on your credit report.

Payment Plan Modifications: If you have requested and been granted a modification to your repayment plan, such as changing your monthly payment amount or switching to an income-driven repayment plan, it may take some time for the updated information to be reflected on your credit report. It’s important to communicate with your loan servicer to ensure that the new payment plan is accurately reported.

Rehabilitation or Consolidation: If you have gone through a loan rehabilitation or consolidation program for your student loan, the reporting of your loan may differ. In the case of rehabilitation, the default status will be removed from your credit report after successfully completing the rehabilitation program. Similarly, consolidation of your loans may result in a new loan account being reported on your credit report instead of the individual loan accounts.

Partial or Full Repayment: If you have made partial or full repayment of your student loan, it should be reflected on your credit report. Lenders and credit bureaus consider this as positive activity, showing that you are actively reducing your debt. It’s important to review your credit report to ensure that the repayment status is accurately reported.

It’s crucial to stay aware of the repayment status of your student loan and the impact it may have on your credit report. Maintaining regular and timely payments is essential for building a strong credit history. If you encounter any issues or discrepancies with the reporting of your repayment status, it’s important to contact your loan servicer and credit bureaus to rectify the situation and ensure the accurate reporting of your student loan on your credit report.

Reporting Delays

Reporting delays can occur when it comes to the visibility of your student loan on your credit report. These delays can be caused by various factors, such as administrative processes, technical issues, or timing discrepancies. Here are some common reasons why reporting delays may occur:

Loan Disbursement Timeframe: It usually takes some time for your student loan to be disbursed by the lender or loan servicer. During this period, while your loan is in the process of being finalized, it may not appear on your credit report. Typically, once the loan is disbursed, it should be reported on your credit report within a reasonable timeframe.

Credit Bureau Processing Time: Credit bureaus need time to process and update information provided by lenders and loan servicers. The timing of when your student loan information is reported to the credit bureaus may not align with your loan payment schedule. Therefore, there may be a delay between when you make a payment and when it is reflected on your credit report.

Reporting Cycles: Some lenders or loan servicers have specific reporting cycles, which means they only report loan information to credit bureaus at certain intervals. This can lead to a delay in the visibility of your student loan on your credit report. For example, if the lender reports at the end of each month and you make a payment early in the month, it may not be reflected on your credit report until the following month.

Administrative Errors: Sometimes, reporting delays can occur due to administrative errors. This can include mistakes made by the lender, loan servicer, or credit bureau when inputting or updating loan information. These errors can result in the incorrect or delayed reporting of your student loan on your credit report.

Technical Issues: Technological glitches or system difficulties can also cause delays in the reporting of your student loan on your credit report. These issues can cause a disruption in the transmission of information between lenders, loan servicers, and credit bureaus, resulting in reporting delays.

If you believe there is a reporting delay with your student loan, it is important to monitor your credit report regularly and maintain records of your loan payments and communications with your loan servicer. If you notice a significant delay or an absence of your student loan on your credit report, contact your loan servicer to inquire about the reporting status and verify that the necessary information is being provided to the credit bureaus.

Although reporting delays are not uncommon, it is crucial to ensure that your student loan is accurately reported on your credit report to maintain a comprehensive financial profile and credit history. Taking proactive steps to address reporting delays can help ensure the accuracy of your credit report and positively impact your overall creditworthiness.

Credit Bureau Errors

Credit bureau errors can occur, leading to the incorrect or incomplete reporting of your student loan on your credit report. These errors can have a significant impact on your credit score and overall creditworthiness. Here are some common credit bureau errors that may affect the visibility of your student loan:

Incorrect Loan Information: Credit bureaus rely on accurate information from lenders and loan servicers to update your credit report. If there are discrepancies or incorrect details regarding your student loan, such as the loan amount, repayment terms, or outstanding balance, it can result in the loan not being accurately reported. It’s important to review your loan documents and compare them with the information on your credit report to identify any errors.

Misidentification: Credit bureau errors can also occur when your student loan is mistakenly attributed to another individual with a similar name or social security number. This can lead to your loan not appearing on your credit report or being inaccurately reported under someone else’s account. It’s essential to regularly check your credit report to ensure that all the information is correctly linked to you.

Outdated or Incomplete Reporting: Credit bureaus rely on regular updates from lenders and loan servicers to ensure accurate reporting. However, if there are delays or omissions in updating your student loan information, it may result in outdated or incomplete reporting. For example, if you have recently made a payment or entered a new repayment plan, but the credit bureau has not received the updated information, it could lead to discrepancies on your credit report.

Identity Theft or Fraudulent Activity: Unfortunately, identity theft and fraudulent activity can occur, whereby someone fraudulently takes out a student loan or manipulates your existing loan information. If such activities go unnoticed, they can impact the accuracy of your credit report, including the visibility of your student loan. Monitoring your credit report regularly can help identify any unauthorized activity and address it promptly.

If you suspect that there are credit bureau errors affecting the reporting of your student loan, it is important to take action. Start by reviewing your credit report from all three major credit bureaus (Equifax, Experian, and TransUnion) to identify any discrepancies. If you find errors, you should file a dispute directly with the credit bureau, providing any supporting documentation that can help rectify the issue.

Additionally, contact your loan servicer to ensure that they have provided accurate and updated information to the credit bureaus. They can help address any problems with reporting and work with the credit bureaus to correct the errors.

Regularly monitoring your credit report and promptly addressing any credit bureau errors involving your student loan can help maintain the accuracy of your credit profile. This ensures that your creditworthiness is accurately represented and can positively impact your ability to obtain credit in the future.

Private Student Loan Reporting

When it comes to private student loans, the reporting practices may vary compared to federal student loans. Private student loan lenders are not required by law to report loan information to the credit bureaus. As a result, the reporting of private student loans on your credit report may differ from that of federal student loans. Here are some key points to consider regarding private student loan reporting:

Varying Reporting Policies: Private student loan lenders have the discretion to choose whether or not to report loan information to the credit bureaus. Some lenders report to all three major credit bureaus (Equifax, Experian, and TransUnion), while others may report to only one or two bureaus. This can result in differences in your credit report depending on the bureau used.

Reporting Frequency: Private student loan lenders may have specific reporting cycles, similar to federal student loans. This means that updates to your loan information, such as payments or changes in status, may not be immediately reflected on your credit report. It’s important to be aware of the reporting frequency of your lender to understand when your loan information will be updated on your credit report.

Inconsistent Reporting Standards: Unlike federal student loans, which have standardized reporting requirements, private student loan reporting practices can vary among lenders. This can lead to inconsistencies in how private student loans are reported on credit reports. It’s important to review your credit report carefully to ensure that the reported information is accurate and up to date.

Opting for Reporting: Some private student loan lenders may give borrowers the option to request reporting or opt out of reporting their loans to credit bureaus. If you wish to have your private student loan reported on your credit report, it’s important to communicate your preference with your lender. Opting for reporting can help establish a credit history and build your credit score.

Supplemental Reporting: In addition to private student loan lenders, there are third-party companies that specialize in supplemental reporting of private student loans. These companies can report your private student loan information to credit bureaus, providing an additional layer of visibility on your credit report. However, it’s important to research and understand the services and fees associated with these companies before opting for supplemental reporting.

If you have a private student loan and are concerned about its visibility on your credit report, it is recommended to check with your lender regarding their reporting practices. Understanding how your private student loan is reported can help you monitor and manage your credit effectively. Additionally, regularly reviewing your credit report and addressing any discrepancies or errors is crucial to ensuring the accuracy of your credit profile.

Loan Consolidation or Refinancing

Loan consolidation or refinancing can impact the reporting of your student loan on your credit report. Consolidating or refinancing your student loans involves combining multiple loans into a single loan with new terms, such as a lower interest rate or extended repayment period. Here’s how loan consolidation or refinancing can affect your student loan reporting:

Consolidation: When you consolidate your student loans, the existing individual loans are paid off with a new loan. As a result, the original loans may no longer appear on your credit report, as they are now considered satisfied and closed accounts. Instead, the consolidated loan will be reported as a new loan on your credit report. It’s important to note that the credit history associated with the original loans may still be taken into account when assessing your creditworthiness.

Refinancing: Refinancing your student loans involves obtaining a new loan with different terms to replace your existing loans. Similar to consolidation, the original loans may be paid off and closed. The refinanced loan will then be reported on your credit report as a new loan. It’s important to review your credit report to ensure that the refinanced loan is accurately reported, and the details of the previous loans are no longer active.

Impact on Credit Score: Loan consolidation or refinancing can affect your credit score. When you apply for a consolidation or refinancing loan, the lender will likely conduct a hard inquiry on your credit report. This inquiry can temporarily lower your credit score. However, once the new loan is established and you make regular on-time payments, it can positively impact your credit score over time.

Repayment History: The repayment history of your original loans may still be considered in your credit score, even if they are no longer visible on your credit report. Lenders and credit scoring models may take into account the information from your original loans to assess your creditworthiness when evaluating your consolidated or refinanced loan.

If you have consolidated or refinanced your student loans and notice any issues with the reporting on your credit report, it’s important to contact your loan servicer or lender. They can provide clarification and ensure that the new loan is accurately reported. Regularly checking your credit report and monitoring your credit score will help you stay informed about any changes resulting from loan consolidation or refinancing.

Keep in mind that consolidating or refinancing your student loans should be a carefully considered decision. While it can provide benefits such as lower interest rates or simplified repayment, it’s important to evaluate the terms and potential impact on your credit before making a decision.

Reporting Frequency

The frequency at which your student loan is reported to the credit bureaus can vary, which can impact its visibility on your credit report. Lenders and loan servicers have different reporting practices, and understanding the reporting frequency is important for staying informed about your loan’s status. Here are some key factors to consider regarding reporting frequency:

Monthly Reporting: Many lenders and loan servicers report loan information on a monthly basis. This means that your payment history, outstanding balance, and loan status are updated every month. Regular reporting allows for a comprehensive and up-to-date view of your student loan on your credit report.

Periodic Reporting: Some lenders or loan servicers may report loan information less frequently, such as every quarter or every six months. This means that there may be gaps in the reporting of your loan activity on your credit report. It’s important to be aware of your loan servicer’s reporting frequency to understand when updates will be reflected on your credit report.

Payment Timing: The timing of your loan payments in relation to the reporting cycle can also impact how they appear on your credit report. If your loan payment falls shortly before or after the reporting date, it may not be included in the most recent update. This can result in a temporary delay in the visibility of your payment activity on your credit report.

Payment Allocations: When you make a payment on your student loan, it may be allocated across multiple loans or different loan categories (e.g., principal, interest, fees). The way your lender or loan servicer allocates the payment may affect how the payment is reported on your credit report. It’s important to review your loan statements and communicate with your loan servicer if you have any questions regarding payment allocations and reporting.

Reporting Lag: There can sometimes be a lag between when the loan payment is made and when it is reflected on your credit report. This lag may be due to processing time, where the credit bureaus need to receive and update the information from the lender or loan servicer. It’s important to be aware of this delay and allow sufficient time for your payment activity to be accurately reported.

Regularly monitoring your student loan and checking your credit report can help you understand the reporting frequency of your loan servicer and ensure that your loan information is accurately reflected. If you notice any discrepancies or issues with the reporting of your loan, it’s advisable to contact your loan servicer and the credit bureaus to address and rectify the situation.

Remember that maintaining a positive repayment history, regardless of the reporting frequency, is crucial for building good credit. Consistently making on-time payments and managing your student loan responsibly will contribute to a healthy credit profile and increase your chances of obtaining credit in the future.

Inactive or Dormant Status

If your student loan has been in an inactive or dormant status for an extended period, it may not appear on your credit report. This status typically occurs when there has been no activity or payment on the loan for a significant amount of time. Here are some important points to understand about inactive or dormant status and its impact on loan reporting:

Lack of Recent Activity: Student loans that have been dormant for a significant period may not be reported on your credit report. This can happen if you have not made any payments, communicated with your loan servicer, or engaged with the loan in any way. Inactive loans may not be visible on your credit report as they are not considered an active debt obligation.

Temporary Loss of Visibility: While your loan may not appear on your credit report during its dormant status, this does not mean that it has been forgotten or forgiven. The loan is still valid and will reappear on your credit report once there is renewed activity, such as making a payment or contacting your loan servicer. It’s important to keep track of your student loan and take steps to address its dormant status when you are ready to resume repayment.

Reactivation Process: To reactivate an inactive or dormant student loan, you will typically need to contact your loan servicer or lender. They can provide guidance on the necessary steps to bring your loan out of inactive status. This may include updating your contact information, confirming your repayment plan, or making a payment towards the loan.

Impact on Credit Score: While your loan is in an inactive or dormant status, it does not contribute to your credit score. However, it’s important to note that if your loan becomes active again, such as when you resume payments, the activity will be reported and can impact your credit score positively or negatively, depending on your repayment behavior.

Loan Discharge or Forgiveness: In some cases, student loans may be discharged or forgiven due to specific circumstances, such as disability, public service, or certain forgiveness programs. If your loan has been discharged or forgiven, it may no longer appear on your credit report. This can be a positive outcome, particularly if the discharge or forgiveness was granted due to meeting specific criteria or fulfilling certain obligations.

If you have a student loan in an inactive or dormant status and wish to resume repayment or discuss its impact on your credit report, reach out to your loan servicer or lender. They can provide guidance and assist you in bringing your loan back to an active status. Monitoring your credit report regularly and communicating with your loan servicer will ensure that your student loan is accurately reported and that you maintain a comprehensive view of your credit history.

Loan Discharge or Forgiveness

Student loan discharge or forgiveness can have a significant impact on the visibility of your loan on your credit report. Discharge or forgiveness occurs in specific circumstances, such as meeting certain criteria or fulfilling obligations, and can result in the removal of your loan from your credit report. Here’s what you need to know about loan discharge or forgiveness and its effect on credit reporting:

Qualification Criteria: Loan discharge or forgiveness programs are available for specific situations, such as total and permanent disability, public service, or certain forgiveness programs. Qualifying for these programs often involves meeting specific requirements, such as completing a certain number of years in a public service job or demonstrating a certified disability. Once your loan qualifies for discharge or forgiveness, it may no longer be reported on your credit report.

Positive Impact: Loan discharge or forgiveness can provide a positive outcome for borrowers who meet the necessary criteria. Having your loan discharged or forgiven can relieve you from the financial burden of repaying the loan and give you a fresh start. Additionally, the removal of the loan from your credit report may have a positive effect, as it eliminates the potential impact of any late payments or negative reporting associated with the loan.

Reporting Removal: Once your student loan is discharged or forgiven, the loan may no longer appear on your credit report. This is because the debt has been officially canceled or eliminated. However, it’s important to note that the discharge or forgiveness status itself may be reported on your credit report to indicate the resolution of the loan obligation.

Credit Effects: While the loan itself may be removed from your credit report, the discharge or forgiveness status can still have an impact on your credit. Lenders and credit scoring models may consider this status when assessing your creditworthiness, as it reflects how you managed your loan obligation. In some cases, loan forgiveness may have a more positive effect than discharge, as it signifies successful completion of a specific program or requirement.

Documentary Evidence: It’s important to keep and maintain documentation of the loan discharge or forgiveness. This includes any correspondence, certification, or official statements that validate the discharge or forgiveness of your loan. Having these documents on hand can help address any questions or future credit-related inquiries that may arise.

If you have received loan discharge or forgiveness, it’s beneficial to review your credit report to ensure that the loan is appropriately updated. If you notice any discrepancies or errors related to the discharge or forgiveness status, contact the credit bureaus to rectify the situation.

Loan discharge or forgiveness can provide significant relief for borrowers facing financial hardships or meeting specific requirements. It’s important to understand the effects on credit reporting and to keep a clear record of any successful loan discharge or forgiveness, as it can impact your credit history and future borrowing opportunities.

How to Ensure Your Student Loan Appears on Your Credit Report

Ensuring that your student loan appears on your credit report is crucial for establishing a comprehensive credit history and maintaining a positive credit profile. Here are some steps you can take to make sure your student loan is accurately reported:

Stay Informed and Keep Records: Familiarize yourself with the terms and conditions of your student loan. Understand the reporting policies of your loan servicer and any specific requirements for reporting loan information to the credit bureaus. Keep detailed records of your loan disbursements, repayment activities, and communication with your loan servicer.

Regularly Check Your Credit Report: Monitoring your credit report is essential for identifying any errors or discrepancies in the reporting of your student loan. Review your credit report from all three major credit bureaus (Equifax, Experian, and TransUnion) at least once a year. You can access a free copy of your credit report annually from each bureau at AnnualCreditReport.com.

Contact Your Loan Servicer or Credit Bureau: If you notice that your student loan is not appearing on your credit report or if there are inaccuracies, reach out to your loan servicer or the credit bureaus directly. Provide them with the necessary documentation to support the accurate reporting of your loan. Be proactive in addressing any concerns or discrepancies to ensure that your loan is properly reflected on your credit report.

Establish Good Credit Habits: Apart from accurate reporting, it’s important to focus on maintaining good credit habits overall. Make on-time payments, avoid excessive debt, and keep your credit utilization ratio low. These habits contribute to building a positive credit history and can improve your credit score over time.

Additional Reporting Options: If you have a private student loan that is not automatically reported to the credit bureaus, consider exploring supplemental reporting options. Some third-party companies specialize in reporting private student loan information to the credit bureaus. Research these companies to understand their services and fees before opting for supplemental reporting.

Remember, accurate reporting of your student loan is crucial for establishing and maintaining a strong credit profile. By staying informed, regularly checking your credit report, and communicating with your loan servicer or the credit bureaus, you can ensure that your student loan appears on your credit report and positively contributes to your credit history.

Stay Informed and Keep Records

To ensure that your student loan appears on your credit report, it is important to stay informed about the terms and conditions of your loan and keep detailed records of your loan-related activities. Here are some key steps you can take:

Understand Reporting Policies: Familiarize yourself with the reporting policies of your loan servicer or lender. Each institution may have its own guidelines for reporting loan information to the credit bureaus. Be aware of any specific requirements or timelines for reporting loan activities, such as disbursements, payments, or changes in repayment status.

Review Loan Documentation: Carefully review the terms and conditions outlined in your loan agreement. Pay attention to any clauses related to credit reporting and ensure that you understand how your loan information will be reported to the credit bureaus. If you have any questions or concerns, reach out to your loan servicer to clarify the reporting process.

Keep Detailed Loan Records: Maintain thorough records of your loan-related activities. This includes documentation of loan disbursements, payment receipts, correspondence with your loan servicer, and any changes in repayment plans. These records serve as proof of your loan activity and repayment history, which may be useful if there are any reporting discrepancies in the future.

Track Repayment Progress: Keep a record of your loan repayment progress, including the amount and frequency of your payments. This information helps you monitor your repayment history and ensures that your loan servicer has accurate documentation of your payments.

Communicate with Your Loan Servicer: Regularly communicate with your loan servicer to stay updated on any changes in your loan status or repayment plan. If you have questions or concerns about the reporting of your loan, reach out to your loan servicer for clarification. They can provide information on how your loan information is being reported to the credit bureaus and address any issues that arise.

Retain Supporting Documents: Keep copies of important documents related to your student loan, such as loan statements, payment receipts, and any modification agreements. These documents serve as evidence of your loan activity and can be vital if you need to dispute any inaccuracies on your credit report.

By staying informed about your loan terms, maintaining accurate records, and proactively communicating with your loan servicer, you can ensure that your student loan is accurately reported on your credit report. Keeping thorough documentation allows you to have a clear record of your loan activity and aids in resolving any discrepancies or errors that may arise in the reporting process.

Regularly Check Your Credit Report

Regularly checking your credit report is essential to ensure that your student loan appears accurately and positively on your credit report. It allows you to monitor the status of your loan and identify any potential errors or discrepancies that may affect your creditworthiness. Here’s why regularly reviewing your credit report is crucial:

Identify Reporting Inaccuracies: By reviewing your credit report, you can confirm that your student loan is being reported correctly. Look for any errors in loan amounts, repayment status, or payment history. If you notice any discrepancies, such as missing or inaccurate information, it’s important to address them promptly.

Monitor Payment History: Your credit report provides a detailed history of your loan payments. Regularly checking your credit report allows you to ensure that your loan payments are accurately recorded. This is particularly important because payment history is a vital factor in credit scoring models, and late or missed payments can negatively impact your credit score.

Flag Potential Fraud or Identity Theft: Monitoring your credit report helps you detect any suspicious activity that may indicate fraud or identity theft. If you see unfamiliar accounts or loans in your name, it could be a sign of fraudulent activity. Promptly reporting such instances to the credit reporting agencies can help protect your credit and personal information.

Track Credit Score Changes: Regularly reviewing your credit report allows you to track changes in your credit score. Your credit score can fluctuate based on various factors, including payment history, credit utilization, and the presence of any new loans or accounts. Monitoring these changes can help you understand the impact of your student loan and other financial activities on your creditworthiness.

Address Reporting Errors Timely: If you identify any errors or discrepancies on your credit report, it’s crucial to take immediate action. Contact the credit reporting agencies to dispute the errors and provide any supporting documentation. Promptly addressing reporting errors ensures that your credit report accurately reflects your financial history and helps prevent potentially negative consequences on your creditworthiness.

Access Free Annual Credit Reports: Under the Fair Credit Reporting Act, you are entitled to a free annual credit report from each of the three major credit reporting agencies—Equifax, Experian, and TransUnion. By taking advantage of this right, you can obtain a comprehensive view of your credit report and review the information being reported about your student loan.

Regularly checking your credit report empowers you to take control of your credit history, including the accurate reporting of your student loan. It allows you to identify and rectify any errors or discrepancies, maintain a positive credit profile, and protect yourself against fraud or identity theft. By staying vigilant and proactive, you can ensure that your student loan contributes positively to your creditworthiness and financial well-being.

Contact Your Loan Servicer or Credit Bureau

If you have concerns or questions about the reporting of your student loan on your credit report, it is important to reach out to your loan servicer or the credit bureaus directly. These entities can provide clarity, address any issues, and help ensure the accurate reporting of your loan. Here’s how you can contact them:

Contact Your Loan Servicer: Start by contacting your loan servicer—the entity responsible for managing your student loan. They can provide you with information about how your loan information is being reported to the credit bureaus. You can find their contact information on your loan statements, their website, or by calling their customer service line. Explain your concerns and provide any supporting documentation you may have to support your inquiry.

Engage with Credit Bureaus: If you have identified reporting discrepancies on your credit report, it is important to contact the credit bureaus directly. You can do this by submitting a dispute online through their websites or by sending a written letter with supporting documentation to the addresses provided on their websites. Clearly explain the issue, provide details about the inaccuracies, and include any relevant records to support your claim.

Follow up and Document Communications: Keep a record of all your interactions with your loan servicer and credit bureaus. This includes dates, times, names of representatives, and summaries of your conversations. Follow up on any promises made during these conversations and maintain copies of any written communications or dispute letters. Documentation is crucial for tracking the progress of your inquiries and resolving any reporting issues.

Be Patient and Persistent: Resolving reporting issues may take time, so it’s important to be patient. Credit reporting agencies are required to investigate and respond to your dispute within a certain timeframe under the Fair Credit Reporting Act. If you do not receive a satisfactory resolution, it may be necessary to escalate the issue to higher-level contacts within your loan servicer or seek legal assistance if needed.

Monitor Progress and Validate Updates: After contacting your loan servicer or credit bureaus, continue monitoring your credit report to observe any updates or corrections made. It’s crucial to ensure that the reporting discrepancies have been resolved and accurate information about your student loan is being reported. If further issues arise or the inaccuracies persist, continue to reach out and document your attempts to rectify the situation.

By engaging with your loan servicer and credit bureaus, you can address reporting concerns and ensure the accurate representation of your student loan on your credit report. Open communication, persistence, and proper documentation are key to resolving any reporting errors and maintaining a comprehensive and accurate credit history.

Establish Good Credit Habits

Establishing good credit habits is essential for not only ensuring that your student loan appears positively on your credit report but also for overall financial well-being. By practicing responsible borrowing and repayment behaviors, you can build a strong credit profile. Here are some key steps to help you establish good credit habits:

Make On-Time Payments: One of the most important factors in maintaining a positive credit history is consistently making on-time payments. Paying your student loan installments by the due date shows lenders and credit bureaus that you are responsible and reliable with your financial obligations.

Avoid Excessive Debt: Keeping your debt levels in check is crucial for managing your credit effectively. Avoid taking on excessive debt that could strain your financial resources. High debt levels can negatively impact your creditworthiness and make it more difficult to obtain credit in the future.

Keep Credit Utilization Low: Credit utilization refers to the percentage of your available credit that you are currently using. It is important to keep this ratio low. Gradually pay down any credit card balances and strive to maintain a credit utilization ratio of 30% or less. This demonstrates responsible credit management and positively impacts your credit score.

Monitor Your Credit Score: Keep track of your credit score regularly to understand how your financial habits are influencing it. Many free online tools offer access to credit scores or credit monitoring services. Monitoring your credit score allows you to identify any negative changes or potential errors that may impact your creditworthiness.

Review Your Credit Report: Apart from monitoring your credit score, review your credit report periodically to check for inaccuracies or inconsistencies. Look for any reporting errors related to your student loan, such as missed payments or incorrect loan amounts. If you find any issues, take immediate action to address and rectify them.

Limit Credit Applications: Avoid applying for multiple credit lines or loans within a short period. Each application results in a hard inquiry on your credit report, which can temporarily lower your credit score. Be selective when seeking new credit and only apply when it is necessary.

Diversify Your Credit Mix: Having a mix of different types of credit can positively impact your credit score. Alongside your student loan, consider having a credit card or an installment loan in your credit portfolio. This diversification shows lenders that you can manage different types of credit responsibly.

Practice Financial Discipline: Practicing financial discipline is crucial for maintaining good credit habits in the long run. Create a budget, track your expenses, and prioritize your loan payments. Avoid unnecessary spending and make informed financial decisions to ensure that you can meet all your financial obligations.

By establishing and maintaining these good credit habits, you not only ensure that your student loan appears positively on your credit report but also lay the foundation for a healthy credit profile. Responsible credit management demonstrates your financial responsibility, increasing your chances of getting approved for future credit and achieving your financial goals.

Conclusion

Ensuring that your student loan appears accurately on your credit report is essential for managing your financial well-being and securing future borrowing opportunities. By understanding the factors that can influence the reporting of your loan and taking proactive steps, you can ensure that your credit report reflects your loan activity accurately and positively.

It is important to stay informed about your loan terms, keep records of your loan activity, and regularly check your credit report for any errors or discrepancies. By staying engaged with your loan servicer and the credit bureaus, you can address any concerns or issues promptly and ensure that your student loan is accurately reported.

Establishing good credit habits, such as making on-time payments, keeping debt levels low, and monitoring your credit score, also contributes to a positive credit profile. These habits not only help in maintaining a healthy credit history but also enhance your overall financial well-being.

Remember to communicate with your loan servicer and credit bureaus whenever necessary, document all interactions, and follow up on any reported errors or disputes. Persistence and patience are key when dealing with any reporting issues, but the effort is worthwhile to maintain an accurate representation of your student loan on your credit report.

By taking the necessary steps to ensure the accurate reporting of your student loan, you can build a strong credit history, increase your creditworthiness, and set a solid foundation for your financial future.