Finance

How To Avoid Credit Card Annual Fee

Published: October 26, 2023

Learn how to avoid paying credit card annual fees and save money. Get expert tips and advice on managing your finances effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Credit Card Annual Fees

- Evaluating the Value of Credit Card Benefits

- Negotiating Credit Card Annual Fees

- Switching to a No Annual Fee Credit Card

- Maximizing Rewards to Offset Annual Fees

- Utilizing Credit Card Benefits to Offset Annual Fees

- Cancelling a Credit Card to Avoid Annual Fees

- Conclusion

Introduction

Welcome to the world of credit cards, where convenience meets rewards and the promise of financial flexibility. While credit cards offer numerous benefits and perks, it’s important to be aware of the potential costs associated with their usage. One such cost is the annual fee, a fee charged by some credit card issuers for the privilege of owning their card.

Credit card annual fees can vary widely, ranging from a few dollars to hundreds of dollars per year. These fees can certainly add up and impact your overall financial picture. However, with a little knowledge and strategic planning, it is possible to avoid or minimize annual fees without sacrificing the benefits of having a credit card.

In this article, we will explore various strategies to avoid credit card annual fees, evaluate the value of credit card benefits, and provide tips on negotiating and switching to no annual fee credit cards. We will also discuss how to maximize rewards and utilize credit card benefits to offset annual fees. By the end, you’ll have a comprehensive understanding of how to navigate the credit card landscape and ensure you’re not paying a premium for your card.

Understanding Credit Card Annual Fees

When it comes to credit cards, it’s essential to understand the concept of annual fees. An annual fee is a predetermined amount charged by credit card issuers to cardholders each year for the use of their credit card. This fee is often in addition to any interest charges or other fees associated with the card. While not all credit cards come with annual fees, many rewards cards or premium cards tend to have them.

The purpose of annual fees is to help the credit card issuer cover the costs of providing benefits and rewards to cardholders. These benefits can include travel rewards, cashback programs, exclusive access to events, concierge services, and more. The annual fee helps offset the expenses associated with providing these perks.

Annual fees can vary widely depending on the type of credit card and the level of benefits it offers. Basic credit cards may have lower or no annual fees, while premium or exclusive cards with extensive perks may have higher annual fees that can range from $100 to several hundred dollars.

While the idea of paying an annual fee may seem daunting, it’s important to evaluate the value of the benefits and perks that come with the card. In some cases, the benefits can outweigh the cost of the annual fee, making the card worth keeping. However, it’s crucial to assess whether the benefits align with your lifestyle and spending habits to determine if the annual fee is justified.

Additionally, it’s essential to consider your financial situation when deciding whether to pay an annual fee. If you tend to carry a balance on your credit card and accrue interest charges, a high annual fee might not be worth it. On the other hand, if you pay off your balance in full each month and take full advantage of the card’s benefits, the annual fee may be a worthwhile investment.

Evaluating the Value of Credit Card Benefits

When considering whether to pay a credit card annual fee, it’s crucial to thoroughly evaluate the value of the benefits that come with the card. The benefits offered by credit cards can be diverse and range from travel rewards and cashback programs to exclusive perks and insurance coverage. Here are some key factors to consider when evaluating the value of credit card benefits:

1. Rewards Program: Take a close look at the rewards program associated with the credit card. Determine the earning rate, redemption options, and the value you can get from the rewards. For example, if the card offers generous cashback on your regular expenses or provides valuable travel rewards, it may offset the annual fee.

2. Travel Benefits: If the credit card offers travel benefits such as airline miles, airport lounge access, or travel insurance, evaluate how frequently you travel and how much you would typically spend on these benefits if they were not included. Calculate the potential savings or convenience these benefits provide and compare them to the annual fee.

3. Purchase Protection: Some credit cards offer purchase protection, extended warranties, and price protection. Consider the likelihood of needing these benefits and the potential savings they can provide. If you often make significant purchases or are concerned about product reliability, these benefits can be highly valuable.

4. Concierge Services: Premium credit cards often come with concierge services that can assist with various tasks like booking reservations or securing event tickets. If you value the convenience and personalized assistance provided by these services, factor it into your evaluation.

5. Exclusive Perks: Certain credit cards offer exclusive perks like access to exclusive events, VIP experiences, or special discounts at partner merchants. Consider the appeal and value of these perks to you personally.

6. Cardholder Protections: Evaluate the level of protection provided by the credit card, such as fraud protection and zero liability for unauthorized charges. These protections can provide peace of mind and save you money in the long run.

When assessing the value of credit card benefits, it’s important to compare the estimated value of the benefits against the annual fee. If the benefits outweigh the fee and align with your lifestyle and spending habits, it may be worthwhile to keep the card. However, if the benefits don’t align with your needs or can be easily replicated with a lower-cost alternative, it may be time to explore other credit card options with lower or no annual fees.

Negotiating Credit Card Annual Fees

Did you know that you can negotiate your credit card annual fee? Many people are unaware that credit card issuers are often open to negotiating the annual fees associated with their cards. The key to successful negotiation is being prepared and knowing the right strategies to employ. Here are some tips to help you negotiate a lower or waived credit card annual fee:

1. Research Competitor Offers: Before contacting your credit card issuer, research competing credit cards that offer similar benefits but with lower or no annual fees. This will provide you with leverage during the negotiation process, as you can mention the other offers and express your interest in switching if your current annual fee cannot be reduced.

2. Call Customer Service: Reach out to your credit card issuer’s customer service department and express your concern about the annual fee. Be polite and explain your reasons for wanting a lower fee or a waiver. Highlight your loyalty as a customer and mention any positive experiences you’ve had with the card.

3. Mention Card Usage and Payment History: Emphasize your creditworthiness and responsible card usage. If you have been a long-time customer and consistently pay your bills on time, mention this as a basis for negotiating a lower fee. Credit card issuers value customers who use their cards regularly and make timely payments.

4. Discuss Your Card Usage: Highlight the value you bring to the credit card issuer by using the card frequently and making significant purchases. The more you can demonstrate your continued use and potential for generating revenue for the issuer, the stronger your negotiating position becomes.

5. Ask for a Fee Waiver or Reduction: Politely request a fee waiver or reduction. Be prepared to explain why you believe the fee should be waived or lowered based on your research, loyalty, and usage. If the customer service representative is unable to grant your request, politely ask to speak with a supervisor who may have more authority to make exceptions.

6. Consider Retention Offers: Sometimes, credit card issuers may offer retention offers to keep valuable customers. These offers can include fee waivers, bonus rewards, or statement credits. If the representative does not initially offer a solution, inquire about any potential retention offers that might be available.

Remember, credit card issuers want to retain their customers, so they may be open to negotiation in order to keep you. Be persistent, yet polite, during the negotiation process. If one representative is unable to accommodate your request, try reaching out to the issuer multiple times or through different communication channels to increase your chances of success.

Negotiating your credit card annual fee can lead to significant savings, so don’t hesitate to give it a try. You may be surprised by the positive outcome and the impact it can have on your overall financial well-being.

Switching to a No Annual Fee Credit Card

If you find that paying a credit card annual fee is no longer worth it or doesn’t align with your financial goals, switching to a credit card with no annual fee can be a smart move. Moving to a no annual fee credit card allows you to enjoy the benefits of having a credit card without the burden of an annual fee. Here are some steps to consider when switching to a no annual fee credit card:

1. Research No Annual Fee Credit Cards: Begin by researching credit card options that do not charge an annual fee. Look for cards that offer benefits and rewards comparable to your current card. Pay attention to factors such as interest rates, rewards programs, and additional perks to ensure that the new card meets your needs.

2. Consider Balance Transfer Options: If you have an outstanding balance on your current credit card, look for a new no annual fee card that offers a balance transfer option. A balance transfer allows you to transfer your existing debt to the new card, often with a lower or no interest rate for a specified period. This can save you money on interest charges and help you pay off your debt faster.

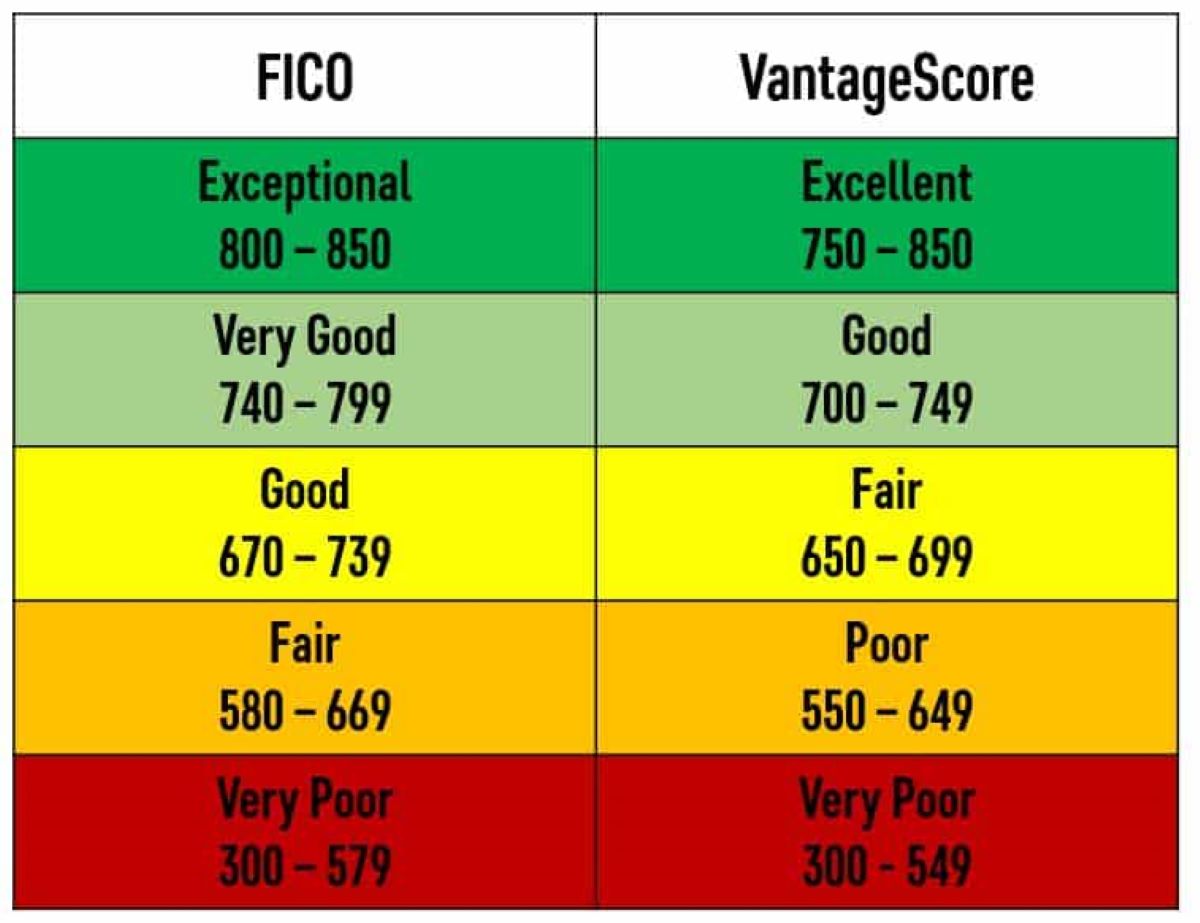

3. Review the Application Process: Take time to review the application process and ensure that you meet the eligibility criteria for the new credit card. Check your credit score to gauge the likelihood of approval. Keep in mind that applying for a new credit card may temporarily impact your credit score, so consider the timing and any potential consequences.

4. Close Your Current Credit Card Account: Once you have been approved for a new no annual fee credit card, consider closing your current credit card account, especially if it charges a high annual fee. However, before closing an account, evaluate the potential impact on your credit history and utilization ratio. If the card has a long credit history or closing it will significantly impact your credit utilization, you may want to keep it open and use it sparingly or talk to the issuer about converting it to a no annual fee card.

5. Transfer Any Recurring Payments: If you have any recurring payments linked to your old credit card, such as subscriptions or utility bills, make sure to update the payment information with your new card details. This ensures that your payments continue uninterrupted and helps you avoid any late fees or service disruptions.

6. Activate and Utilize Your New Card: Once you receive your new no annual fee credit card, activate it and start using it for your everyday purchases. Take advantage of any rewards programs or benefits that come with the card to maximize its value. Be sure to pay your balance in full and on time each month to maintain a positive credit history.

Switching to a no annual fee credit card can save you money in the long run and offer peace of mind knowing that you’re not paying unnecessary fees. Be sure to compare different options, review the terms and conditions, and choose a card that best suits your needs and financial situation.

Maximizing Rewards to Offset Annual Fees

One effective strategy for offsetting credit card annual fees is to maximize the rewards and benefits that come with your card. By optimizing your usage and redemption of rewards, you can help ensure that the value you receive from your credit card outweighs the cost of the annual fee. Here are some tips to help you maximize rewards and offset annual fees:

1. Understand Your Rewards Program: Take the time to fully understand the rewards program associated with your credit card. Know the earning structure, bonus categories, and redemption options. This knowledge will help you make informed decisions about how to maximize your rewards.

2. Choose the Right Card for Your Spending Habits: Select a credit card that aligns with your spending habits to earn rewards on the purchases you make most frequently. For example, if you spend a significant amount on groceries or travel, choose a card that offers bonus rewards in those categories.

3. Use Your Card for Everyday Purchases: Make it a habit to use your credit card for everyday purchases, such as groceries, gas, and bills. By doing so, you can accumulate rewards on essential expenses without changing your spending habits.

4. Combine Rewards with Sign-Up Bonuses: Take advantage of sign-up bonuses offered by credit card issuers. These bonuses often require you to meet a minimum spending requirement within a specified timeframe. By strategically timing your applications and meeting the spending requirements, you can earn valuable rewards that can offset the annual fee.

5. Maximize Bonus Categories: Make a conscious effort to maximize your spending in bonus categories to earn more rewards. For example, if your card offers extra rewards on dining, make it a point to dine out or order takeout regularly to accumulate more rewards in that category.

6. Consider Using Multiple Credit Cards: If you have multiple credit cards with different rewards structures, use them strategically to maximize your rewards. Use one card for specific bonus categories and another for everyday spending, ensuring that you earn the most rewards for each purchase.

7. Look for Redemption Enhancements: Some credit card issuers offer additional value when redeeming rewards, such as travel statement credits or point boosts for certain redemptions. Take advantage of these enhancements to maximize the value of your rewards.

8. Keep Track of Your Rewards Balance: Stay on top of your rewards balance to ensure that you don’t let your earned rewards expire. Set reminders or use mobile apps to track your rewards and plan for their redemption.

By implementing these strategies, you can make the most of your credit card rewards and help offset the annual fees. Remember to evaluate the value of the rewards earned in comparison to the annual fee to ensure that you are truly benefiting from the rewards program.

Utilizing Credit Card Benefits to Offset Annual Fees

Many credit cards come with a range of additional benefits beyond just earning rewards. These benefits can include travel perks, purchase protection, extended warranties, and more. By strategically utilizing these benefits, you can offset the cost of credit card annual fees and maximize the value of your card. Here are some tips on how to utilize credit card benefits to offset annual fees:

1. Travel Benefits: If your credit card offers travel benefits such as airline lounge access, travel insurance, or hotel upgrades, make sure to take advantage of them. By utilizing these perks during your travels, you can enjoy added convenience and savings that can easily offset the annual fee. For example, access to airport lounges can help you save on food and beverages while waiting for your flight.

2. Purchase Protection: Familiarize yourself with the purchase protection benefits provided by your credit card. These benefits can include coverage for items damaged or stolen within a certain timeframe after purchase. If you have an eligible claim, utilizing this protection can save you money on potentially costly repairs or replacement of your purchases.

3. Extended Warranties: If your credit card offers extended warranty coverage, consider utilizing this benefit when purchasing electronics or appliances. By registering your eligible purchases with the credit card issuer, you can extend the manufacturer’s warranty. This can provide you with peace of mind and potentially save you money on costly repairs in the future.

4. Price Protection: Some credit cards offer price protection, which means that if an item you purchased with the card goes on sale within a specified period, you can request a refund for the difference. Keeping an eye on price changes and submitting a claim to take advantage of this benefit can result in significant savings over time.

5. Concierge Services: Take advantage of the concierge services offered by your credit card. These services can assist with a variety of tasks, such as booking reservations, finding event tickets, or arranging transportation. By utilizing these services, you can save time and potentially gain access to exclusive experiences that make the annual fee worthwhile.

6. Insurance Coverage: Check if your credit card provides insurance coverage, such as rental car insurance or travel accident insurance. Using these coverages instead of purchasing separate insurance policies can help you avoid additional expenses and reduce overall costs.

7. Discounts and Special Offers: Many credit cards offer discounts and special offers with partner merchants. Take advantage of these discounts when shopping or dining to save money and offset the annual fee. Keep an eye on promotional emails or notifications from your credit card issuer to stay updated on the latest offers.

Remember to thoroughly review the terms and conditions of your credit card benefits to understand the specific rules and requirements. Proper utilization of these benefits can not only enhance your overall cardholder experience but also help to offset the cost of the annual fee, making your credit card even more valuable.

Cancelling a Credit Card to Avoid Annual Fees

If you have a credit card with an annual fee that no longer aligns with your financial goals or spending habits, one option is to cancel the card to avoid the annual fee. However, it’s important to consider the potential impact on your credit score and overall credit profile before making a decision. Here are some factors to consider when contemplating cancelling a credit card to avoid annual fees:

1. Evaluate the Benefits vs. the Cost: Assess whether the benefits provided by the card justify its annual fee. Consider the rewards, perks, and additional benefits you receive versus the cost of the fee. If the value you receive from the card does not exceed the fee or no longer aligns with your needs, cancelling the card may be a sensible option.

2. Consider the Impact on Credit Utilization: Closing a credit card account can affect your credit utilization ratio, which is the ratio of your total credit card balances to your total credit limits. If you have significant balances on other credit cards and closing the card will increase your utilization ratio, it could negatively impact your credit score. It’s important to analyze the potential consequences before making a decision.

3. Assess Your Credit History: The length of your credit history is an essential factor in determining your credit score. If the card you’re considering cancelling is one of your oldest credit accounts, closing it could shorten the length of your credit history and potentially impact your score. However, if you have other well-established credit accounts, the impact might be minimal.

4. Consider Alternative Options: Before cancelling the card, explore alternative options with the credit card issuer. Some issuers may be willing to downgrade your card to one without an annual fee. This allows you to maintain the credit line and account history while avoiding the fee. Contact customer service to inquire about available options.

5. Impact on Average Age of Accounts: Closing a credit card can also impact the average age of your credit accounts. The longer your credit history, the better it reflects your creditworthiness. If the card you’re considering cancelling has a lengthy history, closing it may result in a decrease in your average age of accounts. This factor should be weighed against other considerations.

6. Monitor Ongoing Fees: Keep an eye on your credit card statements for any additional fees that may be charged. Some credit cards may have hidden fees that are separate from the annual fee. If you discover ongoing fees that were not disclosed when you signed up for the card, consider discussing the matter with customer service or cancelling the card if the fees are not justified.

Before cancelling a credit card, it’s crucial to evaluate the potential impact on your credit score, credit history, and overall credit profile. If the card no longer provides significant value or aligns with your needs, cancelling it may be a reasonable decision. However, if there are negative consequences, consider alternative options such as downgrading the card or negotiating a lower fee with the issuer.

Conclusion

Navigating the world of credit cards and annual fees can seem overwhelming, but armed with the right knowledge and strategies, you can make informed decisions to minimize or avoid these fees. Understanding the concept of credit card annual fees and evaluating the value of the benefits provided by your card is crucial. By carefully assessing the benefits and costs, you can determine if paying an annual fee is truly worthwhile.

If you find that the annual fee is no longer justifiable or aligns with your financial goals, you have several options. You can negotiate with your credit card issuer to lower or waive the fee, especially if you have been a loyal customer. If that doesn’t work, switching to a credit card with no annual fee can be a smart move. This allows you to enjoy the perks of owning a credit card without the burden of a recurring fee.

To offset annual fees, make sure to maximize your credit card rewards and benefits. Utilize your card for everyday purchases, take advantage of bonus categories, and explore redemption options to make the most of your rewards. Additionally, leverage the various benefits provided by your credit card, such as travel perks, purchase protection, extended warranties, and concierge services.

While cancelling a credit card to avoid annual fees is an option, it’s essential to consider the potential impact on your credit score and credit profile. Analyze the implications on your credit utilization, credit history, and average age of accounts before making a decision. Explore alternative options like downgrading the card or negotiating with the issuer to find the best solution for your specific circumstances.

In conclusion, understanding credit card annual fees and utilizing effective strategies can help you make the most of your credit card benefits while minimizing or avoiding the associated costs. By evaluating the value of the benefits, negotiating, switching to no annual fee cards, maximizing rewards, and utilizing benefits, you can navigate the credit card landscape to your advantage. Make informed decisions, and remember to review the terms and conditions of your credit cards to ensure you’re getting the most value out of your cards while keeping your financial goals in mind.