Finance

What Is Performance Budgeting

Published: October 11, 2023

Learn the concept of performance budgeting and its importance in finance. Discover how performance budgeting can optimize your financial management and decision-making.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Performance budgeting is a crucial concept in the field of finance and budgeting. It is a strategic approach that focuses on achieving desired outcomes and optimizing the use of available resources. In traditional budgeting, the emphasis is mainly on inputs and expenditures, whereas performance budgeting shifts the focus to outcomes and results.

Performance budgeting goes beyond just allocating funds based on historical spending patterns. It requires thorough planning, goal setting, and evaluation of performance metrics. By tying budgetary decisions to specific performance goals, organizations can improve accountability, transparency, and efficiency in resource allocation.

Unlike traditional budgeting, performance budgeting takes a more results-oriented approach. It provides a framework for measuring the effectiveness and efficiency of government programs, non-profit organizations, and even businesses. With performance budgeting, decision-makers can assess the value and impact of their investments and make data-driven decisions.

Performance budgeting has gained significant popularity in recent years due to its ability to align financial resources with strategic priorities. It allows for a more holistic view of budgeting, considering both the financial implications and the expected outcomes of expenditures. By focusing on the results organizations aim to achieve, performance budgeting encourages thoughtful resource allocation that can drive progress and growth.

Moreover, performance budgeting provides a platform for measuring the performance of different departments or units within an organization. This enables leaders to identify areas of improvement, track progress, and make informed decisions on resource allocation for maximum impact.

In this article, we will explore the definition of performance budgeting, its benefits and challenges, key components, and steps to implement it effectively. We will also examine examples of organizations successfully using performance budgeting and address some criticisms surrounding the approach. By the end of this article, you will have a comprehensive understanding of performance budgeting and its relevance in the world of finance.

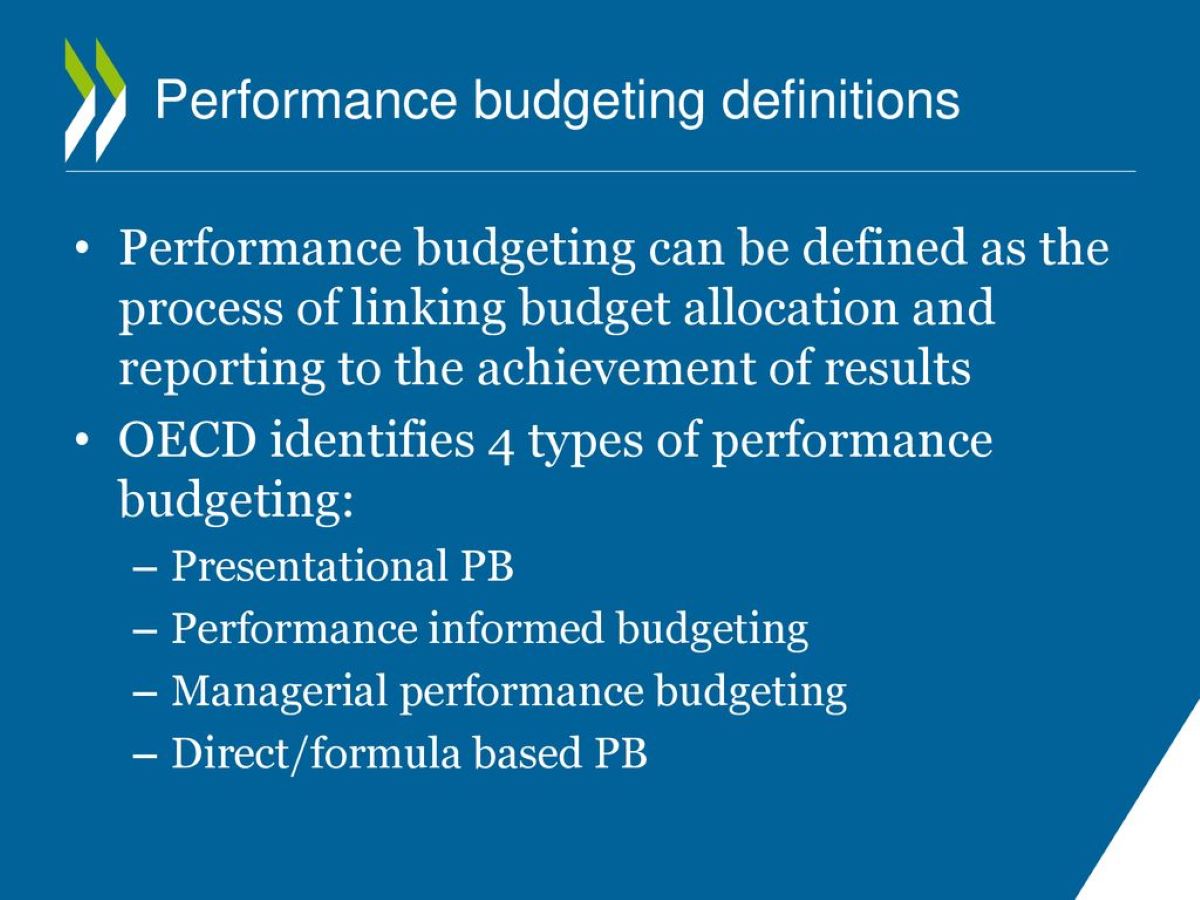

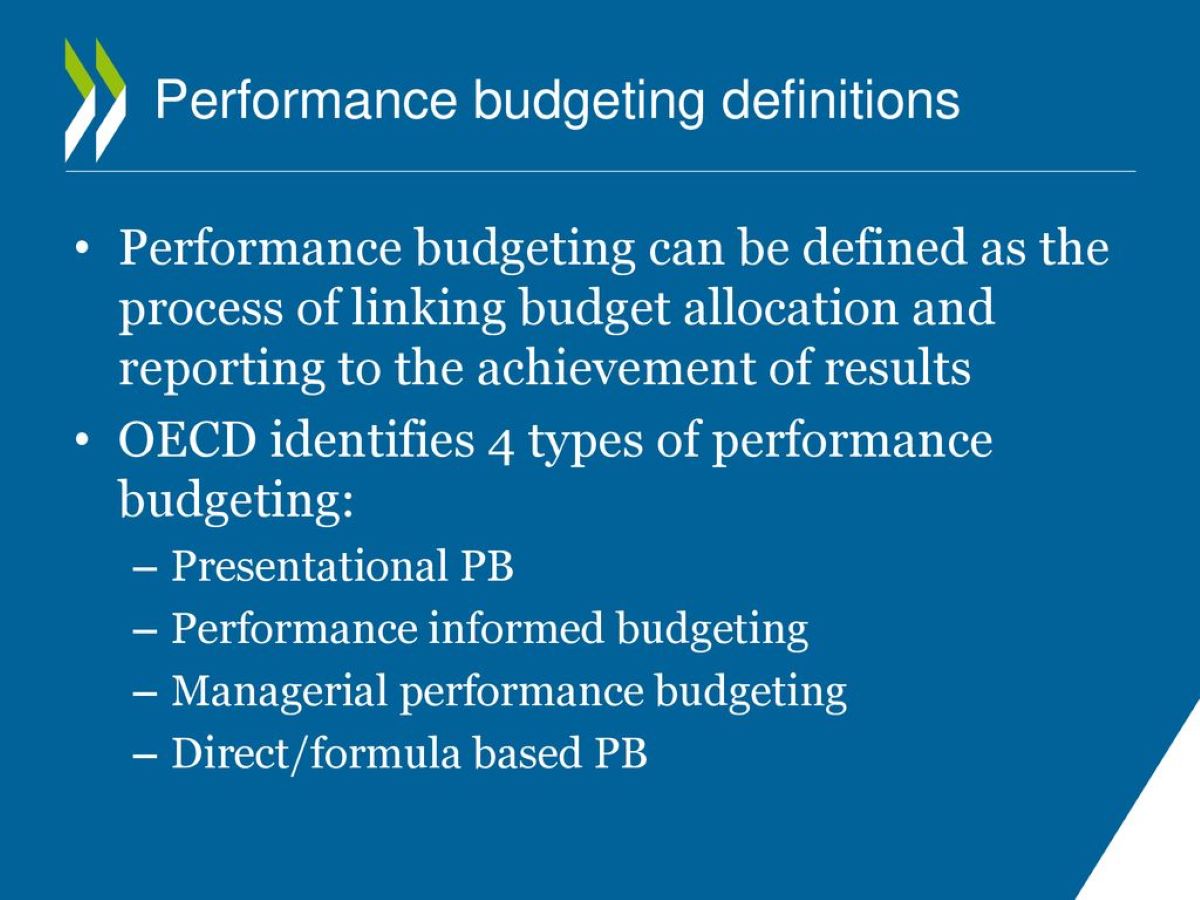

Definition of Performance Budgeting

Performance budgeting is a budgeting approach that focuses on linking financial resources to the expected outcomes and performance of an organization. It moves beyond traditional budgeting methods that prioritize input-based allocations and examines the effectiveness and efficiency of expenditures. Performance budgeting emphasizes the achievement of specific goals and objectives, making it a strategic tool for resource allocation.

In performance budgeting, the budgeting process is guided by the desired results and outcomes. It involves setting clear performance targets and aligning financial resources accordingly. The aim is to ensure that every dollar spent contributes to the intended outcomes and provides value for money.

One of the key features of performance budgeting is the use of performance indicators or metrics to evaluate the effectiveness of programs or projects. These indicators can be both quantitative and qualitative, measuring various dimensions such as cost-effectiveness, efficiency, quality, and impact.

Performance budgeting also takes into account the concept of performance measurement, which involves tracking and monitoring the progress and outcomes of budgeted activities. This allows organizations to assess the actual performance against the planned targets and make necessary adjustments to improve future performance.

Furthermore, performance budgeting promotes accountability and transparency. By tying budgetary decisions to specific outcomes, it becomes easier for stakeholders to understand how resources are being utilized and the results that are being achieved. This helps in building trust and confidence in the organization’s financial management and decision-making process.

In summary, performance budgeting is a results-oriented approach that seeks to align financial resources with the desired outcomes and performance targets of an organization. It focuses on measuring and evaluating the effectiveness of expenditures and promotes transparency, accountability, and efficient resource allocation.

Benefits of Performance Budgeting

Performance budgeting offers several benefits for organizations and governments, providing a more strategic and results-oriented approach to financial planning and resource allocation. Here are some key advantages of performance budgeting:

-

Outcome-based resource allocation: Performance budgeting ensures that financial resources are allocated based on the expected outcomes and performance targets of an organization. This helps in maximizing the impact of expenditures and ensures that resources are used effectively.

-

Improved accountability and transparency: By connecting budget decisions to specific performance goals, performance budgeting enhances accountability and transparency. It allows stakeholders to see how resources are being utilized and the results that are being achieved, fostering trust and confidence in the organization.

-

Strategic decision-making: Performance budgeting enables organizations to make data-driven and informed decisions. By evaluating the performance indicators and metrics, leaders can identify areas of improvement, allocate resources strategically, and make necessary adjustments to achieve desired outcomes.

-

Efficient resource allocation: With performance budgeting, resources are allocated based on the effectiveness and efficiency of programs or projects. It helps in eliminating unnecessary or low-performing initiatives and reallocating resources to high-impact activities, optimizing the use of available funds.

-

Enhanced performance measurement: Performance budgeting provides a framework for measuring and evaluating the performance of programs and projects. This allows organizations to track progress, identify bottlenecks, and take corrective actions to improve performance over time.

-

Alignment with strategic priorities: Performance budgeting ensures that budgetary decisions are aligned with the strategic goals and priorities of an organization. It helps in focusing resources on activities and initiatives that directly contribute to the overall mission and vision.

-

Accounting for cost-effectiveness: Performance budgeting considers the cost-effectiveness of expenditures. By assessing the outcomes achieved relative to the resources invested, organizations can identify efficient and cost-saving practices, leading to improved financial management.

Overall, performance budgeting provides a framework to optimize resource allocation, improve decision-making, and enhance accountability and transparency. It promotes a results-oriented culture and helps organizations achieve their desired outcomes effectively and efficiently.

Challenges of Performance Budgeting

While performance budgeting offers numerous benefits, there are also challenges associated with its implementation. It is important to acknowledge these challenges to ensure successful adoption and utilization of performance budgeting. Here are some common challenges:

-

Data availability and quality: One of the primary challenges of performance budgeting is the availability and quality of data. Performance indicators and metrics require accurate and reliable data for effective evaluation. However, organizations may face difficulties in collecting, analyzing, and verifying the data needed for performance measurement.

-

Defining and measuring performance: Another challenge is the definition and measurement of performance. Establishing clear and meaningful performance indicators that align with organizational goals can be complex. It requires a thorough understanding of the organization’s mission and objectives, as well as a consensus on what constitutes successful performance.

-

Subjectivity and biases: Performance evaluation can be subjective and prone to biases. Different stakeholders may have different perceptions of what constitutes successful performance, leading to conflicting evaluations. It is important to establish a fair and impartial evaluation process to mitigate the impact of personal biases.

-

Resistance to change: Implementing performance budgeting often requires significant changes in organizational culture, processes, and mindsets. Resistance to change from stakeholders, such as employees and management, can impede the successful adoption of performance budgeting. It is crucial to communicate the benefits and address concerns to overcome resistance and ensure buy-in.

-

Resource constraints: Limited resources can pose a challenge in implementing performance budgeting. Organizations may not have the necessary funds, technology, or expertise required for effective performance measurement and evaluation. It is important to consider resource constraints and plan accordingly to optimize the use of available resources.

-

Complexity and time commitment: Performance budgeting can be a complex process that requires dedicated time and effort. Collecting and analyzing performance data, setting targets, and evaluating outcomes can be time-consuming. It requires commitment and resources to ensure the accuracy and reliability of performance measurement.

-

Short-term focus: Performance budgeting can sometimes lead to a short-term focus on immediate results rather than long-term strategic goals. Organizations may prioritize activities that yield quick wins or demonstrate immediate impact, neglecting long-term investments and outcomes. It is important to strike a balance between short-term and long-term performance goals.

Despite these challenges, organizations can overcome them through proper planning, stakeholder engagement, capacity building, and continuous improvement. Addressing these challenges is crucial in maximizing the benefits of performance budgeting and achieving desired outcomes effectively and efficiently.

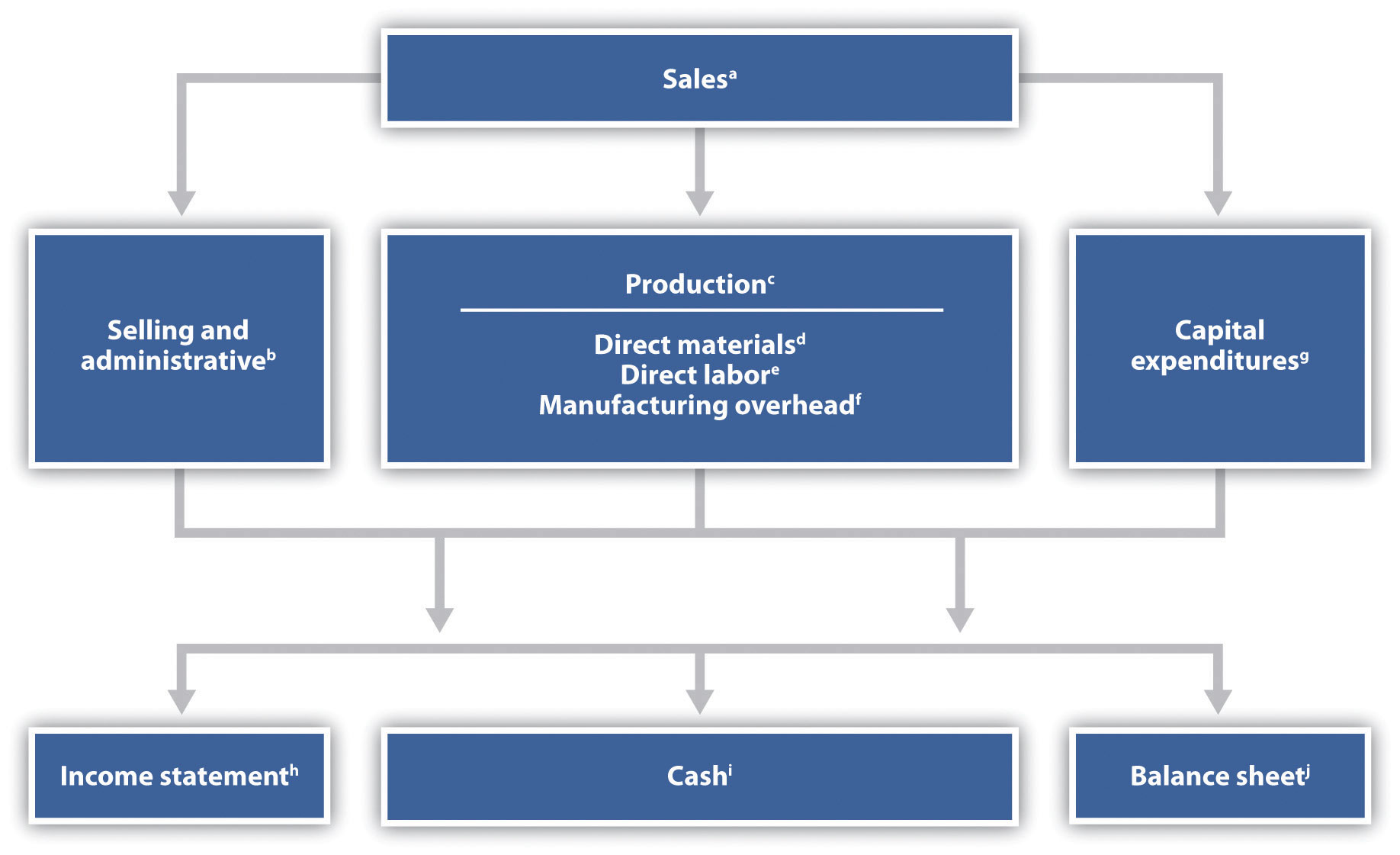

Key Components of Performance Budgeting

Performance budgeting comprises several key components that lay the foundation for effective resource allocation and evaluation of outcomes. These components work together to ensure a comprehensive and systematic approach to performance-oriented budgeting. Here are the key components of performance budgeting:

-

Performance Goals and Objectives: The first component of performance budgeting is defining clear performance goals and objectives. These goals should be specific, measurable, attainable, relevant, and timebound (SMART). They provide a clear direction for resource allocation and serve as benchmarks for evaluating performance.

-

Performance Indicators: Performance indicators are measurable parameters that track progress towards achieving performance goals. These indicators can be quantitative or qualitative, and they enable organizations to assess the effectiveness and efficiency of their programs or projects. It is essential to select meaningful and relevant indicators that align with the desired outcomes.

-

Performance Measures: Performance measures are the metrics used to quantify and evaluate the performance of a specific activity or initiative. These measures provide a standardized way to assess progress and determine the level of achievement. They can include cost per outcome, time to completion, customer satisfaction ratings, and other relevant metrics.

-

Budgetary Allocations: Budgetary allocations in performance budgeting are tied to the achievement of performance goals. Instead of allocating funds based solely on historical spending patterns, performance budgeting allocates resources based on the expected outcomes and priorities. The budget is aligned with the performance indicators and measures, ensuring that resources are directed towards activities that contribute to the desired results.

-

Performance Reporting and Evaluation: Performance reporting and evaluation involve tracking and assessing the progress and outcomes against the set goals and indicators. Regular reports are generated to provide visibility into the performance of various programs or projects. Evaluation helps identify areas of improvement, track the effectiveness of resource allocation, and inform decision-making.

-

Performance Improvement Strategies: Performance budgeting also involves developing strategies to improve performance over time. This includes identifying areas of underperformance and implementing targeted interventions to enhance effectiveness and efficiency. Strategies can include process improvements, staff training, technological enhancements, and other measures aimed at optimizing performance and achieving better outcomes.

These key components work synergistically to ensure a robust performance budgeting framework. By integrating these components into the budgeting process, organizations can enhance accountability, transparency, and effectiveness in resource allocation and achieve desired outcomes.

Steps to Implement Performance Budgeting

Implementing performance budgeting requires a systematic and well-planned approach. While specific steps may vary depending on the organization and context, here is a general outline of the key steps involved in implementing performance budgeting:

-

Define Performance Goals: Begin by clearly defining the performance goals and outcomes that the organization wants to achieve. These goals should be aligned with the organization’s strategic objectives and vision. It is essential to ensure that the goals are specific, measurable, attainable, relevant, and timebound (SMART).

-

Identify Performance Indicators: Once the performance goals are defined, identify the performance indicators that will be used to measure progress towards those goals. These indicators should be aligned with the goals and represent key dimensions of performance, such as efficiency, effectiveness, quality, or customer satisfaction.

-

Collect and Analyze Data: Collect the necessary data to measure the identified performance indicators. Analyze the data to gain insights into the organization’s current performance and identify areas for improvement. This may involve reviewing existing performance data, conducting surveys or interviews, or implementing data tracking systems.

-

Set Performance Targets: Based on the analysis of data and the desired outcomes, set realistic and achievable performance targets for each indicator. These targets should be ambitious enough to drive improvement but also attainable given the available resources and constraints.

-

Allocate Resources: Align budgetary allocations with the performance goals and indicators. Ensure that resources are allocated based on the expected outcomes and priorities. This may involve reallocating funds from low-performing initiatives to high-impact activities and ensuring that resources are optimized to maximize the organization’s performance.

-

Monitor and Evaluate: Establish a monitoring and evaluation system to track the progress towards meeting the performance targets. Regularly review and assess the actual performance against the set targets. This will help identify any deviations, evaluate the effectiveness of resource allocation, and inform decision-making for future periods.

-

Continuously Improve: Use the performance evaluation findings to drive continuous improvement. Identify areas where performance falls short or where there is room for enhancement, and devise strategies to address those gaps. This may involve process improvements, staff training, technology upgrades, or other measures to optimize performance.

-

Communicate and Engage: Ensure effective communication and engagement with key stakeholders throughout the implementation process. Foster understanding and buy-in by clearly explaining the purposes and benefits of performance budgeting. Engage stakeholders in the goal-setting and decision-making processes to enhance ownership and commitment.

Implementing performance budgeting is an ongoing process that requires continuous monitoring, evaluation, and improvement. By following these steps and adapting them to the organization’s specific needs, performance budgeting can be effectively implemented to drive accountability, efficiency, and improved outcomes.

Examples of Performance Budgeting

Performance budgeting has been widely adopted by various organizations and governments around the world. Here are a few examples of entities that have successfully implemented performance budgeting:

-

Government of New Zealand: The New Zealand government implemented performance budgeting in the late 1980s. They introduced the concept of “outputs” and “outcomes” as the basis for budgeting, focusing on the results achieved rather than just the inputs. This approach allowed for better alignment of resources with the government’s policy priorities and improved accountability.

-

City of Baltimore, USA: The City of Baltimore implemented performance budgeting to improve the efficiency and effectiveness of service delivery. They set performance goals, established performance indicators, and used data to drive decision-making. This approach led to improved transparency and enabled the city to allocate resources based on the performance and impact of various programs and initiatives.

-

European Union: The European Union (EU) implemented performance budgeting to better link funding to outcomes and results. Their budget framework focuses on achieving specific EU policy goals, such as economic growth, job creation, and environmental sustainability. The performance budgeting approach allows for more targeted and effective allocation of funds across different policy areas.

-

Singapore government: The Singapore government has been using performance budgeting for many years as part of their overall budgeting process. They set clear performance targets and indicators for each ministry and agency and track their progress regularly. This helps ensure accountability and drives efficiency in resource allocation to achieve desired outcomes.

-

World Bank: The World Bank uses performance budgeting as a tool to assess the impact and effectiveness of its development projects. They set specific targets, measure outcomes, and link funding to the achievement of these targets. The performance budgeting approach helps them ensure that resources are allocated to projects that have the greatest impact on poverty reduction and sustainable development.

These examples demonstrate the diverse range of organizations that have successfully implemented performance budgeting. Whether at the government level or in non-profit organizations, performance budgeting has proven to be an effective tool for aligning resources, improving accountability, and achieving desired outcomes.

Criticisms of Performance Budgeting

While performance budgeting has its benefits, it is not without its criticisms. It is important to recognize these criticisms to have a comprehensive understanding of the limitations and challenges of performance budgeting. Here are some common criticisms:

-

Overemphasis on quantitative measures: One criticism of performance budgeting is that it often focuses too heavily on quantitative measures and ignores the qualitative aspects of performance. Not all outcomes can be easily quantified, and relying solely on numbers may lead to a narrow assessment of performance.

-

Risk of gaming and manipulation: Performance budgeting introduces the risk of gaming and manipulation of performance indicators. Organizations may be tempted to manipulate data or choose indicators that are easier to achieve to present a more favorable performance picture. This can compromise the accuracy and integrity of performance measurement.

-

Narrow view of performance: Critics argue that performance budgeting tends to have a narrow view of performance, focusing on short-term and easily quantifiable outcomes. This may overlook the long-term impacts, unintended consequences, or the qualitative aspects of performance that are not easily captured by metrics.

-

Complexity and resource requirements: Implementing performance budgeting can be complex and resource-intensive. It requires substantial investment in data collection, analysis, and reporting systems. Small organizations or those with limited resources may struggle to meet these requirements, hindering their ability to effectively implement performance budgeting.

-

Potential for unintended consequences: Critics argue that performance-based budgeting can lead to unintended consequences. For example, organizations may prioritize activities that can easily demonstrate short-term results, neglecting long-term investments or strategies that require more time to yield outcomes. This can create a skewed focus on easily measurable outcomes and overlook the broader organizational objectives.

-

Difficulty in measuring complex outcomes: Some critics argue that certain social or public sector outcomes are inherently complex and challenging to measure accurately. For example, measuring the impact of education programs or healthcare initiatives may not be straightforward due to multiple influencing factors and long-term effects. This can make it difficult to assess performance and allocate resources effectively.

While these criticisms highlight the limitations of performance budgeting, it is important to address them through careful design and implementation. Transparent and robust performance measurement systems, stakeholder engagement, and a balanced approach to measuring both quantitative and qualitative outcomes can help mitigate these criticisms and improve the effectiveness of performance budgeting.

Conclusion

Performance budgeting is a strategic approach to financial planning and resource allocation that focuses on outcomes and results. It offers several benefits, including improved accountability, transparency, and efficient resource allocation. By linking financial decisions to specific performance goals and indicators, organizations can optimize the use of available resources and drive progress towards their desired outcomes.

While there are challenges and criticisms associated with performance budgeting, such as the overemphasis on quantitative measures and the potential for gaming and manipulation, these can be addressed through careful design and implementation. Organizations need to consider the specific context and objectives when implementing performance budgeting and ensure a balanced approach that includes qualitative assessments and long-term perspectives.

Implementing performance budgeting requires defining clear performance goals, establishing appropriate indicators and measures, and aligning budgetary allocations with desired outcomes. The process also involves monitoring and evaluating performance, continuously improving, and effectively engaging stakeholders throughout the process.

Examples of successful implementation of performance budgeting can be seen in various organizations and governments worldwide, demonstrating its potential effectiveness in driving accountability, efficiency, and improved outcomes.

In conclusion, performance budgeting offers a strategic and results-oriented approach to financial management. By embracing the principles of performance budgeting, organizations can allocate resources more effectively, enhance accountability and transparency, and work towards achieving their goals and desired outcomes.