Finance

What Is Financial Budgeting

Published: October 11, 2023

Learn the importance of financial budgeting and how it can help you manage your finances effectively. Discover key tips and strategies to improve your financial planning.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Financial Budgeting

- Purpose of Financial Budgeting

- Benefits of Financial Budgeting

- Key Components of Financial Budgeting

- Types of Financial Budgeting

- Steps in the Financial Budgeting Process

- Importance of Financial Budgeting for Businesses

- Challenges and Limitations of Financial Budgeting

- Best Practices for Effective Financial Budgeting

- Conclusion

Introduction

Financial budgeting is a fundamental aspect of managing personal and business finances. It involves the process of planning, organizing, and allocating financial resources to achieve specific goals and objectives. By creating a detailed financial plan, individuals and organizations can make informed decisions about spending, saving, and investing.

Financial budgeting is not merely about tracking expenses and income; it is a comprehensive approach to managing finances that involves forecasting future financial outcomes and making strategic decisions based on that forecast. It provides a roadmap for financial success and allows individuals and businesses to effectively manage their cash flow, make investments, and adapt to changing economic conditions.

Whether you are an individual trying to plan for your retirement or a business owner looking to expand operations, having a well-structured financial budget is crucial. It helps in setting achievable financial targets, monitoring progress, and making necessary adjustments along the way.

Financial budgeting is a dynamic and iterative process that involves continuous evaluation and adjusting of financial plans to reflect the changing needs and circumstances. It requires discipline, accuracy, and a deep understanding of financial concepts and principles.

In this article, we will explore the various aspects of financial budgeting, including its definition, purpose, benefits, key components, types, process, as well as its importance and challenges for businesses. We will also provide some best practices for effective financial budgeting.

So, whether you are a novice looking to gain a basic understanding of financial budgeting or an experienced professional seeking to refine your skills, this article aims to equip you with the knowledge and insights needed to successfully navigate the world of financial planning and budgeting.

Definition of Financial Budgeting

Financial budgeting refers to the process of creating a comprehensive plan that outlines an individual’s or an organization’s expected income and expenses over a specific period of time. It involves estimating future cash flows and allocating resources towards different financial activities in order to achieve financial goals and objectives.

In simpler terms, financial budgeting is a method of forecasting and managing financial resources to ensure the effective allocation of funds. It provides a framework for making financial decisions, such as determining how much money should be allocated for various expenses, savings, investments, and debt repayments.

A financial budget serves as a financial roadmap that guides individuals and organizations in effectively managing their financial activities. It helps in setting realistic financial targets, identifying areas of improvement, and making well-informed financial decisions.

Financial budgeting involves a thorough analysis of an individual’s or an organization’s financial situation, including income sources, expenses, assets, liabilities, and financial obligations. It takes into account both short-term and long-term financial goals, as well as the current economic conditions and market trends.

By creating a financial budget, individuals and organizations can better understand their financial position and make responsible financial choices. It enables individuals to save for future expenses, such as buying a house or funding their children’s education, while allowing organizations to allocate funds towards business expansion, research and development, or debt reduction.

Overall, financial budgeting provides a structured approach to managing financial resources and helps individuals and organizations make informed decisions about their money. It is a proactive approach to financial management, allowing individuals and businesses to have greater control over their financial future and enhance their financial well-being.

Purpose of Financial Budgeting

The purpose of financial budgeting is multifold, serving as a crucial tool for individuals and organizations to achieve financial stability and success. Here are the key purposes of financial budgeting:

1. Planning and Goal Setting: Financial budgeting helps individuals and organizations set financial goals and develop strategies to achieve them. It provides a structured framework for prioritizing financial objectives, whether it’s saving for retirement, funding education, or expanding a business. By setting clear goals and aligning financial resources, individuals and organizations can work towards achieving their desired outcomes.

2. Resource Allocation: Financial budgeting ensures efficient allocation of financial resources, such as income, savings, investments, and expenses. It helps individuals and organizations determine how much money should be allocated to different areas, such as housing, transportation, healthcare, marketing, research and development, and debt repayment. By establishing priorities and allocating resources accordingly, financial budgeting ensures optimal use of funds.

3. Forecasting and Decision Making: Financial budgeting involves forecasting future cash flows based on historical data, market trends, and economic factors. This enables individuals and organizations to make informed financial decisions, such as deciding on investments, budgetary adjustments, or cost reductions. By having a clear understanding of future financial outcomes, individuals and organizations can make proactive choices that align with their financial goals.

4. Tracking and Monitoring: Financial budgeting provides a means to track and monitor financial progress. By comparing actual spending and income against the budgeted amounts, individuals and organizations can identify areas of overspending or cost-savings opportunities. Regular monitoring allows for timely corrective actions and adjustments to ensure financial stability.

5. Debt Management: Financial budgeting plays a crucial role in managing and reducing debt. It helps individuals and organizations allocate funds towards debt repayment, along with other financial obligations. By strategically planning debt repayments and minimizing interest payments, financial budgeting aids in achieving long-term financial freedom and reducing financial stress.

6. Investment and Growth: Financial budgeting facilitates investment decisions by determining the availability of funds for strategic investments. It helps individuals and organizations identify potential investment opportunities and evaluate their financial feasibility. By allocating funds towards growth initiatives, financial budgeting supports an individual’s wealth accumulation and an organization’s business expansion.

In summary, the purpose of financial budgeting is to create a roadmap for financial success and stability. It allows individuals and organizations to set goals, allocate resources, make informed decisions, track progress, manage debt, and explore growth opportunities. Financial budgeting serves as a vital tool for financial management, ensuring individuals and organizations can effectively navigate their financial journey and achieve their desired financial outcomes.

Benefits of Financial Budgeting

Financial budgeting offers numerous advantages for individuals and organizations alike. Here are some of the key benefits:

1. Goal Achievement: Financial budgeting helps individuals and organizations set and achieve their financial goals. By having a clear financial roadmap in place, they can prioritize their spending, savings, and investments towards specific objectives, such as buying a home, starting a business, or retiring comfortably.

2. Improved Decision Making: Financial budgeting provides a solid foundation for making informed financial decisions. It helps individuals and organizations evaluate the costs and benefits of different options, compare alternatives, and choose the most viable course of action. This leads to better financial outcomes and minimizes the risk of impulsive or ill-informed decisions.

3. Enhanced Financial Control: A financial budget allows individuals and organizations to have better control over their finances. It provides a framework to track income and expenses, ensuring that spending remains aligned with available resources. This control helps prevent overspending, reduces financial stress, and improves overall financial well-being.

4. Resource Allocation: Financial budgeting enables efficient allocation of resources. By identifying areas of increased or unnecessary expenditure, individuals and organizations can redirect funds towards more productive areas. This can result in cost savings, improved profitability, and better utilization of financial resources.

5. Cash Flow Management: Effective financial budgeting ensures proper management of cash flow. It helps individuals and organizations forecast their income and expenses, ensuring that there is sufficient liquidity to cover obligations as they arise. This prevents cash shortages, late payments, or excessive reliance on credit.

6. Debt Reduction: Financial budgeting aids in managing and reducing debt. By including debt repayment as a priority in the budget, individuals and organizations can allocate funds towards timely repayment. This reduces interest costs and facilitates faster debt clearance, leading to improved financial stability and creditworthiness.

7. Financial Awareness: Financial budgeting promotes a deeper understanding of personal or organizational finances. It allows individuals and organizations to gain insights into their spending habits, identify areas of financial leakage, and make adjustments accordingly. This awareness fosters a positive financial mindset and encourages responsible financial behavior.

8. Planning for the Future: Financial budgeting helps individuals and organizations plan for future financial needs and contingencies. It allows for the accumulation of funds for emergencies, unexpected expenses, or anticipated life events. This preparedness provides peace of mind and reduces financial vulnerability.

9. Long-Term Sustainability: Financial budgeting supports long-term sustainability and growth. By consistently monitoring financial performance and making necessary adjustments, individuals and organizations can adapt to changing circumstances, seize new opportunities, and ensure continued financial success.

Overall, financial budgeting offers a range of benefits, including goal achievement, informed decision making, financial control, resource allocation, cash flow management, debt reduction, financial awareness, future planning, and long-term sustainability. It is an essential practice for individuals and organizations seeking to optimize their financial well-being and build a solid foundation for future growth and prosperity.

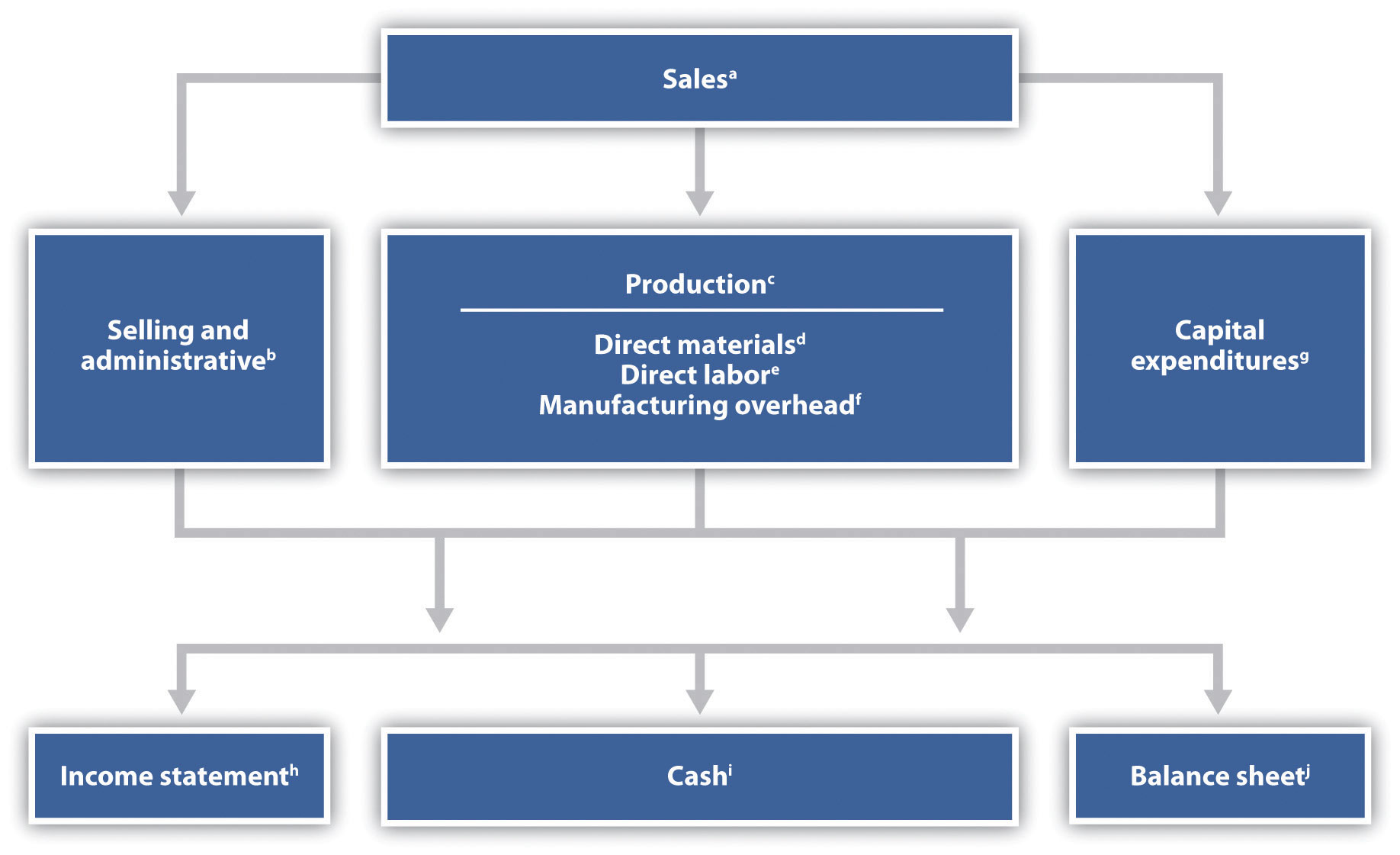

Key Components of Financial Budgeting

Financial budgeting involves several key components that contribute to its effectiveness and functionality. Understanding these components is essential for developing a comprehensive and well-structured financial budget. Here are the key components of financial budgeting:

1. Income: The first component of a financial budget is identifying and estimating the sources of income. This includes salary, wages, rental income, dividends, interest, and any other form of revenue. Accurately forecasting the income helps in determining the available funds for various financial activities.

2. Expenses: Expenses form a critical part of any financial budget. It involves categorizing and estimating all the expenditures, such as housing, utilities, transportation, food, entertainment, healthcare, education, debt repayments, and savings. Tracking and categorizing expenses provides an overview of where money is being spent and allows for better financial planning.

3. Savings and Investments: Financial budgeting should include provisions for savings and investments. Allocating a portion of income towards savings builds an emergency fund and helps achieve future financial goals. Investing surplus funds in assets like stocks, mutual funds, or real estate can generate income and long-term wealth accumulation.

4. Debt Repayment: If there is existing debt, such as credit card debt or loans, it is crucial to allocate funds for timely repayment. Including debt repayment as a separate component in the budget helps in managing and reducing financial obligations over time.

5. Cash Flow Management: Cash flow management involves monitoring income and expenses to ensure sufficient liquidity for day-to-day operations. Balancing income and expenses helps to avoid cash shortages and enables individuals and organizations to meet their financial obligations effectively.

6. Financial Goals and Objectives: Financial budgeting revolves around setting clear financial goals and objectives. Whether it’s saving for retirement, buying a home, expanding a business, or paying off debt, the budget should align with the desired financial outcomes. These goals serve as a guiding framework for financial decision-making.

7. Contingency Planning: A comprehensive financial budget should account for unexpected expenses and contingencies. By setting aside funds for emergencies or unforeseen circumstances, individuals and organizations can have a safety net to rely on without derailing their financial plans.

8. Periodic Evaluation and Adjustments: Financial budgeting is not a one-time activity. It requires periodic evaluation and adjustments to reflect changing circumstances and goals. Regularly monitoring the budget and making necessary revisions ensures its relevance and effectiveness.

9. Accuracy and Documentation: It is important to maintain accurate records and documentation of income, expenses, savings, and investments. This allows for easy reference and reference and facilitates thorough analysis and decision-making.

In summary, the key components of financial budgeting include income, expenses, savings and investments, debt repayment, cash flow management, financial goals and objectives, contingency planning, periodic evaluation and adjustments, and accuracy and documentation. A well-balanced financial budget takes into account all these components to ensure effective financial planning and management.

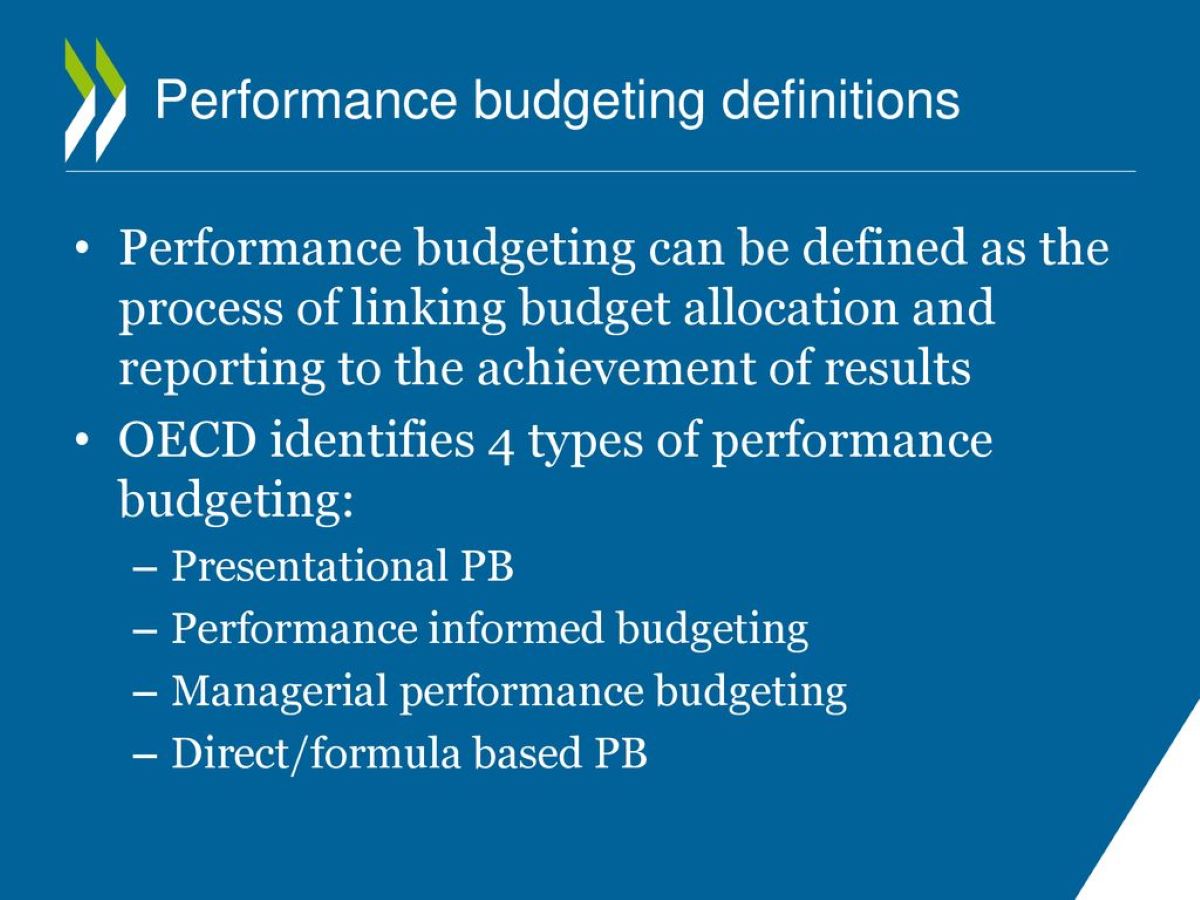

Types of Financial Budgeting

Financial budgeting encompasses various types and approaches that cater to different needs and objectives. Depending on the nature of the individual or organization, different types of financial budgets may be employed. Here are some common types of financial budgeting:

1. Operating Budget: An operating budget focuses on the day-to-day operations and expenses of a business. It includes sales revenue, production costs, administrative expenses, and other costs associated with running the business. This budget helps to track operational performance and forecast profitability.

2. Capital Budget: A capital budget allocates resources for long-term investments and acquisitions. It includes major purchases of equipment, infrastructure development, and expansion projects. This budget is essential for businesses seeking to grow and improve their infrastructure.

3. Cash Budget: A cash budget focuses on tracking the inflows and outflows of cash within a specific period. It helps individuals and organizations manage their cash flow effectively and ensure that there is sufficient cash available to cover expenses and obligations.

4. Master Budget: A master budget consolidates all the individual budgets of various departments within an organization into a comprehensive financial plan. It provides an overview of the organization’s financial performance and aligns the goals of different departments.

5. Zero-Based Budget: A zero-based budget requires individuals or organizations to justify and allocate funds based on their needs and goals. It involves starting each budgeting period from scratch, analyzing all expenses and justifying their inclusion in the budget.

6. Flexible Budget: A flexible budget allows for variations in revenue and expenses based on different levels of activity or changes in economic conditions. It can accommodate unexpected changes and allows for adjustments without compromising the overall financial plan.

7. Rolling Budget: A rolling budget involves continuously updating the budget by adding a new budget period as the previous period expires. It allows for flexibility and adaptability in financial planning and enables timely adjustments based on new information.

8. Incremental Budget: An incremental budget involves making adjustments to the previous budget by incrementally increasing or decreasing the amounts based on factors like inflation, growth rates, or changing circumstances.

9. Fixed Budget: A fixed budget sets specific amounts for income and expenses based on predetermined expectations. It does not allow for changes once the budget period begins and is useful in situations where there is a high degree of predictability.

Ultimately, the type of financial budgeting chosen will depend on the specific needs, goals, and circumstances of the individual or organization. By selecting the most appropriate type of financial budgeting, individuals and organizations can effectively plan and manage their financial resources to achieve their desired outcomes.

Steps in the Financial Budgeting Process

The financial budgeting process involves a series of steps that help individuals and organizations create a comprehensive and effective financial plan. While the specific steps may vary based on the unique circumstances, here are the general steps involved in the financial budgeting process:

1. Set Financial Goals: The first step is to establish clear financial goals and objectives. This involves defining the desired outcomes, such as saving for retirement, paying off debt, or starting a business. Identifying specific financial targets helps guide the budgeting process.

2. Gather Financial Information: The next step is to gather and organize all relevant financial information. This includes income statements, bank statements, expense records, investment portfolios, and any other documentation that provides insights into the individual’s or organization’s financial situation.

3. Analyze Income and Expenses: Analyze income sources and estimate income for the budgeting period. Categorize and analyze expenses from the previous period to identify patterns, trends, and areas for potential cost-saving or reallocation of funds. This analysis helps in creating a realistic budget.

4. Estimate Future Income: Based on historical data and market conditions, estimate future income for the budgeting period. Consider factors such as salary increases, projected sales revenue, or expected investment returns. This estimation forms the basis for income projections in the budget.

5. Allocate Funds: Allocate funds to different categories such as expenses, savings, debt repayment, and investments based on the financial goals and priorities established earlier. This step ensures that financial resources are distributed appropriately to meet various needs.

6. Monitor and Adjust: Regularly monitor budget performance by comparing actual income and expenses against the budgeted amounts. This helps identify any deviations or areas that need adjustments. Make necessary modifications to the budget as circumstances change or new information arises.

7. Track Progress: Continuously track and evaluate progress towards financial goals. Monitor savings, debt reduction, investment growth, or any other milestones set in the budget. Regular tracking helps individuals and organizations stay on track and make informed decisions.

8. Review and Revise: Periodically review the budget and make revisions as needed. This review can be done monthly, quarterly, or annually, depending on the personal or organizational preference. Updating the budget ensures its relevance and alignment with changing financial circumstances.

9. Communicate and Implement: Share the budget with relevant stakeholders, such as family members, team members, or department heads. Communicate the financial objectives, budget constraints, and individual responsibilities. Implement the budget by following the financial plan and making the necessary adjustments.

By following these steps, individuals and organizations can effectively create, implement, and manage a financial budget. The financial budgeting process provides a structured approach to achieve financial goals, make informed decisions, and maintain financial stability.

Importance of Financial Budgeting for Businesses

Financial budgeting plays a crucial role in the success and sustainability of businesses. It provides a roadmap for managing financial resources, making informed decisions, and achieving long-term objectives. Here are some key reasons why financial budgeting is important for businesses:

1. Goal Alignment: Financial budgeting allows businesses to align their financial goals with their overall strategic objectives. It ensures that financial resources are allocated in a way that supports the company’s growth, profitability, and competitiveness.

2. Resource Management: Financial budgeting helps businesses effectively manage their financial resources. It allows for careful allocation of funds to different departments, projects, or initiatives based on their importance and potential return on investment.

3. Cost Control: Financial budgeting enables businesses to monitor and control costs. By setting budgets for different expense categories, businesses can identify areas of excessive spending, implement cost-saving measures, and increase overall operational efficiency.

4. Investment Decision Making: A well-structured financial budget helps businesses make informed investment decisions. It allows for the evaluation of potential investments, including new projects, acquisitions, or expansion plans, based on their financial feasibility and projected returns.

5. Performance Evaluation: Financial budgeting provides a benchmark for assessing business performance. By comparing actual financial results against budgeted targets, businesses can identify areas of improvement, address any deviations, and take corrective actions if necessary.

6. Cash Flow Management: Effective financial budgeting ensures that businesses have sufficient cash flow to meet their financial obligations. It helps in forecasting cash inflows and outflows, managing working capital, and ensuring liquidity for day-to-day operations.

7. Strategic Planning: Financial budgeting is an integral part of strategic planning for businesses. It helps in setting realistic financial objectives, identifying key performance indicators, and establishing milestones to measure progress towards long-term strategic goals.

8. Risk Management: Financial budgeting enables businesses to assess and mitigate financial risks. By including provisions for potential economic downturns, unexpected expenses, or changes in market conditions, businesses can be better prepared to withstand unforeseen challenges.

9. Communication and Accountability: Financial budgeting promotes transparency and accountability within a business. It ensures that financial goals and expectations are communicated to employees, departments, and stakeholders, fostering a sense of responsibility and ownership.

10. Stakeholder Confidence: A well-executed financial budget enhances stakeholder confidence in a business. It demonstrates competent financial management, responsible decision-making, and a clear plan for achieving financial goals. This can lead to increased trust from investors, lenders, partners, and customers.

In summary, financial budgeting is vital for businesses because it aligns financial goals with strategic objectives, optimizes resource allocation, controls costs, aids investment decisions, evaluates performance, manages cash flow, supports strategic planning, mitigates risks, promotes accountability, and builds stakeholder confidence. By incorporating financial budgeting into their operations, businesses can improve financial stability, make informed decisions, and increase their chances of long-term success.

Challenges and Limitations of Financial Budgeting

While financial budgeting is a valuable tool for managing finances, it is not without its challenges and limitations. Understanding these challenges is important for businesses to effectively address them. Here are some common challenges and limitations of financial budgeting:

1. Uncertainty: Financial budgeting relies on assumptions and predictions, which can be challenging in an uncertain and volatile business environment. External factors like economic conditions, market trends, and regulatory changes can impact financial outcomes, making it difficult to accurately forecast and budget.

2. Limited Flexibility: A rigid budget may lack the flexibility needed to accommodate unexpected events or changing business conditions. Strict adherence to the budget may hinder the ability to respond swiftly and exploit emerging opportunities or address unforeseen challenges.

3. Complexity: Financial budgeting can be complex, particularly for large organizations with multiple departments and diverse revenue streams. Coordinating and consolidating budgets from various departments and aligning them with overall business objectives can be challenging and time-consuming.

4. Resistance to Change: Implementing a financial budgeting process may face resistance from employees who are accustomed to existing practices. Overcoming resistance and effectively communicating the benefits of budgeting requires effective change management and employee engagement.

5. Unrealistic Assumptions: Financial budgeting relies on assumptions about future conditions, such as sales growth rates or cost estimates. If these assumptions are overly optimistic or unrealistic, it can lead to inaccurate budget projections and undermine the effectiveness of the budgeting process.

6. Lack of Accountability: In some cases, financial budgeting may not adequately address accountability within an organization. If individuals or departments are not held responsible for adhering to their budgeted amounts, it can lead to overspending or inadequate resource allocation.

7. Time and Resource Constraints: Developing and monitoring a financial budget demands time and resources. Small businesses or those with limited financial expertise may struggle to dedicate the necessary resources, resulting in a less comprehensive or less effective budgeting process.

8. Static Planning: Traditional budgeting can be based on fixed assumptions for the entire budgeting period, making it inflexible and unable to adapt to changing circumstances. This static approach may not support dynamic decision-making and agility in the face of evolving market conditions.

9. Overemphasis on Short-Term Results: Financial budgeting often focuses on short-term financial goals, which may neglect long-term strategic considerations. Overemphasis on short-term results can hinder long-term growth, innovation, and investment planning.

10. Risk of Inaccurate Forecasting: Budgeting relies on accurate forecasting of revenues, expenses, and market conditions. If these forecasts are inaccurate, it can lead to misallocation of resources, missed opportunities, or financial challenges.

While financial budgeting has its limitations, businesses can overcome these challenges by adopting flexible budgeting approaches, regularly reviewing and adjusting the budget, incorporating feedback from stakeholders, improving forecasting accuracy, fostering a culture of accountability, and prioritizing long-term strategic goals alongside short-term financial objectives.

By understanding and addressing these challenges, businesses can optimize their budgeting process, make informed financial decisions, and adapt to dynamic market conditions. Financial budgeting, when implemented with care and consideration, remains a valuable tool for managing and optimizing financial resources in a business context.

Best Practices for Effective Financial Budgeting

To maximize the benefits of financial budgeting, businesses should follow certain best practices. These practices help ensure that the budgeting process is effective, accurate, and aligns with the organization’s goals and objectives. Here are some key best practices for effective financial budgeting:

1. Set Realistic and Achievable Goals: Establish clear, specific, and realistic financial goals that are in line with the organization’s overall strategic objectives. Avoid setting goals that are too ambitious or unattainable, as it can undermine the budgeting process and negatively impact motivation.

2. Involve Key Stakeholders: Include input from relevant stakeholders, such as department heads, managers, and finance professionals, in the budgeting process. This ensures that different perspectives are considered and improves overall buy-in and accountability.

3. Gather Accurate and Comprehensive Data: Base the budget on accurate and up-to-date financial data. Collect and analyze data from different sources, including past financial records, market trends, economic forecasts, and industry benchmarks. The accuracy of the budget depends heavily on reliable data.

4. Regularly Review and Update the Budget: Review the budget periodically to ensure its alignment with changing circumstances, market conditions, and strategic objectives. Incorporate feedback from stakeholders and make necessary adjustments to reflect evolving priorities.

5. Use Different Budgeting Techniques: Consider utilizing various budgeting techniques, such as zero-based budgeting, rolling budgets, or activity-based budgeting. Evaluate the suitability of different techniques based on the organization’s size, complexity, and goals.

6. Implement Effective Financial Planning Tools: Utilize financial planning software or tools that facilitate budget creation, tracking, and analysis. These tools streamline the budgeting process, improve accuracy, and provide better visibility into financial performance.

7. Consider Multiple Scenarios: Develop contingency plans and consider alternative scenarios in the budgeting process. Plan for potential risks, market fluctuations, or unexpected events. This helps in anticipating challenges and preparing appropriate responses.

8. Communicate and Educate: Communicate the budget to all relevant stakeholders and provide adequate training and education on the budgeting process. Ensure that everyone involved understands the budget, their responsibilities, and how their contributions align with the broader financial goals.

9. Monitor and Track Progress: Regularly monitor and track financial performance against the budgeted targets. Analyze variances and investigate the causes of deviations. This enables timely adjustments and corrective actions to keep the organization on track.

10. Prepare for Change and Adaptability: Embrace a culture of adaptability and remain open to adjusting the budget as needed. As circumstances change, be ready to reallocate resources, revise forecasts, and modify budgeted amounts to accommodate new opportunities or challenges.

11. Review and Learn from Past Performance: Conduct a thorough review of past budgeting cycles to identify areas for improvement. Evaluate the accuracy of forecasts and the effectiveness of budgeted allocations. Learn from past mistakes and successes to refine future budgeting processes.

By following these best practices, businesses can optimize their financial budgeting efforts. Effective financial budgeting supports sound financial decision-making, enhances resource allocation, ensures goal attainment, and contributes to the overall success and growth of the organization.

Conclusion

Financial budgeting is an essential practice for individuals and businesses seeking to effectively manage their finances, achieve goals, and ensure long-term financial stability. It provides a structured framework for allocating resources, making informed decisions, and evaluating financial performance.

Through the process of financial budgeting, individuals can gain control over their personal finances, save for future needs, and make strategic investments. For businesses, financial budgeting enables effective resource management, cost control, and strategic planning, leading to improved financial performance and competitiveness.

While financial budgeting offers numerous benefits, it is not without its challenges and limitations. Uncertainty, inflexibility, and unrealistic assumptions are common obstacles that businesses must navigate. However, by implementing best practices, such as setting realistic goals, involving stakeholders, gathering accurate data, and regularly reviewing and updating the budget, businesses can mitigate these challenges and achieve greater success.

Financial budgeting is a dynamic process that requires regular monitoring, evaluation, and adjustment. Businesses must remain adaptable and open to change, recognizing that the budget is a flexible tool that can be revised as needed to accommodate new opportunities or challenges.

By incorporating the key components of financial budgeting, such as income, expenses, savings, investments, debt repayment, and cash flow management, businesses can create comprehensive and effective financial plans that align with their objectives.

In conclusion, financial budgeting is a vital practice for individuals and businesses alike. It empowers individuals to achieve personal financial goals and enables businesses to optimize their financial resources, make informed decisions, and enhance their financial performance. By following best practices, staying adaptable, and learning from past experiences, individuals and businesses can reap the tremendous benefits of financial budgeting and pave the way for a more secure and prosperous financial future.