Finance

What Is Bottom Up Budgeting

Published: October 11, 2023

Discover the concept of bottom-up budgeting in finance and how it empowers organizations to prioritize financial decisions from the ground up. Gain insights into this strategic budgeting approach.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to financial planning and management, budgeting plays a crucial role in ensuring the success and profitability of any organization. There are several approaches to budgeting, but one method that has gained popularity in recent years is bottom-up budgeting. This approach empowers employees at all levels to actively participate in the budgeting process, resulting in a more accurate and realistic budget.

Bottom-up budgeting, also known as participatory budgeting, is a decentralized approach where budget proposals are formulated from the ground up. Instead of top-level executives dictating the budget to lower-level employees, this method encourages employees to provide input based on their day-to-day activities and operational knowledge. The idea is that those closest to the work have the best understanding of the resources needed to achieve organizational goals.

With bottom-up budgeting, employees across different departments and levels are invited to contribute their budget proposals. These proposals are then assessed, consolidated, and integrated into the overall budget. This approach ensures that budgets are more comprehensive and reflective of the diverse needs and priorities of the organization.

Implementing bottom-up budgeting requires a shift in mindset and organizational culture. It emphasizes the importance of collaboration and open communication between management and employees. By involving employees in the budgeting process, organizations can foster a sense of ownership and responsibility among their workforce.

In this article, we will delve deeper into the process of bottom-up budgeting, explore its benefits and challenges, and provide practical steps to implement it effectively within your organization. We will also share best practices to maximize the potential of bottom-up budgeting and ensure its success in driving financial sustainability and growth.

Definition of Bottom-Up Budgeting

Bottom-up budgeting is an approach to budgeting that involves starting the budgeting process at the lowest level of an organization and gradually moving up to the top. It is a participatory and collaborative method that encourages employees at all levels to contribute their insights and recommendations for the budget.

In traditional top-down budgeting, executives and higher-level managers create the budget and then it is imposed on lower-level employees. This approach often leads to a lack of buy-in and understanding from those who are responsible for executing the budget. On the other hand, bottom-up budgeting reverses this process by empowering employees to have a say in the budget creation.

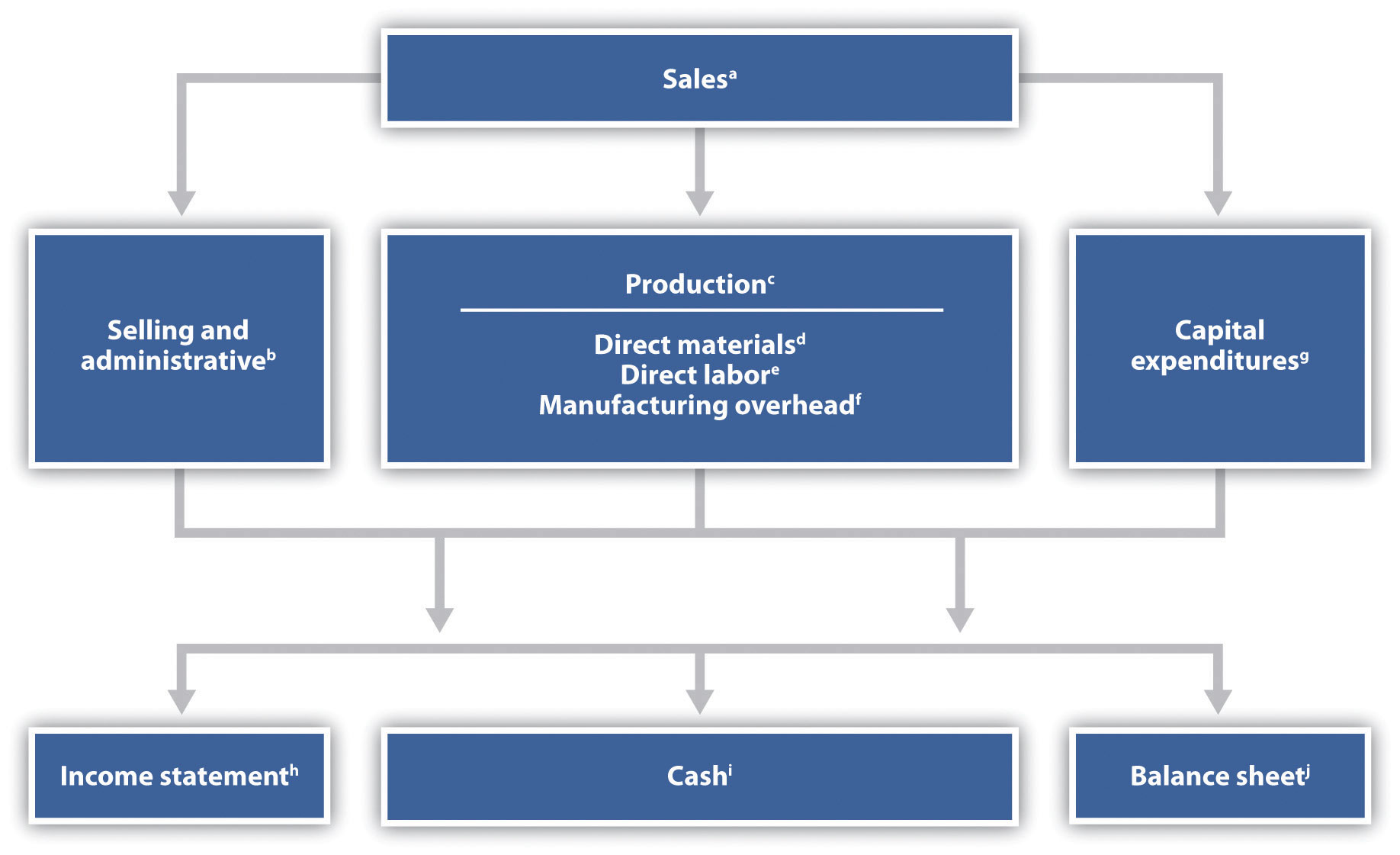

With bottom-up budgeting, each department and individual within the organization is given the opportunity to provide input and propose budget allocations based on their specific needs and objectives. This includes estimating expenses, identifying revenue opportunities, and suggesting investments. Once all the inputs are collected, they are then consolidated and reviewed by management to create a comprehensive budget that aligns with organizational goals.

Bottom-up budgeting is a more inclusive and democratic approach that values the expertise and knowledge of employees. It ensures that the budget reflects the realities and challenges faced by different departments and teams, ultimately leading to more accurate financial planning and resource allocation.

It is important to note that bottom-up budgeting does not mean that higher-level management loses control over the budgeting process. Instead, they play a crucial role in reviewing and refining the proposals received from employees. Their role is to assess the feasibility, alignment with organizational objectives, and financial viability of the proposed budgets.

Overall, bottom-up budgeting promotes a collaborative and transparent budgeting process that fosters employee engagement, accountability, and a sense of ownership. It allows for a more accurate reflection of the needs and priorities of different departments, leading to a more realistic and effective budget that drives organizational success.

Process of Bottom-Up Budgeting

The process of bottom-up budgeting involves several key steps that help ensure employee participation and the integration of their inputs into the overall budget. While specific processes may vary between organizations, the following steps provide a general framework:

- Educating and communicating: It is important to educate employees about the concept and benefits of bottom-up budgeting. Communication should be clear and emphasize the importance of their involvement in the budgeting process. This helps create a supportive and collaborative environment.

- Collecting budget proposals: Employees at all levels are invited to submit their budget proposals based on their department’s goals, needs, and operational requirements. This includes estimating expenses, revenue projections, and justifications for investments or resource allocations.

- Review and consolidation: Once the budget proposals are collected, they are reviewed by management to assess their feasibility, alignment with organizational objectives, and financial viability. This includes identifying any duplicates, overlaps, or conflicting proposals.

- Prioritization and negotiation: During this stage, management works with each department to prioritize and negotiate the proposed budgets. This involves aligning the budget proposals with available resources, strategic goals, and financial constraints.

- Approval and integration: After the budget proposals have been refined and aligned with organizational goals, the final budget is approved and integrated into the overall financial plan. This ensures that all departments’ budgets are collectively balanced and support the organization’s strategic objectives.

- Monitoring and evaluation: Once the budget is in place, it is essential to monitor and evaluate its performance regularly. This includes tracking actual expenses and revenue against budgeted amounts, analyzing variances, and making necessary adjustments to ensure financial targets are met.

It is important to note that the process of bottom-up budgeting is not a one-time event. It should be a continuous and iterative process that enables organizations to adapt to changing circumstances and align budgets with evolving goals and priorities.

By involving employees in the budgeting process, organizations can tap into their expertise, gain valuable insights, and foster a sense of ownership and accountability. This collaborative approach can lead to a more accurate and effective budget that supports the organization’s financial sustainability and growth.

Benefits of Bottom-Up Budgeting

Implementing a bottom-up budgeting approach offers numerous benefits to organizations. Let’s explore some of the key advantages:

- Increased accuracy and detail: Bottom-up budgeting allows employees at all levels to provide input based on their firsthand knowledge and experience. This results in a budget that is more accurate and detailed, as it incorporates specific needs and challenges faced by different departments.

- Enhanced employee engagement: By involving employees in the budgeting process, organizations foster a sense of ownership and engagement. Employees feel valued and are more likely to be invested in achieving the financial goals outlined in the budget. This can lead to higher levels of motivation and productivity.

- Improved communication and collaboration: Bottom-up budgeting promotes open communication and collaboration between different levels and departments within an organization. It encourages dialogue, sharing of ideas, and cross-functional cooperation, which can enhance overall teamwork and organizational cohesion.

- Greater accountability: When employees have a say in the budgeting process, they become more accountable for its outcomes. As they understand and contribute to the budget, they are more likely to take ownership of their financial responsibilities and work towards achieving the budgeted targets.

- Flexibility and adaptability: Bottom-up budgeting allows for greater flexibility and adaptability. As employees provide input based on their field-level knowledge, the budget can better respond to changing market conditions, emerging opportunities, and unforeseen challenges. This enables organizations to make timely adjustments to their financial plans.

- Identification of cost-saving opportunities: Bottom-up budgeting encourages employees to critically evaluate expenses and identify potential cost-saving opportunities. This can lead to more efficient resource allocation, elimination of unnecessary expenses, and overall cost optimization.

- Innovation and creativity: Involving employees in the budgeting process creates a space for innovation and creativity. Employees may propose new ideas, investments, or initiatives that can spur growth and drive the organization forward. Their varied perspectives can bring fresh insights to the budgeting process.

Overall, implementing bottom-up budgeting can empower employees, foster a collaborative culture, and result in more accurate and effective budgets. It promotes employee engagement, accountability, and creativity while aligning financial plans with operational realities. Organizations that embrace bottom-up budgeting often experience improved financial performance and sustainable growth.

Challenges and Limitations of Bottom-Up Budgeting

While bottom-up budgeting offers many benefits, it also comes with its own set of challenges and limitations. It’s important to be aware of these potential drawbacks to effectively implement this approach. Let’s explore some of the main challenges:

- Time-consuming: Bottom-up budgeting requires a significant investment of time and effort. Collecting, reviewing, and consolidating budget proposals from various departments and individuals can be a time-consuming process, especially for larger organizations. This can impact the overall efficiency of the budgeting process.

- Difficulty in prioritization: With a bottom-up approach, there may be a multitude of budget proposals from different departments, each highlighting its own priorities. It can be challenging to prioritize and allocate resources among competing proposals, especially when resources are limited.

- Potential for bias: In a bottom-up budgeting process, biases and personal agendas may influence the proposals submitted by employees. This can result in skewed budget allocations that do not align with the organization’s strategic goals or overall financial feasibility.

- Lack of expertise and financial understanding: Not all employees may have the necessary financial acumen or understanding to develop accurate budget proposals. This can lead to inaccurate estimations, unrealistic goals, and potential budgetary issues down the line.

- Resistance to change: Implementing a bottom-up approach may face resistance from employees who are comfortable with traditional top-down budgeting. Some employees may be reluctant to take on the responsibility of budgeting or may prefer to rely on management for direction.

- Overemphasis on short-term goals: In a bottom-up budgeting process, there is a risk of focusing solely on short-term goals and immediate needs without considering long-term strategic objectives. This can hinder the organization’s ability to invest in future growth and innovation.

- Complexity in budget consolidation: Consolidating numerous budget proposals can be a complex task. It requires careful analysis, comparison, and integration to create a cohesive and realistic budget. Managing conflicting proposals, overlapping expenses, and ensuring consistency across departments can be challenging.

Despite these challenges, organizations can overcome them by implementing appropriate strategies and mitigating their impact. This may involve providing training and support to employees, establishing clear guidelines and criteria for budget proposals, and fostering effective communication and collaboration between different departments.

By being aware of the limitations and addressing them proactively, organizations can harness the benefits of bottom-up budgeting while minimizing potential drawbacks.

Steps to Implement Bottom-Up Budgeting

Implementing bottom-up budgeting requires careful planning and execution to ensure the process is effective and successful. Here are the key steps to follow:

- Educate and communicate: Begin by educating employees about the concept and benefits of bottom-up budgeting. Clearly communicate the objectives of the process, the roles and responsibilities of employees, and the importance of their active participation.

- Establish guidelines and criteria: Set clear guidelines and criteria for budget proposals. Provide templates and frameworks that outline the information required, such as revenue projections, expense estimations, justifications for investments, and measurable goals.

- Collect budget proposals: Invite employees from all levels and departments to submit their budget proposals within a specified timeframe. Provide adequate support and resources to assist employees in preparing their proposals effectively.

- Review and consolidate proposals: Review each budget proposal to ensure accuracy, feasibility, and alignment with organizational goals. Identify duplicate or overlapping proposals and consolidate them into a cohesive budget plan.

- Negotiate and refine: Engage in discussions and negotiations with department heads and employees to refine the budget proposals. Prioritize proposals based on strategic goals, available resources, and financial viability. Seek a consensus and ensure all proposals are aligned with the overall organizational objectives.

- Obtain management approval: Present the final budget plan to top-level management for approval. Explain the rationale behind the budget allocations, highlighting the employee involvement and contributions that have shaped the budget.

- Implement and monitor: Once the budget is approved, implement it across the organization. Establish a monitoring and evaluation system to track actual expenses, revenue, and performance against the budget. Regularly review variances and make necessary adjustments to ensure financial targets are met.

- Provide ongoing support: Offer continuous support and training to employees to enhance their financial acumen and understanding. Keep the communication channels open to address any concerns, questions or suggestions related to the budgeting process.

It is crucial to remember that implementing bottom-up budgeting is an ongoing process, not a one-time event. Continuously seek feedback from employees and make adjustments to improve the process in subsequent budget cycles. Regularly communicate the impact and outcomes of the budgeting process to reinforce the value of employee involvement.

By following these steps and fostering a culture of collaboration, organizations can successfully implement bottom-up budgeting and reap its benefits of increased employee engagement, accurate budgeting, and alignment with organizational objectives.

Best Practices for Successful Bottom-Up Budgeting

To ensure the success of bottom-up budgeting, organizations can follow these best practices:

- Establish a supportive culture: Foster a culture that values employee participation and encourages open communication. Create an environment where employees feel comfortable and empowered to contribute their ideas and insights to the budgeting process.

- Provide training and support: Offer training programs and resources to improve employees’ financial literacy and budgeting skills. This will enable them to develop more accurate and informed budget proposals.

- Set clear expectations: Clearly communicate the goals, objectives, and guidelines of the bottom-up budgeting process. Provide employees with a clear understanding of their roles, responsibilities, and the timeline for submitting their budget proposals.

- Promote collaboration: Encourage cross-functional collaboration and communication during the budgeting process. Facilitate discussions and feedback sessions among different departments and teams to ensure an integrated and comprehensive budget plan.

- Establish evaluation criteria: Develop standardized evaluation criteria to assess and compare budget proposals. This will ensure consistency and transparency throughout the evaluation process, making it easier to prioritize and integrate the proposals into the final budget.

- Involve stakeholders: Engage stakeholders, including department heads, managers, and key decision-makers, in the budgeting process. Seek their input and gain their buy-in to enhance the credibility of the bottom-up budgeting approach.

- Monitor and track performance: Implement a robust monitoring and evaluation system to track the actual performance of the budget. Regularly review variances, assess the impact of the budget, and make adjustments as necessary to keep the budget on track.

- Recognize and reward participation: Acknowledge and reward employees who actively participate in the budgeting process. This can be done through recognition programs, incentives, or career advancement opportunities, highlighting the value placed on their contributions.

- Continuously improve the process: Solicit feedback from employees and stakeholders to identify areas for improvement in the bottom-up budgeting process. Implement changes and modifications to enhance the process in subsequent budget cycles.

- Communicate outcomes: Regularly communicate the outcomes and impact of the bottom-up budgeting process to employees and stakeholders. Share the successes and achievements made possible through their involvement in the budgeting process to reinforce the value of bottom-up budgeting.

By following these best practices, organizations can create a collaborative and transparent budgeting process that leverages the collective knowledge and insights of employees. This can lead to more accurate budgets, higher employee engagement, and better alignment between financial plans and organizational goals.

Conclusion

Bottom-up budgeting is a dynamic and inclusive approach that empowers employees at all levels to actively participate in the budgeting process. By involving employees in the creation of the budget, organizations can tap into their knowledge and experience, resulting in more accurate, detailed, and realistic budgets.

This participatory budgeting approach offers several benefits, including increased employee engagement, improved communication and collaboration, greater accountability, and the identification of cost-saving opportunities. Employees feel a sense of ownership and responsibility for the budget, leading to higher motivation and productivity.

However, bottom-up budgeting does come with its challenges and limitations, such as the time-consuming nature of the process, difficulty in prioritization, potential biases, and the need for financial expertise. Organizations must address these challenges by establishing clear guidelines, providing training and support, and fostering a culture of collaboration and open communication.

To successfully implement bottom-up budgeting, organizations should follow a series of steps, including educating and communicating with employees, collecting and reviewing budget proposals, negotiating and refining the budget, and obtaining management approval. Ongoing monitoring and evaluation are also crucial for assessing budget performance and making necessary adjustments.

Adhering to best practices, such as creating a supportive culture, providing training and support, promoting collaboration, and continuously improving the process, can further enhance the success of bottom-up budgeting initiatives.

In conclusion, bottom-up budgeting offers a more inclusive and accurate approach to financial planning. By involving employees and valuing their insights, organizations can create budgets that better reflect operational realities, increase employee engagement, and drive sustainable financial success.