Finance

How Do Debt Consolidation Companies Make Money

Published: December 21, 2023

Find out how debt consolidation companies in the finance industry make money and discover the strategies they use to help you manage your debts effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

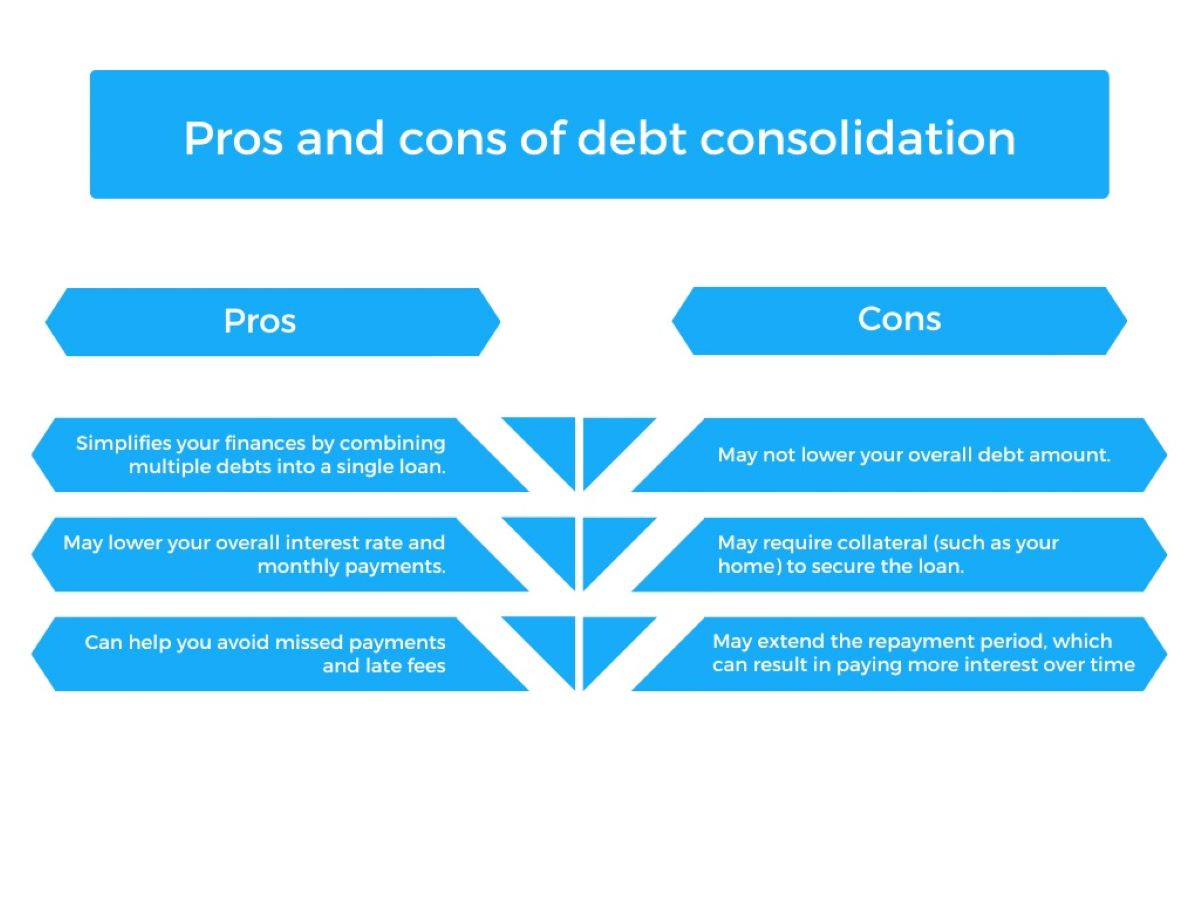

Debt consolidation can be a practical solution for individuals struggling with multiple debts. It involves combining multiple loans into one, making it easier to manage and potentially reducing the overall interest rates and monthly payments. Debt consolidation companies offer specialized services to assist individuals in consolidating their debts, providing them with a clearer path towards financial stability.

In this article, we will explore the inner workings of debt consolidation companies and their strategies for making money. Understanding how these companies generate revenue can help consumers make informed decisions when seeking debt consolidation services.

Debt consolidation companies serve as intermediaries between borrowers and lenders. They negotiate with creditors to consolidate outstanding debt into a single loan or debt consolidation program. By doing so, borrowers can simplify their repayments and reduce the stress associated with managing multiple debts.

While debt consolidation can bring relief, it’s important to understand that debt consolidation companies are not charities and operate as businesses. They need to generate revenue to cover their operational costs and make a profit. This is achieved through various means, including fees and commissions from lenders, and additional services and upselling.

In the following sections, we will delve deeper into these revenue-generating mechanisms utilized by debt consolidation companies. By gaining insight into their business models, you’ll be better equipped to assess the true cost and value of their services.

Understanding Debt Consolidation

Before diving into how debt consolidation companies make money, it’s crucial to have a clear understanding of what debt consolidation is. Debt consolidation is a financial strategy that combines multiple debts into a single loan or payment plan. This allows borrowers to simplify their debt management and potentially reduce their overall interest rates and monthly payments.

The process typically involves taking out a new loan, often referred to as a debt consolidation loan, to pay off existing debts. Alternatively, borrowers may opt for a debt management program, where they deposit monthly payments with a debt consolidation company, who then distributes the funds to creditors on their behalf.

By consolidating their debts, individuals can benefit from several advantages. First, it streamlines their payments, as they only need to worry about making one monthly payment instead of juggling multiple creditors. This can greatly simplify financial management and reduce the chances of missing payments.

Second, debt consolidation can potentially lower interest rates. If borrowers are able to secure a new loan with a lower interest rate than their current debts, they may save money in the long run. This is particularly beneficial for individuals with high-interest credit card debt.

Lastly, debt consolidation can offer psychological relief. The burden of multiple debts can be overwhelming and stressful. Consolidating these debts into one manageable payment can provide a sense of control and alleviate financial anxiety.

It’s important to note that debt consolidation is not a one-size-fits-all solution. While it can be an effective tool for many individuals, it may not be suitable for everyone. Factors such as credit score, total debt amount, and individual financial circumstances should be taken into consideration when deciding whether debt consolidation is the right choice.

Debt consolidation companies play a crucial role in facilitating this process. They act as intermediaries between borrowers and lenders, helping negotiate favorable terms and providing guidance throughout the debt consolidation journey. By understanding their services and revenue model, consumers can make informed decisions when seeking debt consolidation assistance.

Debt Consolidation Company Services

Debt consolidation companies offer a range of services to assist individuals in consolidating their debts and achieving financial stability. These services aim to simplify the debt consolidation process and provide borrowers with expert guidance and support. Here are some common services offered by debt consolidation companies:

- Assessment and Consultation: Debt consolidation companies typically start by conducting a thorough assessment of a borrower’s financial situation. This includes evaluating their total debt load, income, expenses, and credit history. Based on this assessment, they provide personalized advice and recommendations on the most suitable debt consolidation option.

- Debt Consolidation Loan Assistance: Many debt consolidation companies assist borrowers in obtaining a debt consolidation loan. They help with the loan application process, including gathering the necessary documentation and submitting the application to potential lenders. Their expertise in the industry can be valuable in securing favorable loan terms, such as lower interest rates and longer repayment periods.

- Debt Management Programs: In addition to debt consolidation loans, debt consolidation companies may offer debt management programs. These programs involve the borrower depositing a single monthly payment with the company, who then distributes the funds to creditors on their behalf. Debt consolidation companies work with creditors to negotiate lower interest rates and reduced monthly payments, making it easier for borrowers to manage their debts.

- Credit Counseling: Debt consolidation companies often provide credit counseling services to help borrowers understand the root causes of their debt problems and develop healthy financial habits. Through one-on-one counseling sessions, borrowers can gain insights into budgeting, managing expenses, and improving their credit score.

- Debt Settlement and Negotiation: Some debt consolidation companies specialize in debt settlement and negotiation. They work with creditors to negotiate reduced payoff amounts for borrowers who are facing extreme financial hardship. This option is typically reserved for individuals with significant outstanding debts and may have a negative impact on their credit score.

It’s important to note that the specific services offered by debt consolidation companies may vary. Some companies may have a comprehensive range of services, while others may specialize in specific areas. When considering debt consolidation assistance, it’s essential to research and choose a reputable company that aligns with your needs and financial goals.

How Debt Consolidation Companies Make Money

Debt consolidation companies operate as businesses and need to generate revenue to cover their operational costs and make a profit. Although their primary objective is to assist individuals in managing their debts, they employ several strategies to monetize their services. Here are some of the ways debt consolidation companies make money:

- Fees and Charges: Debt consolidation companies often charge upfront fees for their services. These fees may include application fees, origination fees, and administrative fees. The specific fees and charges vary among companies, so it’s crucial for borrowers to carefully review and understand the fee structure before entering into an agreement. It’s important to note that reputable debt consolidation companies are transparent about their fees and provide clear explanations of the costs involved.

- Commission from Lenders: When debt consolidation companies assist borrowers in obtaining a debt consolidation loan, they may receive a commission from the lender. This commission is typically a percentage of the loan amount and serves as compensation for their efforts in connecting borrowers with suitable lenders. It’s essential for borrowers to be aware of this commission structure to ensure that the recommendations provided by the debt consolidation company are unbiased and in the borrower’s best interest.

- Additional Services and Upselling: Debt consolidation companies may offer additional services to supplement their core debt consolidation offerings. These services can include credit monitoring, identity theft protection, financial education programs, and debt counseling sessions. These additional services often come with an additional cost, generating revenue for the debt consolidation company. It’s important for borrowers to carefully assess the value and necessity of these services to avoid unnecessary expenses.

- Referral Fees: Debt consolidation companies may generate additional income through referral fees. They may partner with other financial service providers, such as credit repair agencies or mortgage brokers, and receive a commission for referring clients to these partners. While referral fees can create additional revenue streams for debt consolidation companies, borrowers should be aware of any potential conflicts of interest and ensure that referrals are based on the best interests of the borrowers.

- Affiliate Programs: Some debt consolidation companies participate in affiliate programs with financial products and services. They may promote and recommend these products or services, such as credit cards or personal loans, to their clients. If a client chooses to utilize these recommended products or services, the debt consolidation company may receive a commission or referral fee. Transparency and clear disclosure of any affiliate relationships are crucial to maintain the trust and confidence of borrowers.

It’s important for borrowers to carefully review the terms and conditions and understand the revenue-generating mechanisms of debt consolidation companies. Transparent and reputable companies will provide clear explanations of their fees and charges, disclose any relationships with lenders or affiliates, and prioritize the best interests of their clients throughout the debt consolidation process.

Fees and Charges

When working with a debt consolidation company, it’s crucial to understand the fees and charges associated with their services. Debt consolidation companies typically charge a variety of fees that borrowers should be aware of before entering into an agreement. Here are some common fees and charges that borrowers may encounter:

- Application Fee: Some debt consolidation companies may require borrowers to pay an application fee to initiate the debt consolidation process. This fee covers the administrative costs associated with reviewing the borrower’s financial situation and assessing their eligibility for debt consolidation.

- Origination Fee: An origination fee is charged by some debt consolidation companies when borrowers obtain a debt consolidation loan. This fee covers the costs associated with processing the loan application and disbursing the funds to creditors.

- Monthly Maintenance Fee: Some debt consolidation companies charge a monthly maintenance fee for managing the borrower’s debt repayment plan. This fee covers the administrative costs of distributing funds to creditors and providing ongoing support to borrowers.

- Early Repayment Penalty: In certain cases, debt consolidation loans may come with an early repayment penalty. This fee is charged when borrowers pay off the loan before the designated repayment period. It’s crucial for borrowers to carefully review the terms of the loan agreement to understand if an early repayment penalty applies.

- Prepayment Fee: Similar to an early repayment penalty, a prepayment fee may be charged if borrowers decide to make additional payments towards their debt consolidation loan. This fee is meant to compensate the debt consolidation company for the potential interest they would have received if the borrower adhered to the agreed-upon repayment schedule.

- Upfront Counseling Fee: Some debt consolidation companies offer credit counseling services as part of their package. In such cases, borrowers may need to pay an upfront counseling fee to receive guidance and advice on managing their debts and improving their financial health.

It’s essential for borrowers to carefully review the fee structure of debt consolidation companies before engaging their services. Reputable companies will be transparent about their fees, provide a clear breakdown of the costs involved, and offer explanations for each fee charged.

Before committing to a debt consolidation company, it’s advisable for borrowers to compare the fee structures of multiple companies and evaluate the overall cost and value of their services. It’s important to consider not only the cost of the fees but also the quality of service, level of expertise, and reputation of the company.

By thoroughly understanding the fees and charges associated with debt consolidation services, borrowers can make informed decisions and ensure that they are financially prepared for the costs involved. Being diligent and proactive in reviewing the fee structure is crucial for a successful debt consolidation journey.

Commission from Lenders

One of the ways that debt consolidation companies make money is through receiving a commission from lenders. When assisting borrowers in obtaining a debt consolidation loan, debt consolidation companies establish relationships with lenders who provide the funds for the loan. In return for connecting borrowers with these lenders, debt consolidation companies receive a commission or referral fee.

The commission structure may vary among debt consolidation companies and lenders. Typically, the commission is calculated as a percentage of the loan amount. The specific percentage depends on the agreement between the debt consolidation company and the lender.

It’s important for borrowers to understand how the commission from lenders impacts their debt consolidation journey. While debt consolidation companies strive to recommend suitable lenders who offer favorable loan terms, the commission structure may create a potential conflict of interest. Some debt consolidation companies may prioritize lenders that offer higher commission rates, rather than solely focusing on the best interest of the borrowers.

To ensure transparency and maintain credibility, reputable debt consolidation companies will disclose their commission or referral fee structure to borrowers. This allows borrowers to make informed decisions and evaluate the unbiased recommendations provided by the company.

When considering debt consolidation options, borrowers should ask the debt consolidation company about their commission structure and how it may influence their loan recommendations. Asking questions and seeking clarification can help borrowers ensure that their best interests are being prioritized when choosing a lender.

It’s important to note that the commission from lenders does not necessarily mean that borrowers will incur additional costs. The debt consolidation company receives the commission as part of their compensation from the lender, and it is typically separate from any fees charged to borrowers directly by the debt consolidation company.

Ultimately, borrowers should assess the overall value and benefits of the debt consolidation services provided by a company, taking into account not only the commission structure but also the interest rates, repayment terms, and other factors associated with the loan. Being an informed consumer, borrowers can make choices that align with their financial goals and find a debt consolidation loan that meets their needs.

Additional Services and Upselling

In addition to their core debt consolidation services, debt consolidation companies may offer additional services as a way to generate revenue. These additional services can provide borrowers with extra support and resources to improve their overall financial well-being. However, borrowers should be aware that these services often come with an additional cost.

Some common additional services offered by debt consolidation companies include:

- Credit Monitoring: Debt consolidation companies may provide credit monitoring services, which allow borrowers to stay informed about changes to their credit report. This service helps borrowers detect any potential fraud or errors in their credit history and take prompt action to resolve them. While credit monitoring can be beneficial, borrowers should carefully assess the cost and determine if it aligns with their needs.

- Identity Theft Protection: Given the increasing prevalence of identity theft, some debt consolidation companies offer identity theft protection services. These services include proactive monitoring of personal information, alerts for suspicious activities, and assistance in case of identity theft. While valuable, borrowers should consider the cost and weigh it against any existing identity theft protection they may already have.

- Financial Education Programs: Many debt consolidation companies provide financial education programs to empower borrowers with the knowledge and skills needed to make sound financial decisions. These programs may cover topics such as budgeting, saving, credit management, and debt prevention. While these programs can be invaluable for improving financial literacy, borrowers should evaluate the cost and determine if they can access similar resources independently.

- Debt Counseling Sessions: Debt consolidation companies may offer one-on-one debt counseling sessions with financial experts. These sessions allow borrowers to discuss their specific financial challenges and receive personalized advice and strategies for managing their debts. While beneficial, borrowers should evaluate the cost of these counseling sessions and ensure they are receiving value for the fee charged.

Debt consolidation companies may engage in upselling, where they offer additional services or upgrades to borrowers during the debt consolidation process. While upselling can provide borrowers with more comprehensive support, it’s important for borrowers to assess the value and necessity of these additional services. Careful consideration should be given to the potential cost and whether these services genuinely align with the borrower’s needs and financial goals.

Borrowers should be cautious about being pressured into purchasing additional services that they may not truly require. Reputable debt consolidation companies will clearly present these additional services as optional and provide detailed information about the benefits and costs involved. Borrowers should be proactive in asking questions, seeking clarification, and only choosing additional services that truly add value to their debt consolidation journey.

By being aware of the potential upselling techniques and carefully evaluating the cost and value of additional services, borrowers can ensure that their overall experience with a debt consolidation company is positive and aligned with their financial goals.

Conclusion

Debt consolidation companies play a vital role in assisting individuals who are overwhelmed by multiple debts. They offer a range of services to help borrowers manage and consolidate their debts, providing a path towards financial stability. However, it’s important for borrowers to understand how debt consolidation companies make money to make informed decisions when seeking their services.

Debt consolidation companies generate revenue through various means, including fees and charges, commission from lenders, additional services, and upselling. Fees and charges are a common revenue source, encompassing application fees, origination fees, and monthly maintenance fees. Borrowers need to carefully review the fee structure of debt consolidation companies to understand the costs involved.

Commission from lenders is another revenue stream for debt consolidation companies. When borrowers obtain a debt consolidation loan through the company, the company may receive a commission from the lender. Borrowers should be aware of the commission structure and inquire about potential conflicts of interest to ensure unbiased recommendations.

Debt consolidation companies may also offer additional services such as credit monitoring, identity theft protection, financial education programs, and debt counseling. While these services can be beneficial, borrowers should evaluate the cost and determine if they align with their needs and financial goals.

Ultimately, borrowers should carefully assess the overall value and costs associated with the services provided by debt consolidation companies. Comparing different companies, understanding fee structures, and considering the additional services offered can help borrowers make well-informed decisions.

Remember, transparency, credibility, and reputation are key when choosing a debt consolidation company. Seeking recommendations, reading reviews, and conducting thorough research can help borrowers find a reputable company that offers valuable and trustworthy services.

By understanding how debt consolidation companies make money and making thoughtful choices, borrowers can navigate the debt consolidation process with confidence and take significant steps toward achieving financial freedom.