Finance

What Is A Source Of Short-Term Funding?

Modified: December 30, 2023

Finance your short-term needs with a reliable source of short-term funding. Discover various options, including loans and credit lines, to manage your financial requirements efficiently.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In the realm of finance, short-term funding plays a significant role in the smooth operation of businesses and individuals alike. It provides the necessary liquidity needed to fulfill immediate financial obligations, bridge gaps in cash flow, or seize lucrative opportunities. Understanding the concept of short-term funding and its sources is crucial for businesses and individuals to effectively manage their finances and achieve their goals.

Short-term funding refers to borrowing money or acquiring funds for a relatively brief period, typically less than a year. It serves as a temporary solution to meet immediate financial needs until long-term financing options can be secured. Unlike long-term funding, which is primarily utilized for major investments such as purchasing property or expanding business operations, short-term funding provides access to quick cash for day-to-day operations, inventory management, payroll, and unforeseen expenses.

The importance of short-term funding cannot be overstated. It enables businesses to meet their working capital requirements, take advantage of time-sensitive opportunities, and ensure a smooth cash flow cycle. For individuals, it can help manage unexpected financial emergencies, cover short-term expenses, or bridge the gap between paychecks.

Understanding the different sources of short-term funding is crucial, as it allows businesses and individuals to choose the option that aligns best with their specific needs and financial circumstances. These funding sources provide the necessary capital, flexibility, and terms to fulfill short-term financial requirements efficiently.

In this article, we will explore ten common sources of short-term funding, ranging from traditional options like bank overdrafts and commercial paper to alternative methods such as payday loans and crowdfunding. By delving into the characteristics and nuances of each funding source, we will equip you with the knowledge needed to make informed financial decisions.

Definition of Short-Term Funding

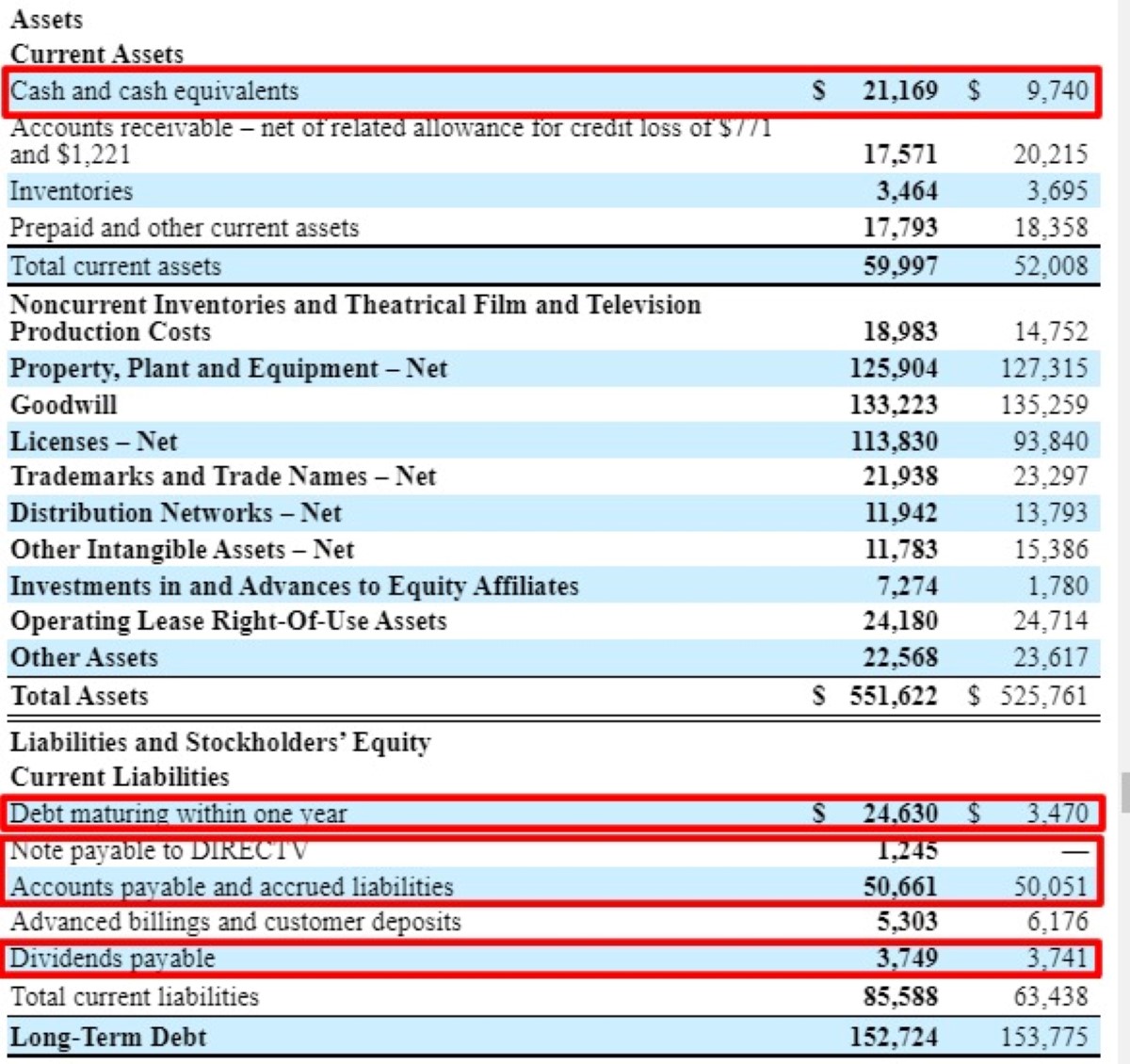

Short-term funding refers to the process of obtaining funds or accessing credit for a relatively short period, typically less than a year. It serves as a temporary financial solution to meet immediate cash flow needs or cover short-term expenses. Unlike long-term funding, which is used for capital investments or major acquisitions, short-term funding is aimed at managing day-to-day financial requirements and ensuring smooth operations.

Short-term funding is essential for businesses to meet their working capital needs, such as purchasing inventory, paying suppliers, and covering operating expenses. It allows businesses to bridge the gap between cash outflows and inflows, ensuring that there is enough liquidity to sustain operations without any disruptions.

For individuals, short-term funding can help manage unexpected expenses or bridge the gap between paychecks. It provides temporary financial relief for emergencies, educational expenses, medical bills, or other short-term financial obligations.

Typically, short-term funding is repaid within a shorter period compared to long-term financing options. The repayment terms can range from a few weeks to a few months, depending on the specific funding source and the agreement between the borrower and the lender.

Short-term funding can be both secured and unsecured. Secured short-term funding requires collateral, such as assets or inventory, to secure the loan. This provides the lender with some assurance that the loan will be repaid, as they can seize the collateral in case of default. Unsecured short-term funding, on the other hand, does not require collateral but may have higher interest rates to compensate for the increased risk to the lender.

Overall, short-term funding is an essential tool for managing cash flow and meeting immediate financial needs. Understanding the different sources of short-term funding and their characteristics is crucial for businesses and individuals to make informed decisions and choose the option that best suits their requirements.

Importance of Short-Term Funding

Short-term funding plays a crucial role in financial management for businesses and individuals. It provides the necessary liquidity to address immediate cash flow needs, seize opportunities, and sustain daily operations. Here are some key reasons why short-term funding is important:

- Working Capital Management: Short-term funding helps businesses effectively manage their working capital, which is the capital used for day-to-day operations. It ensures that there is enough cash available to cover expenses such as payroll, inventory purchases, and supplier payments.

- Cash Flow Stability: Businesses often face uneven cash flow patterns due to variations in sales, seasonal fluctuations, or delays in receiving payments. Short-term funding helps bridge the gap between cash inflows and outflows, ensuring a steady cash flow and minimizing disruptions.

- Opportunity Seizing: Short-term funding provides businesses with the flexibility and agility to seize time-sensitive opportunities. Whether it’s taking advantage of bulk purchasing discounts, fulfilling large orders, or investing in new projects, short-term funding allows businesses to act quickly and capitalize on favorable circumstances.

- Emergency Expenses: Unforeseen expenses can arise at any time, putting businesses and individuals in a financial bind. Short-term funding offers a lifeline during emergencies by providing quick access to funds to cover unexpected costs, such as equipment repairs, legal expenses, or medical bills.

- Seasonal Business Needs: Some businesses experience seasonal fluctuations, such as increased sales during the holiday season or slower periods during off-peak times. Short-term funding helps businesses manage these fluctuations by providing the necessary capital to meet increased demand or cover expenses during slower periods.

- Flexibility: Short-term funding options often provide greater flexibility compared to long-term loans. They can be tailored to meet specific financial needs, offering customizable repayment terms, loan amounts, and interest rates.

For individuals, short-term funding is essential for managing unexpected expenses, ensuring timely bill payments, or bridging the gap between paychecks. It provides financial stability in times of emergencies, avoiding the need to dip into savings or rely on high-interest credit cards.

In summary, short-term funding is vital for businesses and individuals alike. It enables businesses to optimize their cash flow, seize opportunities, and navigate unforeseen challenges. For individuals, it provides a safety net during unexpected financial setbacks. Understanding the importance of short-term funding and leveraging the available options can greatly enhance financial stability and success.

Sources of Short-Term Funding

When it comes to accessing short-term funding, businesses and individuals have a range of options to choose from. Each source of short-term funding has its own characteristics, requirements, and terms. Here are ten common sources of short-term funding:

- Bank Overdrafts: Bank overdrafts allow businesses and individuals to withdraw more money from their bank accounts than they currently have available. It provides a convenient way to cover short-term cash flow gaps, and interest is charged only on the overdraft amount used.

- Commercial Paper: Commercial paper is a short-term unsecured promissory note issued by creditworthy companies to raise funds. It is typically used by large corporations to meet their short-term financing needs and offers relatively low interest rates.

- Trade Credit: Trade credit is an agreement between a supplier and a business, allowing the business to purchase goods or services on credit terms. It provides a short-term interest-free financing option, extending the payment deadline beyond the usual terms.

- Factoring: Factoring involves selling accounts receivable to a third-party company, known as a factor, at a discount. This provides businesses with immediate cash by leveraging their outstanding invoices, helping them manage cash flow and reduce the risk of late payments or non-payment by customers.

- Line of Credit: A line of credit is a revolving credit facility offered by financial institutions. It provides businesses and individuals with access to a predetermined credit limit, allowing them to borrow as needed and repay the funds over time. Interest is only charged on the amount used.

- Revolving Credit Facility: Similar to a line of credit, a revolving credit facility is a flexible funding option that allows businesses to borrow, repay, and borrow again within the predetermined credit limit. It offers ongoing access to short-term funds to support day-to-day operations.

- Asset-Based Lending: Asset-based lending involves using business assets, such as accounts receivable, inventory, or equipment, as collateral to secure a short-term loan. This funding option provides businesses with access to immediate cash flow and is suitable for industries with significant tangible assets.

- Payday Loans: Payday loans are short-term loans designed to provide individuals with quick access to cash between paychecks. They are typically small loan amounts and are repaid in a lump sum on the borrower’s next payday, along with fees and interest.

- Peer-to-Peer Lending: Peer-to-peer lending platforms connect individual borrowers with lenders who are willing to provide short-term loans. These loans are typically facilitated online and offer competitive interest rates and terms.

- Crowdfunding: Crowdfunding platforms allow individuals and businesses to raise funds for specific projects or ventures. Contributors provide financial support in exchange for rewards or equity, making it a popular option for short-term funding needs.

It’s important to carefully evaluate the terms, interest rates, and requirements associated with each source of short-term funding. Analyzing the specific needs and financial circumstances will help determine the most suitable option for accessing short-term funds.

By exploring these diverse sources of short-term funding, businesses and individuals can effectively manage their cash flow, meet financial obligations, and seize opportunities for growth and success.

Bank Overdrafts

Bank overdrafts are a common and convenient source of short-term funding for businesses and individuals. They allow account holders to withdraw more money from their bank accounts than they currently have available, creating a negative balance. Bank overdrafts provide temporary access to additional funds to cover short-term cash flow gaps or unexpected expenses.

Here’s how bank overdrafts typically work:

- Authorized Overdraft: With an authorized overdraft, the account holder and the bank agree on a specific limit that can be exceeded. This limit is pre-approved by the bank, and interest is charged only on the overdraft amount used.

- Unauthorized Overdraft: In some cases, account holders may exceed their available balance without prior authorization from the bank. This is known as an unauthorized overdraft, and it usually incurs higher fees and interest rates than authorized overdrafts.

Bank overdrafts offer several benefits:

- Flexibility: Bank overdrafts provide flexible borrowing options, allowing businesses and individuals to access funds as needed within the approved overdraft limit. This flexibility makes them suitable for managing short-term cash flow gaps or unexpected expenses.

- Convenience: Bank overdrafts are seamlessly integrated into existing bank accounts, making them easily accessible when the need for additional funds arises. Account holders can utilize the overdraft facility through checks, debit cards, or online transactions.

- Interest Calculations: Interest on bank overdrafts is typically calculated on a daily basis, meaning that borrowers only pay interest on the amount they use and for the period they use it. This can make them a cost-effective solution for short-term funding needs.

While bank overdrafts offer quick and convenient access to funds, it’s important to keep in mind a few considerations:

- Interest Rates and Fees: Banks may charge interest rates and fees for using their overdraft facility. It’s crucial to understand the terms and conditions, including any applicable fees or penalties. Comparing different banks and their overdraft options can help find the most favorable terms.

- Repayment: As bank overdrafts are short-term financing solutions, they need to be repaid promptly. It’s essential to have a plan in place to repay the overdraft amount within a reasonable period to avoid excessive interest charges or potential account restrictions.

- Creditworthiness: The approval and limit for a bank overdraft may depend on the account holder’s creditworthiness. Banks will consider factors such as credit history, income, and financial stability when determining the overdraft limit.

Bank overdrafts can be a valuable tool for managing short-term funding needs and maintaining financial stability. By understanding the terms, fees, and repayment obligations associated with bank overdrafts, businesses and individuals can leverage this source of short-term funding effectively.

Commercial Paper

Commercial paper is a widely used source of short-term funding by creditworthy companies, typically large corporations. It is an unsecured promissory note issued to raise funds quickly for a short period, usually ranging from a few days to a year. Commercial paper is commonly issued at a discount to its face value and matures at full face value.

Here’s how commercial paper works:

- Issuer: The issuer of commercial paper is usually a large, well-established corporation with a strong credit rating. These companies have a proven track record of creditworthiness, making commercial paper an attractive investment option for institutional investors, such as money market funds or pension funds.

- Investors: Institutional investors purchase commercial paper as a short-term investment, seeking higher returns than traditional bank deposits. It provides them with a relatively safe and liquid investment option with a low risk of default.

- Maturity: Commercial paper has a short maturity period, typically ranging from a few days to a year. At maturity, investors receive the face value of the commercial paper, which is the original investment amount.

- Interest: The interest earned by investors on commercial paper is the difference between the discounted purchase price and the face value at maturity. The interest rates on commercial paper are generally lower than other forms of short-term financing.

Commercial paper offers several benefits:

- Access to Quick Funds: By issuing commercial paper, companies can quickly raise funds to meet their short-term financing needs. This enables them to manage cash flow, invest in growth opportunities, or fulfill immediate financial obligations.

- Lower Interest Rates: Compared to traditional bank loans or lines of credit, the interest rates on commercial paper are typically lower. This makes it an attractive option for companies looking to minimize financing costs.

- Liquidity: Commercial paper is a highly liquid instrument, often traded in secondary markets. This provides investors with the flexibility to sell their holdings before maturity if needed.

While commercial paper offers numerous advantages, it’s important to consider a few key factors:

- Credit Risk: Investors should carefully assess the creditworthiness of the issuers. The credit rating of the issuing company reflects its ability to repay the commercial paper at maturity. Higher credit ratings indicate a lower risk of default.

- Minimum Investment Amounts: Commercial paper is typically targeted at institutional investors rather than individual investors due to higher minimum investment requirements. This may limit individual participation in this short-term funding option.

- Market Conditions: The issuance and pricing of commercial paper are influenced by market conditions, such as prevailing interest rates and overall investor sentiment. Companies considering issuing commercial paper should assess the market environment to determine the viability of this funding source.

Commercial paper serves as an efficient and cost-effective source of short-term funding for creditworthy companies. By carefully evaluating the creditworthiness of issuers and understanding the potential risks, companies and institutional investors can effectively utilize commercial paper to meet their short-term financing needs.

Trade Credit

Trade credit is a common source of short-term funding that allows businesses to purchase goods or services from suppliers on credit terms. It offers a convenient and interest-free financing option, enabling businesses to manage their cash flow and meet immediate financial obligations.

Here’s how trade credit typically works:

- Agreement: A trade credit agreement is established between a buyer and a supplier, outlining the terms and conditions of credit extended for purchases. These terms may include the credit period, repayment terms, and any applicable discounts.

- Credit Period: The credit period is the agreed-upon time frame within which the buyer must make payment. It can range from a few days to several months, depending on the agreement between the buyer and the supplier.

- Discounts: Some suppliers may offer early payment discounts to incentivize prompt payment. These discounts provide an opportunity for businesses to save on costs by paying their invoices before the due date.

Trade credit offers several advantages:

- Working Capital Management: Trade credit helps businesses effectively manage their working capital by providing a short-term interest-free source of funds. It eliminates the need for immediate cash payment, allowing businesses to allocate their capital towards other operational needs.

- Flexibility: Unlike traditional loans or lines of credit, trade credit does not involve lengthy approval processes or require collateral. It provides businesses with greater flexibility in managing their cash flow and purchasing goods or services when needed.

- Supplier Relationships: Building positive relationships with suppliers is essential for business success. Utilizing trade credit can help foster strong relationships, as timely payments and prompt communication contribute to a mutually beneficial partnership.

While trade credit offers numerous benefits, it’s important to consider the following factors:

- Supplier Terms: Each supplier may have different terms for granting trade credit. It’s crucial to review and negotiate favorable terms that align with the business’s cash flow cycle and payment capabilities.

- Creditworthiness: Maintaining a good credit rating and reputation is essential to secure trade credit from suppliers. Suppliers may evaluate a business’s financial stability and creditworthiness before extending credit terms.

- Credit Management: Effective credit management is crucial to ensure timely payment and avoid late fees or strained relationships with suppliers. Businesses should establish clear processes for tracking and managing trade credit obligations.

Trade credit is a valuable short-term funding source that allows businesses to balance their cash flow needs while maintaining relationships with suppliers. By utilizing trade credit effectively and maintaining good credit management practices, businesses can benefit from improved cash flow and strengthened supplier partnerships.

Factoring

Factoring is a financing option that involves selling accounts receivable to a third-party company, known as a factor, at a discount. It is a popular source of short-term funding for businesses that need immediate cash flow and prefer not to wait for customers to make their invoice payments.

Here’s how factoring typically works:

- Agreement: A business enters into a factoring agreement with a factor, outlining the terms and conditions of the arrangement. This includes the percentage of the invoice value that will be advanced, the fee charged by the factor, and the terms of payment.

- Invoice Submission: The business submits its customer invoices to the factor for verification and approval. The factor assesses the creditworthiness of the customers and determines the eligible funding amount.

- Advance Payment: Once the invoices are approved, the factor advances a percentage of the invoice value, typically around 80-90%, to the business. This provides immediate cash flow that can be used for operational needs or growth opportunities.

- Collection and Payment: The factor takes over the responsibility of collecting payments from the customers. When the customers settle their invoices, the factor deducts its fees and any reserve amounts and transfers the remaining funds to the business.

Factoring offers several advantages:

- Improved Cash Flow: Factoring provides businesses with immediate access to cash flow by converting accounts receivable into cash. This helps businesses manage day-to-day expenses, cover operational costs, and avoid cash flow gaps.

- Reduced Credit Risk: By selling their invoices to a factor, businesses transfer the risk of customer non-payment to the factor. Factors assess the creditworthiness of customers, reducing the risk of bad debts for the business.

- Outsourced Receivables Management: Factoring companies handle the collection and management of receivables, relieving businesses of the administrative burden associated with chasing invoice payments. This allows businesses to focus on core operations and customer relationships.

- Growth Opportunities: With improved cash flow, businesses can take advantage of growth opportunities, such as expanding product lines, investing in marketing campaigns, or fulfilling larger customer orders.

While factoring offers numerous benefits, it’s important to consider the following factors:

- Cost: Factoring fees can be higher compared to other short-term financing options. Businesses should carefully assess the costs involved in factoring and evaluate the impact on their profitability.

- Customer Perception: Factoring involves a third party taking over the collection of invoices. Businesses should consider how their customers perceive this arrangement and communicate clearly to maintain a positive customer relationship.

- Eligibility Criteria: Factors assess the creditworthiness of a business’s customers before approving the factoring arrangement. Businesses with a high proportion of creditworthy customers are more likely to qualify for factoring.

Factoring can be an effective solution for businesses looking to improve cash flow and maintain a steady working capital position. By understanding the costs, eligibility criteria, and impact on customer relationships, businesses can leverage factoring as a valuable source of short-term funding.

Line of Credit

A line of credit is a flexible source of short-term funding that provides businesses and individuals with access to a predetermined credit limit. It allows borrowers to withdraw funds as needed, up to the approved limit, and repay the borrowed amount over time. A line of credit is a revolving facility, meaning that as the borrowed amount is repaid, the funds become available for borrowing again.

Here’s how a line of credit typically works:

- Approval Process: Individuals or businesses apply for a line of credit with a financial institution, such as a bank. The lender evaluates the creditworthiness of the borrower, financial history, and other relevant factors to determine the credit limit.

- Credit Limit: Once approved, the borrower has access to a specified credit limit, which can be used in part or in full. Interest is typically charged only on the amount borrowed.

- Withdrawal and Repayment: Borrowers can withdraw funds from their line of credit, up to the approved limit, as needed. The repayment terms vary but often involve regular minimum payments, including interest charges.

- Flexibility: A line of credit provides flexibility, as borrowers can use the funds for various purposes, such as managing cash flow, purchasing inventory, covering operating expenses, or addressing short-term financial needs.

Line of credit offers several advantages:

- Access to Funds: A line of credit provides immediate access to funds when needed, allowing businesses and individuals to address short-term financial needs or take advantage of time-sensitive opportunities.

- Flexible Borrowing: Borrowers have the flexibility to borrow and repay funds according to their cash flow needs. They can make partial or full repayments at any time and borrow again within the approved credit limit.

- Cost-Efficient: Interest is charged only on the amount borrowed, making a line of credit a cost-effective solution compared to long-term loans or credit cards.

- Establishing Credit: For individuals or businesses looking to establish or improve their credit history, responsibly managing a line of credit can help build a positive credit profile.

While a line of credit offers multiple benefits, there are a few considerations to keep in mind:

- Interest Rates and Fees: Borrowers should carefully review the interest rates, fees, and repayment terms associated with a line of credit. Comparing different lenders and their offerings can help find the most favorable terms.

- Repayment Discipline: It’s important for borrowers to manage their line of credit responsibly and make timely payments. Failing to repay the borrowed amount can negatively impact credit scores and may lead to additional fees or penalties.

- Credit Limit Management: Borrowers must monitor their credit usage to ensure they stay within the approved limit and avoid overextending themselves financially.

A line of credit can be a valuable source of short-term funding for businesses and individuals. By understanding the terms, interest rates, and repayment obligations, borrowers can effectively utilize a line of credit to fulfill their short-term financing needs.

Revolving Credit Facility

A revolving credit facility is a flexible source of short-term funding that provides businesses and individuals with ongoing access to funds up to a predetermined credit limit. It operates like a revolving line of credit, allowing borrowers to withdraw, repay, and borrow again within the approved limit without the need for reapplying for new credit each time.

Here’s how a revolving credit facility typically works:

- Application and Approval: Individuals or businesses apply for a revolving credit facility with a financial institution, such as a bank. The lender evaluates the creditworthiness, financial history, and other relevant factors to determine the credit limit.

- Credit Limit: Once approved, the borrower has access to a specific credit limit. This limit represents the total amount available for borrowing over the duration of the facility.

- Borrowing and Repayment: Borrowers can withdraw funds from their revolving credit facility as needed, up to the approved limit. They are required to make regular minimum payments, which may include both the principal amount and interest charges.

- Flexibility: The revolving credit facility provides flexibility in borrowing and repaying funds. Borrowers can utilize the funds for various purposes, such as managing cash flow, covering operational expenses, or seizing opportunities for growth.

- Revolving Structure: As borrowers repay the borrowed amount, the funds become available again within the agreed credit limit. This revolving structure distinguishes it from traditional loans, allowing for ongoing access to funds without reapplying.

Revolving credit facility offers several advantages:

- Ongoing Access to Funds: With a revolving credit facility, borrowers have continuous access to funds within the approved credit limit. This allows them to address short-term funding needs without requiring new loan applications each time.

- Flexible Repayment: Borrowers have the flexibility to make partial or full repayments as their cash flow allows. They can choose to repay the outstanding balance in minimum installments or clear the entire balance at once.

- Cost-Effective: Interest is charged only on the amount borrowed, making a revolving credit facility a cost-effective solution compared to traditional loans. Borrowers only pay interest on the funds used and enjoy the benefit of lower interest costs when the facility is not fully utilized.

- Convenience: The convenience of having access to funds when needed provides greater financial management flexibility. Borrowers can quickly respond to unexpected expenses or seize time-sensitive opportunities without the delay associated with traditional loan applications.

While a revolving credit facility offers numerous benefits, borrowers should consider the following factors:

- Interest Rates and Fees: It’s important to carefully review and compare the interest rates, fees, and repayment terms associated with revolving credit facilities. This ensures that borrowers secure the most favorable terms and avoid unnecessary costs.

- Disciplined Repayment: To avoid accumulating excessive debt and promoting healthy financial habits, borrowers must make timely payments and adhere to the agreed-upon repayment schedule.

- Credit Limit Management: Monitoring credit usage within the approved limit is essential to avoid overextending financial obligations and potential penalties or restrictions imposed by the lender.

A revolving credit facility can be a valuable financial tool for businesses and individuals to manage short-term funding needs. By understanding the terms, interest rates, and responsibilities associated with it, borrowers can effectively utilize this source of short-term funding for their financial requirements.

Asset-Based Lending

Asset-based lending is a short-term funding option that allows businesses to use their assets as collateral to secure a loan. This type of lending is particularly beneficial for companies with valuable assets, such as accounts receivable, inventory, or equipment, that can be leveraged to obtain immediate cash flow.

Here’s how asset-based lending typically works:

- Collateral Evaluation: The lender assesses the value and quality of the business’s assets that will be used as collateral. This evaluation determines the maximum loan amount that can be granted.

- Loan Agreement: Once the collateral is evaluated, the lender and the borrower enter into a loan agreement. This agreement outlines the terms and conditions, including the interest rate, repayment schedule, and any additional fees.

- Loan Disbursement: Upon agreement, the lender disburses the loan amount to the borrower. The loan amount is typically a percentage of the appraised value of the assets being used as collateral.

- Asset Monitoring: Throughout the duration of the loan, the lender monitors the value and performance of the collateralized assets. This ensures that the assets maintain their value and remain viable as security for the loan.

- Loan Repayment: The borrower is responsible for repaying the loan according to the agreed upon schedule. Failure to repay the loan may result in the lender seizing the collateralized assets.

Asset-based lending offers several advantages:

- Access to Funding: Asset-based lending provides businesses with access to immediate cash flow based on the value of their assets. This allows them to meet short-term financial obligations, invest in growth opportunities, or manage operational expenses.

- Flexible Loan Terms: Asset-based lending offers more flexible terms compared to traditional forms of financing. The loan amount is determined by the value of the assets, and the repayment schedule can be tailored to the business’s cash flow cycle.

- Leveraging Existing Assets: Asset-based lending allows businesses to utilize their existing assets, such as accounts receivable or inventory, to secure quick funding. This can be particularly beneficial for companies with valuable assets but limited access to traditional financing.

- Potential for Higher Loan Amounts: Since the loan amount is based on the value of the collateral, businesses with valuable assets may be eligible for higher loan amounts compared to unsecured loans.

While asset-based lending offers numerous benefits, it’s important to consider the following factors:

- Creditworthiness and Collateral Quality: The lender evaluates the quality and value of the assets being used as collateral, as well as the creditworthiness of the borrower. Businesses should ensure that their assets are adequately valued and maintain records to demonstrate their creditworthiness.

- Risk of Asset Seizure: Defaulting on loan payments may result in the lender seizing the collateralized assets. Businesses should carefully assess their ability to repay the loan and evaluate potential risks before proceeding with asset-based lending.

- Costs and Fees: Businesses should consider the interest rates, fees, and other costs associated with asset-based lending. These costs may be higher compared to other forms of financing due to the evaluation and monitoring of collateralized assets.

Asset-based lending can be a valuable source of short-term funding for businesses that have valuable assets to leverage. By understanding the terms, risks, and costs associated with this type of lending, businesses can effectively utilize asset-based lending to meet their short-term financing needs.

Payday Loans

Payday loans are a type of short-term funding option designed to provide individuals with quick access to cash between paychecks. This type of loan is typically for small amounts and is expected to be repaid in full, along with fees and interest, on the borrower’s next payday.

Here’s how payday loans typically work:

- Application: Individuals can apply for a payday loan either online or at a physical location. The application process is usually quick and straightforward, requiring basic personal and financial information.

- Loan Approval: Payday loan lenders often have more lenient approval criteria compared to traditional lenders. Borrowers are typically required to provide proof of income, such as pay stubs or bank statements, to demonstrate their ability to repay the loan.

- Loan Disbursement: If approved, the borrower receives the loan amount, which is typically a percentage of their regular income. The funds are disbursed quickly, sometimes within a few hours or by the next business day.

- Repayment: The borrower is expected to repay the loan in full, including fees and interest, on their next payday. Some lenders may offer an extension or installment plan, but this often comes with additional costs.

- Interest Rates and Fees: Payday loans typically have higher interest rates and fees compared to other forms of short-term financing. The annual percentage rate (APR) for payday loans can be very high, making them an expensive borrowing option.

Payday loans offer several advantages:

- Quick Access to Cash: Payday loans provide individuals with immediate access to funds when they need it most. This can be helpful for managing unexpected expenses or financial emergencies.

- Easy Approval Process: Payday loans are known for their relatively lenient approval criteria, making them accessible to individuals with less-than-perfect credit scores or limited credit history.

- No Credit Check: Many payday loan lenders do not perform a traditional credit check. Instead, they rely on the borrower’s proof of income as the main factor in determining loan eligibility.

However, there are important factors to consider before opting for a payday loan:

- High Interest Rates: Payday loans often come with extremely high interest rates, resulting in high borrowing costs. Borrowers should carefully consider the potential long-term financial implications before taking out a payday loan.

- Debt Cycle: Due to the high costs associated with payday loans, borrowers may find themselves trapped in a cycle of borrowing and repaying, which can lead to further financial challenges.

- Loan Amount Limitations: Payday loans typically offer smaller loan amounts compared to other financing options. Depending on the individual’s financial needs, a payday loan may not provide sufficient funds to address larger expenses.

- Regulation and Legitimacy: Payday loans can be subject to specific regulations and requirements depending on the jurisdiction. Individuals should ensure they are working with a reputable lender that adheres to responsible lending practices.

Payday loans can be a convenient source of short-term funding for individuals facing urgent financial needs. However, due to their high costs and potential risks, it’s crucial for borrowers to carefully consider their financial situation and explore alternative options before deciding to take out a payday loan.

Peer-to-Peer Lending

Peer-to-peer (P2P) lending, also known as marketplace lending, is a growing source of short-term funding that connects borrowers directly with individual lenders through online platforms. This type of lending eliminates the intermediaries typically associated with traditional lending institutions, allowing borrowers to access loans directly from individual investors.

Here’s how peer-to-peer lending typically works:

- Borrower Application: Individuals or businesses seeking short-term funding can submit loan applications on a P2P lending platform. The application process typically involves providing personal and financial information.

- Loan Listing: Once the application is approved, the borrower’s loan request is listed on the platform, where individual lenders can review the details and decide whether to invest in the loan.

- Funding: Individual lenders can choose to invest in the loan by contributing a portion of the requested loan amount. Multiple lenders may fund a single loan, spreading the risk and diversifying the investment.

- Loan Repayment: Borrowers are responsible for repaying the loan according to the agreed-upon terms, including interest and any fees. The repayments are typically made directly to the P2P lending platform, which then distributes the payments to the individual lenders.

- Platform Fees: P2P lending platforms charge fees for their services, usually a percentage of the loan amount or a flat fee. These fees cover the costs of operating the platform and facilitating the lending process.

Peer-to-peer lending offers several advantages:

- Broad Access to Funding: Peer-to-peer lending provides individuals and businesses with an additional funding avenue beyond traditional banks. This can be especially beneficial for borrowers with limited credit history or unconventional financial profiles.

- Competitive Interest Rates: P2P lending platforms typically offer competitive interest rates that may be lower than those offered by traditional lenders. This can result in cost savings for borrowers compared to other short-term funding options.

- Flexible Loan Terms: Borrowers may have the opportunity to negotiate loan terms that suit their unique financial needs. P2P lending platforms offer a range of loan amounts and repayment periods, allowing borrowers to customize their financing arrangements.

- Investment Opportunity for Lenders: P2P lending allows individual investors to diversify their portfolios and potentially earn higher returns compared to traditional investment options. Lenders can choose the loans they want to invest in based on their risk tolerance and investment objectives.

However, it’s important to consider the following factors before engaging in peer-to-peer lending:

- Risk Assessment: Borrowers should carefully assess their ability to repay the loan and understand the potential risks associated with peer-to-peer lending. This includes evaluating interest rates, fees, and the terms and conditions of the loan.

- Platform Reputation and Regulation: Not all P2P lending platforms are created equal. Borrowers should research and work with reputable platforms that adhere to responsible lending practices and comply with relevant regulations.

- Lender Due Diligence: Borrowers should be aware that individual lenders may conduct their own risk assessments based on the borrower’s creditworthiness and loan details. It’s important to provide accurate and comprehensive information to attract potential lenders.

Peer-to-peer lending can be an alternative source of short-term funding for borrowers who seek competitive interest rates and a streamlined borrowing process. By understanding the terms, risks, and opportunities associated with P2P lending, borrowers can make informed decisions to meet their short-term financing needs.

Crowdfunding

Crowdfunding has emerged as a popular source of short-term funding for individuals, entrepreneurs, and businesses seeking financial support for specific projects or ventures. It involves raising funds from a large number of people, often through online platforms, who contribute small amounts of money towards a common goal.

Here’s how crowdfunding typically works:

- Campaign Creation: The individual or business seeking funding creates a campaign on a crowdfunding platform, outlining the purpose, target amount, and details of the project or venture. They may also offer incentives or rewards to contributors based on the amount donated.

- Fundraising Period: The campaign is typically open for a defined period during which individuals can contribute funds. This timeframe allows for a sense of urgency and helps create momentum for supporters to contribute.

- Contribution Options: Contributors can choose to donate varying amounts of money, often with different tiers of rewards or benefits based on the donation size. This incentivizes supporters to contribute more to receive greater recognition or exclusive perks.

- Fund Disbursement: Once the campaign reaches its funding goal, the funds are typically disbursed to the project creator. Some crowdfunding platforms operate in an “all-or-nothing” model, where funds are only released if the campaign reaches its target, while others allow for the collection of funds regardless of the goal achievement.

- Accountability and Project Completion: The individual or business that receives the funds is expected to carry out the project or venture as outlined in the campaign. Transparency, regular updates, and communication with contributors are essential to maintain trust and accountability.

Crowdfunding offers several advantages:

- Access to Capital: Crowdfunding provides individuals and businesses with an opportunity to raise funds for projects or ventures that may not have been feasible through traditional funding sources. It allows for direct engagement with potential supporters and the wider community.

- Market Validation: Crowdfunding campaigns can help validate demand and market interest for a product, service, or creative project. The level of support received can serve as a gauge for market viability and potential success.

- Engagement and Brand Building: Crowdfunding allows creators to engage directly with their community and build a loyal supporter base. It can generate buzz, create brand awareness, and attract potential customers and collaborators.

However, there are important considerations for crowdfunding:

- Platform Fees: Crowdfunding platforms may charge fees for hosting the campaign and facilitating the funds transfer. It’s important to research and understand the fees associated with each platform.

- Meeting Funding Goals: Not all crowdfunding campaigns reach their target amounts. It requires effective marketing, promotion, and engagement with potential contributors to secure the necessary funding.

- Intellectual Property and Ownership: Creators should carefully consider the implications and potential risks associated with sharing their ideas, products, or ventures in a public crowdfunding campaign. It’s essential to protect intellectual property and maintain ownership rights.

- Delivery of Incentives: Campaign creators must fulfill their promises and deliver rewards or incentives to their contributors. This requires proper planning, logistics, and communication to ensure a positive experience for supporters.

Crowdfunding can be an effective funding option for individuals and businesses looking for short-term financial support to bring their projects or ventures to life. By understanding the dynamics and responsibilities that come with crowdfunding, creators can leverage this source of funding to turn their visions into reality.

Conclusion

Short-term funding plays a vital role in managing financial obligations, addressing immediate cash flow needs, and seizing opportunities for businesses and individuals. Understanding the various sources of short-term funding allows for informed decision-making when it comes to managing financial needs effectively.

Bank overdrafts offer flexibility and convenience, providing a quick solution for meeting short-term cash flow gaps. Commercial paper provides creditworthy companies with access to immediate funds at competitive rates. Trade credit affords businesses the ability to purchase goods or services on credit terms without incurring interest charges. Factoring allows businesses to leverage their accounts receivable to quickly access working capital.

Lines of credit and revolving credit facilities provide ongoing access to funds within predetermined credit limits, empowering businesses and individuals to manage cash flow efficiently. Asset-based lending enables businesses to utilize valuable assets as collateral to secure short-term loans. Payday loans offer quick access to funds between paychecks, although they come with higher interest rates and fees.

Peer-to-peer lending connects borrowers with individual lenders, providing an alternative funding option with competitive interest rates and flexible terms. Crowdfunding allows individuals and businesses to raise funds from a larger community, validating ideas and building a supportive network.

In conclusion, a comprehensive understanding of these sources of short-term funding empowers individuals and businesses to make informed decisions in managing their finances effectively. Each funding option comes with its own set of advantages, considerations, and risks. Therefore, careful evaluation of the specific financial situation, needs, and goals is crucial when deciding on the most suitable source of short-term funding.