Finance

How Do Cash Flow Problems Usually Start

Published: December 21, 2023

Learn how finance-related cash flow problems typically begin and discover effective strategies to manage them.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Cash flow problems are a common challenge for businesses, and they can have a significant impact on the overall financial health and stability of an organization. It is crucial for businesses to understand how cash flow problems start in order to prevent and address them effectively. In this article, we will explore the various factors that typically contribute to cash flow problems.

Every business relies on a steady inflow of cash to cover expenses, invest in growth opportunities, and sustain day-to-day operations. When cash flow becomes insufficient, it can hinder a company’s ability to pay suppliers, meet payroll obligations, and even jeopardize its long-term viability.

It’s important to note that cash flow problems don’t usually happen overnight; they are often the result of underlying issues that have been building up over time. By identifying and addressing these contributing factors early on, businesses can take proactive steps to prevent and mitigate cash flow problems.

There are several common causes of cash flow problems, including insufficient sales, high expenses, poor cash management, unexpected expenses, late-paying customers, inventory management issues, seasonal fluctuations, and changes in the market. Let’s explore each of these factors in more detail.

Insufficient Sales

One of the primary causes of cash flow problems is insufficient sales. When a business fails to generate enough revenue, it can struggle to meet its financial obligations and maintain a healthy cash flow. There are several reasons why sales may be inadequate:

- Market demand: If there is low demand for a company’s products or services, it can result in slow sales and cash flow problems. This may be due to changing consumer preferences, economic downturns, or increased competition.

- Pricing issues: If a business sets prices too high, it may deter potential customers from making a purchase. Conversely, if prices are set too low, it can lead to reduced profit margins and insufficient funds to cover expenses.

- Ineffective marketing: A lack of effective marketing strategies can limit a company’s ability to reach its target audience and generate sales. Businesses need to invest in marketing efforts that effectively highlight the value and benefits of their products or services.

- Poor product or service quality: If a business offers products or services of subpar quality, it can deter customers and result in low sales. Maintaining high standards and addressing any quality issues is essential for driving sales and sustaining cash flow.

To address insufficient sales and improve cash flow, businesses can consider implementing strategies such as:

- Market research: Conducting market research can help businesses identify trends, customer preferences, and potential demand for their products or services. This information can guide decision-making and help tailor marketing efforts to attract more customers.

- Competitive pricing: Analyze pricing strategies to ensure they are competitive within the market while still allowing for sufficient profit margins. Consider offering discounts or promotions to incentivize customers to make a purchase.

- Invest in marketing: Allocate resources to develop and execute effective marketing campaigns. This may include online advertising, social media marketing, content creation, and targeted promotions to reach and engage with the target audience.

- Product or service improvement: Continuously strive to enhance the quality of products or services to meet customer expectations and demands. Solicit customer feedback and make necessary improvements to increase customer satisfaction and loyalty.

By addressing the root causes of insufficient sales and implementing targeted strategies, businesses can improve their revenue generation, boost cash flow, and ensure long-term financial stability.

High Expenses

High expenses are another significant factor that can contribute to cash flow problems for businesses. When expenses outweigh revenue, it can create a strain on the available cash flow. Let’s explore some common reasons why businesses may face high expenses:

- Overhead costs: Overhead costs such as rent, utilities, and insurance can add up significantly and put a strain on cash flow. Businesses need to regularly review their overhead expenses and explore cost-cutting measures such as renegotiating leases or seeking more affordable alternatives.

- Employee costs: Employee salaries, benefits, and payroll taxes can comprise a significant portion of a company’s expenses. Hiring too many employees or paying salaries that are above the market rate can lead to high labor costs. Evaluating staffing needs and considering options such as outsourcing or automation can help control expenses.

- Inventory management: Poor inventory management can result in excess stock that ties up cash. It can lead to obsolescence, storage costs, and the risk of products not selling. Implementing inventory control systems and analyzing demand patterns can help optimize inventory levels, reduce carrying costs, and free up cash.

- Unnecessary expenses: Sometimes businesses may incur unnecessary expenses due to poor decision-making or lack of oversight. This can include excessive advertising spending, unnecessary travel, or frivolous expenditures. Careful monitoring and rationalizing expenses are essential to ensure that cash is utilized efficiently.

To address high expenses and improve cash flow, businesses can consider implementing the following strategies:

- Expense analysis: Conduct a thorough analysis of all expenses to identify areas where cost-cutting measures can be implemented. This may involve negotiating better deals with suppliers, reducing discretionary spending, or finding alternative service providers.

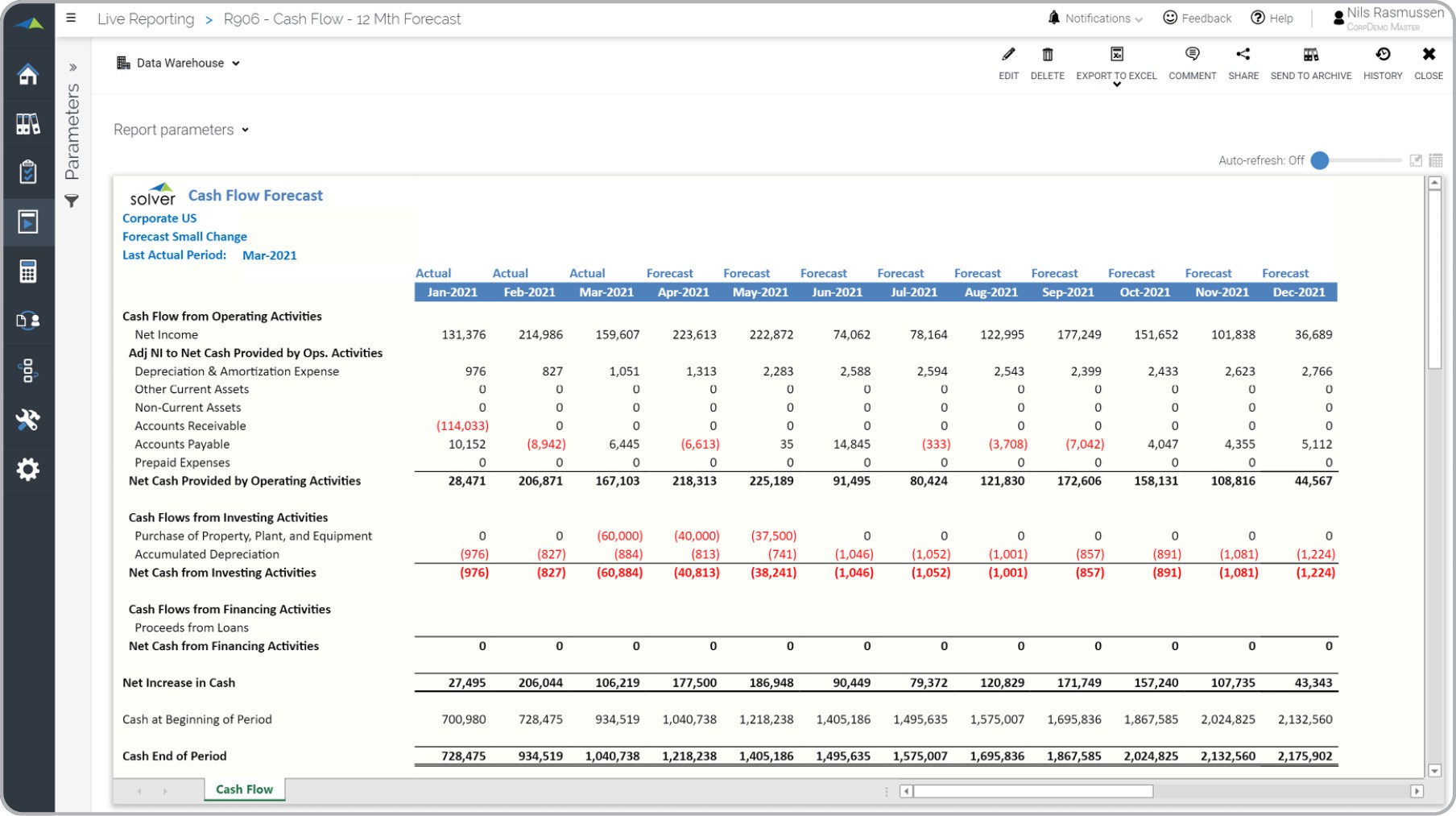

- Budgeting and forecasting: Creating a budget and forecasting cash flow can help businesses anticipate and plan for expenses. This allows for better financial planning and management, reducing the risk of cash flow problems.

- Efficiency improvements: Seek ways to streamline operations and improve efficiency to reduce costs. This can include process automation, adopting technology solutions, or reevaluating workflows to identify bottlenecks and inefficiencies.

- Vendor relationships: Building strong relationships with suppliers can lead to potential cost savings. Negotiating favorable terms, bulk purchasing, or exploring discounts can help reduce expenses and improve cash flow.

By addressing high expenses and implementing strategies to control costs, businesses can optimize their cash flow and improve their overall financial health. It is essential to regularly review and reassess expenses to ensure sustainable and profitable operations.

Poor Cash Management

Poor cash management is a critical factor that can lead to cash flow problems for businesses. It involves the mishandling or misallocation of available funds, resulting in a lack of cash when it is needed most. Here are some common scenarios that indicate poor cash management:

- Lack of cash reserves: Failing to maintain a sufficient cash reserve can leave a business vulnerable to unexpected expenses or sudden drops in revenue. Without a safety net, businesses may be forced to rely on credit or emergency loans, which can further strain their cash flow.

- Delayed payments: Procrastinating on invoice processing or delaying payment of bills can disrupt the cash flow cycle. It can lead to missed payment deadlines, late fees, and strained relationships with suppliers, negatively impacting cash flow in the long run.

- Insufficient tracking and forecasting: Without proper tracking and forecasting of cash flow, businesses may not have a clear understanding of their financial position. This lack of insight can make it challenging to anticipate and address potential cash flow problems before they arise.

- Mixed personal and business finances: Blurring the lines between personal and business finances can create confusion and hinder effective cash management. It is crucial to separate personal and business accounts to accurately track and manage cash flow.

To improve cash management and prevent cash flow problems, businesses can implement the following strategies:

- Create a cash flow forecast: Developing a cash flow forecast helps businesses anticipate cash inflows and outflows. It enables them to identify potential shortfalls or surpluses in advance, allowing for better financial planning.

- Establish cash reserves: Building up cash reserves provides businesses with a safety net for unforeseen circumstances. Setting aside a percentage of revenue regularly helps create a buffer against cash flow fluctuations.

- Implement effective payment processes: Streamlining payment processes, setting clear payment terms, and sending timely invoices can improve cash collection. Offering incentives for early payments or implementing automated payment reminders can also help expedite cash inflow.

- Monitor and review expenses: Regularly track and review expenses to eliminate unnecessary costs and identify opportunities for savings. This can involve negotiating better deals with suppliers, reevaluating subscription services, or renegotiating contracts.

By implementing effective cash management strategies, businesses can better control their cash flow, mitigate cash flow problems, and establish a solid financial foundation for sustainable growth.

Unexpected Expenses

Unexpected expenses can quickly derail a business’s cash flow and create financial challenges. These expenses are often unforeseen and can arise from various situations, including:

- Equipment breakdowns and repairs: When essential equipment malfunctions or requires repairs, businesses must bear the unexpected costs. This can be especially burdensome if the equipment is critical to operations and its failure hinders productivity.

- Unforeseen maintenance or repairs: Buildings, vehicles, or other assets may require unexpected maintenance or repairs due to wear and tear, accidents, or unforeseen issues. These expenses can significantly impact cash flow, especially if they are significant or require immediate attention.

- Legal or compliance costs: Businesses may face unexpected legal fees, fines, or compliance costs due to regulatory changes, lawsuits, or penalties. These expenses can be substantial and eat into cash reserves if not anticipated and prepared for.

- Natural disasters or emergencies: Natural disasters, such as floods, fires, or storms, can cause property damage or disrupt operations. The associated costs of repairs, temporary relocation, or loss of business can place a strain on the cash flow of affected businesses.

To mitigate the impact of unexpected expenses on cash flow, businesses can implement the following strategies:

- Build an emergency fund: By setting aside a portion of profits into an emergency fund, businesses can prepare for unexpected expenses. This fund serves as a safety net and can be utilized to cover unforeseen costs without jeopardizing cash flow.

- Regular maintenance and inspections: Implementing regular maintenance schedules and inspections can help identify and address issues before they become major problems. This proactive approach can reduce the likelihood of unexpected expenses arising from neglected maintenance.

- Insurance coverage: Investing in comprehensive insurance coverage can provide financial protection against unexpected events. This includes property insurance, liability insurance, and business interruption insurance, which can help cover the costs of damages, legal fees, or lost revenue.

- Contingency planning: Developing a contingency plan can help businesses respond to unexpected expenses more effectively. This includes establishing relationships with reliable vendors for repairs, maintaining backup equipment, and preparing alternative business continuity strategies.

While it may be impossible to predict every unexpected expense, taking proactive measures to prepare for and address these situations can help minimize their impact on cash flow. By ensuring there are contingency plans and funds available, businesses can navigate unexpected expenses without severely disrupting their financial stability.

Late-Paying Customers

One common cash flow challenge that businesses face is dealing with late-paying customers. When customers delay their payments, it can create a strain on the cash flow of the business, especially if it heavily relies on timely receivables. Here are some reasons why customers may be late in paying:

- Cash flow issues: Customers may be facing their own cash flow problems, causing delays in payment. They could be prioritizing their own expenses and struggling to meet their payment obligations on time.

- Disputes or discrepancies: Customers may withhold payment or delay it due to disputes or discrepancies with the products or services received. This can occur if there are quality issues, delivery delays, or discrepancies between the provided goods and the agreed-upon terms.

- Poor communication: In some cases, customers may forget or overlook outstanding invoices due to poor communication or lack of clear payment reminders. This can lead to unintentional delays in payment.

- Unfavorable payment terms: If a business has strict or unfavorable payment terms, customers may delay payment as they try to manage their own cash flow. Lengthy payment periods or complicated invoicing procedures can discourage prompt payment.

To encourage timely payments and manage late-paying customers, businesses can implement the following strategies:

- Clear and concise invoicing: Provide customers with clear and easy-to-understand invoices that clearly state payment terms, due dates, and any applicable late fees. Ensure that invoices are sent promptly after a sale or service delivery.

- Regular and friendly payment reminders: Implement a system to send friendly payment reminders as the due date approaches. Personalize these reminders and maintain a professional and polite tone to encourage prompt payment.

- Offer incentives for early payment: Consider offering a small discount or incentive for customers who pay invoices early. This can provide motivation for customers to prioritize payment and improve cash flow for the business.

- Establish strong relationships: Build strong relationships with customers to foster open lines of communication. Address any disputes or issues promptly and proactively to avoid delays in payment.

- Consider alternative payment methods: Explore different payment options, such as online payment platforms or automated direct debits, to make it easier and more convenient for customers to settle their invoices.

By implementing these strategies, businesses can minimize the impact of late-paying customers on their cash flow. Regular communication, clear invoicing, and offering incentives can encourage timely payments and help maintain a healthy cash flow position.

Inventory Management Issues

Inventory management is a crucial aspect of running a successful business, and poor inventory management practices can contribute to cash flow problems. When inventory is not effectively managed, it can tie up valuable cash and lead to financial strain. Here are some common inventory management issues that can impact cash flow:

- Overstocking: Holding excessive inventory beyond what is necessary can result in cash being tied up in unsold products. This ties up valuable capital that could be better utilized elsewhere in the business.

- Understocking: On the flip side, insufficient inventory levels can lead to lost sales opportunities and dissatisfied customers. It may result in rushed or expensive reordering, leading to cash flow issues.

- Slow-moving or obsolete inventory: Products that are not selling or become obsolete over time can be a drain on cash flow. They occupy valuable storage space and restrict cash flow when that capital could be better invested in more popular or profitable products.

- Inaccurate forecasting: Inaccurate demand forecasting can lead to either overstocking or understocking. If a business overestimates demand and orders excessive inventory, it can tie up cash unnecessarily. Conversely, underestimating demand can result in lost sales and impact cash flow.

- Inefficient order fulfillment: Inefficient order fulfillment processes can lead to delays in getting products to customers. This can result in customer dissatisfaction, potential returns, and a strain on cash flow due to increased shipping costs or expedited orders.

To improve inventory management and optimize cash flow, businesses can implement the following strategies:

- Regular inventory analysis: Conduct regular inventory analyses to identify slow-moving or obsolete items. This allows for proactive measures such as clearance sales, discounts, or discontinuations to reduce inventory levels and free up cash.

- Accurate demand forecasting: Utilize historical sales data, market trends, and customer feedback to improve demand forecasting. This will ensure that inventory levels align with expected demand, minimizing the risk of overstocking or understocking.

- Efficient inventory replenishment: Optimize the ordering process by implementing systems that automate replenishment based on demand and lead times. This ensures that inventory is replenished in a timely manner, reducing the risk of stockouts and lost sales.

- Establish strong supplier relationships: Collaborate closely with suppliers to streamline the ordering and delivery process. Building strong relationships can lead to better terms, discounts, and faster delivery times, improving cash flow by reducing costs and fulfilling customer orders promptly.

- Implement just-in-time (JIT) inventory: Just-in-time inventory management involves ordering inventory only as needed, minimizing stock levels and the associated holding costs. This approach helps optimize cash flow by reducing excess inventory.

Improving inventory management practices can have a significant impact on a business’s cash flow. By optimizing inventory levels, accurate forecasting, and efficient order fulfillment, businesses can reduce costs, minimize cash tied up in inventory, and improve overall financial health.

Seasonal Fluctuations

Seasonal fluctuations in sales and cash flow are common for many businesses, particularly those operating in industries that experience peak periods at specific times of the year. Understanding and effectively managing these fluctuations is crucial to maintain a stable cash flow throughout the year. Here are some factors to consider regarding seasonal fluctuations:

- Peak seasons: Some businesses experience a surge in sales and cash flow during specific seasons or holidays. For example, retailers often see a significant increase in sales during the end-of-year holiday season. However, it’s important to note that businesses still need to manage cash flow during off-peak seasons.

- Low seasons: Conversely, businesses may face a slowdown in sales during specific periods. This can be due to various factors, such as weather conditions, economic cycles, or industry trends. It’s essential to plan and prepare for these slower periods to maintain sufficient cash flow.

- Inventory management: Effective inventory management is crucial when dealing with seasonal fluctuations. Businesses need to optimize their inventory levels to meet increased demand during peak seasons while avoiding excess inventory that can tie up cash during slower periods.

- Staffing and labor costs: Seasonal fluctuations may also impact staffing needs. Businesses may need to hire temporary or part-time workers during peak seasons, which can increase labor costs. It’s important to factor in these costs when planning budgets and cash flow.

- Cash reserves: Building up cash reserves during peak seasons can provide a buffer to cover expenses during off-peak periods. This ensures that the business has sufficient cash flow to sustain operations and manage overhead costs.

To effectively manage seasonal fluctuations and maintain a stable cash flow, businesses can consider implementing the following strategies:

- Effective forecasting: Accurate forecasting of sales and expenses can help businesses anticipate and plan for seasonal fluctuations. It allows for better resource allocation, inventory management, and cash flow planning.

- Marketing and promotions: Develop targeted marketing and promotional strategies to capitalize on peak seasons and drive sales. This can help maximize revenue during these periods and mitigate the impact of slower sales during off-peak times.

- Flexible budgeting: Adjust the budgeting process to account for seasonal fluctuations. During peak seasons, allocate funds for increased marketing, inventory, and temporary staffing. During slower periods, focus on managing costs and controlling expenses.

- Proactive cash flow management: Monitor cash flow closely and take proactive measures to ensure a steady inflow of cash during low seasons. This can include offering early payment incentives, renegotiating payment terms with suppliers, or diversifying products or services to appeal to different customer segments.

- Explore diversification: Consider expanding product lines or exploring new markets to reduce reliance on seasonal sales fluctuations. Diversification can help generate consistent revenue streams throughout the year and improve overall cash flow stability.

By understanding the impact of seasonal fluctuations and implementing strategic planning, businesses can effectively manage cash flow and navigate through different sales cycles. Balancing revenue generation during peak seasons and careful cash flow management during off-peak periods is key to ensuring long-term financial stability.

Changes in the Market

Changes in the market can profoundly impact a business’s cash flow. Market dynamics, consumer behavior, and industry trends can all fluctuate over time, presenting both opportunities and challenges for businesses. It is essential for businesses to stay agile and adapt to these changes to maintain a healthy cash flow. Here are some factors to consider regarding changes in the market:

- Customer preferences: Shifting customer preferences can significantly impact sales and cash flow. For example, advancements in technology or changes in consumer values can lead to increased demand for certain products or services while decreasing demand for others.

- Competitive landscape: Increased competition or the entry of new competitors can affect market share and pricing strategies, potentially impacting cash flow. Businesses need to monitor and respond to competitive pressures to remain relevant and sustain their financial health.

- Economic conditions: Economic downturns or periods of economic instability can have a direct impact on consumer spending behavior. Businesses may experience decreased sales and cash flow during such periods, requiring adaptations to navigate through challenging economic climates.

- Technological advancements: Technological advancements can disrupt industries and change market dynamics. Businesses that fail to adopt or adapt to new technologies risk falling behind their competitors and facing reduced sales and cash flow as a result.

- Regulatory changes: Changes in regulations or compliance requirements can create additional expenses or restrict business activities. Businesses need to stay informed and adapt their operations accordingly to mitigate the impact on cash flow.

To effectively manage changes in the market and maintain a healthy cash flow, businesses can consider implementing the following strategies:

- Market research and analysis: Conduct thorough market research to understand customer preferences and industry trends. Stay informed about changes in the market and use this knowledge to inform business strategies and adapt to evolving customer demands.

- Competitive analysis: Regularly assess the competitive landscape to understand how it may affect sales and pricing strategies. Identify opportunities to differentiate from competitors and add unique value to maintain cash flow stability.

- Continuous innovation: Foster a culture of innovation to stay ahead of market changes. Embrace new technologies, explore product enhancements, and stay responsive to customer needs to ensure continued relevance and sustained cash flow.

- Financial planning and risk mitigation: Develop robust financial planning strategies that take into account potential market changes, economic fluctuations, and regulatory requirements. Diversify revenue streams, maintain sufficient cash reserves, and implement risk mitigation strategies to navigate through market uncertainties.

- Agility and adaptability: Stay agile and adaptable as market conditions change. This may involve shifting product or service offerings, exploring new target markets, or revising pricing strategies to remain competitive and drive cash flow.

By staying attuned to market changes, actively monitoring competitors, and embracing innovation, businesses can effectively manage cash flow during market fluctuations. Timely adaptations and strategic planning can position businesses to thrive in ever-evolving market landscapes.

Conclusion

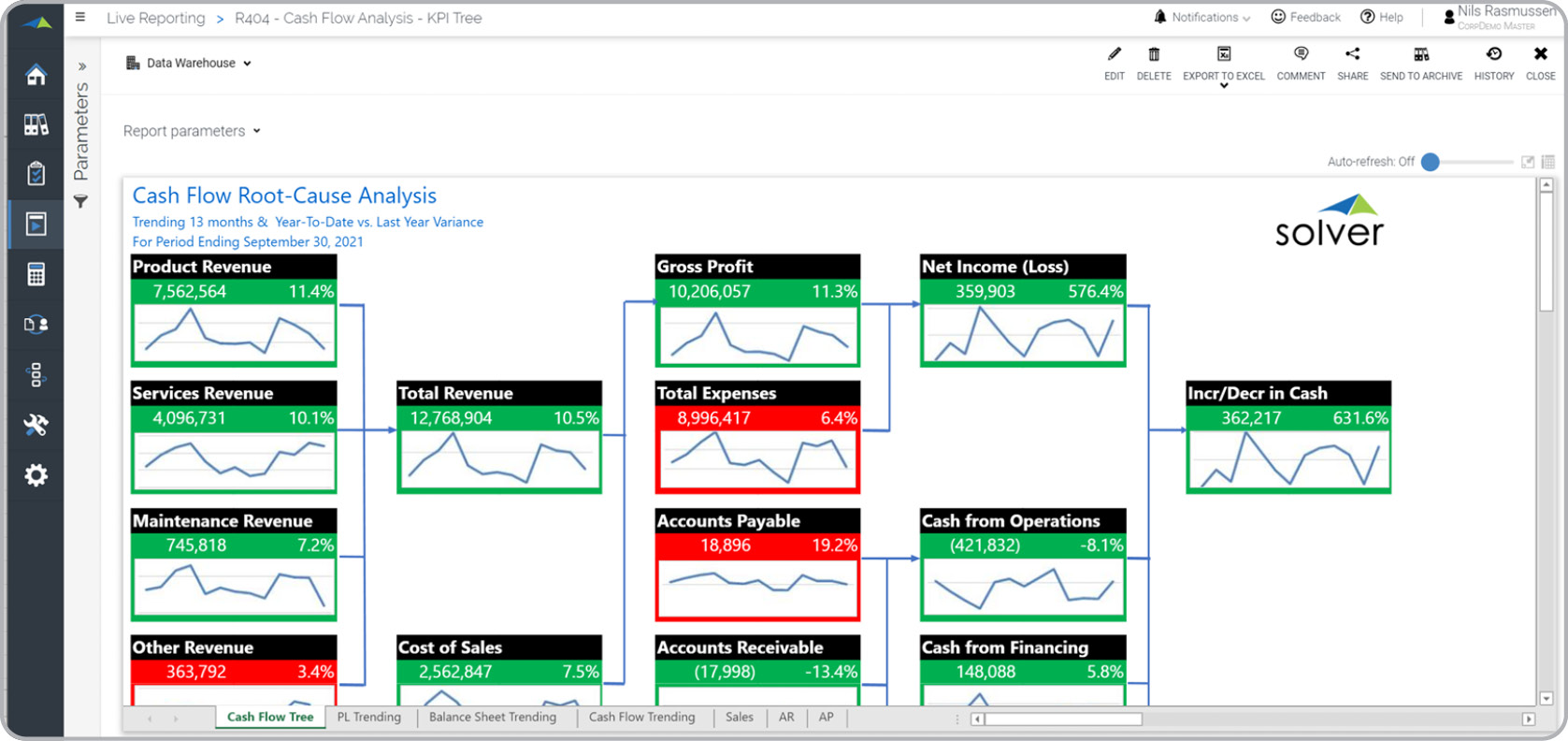

Efficient management of cash flow is vital for the overall financial health and stability of a business. Understanding the factors that contribute to cash flow problems allows businesses to proactively address and mitigate potential challenges. From insufficient sales and high expenses to poor cash management and unexpected expenses, each factor plays a significant role in the cash flow equation.

By implementing strategies such as accurate sales forecasting, effective expense control, proactive cash management, and contingency planning, businesses can improve their cash flow and reduce the risk of encountering financial difficulties. Additionally, addressing late-paying customers, optimizing inventory management, and adapting to seasonal fluctuations and market changes are essential steps in maintaining a healthy cash flow.

It is crucial for businesses to continually review and evaluate their cash flow management strategies, adjusting them as needed to align with current market conditions and evolving customer demands. Regular monitoring of cash flow and financial health enables businesses to make timely decisions and take appropriate actions to avoid cash flow problems.

Ultimately, successful cash flow management requires a combination of proactive planning, diligent monitoring, adaptability, and effective financial management. By staying vigilant and employing the strategies discussed in this article, businesses can navigate potential cash flow challenges and position themselves for long-term success.