Finance

Why Do We Add Depreciation In Cash Flow

Published: December 21, 2023

Learn why depreciation is added in cash flow and its significance in finance. Gain insights into the financial impact and benefits of including depreciation in cash flow analysis.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In the field of finance, understanding the concept of depreciation is crucial for assessing the financial health and performance of a company. Depreciation refers to the gradual decrease in the value of an asset over time due to wear and tear, obsolescence, or other factors. It is an accounting measure that allocates the cost of an asset over its useful life.

Cash flow, on the other hand, is the movement of money into and out of a business. It serves as a vital indicator of a company’s ability to generate sufficient funds to meet its operational needs, repay debt, invest in growth opportunities, and distribute dividends to shareholders.

These two concepts may seem distinct, but they are intertwined. Depreciation has a significant impact on cash flow, as it affects the profitability and financial performance of a company. In this article, we will delve into why we add depreciation in cash flow analysis and explore the importance of considering depreciation when assessing a company’s financial position.

Let’s dive deeper into the connection between depreciation and cash flow to gain a better understanding of their relationship and how depreciation affects a company’s financial statements.

Definition of Depreciation

Before we delve into the role of depreciation in cash flow analysis, let’s first establish a clear understanding of what depreciation entails. Depreciation is an accounting method used to allocate the cost of an asset over its useful life.

When a company acquires an asset, such as machinery, buildings, or vehicles, the initial cost is recorded on the balance sheet as an asset. However, over time, the value of the asset decreases due to wear and tear, technological advancements, or changes in market demand, resulting in a decline in its market value.

Depreciation allows businesses to account for this decrease in value over the asset’s useful life. By allocating the cost of the asset to future periods, companies can match the expense of using the asset with the revenue it generates.

There are several methods used to calculate depreciation, including the straight-line method, accelerated depreciation methods (such as declining balance or sum-of-the-years’-digits), and units-of-production method. Each method has its own set of assumptions and formulas to determine the depreciation expense.

It’s important to note that depreciation is a non-cash expense, meaning it does not directly involve the outflow of cash. Rather, it is an accounting convention used to reflect the decrease in value of an asset over time.

Now that we have a clear understanding of what depreciation entails, let’s explore how it relates to cash flow analysis and why it is important to consider when evaluating a company’s financial position.

Understanding Cash Flow

Cash flow is a fundamental concept in finance that provides insights into a company’s financial health and operational performance. It refers to the movement of money into and out of a business, capturing both the inflows and outflows of cash over a specific period.

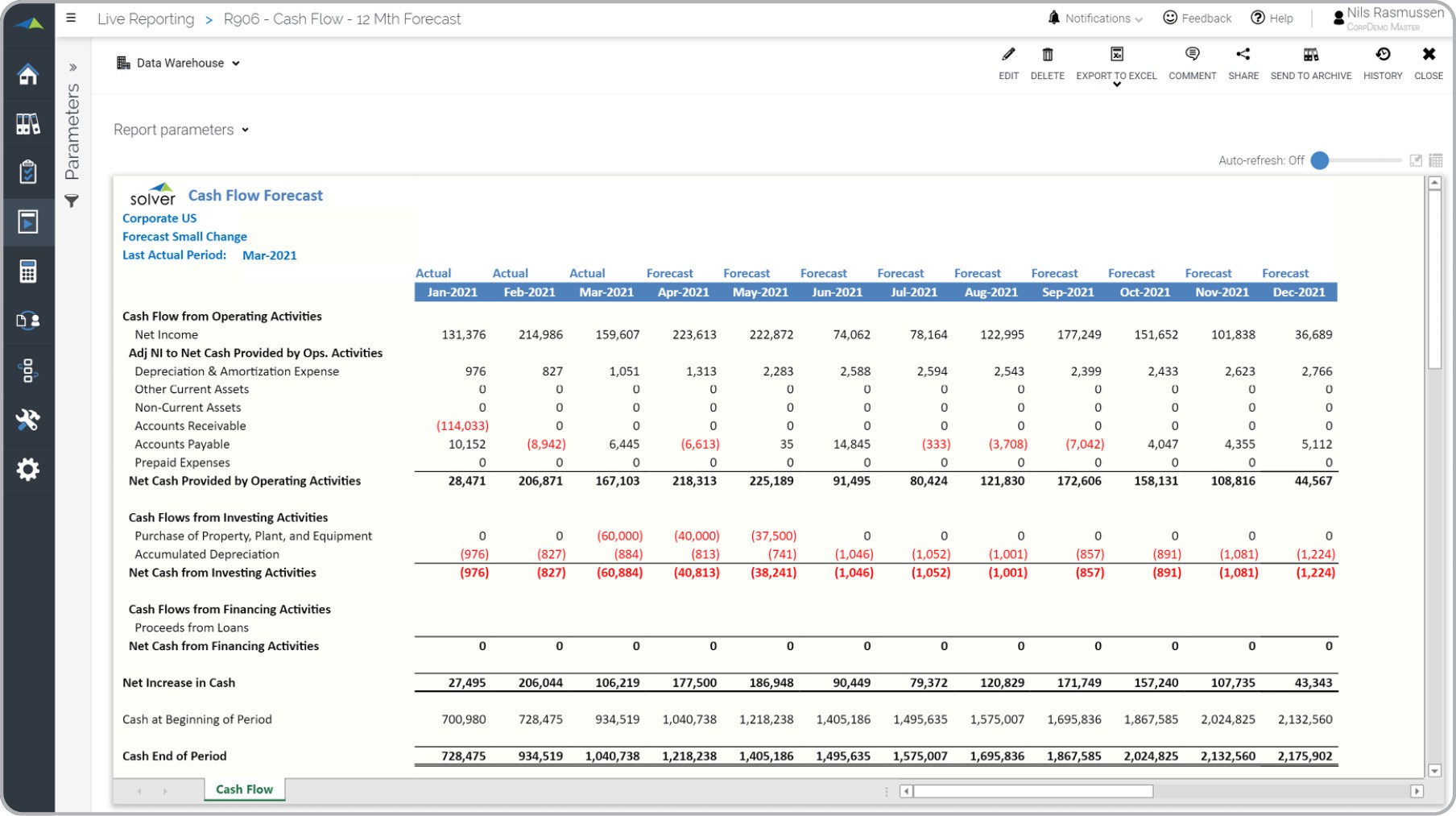

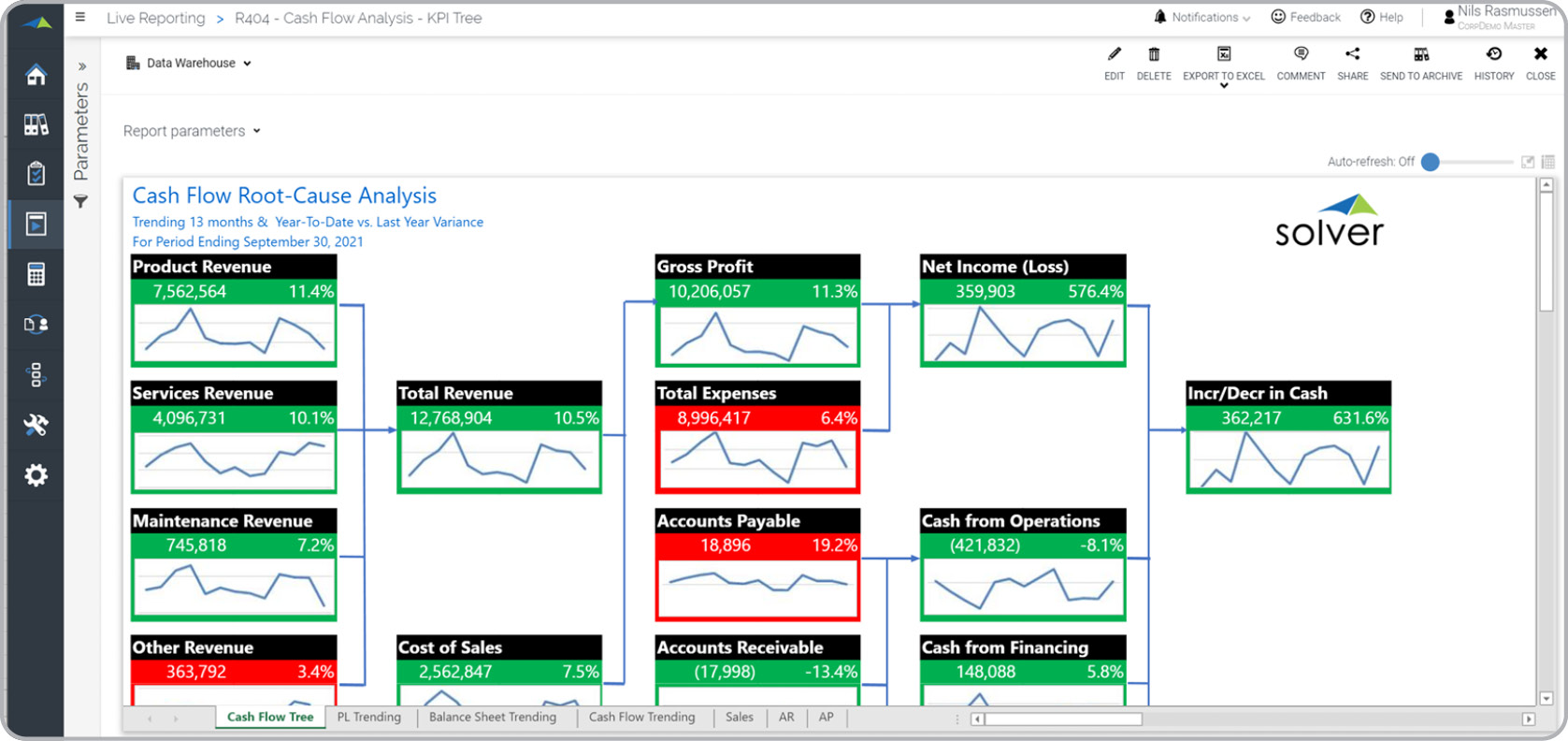

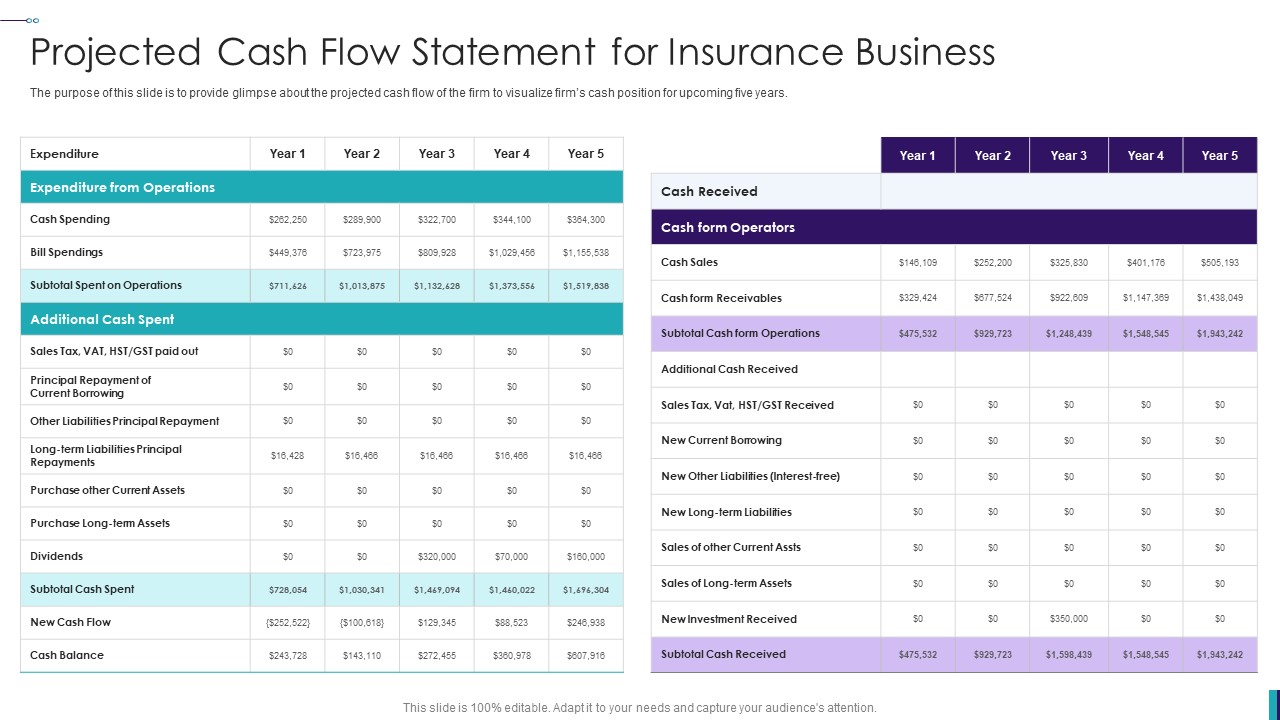

There are three main categories of cash flow: operating cash flow, investing cash flow, and financing cash flow.

Operating Cash Flow: Operating cash flow represents the cash generated or used in the company’s core operations. It includes cash received from sales, payments from customers, and cash payments for expenses such as salaries, raw materials, and utilities. Operating cash flow reflects the company’s ability to generate cash from its core business activities.

Investing Cash Flow: Investing cash flow accounts for the purchase or sale of long-term assets and investments. It includes cash inflows from the sale of assets or investments and cash outflows for the acquisition of new assets or investments. Investing cash flow provides insights into the company’s investment decisions and the allocation of capital.

Financing Cash Flow: Financing cash flow captures the cash inflows and outflows related to the company’s financing activities. This includes cash received from borrowing or issuing equity and cash paid for debt repayments or dividend distributions. Financing cash flow reflects the company’s sources of capital and its debt and equity management.

Assessing cash flow is crucial because it enables investors, creditors, and stakeholders to evaluate a company’s ability to generate and manage cash. Positive cash flow indicates that the company is generating more cash than it is spending, while negative cash flow implies insufficiency of cash to meet obligations.

Now that we have a clear understanding of cash flow, let’s explore why depreciation plays a crucial role in evaluating a company’s cash flow and financial position.

Importance of Depreciation in Cash Flow Analysis

Depreciation is a critical component of cash flow analysis as it provides a more accurate picture of a company’s financial performance and its ability to generate cash. Here are some key reasons why depreciation is essential in cash flow analysis:

1. Reflecting Realistic Costs: Depreciation allows businesses to reflect the gradual wear and tear or obsolescence of their assets over time. By allocating the cost of an asset over its useful life, depreciation helps capture the true expenses associated with using those assets. This provides a more realistic representation of the costs incurred in generating revenue, improving the accuracy of cash flow projections.

2. Cash Flow Projection Accuracy: Including depreciation in cash flow analysis aids in accurately projecting future cash flows. By factoring in the depreciation expense, companies can estimate the cash outflows required for asset replacement or maintenance. This helps in identifying potential shortfalls in cash flow and planning for necessary investments or financing options.

3. Impact on Profitability: Depreciation is a non-cash expense that reduces a company’s reported profit but does not involve an actual outflow of cash. By adding back depreciation to net income, cash flow analysis adjusts for this non-cash expense and provides a clearer picture of a company’s true profitability. This is particularly important for businesses with significant capital expenditures, as excluding depreciation would underestimate their actual cash-generating capacity.

4. Assessing Investment Decisions: Cash flow analysis that incorporates depreciation helps in evaluating the impact of investment decisions on a company’s cash position. When analyzing potential investments or capital expenditure projects, considering the depreciation expense enables a more accurate assessment of the expected cash inflows and outflows over the investment’s useful life. This allows for better-informed decisions that align with the company’s cash flow objectives.

5. Transparency and Investor Confidence: Including depreciation in cash flow analysis enhances transparency and builds investor confidence. Investors and stakeholders appreciate a comprehensive cash flow analysis that considers all relevant factors, including depreciation. It provides a clearer understanding of the company’s financial position, cash flow generation capability, and potential for long-term sustainability.

It is important to note that while depreciation is a crucial component of cash flow analysis, it is not the only factor to consider. Other aspects, such as changes in working capital, tax payments, and non-operating cash flows, should also be taken into account for a comprehensive evaluation of a company’s cash flow situation.

Now that we understand the importance of depreciation in cash flow analysis, let’s explore the specific impact it has on cash flow.

Impact of Depreciation on Cash Flow

Depreciation has a significant impact on a company’s cash flow statement, affecting both the operating cash flow and the overall cash position. Understanding this impact is crucial for accurately assessing a company’s financial performance. Here are the key impacts of depreciation on cash flow:

1. Operating Cash Flow: Depreciation is added back to net income when calculating operating cash flow. Since it is a non-cash expense, it does not directly affect the cash inflows or outflows from a company’s operations. By adding back depreciation, cash flow analysis reflects the fact that depreciation is not a cash outflow and adjusts net income to provide a more accurate measure of the company’s cash generated from its operating activities.

2. Tax Shield: Depreciation also has an indirect impact on cash flow through its effect on taxes. Depreciation expense lowers the reported taxable income, reducing the company’s tax liability. The tax savings resulting from depreciation, known as the tax shield, increase the company’s cash flow. This additional cash flow can be reinvested in the business, used to repay debt, or distributed to shareholders as dividends.

3. Capital Expenditure and Investing Cash Flow: Depreciation is closely linked to capital expenditure, which represents the cash outflows for acquiring new assets or replacing existing ones. When assessing investing cash flow, it is crucial to consider the impact of depreciation on capital expenditure. Depreciation provides an indication of the ongoing investment required to maintain or upgrade the company’s asset base. By accounting for potential future capital expenditures, cash flow analysis can better assess the company’s ability to fund these investments and maintain its competitive position.

4. Financing Cash Flow: Depreciation does not have a direct impact on financing cash flow, which mainly consists of cash inflows from borrowing or equity issuance and outflows from debt repayments or dividend payments. However, the inclusion of depreciation in cash flow analysis provides a more accurate representation of a company’s cash-generating capacity. This information is crucial for lenders and investors when evaluating the company’s ability to service its debt, meet financial obligations, and provide returns to shareholders.

Overall, by considering the impact of depreciation on different components of the cash flow statement, including operating, investing, and financing cash flows, we obtain a comprehensive understanding of a company’s cash flow position. This understanding is vital for making informed investment decisions, assessing operational efficiency, and evaluating long-term sustainability.

Next, let’s explore the different methods used to calculate depreciation and their relationship with cash flow.

Depreciation Methods and Cash Flow

Various methods can be employed to calculate depreciation, each with its own impact on cash flow. The choice of depreciation method affects the allocation of the asset’s cost over its useful life, and subsequently, the reported depreciation expense and cash flow. Let’s explore some common depreciation methods and their relationship with cash flow:

1. Straight-Line Method: The straight-line method is one of the most straightforward and widely used depreciation methods. It evenly distributes the cost of an asset over its useful life. With this method, the same amount of depreciation expense is recognized in each accounting period, resulting in a consistent impact on cash flow. The depreciation expense is subtracted from net income to calculate operating cash flow, effectively adjusting for the non-cash charge and providing a more accurate measure of cash generated from operations.

2. Accelerated Depreciation Methods: Accelerated depreciation methods, such as the declining balance method or the sum-of-the-years’-digits method, allocate a greater portion of the asset’s cost to earlier periods of its useful life. This results in higher depreciation expense in the early years, gradually declining over time. These methods allow for a faster write-off of the asset’s value, which can be particularly useful for assets that experience rapid technological advancements or obsolescence.

From a cash flow perspective, accelerated depreciation methods may have a more immediate impact on cash flow in the early years of the asset’s life. This is because the higher depreciation expense reduces taxable income, leading to lower tax liabilities and increased cash flow through the tax shield effect. However, it is important to note that while cash flow is positively impacted in the short term, the total cash outflow for the asset remains the same over its useful life.

3. Units-of-Production Method: The units-of-production method allocates the cost of an asset based on its usage or production output. This method is particularly suited for assets where the level of usage or production directly relates to their wear and tear. The depreciation expense is determined by dividing the total cost of the asset by its estimated total units of production. As the asset’s usage changes, the depreciation expense and its impact on cash flow will vary accordingly.

It’s important to note that while the choice of depreciation method impacts the timing and amount of the reported depreciation expense, it does not affect the total cash flow requirement for acquiring or maintaining the asset over its useful life. Regardless of the depreciation method used, cash flow analysis adjusts for these expenses to accurately reflect the cash generated or used in the company’s operations.

Understanding the correlation between depreciation methods and their impact on cash flow allows for more informed decision-making, especially with regard to assessing capital investment projects, evaluating tax implications, and planning for future cash flow requirements.

Now let’s explore some examples to illustrate the role of depreciation in cash flow analysis.

Examples of Depreciation’s Role in Cash Flow

Examining specific examples can demonstrate how depreciation plays a vital role in cash flow analysis. Let’s explore two scenarios to understand depreciation’s impact on cash flow:

Example 1: Manufacturing Company

A manufacturing company purchases a new piece of machinery for $100,000, which has an estimated useful life of 10 years. Using the straight-line depreciation method, the annual depreciation expense is $10,000 (cost divided by useful life). The company generates $500,000 in sales revenue per year and incurs $300,000 in operating expenses, excluding depreciation.

Without considering depreciation, the net income would be $200,000 ($500,000 – $300,000). However, by adding back the depreciation expense of $10,000, the operating cash flow becomes $210,000, providing a more accurate measure of cash generated from operations.

Furthermore, when assessing investing cash flow, the depreciation expense of $10,000 highlights the ongoing investment required for replacing the machinery at the end of its useful life. This ensures that cash flow projections consider the future capital expenditure needed to maintain the company’s operational efficiency.

Example 2: Real Estate Investment

An investor purchases a commercial property for $1 million and expects to earn rental income for the next 20 years. Using the straight-line depreciation method with no salvage value, the annual depreciation expense is $50,000 ($1,000,000 divided by 20 years).

When analyzing cash flow, the depreciation expense of $50,000 is added back to net income to calculate the operating cash flow. This adjustment reflects the fact that depreciation is a non-cash expense and provides a more accurate measure of cash generated by the rental income.

Additionally, when evaluating the investment’s financial viability, the inclusion of depreciation in cash flow analysis allows for a more comprehensive assessment. It considers the ongoing wear and tear of the property, the need for potential repairs, and the requirement for future capital expenditure to maintain the property’s value. This information assists in making informed decisions regarding the property’s rental income potential and potential future cash flow generation.

These examples illustrate how depreciation influences cash flow analysis. By adjusting net income for depreciation, cash flow analysis provides a more accurate representation of a company’s cash generation from operations and a clearer picture of potential cash flow requirements for investing activities.

Now that we have explored the role of depreciation in cash flow analysis through examples, let’s summarize the importance of considering depreciation in evaluating a company’s financial position.

Conclusion

Depreciation plays a crucial role in cash flow analysis, providing insights into a company’s financial performance and its ability to generate cash. By reflecting the gradual decrease in the value of assets over time, depreciation ensures that the costs associated with using those assets are accurately accounted for. This enhances the accuracy of cash flow projections and allows for better-informed financial decision-making.

When assessing a company’s cash flow, it is essential to consider the impact of depreciation on operating cash flow, tax liabilities, and investing activities. By adding back depreciation to net income, operating cash flow provides a more accurate measure of the cash generated from core business operations. The tax shield effect of depreciation reduces tax liabilities and increases cash flow. Furthermore, depreciation helps in evaluating the ongoing investment required and potential capital expenditure for maintaining and upgrading assets.

Various depreciation methods, such as the straight-line method, accelerated depreciation methods, and units-of-production method, can affect the timing and amount of the reported depreciation expense. However, regardless of the depreciation method chosen, cash flow analysis adjusts for these expenses to reflect the actual cash generated or used by the company.

In conclusion, considering depreciation in cash flow analysis enables a more accurate assessment of a company’s financial position, profitability, and long-term sustainability. It enhances transparency, facilitates informed decision-making, and provides valuable insights for investors, creditors, and stakeholders.

By understanding the role of depreciation in cash flow analysis and its impact on a company’s financial statements, individuals can better evaluate a company’s ability to meet its financial obligations, fund future investments, and generate sustainable cash flow for growth and success.