Finance

How To Do Cash Flow Analysis

Published: December 20, 2023

Learn how to conduct cash flow analysis for your financial needs with our comprehensive finance guide. Gain insights and make informed decisions to improve your financial health and stability.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Cash Flow Analysis

- Importance of Cash Flow Analysis

- Steps to Conduct Cash Flow Analysis

- Prepare Financial Statements

- Calculate Net Cash Flow from Operating Activities

- Determine Net Cash Flow from Investing Activities

- Calculate Net Cash Flow from Financing Activities

- Analyze Cash Flow Ratios

- Interpret and Evaluate the Cash Flow Analysis

- Limitations of Cash Flow Analysis

- Conclusion

How To Do Cash Flow Analysis

Introduction

Cash flow analysis is a vital tool for individuals and businesses to assess their financial health and make informed decisions. It involves examining the cash inflows and outflows over a specific period of time to determine the availability and management of cash. By analyzing cash flow, you can gain insights into the liquidity of your business, identify potential financial risks, and evaluate the ability to meet financial obligations.

Cash flow is the movement of cash in and out of a business or personal finances. It includes cash from operations, investments, and financing activities. Understanding and managing cash flow effectively is crucial for any organization or individual to maintain financial stability and sustain growth.

In this article, we will explore the importance of cash flow analysis and provide a step-by-step guide on how to conduct a comprehensive cash flow analysis. By following these steps, you will be equipped with the knowledge and tools to assess the financial health of your business or personal finances.

So, let’s dive in and learn how to perform a cash flow analysis!

Definition of Cash Flow Analysis

Cash flow analysis is the process of evaluating the cash inflows and outflows of an individual or organization over a specific period of time. It involves examining the sources and uses of cash to determine how well an entity manages its liquidity and cash position. This analysis provides valuable insights into the financial health, operational efficiency, and sustainability of a business or personal finances.

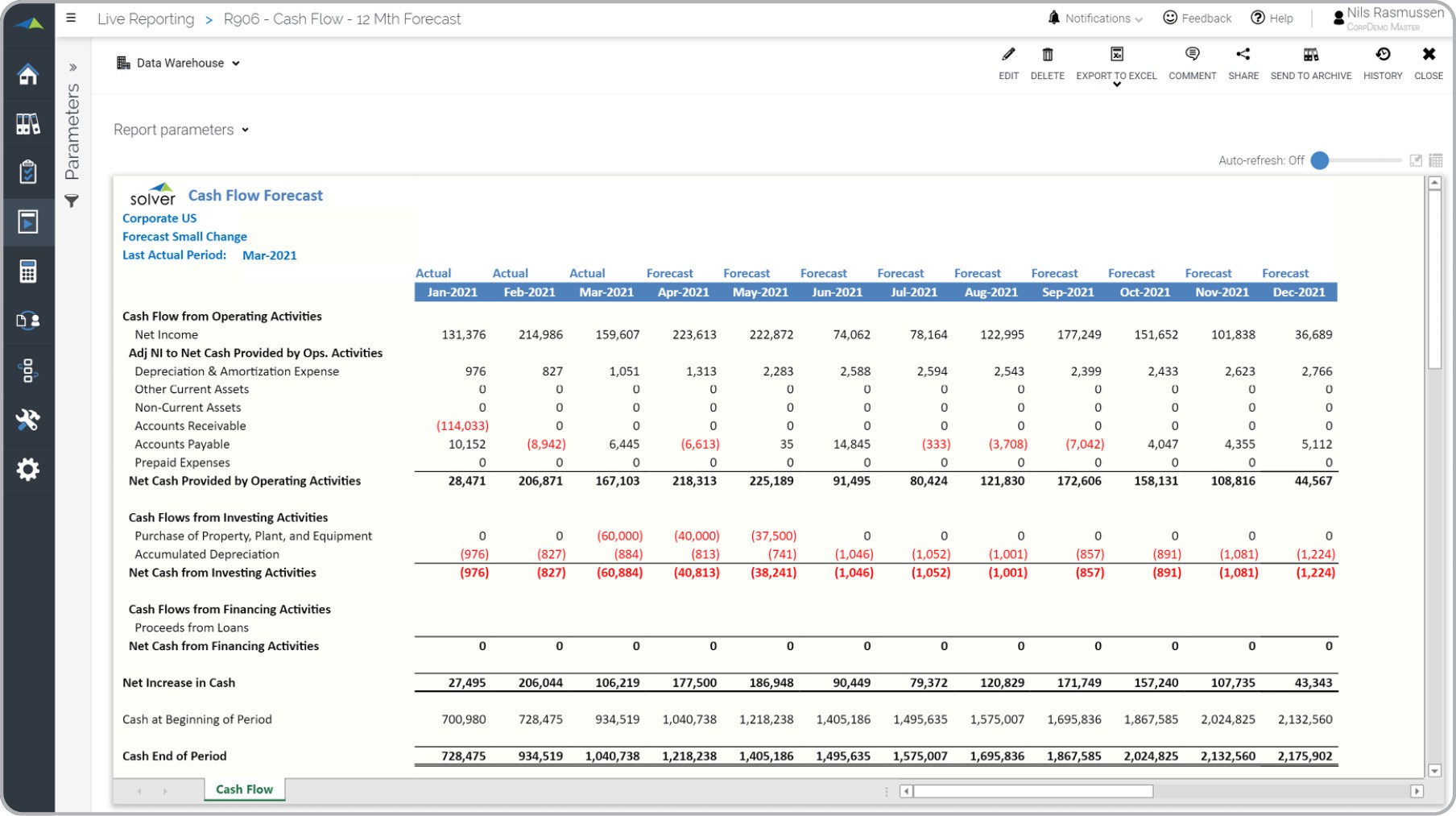

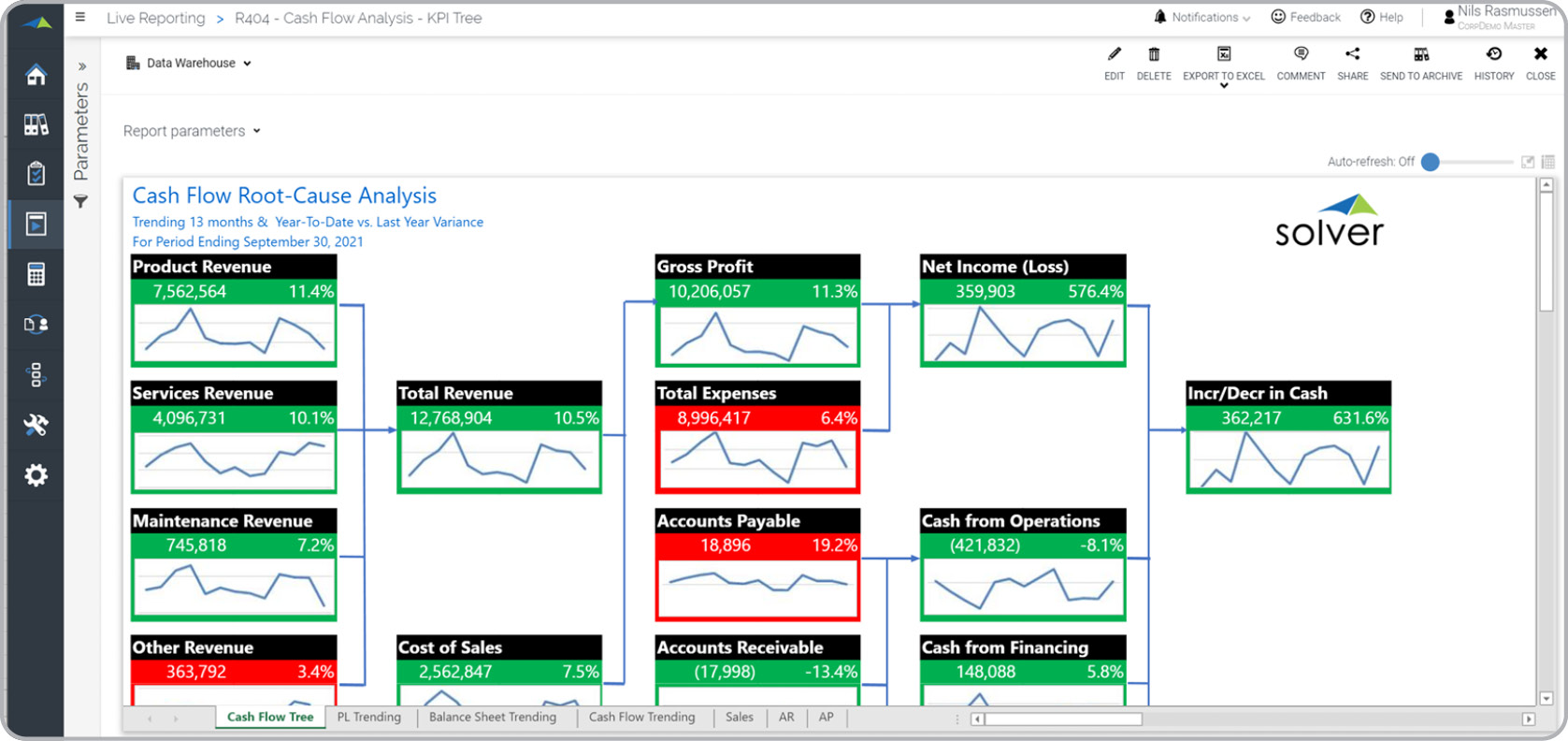

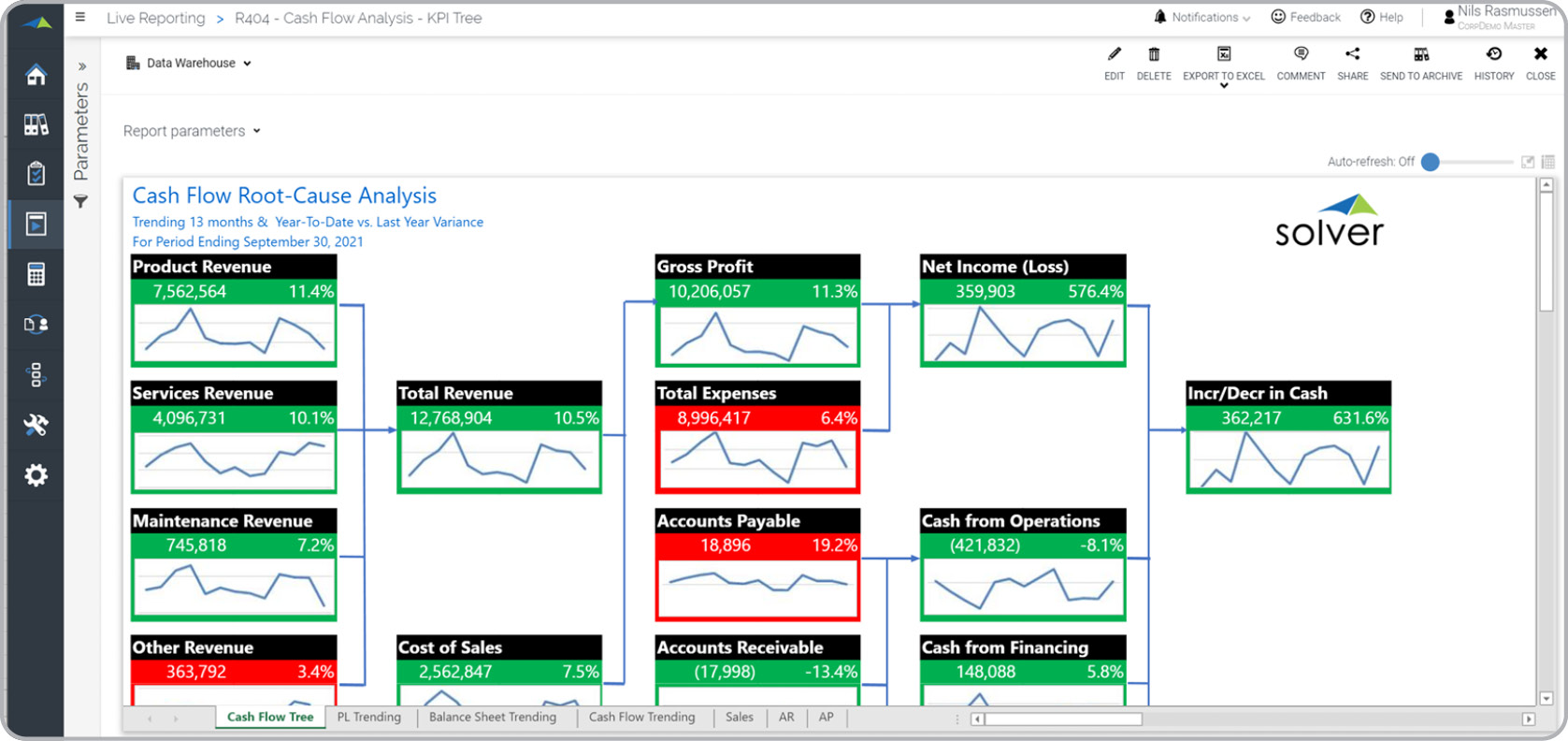

There are three main components of cash flow that are analyzed:

- Cash flow from operating activities: This includes cash generated or used in the day-to-day operations of a business. It includes cash received from sales, payment of expenses, and payment of taxes.

- Cash flow from investing activities: This refers to cash flows related to investments made by an entity. It includes the purchase or sale of assets such as property, equipment, or securities.

- Cash flow from financing activities: This category includes cash flows related to the financing of a business or personal finances. It includes cash from borrowing, repayment of debt, issuance of stock, and payment of dividends.

By assessing these components of cash flow, individuals and businesses can gain valuable insights into their financial operations, identify areas of improvement, and make informed decisions regarding investment, debt management, and budgeting.

Cash flow analysis is not only important for businesses but also for individuals managing their personal finances. It helps individuals understand their income, expenses, and cash flow patterns, enabling them to make better financial decisions and achieve their financial goals.

Now that we have a clear understanding of what cash flow analysis is, let’s explore why it is important to perform this analysis.

Importance of Cash Flow Analysis

Cash flow analysis plays a crucial role in assessing the financial health and stability of a business or individual. It provides valuable insights into the management of cash, which is the lifeblood of any entity. Here are some key reasons why cash flow analysis is important:

- Liquidity and Financial Stability: Cash flow analysis helps determine the availability of cash to meet short-term financial obligations. By monitoring the inflows and outflows of cash, businesses can ensure they have enough liquidity to pay suppliers, employees, and other expenses on time. It also helps individuals assess their ability to cover living expenses and debt obligations.

- Ability to Plan and Forecast: Cash flow analysis provides a clear picture of cash inflows and outflows, enabling businesses and individuals to plan and forecast their financial needs. It helps identify seasonal cash fluctuations, predict future expenses, and anticipate potential cash shortages. This allows for better financial planning, budgeting, and decision-making.

- Identifying Cash Flow Issues: Regularly analyzing cash flow can help identify potential cash flow problems such as delayed payments, excessive spending, or inefficient operations. By identifying these issues early on, businesses can take corrective measures to improve cash flow management and prevent financial crises.

- Better Decision-Making: Cash flow analysis provides valuable insights into the financial performance of a business or individual. It helps in evaluating the profitability of projects, assessing the impact of investment decisions, and determining the need for external financing. This enables informed decision-making and helps in maximizing returns and minimizing risks.

- Attracting Investors and Lenders: Strong cash flow is a key indicator of financial stability and business viability. When seeking external funding or attracting investors, a positive cash flow analysis lends credibility and demonstrates the ability to repay debt and generate returns. It enhances the chances of securing loans or attracting potential investors.

Overall, cash flow analysis serves as a crucial tool for financial management, risk assessment, and strategic planning. It helps maintain financial stability, supports growth initiatives, and ensures the long-term success of businesses and individuals alike.

Now that we understand the importance of cash flow analysis, let’s move on to the steps involved in conducting a cash flow analysis.

Steps to Conduct Cash Flow Analysis

Performing a cash flow analysis involves several steps to ensure a comprehensive assessment of the cash inflows and outflows of a business or individual. Here are the key steps to conduct a cash flow analysis:

- Prepare Financial Statements: Begin by gathering the necessary financial statements, including the income statement, balance sheet, and statement of cash flows. These statements provide a detailed overview of the financial activities of the entity.

- Calculate Net Cash Flow from Operating Activities: Determine the cash flow generated or used in day-to-day operations. Start with the net income figure from the income statement and make adjustments for non-cash expenses or revenues and changes in working capital.

- Determine Net Cash Flow from Investing Activities: Identify the cash flow related to investments, such as the purchase or sale of assets. Consider cash flows from acquisitions, disposals, and capital expenditures.

- Calculate Net Cash Flow from Financing Activities: Analyze the cash flows associated with the financing of the business. This includes cash flows from loans, repayments, equity investments, and dividends.

- Analyze Cash Flow Ratios: Use cash flow ratios to assess the financial health and performance of the entity. Some commonly used ratios include the cash flow margin, cash flow coverage ratio, and free cash flow to equity.

- Interpret and Evaluate the Cash Flow Analysis: Analyze the cash flow results and interpret them in the context of the entity’s financial goals and industry benchmarks. Identify strengths, weaknesses, and areas for improvement.

By following these steps, you will be able to conduct a comprehensive cash flow analysis. It is important to note that cash flow analysis should be performed regularly to monitor changes in cash flow patterns and make informed financial decisions.

Now, let’s explore the limitations of cash flow analysis to ensure a balanced understanding of its application.

Prepare Financial Statements

Before you can begin analyzing cash flow, it is essential to gather the necessary financial statements. These statements provide a snapshot of the financial activities of the entity and serve as the foundation for conducting a cash flow analysis. The key financial statements involved are:

- Income Statement: Also known as the profit and loss statement, the income statement provides an overview of the revenue, expenses, and net income or net loss generated by the entity over a specific period. It helps identify the profitability of the business or individual.

- Balance Sheet: The balance sheet represents the financial position of the entity at a specific point in time. It lists the assets, liabilities, and owner’s equity. The balance sheet is important for assessing the financial strength and solvency of the entity.

- Statement of Cash Flows: The statement of cash flows is the primary source of data for cash flow analysis. It provides a summary of the cash inflows and outflows from operating, investing, and financing activities of the entity during a specific period. This statement helps identify the sources and uses of cash.

Preparation of these financial statements involves recording and summarizing the financial transactions and events of the entity. It is important to ensure accuracy and integrity in the financial reporting process by following proper accounting standards and guidelines.

For businesses, financial statements are typically prepared by the accounting department or a hired professional accountant. Individual personal finances may require the assistance of a financial advisor or the use of financial management software.

Once the financial statements are prepared and available, you can proceed to the next step of calculating the net cash flow from operating activities.

Now, let’s move on to step 2 of the cash flow analysis process.

Calculate Net Cash Flow from Operating Activities

Calculating the net cash flow from operating activities is a crucial step in cash flow analysis. It involves determining the cash generated or used in the day-to-day operations of the business or individual.

To calculate the net cash flow from operating activities, follow these steps:

- Start with Net Income: Begin with the net income figure from the income statement. Net income is the total revenue minus the total expenses for a specific period.

- Consider Non-Cash Expenses or Revenues: Adjust the net income by adding back any non-cash expenses (e.g., depreciation, amortization) or subtracting any non-cash revenues.

- Factor in Changes in Working Capital: Analyze changes in working capital items such as accounts receivable, accounts payable, and inventory. Increase in these items represents cash used, while a decrease represents cash generated.

- Calculate Net Cash Flow from Operating Activities: Sum up the adjustments made to net income and changes in working capital to determine the net cash flow from operating activities.

The net cash flow from operating activities provides insights into the cash generated or used by the core business operations. A positive net cash flow indicates that the operations are generating enough cash to cover expenses and potentially fund growth initiatives. Conversely, a negative net cash flow suggests a cash outflow that may require additional financing or cost-cutting measures.

It is worth noting that a healthy net cash flow from operating activities is essential for the long-term sustainability of the business or individual’s finances. A thorough analysis of this component helps identify inefficiencies, improve profitability, and make informed decisions regarding working capital management and operational improvements.

Once the net cash flow from operating activities is calculated, we can move on to the next step, which is determining the net cash flow from investing activities.

Determine Net Cash Flow from Investing Activities

After calculating the net cash flow from operating activities, the next step in the cash flow analysis process is to determine the net cash flow from investing activities. This step involves analyzing the cash inflows and outflows related to investments made by the business or individual.

To determine the net cash flow from investing activities, follow these steps:

- Identify Cash Inflows: Identify any cash received from investments, such as the sale of assets, dividends received from investments, or interest earned on investments.

- Identify Cash Outflows: Identify any cash paid for investments, such as the purchase of property, equipment, or securities.

- Calculate Net Cash Flow: Subtract the total cash outflows from the total cash inflows to determine the net cash flow from investing activities.

The net cash flow from investing activities provides insights into the cash flows related to the entity’s investments. A positive net cash flow indicates that the investments are generating cash inflows, while a negative net cash flow suggests cash outflows for investments.

An analysis of the net cash flow from investing activities helps in evaluating the effectiveness of investment decisions, assessing the financial impact of buying or selling assets, and identifying trends in investment strategies.

It is important to carefully analyze the net cash flow from investing activities to ensure that investments align with the entity’s financial goals and contribute to long-term sustainability and growth. Additionally, this analysis can provide insights into whether the entity is effectively managing its capital expenditures and optimizing returns on investments.

Now that we have determined the net cash flow from investing activities, let’s move on to the next step, which is calculating the net cash flow from financing activities.

Calculate Net Cash Flow from Financing Activities

Calculating the net cash flow from financing activities is an essential step in cash flow analysis. This step involves analyzing the cash inflows and outflows related to financing activities, such as borrowing, repaying debt, issuing equity, or paying dividends.

To calculate the net cash flow from financing activities, follow these steps:

- Identify Cash Inflows: Identify any cash received from financing activities, such as loans obtained, issuance of equity, or investment from partners.

- Identify Cash Outflows: Identify any cash paid for financing activities, such as debt repayments, dividend payments, or the repurchase of shares.

- Calculate Net Cash Flow: Subtract the total cash outflows from the total cash inflows to determine the net cash flow from financing activities.

The net cash flow from financing activities sheds light on the cash flows related to the entity’s financing decisions. A positive net cash flow indicates a net cash inflow from financing activities, while a negative net cash flow suggests a net cash outflow.

An analysis of the net cash flow from financing activities helps in evaluating the entity’s ability to raise and repay funds, determining the impact of debt and equity financing on cash flow, and assessing the distribution of profits to investors or owners.

It is important to carefully analyze the net cash flow from financing activities to understand the entity’s financing structure and its impact on cash flow. This analysis helps in making informed decisions regarding debt management, equity financing, and dividend policy.

Now that we have calculated the net cash flow from financing activities, let’s move on to the next step, which is analyzing cash flow ratios.

Analyze Cash Flow Ratios

Once the net cash flow from operating, investing, and financing activities has been determined, the next step in cash flow analysis is to analyze cash flow ratios. Cash flow ratios provide additional insights into the financial health and performance of the entity by comparing cash flow figures to other financial metrics.

Here are some commonly used cash flow ratios:

- Cash Flow Margin: This ratio measures the percentage of cash flow generated from operating activities in comparison to the company’s net sales. A higher cash flow margin suggests better profitability and efficiency in converting sales into cash flow.

- Cash Flow Coverage Ratio: This ratio compares the company’s operating cash flow to its total debt obligations. It shows the company’s ability to generate cash flow to cover its debt payments. A higher ratio indicates better ability to meet debt obligations and financial stability.

- Free Cash Flow to Equity Ratio: This ratio measures the amount of cash flow available to shareholders after deducting capital expenditures and debt repayments. It indicates the company’s capacity to generate cash flow for reinvestment or distribution to shareholders.

Analyze these ratios in the context of industry benchmarks and historical data to gain a deeper understanding of the entity’s cash flow position. Compare the ratios over multiple periods to identify trends and assess the progress of the entity’s financial performance.

Identify areas of strength and areas that require improvement based on the results of the cash flow ratios. For example, a low cash flow margin may indicate inefficient cost management, while a low cash flow coverage ratio may suggest higher financial risk.

It is essential to note that cash flow ratios should be analyzed alongside other financial ratios and key performance indicators to obtain a comprehensive assessment of the entity’s financial health and identify potential areas for improvement.

Now that we have analyzed the cash flow ratios, let’s proceed to the final step – interpreting and evaluating the cash flow analysis.

Interpret and Evaluate the Cash Flow Analysis

In the final step of the cash flow analysis process, it is crucial to interpret and evaluate the results obtained from the previous steps. This step involves analyzing the cash flow statement, ratios, and trends to gain insights into the financial health and performance of the entity.

Here are some key points to consider when interpreting and evaluating the cash flow analysis:

- Positive Cash Flow: If the entity’s cash flow from operations is positive, it indicates that the core operations are generating cash inflows. This is generally a positive sign of financial health and operational efficiency.

- Cash Flow Shortages: If the entity is experiencing negative cash flow or cash flow shortages, it may indicate underlying financial difficulties and the need to address cash flow management issues promptly.

- Comparison to Industry Benchmarks: Compare the cash flow performance to industry benchmarks to gauge how well the entity is performing in relation to its peers. This helps identify areas of strength or weakness within the industry.

- Trends and Patterns: Analyze the trends and patterns in the cash flow statement over multiple periods. Look for consistent patterns of positive or negative cash flow, as well as any significant deviations from previous periods.

- Identify Potential Risk Factors: Assess the impact of potential risk factors on the cash flow analysis. Consider factors such as changes in market conditions, industry trends, and regulatory changes that may affect the entity’s cash flow prospects.

- Consider External Factors: Evaluate the impact of external factors, such as economic conditions or changes in interest rates, on the cash flow analysis. These factors can significantly influence cash flow patterns and financial performance.

By interpreting and evaluating the cash flow analysis, you can gain valuable insights into the entity’s financial health, identify areas for improvement, and make informed decisions regarding business strategies, investment opportunities, and cash flow management.

Keep in mind that cash flow analysis is an ongoing process. Regularly monitor and update the analysis to reflect changes in the entity’s financial position, market conditions, and overall business environment.

With a comprehensive cash flow analysis, you will be equipped with valuable information to support strategic decision-making and ensure the financial stability and success of the entity.

Now, it’s time to summarize the key points and consider the limitations of cash flow analysis.

Limitations of Cash Flow Analysis

While cash flow analysis is a valuable tool for assessing financial health and making informed decisions, it is important to be aware of its limitations. Understanding these limitations allows for a more comprehensive evaluation of an entity’s financial position. Here are some key limitations to consider:

- Non-Cash Transactions: Cash flow analysis focuses on cash movements and may overlook non-cash transactions that impact financial performance. For example, changes in accounts payable or receivable can affect cash flow, but they do not involve actual cash transactions.

- Timing: Cash flow analysis does not consider the timing of cash flow events. It may not capture the short-term liquidity challenges or cash flow fluctuations that occur within specific periods. Timing differences between inflows and outflows can impact the accuracy of the analysis.

- Depreciation and Amortization: Companies may have significant depreciation and amortization expenses, which are non-cash expenses. These expenses can lead to a mismatch between net income and cash flow, potentially affecting the interpretation of the analysis.

- Quality of Financial Reporting: Cash flow analysis relies on accurate and reliable financial statements. If the financial statements are inaccurate or manipulated, it can obscure the true cash flow position and lead to inaccurate analysis and decisions.

- External Factors: Cash flow analysis does not consider external factors such as changes in the economy, industry trends, or competitor actions. These external factors can impact cash flow and financial performance, making it necessary to consider them in conjunction with the analysis.

- Future Predictions: Cash flow analysis is based on historical data and may not accurately predict future cash flows. It provides insights into past performance but may not account for changes in market conditions or unforeseen events that can impact future cash flow.

While these limitations exist, cash flow analysis remains a valuable tool for assessing financial health and making informed decisions. By acknowledging these limitations and complementing cash flow analysis with other financial indicators and qualitative factors, you can achieve a more comprehensive understanding of an entity’s financial position.

Now, let’s summarize the key points of this cash flow analysis guide.

Conclusion

Cash flow analysis is a vital tool for assessing the financial health, liquidity, and operational efficiency of a business or individual. By analyzing cash inflows and outflows from operating, investing, and financing activities, you can gain valuable insights into the availability and management of cash.

In this article, we have explored the steps involved in conducting a comprehensive cash flow analysis. Starting with the preparation of financial statements, we calculated the net cash flow from operating, investing, and financing activities. We then analyzed cash flow ratios and interpreted the results to evaluate the financial health and performance of the entity.

Throughout the analysis process, we have highlighted the importance of cash flow analysis, such as determining liquidity, aiding in financial planning, identifying cash flow issues, supporting decision-making, and attracting investors and lenders.

However, it is important to acknowledge the limitations of cash flow analysis, such as its focus on cash movements, the timing of cash flows, the impact of non-cash transactions, and the influence of external factors.

To overcome these limitations and obtain a comprehensive understanding of an entity’s financial position, it is recommended to complement cash flow analysis with other financial indicators, industry benchmarks, and qualitative factors.

In conclusion, performing regular cash flow analysis is crucial for maintaining financial stability, identifying areas for improvement, and making informed financial decisions. By closely monitoring cash inflows and outflows, understanding the sources and uses of cash, and evaluating cash flow ratios, businesses and individuals can proactively manage their financial resources and ensure long-term success.

Remember, cash flow analysis is a dynamic process that requires regular review and adjustment to reflect changing market conditions and financial objectives. By leveraging the insights gained from cash flow analysis, you can pave the way for financial growth and success.

Thank you for joining us in this guide on how to do cash flow analysis. We hope you found it informative and helpful in enhancing your financial management practices.