Home>Finance>How Can Short And Long Interest Rate Futures Contracts Be Used To Hedge Against Interest Rate Risk?

Finance

How Can Short And Long Interest Rate Futures Contracts Be Used To Hedge Against Interest Rate Risk?

Published: December 24, 2023

Discover how short and long interest rate futures contracts can effectively hedge against interest rate risk in the field of finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Interest Rate Risk

- Short Interest Rate Futures Contracts

- Long Interest Rate Futures Contracts

- Using Short Interest Rate Futures Contracts to Hedge Against Interest Rate Risk

- Using Long Interest Rate Futures Contracts to Hedge Against Interest Rate Risk

- Benefits and Drawbacks of Hedging with Interest Rate Futures Contracts

- Conclusion

Introduction

Welcome to the world of finance, where risks and rewards go hand in hand. One of the key risks that investors and businesses face is interest rate risk. Fluctuations in interest rates can have a profound impact on financial markets and individual portfolios. Fortunately, there are tools available to help mitigate this risk, and one such tool is the use of short and long interest rate futures contracts.

Interest rate risk refers to the potential for changes in interest rates to negatively impact the value of fixed income securities. For example, when interest rates rise, the value of existing bonds decreases, leading to potential losses for bondholders. To protect against this risk, investors can utilize hedging strategies, and one popular method is through the use of interest rate futures contracts.

Short interest rate futures contracts allow market participants to profit from the expected decrease in interest rates. These contracts obligate the seller to deliver a specified amount of a financial instrument (such as a Treasury bond or Eurodollar deposit) at a predetermined future date and at an agreed-upon price. By selling these contracts, investors can benefit if interest rates decrease, as the value of the contracts will increase.

On the other hand, long interest rate futures contracts allow market participants to profit from the expected increase in interest rates. These contracts give the buyer the right to purchase a financial instrument at a future date and at an agreed-upon price. If interest rates rise as predicted, the value of the contracts will increase, allowing long position holders to profit.

Both short and long interest rate futures contracts offer a means for investors to hedge against interest rate risk. By taking opposing positions in these contracts based on their interest rate expectations, investors can protect themselves from potential losses caused by adverse interest rate movements.

In this article, we will delve deeper into how short and long interest rate futures contracts can be used to hedge against interest rate risk. We will explore the mechanics of these contracts, their benefits and drawbacks, and provide real-world examples of their application. So, let’s dive in and uncover the secrets of using short and long interest rate futures contracts to manage interest rate risk.

Understanding Interest Rate Risk

Before diving into the details of using short and long interest rate futures contracts to hedge against interest rate risk, it’s important to have a clear understanding of what interest rate risk entails. Interest rate risk refers to the potential impact that changes in interest rates can have on the value of fixed income securities, such as bonds.

When interest rates rise, the value of existing fixed income securities tends to decrease. This is because new bonds issued in the market are now offering higher interest rates, making existing bonds with lower rates less attractive to investors. Conversely, when interest rates decline, the value of existing fixed income securities tends to rise, as they are now offering higher interest rates compared to new bonds being issued.

The impact of interest rate changes on fixed income securities can have profound effects on investment portfolios. For example, if an investor holds a portfolio of bonds with fixed interest rates and interest rates rise, the value of those bonds may decrease, potentially resulting in losses if the investor decides to sell them.

Additionally, interest rate risk also affects businesses and institutions that rely on borrowing for their operations. A rise in interest rates can increase borrowing costs, making it more expensive for these entities to access capital. This can result in reduced profitability and hinder growth prospects.

It’s important to note that interest rate risk is not limited to changes in short-term interest rates. It also encompasses changes in long-term interest rates, such as those tied to mortgages and other long-term loans. Therefore, having a comprehensive understanding of interest rate risk and the tools available to manage it is crucial in today’s dynamic financial landscape.

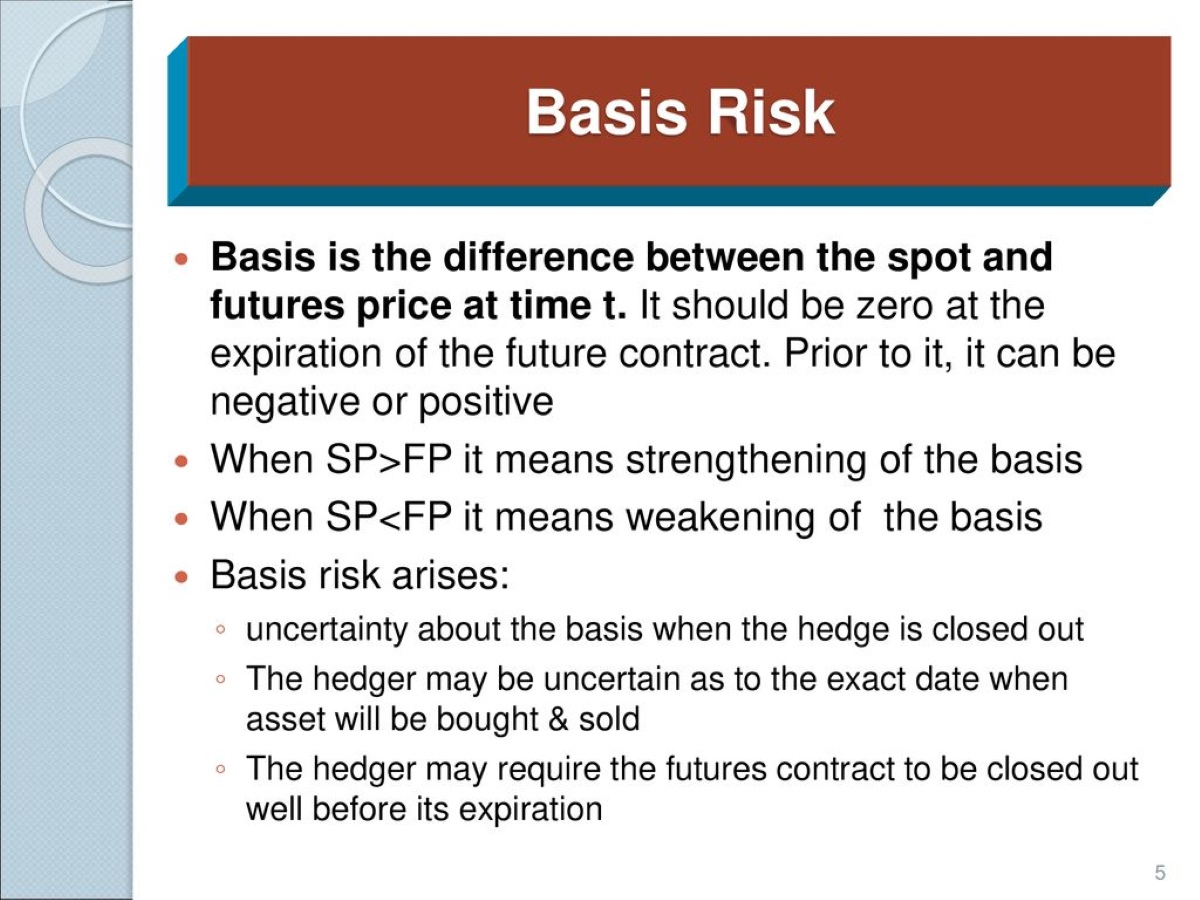

One effective strategy to mitigate interest rate risk is through hedging. Hedging involves taking offsetting positions in related financial instruments to reduce the potential impact of market fluctuations. This is where interest rate futures contracts come into play, offering market participants the opportunity to hedge against interest rate risk and potentially profit from their expectations of future interest rate movements.

In the next sections, we will explore the mechanics and application of short and long interest rate futures contracts in hedging against interest rate risk. We will delve into the benefits, drawbacks, and real-world examples to provide a comprehensive understanding of how these contracts can be utilized effectively.

Short Interest Rate Futures Contracts

Short interest rate futures contracts provide market participants with an opportunity to profit from the expected decrease in interest rates. These contracts are typically based on underlying assets such as Treasury bills, Treasury bonds, or Eurodollar deposits.

When an investor enters into a short interest rate futures contract, they agree to sell the underlying asset at a predetermined future date and at an agreed-upon price. The buyer of the contract, on the other hand, agrees to purchase the asset at that future date and price.

The value of short interest rate futures contracts is inversely related to interest rates. This means that if interest rates decrease as anticipated, the value of the contracts will increase. For example, if an investor sells a short interest rate futures contract and interest rates subsequently decline, the value of the contract will rise, allowing the investor to buy it back at a lower price and pocket the difference as profit.

Short interest rate futures contracts are traded on designated futures exchanges and are standardized in terms of contract size, maturity dates, and underlying assets. This standardization ensures liquidity and ease of trading for market participants.

One of the key advantages of short interest rate futures contracts is their ability to provide an effective hedge against interest rate risk. By taking a short position in these contracts, investors can protect themselves from potential losses in the value of fixed income securities caused by rising interest rates.

For example, let’s say an investor holds a portfolio of bonds with fixed interest rates. As interest rates begin to rise, the value of these bonds may decrease. However, by selling short interest rate futures contracts, the investor can profit if interest rates do indeed rise, as the increase in the value of the contracts will offset the decline in the value of the bonds.

It’s important to note that short interest rate futures contracts are typically used by sophisticated investors, such as institutional investors and hedge funds, due to the complexities involved in futures trading. These contracts require a deep understanding of the underlying assets and the dynamics of interest rate movements.

In the next section, we will explore the application of short interest rate futures contracts in hedging against interest rate risk and provide real-world examples to illustrate their effectiveness.

Long Interest Rate Futures Contracts

While short interest rate futures contracts allow investors to profit from the expected decrease in interest rates, long interest rate futures contracts offer an opportunity to profit from the anticipated increase in interest rates. These contracts are also based on underlying assets such as Treasury bills, Treasury bonds, or Eurodollar deposits.

When a market participant enters into a long interest rate futures contract, they agree to purchase the underlying asset at a predetermined future date and at an agreed-upon price. The seller of the contract, in turn, agrees to deliver the asset at that future date and price.

Similar to short interest rate futures contracts, the value of long interest rate futures contracts is also inversely related to interest rates. If interest rates rise as expected, the value of the contracts will increase. In this scenario, the investor who holds a long position in the contract can sell it at a higher price, thereby realizing a profit.

Like short interest rate futures contracts, long interest rate futures contracts are traded on futures exchanges and are standardized in terms of contract size, maturity dates, and underlying assets. This standardization ensures liquidity and facilitates efficient trading.

Long interest rate futures contracts can be used by investors to hedge against interest rate risk, particularly when they anticipate a rise in interest rates. For example, suppose an investor holds a variable-rate bond or has an upcoming loan payment tied to prevailing interest rates. By purchasing long interest rate futures contracts, the investor can potentially profit if interest rates increase, as the contracts’ value will rise and offset the increase in borrowing costs or the decline in the value of the bond.

It is important to note that trading long interest rate futures contracts requires a thorough understanding of the underlying assets and interest rate dynamics. Therefore, these contracts are typically used by sophisticated investors who possess expertise in futures trading and analysis.

By taking a long position in interest rate futures contracts, market participants can potentially capture the upside potential of rising interest rates while managing their exposure to interest rate risk. This can be particularly beneficial in an environment where interest rates are expected to increase due to economic conditions or monetary policy shifts.

In the following sections, we will further explore how short and long interest rate futures contracts can be effectively utilized to hedge against interest rate risk. We will also discuss the benefits and drawbacks of using these contracts and provide real-world examples to illustrate their application.

Using Short Interest Rate Futures Contracts to Hedge Against Interest Rate Risk

Short interest rate futures contracts provide investors with a powerful tool to hedge against interest rate risk and potentially profit from anticipated decreases in interest rates. By taking a short position in these contracts, investors can protect their portfolios from potential losses caused by rising interest rates.

One common strategy is to use short interest rate futures contracts to hedge existing fixed income securities, such as bonds. As interest rates rise, the value of fixed income securities typically declines. However, by taking a short position in interest rate futures contracts, investors can offset these potential losses.

Let’s consider an example. Suppose an investor holds a portfolio of bonds with fixed interest rates. They are concerned about the possibility of interest rates increasing in the near future. To hedge against this risk, the investor can sell short interest rate futures contracts. If interest rates do indeed rise, the value of the contracts will increase, compensating for the decline in the value of the bonds. This allows the investor to potentially offset their losses and mitigate the impact of rising interest rates on their portfolio.

Furthermore, short interest rate futures contracts can also be used to hedge other interest rate-sensitive positions. For instance, if a business has variable-rate debt and wants to protect against increasing borrowing costs, they can enter into short interest rate futures contracts to offset the potential interest rate risk. By doing so, the business can ensure more certainty in its interest expenses and mitigate any adverse impact on profitability.

It’s important to note that while short interest rate futures contracts provide an effective hedge against interest rate risk, they do come with certain considerations. These contracts have expiration dates, and as the expiration date approaches, investors may need to roll over their positions to maintain the hedge. Additionally, the market for short interest rate futures contracts can be highly liquid, which may impact trading costs and execution.

In summary, short interest rate futures contracts offer investors a valuable tool to hedge against interest rate risk. By taking a short position in these contracts, investors can potentially profit from anticipated decreases in interest rates and protect their portfolios from the adverse effects of rising interest rates. However, it is crucial to carefully assess the specific dynamics of the market and the associated risks before implementing a hedging strategy using short interest rate futures contracts.

Using Long Interest Rate Futures Contracts to Hedge Against Interest Rate Risk

Long interest rate futures contracts can be utilized as a powerful tool to hedge against interest rate risk and potentially profit from anticipated increases in interest rates. By taking a long position in these contracts, investors can protect their portfolios from potential losses caused by declining interest rates.

One common strategy is to use long interest rate futures contracts to hedge variable-rate debt. For example, if a company has borrowed funds at a variable interest rate, they may be exposed to the risk of rising interest rates, which would increase their borrowing costs. To mitigate this risk, the company can enter into long interest rate futures contracts. If interest rates do indeed rise, the value of the contracts will increase, offsetting the higher borrowing costs and helping to protect the company’s profitability.

In a similar vein, investors who anticipate an increase in interest rates may use long interest rate futures contracts to hedge against potential losses in their fixed income securities. For instance, if an investor holds a portfolio of bonds with fixed interest rates, they may be concerned about the adverse impact of falling interest rates on the value of those bonds. By taking a long position in interest rate futures contracts, the investor can potentially profit if interest rates rise, offsetting any decline in the value of their fixed income securities.

Long interest rate futures contracts can also be utilized to hedge other interest rate-sensitive positions. For example, if an individual intends to purchase a property and anticipates a rise in mortgage rates, they can enter into long interest rate futures contracts to offset the potential increase in borrowing costs. This allows the individual to lock in a more favorable mortgage rate and manage their exposure to interest rate risk.

However, it’s important to note that like any investment strategy, using long interest rate futures contracts for hedging comes with considerations and risks. These contracts have expiration dates, and rollover or reinvestment strategies may be necessary to maintain the hedge over time. Additionally, market conditions and timing can significantly impact the effectiveness of using long interest rate futures contracts for hedging.

In summary, long interest rate futures contracts offer investors a valuable tool to hedge against interest rate risk and potentially profit from expected increases in interest rates. By taking a long position in these contracts, investors can protect their portfolios from potential losses caused by declining interest rates and manage their exposure to interest rate-sensitive positions. However, careful assessment of market conditions, expiration dates, and associated risks is essential when implementing a hedging strategy using long interest rate futures contracts.

Benefits and Drawbacks of Hedging with Interest Rate Futures Contracts

Hedging with interest rate futures contracts offers several benefits, but it also comes with certain drawbacks. Understanding these advantages and disadvantages is essential for investors considering the use of these contracts to manage interest rate risk.

Benefits:

1. Risk Mitigation: One of the primary benefits of hedging with interest rate futures contracts is the ability to mitigate interest rate risk. By taking opposite positions in these contracts based on interest rate expectations, investors can offset potential losses in their portfolios caused by adverse interest rate movements.

2. Potentially Profitable: Interest rate futures contracts offer the potential for profit if interest rate expectations are accurately anticipated. Whether taking a short or long position, investors can profit from changes in interest rates and leverage these contracts to enhance portfolio returns.

3. Flexibility: Interest rate futures contracts are traded on exchanges, providing investors with flexibility in managing their positions. They can easily enter and exit positions as needed based on changing market conditions or their hedging requirements.

4. Liquidity: Interest rate futures contracts tend to have high liquidity, making them easily tradable. This liquidity ensures efficient execution, tight bid-ask spreads, and lower transaction costs for market participants.

Drawbacks:

1. Complex Instruments: Interest rate futures contracts can be complex financial instruments, requiring a deep understanding of the underlying assets, interest rate dynamics, and futures trading strategies. Individuals without sufficient knowledge or experience may struggle to effectively utilize these contracts for hedging.

2. Market Volatility: The interest rate market can be prone to volatility due to various economic and geopolitical factors. Sudden or unexpected changes in interest rates can affect the value of interest rate futures contracts, potentially leading to losses for investors.

3. Rollover Risks: Interest rate futures contracts have expiration dates, and managing rollover or reinvestment strategies is essential to maintain the hedge over time. Rollover risks involve potential costs and complexities associated with transitioning from one contract to another as the expiration date approaches.

4. Leveraged Nature: Trading interest rate futures contracts involves leverage, which can amplify both gains and losses. While leverage can enhance potential returns, it also increases the investor’s exposure to market fluctuations and the risk of significant losses.

It is crucial for investors to carefully consider the benefits and drawbacks of hedging with interest rate futures contracts and assess their own risk tolerance, market expertise, and specific hedging needs before incorporating these contracts into their investment strategies.

Conclusion

Hedging against interest rate risk is a crucial element of risk management for investors and businesses alike. Short and long interest rate futures contracts provide effective tools to hedge against this risk and potentially profit from anticipated changes in interest rates.

Short interest rate futures contracts allow investors to protect their portfolios from potential losses caused by rising interest rates. By taking a short position in these contracts, investors can offset the decline in the value of fixed income securities or mitigate the increase in borrowing costs. Moreover, long interest rate futures contracts enable investors to hedge against potential losses caused by declining interest rates. By taking a long position, investors can potentially profit if interest rates rise, protecting the value of their portfolios or offsetting higher borrowing costs.

However, it’s important to note that using these contracts for hedging purposes requires a comprehensive understanding of the underlying assets, interest rate dynamics, and futures trading strategies. These complexities, along with associated risks such as market volatility and rollover considerations, need to be carefully evaluated.

Despite the challenges, hedging with interest rate futures contracts offers numerous benefits. These contracts provide risk mitigation, potential profitability, flexibility, and liquidity. They offer investors the ability to actively manage their exposure to interest rate risk and enhance their portfolio performance.

In conclusion, short and long interest rate futures contracts are valuable tools for managing interest rate risk. Whether through hedging fixed income securities or interest rate-sensitive positions, these contracts offer investors the potential to protect their portfolios and potentially profit from predicted interest rate movements. However, investors should evaluate their own risk tolerance, market expertise, and specific hedging needs before incorporating these contracts into their investment strategies. With careful consideration and proper risk management, interest rate futures contracts can be instrumental in navigating the dynamic world of finance.