Home>Finance>Why Are Futures Contracts Often Used As A “Hedge” Against Losing Money In The Future?

Finance

Why Are Futures Contracts Often Used As A “Hedge” Against Losing Money In The Future?

Published: December 23, 2023

Explore how futures contracts in finance act as a valuable hedging tool, protecting against potential financial losses in the future.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In the world of finance, managing risk is a crucial aspect of any investment strategy. Whether you are an individual investor or a large corporation, the desire to protect yourself from potential losses in the future is a primary concern. This is where futures contracts come into play as a hedging tool.

Futures contracts are financial derivatives that allow investors to buy or sell an asset, such as commodities, currencies, or stock indexes, at a predetermined price and date in the future. They are extensively used by traders, speculators, and institutional investors, but one of their primary purposes is to serve as a hedge against potential losses.

The concept of hedging is rooted in the idea of reducing or offsetting risk. By entering into a futures contract, an investor can protect themselves from adverse price movements in the underlying asset. This means that even if the asset’s price decreases or increases, the investor can still lock in a predetermined price, mitigating potential losses.

There are several reasons why futures contracts are often used as a hedge against losing money in the future. First and foremost, these contracts provide a level of certainty, allowing investors to plan for the future with more confidence. By establishing fixed prices and dates, investors can make informed decisions based on their expectations and risk tolerance.

Additionally, futures contracts offer flexibility, as they can be customized to fit specific needs. Whether an investor wants to hedge against price fluctuations, interest rate changes, or currency risks, futures contracts provide a versatile tool that can be tailored to different market conditions and individual requirements.

Moreover, futures contracts are highly liquid, meaning they can be bought or sold quickly and at a fair market price. This liquidity is essential for hedging purposes, as it ensures that investors can enter or exit positions efficiently, even in times of volatile markets or unexpected events.

Lastly, futures contracts offer transparency and standardized trading rules, which further enhance their appeal as a hedging instrument. Through regulated exchanges, investors can access reliable information, monitor market trends, and execute trades in a fair and orderly manner.

As we delve deeper into the world of futures contracts and hedging, it is important to understand the advantages, considerations, and potential risks associated with this strategy. By harnessing the power of futures contracts, investors can navigate the uncertain future with greater confidence and protect against potential losses.

Understanding Futures Contracts

Futures contracts are financial instruments that represent an agreement between two parties to buy or sell an asset at a predetermined price and date in the future. These standardized contracts are traded on various exchanges and provide investors with the opportunity to speculate on the future price movements of commodities, currencies, indexes, and more.

One key aspect of futures contracts is their standardized nature. They have specific contract sizes, delivery dates, and quality requirements that are determined by the exchange. For example, a futures contract for crude oil may represent 1,000 barrels, have a delivery date in three months, and adhere to certain quality standards.

Unlike options contracts, which give the holder the right but not the obligation to buy or sell an asset, futures contracts require both parties to fulfill their obligations at the agreed-upon price and date. This means that if an investor holds a long futures contract, they are obligated to buy the asset on the delivery date, while a short holder is obligated to sell.

Futures contracts offer investors several advantages, including leverage and the ability to benefit from both rising and falling markets. Leverage allows investors to control a larger position with a smaller amount of capital, potentially amplifying gains. However, it is important to note that leverage also increases the risk of losses.

Another critical aspect of futures contracts is their role as a price discovery mechanism. By bringing together buyers and sellers on an exchange, futures contracts help to establish a market-clearing price. This price reflects the collective sentiment and expectations of market participants, making it a valuable benchmark for related spot markets.

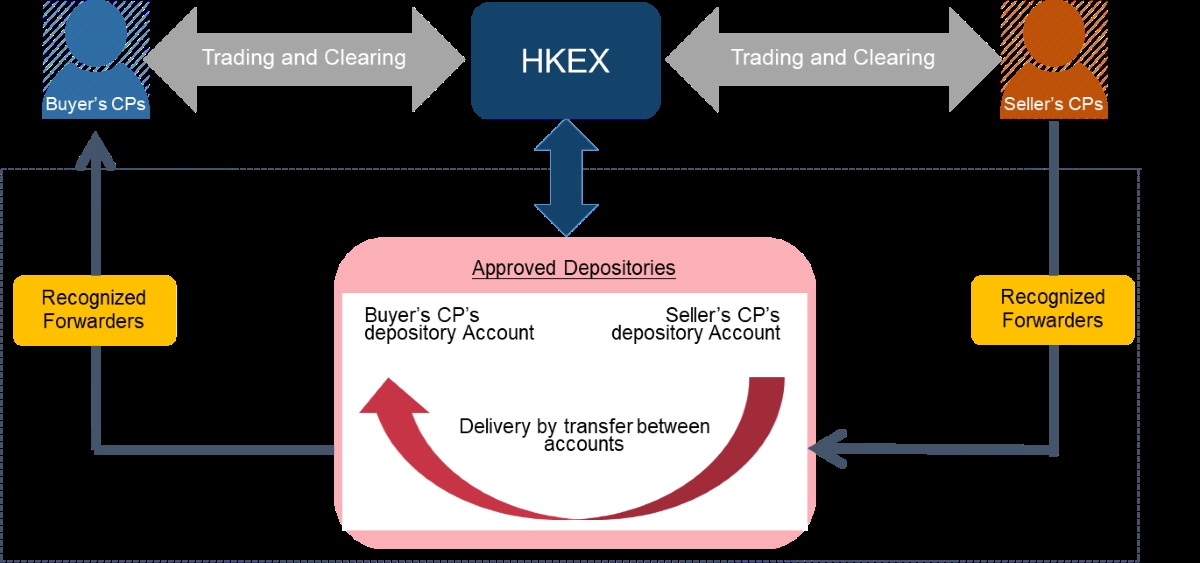

In the realm of hedging, futures contracts play a vital role. By taking a position in a futures contract that is opposite to their existing exposure in the underlying asset, investors can protect themselves against adverse price movements. For example, a farmer may sell futures contracts to hedge against a potential decrease in the price of their crops.

Overall, understanding futures contracts is crucial for investors looking to protect themselves against potential losses and take advantage of market movements. By harnessing the power of these standardized and versatile instruments, investors can navigate the complex world of finance and increase their chances of success.

Purpose of Hedging

In the realm of finance, hedging is a risk management strategy employed by investors to protect themselves from potential losses. The primary purpose of hedging is to offset or reduce the impact of adverse price movements in the underlying assets or investments.

Hedging serves as a form of insurance. Just as individuals purchase insurance policies to protect themselves against unforeseen events, investors use hedging strategies to safeguard their portfolios from market volatility and uncertainty. By hedging, investors aim to minimize the potential for losses when the value of their investments is threatened by unfavorable market conditions.

One of the key goals of hedging is to stabilize cash flow and protect the value of assets. By implementing hedging strategies, investors can create a level of certainty in their financial planning. This is particularly important for businesses that rely on the consistent availability and pricing of raw materials or commodities.

Another purpose of hedging is to manage price risk. Price fluctuations can have a significant impact on the profitability of businesses. For example, a company that depends on a particular commodity may face financial challenges if the price of that commodity increases unexpectedly. By hedging, businesses can lock in favorable prices to ensure stability and protect against potential losses.

Hedging can also be used to mitigate currency risk. In an increasingly globalized world, fluctuations in currency exchange rates can have a substantial impact on international trade and investments. Hedging strategies, such as using futures contracts or options, allow businesses to protect themselves against adverse movements in exchange rates, minimizing the impact on their bottom line.

Furthermore, hedging is often employed to manage interest rate risk. Interest rates play a crucial role in the cost of borrowing and the valuation of financial instruments. Changes in interest rates can impact businesses and investors in various ways. By implementing hedging strategies, such as interest rate swaps or futures contracts, parties can reduce the risk associated with interest rate fluctuations.

Overall, the primary purpose of hedging is to provide protection and stability in the face of market uncertainties. By implementing effective hedging strategies, investors can minimize potential losses, manage price risk, stabilize cash flow, protect against currency risk, and mitigate the impact of interest rate fluctuations. Hedging is an important tool in the financial toolkit for both individual investors and businesses, allowing them to navigate volatile markets and safeguard their financial interests.

Advantages of Futures Contracts as a Hedge

When it comes to hedging, futures contracts offer several advantages that make them a popular choice among investors. These advantages provide a range of benefits and opportunities for mitigating risk and protecting against potential losses.

One of the primary advantages of futures contracts as a hedge is their ability to provide a level of certainty. By entering into a futures contract, investors can establish fixed prices and dates for buying or selling the underlying asset. This allows them to plan for the future with more confidence, as they know in advance the price at which they will buy or sell the asset.

Additionally, futures contracts offer flexibility, allowing investors to tailor their hedges to specific needs. Whether it’s hedging against price fluctuations, interest rate changes, or currency risks, futures contracts can be customized to address different types of market risks. This versatility allows investors to develop strategies that align with their risk tolerance and individual circumstances.

Another advantage of using futures contracts as a hedge is their high liquidity. Futures markets are highly liquid, meaning that these contracts can be bought or sold quickly and at a fair market price. This liquidity is crucial for effective hedging, as it ensures that investors can enter or exit positions efficiently, even in times of market volatility or unexpected events.

Futures contracts also offer transparency and standardized trading rules. They are traded on regulated exchanges, providing investors with access to reliable information, fair pricing, and a transparent marketplace. This transparency enables investors to make informed decisions, monitor market trends, and execute trades in a fair and orderly manner.

In addition, futures contracts have lower transaction costs compared to other hedging instruments. The costs associated with trading futures contracts, such as commissions and fees, are generally lower than those associated with options contracts or over-the-counter derivatives. This cost efficiency makes futures contracts an attractive choice for investors looking to hedge their positions without incurring significant expenses.

Furthermore, futures contracts provide an efficient means of gaining exposure to various asset classes, including commodities, currencies, and stock indexes. By utilizing futures contracts, investors can manage risk across different markets and diversify their portfolios effectively. This diversification potential allows investors to reduce the impact of market-specific risks on their overall investment performance.

Overall, the advantages of futures contracts as a hedge include certainty, flexibility, liquidity, transparency, lower transaction costs, and diversification opportunities. These advantages make futures contracts a valuable tool for investors seeking to protect themselves against potential losses and manage risk effectively in dynamic and uncertain markets.

Factors to Consider When Hedging with Futures Contracts

While futures contracts can be an effective hedging tool, it is crucial for investors to consider several factors before implementing a hedging strategy. These factors can impact the success and effectiveness of the hedge, and taking them into account can help investors make informed decisions and manage risk more effectively.

The first factor to consider is the correlation between the futures contract and the underlying asset being hedged. Correlation measures the degree to which the prices of the two instruments move in relation to each other. It is important to choose a futures contract that exhibits a strong correlation with the asset being hedged. A high correlation ensures that the hedge provides effective protection against price movements in the underlying asset.

Another critical factor to consider is the cost of the futures contract. This includes transaction costs, margin requirements, and any other fees associated with trading the contract. It is essential to evaluate and factor in these costs when assessing the viability of a hedging strategy. High costs can erode the effectiveness of the hedge, potentially outweighing any benefits gained from price protection.

Timing is also an important consideration when hedging with futures contracts. Investors need to accurately determine when to enter or exit the hedge position to maximize its effectiveness. This requires the ability to analyze market trends, monitor key indicators, and make informed predictions about price movements. Implementing the hedge too early or too late can result in missed opportunities or inadequate protection against losses.

Liquidity of the futures market is another crucial factor to consider. A liquid market ensures that investors can easily enter or exit positions without significant price slippage. Thinly traded or illiquid markets can make it challenging to establish or unwind hedging positions, potentially impacting the effectiveness of the strategy. It is advisable to choose futures contracts that are traded on active and regulated exchanges to ensure sufficient liquidity.

Hedging effectiveness and potential risks should also be carefully evaluated. While hedging aims to protect against losses, it is important to understand that it does not guarantee profits. There is always the possibility of a hedging strategy not performing as expected or introducing unintended risks. Investors should consider the potential benefits and drawbacks of the hedge and assess whether it aligns with their risk tolerance and investment objectives.

Lastly, it is crucial to monitor and adjust the hedge position as market conditions evolve. Markets are dynamic, and factors influencing the underlying asset’s price can change over time. Regular evaluation and adjustments to the hedging strategy may be necessary to ensure that it remains effective and aligned with the investor’s goals.

By taking into account factors such as correlation, cost, timing, liquidity, effectiveness, and ongoing monitoring, investors can enhance their chances of implementing a successful hedging strategy using futures contracts. Careful consideration of these factors helps investors mitigate risk, protect against losses, and navigate the complexities of the financial markets.

Examples of Hedging with Futures Contracts

Hedging with futures contracts can take various forms and be applied across different asset classes. Let’s explore some examples of how investors can utilize futures contracts to manage risk and protect against potential losses.

1. Hedging Commodity Price Risk: A wheat farmer may use futures contracts to hedge against potential price declines in wheat. By selling wheat futures contracts, the farmer can lock in a predetermined selling price, protecting themselves from any future price decreases. This hedge ensures that the farmer can sell their crop at a favorable price, regardless of market fluctuations.

2. Hedging Currency Exchange Risk: A multinational company conducting business in a foreign country may be exposed to currency exchange rate fluctuations. To manage this risk, the company can enter into currency futures contracts to lock in a favorable exchange rate for future transactions. This hedge protects the company from potential losses due to adverse currency movements.

3. Hedging Interest Rate Risk: A real estate developer looking to build a new property may be concerned about rising interest rates during the construction process. To mitigate this risk, the developer can enter into interest rate futures contracts to lock in favorable borrowing rates. This hedge protects the developer from potential increases in borrowing costs, ensuring more predictable project financing.

4. Hedging Stock Market Risk: An investor holding a portfolio of stocks may be concerned about a potential market downturn. To hedge against this risk, the investor can sell stock index futures contracts that mirror the performance of their stock portfolio. If the stock market declines, the investor profits from the futures contract, offsetting potential losses in the stock portfolio.

5. Hedging Fuel Price Risk: Airlines are highly exposed to fluctuations in fuel prices, which significantly impact their operating costs. To manage this risk, airlines can enter into futures contracts for crude oil, jet fuel, or other energy commodities. By locking in prices for future fuel purchases, airlines can hedge against potential increases in fuel costs, providing price stability and protecting profitability.

These are just a few examples of how futures contracts can be used for hedging. Hedging strategies can be customized and tailored to suit the specific needs and circumstances of individual investors or businesses. The key is to identify the underlying risk and utilize futures contracts to offset or protect against potential losses, ensuring more stability and predictability in financial positions.

Risks and Limitations of Hedging with Futures Contracts

While hedging with futures contracts can be an effective risk management strategy, it is important to understand and consider the potential risks and limitations associated with this approach. By being aware of these factors, investors can make informed decisions and navigate the complexities of hedging more effectively.

One of the primary risks of hedging with futures contracts is basis risk. Basis refers to the difference between the price of the underlying asset and the price of the futures contract. If the basis widens or narrows significantly, it can affect the effectiveness of the hedge. Changes in basis can occur due to factors such as supply-demand dynamics, transport costs, or market sentiment. Investors need to monitor and assess any changes in basis to ensure the hedge remains aligned with their objectives.

Another risk is market risk, which stems from fluctuations in the overall market conditions. The performance of the underlying asset and the futures contract can be influenced by a variety of factors, including economic indicators, geopolitical events, and investor sentiment. Hedging with futures contracts does not eliminate exposure to market risk entirely, as the futures contract itself is subject to price movements. It is essential to carefully evaluate the potential impact of market risk on the effectiveness of the hedge.

Liquidity risk is also a consideration when hedging with futures contracts. While futures markets are generally highly liquid, there can be instances of reduced liquidity, particularly during periods of market stress or unexpected events. Thinly traded or illiquid markets can impact the ability to enter or exit hedge positions at desirable prices, potentially limiting the effectiveness of the hedge. Investors should ensure sufficient liquidity in the futures markets they engage with for hedging purposes.

Margin requirements are another limitation of hedging with futures contracts. Futures contracts typically require initial margin and maintenance margin deposits. These margin requirements can tie up capital and potentially limit the ability to engage in other investment activities. It is essential to account for these capital requirements and ensure they align with the overall investment strategy and risk tolerance.

Timing is critical when hedging with futures contracts. Attempting to perfectly time the entry and exit points of the hedge can be challenging. Markets are influenced by numerous variables, and making accurate predictions about price movements can be challenging. Entering the hedge too early or too late can diminish its effectiveness or result in missed opportunities. Investors need to carefully analyze market trends and consider their risk appetite when determining the timing of their hedging strategy.

Finally, it is important to note that hedging does not guarantee profits and may result in additional costs. While hedging aims to protect against losses, it can also limit potential gains. Investors need to carefully evaluate the trade-off between potential costs and benefits of hedging. It is advisable to assess the specific risks, costs, and limitations of the hedging strategy in the context of individual financial situation and investment goals.

Overall, hedging with futures contracts comes with risks and limitations that should be carefully considered. It is crucial to assess factors such as basis risk, market risk, liquidity risk, margin requirements, timing, and the trade-off between costs and benefits. By understanding and managing these factors, investors can make more informed decisions and execute their hedging strategies more effectively.

Conclusion

Futures contracts serve as a valuable tool for hedging against potential losses in the future. By understanding the fundamentals of futures contracts and the purpose of hedging, investors can effectively manage risk and protect their portfolios from adverse market movements.

The advantages of futures contracts as a hedge, including certainty, flexibility, liquidity, transparency, lower transaction costs, and diversification opportunities, make them an attractive choice for investors seeking protection and stability. These contracts provide a level of certainty by establishing fixed prices and dates, allowing investors to plan for the future with more confidence.

However, it is essential to consider various factors when hedging with futures contracts. Factors such as correlation, cost, timing, liquidity, effectiveness, and ongoing monitoring can significantly impact the success of a hedging strategy. Investors must carefully assess these factors to ensure the hedge aligns with their risk tolerance and investment objectives.

Furthermore, it is important to acknowledge the risks and limitations associated with hedging with futures contracts. Basis risk, market risk, liquidity risk, margin requirements, timing, and the potential trade-off between costs and benefits are crucial aspects to consider. Hedging does not guarantee profits and may introduce additional costs, so investors need to evaluate the potential impact on their overall investment strategy.

In conclusion, futures contracts provide investors with a powerful tool for managing risk and protecting against potential losses. By harnessing the benefits of futures contracts as a hedge and understanding the risks and limitations involved, investors can navigate the dynamic and uncertain financial markets with greater confidence. Hedging with futures contracts requires careful analysis, strategic planning, and ongoing monitoring, but when implemented effectively, it can provide stability, protect against losses, and contribute to long-term investment success.