Finance

How To Hedge Futures Contracts

Published: December 23, 2023

Learn how to effectively hedge futures contracts in the finance industry. Gain valuable insights and strategies to manage risk and protect your investments.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to investing in the stock market, there are numerous tools and strategies available to help mitigate risk and enhance returns. One such tool that is commonly used by investors is the futures contract. Futures contracts are derivative instruments that allow investors to buy or sell an underlying asset at a predetermined price at a future date. While these contracts offer a potential for profit, they also come with a significant amount of risk.

In order to manage the risk associated with futures contracts, investors often turn to hedging. Hedging is an investment strategy designed to offset or protect against potential losses by taking opposite positions in related assets, such as futures contracts. By hedging a futures contract, investors aim to minimize the impact of adverse price movements and ensure a more predictable outcome.

In this article, we will delve into the concept of hedging futures contracts, exploring the basics of hedging and different strategies that investors can employ. We will also provide an example to illustrate how hedging works and discuss the benefits and risks associated with this approach. Finally, we will highlight important factors that investors should consider before engaging in hedging futures contracts.

Whether you are an experienced investor or just starting out, understanding the principles and techniques of hedging futures contracts can greatly enhance your ability to manage risk and make informed investment decisions.

Understanding Futures Contracts

Before diving into the concept of hedging futures contracts, it is essential to have a solid understanding of what futures contracts are and how they function. A futures contract is a legally binding agreement between two parties to buy or sell an underlying asset at a predetermined price on a specified future date. The underlying asset can range from commodities like oil, metals, and agricultural products to financial instruments like stocks, bonds, and currencies.

Futures contracts are standardized and traded on organized exchanges, such as the Chicago Mercantile Exchange (CME) or the New York Mercantile Exchange (NYMEX). These exchanges act as intermediaries, ensuring the integrity of the contracts and providing a centralized marketplace for buyers and sellers to trade.

One of the distinctive features of futures contracts is that they are highly leveraged instruments. This means that investors can control a large amount of the underlying asset with a relatively small upfront amount, known as the margin. While leverage can amplify potential profits, it also magnifies losses. Therefore, it is crucial for investors to understand the associated risks before entering into futures contracts.

The price of a futures contract is determined by various factors, including the supply and demand dynamics of the underlying asset, interest rates, and market sentiment. The price is quoted in terms of the underlying asset per unit and is commonly referred to as the futures price.

It is important to note that most futures contracts do not result in physical delivery of the underlying asset. Instead, they are settled in cash. For instance, if an investor holds a futures contract to buy crude oil at a certain price, they can choose to close out the position before the contract expires by entering into an offsetting trade. The difference between the futures price at the time of opening the contract and the price at which it is closed out will determine the profit or loss.

Now that we have a clear understanding of what futures contracts are, let us explore the concept of hedging and how it can be applied to these contracts.

What is Hedging?

Hedging is an investment strategy used by investors and businesses to mitigate or reduce the risk of price fluctuations in an asset. It involves taking offsetting positions in related assets to minimize potential losses resulting from adverse price movements.

The main objective of hedging is not to generate profits but rather to protect existing investments from unfavorable market conditions. By hedging, investors can limit their exposure to price volatility and create a more predictable financial outcome.

When it comes to futures contracts, hedging involves taking an opposite position in a related asset to offset the potential losses in the futures contract. This related asset is typically highly correlated with the underlying asset of the futures contract. For example, if an investor holds a futures contract to buy a specific stock at a predetermined price and believes that the stock’s price will decline, they can hedge their position by selling the stock in the cash market.

By hedging, investors can effectively lock in a purchase or sale price for the underlying asset, reducing their vulnerability to price fluctuations. This can be especially beneficial for businesses that rely on commodities or raw materials, as it allows them to secure prices in advance and protect their profit margins.

It is important to note that hedging does not eliminate risk entirely but rather helps manage and minimize it. While hedging can protect against losses, it also limits potential gains. This trade-off is an essential consideration for investors, as they must balance risk reduction with profit potential.

Overall, hedging is a risk management strategy that provides investors with a level of protection against adverse price movements. By employing hedging techniques, investors can navigate uncertain market conditions with greater confidence and stability.

Basics of Hedging Futures Contracts

Hedging futures contracts involves taking offsetting positions in related assets to protect against potential losses. It is a risk management technique commonly used by investors to mitigate the impact of adverse price movements in the futures market.

The first step in hedging a futures contract is to identify the underlying asset and the desired position. For example, an investor might hold a futures contract to buy a specific commodity at a predetermined price. To hedge this position, the investor would take an opposite position in the cash market or a related derivative instrument.

There are two main types of hedging positions when it comes to futures contracts:

- Long Hedge: A long hedge involves taking a long position in the futures contract to offset potential price increases in the underlying asset. This is typically done by purchasing futures contracts to buy the asset at a fixed price.

- Short Hedge: A short hedge involves taking a short position in the futures contract to offset potential price declines in the underlying asset. This is typically done by selling futures contracts to sell the asset at a fixed price.

The effectiveness of a hedge is determined by the correlation between the futures contract and the related asset. The closer the correlation, the more effective the hedge will be in offsetting potential losses.

To establish a hedge, investors must carefully consider factors such as the contract size, contract specifications, and the duration of the hedge. Additionally, they must determine the appropriate number of futures contracts needed to offset their exposure to the underlying asset.

It’s important to note that hedging is not a one-time event but an ongoing process. As market conditions change, it may be necessary to adjust or close out the hedge to align with the desired risk management objectives.

Hedging futures contracts can be a complex endeavor, requiring a thorough understanding of the underlying asset, market dynamics, and risk management principles. It is advisable for investors to consult with professionals or engage the services of a financial advisor with experience in futures markets to ensure effective hedging strategies are implemented.

By implementing hedge strategies, investors can manage risks associated with futures contracts, reduce exposure to adverse price movements, and potentially enhance their overall investment performance.

Types of Hedging Strategies

There are several types of hedging strategies that investors can employ when it comes to futures contracts. Each strategy is designed to address specific risk factors and market conditions. Here are a few commonly used hedging strategies:

- Delta Hedging: Delta hedging is a strategy commonly used by options traders to hedge their exposure to changes in the price of the underlying asset. It involves taking offsetting positions in the underlying asset and its corresponding options contracts in order to maintain a neutral overall position.

- Cross Hedging: Cross hedging involves hedging a futures contract using a related but not identical asset. For example, if an investor holds a futures contract on a particular stock and the stock’s price is influenced by the price of another stock in the same industry, the investor may choose to hedge their position by taking a position in the correlated stock.

- Calendar Spread Hedging: Calendar spread hedging involves taking offsetting positions in futures contracts with different expiration dates. This strategy aims to reduce the impact of price fluctuations by spreading the position over multiple contract periods. By doing so, investors can mitigate the risk associated with short-term price movements.

- Options Hedging: Options hedging involves using options contracts to hedge against potential losses in the futures market. Options allow investors to establish specific rights and obligations, such as the right to buy or sell an asset at a predetermined price at a future date. By employing options strategies, investors can protect against adverse price movements while still maintaining the potential to benefit from favorable market conditions.

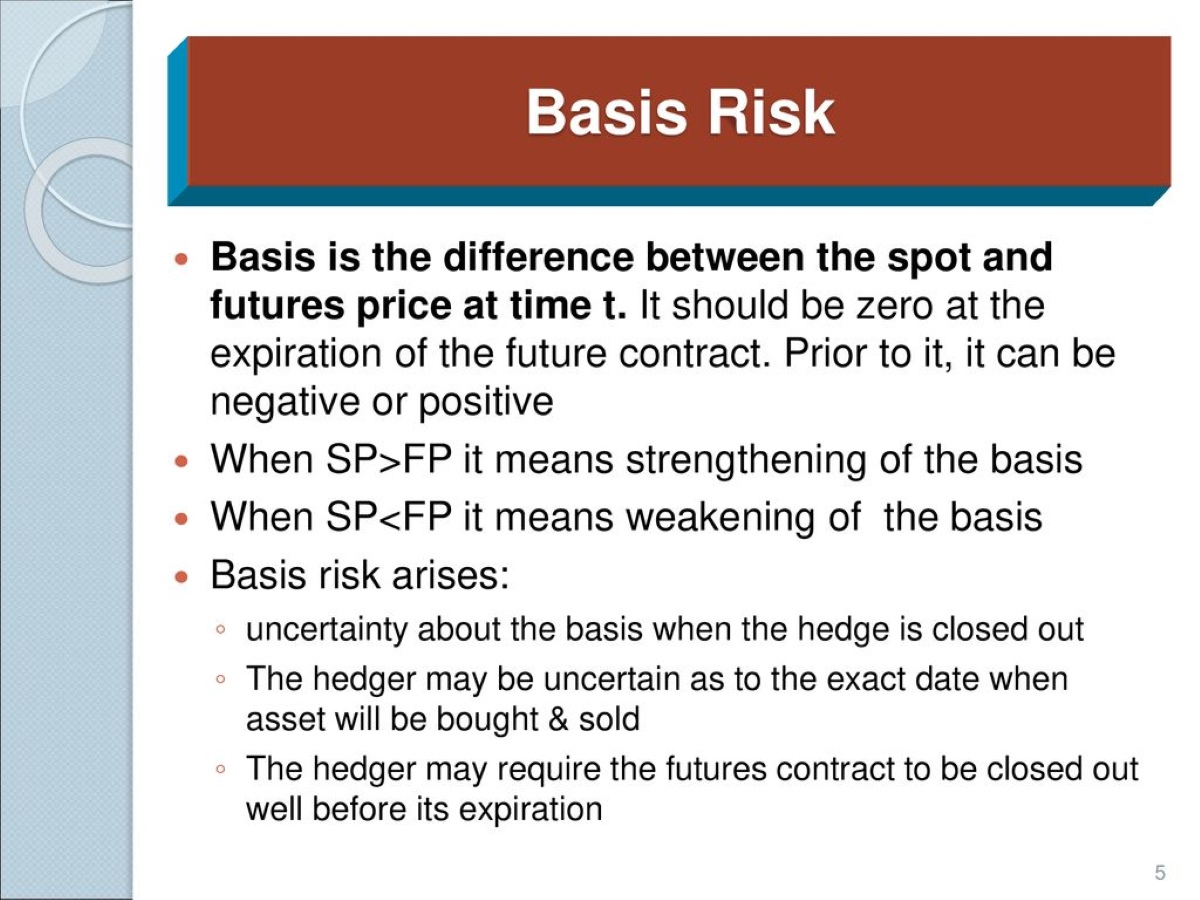

- Basis Hedging: Basis hedging is a strategy that entails taking offsetting positions in the cash market and futures contracts to protect against changes in the basis, which is the difference between the spot (cash) price and the futures price. This strategy is commonly used by producers, consumers, or traders who want to lock in the basis and minimize the impact of basis risk on their operations or investments.

It is worth noting that each hedging strategy has its own advantages and considerations, and not all strategies may be suitable for every investor or market situation. It is crucial for investors to carefully evaluate their risk tolerance, investment objectives, and market conditions before implementing a hedging strategy.

By understanding and applying different hedging strategies, investors can effectively manage risk and enhance their ability to navigate the complex world of futures contracts.

Example of Hedging a Futures Contract

To illustrate how hedging works in practice, let’s consider a hypothetical example of an investor who holds a futures contract to buy 1,000 barrels of crude oil at a price of $50 per barrel, with the contract expiring in three months. The investor is concerned about the possibility of a significant drop in crude oil prices, which could result in substantial losses.

To hedge the position, the investor decides to take a short position in the cash market by selling 1,000 barrels of crude oil. By doing so, the investor will profit from any decrease in the price of crude oil, which will help offset the potential losses on the futures contract.

Now, let’s explore the possible scenarios:

- If the price of crude oil remains stable at $50 per barrel until the expiration of the futures contract, the investor would incur a loss on the futures contract but would also generate profits from the short position in the cash market. Overall, the losses on the futures contract would be partially offset by the profits from the cash market transaction.

- If the price of crude oil declines to $45 per barrel at the expiration of the futures contract, the investor would incur a loss on the futures contract as they are obligated to buy the oil at $50 per barrel. However, the short position in the cash market would generate profits as the investor sold the oil at a higher price. Again, the losses on the futures contract would be partially offset by the gains from the cash market transaction.

- If the price of crude oil increases to $55 per barrel at the expiration of the futures contract, the investor would incur a loss on the short position in the cash market, as they sold the oil at a lower price. However, they would benefit from the futures contract as they can buy the oil at $50 per barrel. Once again, the losses on one side of the hedge are offset by the gains on the other side.

Through this example, we can see how hedging can help mitigate potential losses and create a more predictable outcome. By taking offsetting positions in the futures market and cash market, investors can limit their exposure to price fluctuations and improve their risk management.

It is important to note that the effectiveness of a hedge will depend on factors such as the correlation between the futures contract and the hedging instrument, transaction costs, and market conditions. Therefore, investors must carefully evaluate and monitor their hedging strategies to ensure their objectives are met.

Benefits and Risks of Hedging Futures Contracts

Hedging futures contracts can offer several benefits to investors and businesses, but it also carries certain risks. Let’s explore the advantages and disadvantages of hedging:

Benefits of Hedging Futures Contracts:

- Risk Mitigation: Hedging allows investors to reduce their exposure to potential losses resulting from adverse price movements. By taking offsetting positions, investors can effectively manage and mitigate market risk, creating a more predictable financial outcome.

- Protecting Profit Margins: Hedging is particularly valuable for businesses that rely on commodities or raw materials. By hedging their positions, they can secure prices in advance, ensuring a consistent profit margin even in the face of volatile market conditions.

- Price Stability: By hedging, investors can lock in a purchase or sale price for the underlying asset. This provides a level of price stability, allowing for better financial planning and budgeting.

- Flexibility: Hedging strategies offer investors the flexibility to adjust their positions as market conditions change. They can choose to close out or adjust the hedge if they anticipate a shift in the market, enabling them to adapt their risk management approach accordingly.

Risks of Hedging Futures Contracts:

- Inaccurate Hedging: If the correlation between the hedge instrument and the futures contract is not properly assessed, the hedge may not effectively offset potential losses. This can result in suboptimal risk management and potential financial losses.

- Opportunity Cost: Hedging typically involves taking offsetting positions, which means that potential gains from favorable price movements are limited or eliminated. If the market moves in a favorable direction, the investor may miss out on potential profits.

- Cost of Hedging: Engaging in hedging strategies often involves transaction costs, such as brokerage fees or bid-ask spreads. These costs can impact the overall profitability of the investment and should be considered when evaluating the effectiveness of the hedge.

- Overcomplication: Hedging strategies can be complex, especially for inexperienced investors. It requires an understanding of derivative instruments, market dynamics, and risk management principles. Without proper knowledge and expertise, the implementation of hedging strategies can lead to unintended consequences.

It is essential for investors to carefully weigh the benefits and risks of hedging futures contracts before deciding to implement a hedging strategy. They should conduct thorough research, seek professional advice, and evaluate their risk tolerance and investment objectives.

By effectively managing the risks associated with futures contracts through hedging, investors can enhance their ability to navigate uncertain market conditions and achieve more consistent and predictable investment outcomes.

Factors to Consider When Hedging Futures Contracts

When engaging in hedging futures contracts, there are several important factors that investors should consider in order to maximize the effectiveness of their hedging strategies. Here are some key factors to keep in mind:

- Correlation: It is crucial to assess the correlation between the futures contract and the hedging instrument. The closer the correlation, the more effective the hedge will be in offsetting potential losses. Conduct thorough research and analysis to determine the relationship between the assets and their historical price movements.

- Timing: Timing is crucial in hedging. Deciding when to establish or close out a hedge requires careful consideration of market conditions, price trends, and expected future developments. Monitor the market closely and be prepared to adjust or exit the hedge as needed.

- Transaction Costs: Consider the transaction costs associated with implementing and maintaining a hedge, such as brokerage fees, commissions, and bid-ask spreads. These costs can eat into potential profits and should be factored into the decision-making process. Compare different brokers and platforms to find the most cost-effective solution.

- Risk Tolerance: Understand your risk tolerance and financial objectives. The level of risk you are willing to bear will determine the type and extent of hedging strategies you choose. Assess whether you are more focused on risk mitigation or potential profit generation.

- Hedge Adjustments: Continuously monitor and evaluate the effectiveness of your hedge. As market conditions change, it may be necessary to adjust or close out the hedge to align with your risk management objectives. Stay informed and be ready to make necessary modifications to your hedge portfolio.

- Expert Advice: Seek guidance from professionals or financial advisors with expertise in hedging futures contracts. Their experience and insights can help you navigate the complexities of hedging and provide valuable recommendations tailored to your specific needs and goals.

It is important to remember that hedging is not a one-size-fits-all approach. Each investor’s situation is unique, and considerations may vary depending on individual goals, risk appetite, and market conditions. A well-informed and thoughtful approach to hedging is key to achieving desired outcomes.

By taking these factors into account and carefully designing and executing hedging strategies, investors can effectively manage risks associated with futures contracts and enhance the overall stability and performance of their portfolios.

Conclusion

Hedging futures contracts is a proven strategy to manage risk and protect investments from adverse price movements. By taking offsetting positions in related assets, investors can minimize potential losses and create a more predictable financial outcome.

We have explored the basics of hedging futures contracts, including the understanding of futures contracts themselves and the concept of hedging. We have discussed various types of hedging strategies, such as delta hedging, cross hedging, calendar spread hedging, options hedging, and basis hedging. Each strategy offers its own benefits and considerations, allowing investors to tailor their hedging approach to their specific needs and market conditions.

While hedging provides significant benefits, it is important to recognize the risks associated with these strategies. Assessing correlation, understanding transaction costs, and staying vigilant to market factors are essential elements when considering hedging futures contracts. Additionally, seeking expert advice is advantageous to make well-informed decisions and navigate the complexities of these strategies.

Ultimately, hedging futures contracts aims to mitigate risk, protect profits, and maintain price stability. By carefully evaluating the benefits and risks, understanding individual goals and risk tolerance, and staying vigilant to market conditions, investors can effectively utilize hedging strategies to enhance their risk management and overall investment performance.

Remember, successful hedging requires a balance between risk management and profit potential. By employing hedging strategies wisely and adapting them as market conditions evolve, investors can position themselves for more stable and confident trading in the dynamic world of futures contracts.