Finance

What Credit Companies Use Equifax

Published: January 9, 2024

Discover how credit companies in the finance industry use Equifax for assessing creditworthiness and making informed financial decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of credit companies, where financial institutions rely on a variety of factors to assess an individual’s creditworthiness. One crucial piece of the puzzle is the information provided by credit reporting agencies. Among these agencies, Equifax stands as one of the most renowned and influential players.

In this article, we will delve into the role of Equifax in the realm of credit companies. We will explore the importance of Equifax in credit assessment, identify the companies that rely on Equifax for credit evaluations, highlight the benefits of utilizing Equifax’s services, and examine the challenges and criticisms associated with the use of Equifax data.

Equifax, founded in 1899, is a global data analytics company that specializes in consumer and business insights. With a vast repository of financial information and credit data, Equifax provides valuable resources to assist credit companies in making informed lending decisions.

Let’s take a closer look at how Equifax’s services are utilized in the world of credit companies and the implications associated with its usage.

Equifax: An Overview

Equifax is a renowned credit reporting agency that collects and analyzes consumer financial data to help businesses assess creditworthiness and manage risk. As one of the three major credit reporting agencies in the United States, alongside Experian and TransUnion, Equifax plays a vital role in the evaluation of an individual’s creditworthiness.

The company gathers information from various sources, including lenders, credit card companies, public records, and other financial institutions, to create comprehensive credit reports for individuals and businesses. These reports contain crucial information, such as credit history, payment patterns, outstanding debts, and public records such as bankruptcies or liens.

Equifax utilizes advanced algorithms and analytics to compile this data into credit scores, providing a standardized measure of creditworthiness that credit companies can use to assess financial risk. The credit scores provided by Equifax are widely recognized and utilized by lenders, landlords, insurance companies, and other entities to make informed decisions regarding credit approvals, interest rates, and credit limits.

Furthermore, Equifax also offers risk management solutions to businesses to help them identify and mitigate potential risks associated with fraud, identity theft, and data breaches. By leveraging its extensive data resources, Equifax assists companies in making informed decisions, maintaining compliance with regulations, and safeguarding sensitive customer information.

Equifax’s commitment to data accuracy and security has made it a trusted partner for credit companies seeking reliable and comprehensive credit data. Its extensive data analytics capabilities and industry expertise have established Equifax as a leading authority in the credit assessment industry.

However, it is important to note that Equifax, like any credit reporting agency, may face criticisms and challenges regarding data accuracy, consumer privacy concerns, and the implications of credit scoring methodologies. In the following sections, we will explore these aspects further and examine how credit companies utilize Equifax’s services to assess creditworthiness.

Importance of Equifax in Credit Companies

In the world of credit companies, Equifax plays a vital role in assessing an individual’s creditworthiness. Here are some key reasons why Equifax is important to credit companies:

1. Comprehensive Credit Data: Equifax collects and analyzes a wide range of financial data, including credit history, payment patterns, outstanding debts, and public records. This comprehensive dataset provides credit companies with a holistic view of an individual’s financial health and creditworthiness.

2. Standardized Credit Scores: Equifax utilizes advanced algorithms and analytics to generate credit scores, which serve as a standardized measure of an individual’s creditworthiness. These scores help credit companies in evaluating mortgage applications, credit card approvals, and loan requests efficiently and consistently.

3. Risk Mitigation: Equifax’s risk management solutions enable credit companies to identify and mitigate potential risks associated with fraud, identity theft, and data breaches. By leveraging Equifax’s data resources and expertise, credit companies can make informed decisions, deploy appropriate security measures, and protect their customers’ financial information.

4. Efficient Credit Assessment: Equifax’s access to a vast database of consumer financial information allows credit companies to streamline their credit assessment processes. With accurate and up-to-date credit data from Equifax, credit companies can assess an individual’s creditworthiness quickly and make informed lending decisions in a timely manner.

5. Industry Expertise: Equifax has an established reputation and industry expertise in credit reporting and risk management. Its long-standing presence in the market makes it a trusted partner for credit companies seeking reliable data and insight into credit risk assessment.

6. Compliance with Regulations: Equifax ensures that credit companies adhere to regulatory requirements and compliance standards. By accessing Equifax’s data and utilizing its services, credit companies can navigate the complex landscape of credit reporting regulations and ensure they are acting in accordance with legal obligations.

The importance of Equifax in credit companies cannot be overstated. Its comprehensive data, standardized credit scores, risk management solutions, efficiency, industry expertise, and compliance support make it an essential component in the credit assessment process. However, it is crucial for credit companies to strike a balance between relying on Equifax’s services and considering other pertinent factors to make well-informed lending decisions.

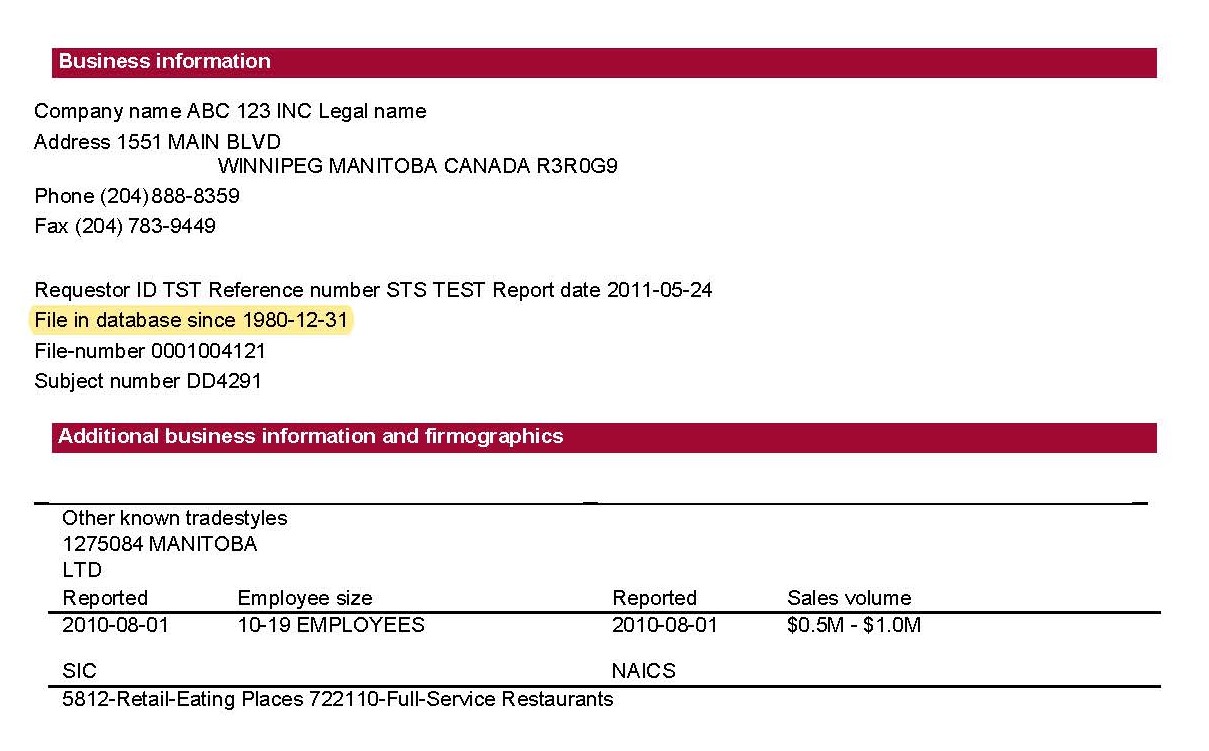

Companies That Use Equifax for Credit Assessment

Equifax’s extensive database and robust credit assessment services make it an indispensable resource for a wide range of companies in various industries. Here are some notable examples of companies that rely on Equifax for credit assessment:

1. Banks and Financial Institutions: Major banks and financial institutions utilize Equifax’s services to evaluate creditworthiness when processing loan applications and determining interest rates. By accessing Equifax’s credit reports and scores, these institutions can make informed decisions regarding loan approvals and mitigate the risk of default.

2. Credit Card Companies: Credit card companies heavily rely on Equifax to assess the creditworthiness of applicants. The information provided by Equifax helps these companies determine credit limits, interest rates, and terms of agreement for new and existing cardholders.

3. Mortgage Lenders: Equifax plays a crucial role in the mortgage industry by providing credit assessment services to mortgage lenders. These lenders use Equifax’s data to evaluate the financial history and creditworthiness of potential homebuyers, determining their eligibility for home loans and establishing suitable interest rates.

4. Auto Financing Companies: Companies in the auto financing industry leverage Equifax’s services to evaluate the creditworthiness of individuals seeking auto loans. Equifax’s credit reports and scores assist these companies in making informed decisions when offering financing options and setting interest rates.

5. Insurance Providers: Insurance companies utilize Equifax’s credit data to assess the risk associated with potential policyholders. By evaluating an individual’s credit history and scores, insurance providers can determine the level of risk involved in providing coverage and adjust premiums accordingly.

6. Property Rental Companies: Equifax’s credit assessment services are also utilized by property rental companies. These companies screen potential tenants by evaluating their creditworthiness, using Equifax’s data to analyze their financial history and determine the level of risk associated with renting a property to them.

7. Utility Service Providers: Equifax’s credit reports assist utility service providers in evaluating prospective customers’ creditworthiness. This enables them to determine the need for security deposits and establish credit terms for new customers.

These are just a few examples of the many companies that rely on Equifax for credit assessment. Equifax’s comprehensive credit data and standardized credit scores provide these companies with valuable insights that aid in making informed decisions, managing financial risk, and ensuring the overall financial health of their businesses.

Benefits of Equifax for Credit Companies

Equifax offers a range of benefits to credit companies, making it an invaluable resource in the credit assessment process. Here are some key advantages of using Equifax’s services:

1. Comprehensive and Reliable Data: Equifax collects a vast amount of financial information from various sources, providing credit companies with comprehensive and reliable data for credit assessment. This data includes credit history, payment patterns, outstanding debts, and public records, allowing credit companies to make well-informed decisions on credit approvals.

2. Standardized Credit Scores: Equifax generates standardized credit scores that enable credit companies to evaluate creditworthiness consistently across applicants. These credit scores provide a reliable measure of individuals’ creditworthiness, supporting credit companies in determining interest rates, credit limits, and loan terms accurately.

3. Efficiency and Streamlined Processes: Equifax’s access to a vast database and advanced analytics enables credit companies to streamline their credit assessment processes. By utilizing Equifax’s services, credit companies can efficiently evaluate the creditworthiness of applicants, reducing the time and effort required for manual analysis.

4. Risk Assessment and Mitigation: Equifax’s risk management solutions help credit companies identify and mitigate potential risks associated with fraud, identity theft, and data breaches. By leveraging Equifax’s expertise and resources, credit companies can make informed decisions, implement suitable risk mitigation strategies, and protect against fraudulent activities.

5. Regulatory Compliance Support: Equifax ensures that credit companies comply with regulatory requirements and standards in credit reporting. By utilizing Equifax’s services, credit companies can navigate the complex landscape of credit reporting regulations and reduce the risk of non-compliance.

6. Industry Expertise and Insights: Equifax has extensive industry experience and expertise in credit reporting and risk management. Credit companies benefit from Equifax’s insights and guidance, gaining valuable industry knowledge that helps them make informed decisions and stay updated with the latest trends and best practices in credit assessment.

7. Data Security and Privacy: Equifax is committed to maintaining the security and privacy of consumer data. By relying on Equifax’s services, credit companies can trust that sensitive customer information is protected and handled with utmost confidentiality, reducing the risk of data breaches and ensuring compliance with privacy regulations.

Equifax’s comprehensive data, standardized credit scores, streamlined processes, risk assessment solutions, compliance support, industry expertise, and commitment to data security provide significant benefits to credit companies. By utilizing Equifax’s services, credit companies can effectively assess creditworthiness, manage financial risk, and make informed lending decisions, ultimately boosting their efficiency and profitability.

Challenges and Criticisms of Equifax in Credit Companies

While Equifax provides valuable services to credit companies, it is not without its challenges and criticisms. Here are some notable concerns associated with Equifax:

1. Data Accuracy and Integrity: One major challenge for Equifax is ensuring the accuracy and integrity of the data it collects and reports. There have been instances where inaccuracies, outdated information, or errors have been found in credit reports, potentially impacting credit decisions. Maintaining accurate and up-to-date data is crucial to minimize the risk of erroneous assessments.

2. Consumer Protection and Privacy Concerns: Equifax, like other credit reporting agencies, holds vast amounts of sensitive personal and financial information. There have been concerns about data breaches and the potential for misuse or unauthorized access to consumer data. Protecting consumer privacy and ensuring robust security measures are in place is an ongoing challenge for Equifax.

3. Transparency and Disclosure: Some critics argue that Equifax should provide greater transparency regarding the factors that contribute to credit scores. There is a desire for clearer explanations and disclosures regarding the calculations and algorithms used to generate credit scores. Increased transparency could help individuals better understand their creditworthiness and address any issues that may affect their credit profiles.

4. Limited Access to Data Sources: Equifax relies on data provided by various financial institutions and other sources. However, certain lenders or institutions may not report data to Equifax, potentially leading to an incomplete picture of an individual’s credit history. This limited access to data sources can impact credit assessments and may result in incomplete or inaccurate credit reports.

5. Lack of Competitive Options: Equifax is one of the three major credit reporting agencies, along with Experian and TransUnion. Some critics argue that the lack of competition in the industry limits the options available to credit companies. Greater competition could potentially lead to improved services, better pricing, and increased innovation in credit assessment processes.

6. Disputes and Resolution Process: Resolving disputes regarding credit reporting errors can be a cumbersome and time-consuming process. Some individuals have experienced difficulties in correcting inaccuracies or discrepancies in their credit reports, which can have significant consequences for their creditworthiness. Improving the dispute resolution process and providing clear guidelines for disputing credit information would benefit both consumers and credit companies.

It is important for credit companies to be aware of these challenges and criticisms associated with Equifax’s services. It highlights the need for ongoing diligence in data accuracy, consumer privacy protection, transparency, and continuous improvement of credit assessment processes. By addressing these concerns, Equifax and credit companies can enhance the reliability and effectiveness of credit assessments for individuals and businesses.

Conclusion

Equifax plays a significant role in the world of credit companies, providing valuable data and services to assess an individual’s creditworthiness. Through its comprehensive credit reports, standardized credit scores, risk management solutions, and industry expertise, Equifax enables credit companies to make informed decisions, streamline their processes, and manage financial risk effectively.

While Equifax offers various benefits, it is not without challenges and criticisms. Ensuring data accuracy and integrity, protecting consumer privacy, increasing transparency, addressing limited access to data sources, and enhancing the dispute resolution process are ongoing concerns that Equifax and credit companies need to address for the betterment of the industry.

Despite these challenges, Equifax remains a trusted resource for credit companies, helping them assess creditworthiness, mitigate risks, and adhere to regulatory compliance. With ongoing improvements and a commitment to data accuracy, privacy, and transparency, Equifax can continue to build trust and provide essential services to credit companies.

As the landscape of credit assessment evolves, credit companies should consider diversifying their data sources and incorporating additional assessment methods to complement Equifax’s services. By utilizing a combination of credit reporting agencies, alternative data sources, and advanced analytics, credit companies can enhance their credit assessment processes and gain a more comprehensive understanding of an individual’s creditworthiness.

In conclusion, Equifax’s role in credit companies is vital, providing essential data-driven insights to assist in making informed lending decisions. By embracing the benefits of Equifax’s services while addressing the associated challenges and criticisms, credit companies can effectively manage financial risk and contribute to a more robust and equitable lending ecosystem.