Finance

What Is Asset Management In Real Estate

Modified: December 30, 2023

Discover the importance of asset management in real estate and how it impacts your financial success. Explore the connection between finance and property management for optimum returns.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Overview of Asset Management in Real Estate

- Benefits of Asset Management in Real Estate

- Key Roles and Responsibilities of Asset Managers

- Asset Management Strategies in Real Estate

- How to Start an Asset Management Career in Real Estate

- Common Challenges in Real Estate Asset Management

- Best Practices for Successful Asset Management in Real Estate

- Technology and Innovation in Real Estate Asset Management

- Case Studies: Successful Asset Management in Real Estate

- Future Trends in Real Estate Asset Management

- Conclusion

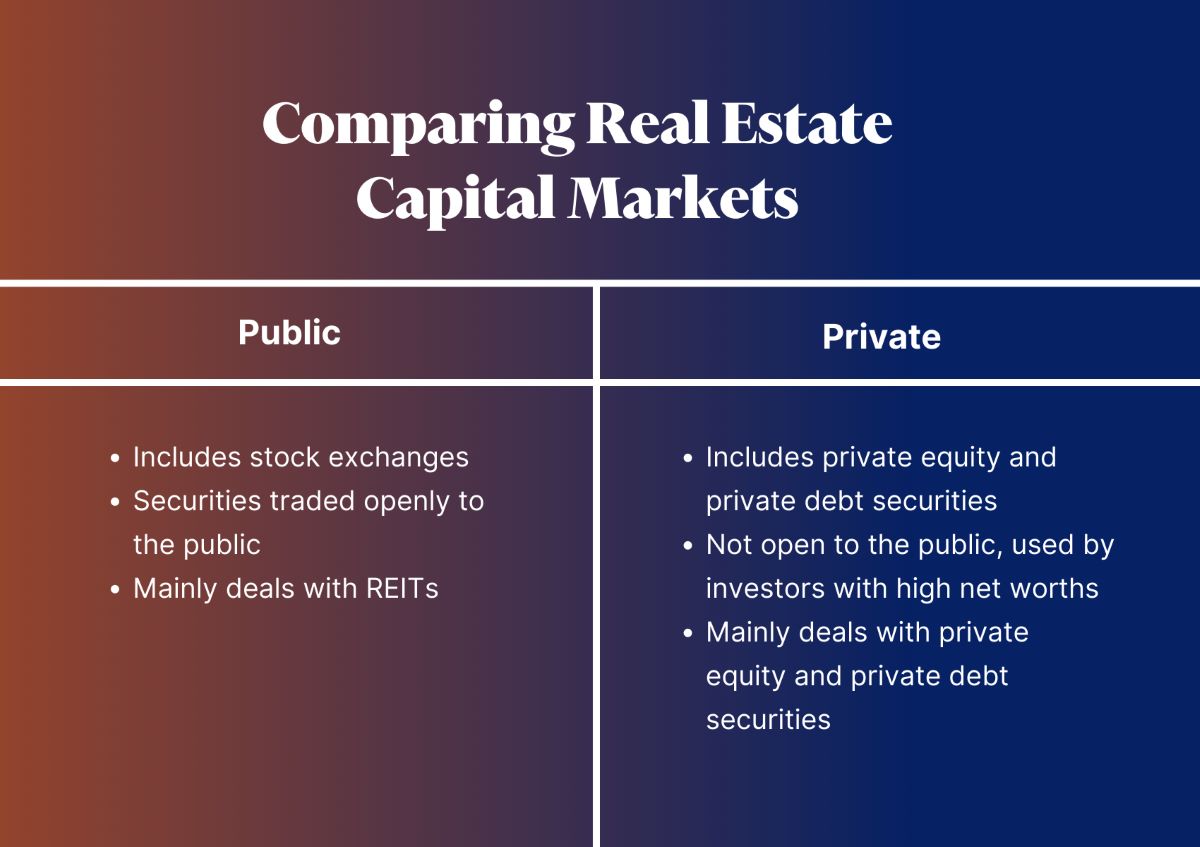

Overview of Asset Management in Real Estate

Asset management plays a crucial role in the real estate industry, ensuring that properties are maximized to their full potential. It involves the strategic planning, operation, and oversight of properties to optimize their financial performance and value. Asset managers are responsible for making informed decisions that contribute to the long-term success of real estate investments.

Asset management in real estate encompasses a wide range of responsibilities, including property acquisition, financing, leasing, maintenance, and disposition. It requires a deep understanding of the market trends, financial analysis, risk management, and legal considerations.

The main goal of asset management in real estate is to enhance the value of properties, increase their cash flow, and ultimately generate higher returns for investors. This is achieved through proactive management, implementing effective strategies, and leveraging market opportunities.

Asset managers are highly skilled professionals who combine their expertise in finance, real estate, and business to create value for property owners. They develop and execute comprehensive business plans that align with the investment objectives, taking into account factors such as market conditions, competition, and tenant demands.

Furthermore, asset managers act as intermediaries between property owners, stakeholders, and service providers. They oversee property management companies, leasing agents, and maintenance teams to ensure that operations are running smoothly and in compliance with regulations.

It’s important to note that asset management in real estate is not limited to commercial properties. It also includes residential properties, mixed-use developments, retail spaces, industrial buildings, and even vacant land. The strategies employed may vary depending on the property type and location.

Overall, asset management in real estate is a multifaceted discipline that requires a comprehensive understanding of the market, strong financial acumen, and effective decision-making skills. By implementing sound strategies and continuously monitoring and adapting to market conditions, asset managers can drive the success of real estate investments and deliver sustainable value to stakeholders.

Benefits of Asset Management in Real Estate

Asset management plays a vital role in the success of real estate investments. By implementing effective strategies and overseeing property operations, asset managers can unlock several key benefits:

- Maximizing Property Value: Asset managers analyze market trends, conduct thorough financial analyses, and identify opportunities to increase property value. By making strategic improvements, optimizing leasing strategies, and implementing cost-saving initiatives, asset managers can significantly enhance the financial performance of properties.

- Generating Higher Returns: Through diligent management and value-enhancing initiatives, asset managers can generate higher investment returns for property owners. By focusing on improving cash flow, minimizing vacancies, and maximizing rental rates, asset managers can deliver attractive returns to investors over the long term.

- Risk Mitigation: Asset managers carefully assess and mitigate risks associated with real estate investments. They conduct thorough due diligence during the acquisition phase, ensuring that potential risks are identified and properly addressed. Additionally, they continuously monitor market trends, tenant demands, and regulatory changes, allowing them to proactively manage risks and adapt their strategies accordingly.

- Enhanced Tenant Satisfaction: Asset managers prioritize tenant satisfaction by ensuring that properties are well-maintained, responsive to tenant needs, and offering desirable amenities. By fostering positive tenant relationships, asset managers can improve tenant retention rates, minimize vacancy periods, and ultimately boost cash flow and property value.

- Optimized Operational Efficiency: Asset managers streamline property operations by implementing efficient processes, leveraging technology, and overseeing service providers. By optimizing operational efficiency, they can reduce costs, improve service quality, and enhance the overall performance of the property.

- Long-term Sustainability: Asset managers take into account sustainability factors when managing properties, such as energy efficiency, green building practices, and environmental impact. By promoting sustainability, asset managers not only contribute to a healthier environment but also attract environmentally-conscious tenants and investors.

In summary, asset management in real estate offers a wide array of benefits. From maximizing property value and generating higher returns to mitigating risks and fostering tenant satisfaction, asset managers play a vital role in the long-term success of real estate investments. Their strategic decision-making and diligent oversight contribute to the overall financial performance, operational efficiency, and sustainability of properties.

Key Roles and Responsibilities of Asset Managers

Asset managers in the real estate industry have a critical role in overseeing and managing properties to ensure optimal financial performance and value. Their responsibilities encompass a wide range of tasks and require a diverse set of skills. Here are some of the key roles and responsibilities of asset managers:

- Property Acquisition: Asset managers are involved in the evaluation and acquisition of properties. They conduct thorough market analysis, financial due diligence, and risk assessments to determine the viability of potential investments. They also negotiate purchase agreements and coordinate the closing process.

- Strategic Planning: Asset managers develop and execute comprehensive business plans for properties under their management. They outline short-term and long-term objectives, identify investment strategies, and define key performance indicators to measure success. This includes analyzing market trends, tenant demands, and competition to align the property’s positioning with market opportunities.

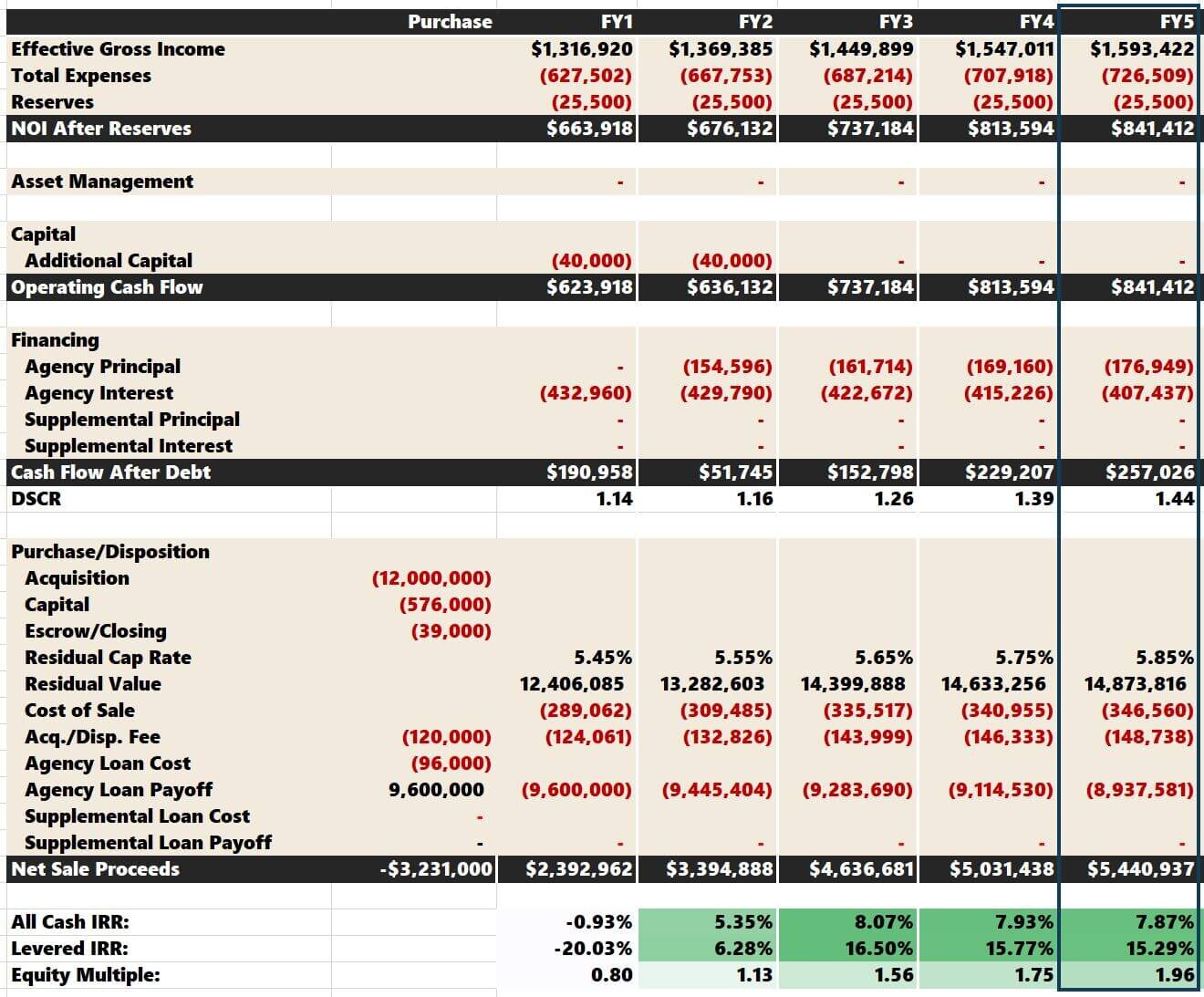

- Financial Analysis: Asset managers perform detailed financial analyses to evaluate the performance of properties. They monitor income and expenses, analyze cash flow, assess profitability, and track key financial metrics. This helps them identify areas for improvement and make informed decisions to maximize returns.

- Lease Management: Asset managers oversee lease management activities, including lease negotiations, renewals, and terminations. They ensure that lease agreements are fair and in compliance with legal requirements. They also monitor rent collection, occupancy rates, and tenant satisfaction to optimize rental income and minimize vacancies.

- Property Operations: Asset managers are responsible for overseeing the day-to-day operations of properties. This includes coordinating property management activities, ensuring proper maintenance and repairs are conducted, and managing relationships with service providers. They monitor property performance, address tenant concerns, and ensure that properties are in compliance with regulations.

- Performance Monitoring: Asset managers continuously monitor the performance of properties and compare it against established goals and benchmarks. They analyze market trends, assess competition, and track key performance indicators to identify areas for improvement and make data-driven decisions.

- Investor Reporting: Asset managers are responsible for providing regular updates and reports to property owners and investors. They communicate financial performance, market insights, and property updates to keep stakeholders informed. They also address any questions or concerns raised by investors and provide recommendations for adjustments to investment strategies.

- Risk Management: Asset managers identify and mitigate risks associated with real estate investments. They assess market risks, regulatory changes, and potential tenant issues to develop risk mitigation strategies. They also stay updated on legal requirements and ensure properties are in compliance with local regulations.

- Asset Disposition: Asset managers are involved in the strategic disposition of properties when it aligns with the investment objectives. They assess market conditions, conduct property valuations, and coordinate the sale process. Their goal is to maximize returns and ensure a smooth transition for property owners.

Overall, asset managers play a pivotal role in managing and optimizing the financial performance of real estate investments. Their responsibilities span from property acquisition to disposition, including strategic planning, financial analysis, lease management, and risk mitigation. With their expertise and diligent oversight, asset managers contribute to the success and long-term value of real estate portfolios.

Asset Management Strategies in Real Estate

Asset management strategies in real estate are crucial for maximizing the value and financial performance of properties. These strategies involve a combination of proactive planning, market analysis, and effective decision-making. Here are some commonly used asset management strategies in the real estate industry:

- Optimizing Rental Income: One of the primary strategies in real estate asset management is to optimize rental income. This can be achieved by conducting thorough market research to determine the appropriate rental rates for the property. Asset managers may also implement strategies such as tenant retention programs, offering desirable amenities, and implementing marketing campaigns to attract high-quality tenants.

- Implementing Cost-Saving Measures: Asset managers strive to reduce operating expenses to maximize the property’s profitability. This can involve negotiating favorable contracts with service providers, implementing energy-efficient measures to reduce utility costs, and identifying opportunities for operational efficiencies.

- Asset Repositioning: Repositioning a property involves making strategic improvements or changes to enhance its market appeal and value. This can include renovating outdated spaces, rebranding the property, or reconfiguring the property layout to attract higher-paying tenants or target a different market segment.

- Active Lease Management: Maximizing lease revenue and occupancy rates is a vital aspect of asset management in real estate. Asset managers actively manage leases, negotiating favorable terms with tenants, and seeking opportunities to increase rental rates as market conditions allow. They also monitor lease expirations to minimize vacancy periods and ensure a steady stream of rental income.

- Proactive Maintenance and Property Upkeep: Regular maintenance and property upkeep are critical to maintaining the property’s value and attractiveness. Asset managers establish preventive maintenance programs to address issues before they escalate, ensure compliance with safety regulations, and maintain a high-quality environment for tenants. This helps prevent costly repairs and enhances tenant satisfaction, leading to higher occupancy rates.

- Market Analysis and Forecasting: Successful asset managers monitor market trends and economic indicators to make informed investment decisions. They analyze factors such as supply and demand, rental rates, vacancy rates, and demographic shifts to identify opportunities in the market. This allows them to adjust asset management strategies accordingly and stay ahead of potential challenges.

- Capital Expenditure Planning: Asset managers develop comprehensive capital expenditure plans to address the property’s short-term and long-term needs. This involves prioritizing necessary repairs and upgrades, estimating costs, and implementing capital projects strategically to maximize returns and minimize disruption to tenants.

- Risk Management: Asset managers actively manage risks associated with real estate investments. This involves assessing potential risks, such as changes in market conditions or regulatory requirements, and developing strategies to mitigate those risks. This may include maintaining adequate insurance coverage, implementing contingency plans, and staying updated on legal and regulatory changes.

- Regular Performance Monitoring and Reporting: Asset managers regularly monitor property performance, comparing it against established goals and benchmarks. This helps identify areas for improvement and allows for timely adjustments to asset management strategies. They also provide regular performance reports to property owners and investors to keep them informed about the property’s financial performance and market outlook.

Implementing effective asset management strategies is essential for optimizing the financial performance and value of real estate investments. By leveraging market opportunities, minimizing operating costs, and proactively managing properties, asset managers can drive the success of real estate portfolios and deliver sustainable returns for investors.

How to Start an Asset Management Career in Real Estate

If you have a passion for real estate and a knack for strategic planning and financial analysis, pursuing a career in asset management can be an excellent choice. Here are the steps to get started on your journey towards becoming an asset manager in the real estate industry:

- Educational Foundation: Start by obtaining a solid educational foundation in real estate, finance, or a related field. Consider pursuing a bachelor’s degree in real estate, finance, business administration, or a similar field. This will provide you with a strong understanding of real estate fundamentals, financial analysis, and investment principles.

- Acquire Industry Knowledge: Gain industry knowledge by staying updated on current trends and developments in the real estate market. Read industry publications, attend real estate conferences and seminars, and network with professionals in the field. This will help you build a strong foundation of industry knowledge and demonstrate your commitment to the field.

- Gain Experience: Seek opportunities to gain practical experience in the real estate industry. Consider internships or entry-level positions at real estate firms, property management companies, or investment firms. This will give you hands-on exposure to the various aspects of real estate asset management and help you build relevant skills.

- Develop Financial Acumen: Asset management in real estate requires a strong understanding of financial analysis and investment principles. Enhance your financial acumen by taking courses or obtaining certifications in areas such as financial analysis, valuation, and investment analysis. This will equip you with the necessary skills to analyze property performance and make informed investment decisions.

- Build a Professional Network: Networking is key in the real estate industry. Attend industry events, join professional organizations, and connect with experienced professionals in the field. Building a strong professional network can open doors to job opportunities, mentorship, and valuable industry insights.

- Continual Learning: The real estate industry is constantly evolving, so it’s important to stay updated on industry trends and best practices. Continual learning through professional development courses, seminars, and certifications will help you stay ahead in the field and demonstrate your commitment to ongoing growth and improvement.

- Obtain Professional Certifications: Consider pursuing professional certifications to enhance your credibility and marketability as an asset manager. Certifications such as Certified Commercial Investment Member (CCIM) and Chartered Financial Analyst (CFA) are highly regarded in the industry and can demonstrate your expertise and commitment to real estate asset management.

- Seek Job Opportunities: Once you have built a strong educational foundation, gained practical experience, and developed industry knowledge, start seeking job opportunities. Look for entry-level positions in real estate firms, asset management companies, or investment firms. Consider roles such as analyst, assistant asset manager, or junior asset manager to gain further experience and grow in your career.

- Continuously Grow and Adapt: The field of real estate asset management is dynamic, so it’s important to continuously grow and adapt to changes in the industry. Stay updated on market trends, technology advancements, and regulatory developments. Seek opportunities to take on new challenges and expand your skillset to thrive in the competitive landscape of real estate asset management.

Starting a career in asset management in the real estate industry requires a combination of education, practical experience, industry knowledge, and networking. By following these steps and continuously investing in your professional development, you can lay a strong foundation for a successful career in real estate asset management.

Common Challenges in Real Estate Asset Management

While asset management in the real estate industry can be rewarding, it also comes with its fair share of challenges. Successful asset managers must navigate these challenges to ensure the long-term success of their real estate investments. Here are some common challenges faced in real estate asset management:

- Market Volatility: Real estate markets can be volatile, with fluctuations in property values, rental rates, and demand. Asset managers must constantly monitor market trends and adjust their strategies accordingly to mitigate potential risks and capitalize on market opportunities.

- Tenant Turnover: Tenant turnover can affect cash flow and create vacancies. Asset managers must implement effective tenant retention strategies, address tenant concerns, and ensure timely lease renewals to minimize turnover and maintain a stable income stream.

- Maintenance and Repairs: Properties require ongoing maintenance and repairs to preserve their value and appeal. Asset managers must effectively manage maintenance budgets, coordinate with service providers, and address repair needs promptly to ensure tenant satisfaction and protect the property’s value.

- Regulatory Compliance: Real estate asset management is subject to various local, state, and federal regulations. Asset managers must stay updated on legal requirements, such as rental laws, safety standards, and environmental regulations, to ensure compliance and mitigate legal risks.

- Financing and Capital Management: Securing financing and managing capital can present challenges for real estate asset managers. Availability of financing, interest rates, and investor expectations can affect the feasibility of projects. Asset managers must carefully manage cash flow, budgeting, and investor expectations to ensure a sound financial foundation.

- Changing Tenant Preferences: Tenant preferences and market demands can evolve over time. Asset managers must stay ahead of changes in tenant preferences, amenities, and technological advancements to attract and retain quality tenants and maintain a competitive edge in the market.

- Market Competition: Real estate asset management is a competitive industry, particularly in desirable markets. Asset managers must differentiate their properties and develop a unique value proposition to attract tenants and maintain a competitive edge in the market.

- Environmental and Sustainability Considerations: Increasing emphasis on sustainability and energy efficiency poses challenges and opportunities for asset managers. They must navigate green building regulations, implement sustainable practices, and adopt energy-efficient technologies to reduce environmental impact and attract environmentally conscious tenants.

- Technological Advancements: Rapid technological advancements impact real estate asset management. Asset managers need to stay updated on emerging technologies, such as property management software, data analytics tools, and smart building technologies, to streamline operations and enhance tenant experiences.

- Asset Disposition: Disposing of assets at the right time and at the best possible price can be a challenge. Asset managers must assess market conditions, property values, and investor expectations to determine the optimal time for asset disposition and execute a successful sale.

Addressing these common challenges requires strategic planning, continuous learning, and adaptability. Successful asset managers embrace these challenges as opportunities for growth and proactively implement strategies to mitigate risks, optimize property performance, and deliver value to investors and stakeholders.

Best Practices for Successful Asset Management in Real Estate

Successful asset management in real estate requires a strategic and proactive approach to maximize property value and financial performance. By implementing best practices, asset managers can effectively navigate challenges and unlock the full potential of their real estate investments. Here are some key best practices for successful asset management in the real estate industry:

- Develop a Comprehensive Business Plan: Start by creating a detailed business plan that outlines specific goals, strategies, and performance metrics for the property. This plan should align with the investment objectives and consider market conditions, tenant demands, and potential risks.

- Thoroughly Analyze and Evaluate Properties: Conduct comprehensive due diligence before acquiring or taking over a property. Assess the property’s financial performance, maintenance needs, tenant leases, and potential risks to make informed investment decisions.

- Proactive Tenant Relationship Management: Cultivate strong relationships with tenants by providing excellent customer service, responding to their needs, and addressing concerns promptly. By fostering positive tenant relationships, asset managers can increase tenant satisfaction and reduce turnover.

- Implement Effective Lease Management: Maintain a proactive approach to lease management, ensuring that lease agreements are properly executed and enforced. Regularly review lease expirations, negotiate competitive rental rates, and implement lease renewal strategies to minimize vacancies and optimize rental income.

- Continuously Monitor and Evaluate Property Performance: Regularly assess property performance by monitoring key performance indicators, financial metrics, and market trends. This allows asset managers to identify areas for improvement, make data-driven decisions, and take proactive actions to maximize property value.

- Invest in Property Maintenance and Upkeep: Implement a proactive maintenance plan to keep properties in optimal condition. This includes conducting regular inspections, preventive maintenance, and addressing repair needs promptly to minimize costly issues and improve tenant satisfaction.

- Stay Updated on Legal and Regulatory Requirements: Maintain a thorough understanding of local, state, and federal laws and regulations that apply to real estate asset management. Stay updated on any changes that may impact property operations, tenant rights, or environmental responsibilities.

- Leverage Technology: Embrace technology tools and platforms to enhance property operations and streamline processes. Utilize property management software, data analytics, and automation systems to track financials, manage leases, and improve overall operational efficiency.

- Regularly Communicate with Stakeholders: Maintain open and transparent communication with property owners, investors, and other stakeholders. Provide regular performance reports, updates on market conditions, and any relevant property information to ensure stakeholders are informed and engaged.

- Adapt to Market Trends and Emerging Opportunities: Stay agile and adaptable to market trends and emerging opportunities in the real estate industry. Continuously monitor market conditions, tenant preferences, and technological advancements to identify potential value-add opportunities and adapt asset management strategies accordingly.

By following these best practices, asset managers can maximize the value and financial performance of real estate investments. Strategic planning, proactive property management, tenant relations, and leveraging technology are key pillars in successful asset management, ensuring long-term success and profitability for real estate portfolios.

Technology and Innovation in Real Estate Asset Management

Technology and innovation have had a significant impact on the real estate industry, including asset management. The adoption of technological solutions has transformed the way asset managers operate, enabling greater efficiency, data-driven decision-making, and enhanced tenant experiences. Here are some key areas where technology and innovation are driving changes in real estate asset management:

Property Management Software: Property management software has revolutionized the way asset managers oversee property operations. These platforms provide a centralized system for managing leases, tracking income and expenses, organizing maintenance requests, and generating reports. Property managers can streamline administrative tasks, improve communication with tenants and service providers, and gain real-time insights into property performance.

Data Analytics and Business Intelligence: The use of data analytics and business intelligence tools allows asset managers to make informed decisions based on accurate and comprehensive data. By analyzing property performance metrics, market trends, and tenant behavior, asset managers can identify opportunities to optimize rental income, reduce expenses, and improve tenant satisfaction. Data analytics also enable proactive maintenance planning and predictive insights, helping to minimize unexpected repairs and disruptions.

Smart Building Technologies: The advent of smart building technologies has transformed how buildings are managed and operated. These technologies include IoT (Internet of Things) devices, sensors, and automation systems that monitor and control various aspects of the building, such as energy usage, HVAC systems, and security. Asset managers can leverage these technologies to optimize energy efficiency, reduce operating costs, and enhance tenant comfort and safety.

Virtual and Augmented Reality: Virtual and augmented reality (VR/AR) technologies are revolutionizing the way properties are showcased and marketed. Asset managers can utilize virtual tours and 3D visualizations to offer immersive property experiences to potential tenants and investors, even if they are located remotely. This technology allows for better decision-making and reduces the need for physical site visits, saving time and resources.

Artificial Intelligence and Machine Learning: Artificial intelligence (AI) and machine learning (ML) algorithms have the potential to automate and optimize various aspects of real estate asset management. These technologies can analyze large volumes of data, identify patterns, and make predictions. AI-powered chatbots can deliver instant customer service to tenants and respond to inquiries, improving efficiency and tenant satisfaction. ML algorithms can also help identify optimal rental rates, predict maintenance needs, and detect anomalies in property performance.

Digital Platforms and Online Marketplaces: Online platforms and marketplaces have transformed the way properties are bought, sold, and leased. Asset managers can leverage these platforms to market and list properties, connect with potential tenants or buyers, and streamline leasing processes. Additionally, digital platforms provide access to a wider pool of potential tenants or investors, increasing the reach and visibility of real estate assets.

Overall, technology and innovation are reshaping the landscape of real estate asset management. By embracing these advancements, asset managers can streamline operations, enhance tenant experiences, and make data-driven decisions to optimize property performance. Staying abreast of emerging technologies and adopting innovative solutions is essential for staying competitive and driving success in the rapidly evolving real estate industry.

Case Studies: Successful Asset Management in Real Estate

Examining real-life case studies of successful asset management in the real estate industry provides valuable insights into effective strategies and best practices. Here are two examples of successful asset management in real estate:

Case Study 1: Green Towers

Green Towers is a mixed-use development located in a major city. The asset management team implemented innovative strategies to optimize its value and financial performance.

First, they conducted a comprehensive analysis of the market and identified a growing demand for sustainable and energy-efficient buildings. Leveraging this trend, the team implemented sustainable energy initiatives, including the installation of solar panels, energy-efficient lighting systems, and smart temperature controls. This not only reduced operational costs but also attracted environmentally-conscious tenants.

Second, the asset managers focused on enhancing the tenant experience. They introduced amenities such as a fitness center, rooftop gardens, and shared workspaces to create a vibrant and desirable living and working environment. This led to increased tenant satisfaction, higher retention rates, and positive word-of-mouth referrals.

Lastly, the team adopted a data-driven approach to decision-making. They utilized advanced property management software to monitor key performance indicators, analyze financial metrics, and track market trends. This allowed them to make informed decisions regarding rental rates, lease renewals, and property maintenance.

As a result of these strategies, Green Towers achieved higher occupancy rates, increased rental income, and enhanced property value. The successful implementation of sustainable initiatives, tenant-centric amenities, and data-driven decision-making contributed to the long-term success of the asset.

Case Study 2: Downtown Retail Plaza

A downtown retail plaza faced challenges due to increased competition from online shopping and changing consumer preferences. The asset management team deployed innovative strategies to revitalize the property.

First, they conducted extensive market research and identified a demand for experiential retail. They repositioned the property by curating a mix of unique, local retailers, and introducing engaging experiences such as live performances and pop-up events. This transformed the plaza into a vibrant community hub and attracted a diverse customer base.

Second, the team leveraged technology to enhance the tenant and customer experience. They implemented an app that provided shoppers with personalized recommendations, special discounts, and convenient parking options. This digital platform improved customer engagement and loyalty while providing valuable data insights for the asset managers.

Lastly, the asset managers focused on proactive tenant relationship management. They fostered strong partnerships with retailers, providing support and guidance to help them succeed. This included collaborating on marketing initiatives, facilitating vendor partnerships, and offering flexible lease terms to adapt to changing business needs.

As a result of these strategies, the downtown retail plaza experienced a revitalization. Vacancy rates decreased, foot traffic increased, and sales improved. By embracing experiential retail, leveraging technology, and nurturing tenant relationships, the asset management team successfully transformed the property into a thriving destination.

These case studies highlight the importance of strategic planning, innovative initiatives, and tenant-centric approaches in achieving successful asset management in real estate. By identifying market trends, adopting sustainable practices, utilizing technology, and focusing on tenant satisfaction, asset managers can drive the success of real estate investments and deliver sustainable value to stakeholders.

Future Trends in Real Estate Asset Management

The real estate industry is constantly evolving, and asset management practices must adapt to emerging trends and technologies. Here are some future trends that are expected to shape the field of real estate asset management:

- Technology Integration: The integration of technology will continue to play a significant role in real estate asset management. Artificial intelligence, machine learning, IoT devices, and data analytics will become increasingly prevalent, allowing asset managers to make more accurate predictions, automate processes, and optimize property performance.

- Eco-Friendly and Sustainable Practices: Sustainability will be at the forefront of real estate asset management. Building certifications, such as LEED (Leadership in Energy and Environmental Design), will become more common. Asset managers will focus on implementing energy-efficient solutions, green building practices, and eco-friendly technologies to reduce environmental impact and attract environmentally-conscious tenants.

- Virtual and Augmented Reality: Virtual and augmented reality technologies will continue to transform the way properties are marketed, leased, and managed. Virtual tours and immersive experiences will become standard practice in showcasing properties, allowing potential tenants and investors to visualize spaces without physical visits. AR applications will enhance maintenance and repair processes, providing real-time information and instructions.

- Data-Centric Decision-Making: Data and analytics will play an increasingly important role in asset management decision-making. Asset managers will rely on advanced data analytics tools to identify trends, make predictions, and optimize property performance. This data-centric approach will enhance strategic planning, risk management, and cost optimization.

- Tenant-Centric Services: Tenant expectations are evolving, and asset managers will prioritize tenant-centric services to attract and retain high-quality tenants. This includes providing personalized experiences, offering flexible leasing options, and delivering amenities that align with the changing work and lifestyle preferences of tenants.

- Proactive Risk Management: As the real estate landscape becomes more complex, asset managers will focus on proactive risk identification and mitigation. They will closely monitor regulatory changes, market shifts, and potential disruptions. This will include incorporating resilience strategies, such as disaster preparedness plans and cybersecurity measures, into asset management practices.

- Social Impact Investing: Investors are increasingly seeking opportunities to achieve financial returns while making a positive social impact. Asset managers will respond to this trend by integrating social impact considerations into their investment strategies. This may include investing in affordable housing, sustainable development, or community-focused initiatives to align with the values of socially-conscious investors.

- Collaborative and Shared Spaces: The rise of remote work and shared economy models will drive the demand for collaborative and shared spaces. Asset managers will adapt to this trend by repurposing underutilized spaces, offering flexible lease agreements, and creating communal areas that foster innovation and collaboration.

- Emphasis on Health and Wellness: The COVID-19 pandemic has heightened the importance of health and wellness in the built environment. Asset managers will prioritize the implementation of health-focused measures, such as improved indoor air quality, touchless technologies, and wellness amenities. This will cater to the increasing demand for healthier and safer spaces.

These future trends in real estate asset management will reshape the industry and present new opportunities for asset managers to optimize property performance, enhance tenant experiences, and deliver sustainable value. By staying agile and embracing these trends, asset managers can thrive in the evolving real estate landscape and drive the success of their real estate investments.

Conclusion

Asset management is a critical component of the real estate industry, encompassing strategic planning, operational oversight, and financial optimization of properties. Successful asset management requires a combination of market knowledge, financial acumen, and innovative thinking.

Throughout this article, we explored various aspects of asset management in real estate, including its overview, benefits, key roles and responsibilities, strategies, career opportunities, challenges, best practices, technology integration, case studies, and future trends.

We learned that asset managers play a pivotal role in maximizing property value, generating higher returns, mitigating risks, and enhancing tenant satisfaction. By implementing effective strategies such as optimizing rental income, managing property operations, and staying updated on market trends, asset managers can drive the long-term success of real estate investments.

However, asset management does come with its fair share of challenges, including market volatility, tenant turnover, regulatory compliance, and market competition. By proactively addressing these challenges and embracing best practices, such as developing comprehensive business plans, utilizing technology, and fostering strong tenant relationships, asset managers can overcome obstacles and achieve success.

Looking to the future, we discussed emerging trends in real estate asset management, including technology integration, sustainable practices, data analytics, tenant-centric services, and social impact investing. By staying ahead of these trends, asset managers can position themselves for success in an evolving industry landscape.

In conclusion, asset management in real estate is a dynamic and rewarding field that requires a deep understanding of the market, financial expertise, and innovative thinking. By embracing best practices, leveraging technology, and adapting to future trends, asset managers can thrive and drive the success of their real estate investments, delivering sustainable value to stakeholders and shaping the future of the industry.