Finance

How To Read An Equifax Credit Report

Published: October 21, 2023

Learn how to interpret and analyze an Equifax credit report for better financial decision-making. Understand the key sections and information provided in this comprehensive finance resource.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Section 1: Understanding Equifax Credit Reports

- Section 2: Retrieving an Equifax Credit Report

- Section 3: Key Components of an Equifax Credit Report

- Section 4: Interpreting the Personal Information Section

- Section 5: Analyzing the Accounts Section

- Section 6: Examining the Public Records Section

- Section 7: Reviewing the Inquiries Section

- Section 8: Understanding the Credit Score Section

- Section 9: Identifying Errors and Disputing Inaccurate Information

- Section 10: Tips for Improving Your Equifax Credit Report

- Conclusion

Introduction

Welcome to the world of credit reports, specifically Equifax credit reports. Understanding your credit report is crucial for managing your finances effectively and making informed decisions about borrowing, renting, or even landing a job. Equifax, one of the largest credit reporting agencies, collects and maintains extensive information about your credit history.

In this article, we will guide you through the process of reading an Equifax credit report. We will explain how to retrieve your report, highlight the key components to focus on, and provide tips for interpreting and analyzing the information presented. Additionally, we will discuss specific sections such as personal information, accounts, public records, inquiries, and credit scores.

Equifax credit reports contain crucial details on your financial behavior, including your payment history, outstanding debts, credit limits, and any public records associated with your financial activities. This information is used by lenders, landlords, and even employers to assess your creditworthiness and financial stability.

Reading your Equifax credit report can empower you to identify inaccuracies, detect potential identity theft, and take steps to improve your credit standing. Whether you’re a first-time borrower or looking to enhance your financial profile, understanding your Equifax credit report is an essential skill.

Now, let’s delve into the details of retrieving and understanding an Equifax credit report, so that you can take control of your financial future and make well-informed financial decisions.

Section 1: Understanding Equifax Credit Reports

Equifax credit reports provide a comprehensive overview of your credit history and financial behavior. By understanding the structure and content of these reports, you can gain valuable insights into your financial standing.

An Equifax credit report is divided into several sections, each containing specific information about your credit activities:

- Personal Information: This section includes your name, date of birth, Social Security number, current and previous addresses, and employment history.

- Accounts: Here, you’ll find details about your credit accounts, including loans, credit cards, mortgages, and other lines of credit. This section provides information about the balances, payment history, credit limits, and any joint account holders or authorized users.

- Public Records: This section reveals any legal financial obligations or public records associated with your credit history, such as bankruptcies, tax liens, or judgments.

- Inquiries: The inquiries section lists all the entities that have accessed your credit report within a specific time frame. It differentiates between “hard” inquiries (initiated by lenders for credit applications) and “soft” inquiries (typically generated for promotional or background check purposes).

- Credit Scores: This section provides your credit scores based on Equifax’s scoring model. These scores represent your creditworthiness and are crucial for lenders to assess the risk of extending credit to you.

Equifax credit reports are updated regularly and may vary depending on the information reported by your creditors. It’s important to note that Equifax is just one of the three major credit reporting agencies, alongside Experian and TransUnion. While they collect similar information, differences between their reports may occur due to variations in reporting practices by lenders.

Understanding each section of your Equifax credit report is essential for ensuring its accuracy and detecting any potential errors or inconsistencies. In the following sections, we will dive deeper into each of these sections, providing a comprehensive guide to reading and interpreting your Equifax credit report.

Section 2: Retrieving an Equifax Credit Report

Retrieving your Equifax credit report is a straightforward process that can be done online or through mail. You have a right to access your credit report for free once every 12 months, thanks to the Fair Credit Reporting Act (FCRA).

To obtain your Equifax credit report online, you can visit the official Equifax website or use a reputable credit monitoring service. Follow these step-by-step instructions:

- Visit the Equifax website or the website of a trusted credit monitoring service.

- Click on the option to request your credit report.

- Provide the required personal information, such as your name, address, Social Security number, and date of birth.

- Verify your identity by answering security questions or providing necessary documentation.

- Once your identity is confirmed, you will be able to view and download your Equifax credit report.

If you prefer to retrieve your Equifax credit report by mail, you can request a copy by using a standardized request form. Follow these steps:

- Visit the Equifax website or contact their customer service to obtain the request form.

- Fill out the form with your personal information, including your name, address, Social Security number, and date of birth.

- Enclose any required documentation, such as proof of address or identification, if specified.

- Mail the completed form and necessary documentation to the designated Equifax address.

- Allow several business days for Equifax to process your request and mail your credit report to you.

Whether you choose to retrieve your Equifax credit report online or by mail, it’s important to review it regularly to stay aware of your financial standing and ensure the accuracy of the information provided. Keeping track of your credit report allows you to identify any errors, detect fraudulent activity, and take appropriate steps to address and resolve any issues that may arise.

Section 3: Key Components of an Equifax Credit Report

An Equifax credit report comprises several key components that provide a comprehensive overview of your credit history and financial behavior. Understanding these components will help you navigate and analyze your credit report effectively. Let’s explore the main sections of an Equifax credit report:

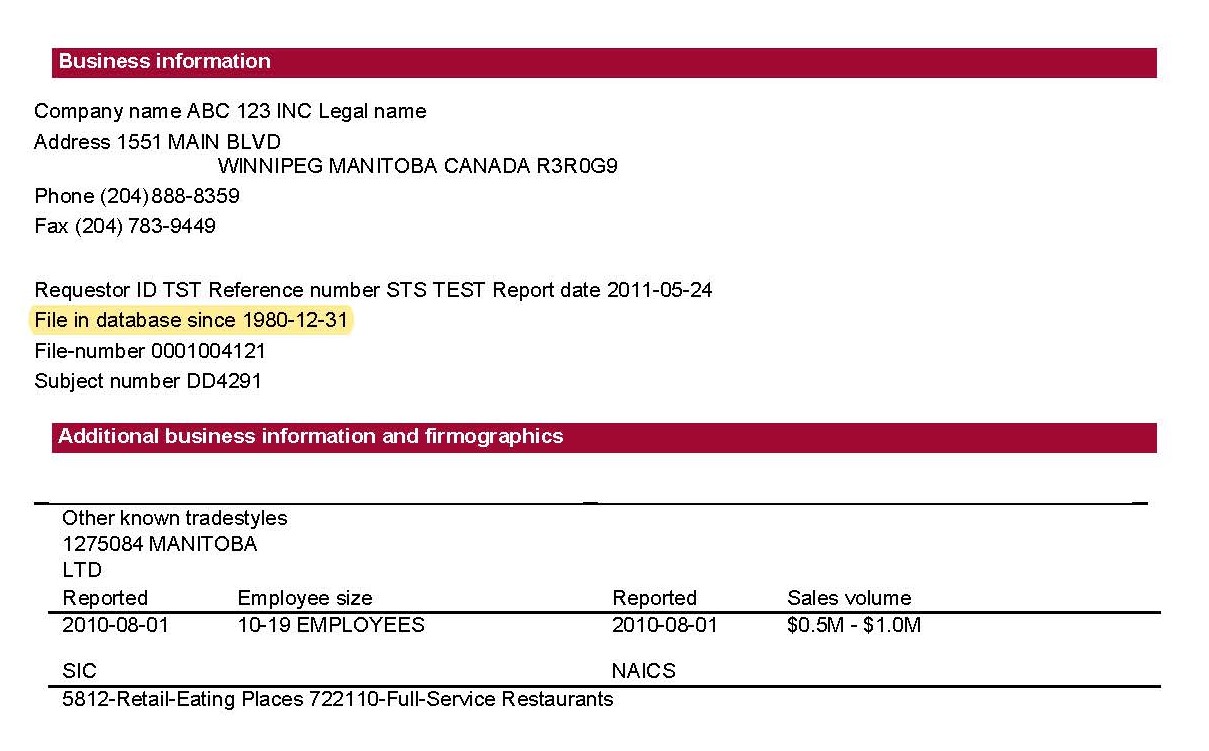

- Personal Information: This section includes your name, date of birth, Social Security number, current and previous addresses, and employment history. It is crucial to review this information for accuracy, as any errors could negatively impact your credit and raise suspicion of fraudulent activity.

- Accounts: The accounts section provides details about your credit accounts, such as credit cards, loans, mortgages, and other lines of credit. It includes information about the balances, payment history, credit limits, and any joint account holders or authorized users.

- Public Records: This section reveals any legal financial obligations or public records associated with your credit history. It may include bankruptcies, tax liens, judgments, or other public records that have a significant impact on your creditworthiness.

- Inquiries: The inquiries section lists all the entities that have accessed your credit report within a certain time frame. It differentiates between “hard” inquiries (initiated by lenders for credit applications) and “soft” inquiries (typically generated for promotional or background check purposes).

- Credit Scores: This section provides your credit scores based on Equifax’s scoring model. Your credit scores represent your creditworthiness and are crucial for lenders to assess the risk of extending credit to you.

These components collectively provide a snapshot of your financial habits, payment history, and creditworthiness. It’s essential to review each section carefully to ensure the accuracy of the information and identify any potential errors or inconsistencies.

By understanding these key components of an Equifax credit report, you can effectively evaluate your financial health, detect any red flags, and take appropriate measures to maintain or improve your credit standing. In the following sections, we will delve deeper into analyzing and interpreting each section of Equifax credit reports, allowing you to maximize the benefits of this valuable resource.

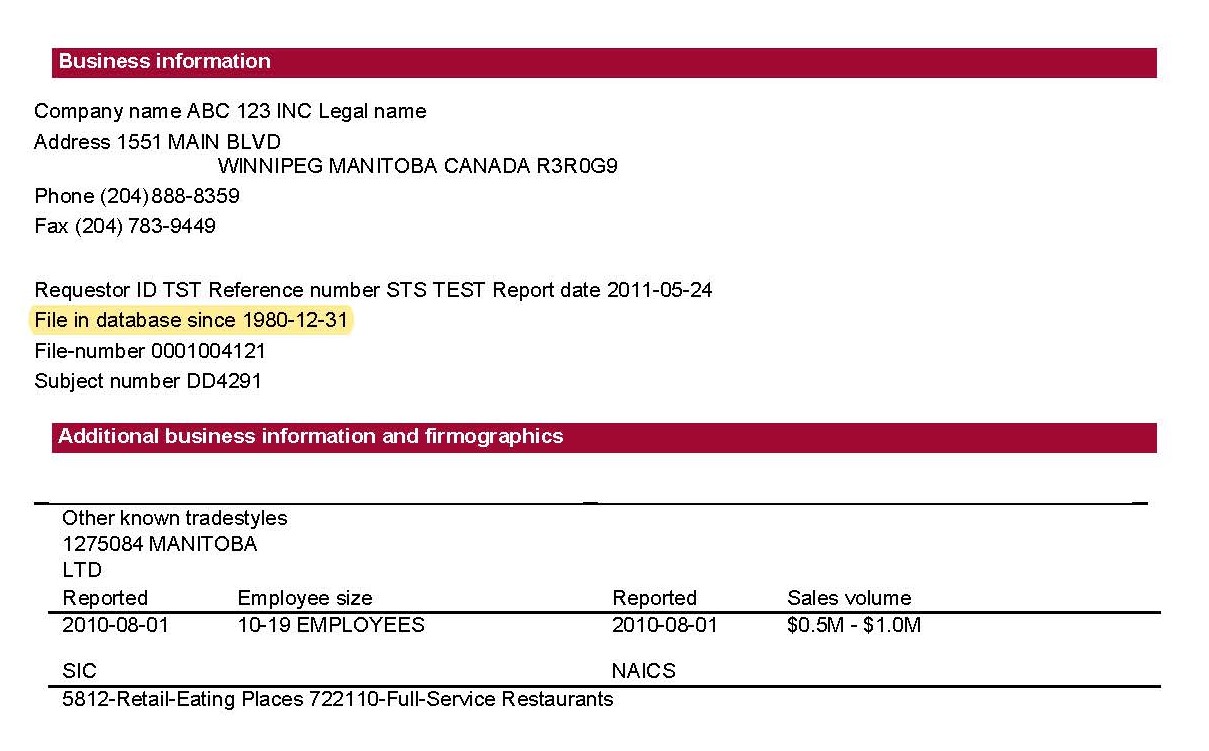

Section 4: Interpreting the Personal Information Section

The personal information section of an Equifax credit report contains vital details about your identity and contact information. Reviewing and interpreting this section is crucial to ensure the accuracy of the information listed. Here’s what you need to know:

1. Name and Identification: Check that your name is spelled correctly and verify that it matches your official identification documents. Any discrepancies could indicate potential identity theft or errors in data entry.

2. Social Security Number (SSN): Ensure that your SSN is accurate and belongs to you. If there are any variations or inconsistencies, it’s imperative to address them promptly to prevent potential fraud or misreporting.

3. Current and Previous Addresses: Verify that the listed addresses are accurate and belong to you. Pay close attention to old addresses, as they could still be associated with your credit history. Inaccurate addresses may impact your creditworthiness and may indicate fraudulent activity.

4. Employment History: Ensure that your employment history is correctly listed. Though this information may not directly impact your credit report, potential employers or lenders may use it as a verification measure. Discrepancies could raise red flags during the application process.

5. Errors and Discrepancies: Review the personal information section for any errors, misspellings, or outdated information. Inaccurate personal information could lead to mix-ups with other individuals or hinder your ability to access credit due to identity-related concerns.

If you identify any errors or discrepancies in the personal information section, it is essential to take prompt action to correct them. Contact Equifax directly to report the inaccuracies and provide any necessary documentation to support the corrections. Additionally, consider monitoring your credit report more frequently to ensure that the correct personal information is reflected on future reports.

By interpreting and verifying the personal information section of your Equifax credit report, you can maintain the accuracy of your credit history and prevent potential issues related to identity theft or reporting errors. Remember to regularly review this section to stay vigilant and protect your financial well-being.

Section 5: Analyzing the Accounts Section

The accounts section of an Equifax credit report provides detailed information about your credit accounts, offering a comprehensive view of your financial obligations and payment history. Analyzing this section is crucial for understanding your overall creditworthiness and financial management. Here’s how to interpret and analyze the accounts section:

1. Types of Accounts: Take note of the different types of accounts listed, such as credit cards, mortgages, student loans, auto loans, and personal loans. Understanding the range of accounts you hold can give you insight into your financial diversity and credit utilization.

2. Account Balances: Review the balances listed for each account. High balances relative to credit limits may indicate a higher credit utilization ratio, which can impact your credit score. Aim to keep your balances low to demonstrate responsible credit utilization.

3. Payment History: Pay close attention to the payment history for each account. This section shows whether your payments have been made on time, late, or if any payments have been missed. Consistently making on-time payments demonstrates responsible financial behavior.

4. Credit Limits: Note the credit limits or loan amounts associated with each account. Understand your credit utilization ratio by comparing your balances to the available credit limits. Lower utilization ratios are generally favored by lenders and can positively impact your credit score.

5. Joint Accounts or Authorized Users: If you share any accounts with another person, such as a joint account holder or authorized user, it will be indicated in this section. Ensure that these accounts are accurately represented and, if applicable, communicate with the other account holder to maintain shared account responsibilities.

6. Closed or Inactive Accounts: Take note of any closed or inactive accounts. While closed accounts still impact your credit history, they may not have a significant effect on your current creditworthiness. However, it’s crucial to confirm that these accounts are accurately marked as closed to avoid any potential reporting errors.

Analyzing the accounts section of your Equifax credit report allows you to assess your overall financial responsibility, credit utilization, and payment history. It’s important to address any negative information, such as late payments or high balances, and take steps to rectify them. By maintaining a positive payment history and responsible credit utilization, you can demonstrate financial stability and improve your creditworthiness over time.

Section 6: Examining the Public Records Section

The public records section of an Equifax credit report provides essential information about any legal financial obligations and public records associated with your credit history. This section allows lenders and other entities to assess your financial stability and responsibility. Here’s how to examine and understand the public records section:

1. Bankruptcies: This section will list any bankruptcy filings you have made. Bankruptcy has a significant impact on your credit report and can stay on your record for several years. It’s important to review this information for accuracy and to understand its potential impact on your creditworthiness.

2. Tax Liens: Tax liens are filed when you owe unpaid taxes to the government. This section will indicate if you have any tax liens filed against you. It’s essential to address any outstanding tax liens promptly to avoid further complications and negative effects on your credit report.

3. Judgments: Judgments occur when a court awards a creditor the right to collect a debt from you. This section will list any outstanding judgments against you. It’s crucial to review this information and take necessary steps to address and resolve the judgments to minimize their impact on your credit standing.

4. Other Public Records: Other public records that may appear in this section include foreclosures, repossessions, or any other legal financial obligations. Carefully review this information for accuracy and take appropriate action to address any discrepancies or outstanding obligations.

Examining the public records section of your Equifax credit report is crucial for maintaining an accurate and up-to-date credit profile. If you identify any inaccuracies or discrepancies, it’s important to dispute these with Equifax to ensure the correction or removal of any erroneous information.

Keep in mind that public records can have a significant impact on your creditworthiness and ability to obtain credit. Understanding and addressing any outstanding public records can help you improve your credit standing and demonstrate to lenders your commitment to financial responsibility.

Section 7: Reviewing the Inquiries Section

The inquiries section of an Equifax credit report provides a record of the entities that have accessed your credit information. It is crucial to review this section to understand who has requested your credit report and for what purpose. Here’s how to effectively review and interpret the inquiries section:

1. Hard Inquiries: Hard inquiries occur when you apply for credit, such as a loan or credit card. These inquiries are initiated by lenders and have a temporary impact on your credit score. Review the list of hard inquiries to ensure that you authorized each inquiry and recognize the associated creditors.

2. Soft Inquiries: Soft inquiries are generated for promotional purposes, pre-approved offers, or when you check your own credit report. These inquiries do not impact your credit score and are typically shown for informational purposes. Verify that the soft inquiries listed are expected and legitimate.

3. Frequency of Inquiries: Take note of the frequency of inquiries in this section. Frequent or multiple hard inquiries within a short period can raise concerns for lenders, as it may indicate a higher risk of overextending credit. Aim to limit the number of hard inquiries you generate within a specified timeframe, especially when actively seeking new credit.

4. Unauthorized Inquiries: Carefully review the inquiries section for any unauthorized or unfamiliar inquiries. If you notice any inquiries that you did not authorize or do not recognize, it may indicate a potential case of identity theft. Take immediate action to report these inquiries to Equifax and protect your credit information.

Regularly reviewing the inquiries section of your Equifax credit report is essential for monitoring who has accessed your credit information. By identifying any unauthorized inquiries, you can take steps to mitigate potential fraud and protect your credit profile. Additionally, familiarizing yourself with the types and frequency of inquiries can help you make informed decisions regarding new credit applications.

Remember, while hard inquiries may have a slight impact on your credit score, the effect is usually temporary and diminishes over time. Focus on maintaining responsible credit behavior and limit unnecessary inquiries to maintain a healthy credit profile.

Section 8: Understanding the Credit Score Section

The credit score section of an Equifax credit report provides valuable information about your creditworthiness. Your credit score is a numerical representation of your credit risk, and it plays a significant role in determining whether lenders approve your loan applications and the terms they offer. Here’s how to understand and interpret the credit score section:

1. Credit Score Range: Equifax credit scores typically range from 300 to 850, with a higher score indicating lower credit risk. Familiarize yourself with the credit score range to understand where your score falls and evaluate your creditworthiness.

2. Score Factors: Equifax provides factors that contribute to your credit score. These factors highlight the elements that have the most significant impact on your creditworthiness, such as payment history, credit utilization, length of credit history, types of credit accounts, and recent credit inquiries. Understanding these factors can guide you in improving your credit score over time.

3. Score History: The score history section displays your credit scores over time. It allows you to track changes in your credit score and identify any significant fluctuations. Monitoring your score history allows you to assess the impact of your financial behavior on your creditworthiness.

4. Comparison to National Average: Equifax may provide a comparison of your credit score to the national average. This information gives you a benchmark to evaluate your credit performance relative to the broader population. Aim to achieve or exceed the national average to demonstrate strong creditworthiness.

5. Credit Score Education: Equifax may offer resources and educational materials to help you understand credit scores and improve your credit health. Take advantage of these resources to gain insights into credit management and make informed decisions regarding your financial well-being.

Understanding the credit score section of your Equifax credit report is essential for assessing your creditworthiness and identifying areas for improvement. By focusing on the factors that contribute to your credit score, you can take steps to maintain a healthy credit profile and improve your overall financial standing.

Remember that credit scores are just one aspect of your creditworthiness, and lenders may consider other factors when evaluating your credit applications. However, a strong credit score increases your chances of obtaining favorable terms, lower interest rates, and greater access to credit. Regularly monitoring your credit score allows you to stay informed about your credit health and take proactive measures to maintain or enhance it.

Section 9: Identifying Errors and Disputing Inaccurate Information

While Equifax strives to provide accurate credit information, errors can still occur on your credit report. Identifying and addressing these errors is crucial for maintaining a fair and accurate representation of your credit history. Here’s how to identify errors and dispute inaccurate information on your Equifax credit report:

1. Carefully Review Your Credit Report: Thoroughly examine each section of your Equifax credit report, including personal information, accounts, public records, inquiries, and credit scores. Look for any discrepancies, inaccuracies, or outdated information that could be negatively impacting your credit standing.

2. Note Inconsistencies: Pay special attention to mismatched or inaccurate account balances, incorrect payment history, unfamiliar accounts, duplicate entries, or any other information that does not align with your financial records. These inconsistencies may suggest reporting errors or potential identity theft.

3. Collect Supporting Documentation: Gather supporting documents that validate your claim of inaccurate or erroneous information. This can include bank statements, payment receipts, correspondence with lenders, or any other relevant documents that prove your case.

4. File a Dispute with Equifax: If you identify an error on your Equifax credit report, file a dispute directly with Equifax to have it corrected. You can initiate a dispute through their website, by mail, or by phone. Provide a clear explanation of the error and include any supporting documentation that strengthens your case.

5. Follow Up on the Dispute: After filing a dispute, monitor the progress and follow up with Equifax to ensure that the incorrect information is thoroughly investigated and corrected. Equifax is required by law to investigate and respond to your dispute within a specified time frame.

6. Monitor Your Credit Report: Regularly review your Equifax credit report to ensure that any disputed errors are resolved and that your credit information remains accurate. Consider enrolling in credit monitoring services or using online tools that provide real-time updates on your credit profile and alert you to any changes.

Disputing inaccurate information on your Equifax credit report is essential for maintaining a fair and accurate credit history. By taking the necessary steps to correct errors, you can ensure that your creditworthiness is properly represented, potentially improving your chances of obtaining favorable credit terms and opportunities in the future.

Remember to also review your credit reports from the other major credit reporting agencies, Experian and TransUnion, and dispute any inaccuracies found on those reports as well. By actively monitoring and managing your credit information, you can maintain a healthy credit profile and have confidence in your financial standing.

Section 10: Tips for Improving Your Equifax Credit Report

Improving your Equifax credit report is a continuous process that requires diligent effort and responsible financial habits. By taking proactive steps, you can strengthen your creditworthiness and increase your chances of accessing favorable credit terms. Here are some tips for improving your Equifax credit report:

1. Pay Your Bills on Time: Consistently making on-time payments is one of the most important factors in maintaining a healthy credit report. Late payments can have a significant negative impact on your credit score. Set up automatic payments or create reminders to ensure you don’t miss payment due dates.

2. Pay Down Debts: Aim to reduce your outstanding balances on credit accounts. Lowering your credit utilization ratio (the amount of credit you’re using compared to your total available credit) can positively impact your credit score. Develop a plan to pay off debts strategically, focusing on high-interest accounts or those with the highest balances.

3. Avoid Opening Unnecessary Credit Accounts: While having a mix of credit types can be beneficial, be cautious about opening new credit accounts unnecessarily. Each new account can potentially lower your average account age and generate hard inquiries, temporarily impacting your credit score.

4. Regularly Monitor Your Credit Report: Stay vigilant by regularly reviewing your Equifax credit report. Look for errors, inaccuracies, or signs of fraudulent activity. Promptly dispute any discrepancies and keep track of the progress in resolving them. Monitoring your credit report can also help you identify areas for improvement and track your credit health.

5. Use Credit Responsibly: Be mindful of your credit usage and avoid maxing out your credit cards or constantly relying on credit for everyday expenses. Aim to keep your credit utilization below 30% of your available credit. Responsible credit usage demonstrates to lenders that you can manage credit responsibly.

6. Build a Positive Credit History: If you have a limited credit history, consider establishing credit by opening a secured credit card or becoming an authorized user on someone else’s credit card. Make small charges and consistently pay off the balances in full each month to build a positive payment history.

7. Establish a Budget: Creating a budget helps you manage your finances effectively and avoid overspending. Prioritize your debt payments, allocate funds for regular expenses, and set aside savings. Sticking to a budget helps ensure that you have enough funds to meet your financial obligations and avoid late payments.

8. Avoid Closing Unused Credit Accounts: While it may be tempting to close unused credit accounts, think twice before doing so. Closing accounts can reduce your available credit, potentially increase your credit utilization ratio, and shorten your credit history. However, if the account has high fees or you’re concerned about security, weigh the pros and cons before making a decision.

Improving your Equifax credit report takes time and consistent effort. By implementing these tips and practicing responsible financial habits, you can gradually enhance your creditworthiness and strengthen your overall financial position.

Remember, improving your credit is a long-term process, and positive changes won’t happen overnight. Be patient, stay consistent, and take the necessary steps to build and maintain a strong credit profile.

Conclusion

Understanding your Equifax credit report is essential for managing your financial health and making informed decisions about your creditworthiness. By familiarizing yourself with the different sections and components of your Equifax credit report, you can gain valuable insights into your credit history, identify any errors or discrepancies, and take steps to improve your credit standing.

In this article, we covered the key aspects of reading an Equifax credit report. We discussed how to retrieve your report, interpret the personal information section, analyze the accounts section, examine the public records section, review the inquiries section, and understand the credit score section. Additionally, we explored tips for identifying errors and disputing inaccurate information, as well as strategies for improving your Equifax credit report.

Remember, maintaining a positive credit history requires responsible financial habits such as making on-time payments, reducing debts, monitoring your credit report regularly, and using credit wisely. It’s important to regularly review your Equifax credit report to ensure its accuracy and address any issues that may arise. By doing so, you can build and maintain a strong credit profile that opens doors to better financial opportunities.

Utilize the information and tips provided in this article to take control of your credit and work towards a healthier financial future. Remember that improving your Equifax credit report is a gradual process, and consistency is key. Stay proactive, stay informed, and continue to make smart financial choices to establish and maintain a solid credit foundation.