Finance

How Much Does VYM Pay In Dividends

Published: January 2, 2024

Discover how much VYM pays in dividends and other important finance information. Maximize your investment potential and plan for your financial future.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of dividend-paying ETFs! If you’re looking for a way to generate passive income and build wealth over time, it’s worth exploring the potential of these investment vehicles. In this article, we’ll focus on one specific dividend-paying ETF called VYM (Vanguard High Dividend Yield ETF) and delve into its dividend payments. By understanding how much VYM pays in dividends, you can make informed decisions about your investment strategy and financial goals.

VYM is an exchange-traded fund that aims to track the performance of the FTSE High Dividend Yield Index. This index is composed of U.S. stocks with above-average dividend yields. By investing in VYM, you gain exposure to a diversified portfolio of companies that regularly distribute a portion of their earnings to shareholders.

Dividend-paying ETFs like VYM have gained popularity among investors for several reasons. First, dividends provide a steady stream of income, making them particularly attractive to income-oriented investors, retirees, and those seeking passive income. Second, dividend-paying stocks have historically outperformed non-dividend-paying stocks, offering the potential for both capital appreciation and income. Finally, dividends can act as a cushion during market downturns, providing a source of stability and income when stock prices are volatile.

If you’re considering investing in VYM or any other dividend-paying ETF, it’s essential to understand how dividend yield is calculated. Dividend yield is a percentage that represents the annual dividend payment as a proportion of the ETF’s price. By calculating and comparing dividend yields, you can assess the income-generating potential of different ETFs and make informed investment decisions.

In the following sections, we’ll explore how to calculate dividend yield, factors that influence VYM dividend payments, historical dividend payments of VYM, and risks to consider when investing in dividend-paying ETFs like VYM. Additionally, we’ll compare VYM’s dividend payments with those of other ETFs and discuss the tax implications of receiving dividends from VYM.

Now, let’s dive into the world of VYM dividends and explore the factors that determine how much VYM pays in dividends.

What is VYM?

VYM, also known as the Vanguard High Dividend Yield ETF, is an exchange-traded fund that focuses on providing investors with exposure to a diversified portfolio of U.S. stocks that have a high dividend yield. The fund is managed by Vanguard, one of the world’s largest investment management companies known for its low-cost index funds and ETFs.

As an ETF, VYM offers the benefits of both mutual funds and individual stocks. It combines the diversification of a mutual fund, which invests in a wide variety of assets, with the tradability and flexibility of individual stocks. This means that investors can buy and sell shares of VYM on an exchange throughout the trading day, just like stocks.

The primary objective of VYM is to track the performance of the FTSE High Dividend Yield Index. This index consists of common stocks of U.S. companies that have higher-than-average dividend yields relative to the broader market.

Dividend yield is a key metric used to determine the attractiveness of dividend-paying stocks and ETFs like VYM. It is calculated by dividing the annual dividends per share by the price per share. A higher dividend yield indicates a higher dividend payment relative to the stock or ETF’s price.

VYM invests in a wide range of sectors like financials, healthcare, technology, consumer goods, and energy, among others. By diversifying across various sectors, VYM aims to reduce the risk associated with investing in individual stocks and provide investors with the opportunity to benefit from dividend payments across different industries.

VYM follows a passive investment strategy, aiming to replicate the performance of its underlying index rather than actively picking stocks. This strategy allows VYM to keep its expenses low, making it an attractive option for cost-conscious investors.

Investing in VYM provides investors with exposure to a portfolio of dividend-paying companies that have a track record of consistent and reliable income distribution. By holding shares of VYM, investors can participate in the dividends paid by these companies, which can provide a regular stream of income and potentially contribute to long-term wealth accumulation.

Now that we have a clear understanding of what VYM is, let’s explore the reasons why investing in dividend-paying ETFs like VYM can be beneficial.

Why Invest in Dividend-Paying ETFs?

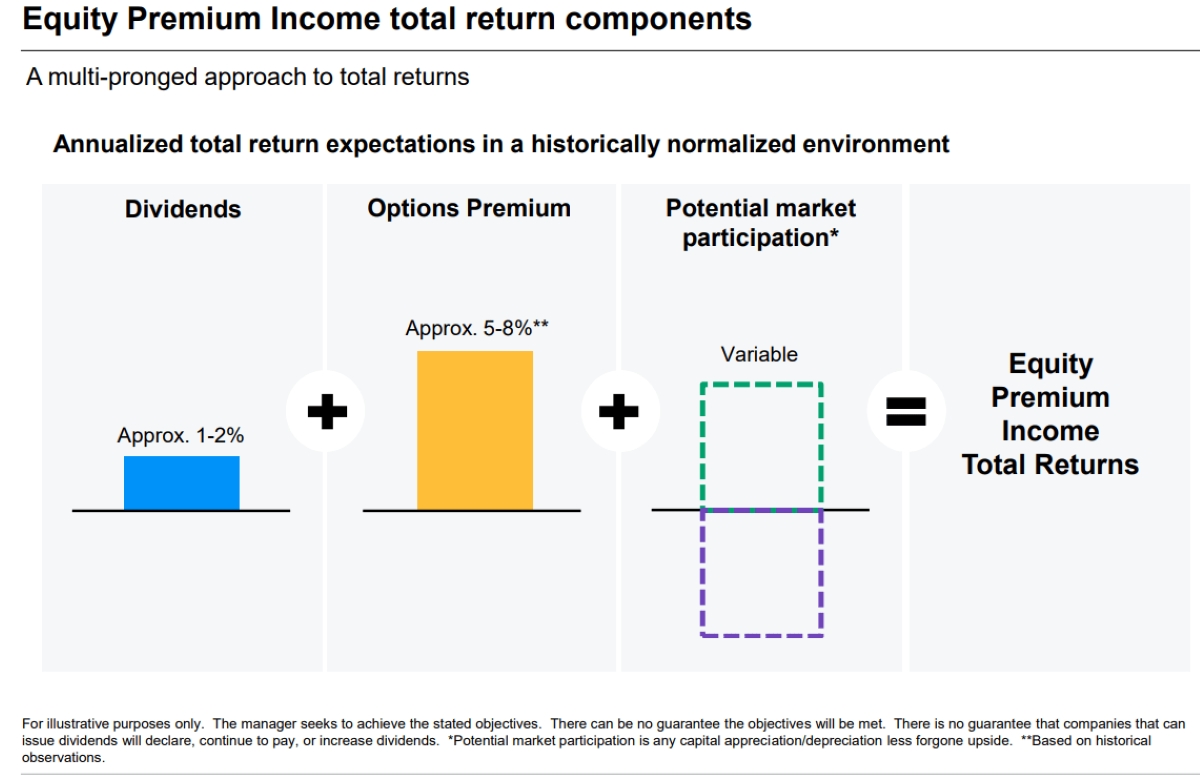

Dividend-paying ETFs, like VYM, offer a unique investment opportunity for investors looking to generate income and potentially grow their wealth over time. Here are some compelling reasons why investing in dividend-paying ETFs can be beneficial:

- Income Generation: Dividend-paying ETFs provide a consistent stream of income. By investing in these funds, investors can receive regular dividend payments, which can help supplement their income or provide a source of passive income in retirement.

- Portfolio Diversification: Dividend-paying ETFs, like VYM, offer exposure to a diversified portfolio of stocks. By investing in a single ETF, investors gain access to a broad range of companies across different sectors and industries. This diversification can help reduce risk and increase the stability of the overall investment portfolio.

- Long-Term Growth Potential: Dividend-paying stocks have historically generated attractive long-term returns. Reinvesting dividends can compound the growth of your investment over time, potentially accelerating wealth accumulation and providing a reliable income stream in the future.

- Stability in Volatile Markets: Dividends can provide stability during market downturns. When stock prices are experiencing volatility, dividend payments can offset some of the losses and provide a consistent income stream, making dividend-paying ETFs an attractive option for risk-averse investors.

- Flexibility and Liquidity: Dividend-paying ETFs, like VYM, can be bought and sold on the stock exchange throughout the trading day. This gives investors the flexibility to adjust their positions as market conditions change and provides liquidity, allowing for easy access to their investment capital.

Additionally, dividend-paying ETFs often offer competitive expense ratios compared to actively managed funds. This means that a larger portion of the investment returns can be passed on to the investor, enhancing the overall performance of the portfolio.

While there are numerous benefits to investing in dividend-paying ETFs, it’s important to consider your individual investment goals, risk tolerance, and time horizon. Dividend payments are not guaranteed, and the performance of dividend-paying stocks and ETFs is subject to market volatility and economic conditions.

Now that we understand the advantages of investing in dividend-paying ETFs, let’s explore how dividend yield is calculated, a key metric that investors use to evaluate the income potential of these ETFs.

How to Calculate Dividend Yield

Dividend yield is a crucial metric that investors use to evaluate the income potential of dividend-paying stocks and ETFs. It represents the percentage of the annual dividend payment relative to the stock or ETF’s price. Calculating dividend yield is relatively straightforward and involves the following formula:

Dividend Yield = (Annual Dividend per Share / Stock or ETF Price) x 100

To calculate the dividend yield of a dividend-paying ETF like VYM, you need two key pieces of information: the annual dividend per share and the current price of the ETF.

The annual dividend per share refers to the total amount of dividends paid by the fund on a per-share basis over the course of a year. This information is readily available and can be found in the fund’s prospectus or through financial websites.

The current price of the ETF represents the price at which the fund is currently trading in the market. This information can be easily accessed through financial news portals, brokerage platforms, or stock market websites.

Once you have the annual dividend per share and the current price of the ETF, you can calculate the dividend yield by dividing the annual dividend per share by the ETF’s price and multiplying the result by 100 to express it as a percentage.

For example, if VYM has an annual dividend per share of $3.00 and is currently trading at $75.00 per share, the calculation would be as follows:

Dividend Yield = ($3.00 / $75.00) x 100 = 4%

In this example, the dividend yield of VYM is 4%, indicating that the annual dividend payment represents 4% of the ETF’s current price.

Calculating dividend yield allows investors to compare the income-generating potential of various dividend-paying stocks and ETFs. The higher the dividend yield, the higher the percentage of income generated by the investment relative to its price.

It’s important to note that dividend yields can fluctuate as stock prices and dividend payments change. Therefore, it’s advisable to regularly review and update the dividend yield calculation to reflect the latest data.

Now that we understand how to calculate dividend yield, let’s explore the factors that influence dividend payments from VYM.

Factors Influencing VYM Dividend Payments

Dividend payments from VYM, like any other dividend-paying ETF, are influenced by a variety of factors. Understanding these factors can help investors gain insights into the sustainability and potential growth of dividend payments. Here are some key factors that influence VYM dividend payments:

- Company Earnings: The earnings of the companies held within VYM’s portfolio are a primary consideration for dividend payments. Strong earnings growth generally translates into higher dividend payments, as companies have more profits to distribute to shareholders. Conversely, if the companies in VYM’s portfolio experience a decline in earnings, dividend payments may be reduced.

- Dividend Policies: Each company within VYM’s portfolio has its own dividend policy that dictates how much and how frequently dividends are paid. Some companies have a long history of consistently increasing their dividends, while others may pay dividends on a more irregular basis. VYM takes into account the dividend policies of the underlying companies when determining its own dividend payments.

- Market Conditions: The overall economic and market conditions can impact dividend payments. During periods of economic growth and stability, companies tend to have stronger earnings, which can lead to higher dividend payments. Conversely, during economic downturns or market volatility, companies may reduce or eliminate dividends to preserve capital and ensure financial stability.

- Interest Rates: Interest rates can influence dividend payments, especially for companies in interest-sensitive sectors such as utilities and financials. When interest rates are low, companies may increase dividend payments to attract investors seeking income. Conversely, if interest rates rise, companies may reduce dividend payments as fixed-income investments become relatively more attractive.

- Profit Margins: Profit margins, which represent the percentage of revenue that a company retains as profits, can impact dividend payments. Companies with higher profit margins are generally more capable of sustaining and increasing dividend payments, as they have a greater ability to generate cash flow for shareholders.

- Industry Trends: Industry-specific factors can also influence dividend payments. Different sectors may have varying levels of profitability, growth prospects, and regulatory environments, which can impact a company’s ability to pay dividends. For example, mature and stable industries like consumer staples and utilities are often associated with higher dividend payouts.

It’s important to note that VYM, as an ETF, is subject to the dividend payments of the underlying companies in its portfolio. The dividend payments received by VYM are then passed on to investors in the form of distributions. The frequency and magnitude of these distributions are determined by the fund’s dividend policy and the factors mentioned above.

Investors should keep in mind that dividend payments can fluctuate over time, and past dividend history is not necessarily indicative of future performance. Therefore, it’s crucial to conduct thorough research, stay informed about the underlying companies, and regularly review the factors influencing dividend payments from VYM.

Now that we have explored the factors influencing VYM dividend payments, let’s delve into the historical dividend payments of VYM to gain further insights into its performance.

Historical Dividend Payments of VYM

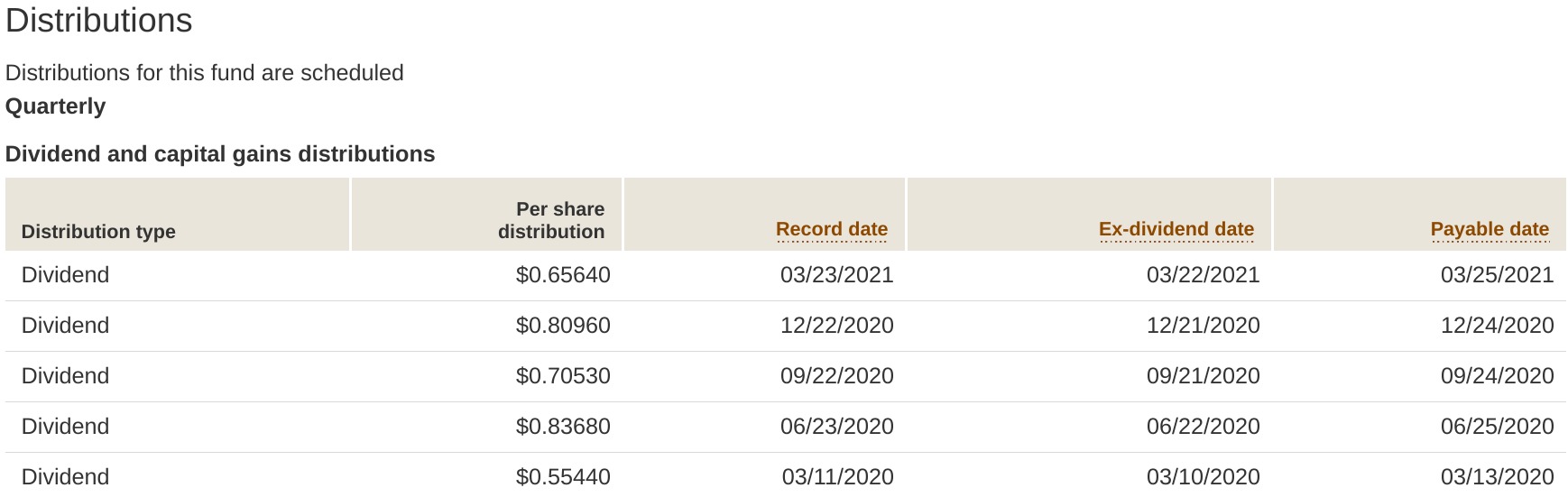

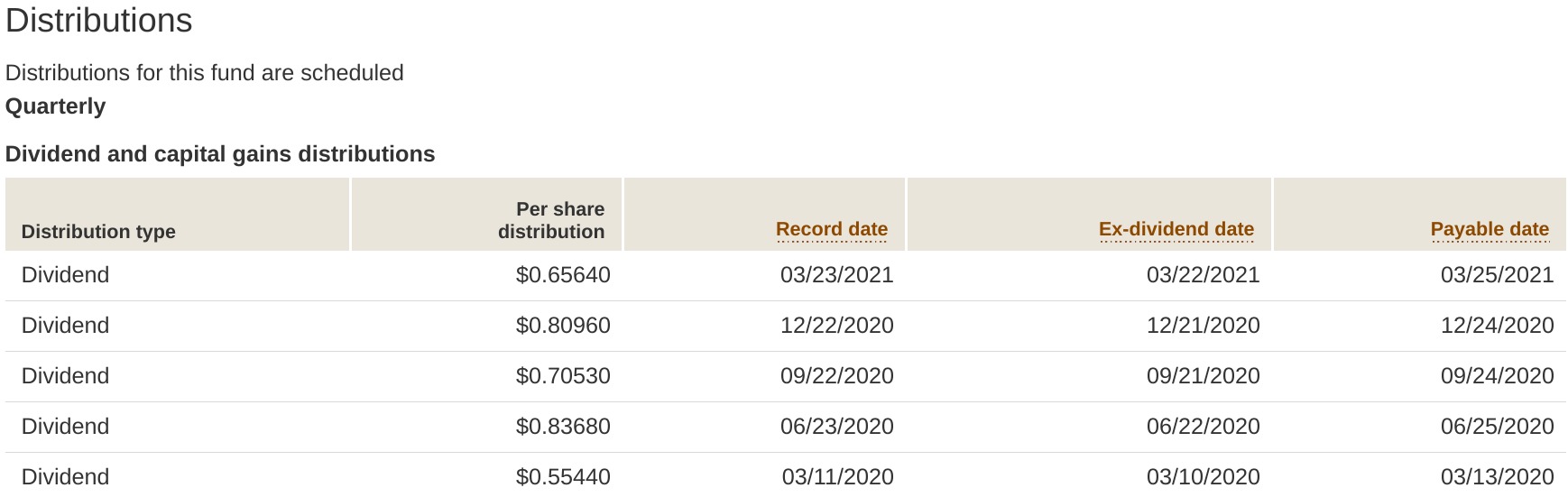

Examining the historical dividend payments of VYM can provide valuable insights into the fund’s dividend performance and the potential income it can generate for investors. VYM has a track record of consistent dividend payments, making it an attractive choice for income-oriented investors. Let’s take a closer look at the historical dividend payments of VYM:

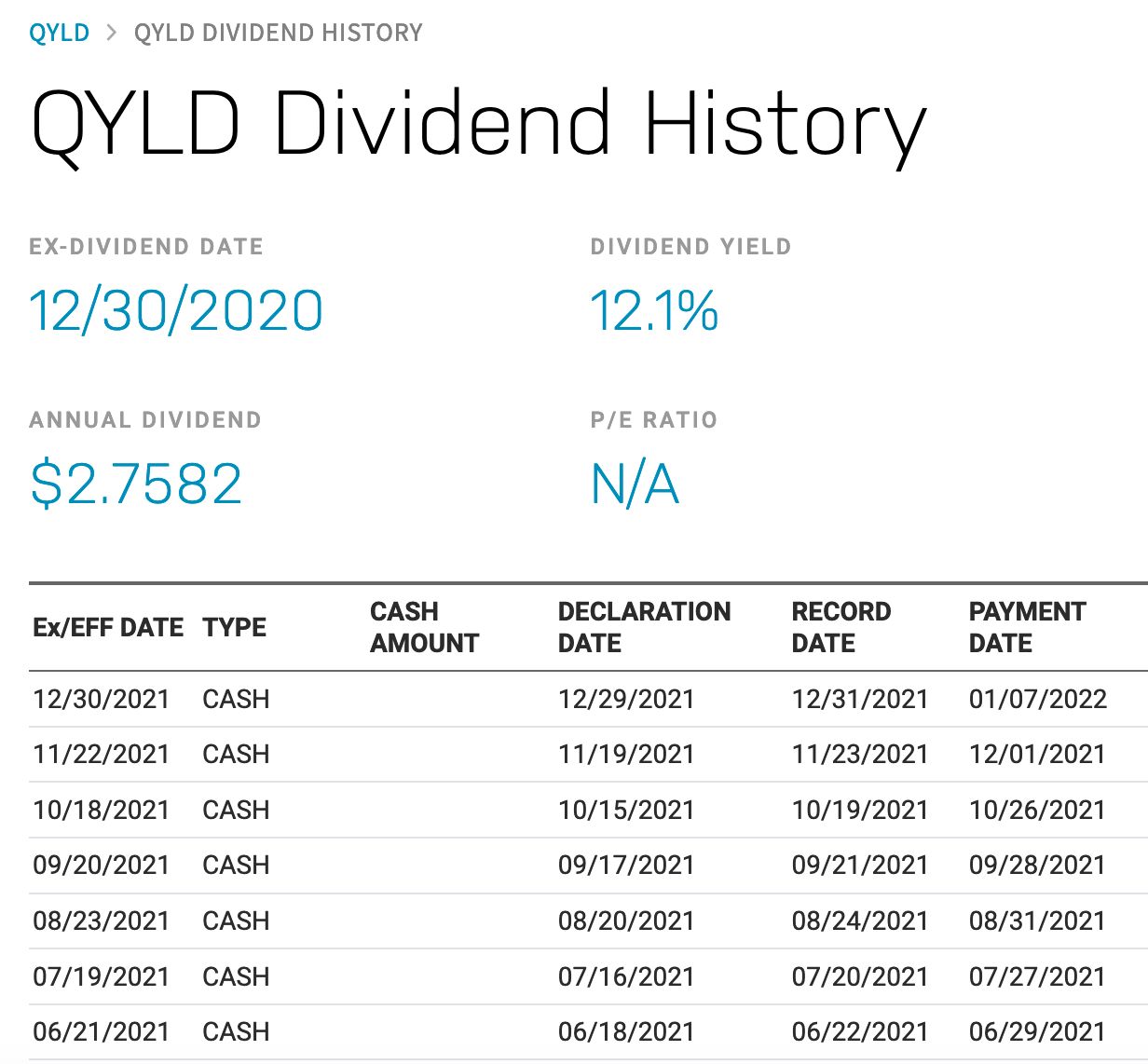

VYM typically pays dividends on a quarterly basis, with the exact amount determined by the dividend policies of the underlying companies held within the ETF. Dividends are typically declared by the ETF’s management and are based on the income generated by the portfolio’s holdings.

Over the years, VYM has displayed a history of reliable dividend payments, often increasing its dividend payout. It’s important to note that dividend payments from VYM may vary from year to year based on market conditions, economic factors, and the performance of the underlying companies.

An effective way to understand the historical dividend payments of VYM is to analyze the dividend distribution during specific time periods. For example, let’s explore the historical dividend payments of VYM for the past five years:

- 2021: In 2021, VYM experienced consistent dividend payments, with quarterly dividends ranging from $0.80 to $0.90 per share. The total annual dividend for 2021 was $3.50 per share.

- 2020: Despite the challenging economic conditions brought on by the COVID-19 pandemic, VYM maintained its dividend payments. Dividends ranged from $0.75 to $0.90 per share per quarter, resulting in a total annual dividend of $3.35 per share.

- 2019: VYM saw an increase in dividend payments in 2019. Quarterly dividends ranged from $0.80 to $0.90 per share, with a total annual dividend of $3.22 per share.

- 2018: The dividend payments of VYM in 2018 were consistent and showed growth compared to previous years. Quarterly dividends ranged from $0.70 to $0.80 per share, resulting in a total annual dividend of $2.92 per share.

- 2017: In 2017, VYM demonstrated stability in dividend payments. Quarterly dividends ranged from $0.60 to $0.70 per share, with a total annual dividend of $2.52 per share.

It’s important to evaluate the historical dividend payments of VYM in the context of your investment goals and income requirements. While past dividend payments can provide a general idea of the fund’s performance, they should not be the only factor influencing investment decisions.

Investors should also consider the fund’s dividend yield, expense ratio, risk profile, and overall investment strategy when assessing the suitability of VYM for their portfolios.

Now that we have explored the historical dividend payments of VYM, let’s compare its dividend performance with other dividend-paying ETFs to gain a broader perspective on dividend investing.

Comparing VYM Dividends with Other ETFs

When considering dividend-paying ETFs, it’s essential to compare the dividend performance of VYM with other similar funds to make an informed investment decision. Conducting a comparative analysis can provide insights into the income potential, dividend growth, and overall value of VYM. Here, we will compare VYM dividends with a few popular dividend-paying ETFs:

- VIG (Vanguard Dividend Appreciation ETF): VIG focuses on dividend growth stocks, which are companies with a history of consistently increasing their dividend payments. While VYM focuses on high dividend yield, VIG emphasizes dividend growth. The dividend payments of VIG have displayed growth over the years, appealing to investors seeking long-term income appreciation.

- SDY (SPDR S&P Dividend ETF): SDY tracks the performance of the S&P High Yield Dividend Aristocrats Index, which comprises companies with a history of increasing their dividends for at least 20 consecutive years. SDY may appeal to investors looking for both dividend income and the stability associated with companies with a long track record of dividend growth.

- DVY (iShares Select Dividend ETF): DVY is designed to track the performance of U.S. companies with a consistent history of dividend payments. It focuses on securities with relatively high dividend yields. DVY may be suitable for investors seeking a high level of current income from dividend payments.

- NOBL (ProShares S&P 500 Dividend Aristocrats ETF): NOBL invests in companies that are members of the S&P 500 Index and have a track record of increasing dividends for a minimum of 25 consecutive years. It offers exposure to companies with a strong dividend history and a commitment to shareholder returns.

While the dividend performance of these ETFs may vary, they all offer investors the opportunity to generate income through their dividend payment strategies. Some may emphasize dividend growth, while others focus on high dividend yields or companies with a history of increasing dividends.

When comparing VYM dividends with other ETFs, consider factors such as dividend yield, dividend growth rate, dividend consistency, and the underlying companies in the portfolio. Additionally, it’s crucial to assess expense ratios, fund management strategies, and risk profiles to ensure a suitable fit with your investment goals and risk tolerance.

By evaluating the dividend performance of VYM in relation to other dividend-paying ETFs, you can identify the fund that aligns best with your investment objectives and helps meet your income needs.

Now that we have compared VYM dividends with other ETFs, let’s discuss the potential tax implications of receiving dividends from VYM.

Tax Implications of VYM Dividends

When investing in dividend-paying ETFs like VYM, it’s important to understand the tax implications of receiving dividends. Dividend income is generally taxable, and the specific tax treatment can depend on various factors, including the type of dividend and the investor’s tax bracket. Here are some key considerations regarding the tax implications of VYM dividends:

Qualified Dividends: Many of the dividends received from VYM may qualify for preferential tax treatment known as qualified dividends. Qualified dividends are taxed at a lower rate than ordinary income, which is beneficial for most investors. To qualify for this tax treatment, the dividends must be issued by U.S. corporations or qualified foreign corporations, and certain holding requirements must be met.

Tax Rates: The tax rates on qualified dividends are linked to an investor’s income tax bracket. For most taxpayers, the rate is either 0%, 15%, or 20%. The rate depends on the level of taxable income and filing status. It’s important to consult with a tax advisor or utilize tax software to determine the exact tax rate applicable to your situation.

Ordinary Dividends: Dividends that do not meet the criteria to be classified as qualified dividends are considered ordinary dividends. Ordinary dividends are taxed at an individual’s ordinary income tax rates, which are generally higher than the rates for qualified dividends.

Foreign Withholding Taxes: VYM may invest in foreign companies, which can subject investors to foreign withholding taxes on the dividends received. These taxes are typically deducted at the source. However, in many cases, investors can claim a foreign tax credit or deduction on their U.S. tax return to offset the impact of foreign withholding taxes.

Tax-Advantaged Accounts: Investors holding VYM in tax-advantaged accounts, such as Individual Retirement Accounts (IRAs) or 401(k) plans, may not be subject to immediate tax consequences. However, distributions from these accounts are generally taxed at ordinary income rates when withdrawn in retirement.

It’s important to keep accurate records of dividend payments received from VYM and consult with a tax professional to understand the specific tax implications for your individual circumstances. Additionally, tax laws and rates are subject to change, so staying informed about current tax regulations is crucial for proper tax planning.

Lastly, it’s worth noting that VYM provides regular tax information to shareholders, including the breakdown of qualified dividends and ordinary dividends, which can assist in tax reporting.

Now that we have discussed the tax implications of VYM dividends, let’s explore some risks to consider when investing in dividend-paying ETFs.

Risks to Consider with VYM Dividend Payments

While dividend-paying ETFs like VYM offer the potential for income generation and long-term growth, it’s important to consider the risks associated with dividend payments. Understanding these risks can help investors make informed decisions and manage their expectations. Here are some key risks to consider when investing in VYM:

- Market Volatility: Dividend payments can be influenced by market conditions. During periods of increased market volatility, companies may face challenges in generating consistent earnings, which could impact their ability to sustain or increase dividend payments. Therefore, the overall performance and stability of the stock market can have an impact on the dividend payments from VYM.

- Company-Specific Risks: VYM holds a diversified portfolio of stocks, but there are still risks associated with individual companies within the fund. Factors such as a decline in company earnings, financial difficulties, or negative industry trends can affect a company’s ability to pay dividends, which, in turn, could impact the dividend payments received from VYM.

- Interest Rate Risks: Dividend-paying stocks, including those held by VYM, can be sensitive to changes in interest rates. When interest rates rise, income-focused investors may shift their investments towards fixed-income assets, which can reduce the demand for dividend-paying stocks and potentially impact their prices and dividend payments.

- Portfolio Composition: The composition of VYM’s portfolio may change over time. The companies included in the fund’s holdings and their respective dividend policies may evolve, which can impact the dividend payments received. It’s important to monitor any changes in VYM’s portfolio and the potential implications for dividend income.

- Dividend Cuts or Suspension: While dividend payments are appealing, they are not guaranteed. Companies, including those held by VYM, may need to reduce or eliminate dividend payments due to various reasons, such as financial difficulties, changes in business strategies, or unforeseen circumstances. These factors can affect the amount and frequency of dividend payments from VYM.

- Tax Considerations: While dividends from VYM can be a source of income, they are generally taxable. Tax regulations and rates can change, which may impact the after-tax returns from dividend payments. It’s crucial to stay informed about tax laws and consult with a tax professional to understand the tax implications based on your individual situation.

These risks should not discourage investors from considering dividend-paying ETFs like VYM. Instead, they highlight the importance of diversification, conducting thorough research, and monitoring the performance of the underlying companies within the fund. By staying informed and regularly evaluating your investment strategy, you can make informed decisions while managing the inherent risks.

Remember that past performance is not indicative of future results, and it’s essential to consider your individual risk tolerance and investment goals before investing in VYM or any other dividend-paying ETF.

Now, let’s wrap up our discussion on VYM dividend payments.

Conclusion

Investing in dividend-paying ETFs like VYM can be a rewarding strategy for generating passive income and potentially growing your wealth over time. VYM, as the Vanguard High Dividend Yield ETF, offers investors exposure to a diversified portfolio of U.S. stocks with above-average dividend yields. By understanding the intricacies of VYM’s dividend payments, investors can make informed decisions to align with their investment objectives.

In this article, we explored various aspects of VYM’s dividend payments. We began by introducing VYM and highlighting the benefits of investing in dividend-paying ETFs, including a consistent income stream, portfolio diversification, and long-term growth potential. We discussed how to calculate dividend yield, which serves as a valuable metric for evaluating the income potential of VYM and comparing it with other ETFs.

We then delved into the factors influencing VYM dividend payments, such as company earnings, dividend policies, market conditions, interest rates, profit margins, and industry trends. Understanding these factors allows investors to assess the sustainability and growth potential of VYM’s dividend payments.

Furthermore, we examined the historical dividend payments of VYM over the past five years, providing insights into its dividend performance and consistency. We also compared VYM’s dividend performance with other popular dividend-paying ETFs, emphasizing the importance of conducting comparative analysis based on dividend yield, growth, and underlying portfolio composition.

Additionally, we discussed the tax implications of receiving dividends from VYM, considering factors such as qualified dividends, tax rates, foreign withholding taxes, and tax-advantaged accounts. Understanding the tax considerations associated with VYM dividends is crucial for effective tax planning and managing your overall investment strategy.

Lastly, we highlighted the risks to consider when investing in VYM’s dividend payments, including market volatility, company-specific risks, interest rate risks, portfolio composition, and risks of dividend cuts or suspension. Recognizing these risks enables investors to make well-informed decisions while managing their investment expectations.

In conclusion, dividend-paying ETFs like VYM can provide a reliable income stream and potential long-term growth for investors seeking passive income and wealth accumulation. By conducting thorough research, evaluating various factors, and considering personal risk tolerance and investment goals, investors can determine if VYM aligns with their investment strategy.

Remember to consult with a financial advisor or do your own due diligence before making any investment decisions. With a well-informed approach, investing in VYM and similar dividend-paying ETFs could be a valuable addition to your investment portfolio.