Finance

How Does JEPI Pay Dividends?

Published: January 2, 2024

JEPI pays dividends by providing a reliable and lucrative financial solution. Discover how their unique approach in finance can benefit you and your investments today.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of JEPI dividends! In this article, we will explore how JEPI pays dividends and provide a comprehensive understanding of the process. Dividends are one of the key reasons why investors, both seasoned and new, are attracted to JEPI. But what exactly are dividends? How are they paid out? And what factors influence their amount?

JEPI, which stands for Jpense Passive Income, is a popular investment opportunity in the finance world. It is an investment vehicle that allows individuals to earn passive income by investing in a diversified portfolio of assets such as stocks, bonds, and real estate. By investing in JEPI, individuals become shareholders and are entitled to receive a share of the profits in the form of dividends.

Dividend payments are a way for companies, and in this case JEPI, to distribute a portion of their profits to shareholders. By paying dividends, companies reward their shareholders for their investment and provide a return on their investment. Dividends are usually paid out on a regular basis, such as quarterly, semi-annually, or annually, depending on the company’s policies and financial performance.

As an investor in JEPI, understanding how dividend payments work is crucial. It helps you plan your finances, assess the income potential of your investment, and make informed decisions. In the following sections, we will delve deeper into the intricacies of JEPI dividend payments, including the factors that influence the dividend amount, the frequency of dividend payments, the methods of payment, taxation on dividends, and the option to reinvest dividends.

So, if you’re ready to uncover the secrets of JEPI dividends and maximize your investment returns, let’s dive right in and explore the fascinating world of JEPI dividend payments!

Understanding JEPI

Before we delve into the specifics of JEPI dividend payments, let’s first gain a clear understanding of what JEPI is and how it operates. JEPI, or Jpense Passive Income, is an investment platform that enables individuals to generate passive income by investing in a diversified portfolio of assets.

JEPI operates on the principle of pooling funds from multiple investors to create a large investment portfolio. This portfolio includes a variety of assets such as stocks, bonds, real estate, and other income-generating instruments. By investing in JEPI, individuals become shareholders and indirectly own a portion of the overall portfolio.

One of the key advantages of investing in JEPI is the ability to benefit from a diversified portfolio. Diversification helps to minimize risk by spreading investments across different asset classes and sectors. By investing in a range of assets, investors can potentially mitigate the impact of market fluctuations and achieve more consistent returns over time.

In addition to diversification, JEPI offers several other advantages for investors. Firstly, it provides access to professional investment management. JEPI’s team of experienced fund managers leverages their expertise to make informed investment decisions on behalf of shareholders, aiming to maximize returns while managing risk.

Secondly, investing in JEPI provides liquidity. Unlike investing in individual stocks or properties, where it may be difficult to sell investments quickly, JEPI allows investors to buy and sell their shares easily. This flexibility ensures that investors can access their funds whenever needed, providing a level of financial security and convenience.

Moreover, JEPI operates on a transparent and regulated platform. It adheres to strict regulatory requirements, ensuring that investors’ funds are safeguarded and the investment process is transparent. This level of oversight provides peace of mind for investors, knowing that their investments are being managed in a responsible and regulated manner.

Overall, JEPI offers investors the opportunity to generate passive income and achieve long-term wealth accumulation. By investing in a diversified portfolio and benefiting from professional management, investors can potentially enjoy steady income streams and capital growth. Now that we have a solid understanding of JEPI let’s move on to exploring the fascinating world of JEPI dividend payments.

Dividend Payments Explained

Dividend payments are a way for JEPI to distribute a portion of its profits to its shareholders. As an investor, when you own shares in JEPI, you become eligible to receive dividends. Dividends can be considered as your share of the company’s earnings.

The amount of dividend you receive depends on various factors, such as the financial performance of JEPI, the profitability of the underlying assets in the portfolio, and the dividend distribution policy set by the company. JEPI aims to provide consistent and attractive dividend payments to its shareholders, reflecting the income generated by the assets in the portfolio.

JEPI typically calculates dividends based on the net income generated by the investment portfolio. The net income is the total income earned from dividends, interest, rental income, and any other sources, minus the expenses incurred in managing the portfolio. This net income is then distributed among the shareholders in the form of dividends.

Dividend payments are usually made on a regular basis, such as quarterly, semi-annually, or annually. However, it’s important to note that dividend payments are not guaranteed. The actual dividend amount and frequency may vary based on the performance of the investment portfolio and market conditions.

It’s also worth mentioning that dividend payments can be affected by changes in the company’s dividend policy. JEPI may adjust its dividend distribution policy based on various factors, including market conditions, regulatory requirements, and the overall financial health of the company. It’s essential for investors to stay updated on any changes in the dividend policy and understand the potential impact on their dividend income.

Receiving dividend payments from JEPI can be an attractive feature for investors looking for regular income. By investing in a diversified portfolio, you can potentially benefit from a steady stream of dividend payments, providing passive income to support your financial goals.

Now that we’ve explored the basics of dividend payments, let’s delve into the factors that can influence the amount of dividends distributed by JEPI.

Factors Influencing JEPI Dividends

Several key factors influence the amount of dividends distributed by JEPI. Understanding these factors can help investors better predict and assess their potential dividend income. Let’s explore the main factors that influence JEPI dividends:

- Net Income and Portfolio Performance: The net income generated by JEPI’s investment portfolio plays a significant role in determining dividend payments. If the portfolio performs well and generates higher income, it is likely that the dividend payments will be higher. Conversely, if the portfolio underperforms, dividend payments may be lower or non-existent. It’s important to monitor the performance of the underlying assets to gauge the potential impact on dividend payments.

- Investment Expenses: JEPI incurs expenses in managing the investment portfolio, such as fund management fees, operational costs, and administrative expenses. These expenses are deducted from the overall income generated by the portfolio before dividend payments are calculated. Higher expenses can reduce the amount available for distribution as dividends.

- Market Conditions: The broader market conditions can have an impact on dividend payments. During periods of economic downturn or market volatility, companies may choose to conserve cash and reduce or suspend dividend payments. On the other hand, during periods of economic expansion, companies may increase dividend payments as profitability improves. JEPI’s dividend payments may fluctuate based on these market conditions.

- Regulatory Requirements: JEPI operates within the framework of regulatory guidelines and requirements. There may be regulations that restrict the amount of dividends that can be distributed by the company or impose specific criteria for dividend payments. These regulatory requirements can influence the dividend policy and ultimately impact the amount of dividends received by investors.

- Company’s Dividend Policy: JEPI sets its dividend distribution policy, which outlines how dividends are calculated and the frequency of payments. The dividend policy may specify a target payout ratio, which is the percentage of earnings that will be distributed as dividends. Factors such as sustainability of dividend payments, capital requirements, and reinvestment opportunities are taken into consideration when determining the dividend policy.

By considering these factors, investors can gain a better understanding of the potential dividend income from their investment in JEPI. It’s important to note that dividend payments are subject to change and are not guaranteed. It is advisable for investors to review JEPI’s financial statements, dividend history, and stay informed about any updates or changes in the dividend policy to make informed investment decisions.

Now that we’ve explored the factors influencing JEPI dividends, let’s move on to understanding how the dividend amount is calculated.

Calculation of Dividend Amount

The calculation of dividend amount in JEPI is primarily based on the company’s net income and its dividend distribution policy. Let’s explore how dividend amount is calculated:

1. Net Income: JEPI calculates its net income by deducting expenses, such as fund management fees, operational costs, and administrative expenses, from the total income generated by the investment portfolio. This net income represents the available income that can be distributed as dividends.

2. Dividend Distribution Policy: JEPI sets a dividend distribution policy that outlines the percentage of net income that will be distributed as dividends. This policy considers various factors, including the company’s financial health, growth prospects, regulatory constraints, and shareholder expectations. The dividend distribution policy may specify a target payout ratio, which is the percentage of net income allocated for dividends.

3. Calculation of Dividend Amount: Dividend amount is determined by applying the dividend distribution policy to the net income. For example, if JEPI’s dividend distribution policy states a payout ratio of 50%, and the net income for a specific period is $100,000, the dividend amount would be $50,000 (50% of $100,000).

4. Dividend Per Share: To determine the dividend amount per share, the calculated dividend amount is divided by the total number of outstanding shares. For instance, if JEPI has 1,000,000 outstanding shares and a dividend amount of $50,000, the dividend per share would be $0.05 ($50,000/1,000,000).

It’s important to note that the dividend amount can vary from one period to another based on changes in the net income and the dividend distribution policy. Higher net income and a higher payout ratio can result in larger dividend payments, while lower net income or a lower payout ratio can lead to smaller dividend payments.

Investors should carefully consider the dividend calculation methodology, as well as other financial indicators, when evaluating the potential income from their investment in JEPI. It’s advisable to review JEPI’s financial reports, understand the dividend policy, and monitor any updates or changes to make informed investment decisions.

Now that we understand how dividend amount is calculated, let’s explore the frequency of dividend payments in JEPI.

Dividend Payment Frequency

The frequency of dividend payments in JEPI depends on the company’s dividend distribution policy. Typically, dividend payments are made on a regular basis, which can vary from quarterly to annually. Let’s explore the common dividend payment frequencies in JEPI:

1. Quarterly Payments: Many companies, including JEPI, opt for quarterly dividend payments. This means that dividends are paid out every three months. Quarterly payments provide investors with regular income and allow for more consistent cash flow throughout the year. It also enables investors to reinvest their dividends or utilize them as desired in a shorter time frame.

2. Semi-Annual Payments: Some companies may choose to make dividend payments semi-annually, meaning twice a year. This payment frequency allows for longer periods between dividend distributions and may be suitable for companies with more volatile income streams or those that prefer to retain a larger portion of their earnings for internal growth or investments.

3. Annual Payments: In certain cases, companies may opt for annual dividend payments, where dividends are distributed once a year. This payment frequency is relatively less common and is typically seen in companies with stable and predictable income sources or those that prioritize reinvesting a significant portion of their earnings back into the business.

It’s important for investors to be aware of the dividend payment frequency of JEPI or any other investment they consider. Knowing the frequency allows investors to plan their finances accordingly and align their expectations with the cash flow generated by their investment.

Moreover, it’s crucial to keep in mind that dividend payments are not guaranteed and can vary based on the financial performance of JEPI and other relevant factors. It’s advisable for investors to review the dividend history of JEPI, including the consistency and stability of dividend payments, to assess the company’s track record and potential income generation.

Now that we understand the frequency of dividend payments, let’s explore the different methods of receiving dividends in JEPI.

Payment Methods for Dividends

Dividends in JEPI can be received through various payment methods, providing flexibility and convenience for investors. The specific payment methods available may vary depending on the policies and options offered by JEPI. Let’s explore some common payment methods for dividends:

- Direct Deposit: Direct deposit is a popular method for receiving dividend payments. With this method, dividend earnings are directly deposited into the investor’s designated bank account. This automated process ensures quick and seamless transfer of funds, eliminating the need for physical checks or manual transactions.

- Physical Checks: Another common method is to receive dividend payments through physical checks. In this case, JEPI issues a check payable to the investor and mails it to the registered address. Investors can deposit the check into their bank account or cash it as per their preference.

- Electronic Funds Transfer: Some investors may opt for electronic funds transfer, which involves the transfer of dividend payments from JEPI’s account to the investor’s designated bank account electronically. This method allows for faster and more secure transfer of funds without the need for physical checks.

- Dividend Reinvestment: Dividend reinvestment is a unique payment method that allows investors to automatically reinvest their dividend earnings back into JEPI’s investment portfolio. This method provides an opportunity for compounded growth, as the reinvested dividends can generate additional income and potentially increase the value of the investment.

Investors should review JEPI’s policies and offerings to determine the available payment methods for dividends. It’s important to consider factors such as convenience, transaction fees (if any), and personal preferences when selecting a payment method.

Additionally, it’s worth noting that tax implications may vary depending on the payment method and the investor’s location and tax regulations. Investors should consult with a tax professional or refer to relevant tax guidelines to understand the tax implications associated with the chosen payment method.

Now that we’ve explored the payment methods for dividends, let’s discuss the taxation aspect related to JEPI dividends.

Taxation on JEPI Dividends

Taxation on JEPI dividends varies depending on several factors, including the investor’s jurisdiction, the type of dividend, and the applicable tax laws. Understanding the tax implications of dividend income is essential for investors to accurately assess their overall returns. Here are some key points regarding taxation on JEPI dividends:

1. Tax Rates: Dividend income is typically subject to income tax. The tax rates applied to dividend income can vary based on the investor’s tax bracket and the tax laws of their jurisdiction. It’s important for investors to consult with a tax professional or refer to the relevant tax regulations to determine the applicable tax rates for dividend income.

2. Tax Treatment of Qualified Dividends: In many jurisdictions, including the United States, qualified dividends are subject to a lower tax rate. Qualified dividends are dividends that meet specified criteria, such as being paid by eligible domestic or foreign corporations. These dividends are typically taxed at the long-term capital gains tax rate, which is generally lower than the ordinary income tax rate. It’s important for investors to ascertain the classification of JEPI dividends to determine if they qualify for any preferential tax treatment.

3. Dividend Withholding Tax: Dividend payments made by JEPI to non-resident investors may be subject to withholding tax. Withholding tax is a tax deduction made at source by JEPI before distributing the dividends to investors. The withholding tax rate can vary depending on the tax treaty agreements between the investor’s country of residence and the jurisdiction where JEPI is based.

4. Reporting Requirements: Investors receiving dividends from JEPI may be required to report the dividend income on their tax returns. It’s essential to maintain accurate records of dividend payments received and consult with a tax professional to ensure compliance with reporting requirements.

5. Tax-Advantaged Accounts: Investors holding JEPI shares within tax-advantaged accounts, such as individual retirement accounts (IRAs) or tax-free savings accounts (TFSAs), may enjoy certain tax benefits. The tax treatment of dividends received within these accounts may differ from regular taxable accounts. Investors should understand the specific rules and regulations governing tax-advantaged accounts in their jurisdiction.

It’s crucial for investors to seek guidance from a tax professional or consult the tax regulations applicable to their jurisdiction for accurate and up-to-date information regarding the taxation of JEPI dividends. Being aware of the tax implications allows investors to effectively plan their tax obligations and optimize their overall investment returns.

Now, let’s explore the option to reinvest dividends with JEPI.

Reinvesting Dividends with JEPI

One attractive feature that JEPI offers to investors is the option to reinvest dividends. Dividend reinvestment allows shareholders to use their dividend earnings to purchase additional shares of JEPI, rather than receiving the dividends as cash. Reinvesting dividends can have several benefits:

1. Compounding Growth: By reinvesting dividends, investors can benefit from the power of compounding. The reinvested dividends purchase additional shares, which can potentially generate future dividends. Over time, this compounding effect can significantly enhance investment growth and potentially lead to higher overall returns.

2. Automatic Investment: Dividend reinvestment eliminates the need for investors to decide how to allocate their dividend income. Instead of manually reinvesting dividends, JEPI’s dividend reinvestment program (DRIP) automatically uses the dividend earnings to purchase more shares on behalf of the investor. It simplifies the investment process and ensures that dividends are utilized efficiently.

3. Cost Averaging: Reinvesting dividends may enable investors to practice cost averaging. In periods of market volatility, when share prices may fluctuate, reinvesting dividends allows investors to buy more shares when prices are lower. This can help to reduce the average cost per share and potentially enhance long-term investment performance.

4. Building a Larger Position: Over time, reinvesting dividends can help investors increase their overall position in JEPI. By consistently reinvesting dividends, investors can steadily build their shareholding and potentially benefit from long-term capital appreciation.

It’s important for investors to understand the specifics of JEPI’s dividend reinvestment program. They should review the terms and conditions, any associated fees or costs, and how the reinvested dividends are allocated. JEPI may offer partial dividend reinvestment options or reinvestment discounts in certain cases, which can further optimize the benefits of reinvesting dividends.

It’s worth noting that dividend reinvestment may not be suitable for all investors. Some investors may prefer to receive dividend income as cash for personal expenses or other financial commitments. It’s an individual decision based on financial goals, personal circumstances, and investment strategies.

Investors interested in reinvesting dividends with JEPI should consult with their broker or financial advisor to understand the process, requirements, and potential benefits. It’s essential to consider the objectives and risk tolerance before making any investment decisions.

Now that we’ve explored dividend reinvestment, let’s conclude our journey into the world of JEPI dividends.

Conclusion

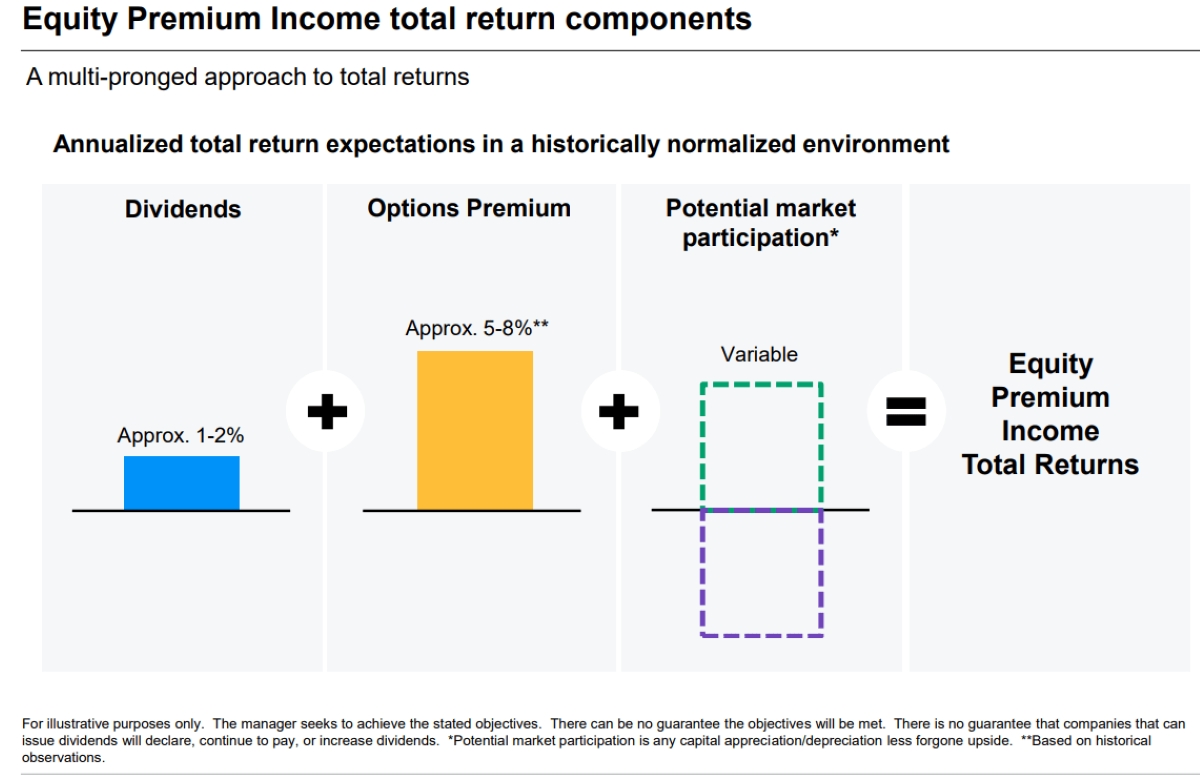

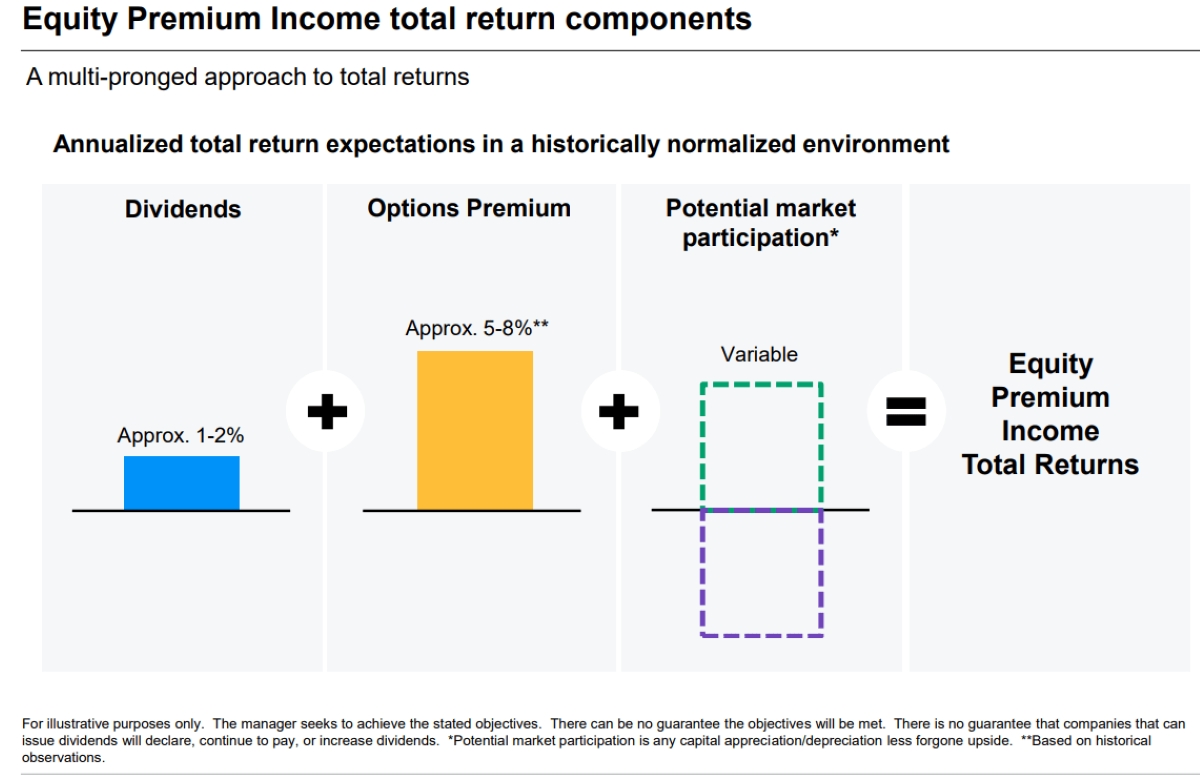

Dividends are an integral part of the JEPI investment experience, providing investors with the opportunity to earn passive income from their investment. In this article, we’ve explored various aspects of JEPI dividends, including how they are paid, the factors influencing their amount, the calculation methodology, the frequency of dividend payments, payment methods, taxation considerations, and the option to reinvest dividends.

JEPI dividends are influenced by factors such as net income, portfolio performance, investment expenses, market conditions, and the company’s dividend distribution policy. Understanding these factors can help investors assess and anticipate their potential dividend income.

The calculation of dividend amount in JEPI is based on net income and the dividend distribution policy. Dividend payments are typically made on a quarterly, semi-annual, or annual basis, depending on the company’s policy. Investors can receive their dividends through direct deposit, physical checks, electronic funds transfer, or opt to reinvest dividends back into JEPI.

Taxation on JEPI dividends depends on the investor’s jurisdiction, the type of dividend, and applicable tax laws. Investors should be aware of the tax rates, withholding tax provisions, and reporting requirements related to dividend income.

Reinvesting dividends offers benefits such as compounding growth, automatic investment, cost averaging, and building a larger position in JEPI over time. However, it’s important for investors to evaluate their preferences and objectives before opting for dividend reinvestment.

In conclusion, JEPI provides investors with the opportunity to earn passive income through dividends. By understanding the workings of JEPI dividends and considering their financial goals, risk tolerance, and tax implications, investors can make informed decisions and maximize the potential of their investment in JEPI.

It’s important to note that investing in JEPI or any other financial instrument involves risks. It’s advisable for investors to conduct thorough research, seek professional advice, and carefully consider their financial situation before making any investment decisions.

We hope this article has provided valuable insights into the world of JEPI dividends and how they contribute to investor returns. Happy investing!