Finance

How Much Does McDonald’s Pay In Dividends?

Published: January 3, 2024

Discover how McDonald's pays dividends in the finance sector. Learn about the payout amounts and potential returns for shareholders.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of dividends, where companies distribute a portion of their earnings to shareholders as a way to reward their investment. Dividends are essentially cash payments made on a regular basis by profitable companies, and they play an important role in attracting investors. In this article, we will dive into the topic of dividends and explore McDonald’s dividend payment history.

McDonald’s, the iconic fast-food restaurant chain, is not only known for its delicious burgers and fries but also for its consistent dividend payments. As one of the largest global fast-food chains, McDonald’s has a long-standing tradition of sharing its success with shareholders through regular dividend payments.

Dividends serve as a way for companies to provide a return on investment to their shareholders. By distributing a portion of its profits, McDonald’s rewards investors for their trust and financial commitment to the company. These payments can provide investors with a steady income stream, making dividend stocks an attractive option for income-focused investors.

In this article, we will take a closer look at McDonald’s dividend history, payment frequency, factors that affect dividend payments, dividend yield, and how McDonald’s dividend payments compare to other companies in the same industry. So, let’s dig in and explore the fascinating world of McDonald’s dividends!

Understanding Dividends

Before we delve into McDonald’s dividend history, let’s take a moment to understand what dividends are and how they function. Dividends are a portion of a company’s earnings that are distributed to its shareholders as a form of cash payment. These payments are typically made on a regular schedule, such as quarterly, semi-annually, or annually.

Dividends are a way for companies to share their profits with their shareholders. When a company is profitable, it has the option to reinvest its earnings back into the business or distribute them to shareholders in the form of dividends. Companies that pay dividends are often seen as financially stable and mature, generating consistent cash flow.

Dividends can be a significant source of income for investors, particularly those seeking a steady stream of cash flow. They can be especially valuable for retirees and income-focused investors. Dividend payments can provide some level of predictability and stability in an investor’s overall returns.

It is important to note that not all companies pay dividends. Growth-oriented companies, particularly in sectors such as technology or biotechnology, may reinvest their earnings into research, development, and expansion to fuel future growth. These companies may not pay dividends or have lower dividend yields compared to more established companies.

One key metric to consider when assessing a dividend-paying company is the dividend yield. The dividend yield is expressed as a percentage and represents the annual dividend payment relative to the company’s stock price. A higher dividend yield indicates a higher return on investment in the form of dividend payments.

Now that we have a better understanding of dividends and their significance, let’s explore McDonald’s dividend payment history and how it has rewarded its shareholders over the years.

McDonald’s Dividend History

McDonald’s has a strong track record of consistently paying dividends to its shareholders. The company first initiated dividend payments in 1976 and has maintained a solid dividend history ever since.

McDonald’s has a dividend policy that focuses on providing shareholders with a reliable and growing stream of dividend income. Over the years, the company has increased its dividend payout on numerous occasions, reflecting its confidence in its financial performance and commitment to delivering value to its shareholders.

Despite facing various challenges in the highly competitive fast-food industry, McDonald’s has prioritized its dividend payments, making it an appealing choice for income-oriented investors. The company’s ability to sustain and increase its dividend payments is a testament to its strong financial position and dedication to creating value for its shareholders.

It’s worth noting that dividend payments are subject to the discretion of the company’s board of directors. They consider several factors, including the company’s financial performance, profitability, cash flow, and future growth prospects when deciding on the dividend amount.

Investors in McDonald’s can take comfort in the company’s commitment to returning capital to shareholders through consistent dividend payments. Let’s now move on to understanding the frequency of these dividend payments.

McDonald’s Dividend Payment Frequency

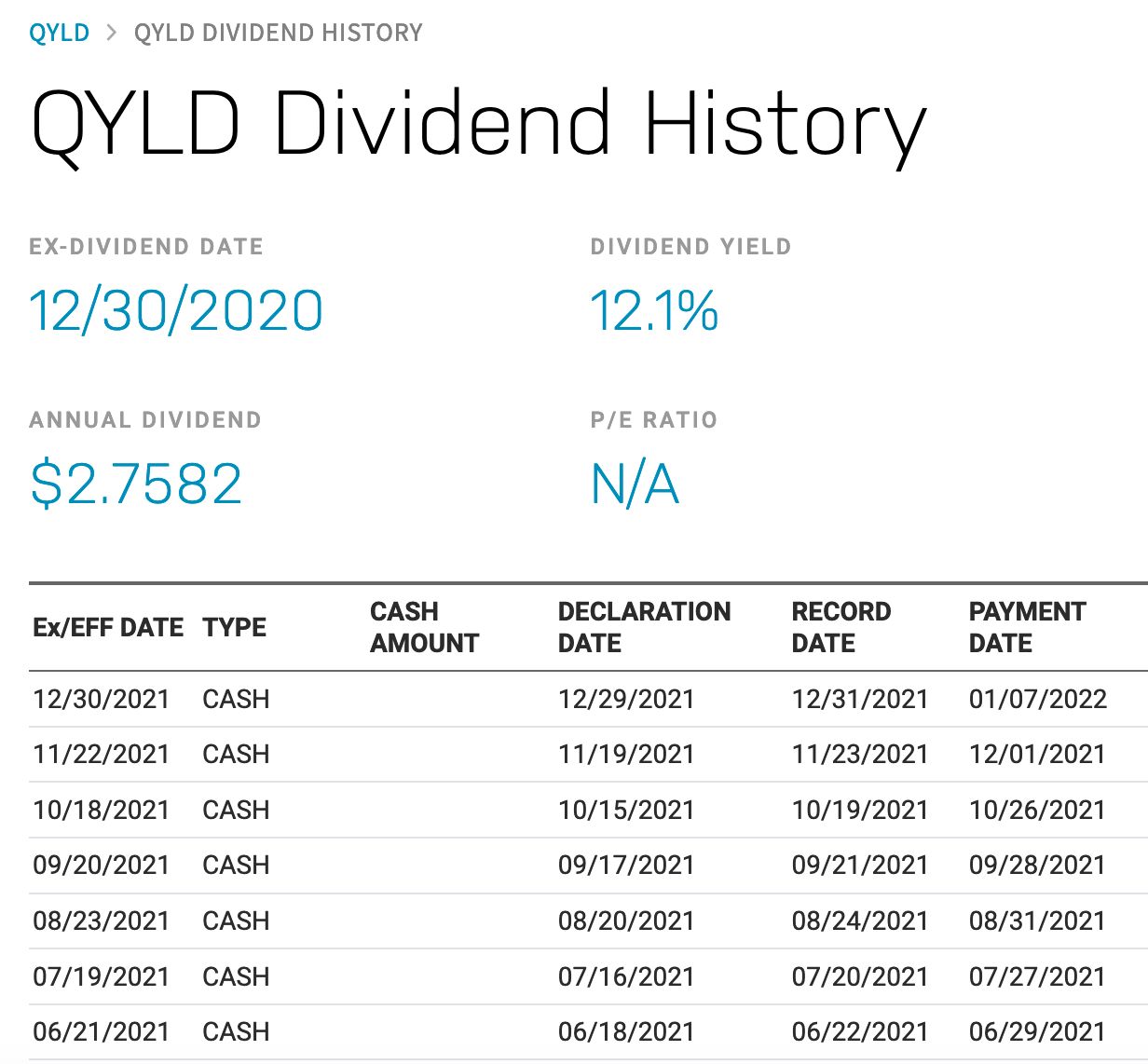

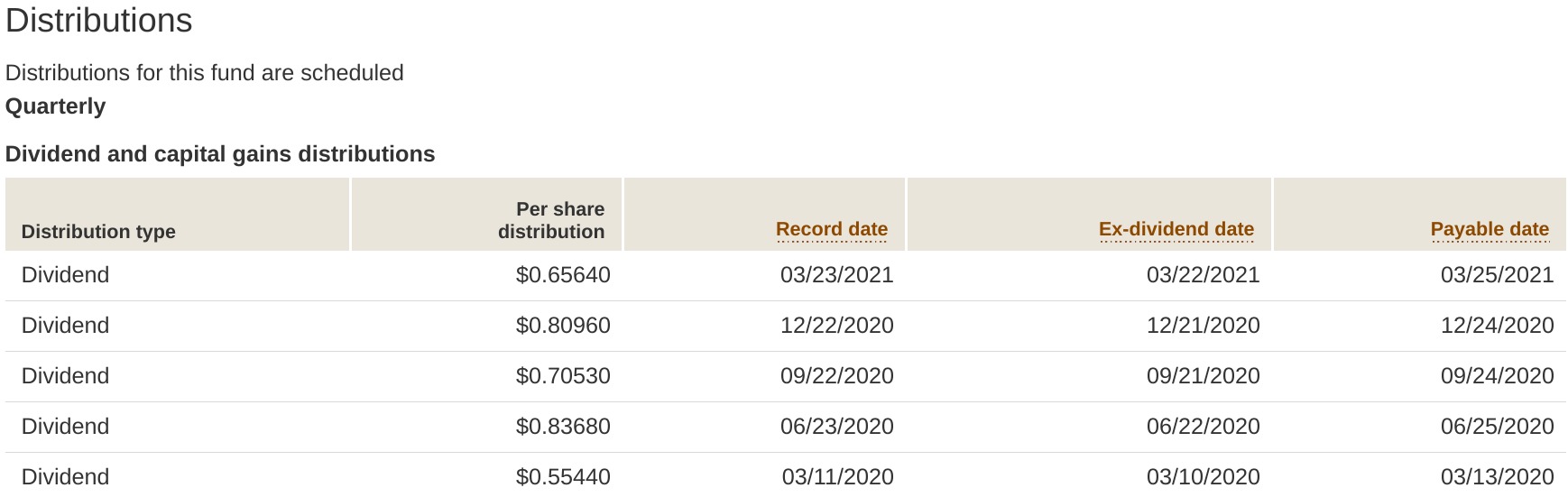

McDonald’s follows a regular schedule for its dividend payments. As of the time of writing, the company pays dividends on a quarterly basis. This means that eligible shareholders can expect to receive dividend payments four times a year.

The quarterly dividend payments by McDonald’s provide shareholders with a steady income stream. These payments are typically paid out in cash, although the company may also choose to offer a dividend reinvestment plan (DRIP) where shareholders can opt to reinvest their dividends back into additional shares of McDonald’s stock.

The regularity of dividend payments is an attractive feature for income-focused investors. It allows for better financial planning and provides a consistent source of income. Shareholders can rely on these quarterly dividend payments as a tangible return on their investment in McDonald’s.

It is essential for investors to be aware of the ex-dividend date, which is the date on which a buyer of a stock is no longer entitled to receive the upcoming dividend payment. It is crucial to purchase the stock before the ex-dividend date to be eligible for the dividend payment.

Overall, McDonald’s commitment to regular dividend payments offers stability and predictability for its shareholders. This, combined with the company’s dividend history, demonstrates McDonald’s dedication to rewarding its investors.

Factors Affecting McDonald’s Dividend Payments

McDonald’s dividend payments are influenced by several key factors that reflect the company’s financial performance and overall strategy. Understanding these factors can provide insights into the stability and growth potential of McDonald’s dividend payments.

1. Earnings: McDonald’s dividend payments are directly tied to its earnings. As a profitable company, McDonald’s generates consistent cash flow, which provides the financial means to make dividend payments. Strong earnings growth can lead to increased dividend payments over time.

2. Free Cash Flow: Free cash flow is the amount of cash that remains after deducting expenses, capital expenditures, and taxes. McDonald’s considers its free cash flow when determining the amount of funds available for dividends. Higher free cash flow provides the company with the ability to maintain or increase dividend payments.

3. Financial Stability: The financial stability and health of McDonald’s play a crucial role in dividend payments. The company needs to preserve an appropriate level of liquidity and maintain a solid balance sheet to fulfill its dividend obligations to shareholders.

4. Growth Prospects: McDonald’s evaluates its growth prospects and future cash flow potential when deciding on dividend payments. The company considers factors such as new store openings, menu innovations, market expansion, and cost management initiatives. Strong growth prospects can support higher dividends.

5. Industry and Economic Conditions: McDonald’s also takes into account the broader industry and economic conditions. Factors such as consumer spending patterns, competition, inflation, and interest rates can impact the company’s financial performance and, consequently, its dividend payments.

6. Regulatory Factors: The regulatory environment, including tax policies and government regulations, can influence the amount and timing of dividend payments. Changes in tax rates or regulations may impact McDonald’s ability to distribute dividends to shareholders.

These factors highlight the complex considerations that McDonald’s takes into account when determining its dividend payments. By carefully analyzing the company’s financial performance, growth prospects, and external factors, investors can gain valuable insights into the stability and potential future growth of McDonald’s dividend payments.

McDonald’s Dividend Yield

The dividend yield is a key metric used by investors to assess the attractiveness of dividend-paying stocks. It is calculated by dividing the annual dividend payment per share by the stock’s current market price. The resulting percentage represents the dividend yield.

The dividend yield serves as an indicator of the return on investment in the form of dividend payments. A higher dividend yield indicates a higher dividend return relative to the stock price. Investors often compare dividend yields across different companies and industries to evaluate potential income opportunities.

McDonald’s dividend yield fluctuates based on its stock price and dividend payments. The company’s consistent dividend payments, combined with its stable stock price appreciation, have historically contributed to a favorable dividend yield for shareholders.

It’s important to note that dividend yield alone should not be the sole deciding factor for making investment decisions. Investors should consider other factors such as the company’s financial health, growth prospects, and dividend sustainability.

McDonald’s dividend yield can be influenced by market dynamics, investor sentiment, and changes in the company’s dividend policy. Fluctuations in stock price without a corresponding change in dividend payments can cause the dividend yield to vary.

Investors interested in McDonald’s dividend yield should regularly monitor the stock’s price movements, as it can impact the relative attractiveness of the dividend yield. Additionally, comparing McDonald’s dividend yield to peers in the fast-food industry can provide insights into its competitiveness as an income-generating investment.

While McDonald’s dividend yield can provide an indication of its dividend income potential, investors should conduct thorough research and analysis to make informed investment decisions. It is crucial to consider the company’s overall financial performance, dividend history, and future growth prospects in conjunction with its dividend yield.

Comparing McDonald’s Dividend Payments

When considering McDonald’s dividend payments, it is informative to compare them to other companies within the same industry. This analysis can provide insights into how McDonald’s dividend payments stack up against its peers and whether it offers a competitive dividend return to its shareholders.

One way to compare dividend payments is by examining the dividend yield. This metric allows investors to assess the relative attractiveness of dividend-paying stocks. By comparing McDonald’s dividend yield to other fast-food chains in the industry, investors can gauge the dividend income potential offered by each company.

In addition to the dividend yield, investors should also consider factors such as dividend growth rate and payout ratio when comparing dividend payments. The dividend growth rate represents the annualized percentage increase in dividend payments over time, reflecting a company’s commitment to raising dividends. A higher dividend growth rate can indicate a company’s confidence in its financial strength and future prospects.

The payout ratio is another crucial factor to consider. It represents the percentage of earnings that a company distributes as dividends. A low payout ratio indicates that a company retains a larger portion of its earnings for reinvestment, while a high payout ratio suggests a larger proportion of earnings being paid out as dividends. Comparing McDonald’s payout ratio with its competitors can provide insights into whether its dividend payments are sustainable and supported by solid earnings.

It’s also worth examining the dividend payment history of McDonald’s and its peers. Companies with a consistent track record of increasing dividends over time may be more attractive to income-focused investors seeking a reliable source of income and potential dividend growth.

Ultimately, conducting a thorough analysis of McDonald’s dividend payments in comparison to its industry peers can help investors make informed decisions. It is important to consider multiple factors such as dividend yield, dividend growth rate, payout ratio, and dividend payment history to assess the overall attractiveness of McDonald’s dividend payments relative to its competitors.

Conclusion

McDonald’s commitment to dividend payments has made it an appealing choice for income-focused investors. With a strong track record of consistent dividend payments and a focus on shareholder value, McDonald’s has demonstrated its dedication to rewarding its investors.

Understanding the factors that influence McDonald’s dividend payments, such as earnings, free cash flow, financial stability, growth prospects, industry conditions, and regulatory factors, can provide valuable insights into the stability and potential growth of its dividends.

The dividend yield, dividend growth rate, payout ratio, and dividend payment history are important metrics to consider when comparing McDonald’s dividend payments to its industry peers. These comparisons can help investors assess the attractiveness of McDonald’s dividend income potential relative to other companies in the fast-food industry.

Investors should remember that dividend payments are subject to the discretion of the company’s board of directors and can fluctuate based on various factors. It is essential to conduct thorough research and analysis, considering the overall financial health, growth prospects, and dividend sustainability of McDonald’s before making investment decisions.

In conclusion, McDonald’s has a solid dividend payment history, offering stable and regular dividend payments to its shareholders. Its consistent dividend payments, combined with its strong financial position and global brand recognition, make McDonald’s an attractive choice for investors seeking a potential income stream and potential dividend growth over time.