Finance

How Much Does Bank Of America Pay In Dividends

Published: January 3, 2024

Find out how much Bank of America pays in dividends and learn more about the finance aspect of investing in this renowned financial institution.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Overview of Bank of America’s Dividends

- Factors Affecting Bank of America’s Dividend Payments

- Historical Dividend Payments by Bank of America

- Current Dividend Yield of Bank of America

- Factors to Consider When Analyzing Bank of America’s Dividend Payments

- Comparison of Bank of America’s Dividend Payments with Competitors

- Outlook for Bank of America’s Dividends

- Conclusion

Introduction

Welcome to our comprehensive guide on Bank of America’s dividend payments. As one of the largest banking institutions in the United States, Bank of America plays a vital role in the financial sector. Dividends are an essential part of the company’s relationship with its shareholders, serving as a way to distribute a portion of its profits back to investors.

In this article, we will delve into the fascinating world of Bank of America’s dividend payments. We will explore the factors that impact the amount and frequency of these dividends, as well as examine the historical data to gain insight into the company’s dividend trends. Additionally, we will discuss the current dividend yield and how it compares to Bank of America’s competitors. Finally, we will look ahead to offer an outlook on the future of Bank of America’s dividends.

Understanding Bank of America’s dividend payments is crucial for both existing shareholders and those considering investing in the company. By analyzing the dividend payments, investors can assess the financial health and stability of the company, and potentially use the dividends as a source of income or reinvest them to grow their portfolio.

Before we dive into the details, it is important to note that the information provided in this guide is for educational purposes only. Investors should always conduct thorough research and consult with a financial advisor before making any investment decisions.

Now, let’s begin our exploration of Bank of America’s dividend payments and unravel the factors that influence these payouts.

Overview of Bank of America’s Dividends

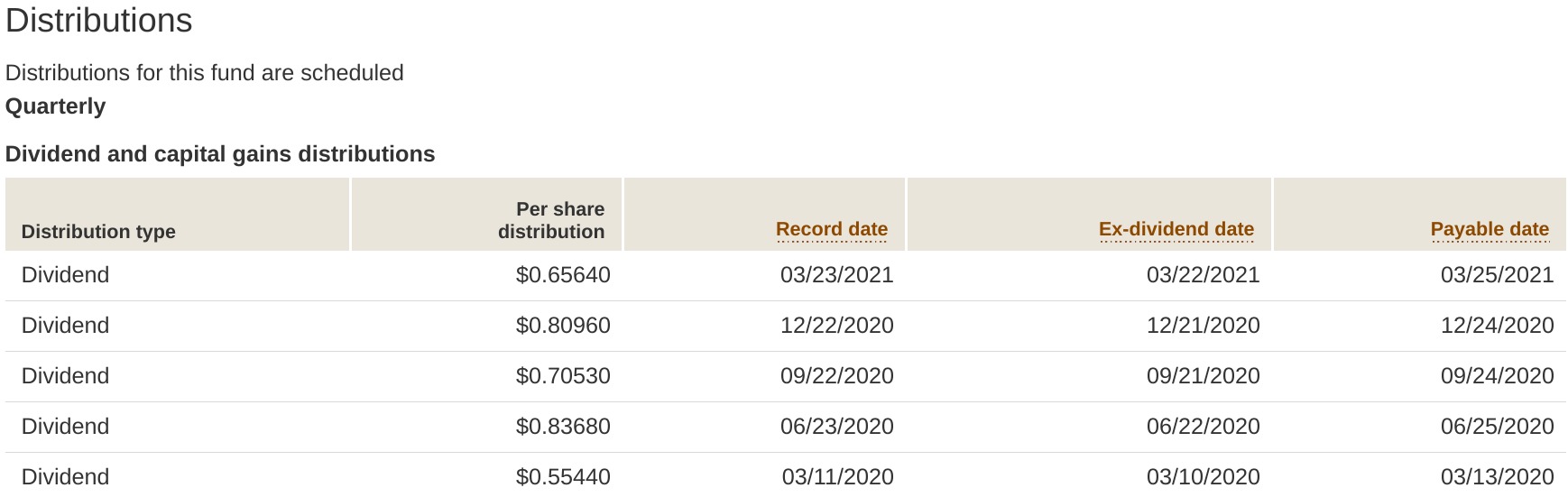

Bank of America is committed to creating value for its shareholders through its dividend payments. Dividends are a portion of the company’s profits that are distributed to its shareholders on a regular basis. These payments are typically made quarterly, although some companies may choose to distribute dividends on a different schedule.

At Bank of America, the board of directors is responsible for determining the dividend policy, including the amount and frequency of the dividend payments. The decision is based on various factors, including the company’s financial performance, cash flow, and future growth prospects.

Dividends can be in the form of cash or additional shares of stock, known as stock dividends. Cash dividends are the most common type and are typically paid out as a fixed amount per share. Stock dividends, on the other hand, involve issuing additional shares to shareholders, effectively increasing their ownership stake in the company.

Bank of America has a long history of paying dividends to its shareholders. Dividend payments provide a tangible return on investment and attract investors seeking income and stability. Additionally, consistent dividend payments can help support the stock price by signaling the company’s financial strength and commitment to shareholders.

It’s important to note that dividend payments are not guaranteed and can fluctuate based on various factors. Economic conditions, industry trends, regulatory changes, and the company’s financial performance can all impact the amount and frequency of dividends. Therefore, it is crucial for investors to closely monitor the company’s financial health and prospects when considering investing in Bank of America for its dividends.

Now that we have covered the basics of dividends and their importance, let’s explore the factors that affect Bank of America’s dividend payments in more detail.

Factors Affecting Bank of America’s Dividend Payments

Bank of America’s dividend payments are influenced by a variety of factors, which are important to consider when analyzing the sustainability and potential growth of these dividends. Understanding these factors can help investors make informed decisions about investing in the company.

1. Financial Performance: One of the key factors impacting dividend payments is the financial performance of the company. Bank of America’s ability to generate consistent profits and maintain a strong balance sheet is crucial for supporting dividend payments. If the company experiences a decline in earnings or faces financial challenges, it may reduce or suspend its dividend payments.

2. Regulatory Environment: The banking industry is heavily regulated, and changes in regulations can impact dividend payments. Bank of America and other banks must comply with capital requirements and regulatory restrictions on dividend distributions. Changes in these regulations can affect the amount and frequency of dividend payments.

3. Economic Conditions: The overall economic environment plays a role in dividend payments. During periods of economic downturn or uncertainty, companies may choose to conserve cash and reduce or suspend dividend payments to navigate through challenging times. Conversely, during periods of economic growth, companies may increase dividend payments to share their success with shareholders.

4. Interest Rates: Interest rates have a direct impact on banks’ profitability and can influence dividend payments. When interest rates are low, banks may face narrower interest rate spreads, resulting in lower profits. In such cases, banks may reduce their dividend payments. Conversely, rising interest rates can boost banks’ profitability and potentially lead to higher dividend payments.

5. Capital Needs: The capital needs of a bank, including investments in new projects, acquisitions, or regulatory requirements, can impact dividend payments. If Bank of America requires significant capital for expansion or compliance purposes, it may choose to allocate funds towards these initiatives rather than increasing dividend payments.

6. Investor Expectations: The expectations and demands of investors can also influence dividend payments. If Bank of America’s shareholders prioritize consistent dividend income, the company may strive to maintain or increase its dividend payments to satisfy its investors.

It’s important to note that these factors are interconnected and can vary over time. Bank of America’s dividend payments are subject to change depending on the dynamic nature of the banking industry and the overall economic landscape. Therefore, investors should closely monitor these factors and conduct thorough analysis before making investment decisions based on dividend income.

Now that we understand the factors affecting Bank of America’s dividend payments, let’s explore the historical dividend payments by the company.

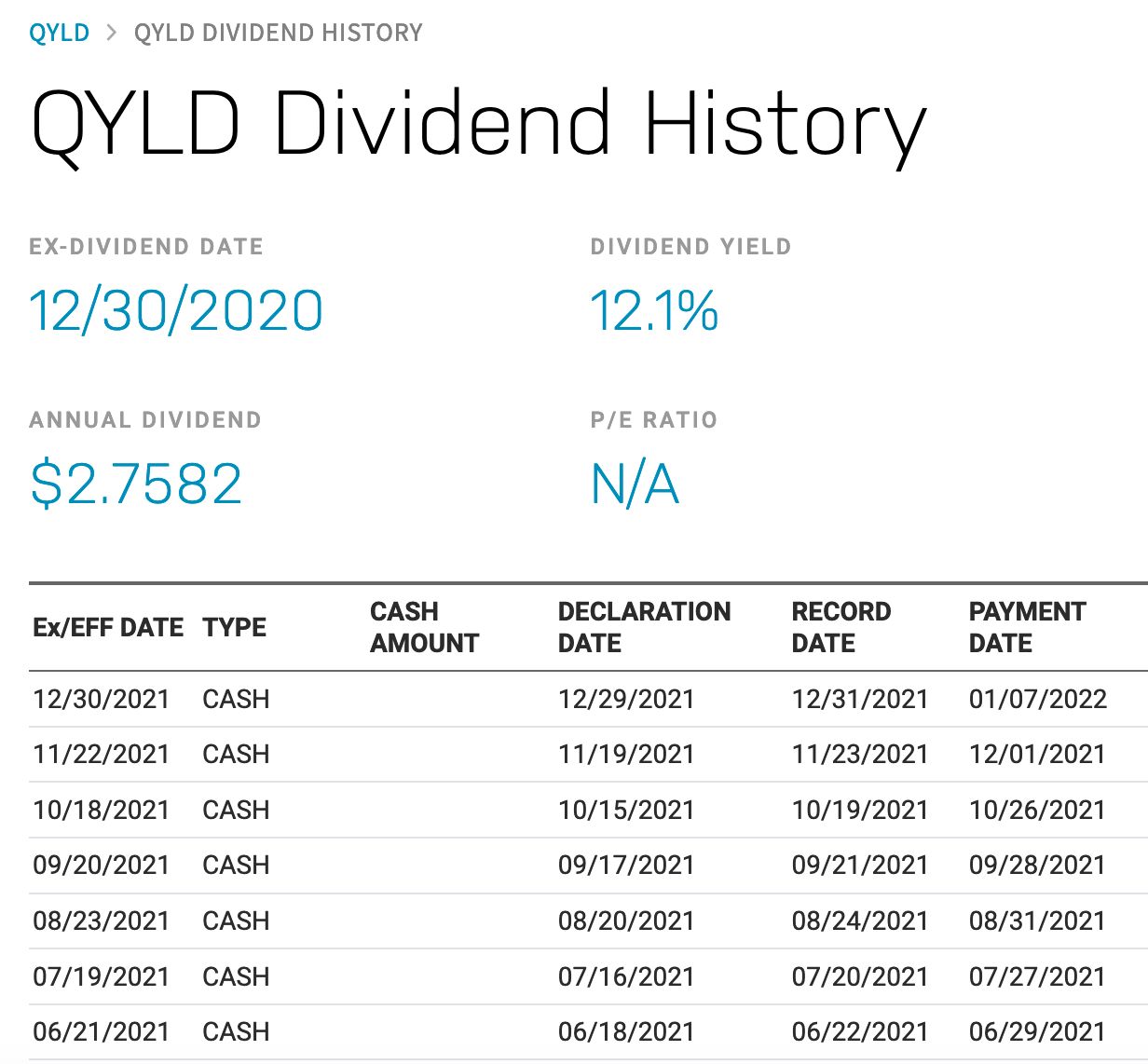

Historical Dividend Payments by Bank of America

Bank of America has a long history of dividend payments, providing shareholders with a consistent stream of income over the years. Examining the historical dividend data can offer insights into the company’s dividend trends and its commitment to returning value to its shareholders.

After the financial crisis of 2008, many banks faced significant challenges and had to cut or suspend their dividend payments. Bank of America was not exempt from these difficulties and had to reduce its dividend to a nominal amount during that period. However, as the company’s financial performance improved and the economy recovered, Bank of America gradually increased its dividend payments.

Since then, Bank of America has demonstrated a commitment to growing its dividends. The company has consistently increased its dividend payments over the past several years, reflecting its improved profitability and strong financial position.

In recent years, Bank of America’s dividend payments have shown steady growth. For example, in 2019, the company paid a quarterly dividend of $0.18 per share, which was increased to $0.20 per share in 2020 and further increased to $0.21 per share in 2021. This demonstrates the company’s willingness to reward shareholders and its confidence in its financial performance.

It’s important to note that dividend payments can be influenced by various factors, as discussed earlier. Therefore, investors should not solely rely on historical data when making investment decisions. However, analyzing the historical dividend payments can provide valuable insights into Bank of America’s commitment to its shareholders and its ability to generate consistent profits.

When evaluating historical dividend data, investors should also consider the dividend payout ratio, which measures the percentage of earnings paid out as dividends. A sustainable payout ratio indicates that the company has a healthy balance between distributing profits to shareholders and retaining earnings for future growth.

Lastly, investors should be aware that past performance is not indicative of future results. While Bank of America has a strong track record of dividend payments, future dividend decisions will depend on the company’s financial performance and overall market conditions.

Now that we have examined the historical dividend payments by Bank of America, let’s move on to explore the current dividend yield of the company.

Current Dividend Yield of Bank of America

The current dividend yield of Bank of America is a crucial metric for investors seeking income from their investments. Dividend yield is calculated by dividing the annual dividend payment per share by the stock’s current market price and expressing it as a percentage.

As the stock price of Bank of America fluctuates in response to market conditions and investor sentiment, the dividend yield can change accordingly. A higher dividend yield indicates a higher return on investment in the form of dividend payments.

Currently, Bank of America offers a competitive dividend yield compared to its industry peers. The specific dividend yield can vary depending on the prevailing market conditions and the stock price at a given time.

It’s important to note that dividend yield should not be the sole factor in making investment decisions. Investors should consider other fundamental factors such as the company’s financial health, growth prospects, and dividend sustainability.

Furthermore, it’s worth mentioning that dividend yield is a dynamic metric and can change over time. Investors should stay updated with the latest financial reports, market trends, and any significant company announcements that could impact future dividend payments.

Investors seeking income from their investments may find the current dividend yield offered by Bank of America attractive. However, it is essential to conduct thorough research and consider other factors before making investment decisions based solely on dividend yield.

Now that we have explored the current dividend yield of Bank of America, let’s discuss the factors to consider when analyzing the company’s dividend payments.

Factors to Consider When Analyzing Bank of America’s Dividend Payments

When analyzing Bank of America’s dividend payments, it is crucial to consider several factors that can provide insights into the sustainability and potential growth of these dividends. By examining these factors, investors can make more informed decisions regarding their investment in the company.

1. Financial Performance: The financial performance of Bank of America is a key factor to assess when analyzing its dividend payments. It is important to examine factors such as the company’s revenue, profitability, and cash flow. A strong and consistent financial performance indicates the company’s ability to generate sufficient profits to sustain and grow its dividend payments.

2. Dividend Payout Ratio: The dividend payout ratio measures the percentage of earnings that are paid out as dividends. It is helpful to analyze this ratio to determine if Bank of America has a sustainable dividend policy. A lower payout ratio suggests that the company retains a larger portion of its earnings for reinvestment or future growth.

3. Capital Adequacy: Banks are required to maintain sufficient capital to support their operations and absorb potential losses. Analyzing Bank of America’s capital adequacy ratios, such as the common equity Tier 1 ratio, can provide insights into the company’s ability to maintain its dividend payments even in adverse economic conditions.

4. Economic and Regulatory Environment: External factors such as the overall economic conditions and changes in regulatory policies can impact Bank of America’s dividend payments. It is important to consider the impact of economic cycles, interest rates, and any changes in banking regulations on the company’s ability to sustain and grow its dividends.

5. Industry and Competitive Landscape: Analyzing Bank of America’s position within the banking industry and its competitive landscape is essential. Understanding the company’s market share, growth potential, and ability to compete can provide insights into its ability to generate sustainable profits and maintain dividend payments.

6. Outlook and Growth Prospects: Evaluating the future outlook and growth prospects of Bank of America is crucial when assessing its dividend payments. Factors such as new business initiatives, technological advancements, and expansion into new markets can contribute to the company’s ability to generate higher profits and potentially increase dividend payments.

It is important to remember that analyzing dividend payments involves a comprehensive evaluation of multiple factors. Investors should carefully consider these factors and conduct thorough research to gain a holistic understanding of Bank of America’s dividend payments.

Now that we have discussed the factors to consider when analyzing Bank of America’s dividend payments, let’s compare its dividend payments with those of its competitors.

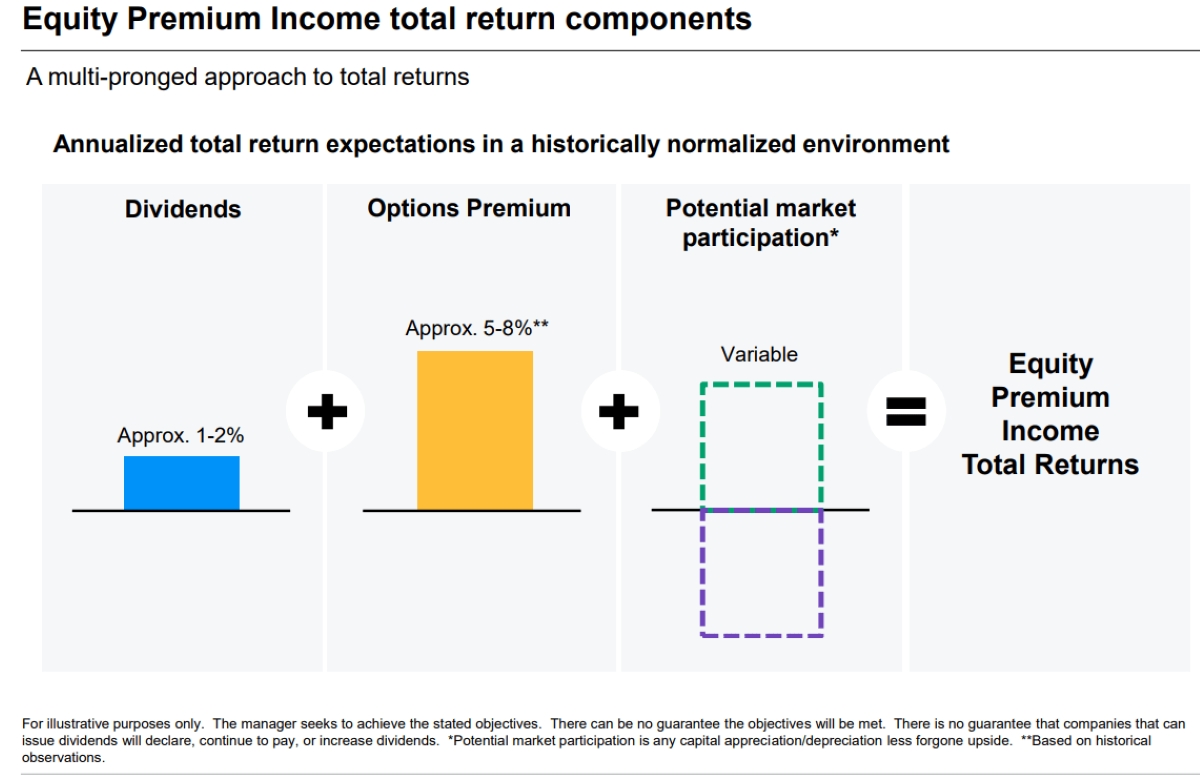

Comparison of Bank of America’s Dividend Payments with Competitors

When evaluating Bank of America’s dividend payments, it is helpful to compare them with those of its competitors in the banking industry. By examining the dividend payments of similar companies, investors can gain insights into how Bank of America’s dividends stack up against its peers.

Some of Bank of America’s key competitors in the banking industry include JPMorgan Chase, Wells Fargo, and Citigroup. These companies also have a history of paying dividends to their shareholders and play a significant role in the financial sector.

Comparing dividend payments involves various aspects, including dividend yield, dividend growth rate, and dividend payout ratio. These metrics help investors assess the attractiveness and sustainability of a company’s dividend payments.

Dividend yield is a key measure to compare Bank of America’s dividend payments with its competitors. It indicates the return on investment in the form of dividend income. By comparing the dividend yields of Bank of America and its competitors, investors can determine which company offers a more appealing dividend yield.

The dividend growth rate is another crucial factor to consider. It shows the rate at which a company’s dividend payments have been increasing over time. Comparing the dividend growth rates of Bank of America and its competitors can provide insights into which companies have a track record of consistently increasing their dividends.

The dividend payout ratio is also important when comparing dividend payments. It measures the percentage of earnings that a company pays out as dividends. By comparing the payout ratios of Bank of America and its competitors, investors can assess which companies allocate a higher portion of their profits towards dividend payments.

It’s important to note that the comparison with competitors should not be the sole basis for investment decisions. Each company has its own unique strengths, weaknesses, and market conditions that can influence dividend payments. Investors should consider the overall financial health, growth prospects, and dividend policies of Bank of America and its competitors before making investment decisions.

Now that we have compared Bank of America’s dividend payments with its competitors, let’s discuss the outlook for Bank of America’s dividends.

Outlook for Bank of America’s Dividends

The outlook for Bank of America’s dividends is an essential consideration for investors looking to invest in the company. While it is impossible to predict future dividend payments with certainty, analyzing various factors can provide insights into the potential direction of Bank of America’s dividends.

Bank of America has demonstrated a commitment to increasing its dividend payments in recent years, reflecting its improved financial performance and strong capital position. The company has consistently increased its dividend payments, providing a positive outlook for investors seeking income.

However, it’s important to recognize that dividend payments are subject to various internal and external factors, including changes in the regulatory environment, economic conditions, and the company’s financial performance. These factors can influence the decision-making process of Bank of America’s board of directors when determining future dividend payments.

One factor to consider is the economic environment. If there are signs of economic downturn or uncertainty, Bank of America may opt to conserve cash and reduce dividend payments to maintain financial stability. Conversely, a favorable economic environment and improved profitability could lead to higher dividend payments.

Additionally, investors should monitor the regulatory landscape. Changes in banking regulations or capital requirements can impact the amount and frequency of dividend payments. Compliance with regulatory restrictions is crucial for Bank of America to ensure the stability and sustainability of its dividend policy.

Furthermore, the company’s financial performance and growth prospects are important considerations. A strong financial position, consistent earnings growth, and effective capital management are indicative of Bank of America’s potential to sustain and potentially increase its dividend payments in the future.

Analysts and financial experts also provide insights into the outlook for Bank of America’s dividends. Monitoring their assessments and projections can help investors gauge market expectations and sentiment regarding future dividend payments.

It’s important for investors to conduct thorough research and monitor these factors to make informed decisions about Bank of America’s dividends in the long term. Diversifying one’s investment portfolio and considering other sources of income are also prudent strategies to mitigate risks associated with dividend payments.

As with any investment decision, it is crucial to review the latest financial reports, company announcements, and industry trends when assessing the outlook for Bank of America’s dividends. This information can help investors gain a better understanding of the company’s direction and make more informed investment decisions.

Now, let’s conclude our comprehensive guide on Bank of America’s dividend payments.

Conclusion

In conclusion, Bank of America’s dividend payments play a significant role in providing value to its shareholders. Understanding the factors that affect these dividend payments is crucial for investors looking to make informed decisions.

We explored the importance of Bank of America’s dividend payments and how they are influenced by factors such as financial performance, regulatory environment, economic conditions, and investor expectations. These factors shape the company’s dividend policy and affect the sustainability and growth potential of its dividend payments.

We also discussed the historical dividend payments by Bank of America, highlighting the company’s commitment to gradually increasing its dividend payments over the years. Examining the historical data can provide valuable insights into the company’s dividend trends and its dedication to returning value to shareholders.

Furthermore, we examined the current dividend yield of Bank of America, which is a critical metric for investors seeking income. While the specific dividend yield can vary based on prevailing market conditions, Bank of America’s dividend yield compares favorably with its competitors in the banking industry.

When analyzing Bank of America’s dividend payments, it is essential to consider factors such as financial performance, dividend payout ratio, capital adequacy, economic and regulatory environment, industry landscape, and growth prospects. Evaluating these factors can provide a comprehensive view of the company’s dividend sustainability and potential for future growth.

While past performance is not indicative of future results, Bank of America’s commitment to increasing dividend payments and its strong financial position provide a positive outlook for its dividends. However, investors should always stay informed about the latest financial reports, market trends, and company updates to make well-informed investment decisions.

In summary, Bank of America’s dividend payments offer investors an opportunity for income and a tangible return on their investment. By considering the various factors discussed in this guide and conducting thorough research, investors can make educated decisions about whether Bank of America’s dividends align with their investment objectives.

Remember, it is important to consult with a financial advisor and conduct independent research before making any investment decisions, as individual circumstances and risk tolerance may vary.

Thank you for joining us on this journey to understand Bank of America’s dividend payments. We hope this guide has provided you with valuable insights and helped you navigate the world of dividends in the finance industry.