Finance

What Is Credit Bank

Modified: February 21, 2024

Discover the role of a credit bank in finance and gain a deeper understanding of its significance for managing your financial affairs effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of credit banks, where finance meets opportunity. Credit banks play a critical role in the global economy by providing financial services, fostering economic growth, and supporting individuals, businesses, and governments in their financial endeavors.

But what exactly is a credit bank? In simple terms, a credit bank is a financial institution that primarily focuses on providing loans and extending credit to individuals and businesses. These banks act as intermediaries between depositors who lend money and borrowers who need funds to finance various projects or fulfill their financial needs.

Credit banks have a long and rich history dating back centuries. Over time, they have evolved, adapting to changing economic landscapes and technological advancements. Today, credit banks are a vital component of the global financial system, catering to the diverse financial needs of individuals and corporations.

Throughout this article, we will delve deeper into the fascinating world of credit banks, exploring their functions, types, role in the economy, benefits, challenges they face, and what the future holds for these financial institutions.

Definition of Credit Bank

A credit bank, also known as a lending institution or a commercial bank, is a financial institution that specializes in offering credit products and financial services to individuals, businesses, and governments. The primary function of a credit bank is to facilitate the borrowing and lending of money, helping to meet the financial needs of various stakeholders.

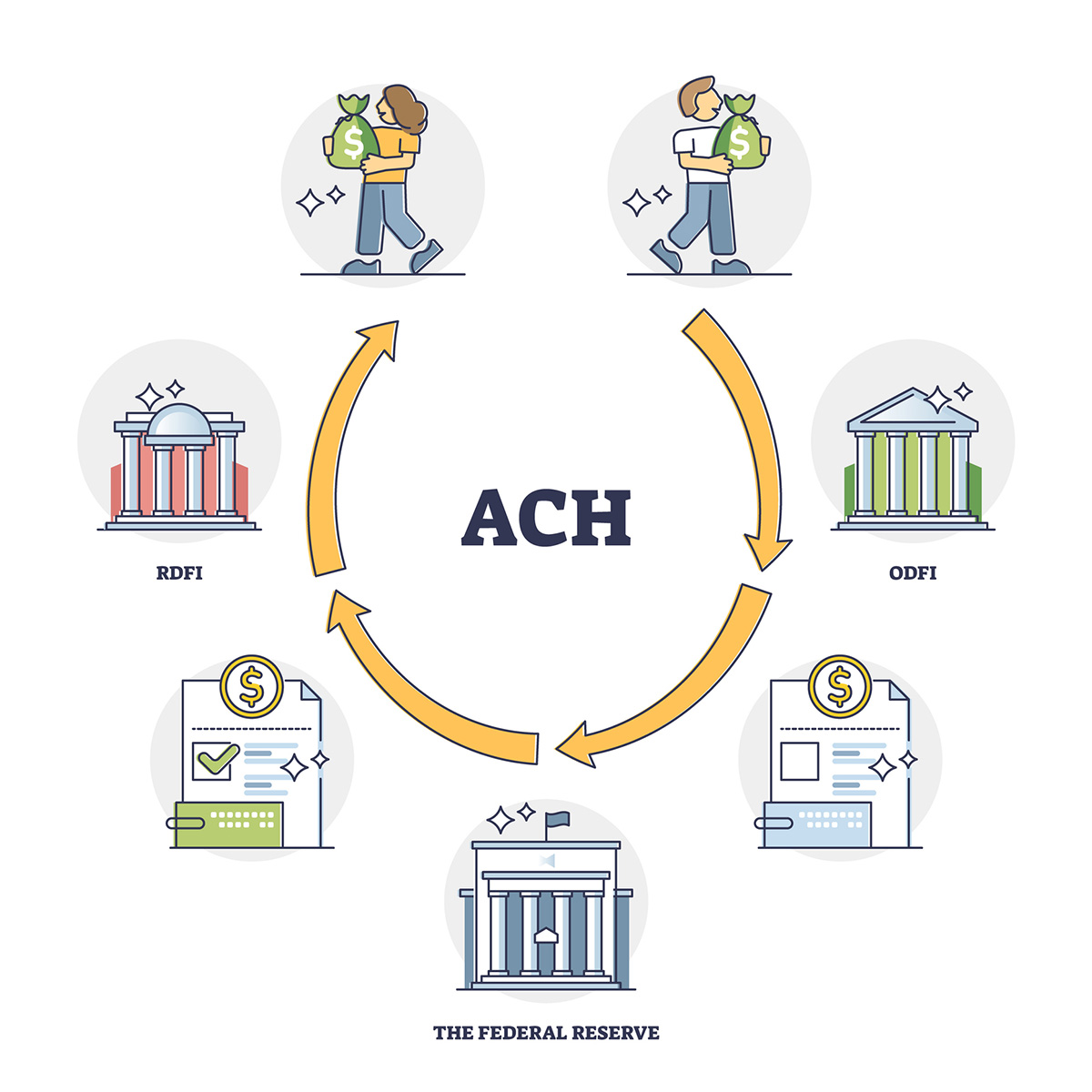

Credit banks attract funds from depositors, who entrust their money to the bank for safekeeping. These funds are then used to grant loans and extend credit to borrowers, who repay the borrowed amount along with interest over a specified period. In essence, credit banks act as intermediaries, connecting surplus funds with those in need of capital.

Unlike investment banks or retail banks, which may have different focuses and services, credit banks center their operations around lending activities. They offer a range of loan products, including personal loans, business loans, mortgage loans, and lines of credit, tailored to suit the specific needs and requirements of their customers.

Furthermore, credit banks provide various banking services, such as savings accounts, checking accounts, payment processing, and credit card services. These services help customers manage their finances, make transactions, and access additional credit when needed.

It is important to note that credit banks are regulated by financial authorities and must comply with relevant laws and regulations to ensure the safety and stability of the banking system. This includes adhering to capital adequacy requirements, maintaining reserve ratios, and conducting regular audits and reporting.

In summary, credit banks are financial institutions that specialize in lending money and extending credit. They play a vital role in the economy by facilitating the flow of funds and supporting the financial needs of individuals, businesses, and governments.

History of Credit Banks

The history of credit banks can be traced back to ancient times, where the concept of lending and borrowing money emerged as a means to facilitate trade and economic activities. However, the modern credit bank as we know it today has its roots in the development of banking systems during the Middle Ages.

During the medieval period, various European cities saw the establishment of early credit banks known as “merchant banks.” These banks primarily focused on facilitating international trade by providing credit and financing to merchants. One notable example is the Medici Bank, founded in Florence, Italy, in the 15th century, which played a significant role in the financial affairs of Europe and contributed to the economic growth of the region.

As trade expanded and economic activities flourished, the need for specialized banking institutions dedicated to lending and credit became more prominent. Over time, credit banks began to emerge in different regions across the world, offering financial services to support local economies.

The Industrial Revolution in the 18th and 19th centuries brought about significant changes in the economic landscape, leading to the establishment of modern credit banks. These banks played a crucial role in financing industrial projects, supporting infrastructure development, and providing capital for the growing business sector.

With the advancement of technology and the advent of the internet in the late 20th century, credit banks underwent further transformations. Online banking and digital services revolutionized the way banking was done, making it more accessible and convenient for customers to access credit and manage their finances.

Today, credit banks continue to evolve and adapt to the changing financial landscape. They employ sophisticated technology, including artificial intelligence and big data analytics, to assess creditworthiness and streamline loan processes. Additionally, credit banks have expanded their services to cater to diverse customer needs, such as specialized lending for small businesses, consumer financing, and investment advisory services.

The history of credit banks showcases their resilience and adaptability over the centuries. From humble beginnings as merchant banks to becoming integral parts of modern economies, credit banks have played a pivotal role in supporting economic growth and facilitating financial transactions for individuals and businesses worldwide.

Functions of Credit Banks

Credit banks play a vital role in the financial system by performing various functions that are essential for the smooth functioning of the economy. Let’s explore some of the key functions of credit banks:

- Providing Loans and Credit: One of the primary functions of credit banks is to grant loans and extend credit to individuals, businesses, and governments. They offer a range of loan products, such as personal loans, business loans, mortgages, and lines of credit, to meet the diverse financial needs of their customers.

- Facilitating Deposits: Credit banks act as custodians for individuals and businesses who deposit their money for safekeeping. They provide various deposit accounts, including savings accounts and checking accounts, allowing customers to securely store their funds and access them when needed.

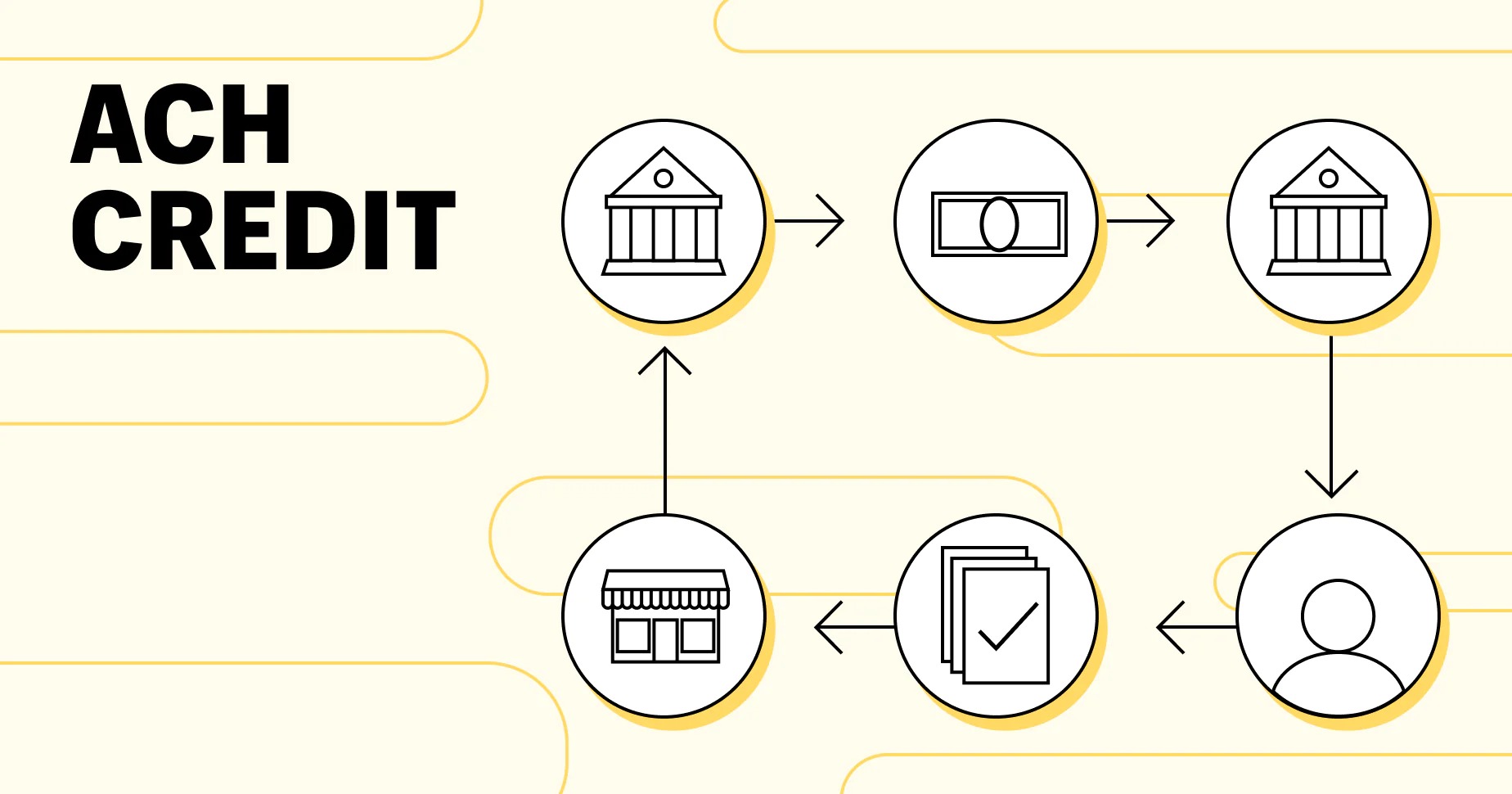

- Payment Processing: Credit banks facilitate payments by offering services such as check clearing, electronic funds transfers, and payment gateways. They ensure the seamless movement of funds between different parties, enabling individuals and businesses to conduct transactions efficiently.

- Managing Risk: Credit banks assess the creditworthiness of borrowers and manage the risks associated with lending. They employ risk management strategies, such as credit scoring models and underwriting processes, to evaluate the repayment capacity of borrowers and mitigate the potential risk of default.

- Capital Market Activities: Credit banks engage in capital market activities, such as buying and selling securities, issuing bonds, and participating in investment banking activities. These activities help mobilize funds from capital markets and facilitate the transfer of capital between investors.

- Financial Advisory Services: Credit banks provide financial advisory services to individuals and businesses. They offer guidance on investment opportunities, financial planning, risk management, and various other financial decisions, helping their clients make informed choices to achieve their financial goals.

- Currency Exchange: Credit banks facilitate currency exchange services, allowing individuals and businesses to convert one currency into another. This service is particularly useful for international travelers, importers, and exporters who need to convert funds into different currencies for their transactions.

- Corporate Banking Services: Credit banks offer specialized services to corporations, including cash management, trade finance, and project financing. These services assist businesses in managing their operational cash flows, facilitating international trade, and financing capital-intensive projects.

These functions collectively contribute to the efficient allocation and utilization of financial resources, promote economic growth, and support the financial needs of individuals, businesses, and governments.

Types of Credit Banks

Credit banks come in various forms, each catering to different segments of the financial market and offering specialized services. Let’s explore some of the common types of credit banks:

- Commercial Banks: Commercial banks are the most common type of credit banks. They provide a wide range of banking services, including lending, deposit accounts, payment processing, and investment advisory. Commercial banks serve both individuals and businesses and operate on a profit-making basis.

- Retail Banks: Retail banks focus primarily on serving individual customers. They offer personal banking services, such as checking and savings accounts, mortgage loans, personal loans, and credit cards. Retail banks aim to provide convenient banking services tailored to the needs of individual consumers.

- Corporate Banks: Corporate banks focus on catering to the financial needs of large corporations and institutions. They provide specialized services such as cash management, trade finance, project financing, and investment banking services. Corporate banks assist businesses in managing their complex financial operations and supporting their growth strategies.

- Investment Banks: Investment banks specialize in underwriting and issuing securities, facilitating mergers and acquisitions, and providing advisory services for capital market transactions. While investment banks are not traditional lending institutions, they play a significant role in the overall credit market by helping companies raise capital through equity or debt offerings.

- Development Banks: Development banks are typically government-owned financial institutions that focus on promoting economic development in specific regions or sectors. They provide long-term financing for infrastructure projects, small business development, and agricultural initiatives. Development banks play a crucial role in fostering economic growth and addressing specific social and economic challenges.

- Cooperative Banks: Cooperative banks are owned and operated by their members, who are typically individuals or small businesses with a common bond or interest. These banks often serve local communities and provide banking services with a focus on meeting the financial needs of their members. Cooperative banks operate on a cooperative principle, where members have a say in the bank’s decision-making process.

- Online Banks: Online banks, also known as virtual banks or internet banks, operate solely through digital platforms without any physical branches. These banks offer a wide range of banking services, including lending, deposit accounts, and payment processing. Online banks provide convenience and often offer competitive interest rates and lower fees due to their lower operating costs.

- Microfinance Institutions: Microfinance institutions focus on providing financial services to individuals and small businesses that do not have access to traditional banking services. They offer small loans, savings accounts, and other financial products tailored to the needs of low-income individuals and underserved communities. Microfinance institutions play a crucial role in poverty alleviation and empowering marginalized individuals through access to credit.

These are just a few examples of the various types of credit banks that exist in the financial industry. Each type serves specific customer segments and fulfills different financial needs, contributing to the overall diversity and accessibility of credit services.

Role of Credit Banks in the Economy

Credit banks play a crucial role in the overall functioning and stability of the economy. Their significance stems from their ability to mobilize savings, allocate capital efficiently, and support economic growth. Let’s explore the key roles that credit banks play in the economy:

- Financial Intermediation: Credit banks act as intermediaries between depositors and borrowers, facilitating the flow of funds in the economy. They attract deposits from individuals and businesses and channel these funds towards productive uses by providing loans to borrowers. This intermediation process helps allocate capital efficiently, directing surplus funds towards investment and fostering economic activity.

- Lending and Credit Creation: Credit banks are the primary source of credit for individuals, businesses, and governments. By providing loans and extending credit, credit banks support various economic activities, including consumer spending, business expansion, and infrastructure development. The availability of credit helps fuel economic growth and enhances purchasing power, driving demand in the economy.

- Supporting Investment and Entrepreneurship: Credit banks play a vital role in providing the necessary capital for investment projects and entrepreneurial ventures. They offer financing options that enable businesses to expand operations, invest in new technologies, and create job opportunities. By supporting investment and entrepreneurship, credit banks contribute to innovation, productivity growth, and overall economic development.

- Stimulating Consumption: Access to credit provided by credit banks allows individuals and households to make purchases and investments that they might not be able to afford immediately. This ability to spread out payments over time promotes consumption, boosts consumer confidence, and stimulates economic activity. This, in turn, drives demand for goods and services, contributing to economic growth.

- Providing Financial Services to Unbanked and Underbanked: Credit banks play a critical role in bridging the gap for individuals and small businesses that have limited access to the financial system. They extend financial services to underserved populations, including those in rural areas or low-income communities, through specialized products and programs. By providing access to credit and banking services, credit banks promote financial inclusion and help reduce poverty and wealth inequality.

- Supporting Government Financing: Credit banks assist governments by providing them with financing options to fund public infrastructure projects and meet their financial obligations. Through the issuance of government bonds and other debt instruments, credit banks enable governments to raise capital and manage their fiscal needs effectively. This helps stimulate economic growth and ensures the smooth functioning of public services.

- Contributing to Monetary Policy: Credit banks play a vital role in the implementation of monetary policy set by central banks. By adjusting interest rates and credit availability, credit banks influence borrowing costs, money supply, and overall economic activity. This collaboration between credit banks and central banks helps maintain price stability, manage inflation, and support macroeconomic stability.

In summary, credit banks are integral to the functioning of the economy. Through their intermediary role, credit creation, support for investment and entrepreneurship, and provision of financial services, they facilitate economic growth, promote financial inclusion, and contribute to the stability and development of the financial system.

Benefits of Credit Banks

Credit banks provide numerous benefits to individuals, businesses, and the economy as a whole. Let’s explore some of the key advantages of credit banks:

- Access to Funds: Credit banks offer individuals and businesses access to funds through loans and credit facilities. This allows borrowers to fulfill their financial needs, whether it’s purchasing a home, starting a business, or financing education. The availability of credit provides opportunities for personal and economic growth.

- Investment Opportunities: Through credit banks, individuals can invest in projects and ventures that they believe in. Credit banks provide a platform for individuals to allocate their savings towards productive activities, such as small business expansion or infrastructure development. This promotes investment, stimulates economic activity, and enhances wealth creation.

- Financial Stability: Credit banks help individuals and businesses manage their financial needs and maintain financial stability. They offer services such as savings accounts, checking accounts, and financial planning advice. By providing a safe place to deposit funds and offering tools for effective money management, credit banks contribute to financial security and peace of mind.

- Liquidity Management: Credit banks enable individuals and businesses to effectively manage their liquidity. Through checking accounts, individuals can easily access their funds for day-to-day transactions. Businesses can also utilize credit bank services to manage cash flow, optimize working capital, and handle payment processing efficiently.

- Financial Advice: Credit banks offer financial advisory services to help individuals and businesses make informed decisions. Whether it’s investment advice, retirement planning, or debt management, credit banks provide guidance and expertise to help customers achieve their financial goals. This helps customers navigate complex financial matters and make sound financial choices.

- Risk Sharing: Credit banks act as risk-sharing institutions. By extending credit and providing loans, credit banks assume the risk associated with lending. They assess the creditworthiness of borrowers and redistribute risk across their customer base. This allows for the efficient allocation of capital and ensures that risk is shared among various stakeholders.

- Contribution to Economic Growth: Credit banks play a fundamental role in fostering economic growth. By providing individuals and businesses with access to credit, credit banks enable entrepreneurial ventures, job creation, and infrastructure development. Increased borrowing and investment stimulate economic activity, leading to higher productivity, GDP growth, and improved living standards.

- Financial Inclusion: Credit banks contribute to financial inclusion by providing services to individuals and businesses that may not have access to traditional banking institutions. They offer specialized products and programs to underserved populations, promoting financial accessibility and empowering marginalized communities. Credit banks help bridge the gap between the banked and unbanked population, fostering economic inclusion and reducing inequality.

These benefits highlight the significant role that credit banks play in the financial well-being of individuals, the growth of businesses, and the overall development of the economy.

Challenges Faced by Credit Banks

Credit banks face a myriad of challenges in today’s complex and dynamic financial landscape. These obstacles can impact their operations, profitability, and ability to effectively serve their customers. Let’s explore some of the key challenges faced by credit banks:

- Economic Volatility: Credit banks operate in an environment of economic volatility, where fluctuations in interest rates, inflation, and overall economic conditions can impact their profitability. Economic downturns can lead to higher default rates, reduced credit demand, and increased loan delinquencies, putting pressure on credit banks’ financial health.

- Credit Risk: Credit banks face the challenge of managing credit risk, ensuring that loans and credit extended to borrowers are repaid on time. Evaluating the creditworthiness of borrowers and mitigating the risk of default requires rigorous risk assessment practices, effective underwriting, and ongoing monitoring of borrowers’ financial positions.

- Regulatory Compliance: Credit banks are subject to extensive regulatory frameworks and compliance requirements. Meeting regulatory standards, such as capital adequacy ratios and reporting obligations, can be complex and costly. Adapting to evolving regulatory changes and ensuring compliance adds a layer of operational complexity for credit banks.

- Technological Disruption: Advances in technology and the rise of digital banking have disrupted the traditional banking landscape. Credit banks must adapt and invest in innovative technologies to stay competitive and provide seamless digital experiences to customers. This requires significant investment in infrastructure, cybersecurity measures, and talent acquisition.

- Customer Expectations: Customers’ expectations around convenience, speed, and personalized services are rapidly evolving. Credit banks must continuously improve their customer experience to meet these changing demands. Providing user-friendly online platforms, efficient loan processing, and personalized financial advice are essential in retaining and attracting customers.

- Competition: Credit banks face intense competition from various players in the financial industry, including traditional banks, online lenders, fintech companies, and non-banking financial institutions. Credit banks must differentiate themselves by offering unique products, competitive interest rates, and exceptional customer service to retain their market share.

- Cybersecurity Risks: As technology advances, the risk of cyber threats and data breaches increases. Credit banks must proactively invest in robust cybersecurity measures to protect customer data, prevent unauthorized access, and ensure the integrity of their systems. A security breach can damage a credit bank’s reputation and erode customer trust.

- Interest Rate Risk: Fluctuations in interest rates can impact credit banks’ profitability and asset-liability management. Banks with a significant portion of variable-rate loans may face challenges in managing interest rate risk. The ability to effectively hedge against interest rate movements and adapt their loan portfolios to changing market conditions is crucial for credit banks.

Successfully navigating these challenges requires credit banks to remain vigilant, adaptable, and innovative. By addressing these challenges head-on, credit banks can position themselves for sustained growth and continue to meet the evolving needs of their customers in a rapidly changing financial landscape.

Future of Credit Banks

The future of credit banks is shaped by ongoing technological advancements, changing customer expectations, and evolving regulatory landscapes. Here are some key trends and possibilities that might shape the future of credit banks:

- Digital Transformation: Credit banks will continue to embrace digital transformation, leveraging technology to enhance customer experiences, streamline operations, and offer innovative products and services. Online and mobile banking capabilities will become more sophisticated, enabling customers to manage their finances conveniently, make transactions seamlessly, and access personalized financial advice.

- Artificial Intelligence and Data Analytics: The use of artificial intelligence (AI) and data analytics will become increasingly common in credit banks. AI-powered chatbots and virtual assistants will handle customer queries, while data analytics will provide valuable insights for risk management, loan underwriting, and personalized financial recommendations. These technologies will enhance credit banks’ decision-making processes and improve customer engagement.

- Open Banking: Open banking initiatives will continue to gain momentum, promoting the sharing of financial data among different financial institutions with customers’ consent. This allows credit banks to offer more personalized services, harnessing a broader range of data and collaborating with fintech firms to provide innovative products such as personalized lending solutions.

- Rise of Fintech and Non-Banking Competitors: Fintech companies, as well as other non-banking players, will pose increasing competition to credit banks. These technology-driven startups can provide agile, user-friendly platforms and innovative financial solutions. Credit banks will need to collaborate with or acquire fintech firms to stay competitive and leverage their cutting-edge technologies.

- Focus on Sustainability and ESG: Credit banks will increasingly prioritize environmental, social, and governance (ESG) factors in their operations. There will be a greater emphasis on sustainable lending and investing practices, supporting green initiatives, and promoting responsible lending to contribute positively to society and align with evolving customer values.

- Enhanced Risk Management: With the growing complexity of the financial landscape, credit banks will invest in advanced risk management tools and strategies. This includes machine learning algorithms to detect and prevent fraud, robust cybersecurity frameworks to protect against cyber threats, and sophisticated modeling techniques to assess and manage credit and market risks.

- Regulatory Changes and Compliance: Regulatory frameworks will continue to evolve, driven by changing market dynamics, technological advancements, and the need for improved consumer protection. Credit banks will need to remain vigilant and adaptable to meet these changing regulatory requirements while ensuring compliance and maintaining the trust of customers.

- Financial Inclusion and Emerging Markets: Credit banks will play a crucial role in expanding financial inclusion, particularly in emerging markets. They will leverage mobile technologies and partnerships with local agents to reach underserved populations and provide them with access to affordable banking services, credit, and financial literacy programs.

The future of credit banks holds both opportunities and challenges. By embracing digital innovation, focusing on customer needs, and adapting to changing regulatory landscapes, credit banks can evolve and thrive in an ever-evolving financial ecosystem, ensuring they remain relevant and indispensable in meeting the financial needs of individuals, businesses, and economies.

Conclusion

Credit banks play a vital role in the global financial system, serving as intermediaries that connect individuals, businesses, and governments with the capital they need to thrive. Throughout history, credit banks have evolved to meet the changing economic landscape and the demands of their customers.

From providing loans and extending credit to managing savings accounts and offering financial advice, credit banks offer a range of services that support economic growth, promote financial inclusion, and enhance the overall stability of the economy.

However, credit banks also face challenges, including economic volatility, regulatory compliance, fierce competition, and the need to adapt to technological advancements and changing customer expectations. To thrive in the future, credit banks must embrace digital transformation, harness innovative technologies like AI and data analytics, and collaborate with fintech firms to enhance customer experiences and stay competitive.

Furthermore, credit banks must continue to be socially responsible and address sustainability and ESG concerns. By prioritizing responsible lending and investing, credit banks can contribute positively to society, align with evolving customer values, and address pressing environmental and social issues.

Despite these challenges, the future of credit banks is promising. As they navigate the dynamic financial landscape, credit banks have the opportunity to shape the future by leveraging technology, nurturing customer relationships, and innovating to meet the evolving needs of their stakeholders.

In conclusion, credit banks are integral to the global financial system, fostering economic growth, supporting investment and entrepreneurship, and providing financial services to individuals and businesses. As the financial landscape continues to evolve, credit banks must adapt, embrace change, and stay focused on delivering value to their customers. By doing so, they can continue to play a pivotal role in driving economic prosperity and financial well-being for individuals and societies around the world.