Home>Finance>Why Might People Refer To Student Loans As “Good Debt”?

Finance

Why Might People Refer To Student Loans As “Good Debt”?

Published: January 20, 2024

Discover why student loans are often considered "good debt" and how they can help finance your education. Explore the benefits of student loans in managing your finances.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Student Loans

- The Concept of “Good Debt”

- Advantages of Student Loans

- Access to Higher Education

- Potential for Higher Income

- Building Credit History

- Tax Benefits

- Student Loan Forgiveness Programs

- Financial Security and Future Opportunities

- The Impact of Student Loans on Financial Well-being

- Considerations and Drawbacks of Student Loans

- Accumulation of Interest

- Repayment Challenges

- Potential Impact on Financial Goals and Priorities

- Exploring Alternatives to Student Loans

- Conclusion

Introduction

Student loans have become an integral part of the financial landscape for many individuals pursuing higher education. These loans provide access to funds that cover the costs of tuition, books, and living expenses during college or university. While taking on debt is generally seen as a negative financial move, student loans are often referred to as “good debt.” But why is that? In this article, we will explore the concept of student loans as “good debt” and delve into the reasons behind this perception.

Student loans are financial resources specifically designed to assist students in paying for their education. Unlike traditional loans, they often come with competitive interest rates, flexible repayment terms, and deferred payment options. This makes them more accessible and manageable for students, particularly those who may not have sufficient personal or family funds to cover the cost of their education upfront.

The concept of “good debt” suggests that some types of borrowing can be considered an investment in one’s future and have long-term benefits that outweigh the immediate financial burden. While it is crucial to approach borrowing responsibly and carefully consider the implications, student loans are often viewed as an investment in oneself and one’s future earning potential.

By obtaining a higher education degree, individuals can enhance their knowledge, skills, and qualifications, thereby positioning themselves for better career opportunities and higher earning potential. This increased income potential is often cited as one of the key reasons why student loans are considered “good debt.

Furthermore, student loans can help individuals establish and build a credit history. Credit history plays a significant role when it comes to future financial endeavors, such as buying a car, renting an apartment, or even applying for certain jobs. Responsible repayment of student loans can demonstrate financial responsibility and lead to favorable credit scores, making it easier to access credit in the future.

Moreover, there are specific tax benefits associated with student loans. In some countries, including the United States, interest paid on qualified student loans may be deductible on income tax returns. This deduction can help reduce the overall tax liability and effectively lower the cost of borrowing.

Additionally, it is worth mentioning that various student loan forgiveness programs exist, depending on the country and other eligibility criteria. These programs can alleviate the burden of repayment for certain individuals, such as those working in public service or in fields with a shortage of qualified professionals.

While student loans can provide individuals with opportunities for higher education, increased income potential, credit building, tax benefits, and potential loan forgiveness, it is essential to consider the potential drawbacks and challenges associated with them as well. As we explore the concept of “good debt” further, we will address these considerations and discuss alternative options to student loans.

Definition of Student Loans

Before delving into the concept of “good debt” associated with student loans, it is essential to understand what student loans are and how they work. In simple terms, student loans are funds borrowed by individuals to finance their education expenses, primarily college or university tuition fees, textbooks, and living costs.

Student loans can be obtained from various sources, including government programs, financial institutions, and private lenders. The specific terms and conditions of these loans may vary depending on the country, lending institution, and individual circumstances. However, they generally come with lower interest rates compared to other forms of borrowing, such as credit cards or personal loans.

There are typically two types of student loans: federal and private. Federal student loans are provided by government agencies, while private student loans are obtained from non-government entities, such as banks, credit unions, or online lenders.

One of the significant differences between federal and private student loans is the eligibility criteria. Federal student loans are generally more accessible and flexible in terms of eligibility requirements, particularly for individuals demonstrating financial need. On the other hand, private student loans typically have stricter lending criteria, including creditworthiness and income stability.

Another critical aspect of student loans is the repayment process. Most student loans have a grace period that allows borrowers to defer repayments until after they complete their education or drop below a certain number of credit hours. Once the grace period ends, borrowers are typically required to make monthly repayments towards the loan, which includes both principal and interest.

It is important to note that student loans often have longer repayment terms compared to other types of loans, allowing borrowers more time to pay off their debt. The repayment period can range from 10 to 25 years, depending on the loan program and the borrower’s financial situation.

In cases where borrowers face financial hardship or struggle to make their loan payments, there may be options for deferment or forbearance. These options allow borrowers to temporarily suspend or reduce their loan payments, providing some relief during challenging times. However, it is crucial to understand that interest may continue to accrue during deferment or forbearance, potentially adding to the overall loan balance.

In summary, student loans are financial instruments that enable individuals to finance their education expenses. They come in the form of federal or private loans and play a crucial role in expanding access to higher education. Understanding the nature of student loans sets the stage for exploring why they are often considered “good debt.”

The Concept of “Good Debt”

When it comes to personal finances, the idea of “good debt” may seem contradictory. After all, debt is often associated with financial burden and the need for repayment. However, the concept of “good debt” suggests that certain types of borrowing can be seen as an investment in one’s future and can potentially yield positive long-term benefits.

In the context of student loans, they are often referred to as “good debt” due to the belief that borrowing money to obtain a higher education can lead to improved career prospects, higher earning potential, and overall financial well-being.

One of the key reasons student loans are considered “good debt” is the potential for higher income. By investing in education, individuals acquire knowledge, skills, and qualifications that can open doors to better job opportunities and increased earning potential over time. As a result, the increased income can help offset the burden of student loan repayment and contribute to long-term financial stability.

Furthermore, student loans can also be viewed as an investment in oneself. By pursuing higher education, individuals can enhance their personal growth and broaden their perspectives, both academically and culturally. These experiences can have a lasting impact on one’s confidence, critical thinking abilities, and overall personal development.

Moreover, student loans can provide individuals with access to higher education, which is often seen as a pathway to greater opportunities and social mobility. Without student loans, many talented and qualified individuals would not be able to afford the soaring costs of education, depriving them of the chance to develop their skills and contribute to society in meaningful ways.

Another factor that contributes to the perception of student loans as “good debt” is the potential positive impact on credit history. Responsible repayment of student loans can help individuals establish and build a credit history, which is a crucial factor in securing future loans, such as mortgages or car loans. A strong credit history opens doors to favorable interest rates and better financial opportunities down the line.

Additionally, student loans often come with certain tax benefits, depending on the country. In some cases, the interest paid on qualified student loans is tax-deductible, lowering the overall tax liability for borrowers. This deduction can reduce the effective cost of borrowing and provide some financial relief for individuals during the repayment period.

While the concept of “good debt” associated with student loans highlights the potential advantages and benefits, it is crucial to approach borrowing responsibly and consider individual circumstances. Not all student loans are created equal, and careful consideration should be given to interest rates, repayment terms, and future financial goals.

In the following sections, we will explore the specific advantages of student loans, the potential impact on financial well-being, and the considerations and drawbacks that individuals should be aware of when considering student loans.

Advantages of Student Loans

Student loans, often referred to as “good debt,” offer several advantages that make them an attractive option for individuals seeking higher education. These advantages include access to higher education, potential for higher income, credit building, tax benefits, and student loan forgiveness programs.

1. Access to Higher Education: One of the most significant advantages of student loans is the ability to access quality education that might otherwise be unattainable due to financial constraints. These loans provide individuals with the means to pay for tuition fees, textbooks, accommodation, and other education-related expenses. By removing the financial barrier, student loans enable individuals to pursue their academic goals and expand their knowledge and skills.

2. Potential for Higher Income: Obtaining a higher education degree can greatly enhance an individual’s earning potential. Studies consistently show that individuals with college degrees or advanced degrees tend to earn higher salaries compared to those with only a high school diploma. By investing in education through student loans, individuals have the opportunity to increase their future income and improve their overall financial well-being.

3. Credit Building: Responsible repayment of student loans can help individuals establish and build their credit history. Building a positive credit history is crucial for future financial endeavors, such as applying for mortgages, car loans, or even renting an apartment. Demonstrating responsible borrowing behavior through student loan repayment can lead to favorable credit scores, which in turn opens doors to better credit opportunities and lower interest rates in the future.

4. Tax Benefits: Depending on the country, student loans often come with certain tax benefits. In some cases, the interest paid on qualified student loans is tax-deductible. This deduction can reduce the overall tax liability for borrowers, effectively lowering the cost of borrowing. Taking advantage of these tax benefits can result in valuable savings and provide financial relief during the repayment period.

5. Student Loan Forgiveness Programs: Many countries have implemented student loan forgiveness programs to assist individuals in managing their student loan debt. These programs often target individuals working in public service or in fields with a shortage of qualified professionals. Under certain conditions, borrowers may have a portion of their student loan debt forgiven, alleviating the burden of repayment and providing financial relief.

While these advantages highlight the positive aspects of student loans, it is important to approach borrowing responsibly and consider individual circumstances. It is crucial to understand the terms and conditions of the loan, including interest rates, repayment plans, and eligibility for forgiveness programs. Additionally, it is essential to have a clear understanding of one’s financial goals and priorities, and to evaluate alternative options before committing to a student loan.

In the following sections, we will examine the potential impact of student loans on financial well-being and discuss the considerations and drawbacks that individuals should carefully consider before taking on student loan debt.

Access to Higher Education

One of the undeniable advantages of student loans is the ability to gain access to higher education that might otherwise be unattainable due to financial constraints. Education is a powerful tool that opens doors to knowledge, skills, and future opportunities. However, the rising costs of tuition, textbooks, and living expenses can be a significant barrier for many individuals.

Student loans bridge this gap by providing the necessary funds to cover the expenses associated with pursuing a college or university degree. These loans enable individuals from diverse backgrounds to access quality education and amplify their potential for personal and professional growth.

Without student loans, many talented and qualified students may be unable to afford the ever-increasing costs of higher education. These loans level the playing field, ensuring that individuals have the opportunity to pursue their academic goals and aspirations, regardless of their financial circumstances.

Access to higher education not only enhances an individual’s knowledge but also equips them with critical thinking abilities, problem-solving skills, and a deeper understanding of the world. It provides individuals with a broader perspective, fostering personal growth and development in various aspects of life.

Furthermore, higher education institutions often offer a wide range of academic programs, allowing individuals to specialize in fields that align with their passions and career goals. Student loans make it feasible for individuals to pursue degrees in areas such as science, technology, engineering, mathematics, medicine, humanities, social sciences, and more, expanding their opportunities in the job market.

By gaining access to higher education through student loans, individuals can acquire the necessary qualifications to compete in a competitive job market. A college or university degree is increasingly becoming a prerequisite for many careers, as employers recognize the value of higher education in preparing individuals for the demands of the workforce.

Beyond the immediate benefits of job prospects, higher education also opens doors to networking opportunities, internships, research projects, and collaborations with professors and peers. These experiences can be invaluable in building professional connections and gaining real-world knowledge that goes beyond textbook learning.

In summary, student loans provide individuals with an opportunity to access higher education and obtain a college or university degree. Through these loans, individuals can overcome financial barriers and pursue their academic aspirations, enabling personal and professional growth. Access to higher education not only expands knowledge but also paves the way for future opportunities and success in the ever-evolving global job market.

Potential for Higher Income

One of the key advantages of obtaining a higher education degree through the help of student loans is the potential for higher income. Investing in education can significantly increase an individual’s earning potential and pave the way for a more prosperous financial future.

Statistics consistently show that individuals with higher levels of education tend to earn higher salaries compared to those with only a high school diploma. A college or university degree equips individuals with specialized knowledge, skills, and qualifications that are highly sought after in the job market.

Higher education provides individuals with the opportunity to develop critical thinking abilities, analytical skills, problem-solving capabilities, and industry-specific expertise. These skills are in demand across various sectors and professions, making degree holders more desirable to employers.

Furthermore, certain occupations require specific degrees or certifications, which can only be obtained through higher education. Fields such as engineering, medicine, law, information technology, and finance often require advanced education to meet the necessary qualifications. By pursuing these degrees through student loans, individuals open doors to lucrative career paths with higher earning potential.

Beyond the immediate financial benefits, higher education offers individuals the chance to enter industries that typically offer higher salaries and greater opportunities for career advancement. Professionals in fields such as medicine, law, engineering, and business management can command higher salaries due to the specialized knowledge and skills they possess.

In addition, individuals with higher education degrees often have access to a broader range of job opportunities. Many employers specifically seek candidates with college degrees for certain positions, as they believe these individuals bring a higher level of expertise and competency to the role. This increased demand can lead to greater job security, more favorable employment terms, and opportunities for career growth.

Beyond the immediate financial benefits, higher education offers individuals the chance to enter industries that typically offer higher salaries and greater opportunities for career advancement. Professionals in fields such as medicine, law, engineering, and business management can command higher salaries due to the specialized knowledge and skills they possess.

Moreover, the potential for higher income extends beyond the initial job placement. Over the course of a career, individuals with higher education degrees tend to earn higher salaries and have greater potential for salary growth compared to those with lower levels of education. This increased income can have a significant impact on overall financial well-being, allowing individuals to achieve their financial goals, build wealth, and enjoy a higher standard of living.

In summary, student loans provide individuals with the means to obtain a higher education degree that can lead to increased earning potential. Investing in education through student loans can open doors to higher-paying job opportunities, enhanced job security, and long-term career growth. By attaining a higher income, individuals can improve their financial stability, achieve their financial goals, and create a better future for themselves and their families.

Building Credit History

One often overlooked advantage of student loans is the opportunity they provide to build credit history. Building and maintaining a good credit history is essential for future financial endeavors, such as obtaining loans, renting an apartment, or even securing certain jobs. Student loans offer a structured way for individuals to establish and improve their creditworthiness.

When individuals take out student loans, they enter into a borrowing relationship with a lender, which is typically a financial institution or a government program. As borrowers make regular, on-time payments towards their student loans, they demonstrate their ability to manage debt responsibly, which is a key factor in determining creditworthiness.

Throughout the repayment period, the borrower’s payment history is typically reported to credit bureaus. These credit bureaus compile this information and assign individuals a credit score, which provides a snapshot of their creditworthiness. A positive credit history and a high credit score can open doors to more competitive interest rates, better loan terms, and improved access to credit in the future.

Building credit history through student loans is particularly advantageous for individuals who are just starting their financial journey and have a limited credit history. Many young individuals may not have had the opportunity to establish credit by owning credit cards or taking out other types of loans. Student loans provide them with an avenue to build creditworthiness and set a solid foundation for future financial endeavors.

Responsible management of student loan debt can have a positive impact on credit scores. Making payments on time, fulfilling the agreed-upon loan terms, and maintaining a good standing with the lender are all factors that contribute to a healthy credit history. This can translate to favorable credit scores, which are crucial when it comes to securing future loans, such as mortgages or car loans.

Beyond securing loans, a good credit history can also influence other areas of life. Landlords often review credit histories when considering tenant applications, and a positive credit history can improve the chances of being approved for a lease. Some employers also conduct credit checks as part of their hiring process, particularly for positions that involve financial responsibilities. A strong credit history can demonstrate financial responsibility and enhance job prospects in certain industries.

It is important to note that building credit history through student loans requires responsible management of the debt. This includes making payments on time, avoiding defaults or delinquencies, and keeping overall debt levels in check. It is crucial to borrow only what is necessary and be mindful of budgeting and financial planning to ensure manageable repayment.

In summary, student loans offer individuals the opportunity to build credit history by making regular, on-time payments towards their debt. Building and maintaining a positive credit history through responsible management of student loans can lead to improved credit scores, better loan terms, and greater access to credit in the future. It is important to approach student loan borrowing responsibly and consider the long-term impact on creditworthiness.

Tax Benefits

One of the advantages of student loans is that they often come with certain tax benefits, depending on the country. These tax benefits can help reduce the overall cost of borrowing and provide some financial relief during the repayment period.

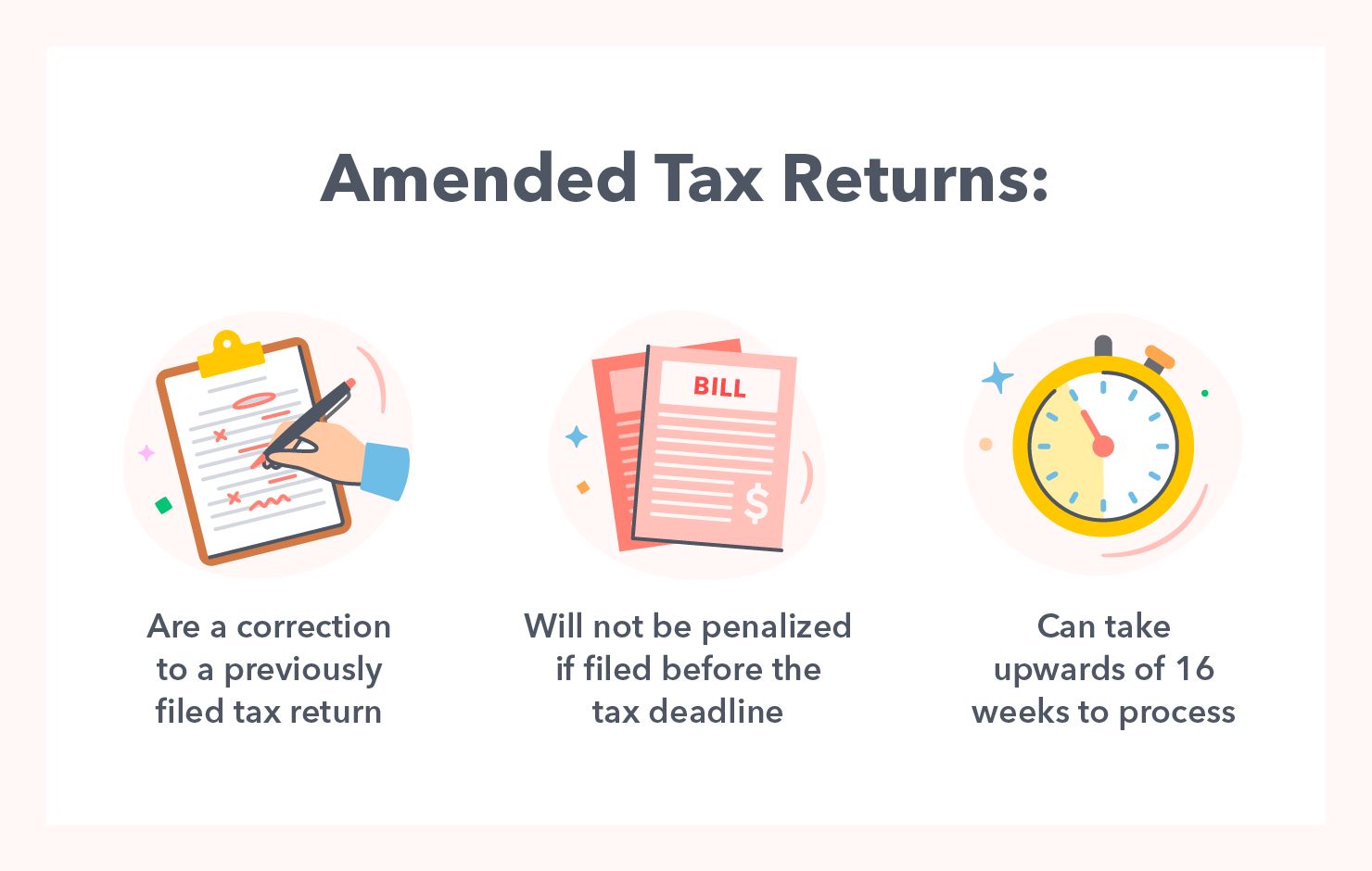

In some countries, such as the United States, the interest paid on qualified student loans is tax-deductible. This means that individuals who have taken out eligible student loans can deduct the interest paid on those loans from their taxable income when filing their income tax returns.

The tax deduction for student loan interest can result in valuable savings for borrowers. By reducing the amount of taxable income, the deduction effectively lowers the overall tax liability, providing individuals with more disposable income that can be used towards other financial goals or additional debt repayment.

It is important to note that the availability and eligibility criteria for the student loan interest deduction may vary from country to country. In some cases, there may be income limitations or restrictions based on the type of loan or the purpose of the loan. Therefore, it is crucial to consult with a tax professional or refer to the specific tax laws of the country to fully understand and take advantage of any available tax benefits related to student loans.

It is also worth mentioning that some countries may offer additional tax incentives or credits for educational expenses, such as tuition fees or education-related expenses. These credits, if available, can further reduce the overall tax liability and provide additional financial relief for individuals with student loans.

When considering the tax benefits of student loans, it is essential to keep accurate records of loan payments and interest paid. Lenders typically provide borrowers with an annual statement, Form 1098-E in the United States, which outlines the amount of interest paid on qualified student loans. This statement is necessary for claiming the interest deduction on income tax returns.

It is crucial to consult with a tax professional or refer to the relevant tax laws to ensure compliance and optimize the tax benefits associated with student loans. The rules and regulations surrounding student loan interest deductions can be complex, and seeking professional advice can help individuals maximize their savings and benefit from these tax incentives.

In summary, student loans can offer tax benefits through the deduction of student loan interest. By reducing the taxable income, the interest deduction lowers the overall tax liability and provides some financial relief for borrowers. It is important to understand and adhere to the specific tax laws and consult with a tax professional to fully optimize the available tax benefits associated with student loans.

Student Loan Forgiveness Programs

Student loan forgiveness programs are initiatives implemented by governments or other entities to help individuals manage their student loan debt. These programs provide partial or complete forgiveness of student loan debt under specific circumstances, offering significant financial relief for eligible borrowers.

The eligibility criteria and conditions for student loan forgiveness programs vary depending on the country and the specific program. Some forgiveness programs target individuals working in public service sectors, such as teachers, nurses, or government employees. Others focus on professions facing a shortage of qualified professionals, such as doctors in rural areas or professionals in certain STEM fields.

Under these programs, eligible individuals who meet specific requirements may have a portion or even their entire student loan debt forgiven. The forgiveness may be granted after a certain number of years of service in a qualifying profession or for fulfilling other specified criteria.

Student loan forgiveness programs serve several purposes. Firstly, they incentivize individuals to pursue careers in public service or high-demand professions by offering financial support in the form of debt forgiveness. This encourages talented individuals to contribute to areas vital for the community’s well-being.

Secondly, these programs alleviate the burden of student loan debt for individuals who may have undertaken significant borrowing to pursue their education. By forgiving a portion or all of their student loan debt, borrowers can experience a substantial reduction in their financial obligations, providing them with increased financial stability and the ability to focus on other financial goals.

It is essential to thoroughly research and understand the specific eligibility requirements and conditions of student loan forgiveness programs. These programs often have specific requirements related to the type of loans, employment duration, repayment plan, and other factors. It is crucial to ensure compliance with the program’s guidelines to maintain eligibility and maximize the benefit.

Furthermore, it is important to note that student loan forgiveness programs may have tax implications. In some cases, the forgiven student loan amount may be considered taxable income, which could result in a tax liability. It is advisable to consult with a tax professional to fully understand and plan for any potential tax consequences of student loan forgiveness.

In summary, student loan forgiveness programs offer eligible individuals the opportunity to have a portion or all of their student loan debt forgiven. These programs incentivize careers in public service and high-demand professions while providing financial relief to borrowers. It is essential to carefully review the specific eligibility criteria and understand any potential tax implications associated with these programs.

Financial Security and Future Opportunities

Obtaining a higher education through student loans can provide individuals with a sense of financial security and open doors to a range of future opportunities. While student loans require careful consideration and management, they can significantly enhance an individual’s long-term financial well-being.

One crucial aspect of student loans is the potential for higher income and improved job prospects. By investing in education, individuals gain knowledge, skills, and qualifications that make them more competitive in the job market. This increased competitiveness can lead to better job opportunities, higher salaries, and greater job security. As a result, individuals who have pursued higher education through student loans may experience greater financial stability and a higher standard of living.

Higher education can also provide individuals with a diverse skill set and a broader range of career options. With specialized knowledge and expertise in their chosen field, individuals can explore different career paths and adapt to changing industry demands. This flexibility and adaptability can position individuals for future growth and advancement, ultimately leading to increased financial opportunities and security.

In addition to higher income potential, student loans can also contribute to long-term financial security through the establishment of credit history. Responsible repayment of student loans helps build a positive credit history, which is vital for future financial endeavors. A good credit history enables individuals to access favorable interest rates, secure loans for major purchases such as homes or cars, and even negotiate better terms on credit cards or other lines of credit.

Moreover, higher education can also provide individuals with valuable networking opportunities. College and university environments are often filled with professors, peers, and professionals who can become valuable connections in various industries. These connections can lead to mentorship, internships, job referrals, and collaborations, presenting individuals with additional avenues for career advancement and financial growth.

By pursuing higher education through student loans, individuals also demonstrate a commitment to investing in themselves and their future. This commitment to personal and professional growth can instill a sense of confidence and empowerment, which can have positive implications for financial decision-making and the pursuit of future opportunities.

Furthermore, with the rapidly evolving job market and the increasing demand for specialized skills, a higher level of education obtained through student loans can provide individuals with a competitive edge. Continuous learning and upgrading of skills are essential to remain relevant and competitive. By gaining access to higher education, individuals can adapt to changing industry trends and seize emerging professional opportunities.

While student loans come with their considerations and responsibilities, when managed effectively, they can provide individuals with financial security and access to a range of future opportunities. By investing in education through student loans, individuals can improve their long-term financial well-being and lay the foundation for a successful and fulfilling career.

The Impact of Student Loans on Financial Well-being

While student loans can provide access to higher education and open doors to future opportunities, it is important to consider their impact on overall financial well-being. Borrowing and repaying student loans can have significant implications for individuals’ finances and require careful planning and management.

One of the primary impacts of student loans is the accumulation of interest. Student loans accrue interest over time, increasing the overall cost of borrowing. This means that borrowers end up repaying more than the original loan amount. It is important to be aware of the interest rates associated with student loans and to factor them into the repayment plan. Managing the interest accrual effectively can help minimize the long-term financial impact.

Repaying student loans can also pose challenges, especially for individuals who have just entered the workforce or are facing other financial obligations. Monthly loan payments can consume a significant portion of one’s income, potentially impacting cash flow and limiting other financial opportunities. It is crucial to budget and plan accordingly to ensure consistency in loan repayment while also balancing other financial obligations.

Moreover, the presence of student loan debt may impact financial goals and priorities. For individuals burdened with significant student loan debt, delayed savings for retirement, homeownership, or other financial milestones may be necessary. Balancing loan repayment with other financial priorities becomes crucial to avoid sacrificing long-term financial plans. It may require careful budgeting, increased discipline in spending, and seeking opportunities to increase income to maintain overall financial well-being.

Another aspect to consider is the potential psychological impact of student loan debt on financial well-being. The weight of debt can cause stress, anxiety, and a sense of instability, which may affect an individual’s overall financial mindset and decision-making. It is important to address these emotional aspects and seek support or guidance to manage the psychological impact of student loan debt.

Notwithstanding the challenges, responsible repayment of student loans can have positive long-term implications for financial well-being. It demonstrates discipline, financial responsibility, and a commitment to honoring financial obligations. Successfully repaying student loans can improve credit scores and build a positive credit history, facilitating future access to credit and better interest rates.

Understanding the impact of student loans on financial well-being is crucial for borrowers to make informed decisions. Conducting thorough research, comparing loan options, considering future earning potential, and creating a realistic repayment plan are vital steps in mitigating the potential negative impact of student loans. Exploring loan forgiveness programs, refinancing options, or seeking financial counseling are additional avenues to navigate the challenges and optimize financial outcomes.

Ultimately, the impact of student loans on financial well-being largely depends on individual circumstances and choices. Although they come with their challenges, student loans can still be a valuable tool for accessing higher education and securing future opportunities. By approaching them responsibly and making informed financial decisions, individuals can successfully navigate their student loan debt while maintaining overall financial well-being.

Considerations and Drawbacks of Student Loans

While student loans can provide access to higher education and potential long-term benefits, it is important to carefully consider their potential drawbacks and implications. Understanding and mitigating these considerations can help borrowers make informed decisions and avoid unnecessary financial burdens.

Accumulation of Interest: One of the primary drawbacks of student loans is the accumulation of interest over time. Borrowers end up repaying more than the original loan amount due to interest charges. It is crucial to understand the interest rates associated with student loans and the impact they can have on the overall cost of borrowing. Minimizing interest accrual through timely repayment and exploring options for lower interest rates, such as federal loans, can help mitigate this drawback.

Repayment Challenges: Repaying student loans can pose challenges, particularly for individuals who are just starting their careers or are facing other financial obligations. The monthly loan payments can impact cash flow and limit opportunities for saving or investing for other financial goals. It is important to develop a realistic budget and repayment plan to ensure consistent loan repayment while managing other financial responsibilities.

Impact on Financial Goals: Taking on student loan debt may impact an individual’s ability to achieve other financial goals, such as saving for retirement or homeownership. The monthly loan payments can limit the amount of disposable income available for these purposes. Balancing loan repayment with other financial priorities becomes crucial to avoid delaying important financial milestones. Creating a comprehensive financial plan that considers loan repayment and other goals can help mitigate this impact.

Potential Long-Term Debt: Depending on the loan amount and interest rates, student loan debt can become a significant financial burden that lasts for many years. The long-term nature of student loans can affect an individual’s financial freedom, limiting their ability to pursue certain career paths or take risks in entrepreneurship or other ventures. Careful consideration of the expected return on investment for the chosen education program is essential to evaluate the potential long-term debt implications.

Psychological Impact: The weight of student loan debt can cause emotional stress, anxiety, and a feeling of financial instability. The pressure to repay loans can impact an individual’s overall financial mindset and decision-making. It is important to address the psychological impact of student loan debt by seeking support, counseling, or adopting stress-reducing strategies to maintain financial well-being.

Limited Options for Loan Discharge: In general, student loans are not easily discharged through bankruptcy. Unlike other forms of debt, student loans are not typically forgiven or discharged even in cases of financial hardship. This means that borrowers are obligated to repay their student loans, regardless of their financial situation. It is important to carefully consider the implications of this limited option for loan discharge and to explore alternative repayment options, such as income-driven repayment plans or forgiveness programs.

Awareness of these considerations and drawbacks is vital in making informed decisions about student loans. It is essential to thoroughly research different loan options, compare interest rates and repayment terms, and accurately assess one’s financial situation and future earning potential. Exploring alternative sources of funding, such as scholarships, grants, or part-time work, can also help reduce reliance on student loans and minimize potential drawbacks.

In summary, while student loans provide access to higher education, they come with a set of considerations and drawbacks that borrowers must carefully navigate. Understanding the potential impact on interest accumulation, loan repayment, and financial goals can help individuals make informed decisions and manage their student loan debt responsibly.

Accumulation of Interest

One significant consideration and drawback of student loans is the accumulation of interest over time. Unlike grants or scholarships, student loans accrue interest, which adds to the overall cost of borrowing and can significantly impact the total amount that borrowers end up repaying.

Interest rates vary depending on the type of loan and the lending institution. It is crucial to carefully review and compare different loan options to understand the associated interest rates and how they will affect the overall repayment amount. Higher interest rates can lead to a larger debt burden and longer repayment periods.

Throughout the life of the loan, interest accrues and compounds, typically on a daily or monthly basis. This means that borrowers not only have to repay the principal amount borrowed but also the accumulated interest over the repayment period.

The impact of interest accumulation can be significant, especially for borrowers with larger loan amounts or longer repayment terms. It is essential to consider the potential long-term cost of borrowing and how interest will affect the overall financial commitment.

To minimize the impact of interest accumulation, borrowers have a few options:

1. Making Payments During School: Some loans offer the option of making interest-only payments or even paying off a portion of the principal while still in school. This can help reduce the overall interest accrued over time.

2. Paying More than the Minimum: By making larger or additional payments towards the loan principal each month, borrowers can reduce the outstanding balance quicker and lower the amount of interest that accrues over time.

3. Choosing Lower Interest Loans: It is crucial to compare loan offers and seek out the lowest interest rates available. Federal loans often have competitive rates compared to private loans. Exploring options for federal loans or refinancing opportunities to secure a lower interest rate can help mitigate the impact of interest accumulation.

4. Repaying Loans Early: Paying off student loans ahead of schedule can significantly reduce the amount of interest paid over the life of the loan. This may require careful financial planning and budgeting to allocate extra funds towards loan repayment early on.

It is essential to carefully consider the impact of interest accumulation when taking on student loans. While borrowing may be necessary to fund education, understanding the long-term cost of interest can help borrowers make informed decisions.

Furthermore, interest capitalization is another aspect to consider. Capitalization occurs when accrued interest is added to the principal loan balance. This can happen during periods of loan deferment, forbearance, or at the end of the grace period. Capitalization effectively increases the loan balance, leading to a higher total repayment amount.

Managing the accumulation of interest requires borrowers to be diligent in making regular, on-time payments and exploring options to reduce the overall interest burden. By minimizing the impact of interest accumulation, borrowers can potentially save thousands of dollars and shorten their repayment journey significantly.

In summary, the accumulation of interest is a significant consideration and drawback of student loans. Understanding the impact of interest on the overall repayment amount is essential for borrowers to make informed decisions and strategize their loan repayment plan effectively. By exploring ways to reduce interest accumulation and prioritizing timely repayment, borrowers can mitigate the financial impact of interest over the life of their student loans.

Repayment Challenges

One of the primary considerations and challenges of student loans is the repayment process. Repaying student loans can pose significant challenges, particularly for individuals who have just entered the workforce or are facing other financial obligations.

One of the key challenges is the monthly loan payment itself. Depending on the loan amount and the repayment term, borrowers may find it challenging to allocate a sufficient portion of their income towards loan repayment. The monthly loan payments can impact cash flow and limit opportunities for saving, investing, or pursuing other financial goals.

For recent graduates or individuals with entry-level positions, the transition into the workforce can involve a period of adjustment and potentially lower income compared to their future earning potential. The combination of a lower income and the necessity to make significant loan payments can create financial strain and limit financial flexibility.

Furthermore, other financial obligations, such as rent, utilities, insurance, and daily living expenses, can compete for the same income and create a delicate balancing act for borrowers. It requires careful budgeting and planning to ensure consistent loan repayment while managing other financial responsibilities.

Repayment challenges can also arise from unexpected life events or financial emergencies. Job loss, illness, or other unforeseen circumstances can disrupt an individual’s ability to meet their loan obligations. In such situations, it is important to communicate with loan servicers, explore options for deferment or forbearance, or seek alternative repayment plans to temporarily alleviate the financial burden.

Another common challenge is managing multiple loans, especially for individuals who have taken out different loans to finance their education. Juggling multiple lenders, keeping track of various repayment terms, and managing multiple monthly payments can be overwhelming. Consolidating loans or exploring repayment plans that simplify the repayment process can help streamline the management of multiple loans.

It is important for borrowers to be proactive and explore options to ease the burden of repayment challenges. Here are a few strategies to consider:

1. Income-Driven Repayment Plans: Income-driven repayment plans adjust the monthly loan payments based on the borrower’s income and family size. These plans can provide more manageable monthly payments, particularly for individuals with lower incomes. It is important to research and understand the specific requirements and potential implications of these plans.

2. Refinancing or Loan Consolidation: Combining multiple loans into a single loan through refinancing or consolidation can simplify the repayment process. This can result in a single monthly payment and potentially lower interest rates, making it more manageable to keep track of repayments.

3. Seeking Employer Assistance: Some employers offer student loan repayment assistance programs as part of their employee benefits. Researching these programs and exploring opportunities for employer assistance can provide additional financial support in managing student loan repayment.

4. Budgeting and Financial Planning: Creating a comprehensive budget and financial plan can help individuals allocate income towards loan repayment while still allowing for other financial obligations and goals. This requires careful evaluation of expenses and prioritizing loan repayment as a financial priority.

It is crucial for borrowers facing repayment challenges to proactively communicate with lenders or loan servicers. They can often provide guidance, explore repayment options, and offer resources to help navigate financial difficulties. Ignoring or neglecting loan repayment can lead to negative consequences on credit history and long-term financial well-being.

In summary, navigating the challenges associated with student loan repayment requires careful financial planning, budgeting, and exploring repayment options. By proactively addressing repayment challenges, borrowers can strive for financial stability and minimize the impact of loan repayment on their overall financial well-being.

Potential Impact on Financial Goals and Priorities

Taking on student loans can have a significant impact on an individual’s financial goals and priorities. The financial obligations associated with student loan repayment may require adjustments and careful consideration of other financial milestones.

One potential impact is the delay or alteration of certain financial goals. Monthly loan payments can limit the amount of disposable income available for other financial priorities, such as saving for retirement, homeownership, or starting a business. Individuals with significant student loan debt may need to adjust their timeline for achieving these goals or allocate a smaller portion of their income towards them.

For aspiring homebuyers, the debt-to-income ratio plays a significant role in mortgage approval. Student loan debt can affect the calculation of this ratio, potentially reducing the amount borrowers qualify to borrow or increasing the interest rates on their mortgage. This impact on homeownership plans requires careful consideration and financial planning.

Additionally, starting a family and the associated expenses can be affected by student loan repayment. Budgeting for daycare, education savings for children, or other family-related expenses may need to be adjusted to accommodate student loan payments and ensure overall financial stability.

The impact on career choices is another consideration. In some cases, individuals may need to prioritize higher-paying jobs over positions they are more passionate about to meet their loan repayment obligations. This can affect job satisfaction and career fulfillment, as individuals may feel limited in pursuing their desired career paths.

Financial independence and the ability to take risks can also be affected by student loan debt. Individuals burdened with significant loans may be hesitant to start businesses, embark on entrepreneurial ventures, or take time off to pursue further education or professional development. The financial responsibility associated with loan repayment can limit the freedom to explore alternative career paths or take calculated risks.

Moreover, the stress and emotional impact of student loan debt can influence an individual’s overall financial mindset and decision-making. The constant weight of debt can create anxiety, affecting financial confidence and the ability to make informed financial decisions. It is important to address the psychological impact and adopt strategies to manage stress related to student loan repayment.

While student loans can impact financial goals and priorities, it is essential to approach the situation proactively. Here are a few strategies to consider:

Budgeting and Planning: Creating a comprehensive budget and financial plan can help individuals prioritize loan repayment while still allocating funds towards other financial goals. This requires careful evaluation of expenses, setting realistic timelines, and regularly revisiting the plan to adjust as needed.

Exploring Income Growth Opportunities: Seeking ways to increase income through career advancement, additional education or certifications, or side jobs can help accelerate the repayment process and free up funds for other financial goals.

Strategic Loan Repayment: Investigating strategies such as paying off higher-interest loans first or focusing on loans with smaller balances can help individuals make progress in their loan repayment journey and gain a sense of accomplishment.

Seeking Professional Assistance: Financial advisors or counselors can provide guidance and expertise in managing student loan repayment alongside other financial goals. They can help individuals optimize their strategies and ensure their financial decisions are aligned with their long-term objectives.

While student loan debt can impact financial goals and priorities, it is important to approach it as a manageable challenge. By making informed decisions, creating actionable plans, and seeking professional guidance when needed, individuals can navigate the potential impact of student loans on their overall financial well-being.

Exploring Alternatives to Student Loans

While student loans are a common way to finance higher education, they are not the only option available. Exploring alternatives to student loans can help mitigate the potential burden of debt and provide individuals with alternative methods of funding their education. Here are a few alternatives to consider:

1. Scholarships and Grants: Scholarships and grants are forms of financial aid that do not need to be repaid. They are awarded based on various criteria, such as academic achievement, athletic abilities, or other talents. Researching and applying for scholarships and grants can provide significant funding and reduce the need for student loans.

2. Work-Study Programs: Many colleges and universities offer work-study programs that provide students with part-time jobs, often on campus, to help cover educational expenses. Work-study programs can provide valuable work experience and income while reducing reliance on student loans.

3. Savings and Education Funds: Starting a dedicated savings plan or contributing to education funds, such as a 529 plan, can help individuals save for their education in advance. It is advisable to explore the available tax advantages and long-term growth potential of such funds to maximize savings.

4. Employer Tuition Assistance: Some employers offer tuition assistance programs as part of their employee benefits. These programs can provide financial support for employees pursuing higher education while working. Exploring employer-sponsored educational benefits can significantly reduce the need for student loans.

5. Income Sharing Agreements (ISAs): Income Sharing Agreements are agreements between students and educational institutions or investors, where the student agrees to pay a percentage of their future income for a certain number of years in exchange for funding their education. ISAs can be an innovative alternative to traditional student loans as they align the repayment with individual income levels.

6. Community College or Trade Schools: Consider attending a community college or trade school for the initial years of education. These institutions often offer more affordable tuition rates and provide opportunities to transfer credits to a four-year university later on.

7. Part-Time Work and Online Education: Working part-time while pursuing education, or taking advantage of online education options, can provide flexibility and the opportunity to earn income while studying. This can help reduce the need for borrowing or allow for more manageable loan amounts.

8. Negotiating Tuition: In some cases, individuals may be able to negotiate tuition costs directly with educational institutions. This can involve negotiating for scholarships, grants, or a tuition reduction based on personal circumstances, talents, or achievements.

It is important to consider a combination of these alternatives and carefully assess their feasibility and potential impact. Each option has its unique considerations and eligibility criteria. Evaluating individual financial circumstances, academic goals, and future earning potential can help determine the most suitable alternatives to student loans.

In summary, exploring alternatives to student loans can present individuals with viable options to fund their education without incurring significant debt. By considering scholarships, grants, work-study programs, employer tuition assistance, and other alternatives, individuals can reduce reliance on student loans and find more sustainable ways to finance their education.

Conclusion

Student loans serve as a financial tool that provides access to higher education and opens doors to future opportunities. While they come with considerations and potential drawbacks, they can be a valuable resource for individuals seeking to invest in their education and long-term financial well-being.

Student loans are often considered “good debt” due to the potential benefits they offer, such as access to higher education, potential for higher income, credit building, tax benefits, and loan forgiveness programs. These advantages can help individuals achieve their educational and career goals while contributing to their overall financial stability.

However, it is crucial to approach student loans responsibly and consider the potential impact on one’s financial goals and priorities. Careful consideration of interest accumulation, repayment challenges, and potential long-term debt is essential for making informed decisions.

Exploring alternatives to student loans, such as scholarships, grants, work-study programs, employer tuition assistance, or savings plans, can help mitigate the need for excessive borrowing and reduce the burden of debt. These alternatives provide individuals with additional options to fund their education and strive for financial stability.

In conclusion, student loans can be a valuable resource for individuals seeking higher education. They provide access to opportunities that may not be otherwise attainable. However, it is important to approach borrowing with caution and a comprehensive understanding of the potential impacts. By carefully managing student loans, exploring alternatives, and making informed financial decisions, individuals can navigate their educational journey while maintaining their long-term financial well-being.