Finance

How To Get Rid Of Savings Cool

Published: January 16, 2024

Learn effective strategies and tips to improve your finances and get rid of Savings Cool. Discover how to save money, budget wisely, and achieve your financial goals.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Assessing Your Savings Goals

- Analyzing Your Spending Habits

- Creating a Budget

- Reducing Unnecessary Expenses

- Finding Additional Income Sources

- Automating Savings

- Exploring Saving Options

- Paying Off Debts

- Prioritizing Saving

- Tracking Your Progress

- Adjusting Your Strategies

- Staying Motivated

- Conclusion

Introduction

Welcome to the ultimate guide on how to get rid of savings cool. Saving money is a common financial goal that many individuals strive for. However, it can sometimes be a challenge to maintain the motivation and discipline necessary to reach your savings goals. The concept of “savings cool” refers to the habit of consistently saving and managing your finances in a way that is not only practical but also enjoyable.

This guide will provide you with practical tips and strategies to break free from savings cool and achieve financial success. Whether you’re saving for a down payment on a house, planning for retirement, or simply looking to build an emergency fund, these steps will help you take control of your financial situation and make progress towards your goals.

Before diving into the specifics, it’s important to understand that getting rid of savings cool requires a mindset shift and a commitment to making long-term changes in your financial habits. It’s not about depriving yourself of the things you enjoy but rather finding a balance between enjoying today and preparing for tomorrow.

Throughout this guide, we’ll explore different aspects of managing your finances, including assessing your savings goals, analyzing your spending habits, creating a budget, reducing unnecessary expenses, finding additional income sources, automating savings, exploring saving options, paying off debts, and staying motivated along the way.

Remember, everyone’s financial situation is unique, so not all strategies will apply to you. It’s important to tailor these recommendations to your specific circumstances and lifestyle. With that said, let’s jump in and discover how to break free from savings cool and achieve your financial dreams.

Assessing Your Savings Goals

Before you can start working towards your savings goals, it’s important to have a clear understanding of what those goals are. Take some time to assess your financial situation and determine what you want to achieve in the short term and long term.

Start by identifying your immediate savings goals. This could include things like saving for a vacation, purchasing a new car, or building an emergency fund. Next, consider your long-term goals, such as saving for retirement, buying a home, or paying for your child’s education.

Once you have a list of your goals, it’s important to prioritize them based on their importance and timeframe. Some goals may require more immediate attention, while others can be worked on over a longer period of time.

When assessing your savings goals, be realistic and specific. Determine how much money you’ll need to achieve each goal and set a timeline for when you want to reach it. This will help you stay motivated and focused on your savings journey.

Additionally, consider the financial milestones you want to achieve along the way. For example, you might aim to save a certain amount of money by the end of each month or increase your savings rate by a certain percentage.

Remember, your savings goals may evolve over time as your financial situation changes. Regularly reassess your goals and make adjustments as needed, but always stay committed to a savings plan that aligns with your overall financial well-being.

Assessing your savings goals is the first step towards breaking free from savings cool. Once you have a clear vision of what you want to achieve, you can start taking the necessary steps to turn your goals into reality.

Analyzing Your Spending Habits

After assessing your savings goals, it’s time to take a closer look at your spending habits. Your spending habits play a crucial role in determining how much money you have available to save. By analyzing and understanding your spending patterns, you can identify areas where you may be overspending and make necessary adjustments to free up more money for savings.

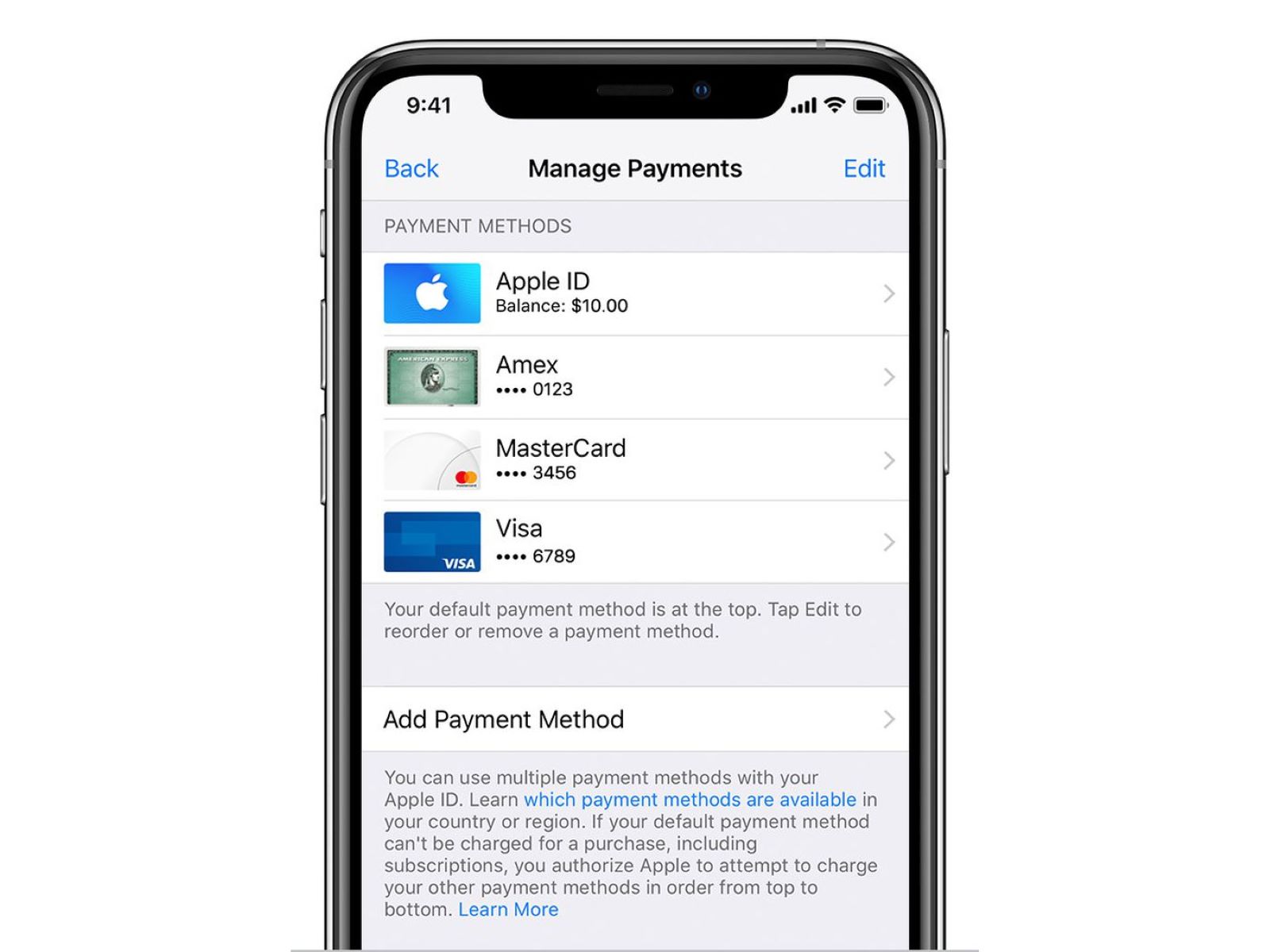

Start by reviewing your bank statements and credit card bills from the past few months. Categorize your expenses into different categories such as housing, transportation, food, entertainment, and so on. This will give you a clear picture of where your money is going and help you identify any excessive or unnecessary spending.

As you analyze your spending habits, ask yourself the following questions:

- Are there any recurring expenses that I can cut back on or eliminate?

- Am I spending more than necessary in certain categories?

- Are there any non-essential items or services that I can live without?

- Am I being mindful of my spending or am I making impulsive purchases?

- Can I find more cost-effective alternatives for some of my regular expenses?

By answering these questions honestly, you’ll be able to identify areas where you can make adjustments. It’s important to be realistic with yourself and prioritize your savings goals over short-term desires.

One effective strategy is to implement the 50/30/20 budgeting rule. This rule suggests allocating 50% of your income to essentials like housing and groceries, 30% to discretionary spending like entertainment and dining out, and 20% to savings. Adjust the percentages as necessary based on your financial goals and current circumstances.

Remember, analyzing your spending habits is a continuous process. It’s not about depriving yourself of all enjoyment but rather finding a balance between your needs and wants. By understanding where your money is going and making conscious choices about your spending, you can free up more funds to allocate towards your savings goals.

Creating a Budget

Creating a budget is a crucial step in taking control of your finances and achieving your savings goals. A budget allows you to allocate your income towards different categories of expenses while ensuring that you have enough money left over for savings.

To create a budget, start by calculating your total monthly income. This includes your salary, any additional sources of income, and any government benefits you may receive. Having an accurate understanding of your income is essential for effective budgeting.

Next, list all of your regular monthly expenses. This includes bills, rent or mortgage payments, groceries, transportation costs, insurance premiums, and any other necessary expenses. Be comprehensive and include both fixed and variable expenses.

Once you have your income and expenses listed, subtract your total expenses from your total income. The resulting amount is what you have available for savings. If you have a surplus, that’s great! You can allocate more money towards your savings goals. However, if your expenses exceed your income, you’ll need to make adjustments.

Review each category of expenses and identify areas where you can cut back or find more cost-effective alternatives. This could include negotiating utility bills, reducing dining out expenses, or finding more affordable transportation options. The key is to find a balance that allows you to maintain a comfortable lifestyle while maximizing your savings potential.

Consider using budgeting apps or spreadsheets to track your income and expenses. These tools can help you visualize your spending patterns and make adjustments as needed. It’s important to regularly review and update your budget to reflect any changes in your income, expenses, or savings goals.

Remember, creating a budget is not about restricting yourself or feeling deprived. It’s about being intentional with your money and making conscious choices that align with your financial goals. A well-planned budget can provide financial clarity and empower you to make the most of your income and savings potential.

Reducing Unnecessary Expenses

One of the key steps to breaking free from savings cool is to reduce unnecessary expenses. By identifying and eliminating expenses that don’t align with your priorities or provide significant value, you can free up more money to save and invest.

The first step is to review your expenses and identify any non-essential or discretionary items that you can eliminate or reduce. This could include subscription services, eating out at restaurants frequently, or unnecessary clothing purchases. Consider whether these expenses truly bring you joy and align with your long-term financial goals.

Next, look for cost-saving opportunities in your everyday spending. For example, consider switching to a more affordable mobile phone plan or renegotiating your cable or internet bills. Look for discounts or promotions when shopping for groceries or household items. Small changes in your spending habits can add up to significant savings over time.

Additionally, be mindful of impulse purchases. Before making a purchase, take a pause and ask yourself if it’s something you truly need or if it’s just a fleeting desire. By practicing mindful spending, you can reduce impulse purchases and direct your money towards more meaningful goals.

Another effective strategy is to avoid lifestyle inflation. As your income increases, it’s tempting to upgrade your lifestyle and spend more on luxury items and experiences. While treating yourself is important, be cautious of falling into the trap of constantly increasing your expenses to match your income. Instead, focus on saving and investing the additional income to secure your financial future.

Finally, consider implementing the “30-day rule” for larger purchases. When you spot something you want to buy, wait for 30 days before making the purchase. This waiting period helps you distinguish between impulsive desires and genuine needs. Oftentimes, you’ll find that your desire for the item fades away, saving you from unnecessary spending.

Reducing unnecessary expenses requires discipline and a mindset shift. It’s about focusing on your long-term financial goals and making intentional choices that align with them. By avoiding unnecessary costs and being mindful of your spending, you can redirect more money towards savings and accelerate your journey towards financial freedom.

Finding Additional Income Sources

In addition to reducing expenses, finding additional income sources can greatly contribute to your savings goals. Generating extra income can provide you with more financial flexibility and accelerate your progress towards achieving financial freedom.

Here are some strategies to consider for finding additional income:

- Freelancing or Side Gigs: Utilize your skills and expertise to freelance or take on side gigs in your spare time. This could include freelance writing, graphic design, tutoring, or providing consulting services. Platforms like Upwork, Fiverr, and TaskRabbit can connect you with potential clients and opportunities.

- Renting Out Unused Space: If you have spare rooms, a basement, or a vacation property, consider renting it out on platforms like Airbnb or VRBO. This can generate a steady stream of income while making use of unused space.

- Monetizing Hobbies: Explore ways to turn your hobbies into income-generating ventures. For example, if you enjoy photography, you can offer photography services for events or sell your prints online. If you love to bake, consider selling homemade treats or starting a small catering business.

- Part-Time Employment: Look for part-time job opportunities that can fit into your schedule. This could involve working evenings or weekends in industries such as retail, hospitality, or food service.

- Online Surveys and Microtasks: Participate in online surveys or complete microtasks on platforms like Amazon Mechanical Turk or Swagbucks. While these may not generate substantial income, they can provide extra cash for smaller savings goals.

- Rent Out Possessions: Consider renting out possessions that you don’t use often, such as camping equipment, power tools, or even your car. Platforms like Turo and Fat Llama facilitate the sharing economy and enable you to earn money from your unused belongings.

It’s important to note that finding additional income sources requires dedication and commitment. You will need to manage your time effectively and ensure that your side ventures are not negatively impacting your primary source of income or other obligations.

Lastly, be mindful of any legal or tax implications associated with generating additional income. Consult with a financial advisor or tax professional to ensure that you are adhering to the proper regulations and reporting your income correctly.

By finding additional income sources, you can boost your savings and reach your financial goals more quickly. Each additional dollar earned brings you one step closer to achieving the financial freedom you desire.

Automating Savings

Automating your savings is a powerful strategy to ensure consistent progress towards your savings goals. By setting up automatic transfers or contributions, you can prioritize savings without having to rely solely on willpower or remembering to manually transfer money.

Here are some key benefits of automating your savings:

- Consistency: Automating your savings ensures that money is consistently set aside for savings before it has a chance to be spent elsewhere. Treat your savings contributions as non-negotiable, just like any other bill or financial obligation.

- Discipline: It eliminates the temptation to spend the money that you intended to save. Once the automated transfer is set up, the money is moved to your savings account before you have a chance to consider using it for other purposes.

- Accumulation: Over time, the regular contributions can accumulate to a significant amount, helping you achieve your savings goals faster.

To begin automating your savings, start by identifying the amount you want to save on a regular basis. This can be a fixed dollar amount or a percentage of your income. Aim to save at least 10-15% of your income, but adjust this amount based on your financial situation and goals.

Next, set up automatic transfers or deductions from your paycheck that go directly to your savings account or an investment account. You can usually arrange this through your employer’s payroll system or by setting up automatic transfers with your bank or financial institution.

If you receive irregular income or freelance income, consider setting up a separate savings account specifically for this income stream. Whenever you receive a payment, transfer a percentage directly into your designated savings account.

As your income increases or you experience windfalls, such as tax refunds or bonuses, consider allocating a portion of these extra funds towards savings as well. This can help accelerate your progress towards your savings goals.

It’s important to regularly review and adjust your automated savings contributions as your financial situation changes. This includes evaluating your budget, tracking your progress, and making adjustments to ensure that your savings goals remain realistic and achievable.

Automating your savings takes the guesswork out of saving and ensures that you consistently allocate money towards your financial future. By making saving a priority and setting up automatic transfers, you’ll be well on your way to achieving your savings goals.

Exploring Saving Options

When it comes to saving money, there are various options to consider beyond just a basic savings account. Exploring different saving options allows you to potentially maximize your returns and find the best strategy that aligns with your financial goals and risk tolerance.

Here are a few saving options to explore:

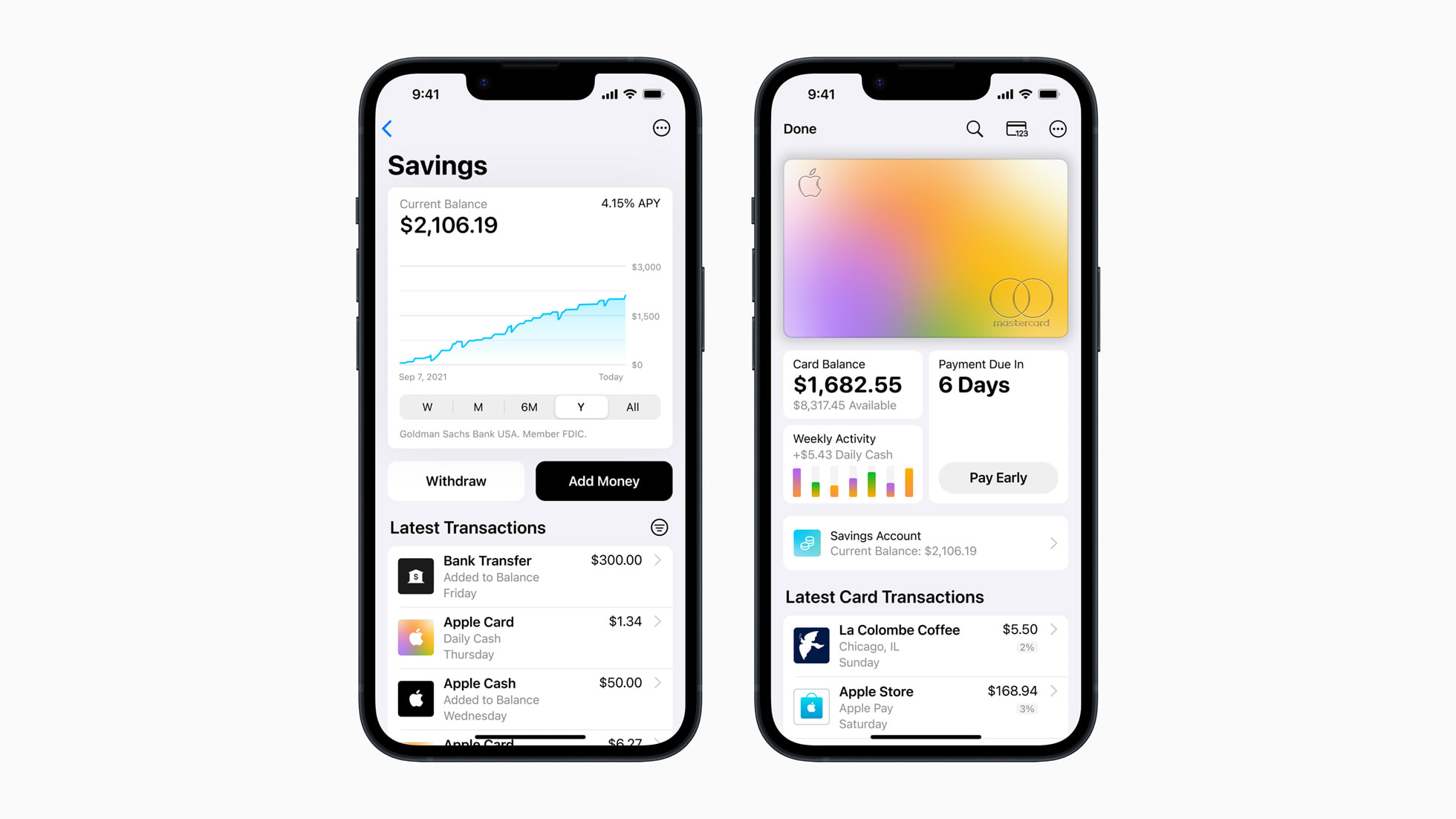

- High-yield Savings Accounts: Consider opening a high-yield savings account that offers a higher interest rate compared to traditional savings accounts. These accounts typically have higher minimum balance requirements, but the additional interest earned can help your savings grow faster over time.

- Certificates of Deposit (CDs): A CD is a time-deposit account that locks in your money for a specified period of time, such as six months or one year. In exchange, you’ll receive a fixed interest rate that is typically higher than a regular savings account. CDs can be a good option if you have a specific savings goal with a known timeframe.

- Money Market Accounts: Money market accounts are similar to savings accounts but typically offer higher interest rates. They may require a higher minimum balance and limit the number of withdrawals you can make per month.

- Individual Retirement Accounts (IRAs): IRAs are tax-advantaged retirement savings accounts that allow you to save for retirement. There are different types of IRAs, including Traditional IRAs and Roth IRAs, each with its own tax benefits. Consider contributing to an IRA if you’re eligible and want to maximize your retirement savings.

- Investment Accounts: Investing your savings in a diversified portfolio of stocks, bonds, mutual funds, or exchange-traded funds (ETFs) can potentially generate higher returns over the long term compared to traditional savings accounts. However, investing carries inherent risks, and it’s important to carefully assess your risk tolerance and seek professional advice.

- Employer-sponsored Retirement Plans: If your employer offers a retirement plan, such as a 401(k) or 403(b), take advantage of it by contributing to the plan. Your contributions are typically tax-deductible, and some employers may match a portion of your contributions. This can be an excellent way to save for retirement and benefit from employer contributions.

When exploring different saving options, consider your financial goals, time horizon, and risk tolerance. It’s important to strike a balance between preserving capital, generating returns, and being comfortable with the level of risk associated with each option.

Remember to diversify your savings across different accounts and investment vehicles to spread out risk and potentially take advantage of different potential returns.

Be sure to thoroughly research each option and seek advice from financial professionals to ensure you make informed decisions that align with your personal financial situation and goals.

Exploring saving options beyond traditional savings accounts can help you optimize your savings and make the most of your hard-earned money.

Paying Off Debts

When working towards your savings goals, it’s important to address any outstanding debts that you have. Paying off debts not only helps you become financially healthier but also frees up more funds that can be allocated towards savings.

Here are some strategies to consider when paying off debts:

- Create a Debt Repayment Plan: Start by listing all your debts, including credit card balances, student loans, car loans, and any other outstanding loans. Organize them by interest rate and total amount owed. Create a repayment plan that focuses on paying off debts with higher interest rates first while making minimum payments on the rest.

- Snowball or Avalanche Method: The snowball method involves paying off the smallest debts first and then applying those payments towards the next debt on the list. The avalanche method, on the other hand, prioritizes debts with the highest interest rates first. Choose the method that aligns with your motivation and financial situation.

- Consolidation or Refinancing: Explore options to consolidate multiple debts into a single loan or refinance high-interest debts to lower-interest loans. This can potentially reduce your overall interest payments and simplify your debt repayment strategy.

- Negotiate with Creditors: If you’re struggling to meet your debt payments, reach out to your creditors and explain your situation. They may be willing to negotiate a lower interest rate, reduced fees, or a more manageable repayment plan.

- Increase Your Income: Finding ways to increase your income, such as taking on a part-time job or freelancing, can provide you with extra funds to put towards debt repayment.

- Cut Back on Expenses: Review your budget and identify areas where you can cut back on expenses. Redirect the money saved towards paying off debts faster.

When paying off debts, it’s important to stay committed and disciplined. Avoid taking on new debts and resist the temptation to use credit cards excessively. Consistency and persistence are key to successfully paying off debts and improving your financial situation.

It’s also important to prioritize your debts based on their impact on your overall financial health. High-interest debts should typically be tackled first, as they can accumulate quickly and hinder your ability to save and invest.

Remember, eliminating debt not only reduces financial stress but also enables you to redirect your money towards savings and investments, allowing you to build wealth and achieve your financial goals more effectively.

Prioritizing Saving

Prioritizing saving is crucial for achieving your financial goals and breaking free from savings cool. By making saving a non-negotiable part of your financial routine, you can build a solid financial foundation and secure your future.

Here are some strategies to help you prioritize saving:

- Pay Yourself First: Treat saving as an expense and prioritize it by paying yourself first. Set up automatic transfers that move a portion of your income directly into your savings or investment accounts. This ensures that saving happens before you have a chance to spend or allocate the money elsewhere.

- Set Specific Goals: Establish clear and specific savings goals to provide focus and motivation. Whether you’re saving for a down payment on a house, a dream vacation, or retirement, having a target in mind allows you to track your progress and celebrate milestones along the way.

- Track Your Expenses: Keep a close eye on your spending habits and identify areas where you can cut back. By knowing where your money is going, you can make informed decisions and free up more funds for saving.

- Make Saving a Habit: Treat saving as a non-negotiable habit, just like brushing your teeth or exercising. Consistency is key, even if you can only save a small amount each month. Over time, these regular contributions can accumulate and make a significant difference.

- Adjust Your Lifestyle: Review your lifestyle and identify areas where you can make adjustments to free up more funds for saving. This may involve reducing discretionary expenses, downsizing your living arrangements, or finding more cost-effective alternatives for everyday necessities.

- Take Advantage of Windfalls: Whenever you receive unexpected money, such as a tax refund or a bonus, resist the temptation to splurge. Instead, consider allocating a portion of these windfalls towards your savings goals.

- Stay Committed: It’s easy to get derailed or discouraged along the way, but staying committed to your saving goals is vital. Keep your eye on the long-term and remind yourself of the financial security and freedom that saving can provide.

Remember, saving is not just about putting money aside; it’s a mindset and a commitment to your financial future. By prioritizing saving, you’re making a proactive choice to take control of your finances and build a solid foundation for a more secure and fulfilling life.

Tracking Your Progress

Tracking your progress is an essential part of the savings journey. It allows you to evaluate your financial health, measure your success, and make necessary adjustments along the way. By monitoring your progress, you can stay motivated and ensure that you’re on track to achieve your savings goals.

Here are some key steps to effectively track your progress:

- Set Clear Milestones: Break down your savings goals into smaller, achievable milestones. By setting clear targets, such as saving a certain amount of money by a specific date, you can measure your progress more easily and track your success along the way.

- Utilize a Budgeting Tool: Take advantage of budgeting tools and apps that can help you monitor your income, track your expenses, and evaluate your progress towards your savings goals. These tools can provide insights and visualizations to help you stay organized and make informed financial decisions.

- Review Your Financial Statements: Regularly review your bank statements, credit card bills, and investment account statements. This will give you a clear picture of your income, expenses, and savings progress. Compare your actual savings to your planned savings to assess how well you’re adhering to your goals.

- Track Your Net Worth: Your net worth is an important indicator of your overall financial health. Calculate your net worth regularly by subtracting your liabilities (debts and outstanding balances) from your assets (savings, investments, and property). Tracking your net worth over time can give you insight into your progress towards financial independence.

- Monitor Your Savings Rate: Your savings rate is the percentage of your income that you’re saving. Calculate it regularly to determine if you’re saving enough to reach your goals. Aim for a savings rate of 20% or higher, if possible, and adjust your budget and spending habits accordingly.

- Use Visual Reminders and Rewards: Create visual reminders of your savings goals, such as a vision board or progress chart. Celebrate milestones and achievements along the way to stay motivated. Consider treating yourself with a small reward when you reach significant milestones, keeping in mind the importance of not derailing your progress with excessive spending.

Regularly tracking your progress not only allows you to stay focused and motivated but also provides an opportunity to identify any areas of improvement. If you notice that you’re off track or not saving as much as planned, reassess your budget, expenses, and savings strategies. Make necessary adjustments to get back on course and stay proactive in pursuing your goals.

Remember, tracking your progress is an ongoing process. It’s important to review your financial situation regularly, make adjustments as needed, and celebrate your wins along the way. By staying on top of your progress, you’ll be better equipped to achieve your savings goals and create a solid financial future.

Adjusting Your Strategies

As you progress on your savings journey, it’s important to regularly assess and adjust your strategies to ensure that you’re making the most effective use of your resources. Financial circumstances and goals can change over time, and being flexible in your approach will help you stay on track and continue progressing towards your objectives.

Here are some key considerations when adjusting your savings strategies:

- Review Your Budget: Periodically review your budget to assess whether it’s still aligned with your current financial situation and goals. Look for areas where you can cut back on expenses or reallocate funds towards your savings priorities. Adjust your budget as necessary to reflect any changes in income, expenses, or financial goals.

- Reevaluate Your Saving Goals: Circumstances may change, and your savings goals may need to be adjusted. Life events, such as getting married, starting a family, or changing careers, can impact your financial priorities. Regularly reassess your savings goals to ensure they are still realistic and meaningful to your current situation.

- Consider Changes in Investment Strategy: If you have investments, evaluate their performance and consider adjusting your investment strategy. Rebalancing your portfolio periodically can help ensure that your asset allocation aligns with your risk tolerance and financial goals.

- Explore New Income Streams: Look for additional opportunities to increase your income or generate extra money. This could involve taking on side gigs, freelancing, or exploring new business ventures. Diversifying your income can accelerate your savings progress and provide added financial security.

- Take Advantage of Tax Benefits: Regularly review tax laws and regulations to identify potential tax benefits or deductions that may help you save more. Maximize contributions to tax-advantaged retirement accounts, such as IRAs or employer-sponsored plans, to take advantage of any available tax savings.

- Seek Professional Advice: If you find yourself unsure about adjusting your strategies or need guidance on complex financial matters, consider consulting with a financial advisor. They can provide personalized insights and recommendations based on your unique circumstances and goals.

Being proactive and regularly adjusting your strategies will help you stay on track towards achieving your savings goals. Embrace the flexibility to adapt your approaches as needed, keeping in mind that financial planning is an ongoing process.

Remember, your savings journey is unique to you, and there is no one-size-fits-all approach. The key is to be attentive, assess your progress regularly, and make adjustments that align with your evolving circumstances and aspirations. By remaining adaptable and open to change, you can optimize your efforts and continue moving closer to financial success.

Staying Motivated

Staying motivated is crucial on your savings journey, especially when faced with challenges or tempted by short-term desires. By maintaining your focus and staying committed, you can overcome obstacles and continue making progress towards your financial goals. Here are some strategies to help you stay motivated:

- Visualize Your Goals: Create a vivid mental image of what achieving your savings goals will look like. Whether it’s owning a home, traveling the world, or retiring comfortably, having a clear vision of your aspirations can fuel your motivation and help you stay on track.

- Celebrate Milestones: Break your savings goals into smaller milestones and celebrate each achievement along the way. Treat yourself to a small reward or engage in a meaningful and low-cost celebration to acknowledge your progress and stay motivated for the next milestone.

- Remind Yourself of Financial Security: Reflect on the financial security and peace of mind that saving provides. Remind yourself of the freedom from debt, the ability to handle emergencies, and the potential for building wealth. Understanding the long-term benefits of saving can help you resist impulsive spending and stay focused on your goals.

- Connect with Like-minded Individuals: Surround yourself with people who share your financial values and goals. Engage in conversations and discussions with friends, family, or online communities focused on personal finance and savings. Sharing experiences, tips, and progress with others can provide support and motivation on your savings journey.

- Track Your Progress: Regularly review your progress towards your savings goals. Use visual aids, such as charts or progress trackers, to see how far you’ve come. Seeing tangible evidence of your efforts and accomplishments can be highly motivating and encourage you to stay disciplined.

- Seek Inspiration: Read success stories or books on personal finance and saving. Watch documentaries or listen to podcasts that showcase people who have achieved financial freedom. Drawing inspiration from others’ accomplishments can reignite your motivation and inspire new ideas for your own financial journey.

- Revisit Your “Why”: Remind yourself of the reasons you embarked on your savings journey in the first place. Whether it’s providing for your family, achieving financial independence, or pursuing a lifelong dream, reconnecting with your “why” can reignite your passion and help you stay motivated during challenging times.

Remember, staying motivated is a continuous effort. There may be moments when your motivation wanes, but it’s important to stay committed and refocus on your goals. Celebrate the small wins, seek support from others, and remind yourself of the bigger picture to maintain your momentum and continue progressing towards financial success.

Conclusion

Congratulations on completing this comprehensive guide on how to break free from savings cool and achieve your financial goals. By following the strategies outlined in this guide, you’ve gained the knowledge and tools necessary to take control of your finances and build a more secure future.

Throughout this journey, you’ve learned the importance of assessing your savings goals, analyzing your spending habits, creating a budget, reducing unnecessary expenses, finding additional income sources, automating your savings, exploring different saving options, paying off debts, tracking your progress, adjusting your strategies, and staying motivated.

Remember that achieving your financial goals requires discipline, consistency, and a long-term mindset. It’s about finding a balance between enjoying today and preparing for tomorrow. No matter where you currently stand in your financial journey, it’s never too late to make positive changes and prioritize your savings.

Take the time to regularly review and reassess your goals, adjust your strategies as needed, and stay focused on the bigger picture. Celebrate each milestone and be proud of the progress you make along the way.

By breaking free from savings cool and implementing these strategies, you’re setting yourself up for financial success and greater financial freedom. Whether your goals include buying a home, traveling the world, retiring comfortably, or achieving other dreams, your commitment to saving and managing your finances will pave the way towards achieving them.

Remember to stay motivated, seek support from like-minded individuals, and adapt to the changing landscapes of your financial journey. Financial success is within your reach, and with determination and smart financial practices, you will make your dreams a reality.

Now, go forth and embrace the power of saving and financial control. Your future self will thank you for the steps you take today. Best of luck on your savings journey!