Finance

How To Get Rid Of Credit Card Interest

Modified: March 3, 2024

Learn effective strategies to eliminate credit card interest and take control of your finances. Discover how to free yourself from high interest rates and save money.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Credit card interest can be a significant burden for many consumers. If you find yourself struggling to pay off your credit card balances due to high interest rates, it’s time to take action. Luckily, there are several strategies you can implement to get rid of credit card interest and regain control of your financial situation.

In this article, we will explore various methods to eliminate credit card interest and provide you with actionable steps to achieve your goal. By understanding credit card interest, evaluating your options, and taking proactive measures, you can significantly reduce or even eliminate the amount of interest you pay.

It’s essential to remember that getting rid of credit card interest requires discipline, commitment, and a strategic approach to handling debt. By following the advice outlined in this article, you can take control of your finances and work towards becoming debt-free.

So, if you’re tired of paying high interest rates and want to find a way out, keep reading to discover the steps you can take to get rid of credit card interest once and for all.

Understanding Credit Card Interest

Before you can effectively eliminate credit card interest, it’s crucial to have a good understanding of how it works. Credit card interest is the cost you pay to borrow money from your credit card provider. It is calculated as a percentage of your outstanding balance and added to your monthly payment.

Most credit cards have an annual percentage rate (APR) that determines the interest rate you will be charged. The APR can vary depending on your creditworthiness and the type of credit card you have. It’s usually a good practice to find out the APR on your credit card as a starting point.

When you make a credit card purchase and carry a balance, the interest begins to accrue. This means that if you don’t pay off your balance in full by the due date, interest will be charged on the remaining balance. The longer you carry the balance, the more interest you accumulate.

A common misconception is that paying the minimum payment each month will keep you in good standing. While it may prevent you from being late on your payments, paying only the minimum amount means that you will be charged interest on the remaining balance. This can lead to a never-ending cycle of debt.

To fully understand how credit card interest affects your finances, it’s helpful to consider an example. Let’s say you have a credit card balance of $5,000 with an APR of 18%. If you were to pay only the minimum payment each month, it could take you more than 20 years to pay off the balance, and you would end up paying over $8,000 in interest alone.

By understanding the impact of credit card interest on your financial situation, you can take the necessary steps to eliminate or minimize it. In the following sections, we will explore strategies to reduce or get rid of credit card interest altogether.

Evaluating Your Credit Card Options

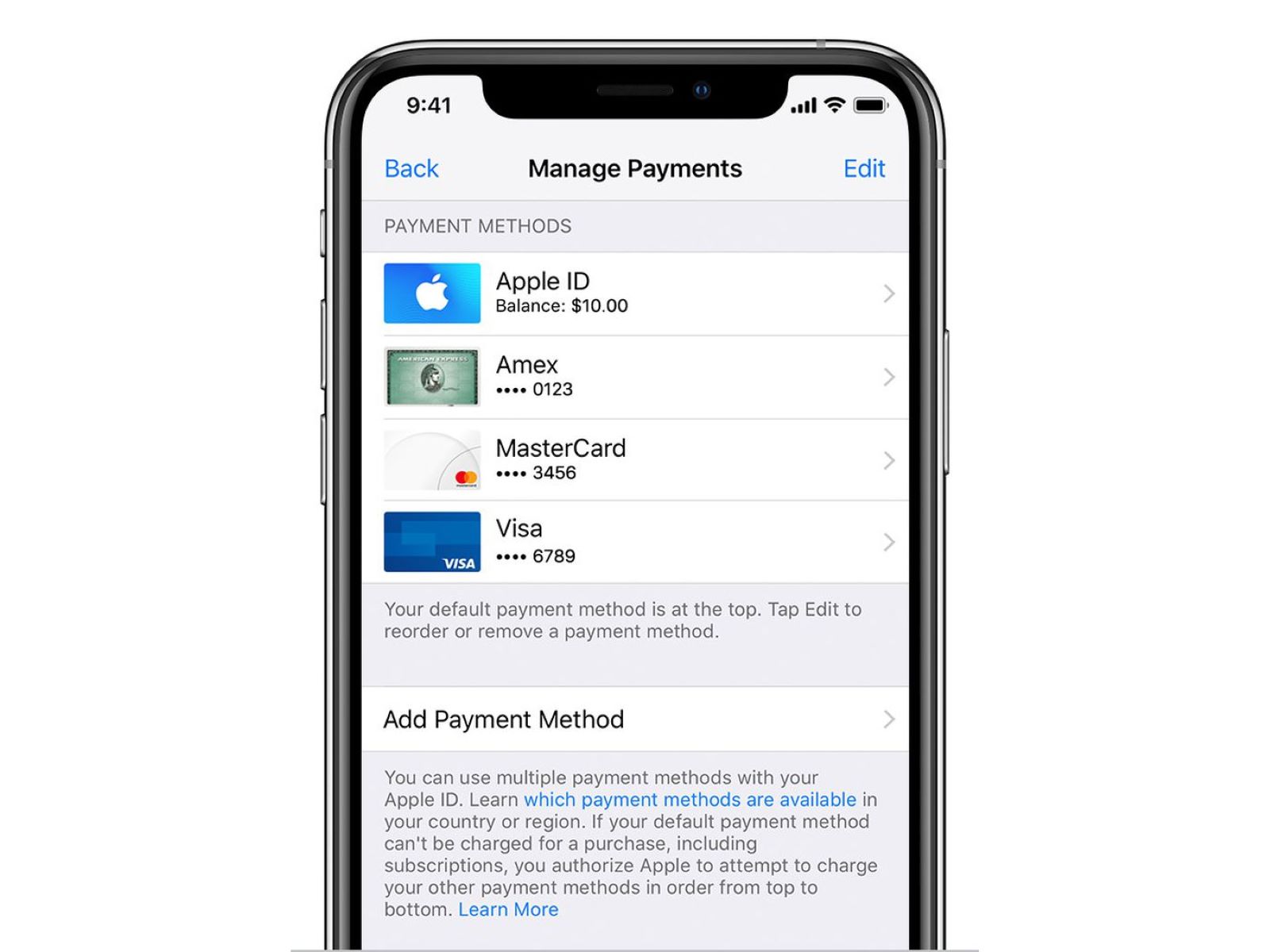

When it comes to getting rid of credit card interest, one effective approach is to evaluate your current credit card options and consider alternative cards that offer lower interest rates or promotional balance transfer offers.

Start by reviewing the terms and conditions of your current credit cards. Look for the APR and any potential fees associated with your account. If you have multiple credit cards, compare the interest rates and fees to determine which ones are costing you the most.

Next, research other credit card options that may offer more favorable terms. Look for credit cards that have lower interest rates, especially if you plan to carry a balance. Some credit cards even offer introductory 0% APR balance transfer promotions, allowing you to transfer your existing high-interest balances to a new card with no interest for a certain period.

Take the time to read the fine print and understand the terms and conditions of any new credit card you are considering. Pay attention to the length of the promotional period, any balance transfer fees, and what the interest rate will be after the introductory period ends.

When evaluating your credit card options, also consider any rewards or perks that are offered. While these may not directly eliminate your credit card interest, they can provide some additional value and offset other costs.

Before applying for a new credit card, it’s important to weigh the potential benefits against any potential drawbacks or fees. Consider factors such as your credit score, any applicable annual fees, and the overall cost-effectiveness of transferring your balances.

Additionally, keep in mind that opening new credit card accounts can impact your credit score, so be strategic in your decision-making. If you decide to open a new credit card, consider closing any unnecessary accounts to simplify your financial situation and avoid the temptation of accumulating more debt.

By evaluating your credit card options, you can identify opportunities to reduce your interest rates and potentially save money. However, it’s important to remember that this strategy may not be suitable for everyone and should be approached with caution. Consider consulting with a financial advisor to make informed decisions based on your unique financial circumstances.

Negotiating with Your Credit Card Company

If you’re looking to get rid of credit card interest, don’t underestimate the power of negotiation. Many credit card companies are willing to work with you to find a mutually beneficial solution. By reaching out and discussing your financial situation, you may be able to negotiate for lower interest rates or more favorable repayment terms.

Start by contacting your credit card company’s customer service department. Explain your desire to pay off your debt and ask if they can lower your interest rate. Highlight any positive factors, such as a history of on-time payments or your willingness to commit to a specific payment plan.

During your conversation, be polite, assertive, and persistent. Request to speak with a supervisor if necessary. Remember that the goal is to establish a cooperative relationship and find a solution that benefits both parties.

In some cases, credit card companies may be willing to reduce your interest rate temporarily, offer a promotional interest rate, or waive certain fees. If they are unable to provide a lower rate, inquire about other possible options, such as a hardship program or a debt management plan, which may offer more favorable terms.

Keep in mind that credit card companies are more likely to be open to negotiation if you have a history of responsible credit card usage and on-time payments. If you have multiple credit cards with the same issuer, it may be helpful to consolidate your requests and negotiate for better terms across all your accounts.

It’s important to note that negotiating with your credit card company is not guaranteed to be successful. However, it’s worth the effort and can potentially save you a significant amount of money in interest payments.

If you’re uncomfortable negotiating on your own or if you’re facing a particularly challenging financial situation, consider seeking assistance from a credit counseling service. These nonprofit organizations can provide guidance and help you navigate the negotiation process.

Remember, the key to successful negotiation is to be proactive and persistent. Don’t be afraid to advocate for yourself and explore all available options to get rid of credit card interest.

Transferring Your Balance to a Lower Interest Rate Card

Transferring your credit card balance to a card with a lower interest rate can be a smart move to help you get rid of credit card interest. By taking advantage of balance transfer offers, you can consolidate your debts and save money on interest payments.

Start by comparing credit cards that offer balance transfer promotions. Look for cards with low or 0% introductory APR for balance transfers. These promotions typically last for a specified period, such as 6 months to 18 months, during which little or no interest is charged on the transferred balance.

Before applying for a new card, read the terms and conditions carefully to understand any fees associated with the balance transfer. Some cards may charge a balance transfer fee, which is usually a percentage of the amount being transferred.

Once you’ve selected a suitable card, complete the application process and, if approved, initiate the balance transfer. Contact your new credit card company and provide the details of the balances you want to transfer from your existing credit cards.

After the transfer is complete, focus on paying off the transferred balance within the promotional period. Make a repayment plan to ensure you pay down the debt before the regular interest rate kicks in.

It’s important to note that while a balance transfer can save you money on interest, it’s crucial to avoid accumulating additional debt on your new credit card. Keep your spending in check and commit to paying off the balance as quickly as possible.

Also, be aware that opening a new credit card account for a balance transfer can impact your credit score. It may cause a temporary dip in your score due to the new account and the potential hard inquiry on your credit report. However, if you manage the new card responsibly, your credit score can recover and potentially improve over time.

Transferring your balance to a lower interest rate card can provide significant relief from credit card interest payments. However, it’s vital to choose a card with terms and conditions that align with your repayment goals and financial situation. Compare options, consider the fees involved, and make a strategic decision to accelerate your journey towards becoming debt-free.

Paying More Than the Minimum Balance

One of the most effective ways to get rid of credit card interest is to pay more than the minimum balance each month. It may seem obvious, but many people underestimate the impact that paying extra can have on reducing their debt and interest charges.

When you only make the minimum payment, a significant portion of it goes towards paying off interest, with only a small fraction applied to the principal balance. This means you’ll be trapped in a cycle of high interest charges, and it will take much longer to pay off your debt.

To break free from this cycle, commit to paying more than the minimum balance whenever possible. Even a small increase in your monthly payments can make a significant difference in the long run. Allocate as much money as you can afford towards your credit card payments, focusing on getting the balance down as quickly as possible.

Consider creating a budget to identify areas where you can reduce expenses and allocate more funds towards paying off your credit card debt. Cut back on discretionary spending and redirect those savings towards your credit card payments. Every extra dollar you put towards paying down your debt will save you in interest charges.

If you have multiple credit card balances, consider using the avalanche or snowball method to prioritize your payments. The avalanche method involves paying off the credit card with the highest interest rate first, while the snowball method involves paying off the smallest balance first. Both methods can provide motivation and momentum as you see progress in paying off your debts.

In addition to paying more than the minimum balance, try to make more frequent payments throughout the month, rather than waiting for the due date. By making biweekly or weekly payments, you can reduce the average daily balance on your credit card, resulting in lower interest charges.

As you steadily pay down your balance, monitor your progress and celebrate milestones along the way. Keep track of how much money you’re saving in interest and remind yourself of the financial freedom you’re working towards.

Paying more than the minimum balance is a powerful strategy to reduce credit card interest and accelerate your journey towards becoming debt-free. Be consistent, disciplined, and proactive in making higher payments, and you’ll see tangible results and savings in the long run.

Consolidating Your Debt

If you’re struggling to manage multiple credit card balances and high interest rates, consolidating your debt can be a viable option to simplify your finances and reduce interest charges.

Debt consolidation involves combining all of your high-interest debts into a single, lower-interest loan or credit card. This allows you to make one monthly payment instead of multiple payments to different creditors, streamlining your repayment process.

One common method of consolidating debt is obtaining a personal loan. With a personal loan, you can borrow a lump sum of money and use it to pay off your credit card balances. Personal loans often have lower interest rates compared to credit cards, which can result in significant savings in interest charges.

Another option for consolidating your debt is to transfer multiple credit card balances to a single credit card that offers a lower interest rate or a 0% introductory APR for balance transfers. This allows you to consolidate your debts onto one card, simplifying your payments and potentially reducing interest charges.

When consolidating your debt, it’s important to consider the terms and fees associated with the new loan or credit card. Evaluate the interest rate, repayment term, and any balance transfer fees or origination fees that may apply.

Before committing to debt consolidation, it’s crucial to assess your ability to repay the new loan or credit card. Consolidating your debts will only be beneficial if you can make consistent, on-time payments towards the new loan or card. Otherwise, you risk falling into a deeper financial hole.

In addition to debt consolidation, it’s important to address the root causes of your debt and make changes to your spending habits. Create a budget, stick to it, and avoid accumulating new debt while you work towards paying off your consolidated loan.

Remember, debt consolidation is not a magic solution – it’s a tool to help you streamline your finances and reduce interest charges. It requires discipline and commitment to stay on track with your payments and avoid falling back into old spending patterns.

Seeking guidance from a financial advisor or credit counseling service can be helpful when considering debt consolidation. They can provide expert advice and help you navigate the process to ensure it aligns with your financial goals.

Consolidating your debt can provide relief from high-interest credit card balances and simplify your repayment plan. Evaluate your options, assess the terms and fees, and make an informed decision to consolidate your debt and work towards becoming debt-free.

Seeking Professional Help

If you’re overwhelmed with credit card debt and struggling to get rid of high interest charges, seeking professional help may be the right choice for you. There are several resources available to assist you in managing your debt and finding a path towards financial freedom.

One option is to consult with a reputable credit counseling agency. Credit counselors can provide guidance on budgeting, debt management, and consolidation options. They will assess your financial situation, develop a personalized repayment plan, and negotiate with your creditors on your behalf to potentially secure lower interest rates or reduced fees.

Credit counseling agencies can also offer educational resources and workshops to help you improve your financial literacy and develop responsible spending habits. They can provide ongoing support as you work towards paying off your credit card debt.

In some cases, bankruptcy may be the most viable solution for individuals who are unable to manage their debt. If you’re considering bankruptcy, it’s essential to consult with a qualified bankruptcy attorney who can guide you through the process and provide advice based on your specific circumstances.

Another professional option to consider is working with a debt settlement company. Debt settlement companies negotiate with your creditors to settle your debts for less than the full amount owed. This can be an alternative to bankruptcy and can help you become debt-free faster. However, it’s crucial to research and choose a reputable debt settlement company to ensure you’re working with a trusted organization.

When seeking professional help, be cautious of scams and fraudulent companies that promise quick fixes and unrealistic outcomes. Do thorough research, read reviews, and check the credentials of any organization or professional you are considering working with.

Remember that seeking professional help does not absolve you of personal responsibility in managing your debt. It’s still crucial to actively participate in the process, follow through with recommended actions, and make necessary lifestyle changes to avoid accumulating additional debt in the future.

Each person’s financial situation is unique, so it’s essential to evaluate your options and choose the path that aligns with your goals and circumstances. Seeking professional help can provide you with the support and expertise you need to navigate the complexities of debt management and ultimately get rid of credit card interest for good.

Conclusion

Credit card interest can quickly become a financial burden, but you have the power to take control of your debt and eliminate those high interest charges. By understanding credit card interest, evaluating your options, and taking proactive steps, you can regain control of your financial situation and work towards becoming debt-free.

Start by understanding how credit card interest works and the impact it has on your debt. Armed with this knowledge, you can evaluate your credit card options and consider transferring your balances to a lower interest rate card or consolidating your debt to simplify your payments and reduce interest charges.

Don’t be afraid to negotiate with your credit card company, as they may be willing to lower your interest rate or offer alternative repayment options. Making more than the minimum payment each month and paying down your balances as quickly as possible will also save you money in interest over time.

If you find yourself overwhelmed or unsure about how to tackle your debt, consider seeking professional help from credit counseling agencies or debt settlement companies. These organizations can provide guidance, develop customized repayment plans, and negotiate on your behalf.

Remember, getting rid of credit card interest requires discipline, commitment, and a strategic approach to handling your debt. It’s important to create a budget, control your spending, and make necessary lifestyle changes to avoid accumulating new debt.

Ultimately, the journey to becoming debt-free may take time and effort, but the rewards are well worth it. By implementing these strategies and taking proactive steps towards eliminating credit card interest, you can regain control of your financial well-being and set yourself up for a more secure and stable future.

So, take that first step today and start your journey towards a life free from credit card interest and the burdens of debt. With the right mindset and determination, financial freedom is within reach.