Finance

How Do I Get A Premarin Savings Card

Published: January 16, 2024

Save on your Premarin prescriptions with a convenient savings card. Find out how to get a Premarin savings card and start saving today. Finance your healthcare with ease!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is Premarin?

- Why Use a Premarin Savings Card?

- How Does a Premarin Savings Card Work?

- Where Can I Get a Premarin Savings Card?

- How to Apply for a Premarin Savings Card

- Eligibility Requirements for a Premarin Savings Card

- Benefits of a Premarin Savings Card

- Restrictions and Limitations of a Premarin Savings Card

- Frequently Asked Questions about Premarin Savings Card

- Conclusion

Introduction

Welcome to the world of finance, where money matters and financial decisions can have a significant impact on your life. As a savvy individual, you understand the importance of managing your finances effectively. Whether you’re planning for retirement, seeking investment opportunities, or simply looking to save money on everyday expenses, having a solid understanding of finance is crucial.

In this article, we will delve into the world of finance and explore various topics such as budgeting, saving, investing, and more. We will provide valuable insights and practical tips to help you navigate the complex world of personal finance and make informed decisions.

Finance is a vast field with a plethora of sub-disciplines, each requiring its own set of expertise. From personal finance to corporate finance, from investments to loans, there’s a wealth of knowledge to explore. Understanding the basics of financial concepts can empower you to take control of your financial future and make sound financial decisions.

Whether you’re a beginner looking to establish a strong financial foundation or a seasoned investor seeking new opportunities, this article is designed to cater to your needs. We will unravel the complexities of finance and present the information in a simplified manner, making it accessible to individuals of all backgrounds and knowledge levels.

In addition, as an SEO expert, I will ensure that this article is optimized for search engines, making it easy for readers to find and engage with the content. By strategically incorporating relevant keywords and phrases, we can boost the article’s visibility and reach a wider audience.

So, get ready to embark on a financial journey full of valuable insights, practical tips, and expert advice. Let’s dive into the world of finance and unlock the secrets to financial success.

What is Premarin?

Premarin is a prescription medication that contains a combination of estrogens derived from the urine of pregnant mares. The name “Premarin” is derived from its main source, which is pregnant mare urine. It is primarily used by women to alleviate menopausal symptoms, such as hot flashes, vaginal dryness, and mood swings.

The estrogens in Premarin are similar to the hormones naturally produced by a woman’s body. However, during menopause, the body’s estrogen production decreases, leading to uncomfortable symptoms. Premarin helps to supplement the declining estrogen levels and provide relief from these symptoms.

Premarin is available in various forms, including oral tablets, vaginal creams, and topical gels. The dosage and administration are determined by a healthcare professional based on the individual’s specific needs and medical history.

It’s important to note that Premarin is classified as a hormone replacement therapy (HRT) medication. HRT has been subject to extensive research and debate regarding its benefits and potential risks. It is crucial to consult with a healthcare professional to discuss the risks, potential side effects, and individual suitability before starting Premarin or any other HRT medication.

It’s also worth mentioning that Premarin is a brand name medication and may have generic alternatives available. Generic versions of Premarin are FDA-approved and contain the same active ingredients as the brand-name medication. Consulting with your doctor or pharmacist can help you determine whether generic alternatives are suitable for your specific needs.

As with any medication, it is important to follow the prescribed dosage and instructions provided by your healthcare professional. If you have any questions or concerns about Premarin, its usage, or potential side effects, it’s important to discuss them with your healthcare provider.

Why Use a Premarin Savings Card?

Managing healthcare costs is an important aspect of maintaining your overall well-being. Prescription medications, such as Premarin, can be a significant financial burden, especially for those without insurance or with high deductible health plans. This is where a Premarin savings card can provide valuable assistance.

A Premarin savings card is a special program offered by the manufacturer or pharmaceutical company, designed to help eligible patients save money on their medication expenses. By using a Premarin savings card, you can potentially reduce the out-of-pocket costs associated with your Premarin prescription.

Here are some reasons why you should consider using a Premarin savings card:

- Cost Savings: One of the primary benefits of using a Premarin savings card is the potential cost savings. These cards often provide discounts or rebates that can significantly reduce the price of your Premarin prescription, making it more affordable for you.

- Accessibility: By utilizing a Premarin savings card, you can access discounted prices at participating pharmacies. This ensures that you have access to the medication you need, regardless of your financial circumstances.

- Convenience: Applying for and using a Premarin savings card is typically a straightforward process. Once approved, you can simply present the card to your pharmacist when filling your prescription to take advantage of the savings.

- Continuity of Treatment: For those who rely on Premarin for the management of menopausal symptoms, a savings card can help ensure a continued supply of medication without interruption. Financial savings can make it easier to adhere to your prescribed treatment plan.

- Support and Resources: Some savings card programs may offer additional support and resources to cardholders, such as educational materials, access to patient assistance programs, or reminders for medication refills.

It is important to note that eligibility criteria, terms, and restrictions may vary depending on the specific Premarin savings card program. It’s advisable to carefully review the details and requirements of the program to ensure you meet the necessary criteria and understand the benefits and limitations.

By taking advantage of a Premarin savings card, you can potentially reduce the financial burden of your Premarin prescription and make managing your healthcare costs more manageable. Consult with your healthcare provider or pharmacist to learn more about available savings card programs and determine if they are suitable for your specific situation.

How Does a Premarin Savings Card Work?

A Premarin savings card is a valuable resource that allows eligible patients to save money on their Premarin prescriptions. Understanding how a savings card works can help you make the most of this cost-saving opportunity.

Here’s a breakdown of how a Premarin savings card typically functions:

1. Eligibility: Each savings card program has specific eligibility requirements, such as income limits or insurance coverage criteria. To determine if you qualify for a Premarin savings card, you may need to fill out an application or provide certain information, such as income verification or insurance details.

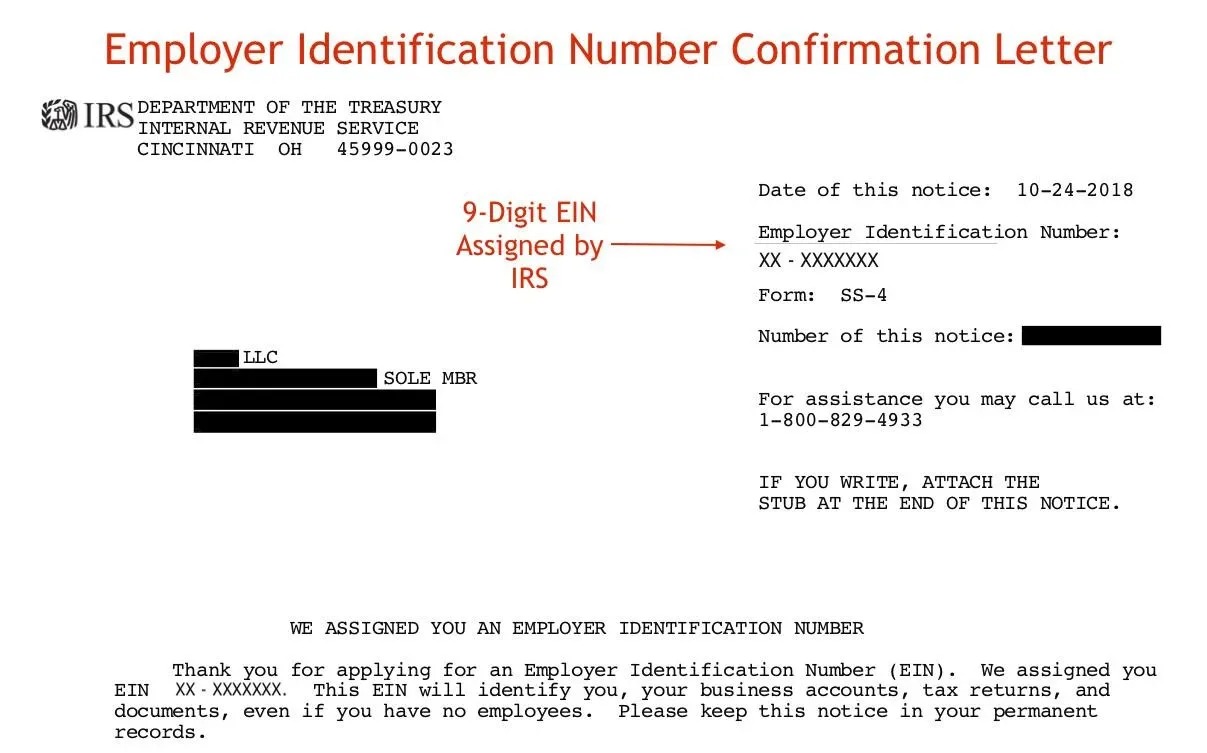

2. Approval: Once your application is submitted, it will be reviewed by the program administrator. If you meet the eligibility criteria, you’ll receive approval and be issued a savings card. This card is usually unique to you and may have your name or a specific identification number.

3. Presenting the Card: When you go to the pharmacy to fill your Premarin prescription, present your savings card to the pharmacist along with your prescription. The pharmacist will then process the card and apply any applicable discounts or rebates to your purchase.

4. Savings: The savings provided by the Premarin savings card can vary depending on the program. It may involve discounts off the list price, percentage savings, or a set amount off the cost of your prescription. The savings are applied at the point of purchase, reducing the out-of-pocket expense you would otherwise have to pay.

5. Restrictions: It’s important to be aware that there may be certain restrictions associated with the savings card. These can include limits on the number of times the card can be used, restrictions on the quantity or dosage of medication covered, or specific pharmacies where the card can be used. Be sure to review the terms and conditions of the savings card program to understand any limitations.

6. Replenishing the Card: Some savings card programs provide ongoing benefits, while others may have a limited duration. If the savings card is valid for a specific period, you may need to reapply or renew it when it expires to continue receiving the benefits.

It’s important to note that savings card programs can be subject to change, and specific details may vary depending on the program and your location. It’s always a good idea to review the terms and conditions of the savings card program to ensure you understand how it works and what benefits you are eligible for.

By utilizing a Premarin savings card, you can enjoy cost savings on your Premarin prescription, making it more affordable and accessible. Consult with your healthcare provider or pharmacist to learn more about available savings card programs and take advantage of the financial support provided.

Where Can I Get a Premarin Savings Card?

If you’re interested in obtaining a Premarin savings card to help reduce the cost of your prescription medication, there are a few avenues you can explore to obtain one.

Here are some places where you can inquire about and potentially obtain a Premarin savings card:

- Pharmaceutical Manufacturer: The pharmaceutical company that manufactures Premarin may offer a savings card program. Visit the manufacturer’s website or contact their customer service to inquire about any available savings card programs. They will be able to provide you with information on how to apply and obtain a Premarin savings card.

- Healthcare Provider: Your healthcare provider, such as your doctor or gynecologist, may have information about Premarin savings card programs. During your appointment, ask your healthcare provider if they are aware of any resources or patient assistance programs that can help you save money on your Premarin prescription.

- Pharmacies: Local pharmacies often have information about savings card programs and may be able to help you obtain a Premarin savings card. Speak with your pharmacist and inquire about any available savings programs that can help reduce the cost of your medication.

- Patient Assistance Programs: Some organizations and foundations offer patient assistance programs, which can provide financial support for prescription medications. Search online for patient assistance programs or contact organizations like the Partnership for Prescription Assistance to inquire about any available resources for Premarin savings.

- Online Resources: Check the Premarin website or other reputable medical websites for information on savings card programs or patient assistance resources. Online platforms often provide details about ongoing promotions, discounts, or manufacturer-sponsored programs that can help you obtain a savings card.

It’s important to research and explore multiple avenues to increase your chances of finding a Premarin savings card. Different programs may have varying eligibility criteria or offer different levels of savings, so it’s worth considering multiple options.

Once you have obtained a Premarin savings card, be sure to review the terms and conditions of the program to understand any limitations or restrictions. This will help ensure that you maximize the benefits of the savings card and properly utilize it when filling your Premarin prescription.

Remember, a Premarin savings card can provide valuable cost savings, making your medication more affordable and accessible. Take the initiative to inquire about and obtain a savings card to optimize your healthcare expenses.

How to Apply for a Premarin Savings Card

If you’re interested in applying for a Premarin savings card to help reduce the cost of your Premarin prescription, the application process is typically straightforward. Here are the general steps you can follow to apply for a Premarin savings card:

1. Research: Start by conducting research to identify the specific savings card program you want to apply for. Look for information on the official Premarin website, the manufacturer’s website, or reputable medical websites. Take note of any eligibility criteria, terms, or restrictions associated with the savings card program.

2. Gather Required Information: Before applying for a Premarin savings card, gather any required information or documentation. This may include your personal details, contact information, proof of income, insurance information, or any other specific requirements stated by the savings card program.

3. Visit the Website or Contact the Program Administrator: Once you have all the necessary information, visit the official website of the specific savings card program you want to apply for. Most programs provide an online application form that you can fill out directly on their website. Alternatively, you can contact the program administrator via phone or email to inquire about the application process.

4. Complete the Application: Fill out the application form with accurate and up-to-date information. Be sure to carefully read the instructions and provide all requested information, as incomplete applications may delay the processing of your request. Double-check your application for any errors before submitting it.

5. Submit the Application: After completing the application, submit it either electronically through the online form or via the provided email or mailing address. If you have any questions or concerns during the application process, don’t hesitate to contact the program administrator for clarification.

6. Await Approval: Once your application is submitted, it will be reviewed by the savings card program administrator. The approval process duration may vary depending on the program. In some cases, you may receive an immediate response, while for others, it may take several days or weeks to receive a decision.

7. Receive and Activate the Savings Card: If your application is approved, you will receive the Premarin savings card either digitally or by mail. Follow the instructions provided to activate the card before using it. Activation may involve calling a toll-free number or visiting a specific website.

8. Present the Card at the Pharmacy: When filling your Premarin prescription at a participating pharmacy, present your activated savings card to the pharmacist. They will process the card and apply any applicable discounts or savings to your purchase.

It’s important to remember that each savings card program can have its own specific application process and requirements. Be sure to carefully review the instructions and guidelines provided by the program you are applying to in order to submit an accurate and complete application.

By following these steps, you can apply for a Premarin savings card and potentially reduce the financial burden associated with your Premarin prescription. Consult with your healthcare provider or pharmacist for further guidance and assistance in obtaining a Premarin savings card.

Eligibility Requirements for a Premarin Savings Card

To qualify for a Premarin savings card and benefit from the cost savings it offers, you must meet certain eligibility requirements. These requirements can vary depending on the specific savings card program. Here are some common eligibility criteria to consider:

1. Insurance Coverage: Some savings card programs require that you have commercial insurance coverage or private health insurance. This means that individuals without insurance or those with government-funded healthcare programs may not be eligible for these specific savings card programs. However, there may be alternative assistance programs available for those without insurance.

2. Income Restrictions: Certain savings card programs have income limitations. These limitations are typically based on the federal poverty level or a percentage of it. The purpose of income restrictions is to provide assistance to individuals with financial need. Be prepared to provide proof of income when applying, such as tax returns or pay stubs.

3. Prescription Requirement: In most cases, savings card programs require that you have a valid prescription for Premarin from a licensed healthcare provider. This ensures that the savings card is used for its intended purpose and to support individuals who require the medication for medical reasons.

4. Legal Residency: Savings card programs may require that applicants be legal residents of the country where the program is offered. This requirement ensures that the benefits go to eligible individuals within the specified region or country.

5. Age Limitations: Some savings card programs may have age limitations on eligibility. For instance, the program may only be available to individuals above a certain age, typically 18 years or older.

It’s important to note that these eligibility requirements are general examples, and specific savings card programs may have additional or different criteria. To determine if you meet the eligibility requirements for a specific Premarin savings card program, review the program details, guidelines, and terms provided by the program administrator.

If you find that you do not meet the eligibility criteria for a particular savings card program, don’t get discouraged. There may be alternative resources or patient assistance programs available to help you access affordable medication. Discuss your situation with your healthcare provider, pharmacist, or contact organizations that offer patient assistance programs for further guidance.

Remember to carefully review the eligibility requirements of any savings card program you wish to apply for to ensure that you meet the criteria. By meeting the eligibility requirements, you can potentially qualify for a Premarin savings card and benefit from the cost savings it provides.

Benefits of a Premarin Savings Card

A Premarin savings card can offer several significant benefits to individuals who are prescribed Premarin, helping them save money on their medication expenses. Here are some key advantages of using a Premarin savings card:

- Cost Savings: The primary benefit of a Premarin savings card is the potential cost savings. These savings cards often provide discounts or rebates that can significantly reduce the out-of-pocket cost of your Premarin prescription. This can make the medication more affordable and accessible for individuals who may be struggling with the high cost of their prescriptions.

- Affordability: By utilizing a Premarin savings card, individuals may have a better chance of affording their medication without compromising on their other financial obligations. This can alleviate the financial burden associated with managing menopausal symptoms and enable individuals to continue their treatment as prescribed.

- Continuity of Treatment: For individuals who rely on Premarin to alleviate menopausal symptoms, a savings card can help ensure a continuous supply of medication. The cost savings provided by the card can make it easier to adhere to the prescribed treatment plan by reducing the financial strain of refilling the prescription regularly.

- Improved Well-being: Menopausal symptoms, such as hot flashes, night sweats, and mood changes, can significantly impact a person’s quality of life. By making Premarin more affordable, a savings card can contribute to improved well-being by relieving these uncomfortable symptoms and enhancing overall comfort and mental health.

- Accessible Medication: The accessibility of medication is a crucial factor for individuals who need Premarin to manage their menopausal symptoms. By utilizing a savings card, individuals can access their medication at participating pharmacies without facing financial barriers, ensuring they can obtain and use their prescription as needed.

- Support and Resources: Some savings card programs provide additional support and resources to cardholders. These may include educational materials, access to patient assistance programs, or reminders for medication refills. Such resources can enhance the overall experience of using a savings card and provide valuable information and assistance.

It’s important to note that the specific benefits and terms of a Premarin savings card can vary depending on the savings card program. Thus, it is advisable to carefully review the details and requirements of the program to understand the specific benefits it offers and any limitations or restrictions that may apply.

By taking advantage of a Premarin savings card, individuals prescribed Premarin can experience significant cost savings, improved affordability, and enhanced access to their medication. Consult with your healthcare provider or pharmacist to learn more about available savings card programs and maximize the benefits of utilizing a Premarin savings card.

Restrictions and Limitations of a Premarin Savings Card

While a Premarin savings card can provide valuable cost savings on your Premarin prescription, it’s important to be aware of the restrictions and limitations that may apply to the program. Understanding these restrictions ensures that you have realistic expectations and can make informed decisions about utilizing the savings card. Here are some common restrictions and limitations to consider:

- Insurance Coverage: Some savings card programs require that you have commercial insurance or private health insurance coverage. Individuals without insurance or those with government-funded healthcare programs may not be eligible for certain savings card programs. It’s important to check the program’s eligibility criteria to determine if your insurance coverage meets the requirements.

- Expiration Date: Savings card programs often have an expiration date. The card may be valid for a specified period, after which it will no longer provide discounts or savings. Make sure to check the expiration date of your Premarin savings card and plan accordingly to ensure you make the most of the savings offered.

- Pharmacy Restrictions: Some savings card programs may limit the participating pharmacies where the card can be used. It’s essential to verify that your preferred pharmacy accepts the Premarin savings card or check the program’s website for a list of participating pharmacies in your area.

- Quantity and Dosage Limits: Certain savings card programs may apply limits on the quantity or dosage of medication covered by the card. This means that the savings may only apply to a specific number of prescriptions or a certain dosage strength. It’s important to be aware of these limits when using the savings card to avoid any unexpected out-of-pocket expenses.

- Single-Use or Multiple Uses: Some savings card programs can only be used for a single prescription fill, while others may allow for multiple uses until the card’s benefits are exhausted. Be sure to check the terms and conditions to understand the number of times you can use the card and maximize its benefits accordingly.

- Non-Transferable: In most cases, savings cards are non-transferable, meaning they are intended for the individual the card is issued to and are not to be shared with others. The savings card is usually associated with your personal information, and using it for someone else’s prescription may result in disqualification from the program.

These are general examples of restrictions and limitations that may be associated with a Premarin savings card. It’s crucial to carefully read the terms and conditions of the specific savings card program you utilize to understand the exact restrictions and limitations that apply.

By being aware of these restrictions, you can plan and use the Premarin savings card in a manner that aligns with the program’s guidelines. This will ensure that you receive the full benefits of the savings card and make the most of the cost savings it offers.

Frequently Asked Questions about Premarin Savings Card

1. How can I apply for a Premarin savings card?

The application process for a Premarin savings card typically involves filling out an application form provided by the savings card program. You may need to provide basic personal and contact information, as well as any required documentation, such as proof of income or insurance details. Visit the Premarin website, contact the manufacturer, or consult with your healthcare provider or pharmacist to inquire about the specific application process.

2. Who is eligible for a Premarin savings card?

Eligibility for a Premarin savings card can vary depending on the program. Common eligibility requirements may include having commercial insurance coverage, meeting certain income restrictions, having a valid prescription for Premarin, and being a legal resident of the country where the savings card program is offered. Review the specific eligibility criteria provided by the savings card program to determine if you meet the requirements.

3. Can I use a Premarin savings card if I have Medicare or Medicaid?

Savings card programs may have restrictions regarding government-funded healthcare programs like Medicare or Medicaid. Some programs may not be available to individuals with these insurance coverages. However, there may be alternative patient assistance programs or resources available specifically for those with government-funded healthcare. Consult with your healthcare provider or pharmacist to explore other options.

4. How much can I save with a Premarin savings card?

The amount of savings can vary depending on the specific savings card program. Savings cards often offer discounts or rebates that can significantly reduce the out-of-pocket cost of your Premarin prescription. The exact savings amount will depend on factors such as the program’s terms, your insurance coverage, and the pharmacy you use. Review the details of the savings card program to understand the potential savings you can expect.

5. Can I use a Premarin savings card in addition to my insurance?

In many cases, a Premarin savings card can be used in addition to your insurance coverage. Check with the specific savings card program to confirm this. However, keep in mind that certain restrictions and limitations may apply. For example, the savings card may not be usable if your insurance copay is already lower than the savings card discount. It’s important to review the terms and conditions of both your insurance coverage and the savings card program to understand how they can be used in conjunction.

6. How long is a Premarin savings card valid for?

The validity period of a Premarin savings card can vary depending on the specific program. Some savings cards may have an expiration date and need to be renewed periodically, while others may provide ongoing benefits without an expiration date. Check the terms and conditions of the savings card program or contact the program administrator to determine the duration of validity.

7. Are there any limitations on the number of times I can use the savings card?

Savings card programs may have limitations on the number of times the card can be used. Some cards have a set number of uses, while others may allow for unlimited usage until the benefits are exhausted. Review the specific terms and conditions of the savings card program to understand the limitations on card usage.

8. Can I share my Premarin savings card with someone else?

Premarin savings cards are typically non-transferable and intended for the individual to whom it is issued. Sharing your savings card with someone else may result in disqualification from the program. These cards are often associated with your personal details, and using them for someone else’s prescription may be a violation of the program’s terms and conditions.

Remember, it’s crucial to review the specific details and guidelines of the Premarin savings card program you are applying for or using to ensure you fully understand the program’s benefits, limitations, and any applicable restrictions.

Conclusion

Understanding the ins and outs of a Premarin savings card can be instrumental in managing the cost of your Premarin prescription. These savings cards offer a range of benefits, including cost savings, improved affordability, and enhanced access to medication. By leveraging a Premarin savings card, you can alleviate the financial burden associated with managing menopausal symptoms and ensure a continuous supply of medication.

However, it’s important to keep in mind the restrictions and limitations that may apply to these savings card programs. Factors such as insurance coverage, eligibility criteria, expiration dates, pharmacy restrictions, and quantity limits can impact the usability and benefits of the savings card. It’s essential to review the specific terms and conditions of the savings card program you are considering to ensure it aligns with your needs.

To obtain a Premarin savings card, you can research the manufacturer’s website, consult with your healthcare provider or pharmacist, or explore online platforms that provide information on patient assistance programs. Following the application process and meeting the eligibility requirements will allow you to acquire a Premarin savings card and benefit from the cost-saving opportunities it provides.

By utilizing a Premarin savings card, you can ensure continuity of treatment, improve your well-being, and minimize the financial strain of managing menopausal symptoms. Consult with your healthcare provider or pharmacist for guidance on finding the right savings card program for your specific situation.

Remember, while a Premarin savings card can alleviate some of the financial challenges associated with prescription medications, it’s crucial to continue working closely with your healthcare provider for proper medical guidance and personalized care.

Take control of your medication costs, access the benefits of a Premarin savings card, and make managing your menopausal symptoms more affordable and accessible.