Home>Finance>How To Transfer Money From Savings To Checking (Chime)

Finance

How To Transfer Money From Savings To Checking (Chime)

Published: January 16, 2024

Learn how to transfer money from your savings account to your checking account with Chime. Manage your finances easily and securely.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

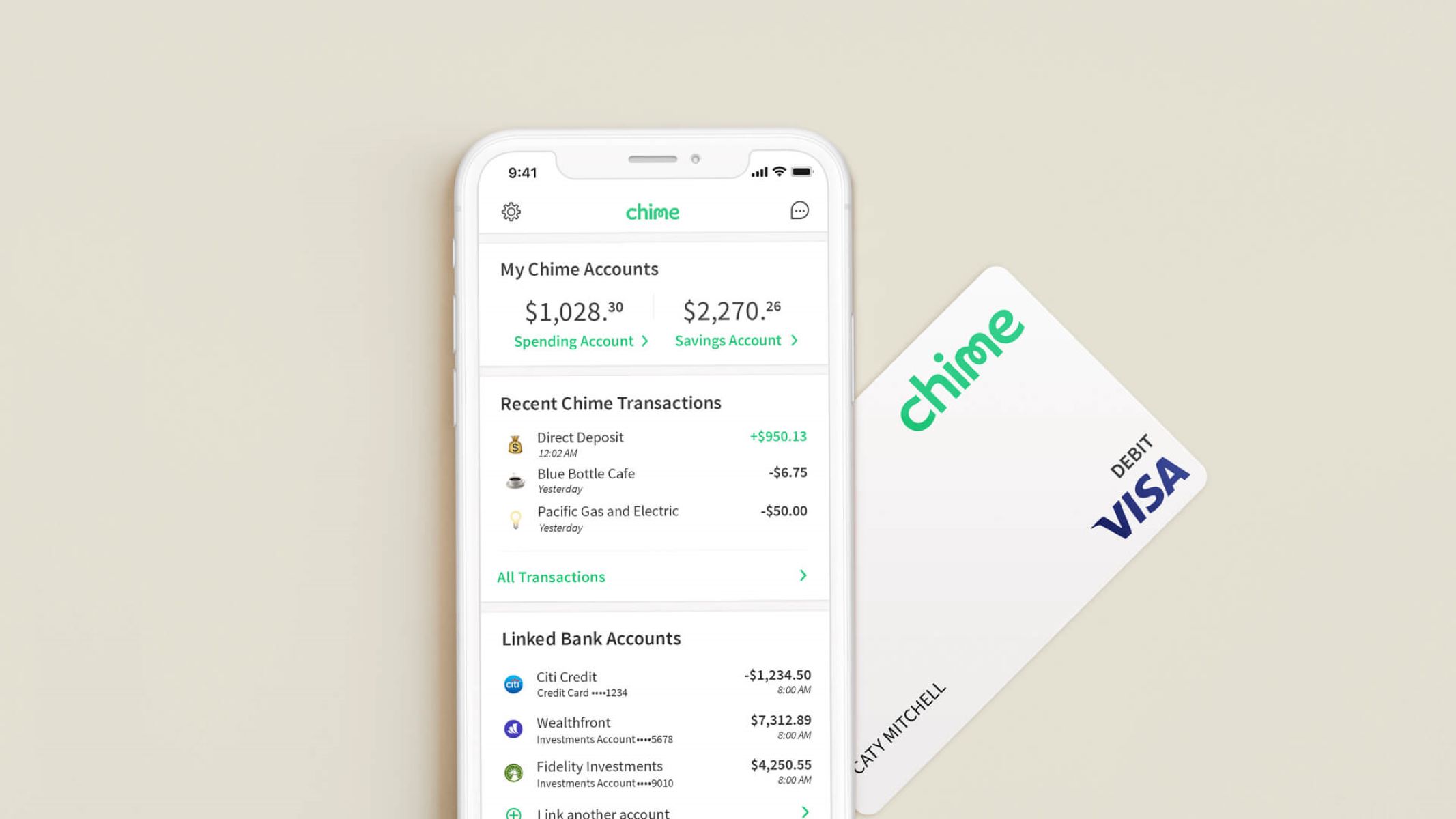

Welcome to the world of Chime, a modern banking platform that offers convenient and innovative financial solutions. If you’re a Chime account holder and have both a savings account and a checking account, you may find yourself in a situation where you need to transfer funds from your savings to your checking. Perhaps you have an upcoming expense or want to ensure that you have enough money available for everyday spending.

In this article, we will guide you through the process of transferring money from your Chime savings account to your checking account, ensuring that you have a clear understanding of how to manage your finances effectively with Chime.

Chime’s user-friendly interface and streamlined features make managing your finances effortless. Here, you’ll discover the benefits of transferring money from your savings to your checking account, as well as step-by-step instructions so you can confidently perform the transfer on your own.

Whether you’re looking to make a one-time transfer or want to establish a routine transfer schedule, Chime makes it a breeze to transfer funds between your accounts, allowing you to take full control of your financial situation.

So, let’s delve into the details of Chime’s savings and checking accounts and explore the various benefits of transferring money from your savings to your checking.

Understanding Chime Savings and Checking Accounts

Before we dive into the process of transferring money from your Chime savings account to your checking account, let’s first understand the key features and functionalities of these two account types.

Chime offers a modern and mobile-first approach to banking, making it easy and convenient for users to manage their finances. With Chime, you can open both a savings account and a checking account, each serving different purposes.

The Chime savings account is designed to help you save money and grow your savings over time. It offers a competitive interest rate, allowing you to earn money on your deposited funds. The savings account acts as a store of your extra funds, providing you with a safe and secure place to hold your savings separate from your everyday spending.

The Chime checking account, on the other hand, is your primary account for day-to-day transactions. It functions like a traditional checking account, allowing you to deposit your income, make purchases with your Chime debit card, pay bills, and withdraw cash from ATMs.

One of the standout features of Chime’s checking account is the SpotMe feature, which provides you with fee-free overdraft protection. With SpotMe, you can make debit card purchases even if you don’t have sufficient funds in your account, with Chime covering the negative balance temporarily.

Both the Chime savings and checking accounts can be accessed through the Chime mobile app or Chime’s website, giving you convenient access to your finances wherever you go. You can easily view your account balance, transaction history, set up automated savings and spending goals, and perform various banking activities with just a few taps.

Now that you have a basic understanding of Chime’s savings and checking accounts, let’s explore the benefits of transferring money from your savings to your checking account.

Benefits of Transferring Money from Savings to Checking

Transferring money from your Chime savings account to your checking account can offer several advantages and improve your overall financial management. Here are some key benefits of utilizing this feature:

- Ease of Access: By transferring funds from your savings to your checking account, you ensure that the money is readily available for your day-to-day spending. This gives you the flexibility to use your Chime debit card for purchases, pay bills, and cover any immediate expenses without having to worry about insufficient funds.

- Budgeting and Expense Tracking: Transferring money from your savings to your checking account allows you to have more visibility and control over your spending. By allocating a specific amount from your savings to your checking, you can effectively manage your budget and track your expenses. This helps you make informed financial decisions and avoid overspending.

- Opportunity to Earn Rewards: If you have a Chime account that offers cash back or rewards for certain purchases, transferring money from your savings to your checking allows you to maximize your earning potential. By using your Chime debit card for eligible transactions, you can earn rewards on your everyday spending and potentially redeem them for various benefits or discounts.

- Emergency or Unplanned Expenses: Life is unpredictable, and unexpected expenses can arise at any time. Transferring money from your savings to your checking account ensures that you have a financial safety net to cover emergencies or unplanned costs. It provides peace of mind knowing that you have the necessary funds readily accessible to handle any unforeseen circumstances.

- Higher Interest Earnings: While Chime’s savings account offers competitive interest rates, transferring money from your savings to your checking account allows you to take advantage of interest opportunities in both accounts. By keeping a portion of your funds in your savings and utilizing the remaining balance in your checking, you can maximize your overall interest earnings.

These benefits highlight the value and flexibility that transferring money from your Chime savings account to your checking account can bring to your financial management. Now, let’s dive into the step-by-step guide of how to perform this transfer seamlessly.

Step-by-Step Guide to Transferring Money from Chime Savings to Checking

Transferring money from your Chime savings account to your checking account is a straightforward process that can be done in just a few simple steps. Here’s a step-by-step guide to help you through the process:

- Step 1: Open the Chime Mobile App or Access Chime’s Website: Launch the Chime mobile app on your smartphone or visit the Chime website on your computer.

- Step 2: Log In to Your Chime Account: Enter your Chime account login credentials to access your account.

- Step 3: Navigate to the Transfers Section: Once you’re logged in, locate the “Transfers” section within the Chime mobile app or on the Chime website. This is where you’ll initiate the transfer process.

- Step 4: Select “Transfer to Checking”: Within the Transfers section, choose the option to transfer funds from your savings account to your checking account. This option may be labeled as “Transfer to Checking” or something similar.

- Step 5: Choose the Amount to Transfer: Enter the desired amount that you wish to transfer from your savings account to your checking account. Keep in mind any minimum or maximum limits that may apply.

- Step 6: Confirm the Transfer: Review the details of the transfer, including the amount and the accounts involved. Once you are satisfied, confirm the transfer to proceed.

- Step 7: Verify the Transfer: After confirming the transfer, Chime may require you to verify your action through a security measure such as a fingerprint scan or a PIN code.

- Step 8: Get Confirmation: Once the transfer is complete, you will receive a confirmation message or notification stating that the funds have been successfully transferred from your savings to your checking account.

Following these steps will ensure a smooth and hassle-free transfer of funds from your Chime savings account to your checking account. It’s important to note that transfer times may vary, but Chime typically processes transfers between accounts quickly, allowing you to access your funds without delay.

Keep in mind that Chime may have certain limitations and restrictions on the number of transfers you can make within a specific timeframe. It’s always a good idea to review the terms and conditions or contact Chime’s customer support for any additional information regarding transfers.

Now that you know how to transfer money from your Chime savings account to your checking account, let’s explore some potential considerations and limitations you should be aware of.

Potential Considerations and Limitations

While transferring money from your Chime savings account to your checking account offers numerous benefits, it’s important to be aware of any potential considerations and limitations that may apply. Here are a few factors to keep in mind:

- Transfer Frequency: Chime may have restrictions on the number of transfers you can make within a specific timeframe. It’s a good idea to familiarize yourself with these limitations to avoid any unexpected surprises or delays.

- Transfer Fees: Chime typically does not charge any fees for transferring money between your savings and checking accounts. However, it’s important to review Chime’s fee schedule to ensure you understand any potential charges that may apply.

- Savings Account Minimum Balance: If you plan on transferring a significant amount from your savings to your checking, be mindful of any minimum balance requirements for your savings account. Ensure that you are maintaining the required minimum balance to avoid any penalties or account closures.

- Transaction Processing Time: While Chime aims to process transfers quickly, the exact time it takes for the funds to appear in your checking account may vary. It’s advisable to check Chime’s website or contact their customer support for information on typical transfer processing times.

- Impact on Interest Earnings: Remember that the funds you transfer from your savings to your checking account will no longer contribute to the interest earnings in your savings account. If maximizing your interest earnings is a priority, consider leaving a portion of your savings untouched.

- Overall Account Balance: Before initiating a transfer, evaluate your overall account balance to ensure that transferring the funds will not have any adverse impact on your financial stability or other financial goals.

Understanding these considerations and limitations will help you make informed decisions when it comes to transferring money from your Chime savings account to your checking account. By being aware of these factors, you can optimize your financial management and avoid any potential challenges or misunderstandings.

Now that we’ve covered the considerations and limitations, let’s wrap up this guide.

Conclusion

Transferring money from your Chime savings account to your checking account is a simple and convenient process that can offer several benefits. It allows for easy access to your funds, helps with budgeting and expense tracking, maximizes rewards potential, and provides a safety net for emergencies. By following the step-by-step guide provided in this article, you can transfer money seamlessly and efficiently.

It’s important to keep in mind potential considerations and limitations, such as transfer frequency, fees, minimum balance requirements, and processing times. Being aware of these factors will help you manage your finances effectively and make informed decisions.

Chime’s modern banking platform, user-friendly interface, and features like SpotMe make it an ideal choice for individuals looking for easy and convenient financial management. Whether you’re saving for a goal, managing your day-to-day expenses, or dealing with unexpected costs, Chime provides the tools and flexibility to ensure that your financial needs are met.

Remember to regularly review your accounts, set savings goals, and track your expenses to maintain a healthy financial balance. By utilizing the features and benefits of Chime’s savings and checking accounts, you can stay on top of your financial game and achieve your financial goals.

So, take control of your finances and start making the most out of your Chime savings and checking accounts today!