Finance

How To Use Balance Transfer Checks

Modified: March 3, 2024

Learn how to make the most of balance transfer checks and manage your finances effectively with our comprehensive guide. Discover expert tips and strategies to optimize your financial situation.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of balance transfer checks, a powerful tool that can help you manage your credit card debt more effectively. If you’re looking to save money on interest and simplify your finances, balance transfer checks could be the solution you’ve been seeking. In this comprehensive guide, we’ll delve into the intricacies of balance transfer checks, exploring how they work, how to use them wisely, and the important considerations to keep in mind.

For many individuals, credit card debt can be a source of stress and financial burden. High-interest rates can make it challenging to pay down the principal balance, resulting in a cycle of debt accumulation. This is where balance transfer checks come into play, offering a potential lifeline for those seeking relief from mounting interest charges.

Throughout this article, we’ll provide you with a clear understanding of balance transfer checks, including their benefits and potential pitfalls. By the time you reach the end, you’ll be equipped with the knowledge and insights to make informed decisions about utilizing balance transfer checks to improve your financial situation.

Understanding Balance Transfer Checks

Balance transfer checks, also known as credit card checks, are a financial instrument that allows you to transfer funds from your credit card account to another account, typically to pay off debt from another card or loan. These checks often come with promotional offers, such as a low or 0% annual percentage rate (APR) for a specified introductory period, making them an attractive option for individuals aiming to reduce interest expenses.

It’s important to note that balance transfer checks are not free money; rather, they represent a transfer of debt from one account to another. When you use a balance transfer check, the transferred amount becomes part of your credit card balance, subject to the terms and conditions outlined by the issuing financial institution.

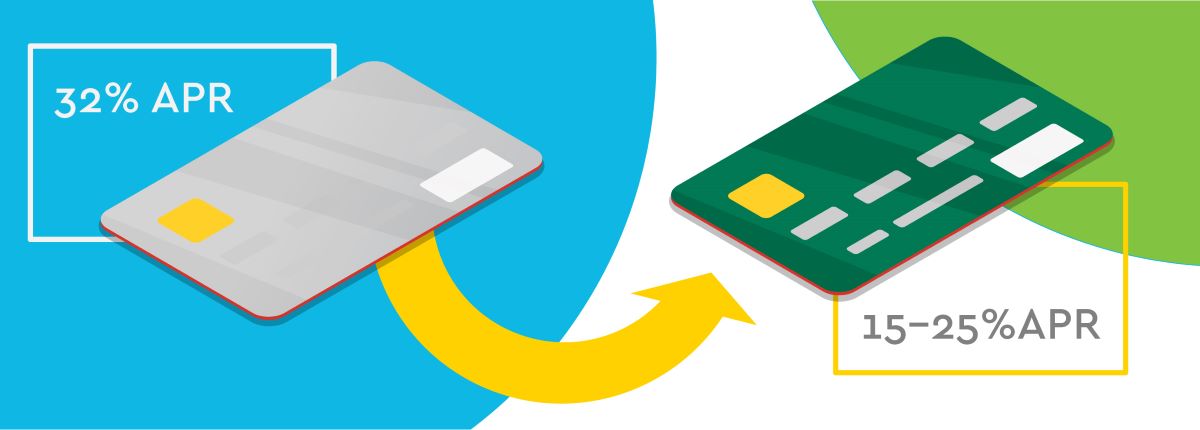

One of the key benefits of balance transfer checks is the potential to save money on interest payments. By consolidating high-interest debt onto a card with a lower or 0% APR promotional period, you can allocate more of your payments toward reducing the principal balance, accelerating your journey toward debt freedom.

However, it’s crucial to understand the terms and limitations associated with balance transfer checks. While the promotional APR may offer significant savings, it’s typically valid for a limited time, after which any remaining balance will be subject to the card’s standard APR. Additionally, balance transfer checks often incur a fee, usually calculated as a percentage of the transferred amount. Carefully reviewing the terms and conditions, including the promotional period duration, standard APR, and associated fees, is essential to making an informed decision about utilizing balance transfer checks.

Furthermore, not all types of debt are eligible for balance transfers. For example, transferring funds from one credit card to another within the same financial institution may not be permitted. Understanding the specific guidelines and restrictions set forth by the issuing institution is crucial to leveraging balance transfer checks effectively.

By gaining a solid grasp of how balance transfer checks function and the potential benefits they offer, you can approach their utilization with confidence and strategic intent, ultimately working toward improved financial stability and reduced interest expenses.

How to Use Balance Transfer Checks

Utilizing balance transfer checks effectively involves a strategic approach to managing your debt and maximizing the benefits of the promotional offer. Here’s a step-by-step guide to help you make the most of balance transfer checks:

- Evaluate Your Current Debt Situation: Before proceeding with a balance transfer, assess your existing debts, including the outstanding balances, interest rates, and minimum monthly payments. This evaluation will provide clarity on which accounts would benefit most from a balance transfer.

- Compare Balance Transfer Offers: Research and compare balance transfer offers from different credit card issuers. Look for promotional periods with low or 0% APR, taking note of the duration of the offer and any associated fees.

- Apply for a Balance Transfer Credit Card: Once you’ve identified a favorable offer, apply for a new credit card with a sufficient credit limit to accommodate the desired balance transfer. Ensure that the new card’s terms align with your financial goals and repayment timeline.

- Receive and Activate the Balance Transfer Checks: Upon approval, you’ll receive balance transfer checks from the new credit card issuer. Activate these checks according to the provided instructions, typically by endorsing them with your signature.

- Write the Balance Transfer Check: Select the account or accounts from which you wish to transfer balances and write the corresponding balance transfer checks to pay off the specified debts. Be mindful of any restrictions or limitations outlined by the issuing institution.

- Monitor the Transfer and Account Activity: Keep a close eye on the status of the balance transfers to ensure that the designated accounts receive the funds as intended. Verify that the balances on the original accounts reflect the payments made with the balance transfer checks.

- Adhere to the Repayment Plan: With the balances transferred, commit to a structured repayment plan to steadily reduce the consolidated debt. Make timely payments in accordance with the terms of the new credit card, aiming to clear the transferred balance before the promotional period expires.

By following these steps and exercising prudence in your financial decision-making, you can harness the potential of balance transfer checks to streamline your debt management and make meaningful progress toward financial freedom.

Things to Consider Before Using Balance Transfer Checks

Before embarking on a balance transfer journey, it’s essential to carefully consider several crucial factors to ensure that this financial strategy aligns with your goals and circumstances. Here are key considerations to ponder:

- Transfer Fees: Many balance transfer offers entail a one-time fee, typically calculated as a percentage of the transferred amount. It’s important to factor in these fees when evaluating the overall cost-effectiveness of the transfer. While the promotional APR may offer savings, the transfer fee can impact the immediate financial benefit.

- Promotional Period Duration: Assess the duration of the promotional APR period offered for balance transfers. Understanding how long the reduced or 0% APR will be in effect allows you to gauge the timeframe within which you can make substantial progress in paying down the transferred balance without incurring additional interest charges.

- Standard APR After the Promotional Period: Familiarize yourself with the standard APR that will apply to any remaining balance once the promotional period concludes. This rate will influence the long-term cost of the transferred debt, potentially impacting your repayment strategy and overall financial outlook.

- Credit Limit and Eligible Accounts: Confirm that the credit limit on the new card is sufficient to accommodate the desired balance transfer. Additionally, ensure that the types of accounts you intend to transfer balances from are eligible for balance transfers, as certain debts, such as those within the same card issuer, may not qualify.

- Impact on Credit Score: Understand that initiating a balance transfer may affect your credit score. While consolidating high-interest debt can have a positive impact on your credit utilization ratio, the act of opening a new credit account and closing existing accounts can influence your credit score in the short term.

- Repayment Discipline: Assess your ability to adhere to a structured repayment plan. While balance transfer checks offer a valuable opportunity to save on interest, maintaining discipline in making timely payments is crucial to fully capitalize on the promotional offer and avoid potential penalties or reverted interest rates.

By carefully considering these factors and evaluating how they align with your financial objectives, you can approach the utilization of balance transfer checks with informed decision-making and a clear understanding of the potential implications on your financial well-being.

Tips for Using Balance Transfer Checks Wisely

When leveraging balance transfer checks as part of your debt management strategy, employing them wisely can significantly impact your financial outlook. Here are valuable tips to ensure that you make the most of balance transfer checks:

- Thoroughly Understand the Terms: Before initiating a balance transfer, carefully review and comprehend the terms and conditions of the offer. Pay close attention to the promotional APR duration, transfer fees, and the standard APR that will apply after the promotional period expires.

- Create a Repayment Plan: Develop a structured repayment plan that aligns with the promotional period and the total transferred balance. Calculate the monthly payments required to pay off the debt before the promotional APR expires, factoring in any transfer fees and the standard APR that will apply thereafter.

- Refrain from New Charges: While focusing on paying down the transferred balance, avoid making new charges on the credit card to which the balance was transferred. New purchases may accrue interest at the standard APR and complicate your repayment efforts.

- Monitor the Promotional Period End Date: Stay mindful of the expiration date of the promotional APR. Set reminders to ensure that you are prepared to address any remaining balance before the standard APR takes effect, potentially increasing your interest expenses.

- Consider Additional Payments: If feasible within your budget, strive to make additional payments toward the transferred balance. Supplementing the minimum payments can expedite the debt reduction process and minimize the impact of the standard APR once the promotional period concludes.

- Preserve Emergency Funds: While focusing on debt repayment, maintain a financial safety net to address unexpected expenses or emergencies. Having accessible funds can prevent the need to rely on credit cards for unforeseen costs, preserving your debt reduction momentum.

- Assess Long-Term Financial Habits: Use the balance transfer period as an opportunity to evaluate and improve your financial habits. Identify areas where you can optimize spending, increase savings, and cultivate a more sustainable approach to managing your financial well-being.

By implementing these tips and integrating prudent financial habits into your approach to utilizing balance transfer checks, you can harness their potential to reduce interest expenses, accelerate debt repayment, and pave the way toward enhanced financial stability.

Conclusion

In navigating the realm of personal finance, the judicious use of balance transfer checks can serve as a valuable tool for individuals seeking to alleviate the burden of high-interest debt. By consolidating balances onto a credit card offering a promotional APR, you can mitigate interest expenses and streamline your path toward debt freedom. However, it’s imperative to approach balance transfer checks with a comprehensive understanding of their implications and strategic considerations.

Before embarking on a balance transfer journey, take the time to evaluate your current debt landscape, compare offers from various credit card issuers, and assess the potential impact on your financial well-being. Understanding the promotional period duration, transfer fees, and the standard APR that will apply post-promotion is essential in making an informed decision.

When using balance transfer checks, diligence in crafting a repayment plan and adhering to disciplined financial habits is paramount. By leveraging these checks wisely, you can optimize the benefits of the promotional offer and expedite your progress toward debt repayment.

As you embark on this financial endeavor, remember that balance transfer checks are a means to an end – a tool to facilitate your journey toward financial stability and independence. By integrating these checks into a comprehensive debt management strategy and adopting prudent financial practices, you can harness their potential to reduce interest costs, gain control over your finances, and pave the way for a brighter financial future.

Ultimately, the effective utilization of balance transfer checks hinges on a blend of financial acumen, strategic planning, and disciplined execution. Armed with the insights and tips provided in this guide, you are well-equipped to navigate the realm of balance transfer checks with confidence and purpose, leveraging them as a catalyst for positive change in your financial landscape.