Home>Finance>How Do I Withdraw Money From My Chime Savings Account

Finance

How Do I Withdraw Money From My Chime Savings Account

Modified: December 30, 2023

Learn how to withdraw money from your Chime savings account and manage your finances effectively. Take control of your financial future and make the most of your savings with our easy-to-follow guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Step 1: Understanding Chime Savings Account

- Step 2: Checking Available Balance

- Step 3: Withdrawing Funds from Chime Savings Account

- Step 4: Choosing Withdrawal Methods

- Step 5: Initiating the Withdrawal Process

- Step 6: Verification and Confirmation

- Step 7: Receiving the Withdrawn Funds

- Step 8: Managing Withdrawal Limits

- Step 9: Understanding Fees and Charges

- Conclusion

Introduction

Withdrawing money from a financial institution’s savings account is a common practice for individuals looking to access their funds for various purposes. If you are a Chime Savings account holder and wondering how you can withdraw money from your account, you’ve come to the right place.

Chime is a popular online banking platform that offers a range of financial products, including a high-yield savings account. This account allows you to earn interest on your savings and provides a seamless and convenient banking experience. When it comes to withdrawing funds from your Chime Savings account, the process is relatively straightforward, whether you need the money for everyday expenses, emergencies, or other financial goals.

In this article, we will guide you through the step-by-step process of withdrawing money from your Chime Savings account. From checking your account balance to choosing the withdrawal method and verifying the transaction, we will cover all the essential aspects to ensure a smooth and hassle-free withdrawal experience.

Whether you prefer to withdraw funds electronically or through a physical bank branch, Chime offers a range of withdrawal options to cater to your needs. Furthermore, understanding the withdrawal limits and any associated fees is crucial to manage your finances effectively. We will explore these factors in detail to keep you informed and help you make informed decisions.

So, without further ado, let’s dive into the world of Chime Savings account withdrawals and learn how to access your hard-earned money whenever you need it.

Step 1: Understanding Chime Savings Account

Before delving into the process of withdrawing money from your Chime Savings account, it’s important to have a clear understanding of how the account works. Chime offers a modern and digital approach to banking, and their savings account is designed to help you grow your money while providing easy access to your funds.

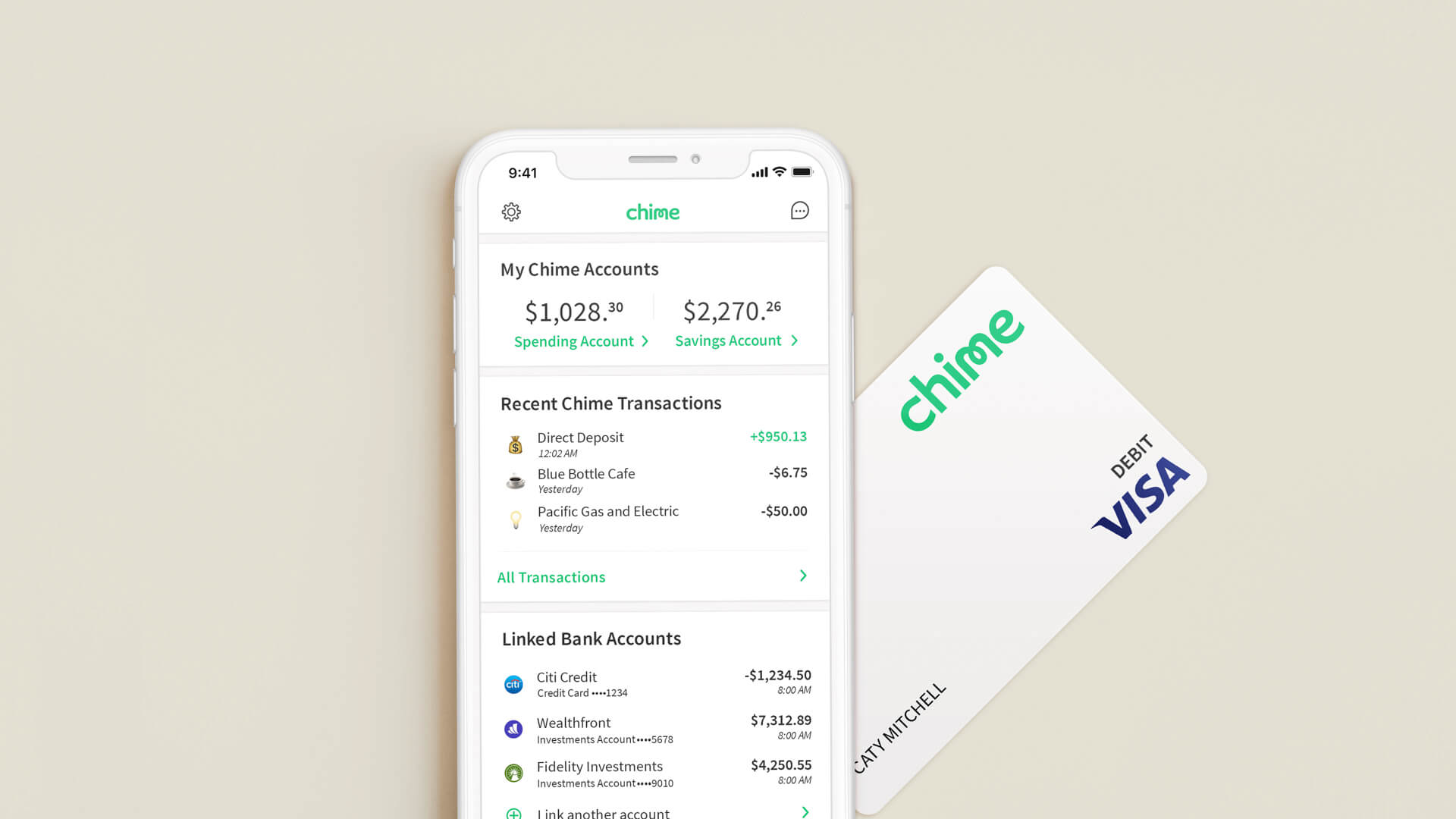

The Chime Savings account is a high-yield savings account that offers competitive interest rates, allowing you to earn more on your savings compared to traditional brick-and-mortar banks. The account is linked to your Chime Spending account, making it seamless to transfer funds between the two accounts for spending and saving purposes.

One key feature of the Chime Savings account is the automatic savings feature. Chime enables you to set up automatic transfers from your Chime Spending account to your Savings account. This feature allows you to effortlessly save a portion of your income without having to manually initiate transfers every time.

Another benefit of the Chime Savings account is that it does not charge any monthly maintenance fees or require a minimum balance. This makes it an attractive option for individuals looking to avoid unnecessary fees while still enjoying the perks of a high-yield savings account.

Chime Savings account also provides access to a range of tools and features aimed at helping you manage and track your savings goals. You can set specific savings targets, view your progress, and receive notifications to stay on top of your financial goals.

Understanding the terms and features of your Chime Savings account is crucial as it sets the foundation for managing your funds and makes the withdrawal process more streamlined. Now that you have a good grasp of what the Chime Savings account offers let’s move on to the next step: checking your available balance.

Step 2: Checking Available Balance

Before you can proceed with withdrawing money from your Chime Savings account, it is important to check your available balance. This will ensure that you have sufficient funds to withdraw and help you plan your withdrawal accordingly.

To check your Chime Savings account balance, you have a few options available:

- Chime Mobile App: The easiest and most convenient way to check your balance is through the Chime mobile app. Simply open the app on your smartphone, log in to your account, and navigate to the savings account section. There, you will be able to view your available balance in real-time.

- Chime Website: If you prefer to check your balance on a computer, you can log in to your Chime account through the official Chime website. Once logged in, navigate to the savings account section, and you will find your available balance displayed.

- Text Message: Alternatively, you can also check your Chime Savings account balance by sending a text message to Chime’s designated phone number. Simply text “BAL” to the number provided, and you will receive a text message with your available balance.

By regularly checking your Chime Savings account balance, you can stay informed about how much money you have available to withdraw and make informed decisions about your finances.

Now that you have confirmed your available balance, it’s time to move on to the next step: withdrawing funds from your Chime Savings account.

Step 3: Withdrawing Funds from Chime Savings Account

Once you have assessed your available balance and decided to proceed with withdrawing funds from your Chime Savings account, you have several options available to you. Chime offers multiple methods to withdraw your money, providing flexibility and convenience to meet your specific needs.

Here are the different ways you can withdraw funds from your Chime Savings account:

- Transfer to Chime Spending Account: As your Chime Savings account is linked to your Chime Spending account, you can easily transfer funds between the two accounts. This option is useful if you plan to use the funds for everyday expenses or need quick access to the money. Simply initiate a transfer within the Chime mobile app or website, specifying the amount you wish to transfer from your Savings account to your Spending account.

- ATM Withdrawal: Chime provides access to over 38,000 fee-free ATMs through their network partners, which include MoneyPass and Visa Plus Alliance. You can use your Chime debit card to withdraw cash from any of these ATMs. Keep in mind that some ATMs may impose their own surcharges, so it’s advisable to choose ATMs within Chime’s network to avoid additional fees.

- Debit Card Purchases: If you prefer to use your Chime debit card for purchases rather than withdrawing cash, you can simply make purchases directly with the card. The funds will be deducted from your Chime Spending account, but you should ensure that you have sufficient funds available to cover the purchase.

- Check withdrawal: In certain cases, you may need to withdraw money from your Chime Savings account by writing a check. Chime provides the option to request a check withdrawal through their customer support. Keep in mind that there may be additional processing time and potential fees associated with this method.

Choosing the most suitable withdrawal method depends on your specific requirements and preferences. If you need the funds in cash, using an ATM withdrawal or transferring to your Chime Spending account will be the best options. On the other hand, if you require the funds for purchases, utilizing your Chime debit card might be more convenient.

Once you have decided on the withdrawal method that best suits your needs, you can move on to the next step: initiating the withdrawal process.

Step 4: Choosing Withdrawal Methods

When it comes to withdrawing funds from your Chime Savings account, you have multiple withdrawal methods to choose from. The method you select will depend on factors such as your immediate needs, accessibility, and personal preference.

Here are the different withdrawal methods available for Chime Savings account holders:

- Transfer to Chime Spending Account: This method allows you to transfer funds from your Chime Savings account to your Chime Spending account. It is a convenient option if you plan to use the funds for daily expenses or if you have a linked Chime debit card that you can use for purchases or ATM withdrawals.

- ATM Withdrawal: If you need cash, you can use your Chime debit card to make withdrawals at any of the fee-free ATMs in Chime’s network. Chime has partnered with networks like MoneyPass and Visa Plus Alliance, providing you access to thousands of ATMs without incurring extra fees. However, it’s important to note that some ATMs may still charge their own surcharges.

- Debit Card Purchases: Another way to access your funds is by using your Chime debit card for purchases. This method is convenient if you need to make payments at merchants that accept debit cards. The purchase amount will be deducted directly from your Chime Spending account.

- Check Withdrawal: In certain situations, you may need to request a check withdrawal from your Chime Savings account. This method allows you to receive funds by issuing a paper check. While it may take a bit longer compared to other methods, it can be useful for situations where a physical check is required.

Consider your immediate needs and preferences when choosing the withdrawal method. If you need cash on-hand, an ATM withdrawal may be the most suitable option. On the other hand, if you prefer to use your card for purchases, opting for debit card transactions might be more convenient.

Once you have decided on the withdrawal method, you can proceed to the next step: initiating the actual withdrawal process.

Step 5: Initiating the Withdrawal Process

After selecting the withdrawal method that best suits your needs, it’s time to initiate the actual withdrawal process from your Chime Savings account. The steps involved may vary depending on the chosen method, so let’s explore each option:

- Transfer to Chime Spending Account: If you decide to transfer funds from your Chime Savings account to your Chime Spending account, you can easily do so through the Chime mobile app or website. Log in to your Chime account, navigate to the Savings account section, and select the option to initiate a transfer. Specify the amount you wish to transfer, ensuring that it does not exceed your available savings balance.

- ATM Withdrawal: To withdraw cash from an ATM, locate a fee-free ATM within Chime’s network. Insert your Chime debit card into the ATM machine and follow the on-screen instructions. Enter your PIN when prompted and select the desired withdrawal amount. The ATM will dispense the cash, and your Chime Savings account will be debited accordingly. Remember to keep your card and PIN secure.

- Debit Card Purchases: When using your Chime debit card for purchases, simply swipe or insert your card at a merchant’s card reader. Follow the prompts on the terminal and authorize the transaction using your PIN or signature, depending on the merchant’s requirements. The purchase amount will be deducted from your Chime Spending account, which is linked to your Savings account.

- Check Withdrawal: If you need to request a check withdrawal, reach out to Chime’s customer support. They will guide you through the process and assist you in initiating the check withdrawal. Provide the necessary details, such as the withdrawal amount and recipient information. Keep in mind that check withdrawals may take longer to process and deliver compared to other methods.

Whether you are performing a transfer, using an ATM, making a purchase, or requesting a check withdrawal, ensure that you follow the necessary steps accurately to complete the withdrawal process successfully.

Once you have initiated the withdrawal, you may need to go through additional verification and confirmation steps. We will cover these in the next step.

Step 6: Verification and Confirmation

After initiating the withdrawal process from your Chime Savings account, you may be required to go through verification and confirmation steps to ensure the security of your transaction. These steps are in place to verify your identity and safeguard against unauthorized access to your funds.

The verification and confirmation process may differ based on the chosen withdrawal method. Here are some common verification measures you may encounter:

- Transfer to Chime Spending Account: As you transfer funds from your Chime Savings account to your Chime Spending account, you may need to enter your account credentials or provide additional authentication information, such as a one-time password or security question answer.

- ATM Withdrawal: When using an ATM to withdraw cash, you will typically enter your PIN to authenticate the transaction. This PIN should be known only to you and kept secure to prevent unauthorized access to your funds.

- Debit Card Purchases: For debit card purchases, you may be required to enter your PIN or sign a receipt to verify the transaction. This step ensures that only authorized cardholders can use your Chime debit card for purchases.

- Check Withdrawal: If you opt for a check withdrawal, you may need to provide additional information, such as your account details or personal identification, to verify your identity and facilitate the issuance of the check.

Verification and confirmation steps are in place to protect your account and prevent fraudulent activity. By providing accurate information and following the necessary authentication procedures, you can ensure the secure withdrawal of funds from your Chime Savings account.

Once you have completed the verification and confirmation process, you can proceed to the next step: receiving the withdrawn funds.

Step 7: Receiving the Withdrawn Funds

After successfully initiating and verifying your withdrawal from your Chime Savings account, it’s time to receive the funds you have withdrawn. The method you have chosen for withdrawal will determine how you will receive the funds.

Let’s explore the different ways you can receive the withdrawn funds:

- Transfer to Chime Spending Account: If you transferred funds from your Chime Savings account to your Chime Spending account, the withdrawn amount will be available immediately in your Spending account. You can access the funds through your Chime debit card for purchases, ATM withdrawals, or digital payments.

- ATM Withdrawal: When you perform an ATM withdrawal, the cash will be dispensed from the ATM machine, allowing you to receive it instantly. Ensure that you securely collect the withdrawn funds and keep them in a safe place.

- Debit Card Purchases: If you used your Chime debit card for purchases, the funds will be deducted from your Chime Spending account at the time of the transaction. The purchased goods or services will be received instantly upon successful authorization of the purchase.

- Check Withdrawal: In the case of a check withdrawal, the funds will be disbursed by issuing a physical check. The check will be sent to the address specified during the withdrawal process. You will need to wait for the check to arrive in the mail, which may take a few business days.

Ensure that you have provided accurate and up-to-date information during the withdrawal process to avoid any delays or complications in receiving your withdrawn funds.

Once you have received the funds, it’s essential to manage your withdrawal limits and be aware of any associated fees or charges, which we will discuss in the following steps.

Step 8: Managing Withdrawal Limits

When it comes to withdrawing funds from your Chime Savings account, it is important to be aware of any withdrawal limits that may be in place. These limits are set to ensure the security of your account and prevent unauthorized access or fraudulent activities.

The specific withdrawal limits for your Chime Savings account may vary based on various factors, such as the chosen withdrawal method, your account standing, and account history. Here are some considerations for managing withdrawal limits:

- ATM Withdrawal Limits: If you plan to withdraw cash from an ATM using your Chime debit card, there may be limits on the maximum amount you can withdraw per transaction or within a specific time period. These limits are typically set by Chime or the ATM provider and can vary depending on the ATM location and network.

- Transfer Limits: When transferring funds from your Chime Savings account to your Chime Spending account, there may be limits on the maximum amount you can transfer in a single transaction or within a certain timeframe. These limits are in place to prevent unauthorized transfers and ensure the safety of your funds.

- Additional Verification: In some cases, if you need to withdraw a large sum of money or exceed certain limits, you may be required to go through additional verification processes to confirm your identity and authorize the withdrawal. This could involve providing additional documentation or answering security questions.

To manage your withdrawal limits effectively, it is a good practice to familiarize yourself with the specific limits associated with your Chime Savings account. You can find this information on the Chime website or by reaching out to their customer support.

By understanding and adhering to the withdrawal limits, you can ensure a smooth and secure withdrawal process from your Chime Savings account.

Next, we will discuss fees and charges associated with withdrawing funds from your account.

Step 9: Understanding Fees and Charges

When it comes to managing your finances and making withdrawals from your Chime Savings account, it is crucial to have a clear understanding of any fees and charges that may be associated with the process. By being aware of these fees, you can make informed decisions and avoid any unexpected costs.

Here are some key fees and charges you should be aware of when withdrawing funds from your Chime Savings account:

- ATM Fees: While Chime provides access to a vast network of fee-free ATMs, it’s important to note that some ATMs may still charge their own fees. If you choose to withdraw cash from an ATM outside of Chime’s designated network, you may be subject to ATM surcharges imposed by the ATM operator.

- Overdraft Fees: It’s essential to maintain a sufficient balance in your Chime Spending account to cover any withdrawals or purchases. If you attempt to withdraw more funds than you have available, you may incur overdraft fees. Therefore, it is important to keep track of your account balance and ensure you have enough funds for any planned withdrawals.

- Excessive Withdrawal Fees: Chime Savings accounts are subject to federal regulations that limit the number of certain types of withdrawals you can make per month. If you exceed these limits, you may be charged excessive withdrawal fees. Make sure to familiarize yourself with these limitations and keep track of your withdrawals to avoid incurring these fees.

- Check Fees: If you choose to request a check withdrawal from your Chime Savings account, there may be fees associated with this service. It’s important to review the terms and conditions provided by Chime to understand any applicable check fees.

To fully understand the fees and charges specific to your Chime Savings account, it’s recommended to review the account agreement and fee schedule provided by Chime. This will give you a comprehensive overview of all potential fees and charges that may apply to your account.

By being aware of these fees and charges, you can effectively manage your withdrawals and make informed decisions to avoid unnecessary costs.

With a good understanding of the fees and charges, you can now confidently navigate the process of withdrawing funds from your Chime Savings account.

Now that you are equipped with the knowledge of how to withdraw money from your Chime Savings account, you can confidently manage your finances and access your funds whenever needed. Remember to regularly monitor your account balance, choose the most suitable withdrawal method, and stay informed about any fees or limitations to optimize your withdrawal experience.

By leveraging the convenience and flexibility offered by Chime, you can enjoy a seamless banking experience and make the most of your hard-earned savings.

Happy banking with Chime!

Conclusion

Withdrawing money from your Chime Savings account is a straightforward process that offers flexibility and convenience. By following the step-by-step guide outlined in this article, you can confidently access your funds whenever you need them.

We began by understanding the features and benefits of the Chime Savings account, highlighting its high-yield interest rates, automatic savings options, and easy account management through the Chime mobile app and website.

We then explored the steps involved in withdrawing funds from your Chime Savings account, including checking your available balance, choosing the appropriate withdrawal method, initiating the withdrawal process, verifying and confirming the transaction, and receiving the withdrawn funds.

Furthermore, we discussed the importance of managing withdrawal limits to ensure the security of your account, as well as understanding the potential fees and charges associated with withdrawals, such as ATM fees, overdraft fees, excessive withdrawal fees, and check fees.

By being aware of these factors and making informed decisions, you can make the most of your Chime Savings account while avoiding unnecessary costs.

Remember to regularly check your account balance, plan and choose the most suitable withdrawal method for your needs, and stay informed about any fees or limitations to effectively manage your finances.

Chime provides a modern and user-friendly banking experience, empowering you to withdraw and manage your funds efficiently. Through their seamless online platform and support from their customer service team, you can navigate the withdrawal process with confidence.

Now that you have a solid understanding of how to withdraw money from your Chime Savings account, you can take control of your finances and access your savings whenever necessary—whether it’s for day-to-day expenses, emergency situations, or reaching your financial goals.

Enjoy the flexibility and convenience of Chime as you confidently manage your funds and make the most of your Chime Savings account.