Home>Finance>Received Pension Funds: What Are The Correct IRS Forms?

Finance

Received Pension Funds: What Are The Correct IRS Forms?

Published: January 23, 2024

Learn the correct IRS forms for managing received pension funds in finance. Ensure compliance and avoid penalties with the right forms.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Receiving pension funds is a significant milestone in one’s financial journey, often representing years of hard work and dedication. However, navigating the tax implications of these funds can be complex and overwhelming. Understanding the correct Internal Revenue Service (IRS) forms for received pension funds is crucial for ensuring compliance with tax regulations and avoiding potential penalties.

In this comprehensive guide, we will delve into the nuances of pension funds and explore the specific IRS forms that individuals need to be familiar with when receiving such funds. By shedding light on the essential forms and providing insights into the process of filling them out correctly, we aim to empower individuals to navigate this aspect of their financial obligations with confidence and clarity.

Whether you are approaching retirement and anticipating pension disbursements or have already received pension funds, having a thorough understanding of the applicable IRS forms is essential for maintaining financial prudence and ensuring a smooth tax filing process. Let’s embark on this informative journey to unravel the intricacies of received pension funds and the associated IRS forms.

Understanding Pension Funds

Pension funds serve as a critical pillar of financial security for countless individuals, offering a source of income during retirement years. These funds are typically accumulated over the course of an individual’s career through contributions made by the employee, the employer, or both. The funds are then invested to generate returns, ultimately providing a steady stream of income to the retiree.

One of the key distinctions of pension funds is their tax treatment. Contributions made to the pension fund are often tax-deferred, meaning that they are not subject to income tax in the year they are made. Instead, the contributions and their investment earnings are taxed when they are withdrawn during retirement, typically at a potentially lower tax rate due to the retiree’s potentially lower income level.

It’s important to note that the tax treatment of pension funds can vary based on the specific type of pension plan, such as defined benefit plans, defined contribution plans, and individual retirement accounts (IRAs). Each type of plan may have unique tax implications, and understanding these nuances is crucial for effective financial planning and tax compliance.

Moreover, the manner in which pension funds are disbursed can also impact their tax treatment. Whether the funds are received as a lump sum distribution or periodic payments can have significant implications for tax liability. Lump sum distributions may result in a substantial tax burden in the year of receipt, while periodic payments are typically taxed incrementally over time.

Understanding the intricacies of pension funds and their tax implications is essential for making informed financial decisions and ensuring compliance with IRS regulations. By gaining clarity on the tax treatment of pension funds, individuals can effectively plan for their retirement years and navigate the associated tax obligations with confidence.

IRS Forms for Received Pension Funds

When individuals receive pension funds, it is imperative to accurately report these funds to the IRS to ensure compliance with tax regulations. The specific IRS forms required for reporting received pension funds depend on various factors, including the type of pension plan, the manner in which the funds are distributed, and any applicable rollovers or transfers. Understanding the relevant forms and their purposes is essential for fulfilling tax obligations and avoiding potential penalties.

IRS forms related to received pension funds serve as a means of documenting the income derived from these funds and reporting any associated tax withholding. Additionally, these forms provide the IRS with essential information for assessing the tax liability of the recipient and ensuring that the appropriate taxes have been paid on the pension disbursements.

It’s important to note that the specific forms required for reporting received pension funds may vary based on individual circumstances. Factors such as the presence of after-tax contributions, the age of the recipient at the time of distribution, and any rollovers or transfers to other retirement accounts can all influence the applicable forms.

Moreover, the tax treatment of the received pension funds, whether as ordinary income or potentially eligible for special tax treatment, can impact the selection of the relevant IRS forms. Understanding the nuances of these forms and their alignment with the nature of the pension distributions is crucial for accurate reporting and compliance with IRS requirements.

By familiarizing themselves with the appropriate IRS forms for reporting received pension funds, individuals can navigate the tax reporting process with confidence and ensure that their tax obligations are met in accordance with the pertinent regulations. This proactive approach not only fosters financial prudence but also mitigates the risk of potential tax-related issues in the future.

Common IRS Forms for Pension Funds

Several IRS forms are commonly utilized for reporting received pension funds and documenting the associated tax implications. Understanding the purpose of these forms and their relevance to specific pension distributions is essential for accurate tax reporting and compliance. Let’s explore some of the common IRS forms that individuals may encounter when dealing with pension funds:

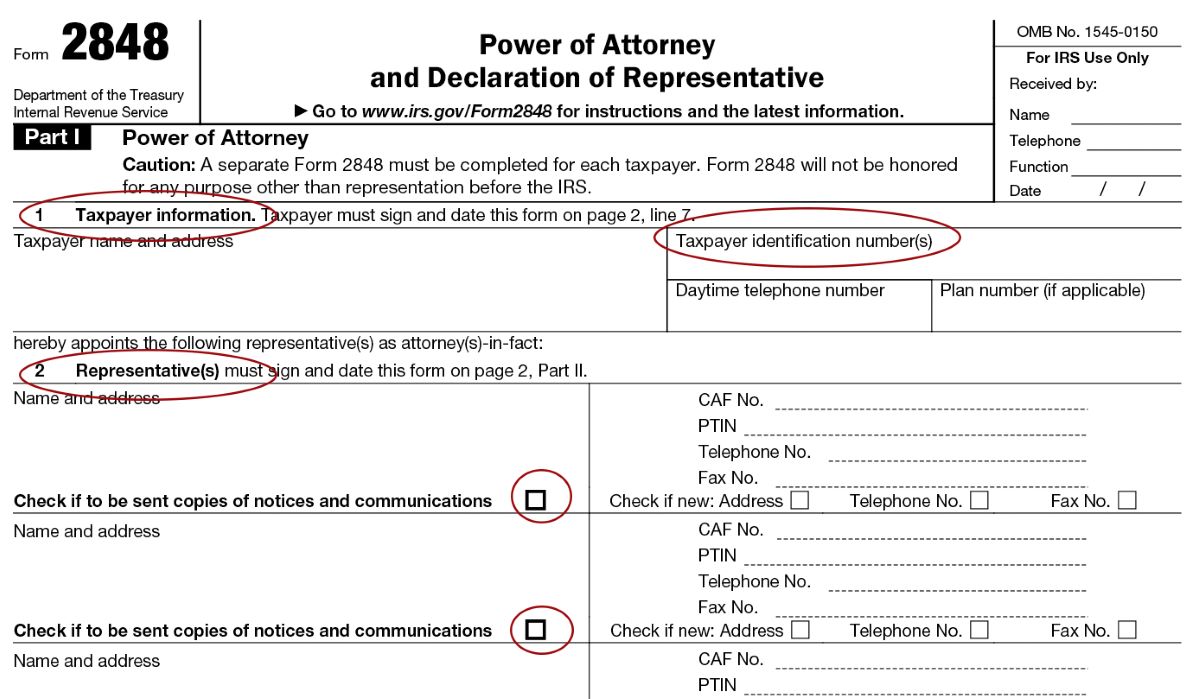

- Form 1099-R: This form is typically provided by the payer of the pension funds to report distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, and other similar arrangements. It outlines the total amount of the distribution, the taxable amount, and any federal income tax withheld. Recipients of pension funds will receive Form 1099-R from the payer, and they must use this form to report the distribution on their tax return.

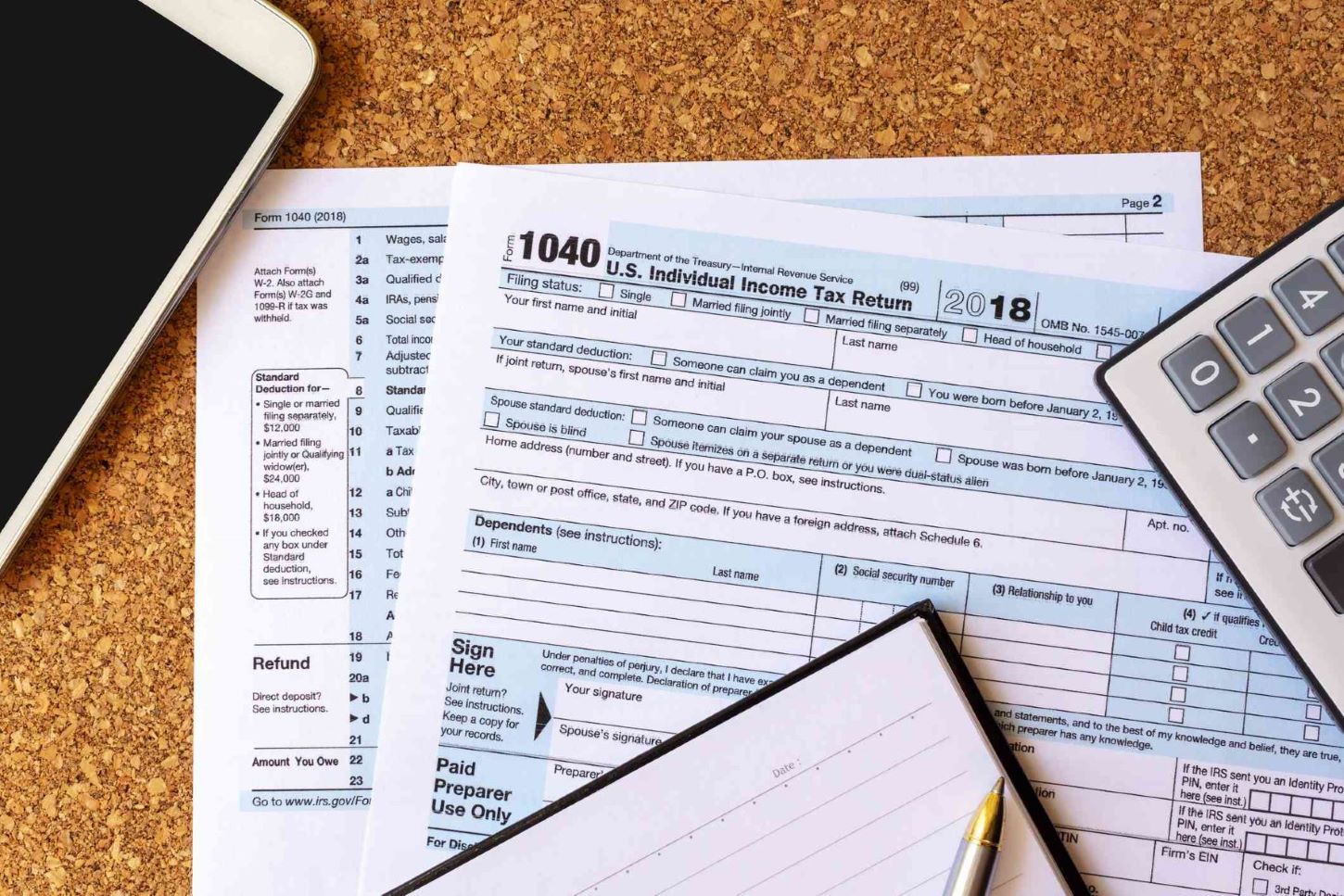

- Form 1040: Individuals often use Form 1040, the U.S. Individual Income Tax Return, to report pension income and any associated tax liability. The taxable amount of the pension distribution, as indicated on Form 1099-R, is included in the income reported on Form 1040. Depending on the nature of the pension distribution, additional forms or schedules may be required to report the income accurately.

- Form 8606: This form is utilized to report nondeductible contributions to traditional IRAs and the associated distributions. If the pension funds include after-tax contributions, Form 8606 is used to determine the taxable portion of the distribution and report it on the individual’s tax return.

- Form 5498: Issued by the trustee or issuer of the individual’s retirement account, such as an IRA, Form 5498 provides information on contributions, rollovers, conversions, and the fair market value of the account. While this form is not filed with the individual’s tax return, it is essential for tracking the basis in the retirement account and reporting any relevant transactions.

These common IRS forms play a pivotal role in the accurate reporting of received pension funds and the associated tax implications. By understanding the purpose and utilization of these forms, individuals can effectively navigate the tax reporting process and fulfill their obligations in compliance with IRS regulations.

Filling Out the Correct IRS Forms

Accurately completing the necessary IRS forms for reporting received pension funds is crucial for ensuring compliance with tax regulations and avoiding potential issues during the tax filing process. When filling out the correct IRS forms, individuals must pay attention to detail and ensure that all relevant information is accurately documented. Let’s explore the essential steps for filling out the correct IRS forms related to received pension funds:

- Review Form 1099-R: Upon receiving Form 1099-R from the payer of the pension funds, carefully review the information provided, including the total distribution amount, the taxable amount, and any federal income tax withheld. Verify the accuracy of the details and retain the form for reference when completing your tax return.

- Utilize Form 1040: When reporting pension income on Form 1040, ensure that the information from Form 1099-R is accurately transferred to the appropriate sections of the tax return. Depending on the nature of the pension distribution and any additional tax considerations, such as after-tax contributions, follow the instructions provided with Form 1040 to report the income correctly.

- Complete Form 8606 if Applicable: If the received pension funds include after-tax contributions, it may be necessary to complete Form 8606 to determine the taxable portion of the distribution. Follow the instructions on the form to accurately calculate and report the taxable amount on your tax return.

- Retain Form 5498 for Reference: While Form 5498 is not typically filed with your tax return, it is important to retain this form for reference, especially if it contains information regarding contributions, rollovers, conversions, or the fair market value of your retirement account. This information may be relevant for future tax reporting or retirement planning.

By diligently following these steps and ensuring the accurate completion of the relevant IRS forms, individuals can effectively report received pension funds and fulfill their tax obligations in accordance with IRS requirements. Additionally, seeking guidance from a tax professional or utilizing tax preparation software can provide valuable support in navigating the process of filling out the correct IRS forms and optimizing the tax reporting for received pension funds.

Conclusion

Understanding the intricacies of received pension funds and the associated IRS forms is essential for individuals navigating their retirement years and fulfilling their tax obligations. By gaining clarity on the tax treatment of pension distributions and familiarizing themselves with the relevant IRS forms, individuals can proactively manage their financial responsibilities and mitigate the risk of potential tax-related issues.

When receiving pension funds, individuals must be mindful of the specific IRS forms required for accurate tax reporting. From Form 1099-R, which outlines the distribution details, to Form 1040, used for reporting pension income on the tax return, each form plays a crucial role in documenting the pension funds and their associated tax implications.

Furthermore, the process of filling out the correct IRS forms demands attention to detail and a comprehensive understanding of the individual’s financial circumstances. Whether navigating after-tax contributions, rollovers, or the fair market value of retirement accounts, individuals must ensure the accurate completion of the necessary forms to fulfill their tax obligations effectively.

By approaching the reporting of received pension funds with diligence and a commitment to accuracy, individuals can streamline the tax filing process and maintain compliance with IRS regulations. Seeking guidance from tax professionals or leveraging tax preparation resources can further support individuals in navigating the complexities of reporting pension income and optimizing their tax outcomes.

Ultimately, a proactive and informed approach to understanding pension funds and the associated IRS forms empowers individuals to make well-informed financial decisions and navigate their retirement years with confidence and financial prudence.