Finance

What Is IRS Form 8821?

Published: November 1, 2023

Learn about IRS Form 8821 and how it can help with your finance matters. Gain insights into its purpose and significance in managing your financial affairs.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to managing finances, there are often instances where individuals or organizations need to grant someone else the authority to access and receive confidential information from the Internal Revenue Service (IRS). This could be for the purpose of seeking professional advice, resolving tax issues, or simply delegating the responsibility of dealing with tax matters to another party.

In such cases, the IRS Form 8821 comes into play. This form, officially known as the “Tax Information Authorization,” allows taxpayers to authorize the IRS to disclose their sensitive information to designated individuals or organizations.

The Form 8821 serves as a crucial tool in maintaining a transparent and secure tax system. It ensures that confidential tax-related information is shared only with authorized parties, safeguarding individuals and organizations from potential breaches of privacy.

Understanding IRS Form 8821 and its implications is essential for anyone who needs to grant access to their tax information. In this article, we will provide a comprehensive overview of Form 8821, including its purpose, the information required, the duration of authorization, and the process for submitting the form.

Purpose of IRS Form 8821

The primary purpose of IRS Form 8821 is to grant a third-party designated individual or organization the authority to receive and access a taxpayer’s confidential tax information. This authorization allows the designated party to communicate with the IRS on behalf of the taxpayer, gather necessary information, and represent the taxpayer in various tax-related matters.

There are several situations where individuals or organizations might need to use Form 8821:

- Seeking professional tax advice: Taxpayers often enlist the help of tax professionals such as accountants or attorneys to assist them in managing their tax affairs. By completing Form 8821, the taxpayer authorizes these professionals to access relevant tax information, enabling them to provide accurate advice and support.

- Delegating tax responsibilities: Individuals or organizations may choose to delegate the responsibility of interacting with the IRS to another party. This could be for reasons such as time constraints, lack of expertise in tax matters, or the desire to have a designated representative handle all tax-related communications.

- Resolving tax issues: In cases where a taxpayer is facing tax issues, such as an audit or an ongoing dispute with the IRS, Form 8821 allows the taxpayer to authorize a representative to handle and resolve these matters on their behalf.

It’s important to note that Form 8821 does not grant the designated individual or organization the power to act on behalf of the taxpayer in financial or legal matters unrelated to tax. Its specific purpose is to authorize access to and communication with the IRS regarding tax-related information only.

By using Form 8821, taxpayers can ensure that their confidential tax information is shared only with authorized parties, maintaining the necessary level of privacy and security in dealing with their tax affairs.

Information Required on Form 8821

When completing IRS Form 8821, there are specific pieces of information that need to be provided to ensure the authorization is valid and accurate. Here is the information that must be included on Form 8821:

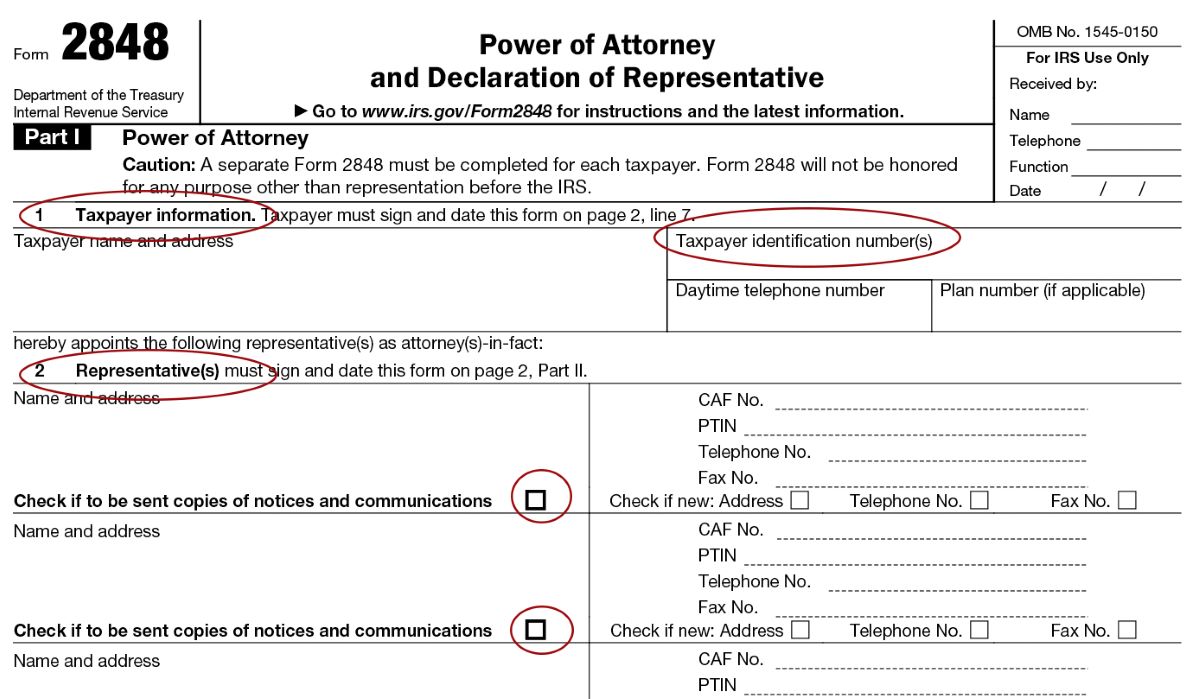

- Taxpayer Information: This section requires the taxpayer’s name, address, social security number (or employer identification number for businesses), and daytime telephone number. It is essential to provide accurate and up-to-date information to avoid any discrepancies or delays in processing the form.

- Authorized Representative Information: The form also requires details about the third-party designated individual or organization. This includes their name, address, and phone number. It is crucial to accurately identify the authorized representative to ensure that the IRS communicates with the correct person or entity.

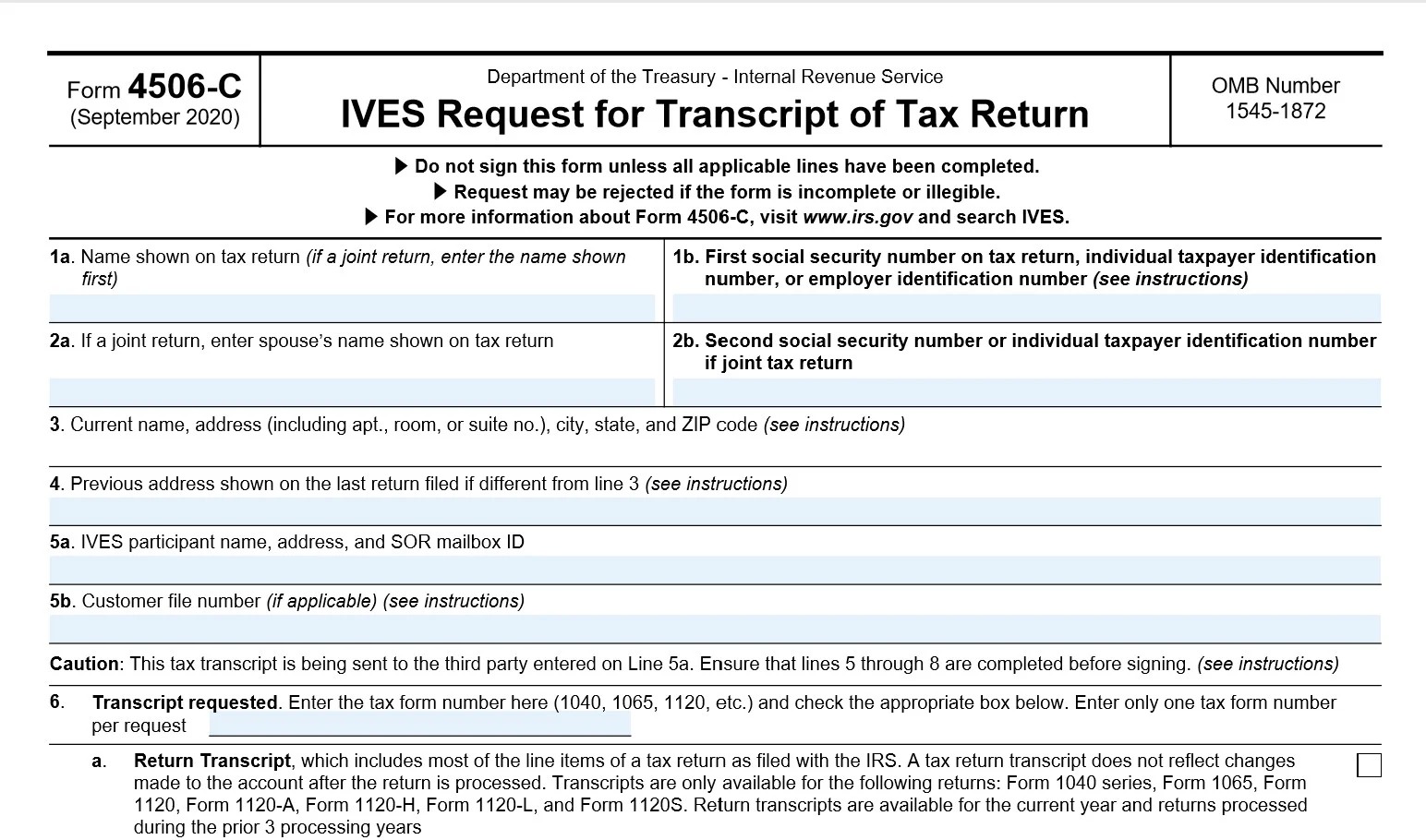

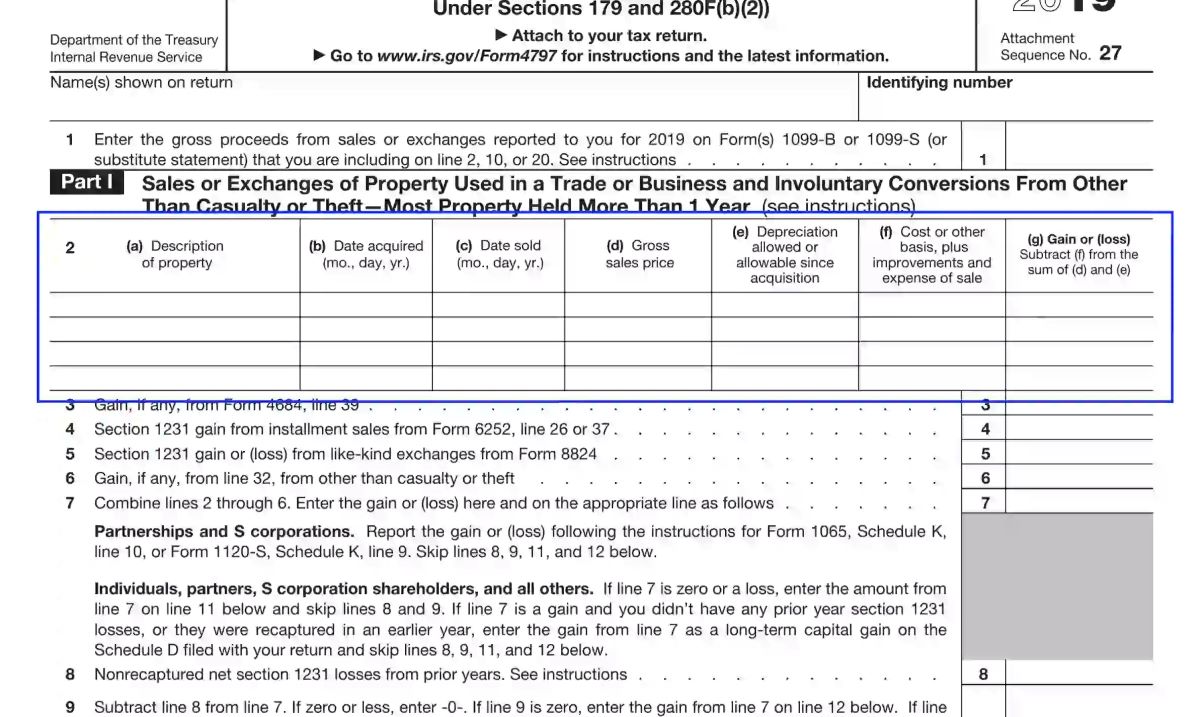

- Specific Tax Matters: In this section, taxpayers must specify the type of tax return and the tax form number for which they are authorizing access. This could be an individual income tax return (Form 1040), a business tax return (such as Form 1120 or Form 1065), or any other applicable tax form.

- Duration of Authorization: The taxpayer needs to specify the duration for which the authorization is valid. This can range from a specific period (e.g., one year) to an indefinite period. It is important to carefully consider the duration required, as it determines how long the designated representative can access the taxpayer’s information.

- Tax Information Access: The taxpayer must indicate the specific tax information that the authorized representative is allowed to access and receive from the IRS. This can include tax returns, account transcripts, tax payment information, and other relevant tax-related documents.

It is important to complete each section accurately and thoroughly to ensure that the authorization is valid and covers the desired scope of access to tax information. Providing incorrect or incomplete information may result in delays or potential issues with the authorization process.

Once all the necessary information has been filled out on Form 8821, the taxpayer must sign and date the form to indicate their consent and authorization. This signature confirms that the taxpayer understands the implications of granting access to their tax information and agrees to the terms of the authorization.

Authorization to Disclose Third-Party Designee

One important feature of IRS Form 8821 is the option to designate a third party to receive tax information from the IRS on behalf of the taxpayer. This designated person or organization is known as the “third-party designee.” The inclusion of this authorization is beneficial for several reasons:

- Convenience: By designating a third-party designee, taxpayers can delegate the responsibility of interacting with the IRS and obtaining their tax information. This can be particularly helpful for individuals or businesses that may not have the time or expertise to handle tax-related matters themselves.

- Representation: Having a designated representative allows taxpayers to have someone experienced in tax matters communicating with the IRS on their behalf. The third-party designee can act as a point of contact, gather necessary information, and potentially resolve any issues or discrepancies.

- Expertise: In many cases, the designated third-party designee is a tax professional, such as an accountant or attorney, who possesses specialized knowledge in tax matters. Their expertise can prove invaluable in navigating complex tax laws, regulations, and procedures.

When completing Form 8821, taxpayers have the option to authorize the IRS to disclose their tax information to the third-party designee. This authorization allows the designated person or organization to receive confidential tax information directly from the IRS, providing them with the necessary access to fulfill their role effectively.

It’s important to note that the authorization to disclose tax information to a third-party designee is voluntary and can be revoked or modified by the taxpayer at any time. The IRS takes privacy seriously and only shares information with authorized individuals or organizations as specified in Form 8821.

By including this authorization in Form 8821, taxpayers can ensure that their designated representative has the necessary access to their tax information, streamlining the communication process with the IRS and facilitating the resolution of tax-related matters.

Duration of the Authorization

When completing IRS Form 8821, taxpayers must indicate the duration for which the authorization to disclose tax information is valid. This timeframe determines how long the designated third-party designee has access to the taxpayer’s confidential tax information. It is crucial to carefully consider the appropriate duration based on individual circumstances.

The duration options available on Form 8821 include:

- Specific Period: Taxpayers can choose to specify a specific period for which the authorization is valid. This may be useful in situations where the designated third-party designee is needed temporarily, such as during the tax filing season or for a specific tax-related issue.

- Indefinite Period: Taxpayers also have the option to grant an indefinite authorization, allowing the designated third-party designee ongoing access to their tax information. This may be beneficial for individuals or businesses that require long-term representation or assistance with their tax matters.

It’s important to note that even if taxpayers choose to grant an indefinite authorization, they can still revoke or modify the authorization at any time by submitting a new Form 8821 to the IRS. This flexibility ensures that taxpayers retain control over who has access to their tax information and for how long.

When determining the duration of the authorization, taxpayers should consider their specific needs and circumstances. Factors such as the complexity of tax matters, ongoing tax obligations, and the level of engagement required with the IRS can play a role in determining the appropriate timeframe for granting access to their confidential tax information.

It is crucial to review and update the authorization periodically to ensure that it aligns with the taxpayer’s current needs and preferences. This allows for adjustments to be made as circumstances change, ensuring that the designated third-party designee continues to have the necessary access to effectively represent the taxpayer in tax-related matters.

By carefully considering the duration of the authorization and making any necessary adjustments as needed, taxpayers can maintain control over their tax information and ensure that the designated representative has the appropriate access for the required period.

Revoking or Modifying the Authorization

Once taxpayers have granted authorization to a designated third-party designee through IRS Form 8821, they have the ability to revoke or modify the authorization at any time. This flexibility ensures that taxpayers retain control over who has access to their tax information and can make changes as their circumstances evolve.

To revoke or modify the authorization, taxpayers can take the following steps:

- Submit a new Form 8821: The most straightforward way to revoke or modify the authorization is by submitting a new Form 8821 with updated information. By completing a new form, taxpayers can either revoke the existing authorization entirely or make specific modifications such as changing the designated third-party designee or adjusting the duration of the authorization.

- Contact the IRS: Alternatively, taxpayers can contact the IRS directly to revoke or modify the authorization. By speaking with an IRS representative, individuals can provide the necessary details and instructions to revoke or modify the authorization to their desired specifications.

Regardless of the method chosen, it is important to ensure that any changes to the authorization are communicated clearly and accurately to avoid any confusion or potential issues. Promptly notifying the IRS or submitting a new Form 8821 with updated information will help ensure that the revocation or modification is processed correctly.

Revoking or modifying the authorization does not retroactively affect any actions taken or information shared before the revocation or modification. It only applies to future interactions and access to tax information by the designated third-party designee. Therefore, it is important to consider the implications of revoking or modifying the authorization and communicate any changes to the relevant parties involved.

By understanding the process of revoking or modifying the authorization and taking the necessary steps to communicate changes to the IRS or by submitting a new Form 8821, taxpayers can maintain control over their tax information and update the authorization to align with their current preferences and needs.

Submitting Form 8821

Submitting IRS Form 8821 is a relatively simple process that taxpayers can complete to authorize the disclosure of their tax information to a designated third-party designee. To ensure a smooth and accurate submission, consider the following steps:

- Download the Form: Begin by downloading Form 8821 from the official IRS website or obtain a physical copy from an IRS office. Ensure that you have access to the most current version of the form to avoid any potential errors or outdated information.

- Complete the Form: Fill out the necessary information on the form accurately and thoroughly. Provide your personal details, including your name, address, social security number (or employer identification number for businesses), and daytime telephone number. Additionally, include the details of the designated third-party designee, such as their name, address, and phone number. Specify the type of tax return and the tax form number for which the authorization pertains.

- Specify the Duration: Indicate the duration for which the authorization is valid, whether it be for a specific period or an indefinite period. Carefully consider your needs and the scope of access required by the designated third-party designee to determine the appropriate duration.

- Sign and Date: Ensure that you sign and date the form to indicate your consent and authorization. Verify that all the information provided is accurate and complete before signing the form.

- Retain a Copy: Make a copy of the completed and signed Form 8821 for your records. This will serve as a reference and proof of the authorization granted.

- Submit the Form: Submit the completed Form 8821 to the IRS. The submission can be done through mail, fax, or electronically (if electronic submission options are available). Refer to the instructions provided on the form or consult the IRS website for the appropriate submission method and address/fax number to use.

After submitting Form 8821, allow sufficient time for the IRS to process the authorization. It is advisable to follow up on the submission after a reasonable period to confirm that the authorization has been received and processed.

Remember that the authorization remains in effect until it is revoked or modified, as specified in the form. If any changes need to be made to the authorization, promptly submit an updated Form 8821 to the IRS or contact them directly.

By following these steps and completing the submission process accurately, taxpayers can authorize the disclosure of their tax information to designated third-party designees, enabling them to effectively act on their behalf in tax-related matters.

Conclusion

IRS Form 8821, or the Tax Information Authorization, plays a vital role in granting individuals or organizations the authority to access and receive confidential tax information from the Internal Revenue Service (IRS). By completing Form 8821, taxpayers can authorize designated third-party designees to communicate with the IRS, gather necessary information, and represent them in various tax-related matters.

The primary purpose of Form 8821 is to maintain a transparent and secure tax system by ensuring that confidential tax information is shared only with authorized parties. It allows taxpayers to seek professional tax advice, delegate tax responsibilities, and resolve tax issues effectively.

When completing Form 8821, taxpayers need to provide essential information, such as their personal details, the details of the designated representative, and the specific tax matters for which access is authorized. The duration of the authorization should be carefully considered, with options ranging from specific periods to indefinite periods.

It is important to note that taxpayers have the flexibility to revoke or modify the authorization at any time. By submitting a new Form 8821 or contacting the IRS directly, individuals can make changes to the authorization as their needs and circumstances evolve.

To submit Form 8821, taxpayers should download the form, complete it accurately, sign and date it, and submit it to the IRS through the appropriate channel, whether by mail, fax, or electronic submission if available. Retaining a copy of the form is recommended for personal records.

In conclusion, IRS Form 8821 is a valuable tool that grants authorized individuals or organizations access to confidential tax information. It ensures a transparent and controlled flow of information while enabling taxpayers to seek help, delegate responsibilities, and resolve tax-related matters effectively. By understanding the purpose, requirements, and process of Form 8821, taxpayers can maintain control over their tax information and engage in efficient and secure interactions with the IRS.