Finance

What Is IRS Form 2553 Used For?

Published: November 1, 2023

Learn how to use IRS Form 2553 for your finance needs and discover its benefits for your business's tax purposes.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is IRS Form 2553?

- Eligibility Criteria for IRS Form 2553

- Benefits of Filing IRS Form 2553

- How to File IRS Form 2553

- Common Mistakes to Avoid When Filing IRS Form 2553

- Important Deadlines for Filing IRS Form 2553

- Consequences of Not Filing IRS Form 2553

- Frequently Asked Questions (FAQs)

- Conclusion

Introduction

Welcome to our comprehensive guide on IRS Form 2553! Whether you’re a small business owner or an aspiring entrepreneur, understanding the ins and outs of tax forms is crucial for your financial success. IRS Form 2553, also known as the “Election by a Small Business Corporation,” is a critical document that allows certain businesses to be treated as S corporations for federal tax purposes.

By filing IRS Form 2553, eligible businesses can enjoy several advantages, including potential tax savings and the ability to avoid double taxation. However, navigating the complexities of this form can be daunting for many. In this article, we will break down IRS Form 2553 in plain language, providing you with a comprehensive understanding of its purpose, eligibility criteria, benefits, filing process, common mistakes to avoid, important deadlines, and the consequences of not filing.

Whether you’re a sole proprietor looking to switch to an S corporation, a partnership seeking tax advantages, or a limited liability company considering a change in tax status, IRS Form 2553 is a vital tool to consider. By electing S corporation status, your business can potentially access a more favorable tax treatment, allowing you to maximize profits and achieve long-term financial stability.

Throughout this guide, we’ll provide you with the necessary information and guidance to navigate the world of IRS Form 2553 with ease. So, without further ado, let’s dive into the details of this important tax document and unlock the benefits it can offer to your business.

What is IRS Form 2553?

IRS Form 2553, also known as the “Election by a Small Business Corporation,” is a tax form that enables eligible businesses to elect S corporation status for federal tax purposes. The S corporation is a unique tax structure that combines the limited liability of a corporation with the pass-through taxation of a partnership or sole proprietorship.

By electing S corporation status using IRS Form 2553, a business can avoid double taxation. Unlike a traditional C corporation where profits are subject to corporate taxes and dividends are subject to personal taxes, an S corporation’s income passes through to the shareholders’ individual tax returns.

Choosing S corporation status can have several advantages for small businesses. Firstly, it allows business owners to avoid paying Social Security and Medicare taxes on their profits. Instead, they only pay these taxes on their wages or salary. This can result in significant tax savings for business owners.

Additionally, a business electing S corporation status can potentially deduct certain expenses, such as health insurance premiums and self-employment taxes, directly on the individual tax returns of shareholders. This can lead to further tax savings for those involved in the business.

It’s important to note that not all businesses are eligible to file IRS Form 2553 and obtain S corporation status. There are specific criteria that must be met in order to qualify for this tax election.

In the next section, we will discuss the eligibility criteria for IRS Form 2553 and who can benefit from electing S corporation status for their business.

Eligibility Criteria for IRS Form 2553

In order to qualify for S corporation status using IRS Form 2553, a business must meet certain eligibility criteria set by the Internal Revenue Service (IRS). It’s essential to understand these requirements to determine if your business is eligible to file this tax form.

1. Business Structure: Only certain business entities can elect S corporation status. These include domestic corporations, limited liability companies (LLCs) with a single-member or multiple members, and eligible partnerships. Sole proprietorships, partnerships with non-qualifying partners, and certain types of corporations cannot elect S corporation status.

2. Shareholder Limitation: To qualify for S corporation status, a business must have no more than 100 shareholders. Spouses and certain family members can be treated as a single shareholder for this purpose. Additionally, all shareholders must be eligible individuals or qualifying trusts.

3. Shareholder Eligibility: In order to be eligible to be a shareholder of an S corporation, an individual must be a U.S. citizen, U.S. resident alien, or certain types of trusts and estates. Nonresident aliens, corporations, and partnerships are generally not allowed to be shareholders of an S corporation.

4. One Class of Stock: An S corporation can only have one class of stock, meaning that all outstanding shares have the same rights and privileges. Different classes of stock with varying rights, such as preferred stock, may disqualify the business from obtaining S corporation status.

5. Timely Filing: To elect S corporation status, the business must file IRS Form 2553 within the first two months and 15 days of the tax year the election is to take effect. In some cases, the IRS may allow a late election if certain conditions are met, but it’s crucial to file in a timely manner to avoid potential penalties.

It’s important to consult with a tax professional or attorney who specializes in small business taxation to ensure that you meet all the eligibility requirements and properly file IRS Form 2553.

In the next section, we will explore the benefits of electing S corporation status using IRS Form 2553 and how it can impact your business’s tax liability.

Benefits of Filing IRS Form 2553

Filing IRS Form 2553 and electing S corporation status can offer several significant advantages for your business. Let’s delve into the key benefits that come with choosing this tax election.

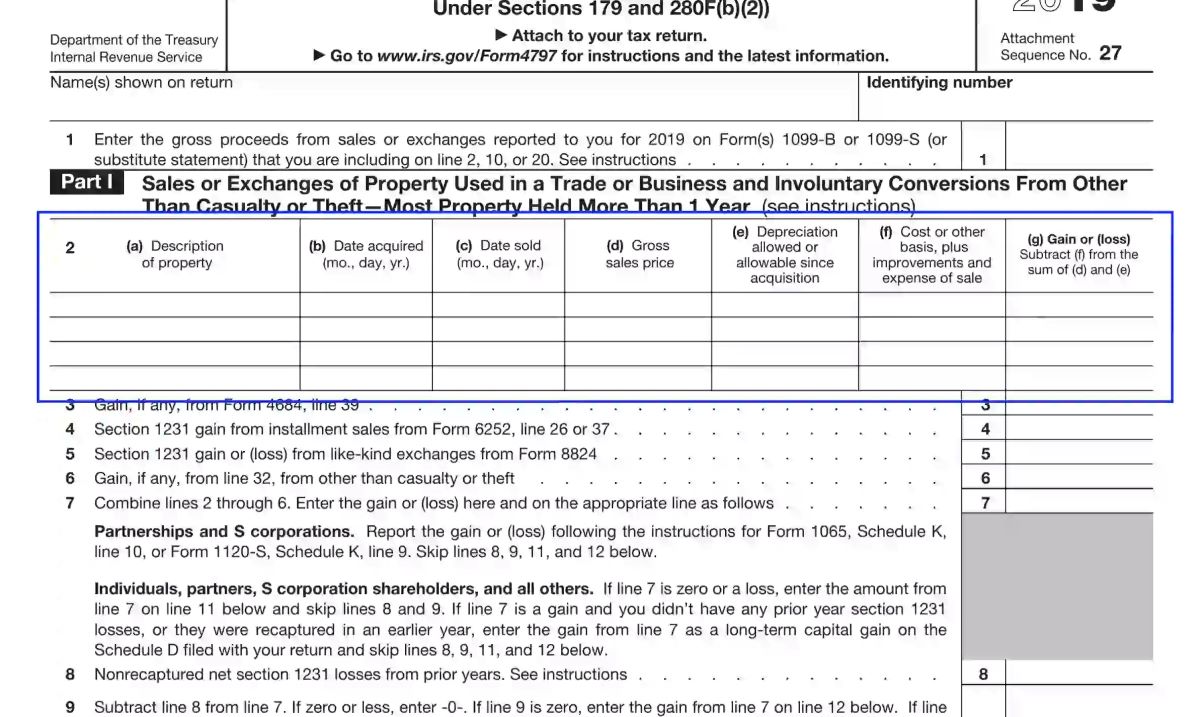

- Tax Savings: One of the primary benefits of obtaining S corporation status is the potential for tax savings. Unlike a traditional C corporation, an S corporation’s profits and losses are passed through to the shareholders’ individual tax returns. This means that the business itself does not pay federal income taxes at the corporate level. Instead, shareholders report their share of the income and losses on their personal tax returns, potentially resulting in lower overall tax liability.

- Pass-Through Taxation: As mentioned earlier, S corporations enjoy pass-through taxation, which eliminates the issue of double taxation faced by C corporations. Pass-through taxation allows business owners to avoid the corporate tax on profits and instead pay taxes at the individual level. This can be particularly beneficial for businesses with significant earnings.

- Avoidance of Self-Employment Taxes: Self-employment taxes, which include Social Security and Medicare taxes, can be a significant expense for self-employed individuals. By electing S corporation status, business owners can potentially reduce their self-employment tax burden. While shareholders must still pay Social Security and Medicare taxes on any wages or salaries received, they are not subject to these taxes on their share of the business’s profits.

- Ability to Deduct Certain Expenses: S corporations have the flexibility to deduct certain business expenses directly on the shareholders’ individual tax returns. This includes deductions for health insurance premiums, self-employment taxes, and contributions to retirement plans. By deducting these expenses, shareholders can reduce their taxable income and potentially lower their overall tax liability.

- Increased Credibility: In some cases, having the S corporation designation can enhance your business’s credibility with clients, suppliers, and potential investors. Being recognized as an S corporation can signal that your business is structured legally and meets specific tax requirements, which may give stakeholders more confidence in your operation.

It’s important to note that the tax benefits and advantages of electing S corporation status can vary depending on your specific circumstances. Consulting with a tax professional is crucial in evaluating the potential tax savings and determining if electing S corporation status is the right choice for your business.

Next, we will guide you through the process of filing IRS Form 2553 to elect S corporation status for your business.

How to File IRS Form 2553

Filing IRS Form 2553 to elect S corporation status for your business involves several steps. It’s important to follow these steps carefully to ensure that your form is completed accurately and submitted on time. Let’s walk through the process:

- Eligibility Confirmation: Before proceeding with the filing process, ensure that your business meets all the eligibility criteria outlined by the IRS. Verify that your business structure, number of shareholders, shareholder eligibility, and stock class all align with the requirements for S corporation status.

- Election Timing: Determine the tax year in which you wish to elect S corporation status. Remember that IRS Form 2553 must be filed within the first two months and 15 days of that tax year to be considered timely.

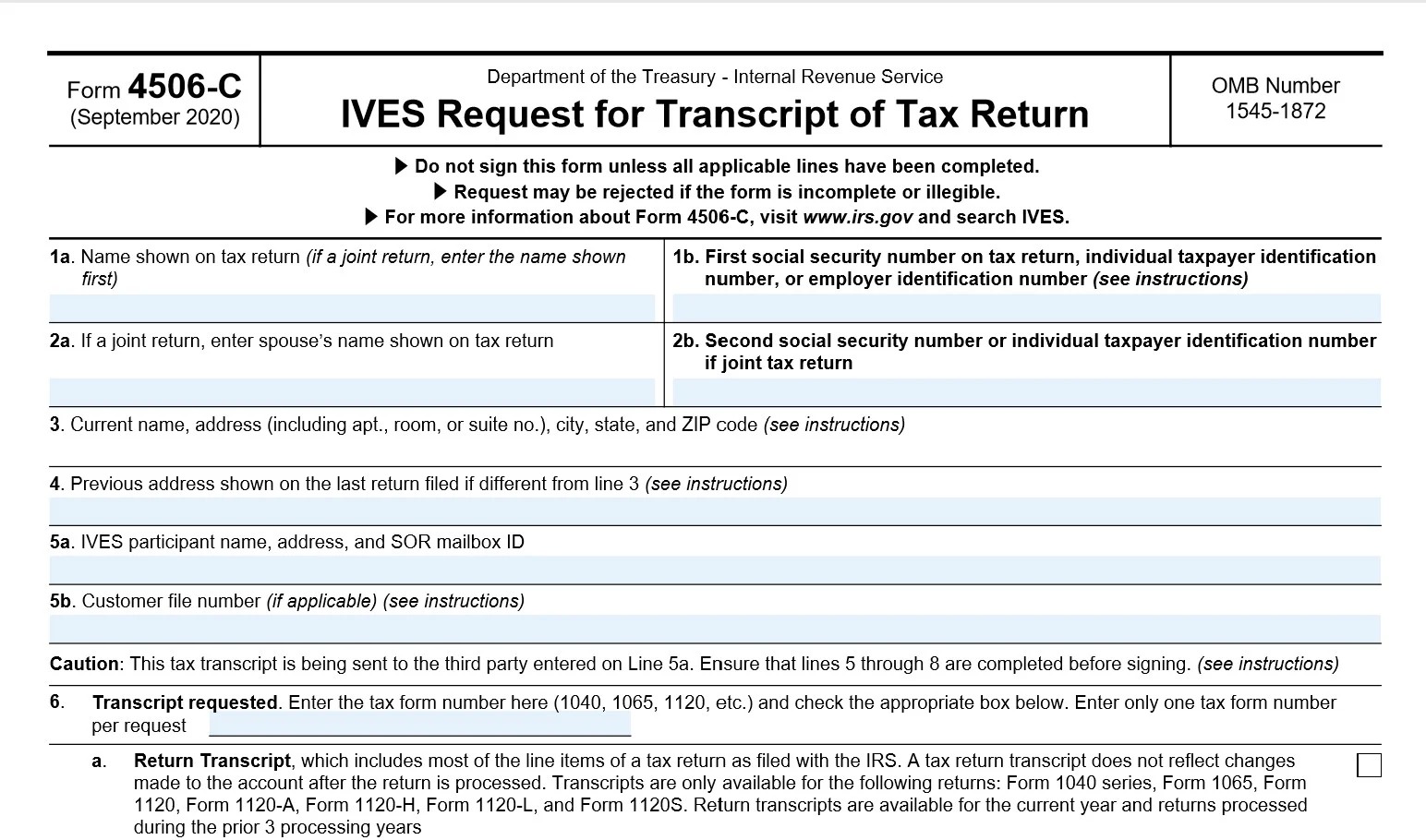

- Gather Required Information: Collect all the necessary information and supporting documents for the filing. This includes details about your business, such as the legal name, address, Employer Identification Number (EIN), and the names, addresses, and Social Security numbers of all shareholders.

- Complete IRS Form 2553: Download and fill out IRS Form 2553. Provide accurate information about your business and the election details. Make sure to double-check all entries for errors or omissions.

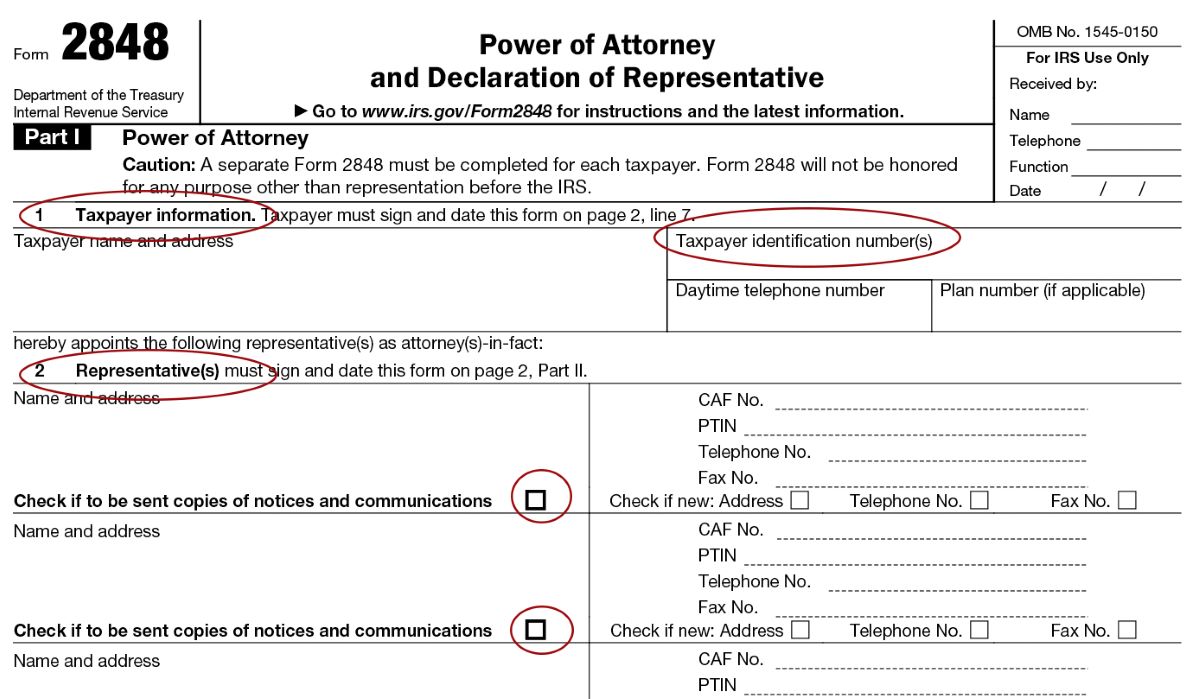

- Obtain Shareholder Approvals: If required by your state regulations or bylaws, obtain written consent or approval from the shareholders to elect S corporation status. Keep these approvals on record for future reference.

- File the Form: Submit IRS Form 2553 to the IRS. Depending on your business structure, you may need to send the form to different locations. Pay attention to the specific instructions provided in the form’s guidelines.

- Keep a Copy: Make sure to keep a copy of the filed IRS Form 2553 for your records. This will serve as documentation of your election and may be needed for future reference or audits.

While filing IRS Form 2553 may seem like a straightforward process, it’s recommended to consult with a tax professional or attorney who specializes in small business taxation. They can provide guidance, ensure accuracy, and address any specific concerns related to your business’s unique circumstances.

Next, let’s explore some common mistakes to avoid when filing IRS Form 2553.

Common Mistakes to Avoid When Filing IRS Form 2553

When filing IRS Form 2553 to elect S corporation status for your business, it’s crucial to avoid certain common mistakes that could lead to delays, penalties, or even the rejection of your application. Let’s take a look at some of the key mistakes to avoid:

- Missing the Filing Deadline: Failing to file IRS Form 2553 within the specified timeframe can result in the rejection of your application. Remember, the form must be submitted within the first two months and 15 days of the tax year in which you wish to elect S corporation status. Make a note of the deadline and ensure timely filing.

- Incomplete or Inaccurate Information: Providing incomplete or inaccurate information on IRS Form 2553 can lead to processing delays or rejection. Double-check all entries, including the business information, shareholder details, and election specifications, to ensure accuracy.

- Failure to Obtain Shareholder Approvals: If required by your state or bylaws, obtaining written consent or approval from the shareholders is essential. Neglecting to do so can result in the invalidation of your election. Keep a record of these approvals for future reference.

- Incorrectly Classifying Shareholders: It’s crucial to correctly classify shareholders as eligible individuals or qualifying trusts. Non-qualifying shareholders, such as nonresident aliens, corporations, or partnerships, could disqualify your business from obtaining S corporation status.

- Ignoring State Requirements: While IRS Form 2553 is a federal tax form, it’s important to adhere to any additional state requirements for electing S corporation status. Some states may have separate forms or procedures that need to be followed.

- Not Retaining Proper Documentation: It’s essential to keep a copy of the filed IRS Form 2553, shareholder approvals, and any other relevant documentation. This documentation acts as proof of your election and can be valuable in the event of an audit or inquiries from the IRS.

- Failure to Seek Professional Guidance: Filing IRS Form 2553 can be complex, and making mistakes can have serious consequences. Consulting with a tax professional or attorney who specializes in small business taxation can help ensure that you navigate the process correctly and avoid costly errors.

By being vigilant and avoiding these common mistakes, you can improve the chances of a successful filing and obtain S corporation status for your business without unnecessary complications.

Next, let’s explore the important deadlines associated with IRS Form 2553.

Important Deadlines for Filing IRS Form 2553

When it comes to filing IRS Form 2553 to elect S corporation status for your business, there are several important deadlines that you need to be aware of. Missing these deadlines can result in penalties or the rejection of your application. Let’s delve into the key timelines you should keep in mind:

- Tax Year Start: The tax year you intend to elect S corporation status will determine the timing of your filing. Ensure that you are mindful of the start of the tax year for which you want the election to be effective.

- Two Months and 15 Days: IRS Form 2553 must be filed within the first two months and 15 days of the tax year in which you wish to elect S corporation status. This deadline is crucial and failing to file within this timeframe can result in the rejection of your application.

- Late Elections: In some cases, the IRS may allow a late election if certain conditions are met. However, it’s important to note that there is a specific process for obtaining late S corporation election relief. If you miss the deadline, consult with a tax professional to determine if you qualify for a late election and to navigate the necessary steps.

- Transition Period: Once IRS Form 2553 is filed and approved, there is a transition period during which your business becomes an S corporation. During this period, it’s important to ensure that you are following the appropriate tax rules and guidelines for S corporations.

Meeting these deadlines is crucial to ensure that your election for S corporation status is valid and effective for the desired tax year. It’s always advisable to consult with a tax professional or attorney to ensure that you understand and comply with the specific deadlines associated with IRS Form 2553.

In the next section, we will explore the potential consequences of not filing IRS Form 2553 for your business.

Consequences of Not Filing IRS Form 2553

Choosing not to file IRS Form 2553 and failing to elect S corporation status for your business can have significant consequences. Let’s explore some of the potential implications of not filing this tax form:

- Double Taxation: By not electing S corporation status, your business will be classified as a default C corporation for tax purposes. C corporations are subject to double taxation, meaning the corporation itself is taxed on its profits, and shareholders are taxed again on any dividends received. This can result in higher overall tax liability for the business and its shareholders.

- Limited Tax Advantages: S corporation status offers various tax advantages, such as pass-through taxation, the ability to deduct certain expenses, and potential savings on self-employment taxes. By not electing S corporation status, your business and its owners will miss out on these tax benefits, potentially reducing the overall profitability of the business.

- Restrictions on Stock Classes: Choosing not to elect S corporation status means that your business will not be restricted to a single class of stock. While this may initially appear advantageous, it can lead to complications in the future, such as the issuance of different classes of stock with varying rights and privileges.

- Missed Opportunities for Tax Planning: S corporations offer greater flexibility for tax planning and optimizing your business’s tax strategy. By not electing S corporation status, you may miss out on opportunities to structure your business in a way that minimizes tax liability and maximizes tax savings.

- Reduced Credibility and Perception: In some instances, businesses that have elected S corporation status may be perceived as having better credibility, especially with clients, suppliers, and potential investors. Failing to file IRS Form 2553 and obtain S corporation status could potentially impact the perceived legitimacy and professionalism of your business.

It’s crucial to carefully consider the potential long-term implications of not electing S corporation status for your business. Consulting with a tax professional or attorney who specializes in small business taxation can provide valuable insights into how choosing S corporation status can positively impact your business’s financial health and tax liability.

In our next section, we will address some frequently asked questions (FAQs) related to IRS Form 2553 and S corporation status.

Frequently Asked Questions (FAQs)

Here are some commonly asked questions about IRS Form 2553 and S corporation status:

- 1. Who is eligible to file IRS Form 2553?

- 2. Can an existing business convert to S corporation status?

- 3. When should I file IRS Form 2553?

- 4. What are the advantages of electing S corporation status?

- 5. Are there any downsides to electing S corporation status?

- 6. Can I revoke S corporation status once it’s elected?

- 7. What happens if I fail to file IRS Form 2553?

Eligible businesses include domestic corporations, limited liability companies (LLCs), and certain partnerships. They must meet specific criteria, such as having no more than 100 shareholders and only one class of stock.

Yes, an existing business can elect S corporation status by filing IRS Form 2553. However, it’s important to carefully consider the potential tax implications and consult with a tax professional to ensure a smooth transition.

The form must be filed within the first two months and 15 days of the tax year in which you wish to elect S corporation status. Filing on time is crucial to ensure the validity of your election.

Some advantages include potential tax savings, pass-through taxation, avoidance of self-employment taxes on profits, the ability to deduct certain business expenses, and increased credibility with clients, suppliers, and investors.

While S corporation status offers numerous benefits, there are also limitations, such as restrictions on the number and type of shareholders, as well as the requirement for a single class of stock. Additionally, not all businesses may meet the eligibility criteria for S corporation status.

Yes, it is possible to revoke S corporation status, but the process may be complex and may have tax implications. It’s advisable to consult with a tax professional before initiating any changes to your business’s tax status.

If you fail to file IRS Form 2553, your business will default to C corporation status, resulting in potential double taxation and the loss of tax advantages associated with S corporation status.

It’s important to note that while these FAQs address general concerns, individual circumstances may vary. It’s always recommended to consult with a tax professional or attorney to ensure compliance with the IRS guidelines and make the best decisions for your specific business needs.

Next, we will conclude our guide on IRS Form 2553 and S corporation status.

Conclusion

Understanding IRS Form 2553 and the benefits of electing S corporation status is crucial for small businesses and aspiring entrepreneurs. By filing this tax form, eligible businesses can enjoy advantages such as potential tax savings, pass-through taxation, and the ability to deduct certain expenses.

Throughout this guide, we’ve covered the important aspects of IRS Form 2553, including its purpose, eligibility criteria, benefits, filing process, common mistakes to avoid, important deadlines, and the consequences of not filing. We’ve also addressed frequently asked questions to provide you with a comprehensive understanding of this significant tax form.

When considering whether to elect S corporation status, it’s important to evaluate your business’s specific circumstances and consult with a tax professional or attorney. They can offer tailored advice and ensure that you meet all the necessary requirements.

Remember, filing IRS Form 2553 within the specified timeframe is crucial for a successful election. By doing so, you can unlock the potential tax advantages and financial benefits that come with S corporation status.

We hope this guide has provided you with valuable insights and guidance on IRS Form 2553 and electing S corporation status for your business. Make sure to stay informed, seek professional assistance when needed, and stay proactive in managing your business’s tax obligations.

Good luck on your journey towards financial success!