Finance

How Does Blockchain Support Data Privacy?

Published: October 23, 2023

Discover how blockchain technology provides a secure framework for data privacy, specifically in the financial sector. Explore the benefits and features of blockchain for finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Blockchain Technology

- Data Privacy Concerns

- How Blockchain Supports Data Privacy

- Transparency and Security of Blockchain

- Immutability and Accountability

- Decentralization and Peer-to-Peer Networks

- Consensus Mechanisms and Data Privacy

- Smart Contracts and Privacy-Enhancing Techniques

- Potential Challenges and Limitations

- Conclusion

Introduction

In today’s digital age, data privacy has become a paramount concern. With the increasing digitization of personal, financial, and sensitive information, there is a pressing need to ensure that this data is protected and secure. This is especially true in the finance sector, where individuals and organizations handle large amounts of sensitive financial data.

Blockchain technology, initially popularized through cryptocurrencies such as Bitcoin, has emerged as a potential solution to address data privacy concerns. The decentralized and transparent nature of blockchain has garnered significant attention from industries seeking secure and efficient ways to store and transfer data.

By its very design, blockchain technology offers unique features that can support and enhance data privacy. In this article, we will explore how blockchain protects data privacy and why it is increasingly being adopted in the finance sector.

We will delve into the underlying principles of blockchain technology, its implications for data privacy concerns, and the various mechanisms it employs to ensure security and transparency. Additionally, we will discuss the potential limitations and challenges that may arise when implementing blockchain for data privacy.

Understanding the fundamentals of blockchain technology is essential to grasp how it can support data privacy. Let’s dive deeper into the workings of blockchain before exploring its specific applications in safeguarding sensitive financial data.

Understanding Blockchain Technology

Blockchain is a distributed ledger technology that allows for transparent and secure transactions. It operates as a decentralized database where multiple participants, known as nodes, maintain a copy of the entire blockchain network. Each transaction is recorded in a block and linked to the previous block, forming a chain of blocks, hence the name blockchain.

One of the fundamental principles of blockchain is decentralization. Unlike traditional centralized systems where a central authority controls and validates transactions, blockchain removes the need for a central intermediary. Each participant in the network has a complete and identical copy of the blockchain, ensuring transparency and reducing the risk of tampering or fraud.

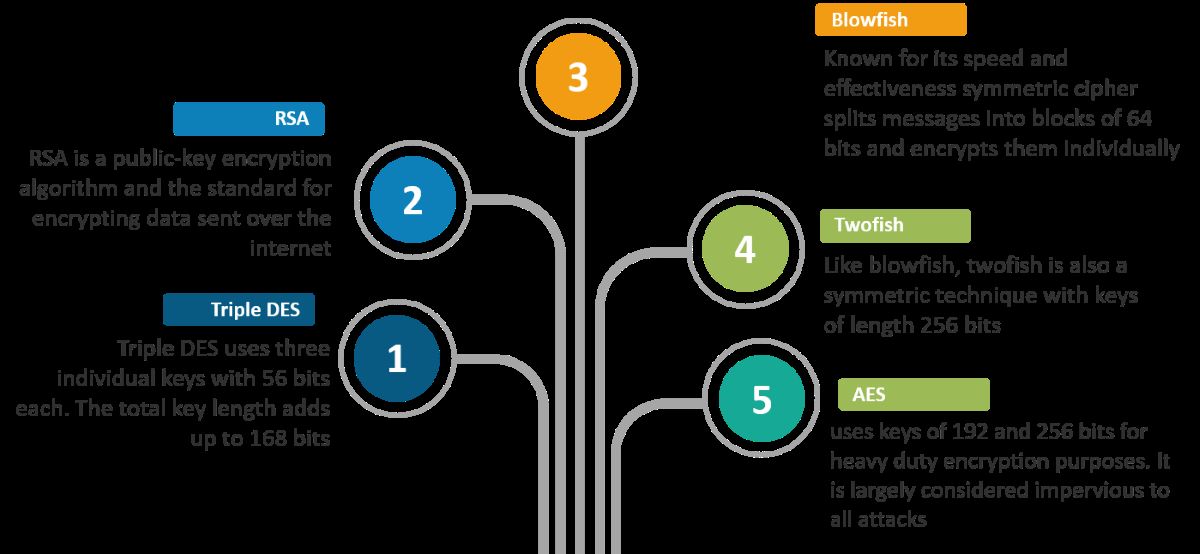

The security of blockchain is reinforced by cryptographic algorithms. Each transaction within a block is cryptographically hashed, creating a unique identifier for that specific block. This hash is then included in the subsequent block, forming a chain of interconnected blocks that cannot be altered without detection.

Furthermore, blockchain employs consensus mechanisms to validate and agree upon the accuracy of transactions. Common consensus mechanisms include Proof of Work and Proof of Stake, which require participants to perform computational or stake-related activities to confirm the validity of transactions. This consensus ensures the integrity and immutability of data within the blockchain.

Overall, blockchain technology offers a transparent and secure way to record and verify transactions. It eliminates the need for intermediaries, reduces the risk of fraud, and provides a tamper-proof and auditable record of all transactions within the network.

Now that we have a basic understanding of blockchain technology, we can explore how it addresses the data privacy concerns prevalent in the finance sector.

Data Privacy Concerns

The finance sector deals with a plethora of sensitive information, including personal financial data, credit card details, and transaction histories. As a result, data privacy is of utmost importance to safeguard against identity theft, fraud, and unauthorized access to financial information.

Traditional centralized databases pose several data privacy concerns. These include:

- Single Point of Failure: Centralized databases are vulnerable to security breaches and hacking attempts. If a centralized database is compromised, it can expose sensitive information of all users.

- Lack of Transparency: Users have limited visibility into how their data is being handled by centralized systems. It can be challenging to ensure that data is used and protected in accordance with privacy regulations.

- Dependence on Third Parties: Centralized systems often require users to trust third-party intermediaries to manage and secure their data. This reliance introduces potential risks, such as data breaches or misuse of information.

These challenges have led to a growing demand for technologies that address data privacy concerns effectively. Blockchain technology has emerged as a potential solution to these issues by providing enhanced security, transparency, and control over personal data.

In the next section, we will explore how blockchain supports data privacy, along with the specific mechanisms and features it offers to protect sensitive financial information.

How Blockchain Supports Data Privacy

Blockchain technology offers several key features that support data privacy in the finance sector. Let’s explore how blockchain addresses data privacy concerns:

- Transparency and Security: Blockchain provides a transparent and secure infrastructure for storing and transferring data. All transactions on the blockchain are recorded in a transparent manner and are visible to all participants in the network. This transparency ensures accountability and reduces the risk of unauthorized modifications or tampering.

- Immutability and Accountability: Once a transaction is recorded on the blockchain, it becomes virtually immutable. This means that it cannot be altered without the consensus of the network participants. This immutability provides a strong level of accountability and ensures that data cannot be manipulated or fraudulently modified.

- Decentralization and Peer-to-Peer Networks: Blockchain operates on a decentralized network of computers, with no central authority controlling the data. This peer-to-peer network ensures that there is no single point of failure or vulnerability. Data is distributed across multiple nodes, making it highly resilient to hacking attempts and reducing the risk of data breaches.

In addition to these fundamental features, blockchain also utilizes various consensus mechanisms and privacy-enhancing techniques to protect sensitive financial data:

- Consensus Mechanisms and Data Privacy: Consensus mechanisms, such as Proof of Work (PoW) or Proof of Stake (PoS), ensure the validation and integrity of transactions on the blockchain. These mechanisms protect against fraudulent transactions and establish trust in the network without compromising the privacy of individual participants.

- Smart Contracts and Privacy-Enhancing Techniques: Smart contracts are self-executing contracts stored on the blockchain that automatically enforce the terms and conditions of an agreement. They can be programmed to include privacy-enhancing techniques, such as zero-knowledge proofs or selective disclosure, which allow parties to share specific information while keeping other data private.

By leveraging these features and techniques, blockchain technology provides a robust framework for safeguarding data privacy in the finance sector. It empowers individuals to have more control over their personal information while ensuring transparency, security, and accountability.

However, it is essential to acknowledge that blockchain is not a one-size-fits-all solution, and there are potential challenges and limitations to consider when implementing blockchain for data privacy, which we will explore in the next section.

Transparency and Security of Blockchain

One of the key advantages of blockchain technology in supporting data privacy is its transparency and security. Blockchain offers a transparent and secure infrastructure for storing and transferring data, providing individuals and organizations with increased visibility and control over their information.

Transparency is a fundamental characteristic of blockchain. All transactions recorded on the blockchain are visible to all participants in the network. This transparency ensures accountability by allowing anyone to verify and audit the transaction history. Each participant has access to the entire blockchain, which is maintained and updated simultaneously across all nodes in the network.

Blockchain’s transparency helps address concerns related to data integrity. Every transaction is time-stamped and cryptographically linked to previous transactions, forming an unchangeable chain of blocks. This means that once a transaction is recorded on the blockchain, it becomes virtually immutable. Any attempts to modify or tamper with data would require consensus from the majority of network participants, making it extremely difficult for malicious actors to alter or manipulate transactions without detection.

Furthermore, the decentralized nature of blockchain enhances its security. Unlike traditional centralized databases that store data in a single location, blockchain data is distributed across multiple nodes in a network. This decentralized architecture makes it highly resistant to hacking attempts and provides added security against data breaches. The compromise of one node does not compromise the entire system, as the majority of nodes in the network must agree on the validity of a transaction before it can be added to the blockchain.

Encryption is another crucial aspect of blockchain security. Transactions and data stored on the blockchain are encrypted using complex cryptographic algorithms. This encryption plays a significant role in protecting sensitive financial information from unauthorized access or tampering.

Overall, the transparency and security of blockchain technology provide individuals and organizations with increased confidence in the integrity and privacy of their data. The distributed nature of the blockchain ensures that data is not controlled by a central authority, reducing the risk of data manipulation or unauthorized access. The transparent and secure framework of blockchain helps instill trust in the finance sector, allowing for more secure and efficient transactions while protecting sensitive financial information.

While transparency and security are key strengths of blockchain, it is essential to consider potential challenges and limitations when implementing this technology for data privacy, which we will explore in the following sections.

Immutability and Accountability

Immutability and accountability are fundamental aspects of blockchain technology that contribute to its effectiveness in supporting data privacy. The immutability of blockchain, coupled with its decentralized nature, ensures the integrity and accountability of data recorded on the blockchain.

Once a transaction is recorded on the blockchain, it becomes virtually immutable. This means that it cannot be altered or modified without the consensus of the network participants. Each block in the blockchain contains a unique identifier, or hash, which is derived from the previous block’s hash. Any changes to the data within a block would result in a different hash value, thus disrupting the chain of blocks. This cryptographic linkage ensures the integrity and tamper-proof nature of the data stored on the blockchain.

The immutability of blockchain provides a valuable layer of accountability. Every transaction recorded on the blockchain is associated with a specific digital signature, indicating the identity of the sender or participant involved. This traceability makes it easier to track and attribute actions to specific individuals or entities. In the finance sector, this feature can be particularly valuable for audit and regulatory purposes, as it allows for a transparent and auditable record of financial transactions.

Additionally, the decentralized nature of blockchain further strengthens the accountability aspect. In a traditional centralized system, the responsibility for data security and integrity rests with a central authority. However, in a decentralized blockchain network, the responsibility is shared among multiple network participants or nodes. Each participant has a copy of the entire blockchain, verifying the accuracy and consistency of transactions. This distributes the accountability and reduces the risk of data manipulation or unauthorized access by any single party.

The immutability and accountability offered by blockchain technology have transformative implications for data privacy in the finance sector. The transparent and tamper-proof nature of blockchain ensures that financial transactions are accurately recorded and can be traced back to their origin. This provides individuals and organizations with increased confidence in the integrity and authenticity of their financial data, strengthening trust and reducing the potential for fraud or malicious activities.

While immutability and accountability are significant strengths of blockchain, it is important to recognize potential challenges and limitations that may arise when implementing blockchain for data privacy, which we will explore in the next section.

Decentralization and Peer-to-Peer Networks

Decentralization and the use of peer-to-peer networks are core principles of blockchain technology. These principles play a crucial role in supporting data privacy in the finance sector.

Traditional centralized systems rely on a central authority to manage and control data. This centralized approach poses several risks, such as a single point of failure, vulnerability to hacking, and concerns regarding data privacy. In contrast, blockchain operates on a decentralized network of computers, known as nodes, where no single entity or authority has control over the entire system.

The decentralized nature of blockchain provides significant benefits for data privacy. Rather than storing data in a single location owned by a central authority, blockchain distributes data across multiple nodes in the network. Each node on the network contains a complete copy of the blockchain, ensuring redundancy and data availability even if some nodes experience downtime or are compromised.

This decentralization enhances the security and privacy of data stored on the blockchain. As data is distributed across multiple nodes, the risk of a single point of failure or vulnerability is greatly reduced. It becomes extremely difficult for malicious actors to manipulate or alter data without obtaining a majority consensus from the network participants. This distributed nature of blockchain ensures that no single entity has full control over the data, providing individuals and organizations with greater control over their own information.

Furthermore, the use of peer-to-peer networks adds an additional layer of privacy and security. In a peer-to-peer network, participants can directly interact and transact with each other, eliminating the need for intermediaries. This direct interaction reduces the reliance on third-party entities to manage and secure data, reducing the potential risks associated with entrusting sensitive financial information to others.

Decentralization also facilitates trust and transparency within the finance sector. Participants in the blockchain network can verify the integrity of transactions and the accuracy of data without relying on a central authority or intermediary. This transparency promotes accountability and reduces the potential for fraudulent activities or unauthorized access to data.

In summary, the decentralized nature of blockchain and the utilization of peer-to-peer networks provide a strong foundation for data privacy in the finance sector. By removing the reliance on a central authority and enabling direct interactions between participants, blockchain enhances security, privacy, and trust in financial transactions, empowering individuals to have more control over their own data.

However, it is important to acknowledge that implementing decentralization and peer-to-peer networks comes with its own set of challenges and considerations, which we will discuss in the next section.

Consensus Mechanisms and Data Privacy

Consensus mechanisms are an integral part of blockchain technology that ensures the validation and integrity of transactions recorded on the blockchain. These mechanisms play a crucial role in supporting data privacy in the finance sector.

Consensus mechanisms are responsible for collectively agreeing upon the validity of transactions and ensuring that the data stored on the blockchain is consistent across all nodes in the network. Common consensus mechanisms used in blockchain include Proof of Work (PoW) and Proof of Stake (PoS).

In a Proof of Work consensus mechanism, participants, known as miners, compete to solve complex computational puzzles to validate transactions and add them to the blockchain. This process requires substantial computing power and energy consumption. Once a miner successfully solves the puzzle, they are rewarded with cryptocurrency tokens. The decentralized nature of PoW makes it difficult for any one participant to manipulate the process and ensures the integrity of the blockchain data.

Proof of Stake, on the other hand, selects block validators based on the participants’ stake or investment in the network. Instead of relying on computational power, PoS considers the participants’ ownership and holds them accountable for maintaining the integrity of the blockchain. Validators are chosen based on their stake, and their chances of being selected increase with the number of tokens they hold. This consensus mechanism is more energy-efficient and offers better scalability compared to PoW, making it an attractive option for privacy-focused blockchain implementations.

Data privacy is bolstered by consensus mechanisms in several ways:

- Protection Against Fraudulent Transactions: Consensus mechanisms ensure that only valid and authorized transactions are added to the blockchain. This protection against fraudulent or malicious transactions enhances data privacy by preventing unauthorized access or manipulation of financial information.

- Data Integrity and Immutability: By achieving consensus on the validity of transactions, the blockchain establishes a chain of blocks that is resistant to tampering or modification. This immutability ensures the privacy and integrity of sensitive financial data stored on the blockchain.

- Resistance to Sybil Attacks: Consensus mechanisms often require participants to prove their stake or computational power, making it difficult for adversaries to create multiple fake identities (known as Sybil attacks) to manipulate the consensus process and compromise data privacy.

Overall, consensus mechanisms are a vital component of blockchain technology that ensures the validation, integrity, and privacy of data recorded on the blockchain. The decentralized and transparent nature of these mechanisms ensures that data is handled in a secure and accountable manner, fostering trust and confidence in the finance sector.

However, it is essential to consider potential challenges and limitations in implementing consensus mechanisms for data privacy, which we will discuss in the following section.

Smart Contracts and Privacy-Enhancing Techniques

Smart contracts are self-executing contracts with predefined rules stored on the blockchain. These contracts automate the execution of transactions and enforce the terms and conditions agreed upon by the parties involved. Smart contracts, combined with privacy-enhancing techniques, play a significant role in supporting data privacy in the finance sector.

Smart contracts offer several key benefits for data privacy:

- Selective Disclosure: Smart contracts enable selective disclosure of information. Parties can define which data is required to be publicly visible on the blockchain and which data should remain private. This selective disclosure allows individuals and organizations to share specific information while protecting sensitive financial data from public scrutiny.

- Zero-Knowledge Proofs: Zero-knowledge proofs are cryptographic techniques that enable a participant to prove the validity of a statement without revealing the underlying data. This technique allows for the verification of information without disclosing the actual data, thereby preserving privacy. Zero-knowledge proofs can be used in conjunction with smart contracts to ensure privacy during transactions and identity verification processes.

- Off-Chain Data Storage: Smart contracts, when combined with off-chain data storage solutions, provide a way to store large volumes of sensitive data off the blockchain, while still maintaining the verifiability and integrity of transactions. This approach allows for the protection of private financial information by storing it securely off the public blockchain.

Privacy-enhancing techniques complement smart contracts in protecting sensitive financial data:

- Encryption: Encrypting data before storing it on the blockchain provides an added layer of protection. Encryption ensures that even if unauthorized individuals gain access to the data, they cannot decipher or make sense of it without the encryption keys.

- Data Minimization: Adopting a data minimization approach involves only storing necessary and relevant data on the blockchain, while keeping sensitive or personal information off-chain. This technique reduces the risk of exposing sensitive financial information to unauthorized parties.

- Pseudonymization: Pseudonymization involves replacing personally identifiable information (PII) with pseudo-identifiers. This process anonymizes data while still allowing for its linkage to a specific individual or entity, maintaining privacy without sacrificing the ability to audit or trace transactions when necessary.

By leveraging smart contracts and privacy-enhancing techniques, blockchain technology can securely handle sensitive financial data while providing individuals and organizations with increased control over their information. These techniques mitigate the risks of exposing sensitive data to unauthorized parties, ensuring that privacy is protected throughout the transaction process.

However, it is important to note that implementing smart contracts and privacy-enhancing techniques requires careful consideration of legal and regulatory compliance, as well as potential challenges and limitations, which we will explore in the next section.

Potential Challenges and Limitations

While blockchain technology offers promising solutions to data privacy concerns in the finance sector, it is important to acknowledge and address potential challenges and limitations that may arise during implementation.

- Scalability: Blockchain networks currently face scalability limitations, which can impact transaction speeds and the ability to handle large volumes of data. As more participants join the network and the number of transactions increases, scalability becomes a crucial consideration for maintaining optimal performance and ensuring timely processing of transactions.

- Regulatory Compliance: Blockchain implementations need to align with existing legal and regulatory requirements, such as data protection laws. Compliance with regulations such as the General Data Protection Regulation (GDPR) may pose challenges, especially when dealing with personally identifiable information (PII) and cross-border transactions.

- Data Storage: While blockchain offers a secure and decentralized method of storing data, the immutability and permanence of data may raise concerns in situations where the right to be forgotten or data deletion is required. Ensuring compliance with data retention and deletion policies can be complex and may require additional technical solutions.

- Energy Consumption: Some consensus mechanisms, particularly Proof of Work, require significant computational power and energy consumption. The environmental impact of energy-intensive blockchain networks is a subject of concern and may need to be addressed through the implementation of more energy-efficient consensus mechanisms.

- Interoperability: Blockchain networks can be fragmented, with different networks operating on incompatible protocols. Achieving interoperability between different blockchain platforms remains a challenge, which hinders seamless data sharing and collaboration between organizations.

- User Experience: The user experience of utilizing blockchain technology may be perceived as cumbersome or complex for non-technical users. Overcoming usability barriers and providing user-friendly interfaces is essential for widespread adoption of blockchain solutions.

To address these challenges, ongoing research and development efforts are focused on improving blockchain scalability, enhancing privacy features, and creating interoperability protocols. Additionally, collaboration between industry stakeholders, policymakers, and regulators is crucial to establishing frameworks and standards that reconcile blockchain technology with existing legal and regulatory requirements.

While blockchain technology shows immense potential for enhancing data privacy, its implementation and integration must be done thoughtfully and with careful consideration of the specific challenges and limitations presented by each use case and regulatory environment.

By addressing these challenges and limitations, organizations can leverage blockchain technology to enhance data privacy in the finance sector while ensuring compliance and maintaining the trust of individuals and institutions.

Conclusion

Blockchain technology has emerged as a viable solution to address data privacy concerns in the finance sector. Its transparent, secure, and decentralized nature provides individuals and organizations with increased control over their sensitive financial data. By leveraging features such as transparency, immutability, decentralization, and consensus mechanisms, blockchain enhances data privacy and fosters trust in the financial system.

Through the use of smart contracts and privacy-enhancing techniques like selective disclosure and zero-knowledge proofs, blockchain enables individuals to share specific information while safeguarding their private financial data. These techniques empower users to have greater control over their own information and protect against unauthorized access and manipulation.

However, implementing blockchain for data privacy does come with challenges and limitations. Scalability concerns, regulatory compliance, data storage requirements, energy consumption, interoperability, and user experience are all important factors that need to be addressed during implementation.

Despite these challenges, ongoing efforts are being made to improve blockchain technology, enhance privacy features, and establish regulatory frameworks that align with its implementation. With continued research and collaboration, blockchain technology has the potential to revolutionize data privacy in the finance sector.

In conclusion, blockchain technology provides a robust and promising solution for enhancing data privacy in the finance sector. It offers transparency, security, and accountability while empowering individuals to have greater control over their sensitive financial information. By addressing the challenges and limitations associated with blockchain implementation, organizations can leverage this transformative technology to build a more secure, efficient, and privacy-conscious financial ecosystem.