Home>Finance>What Is The Minimum Payment On A Citi Prefered Credit Card

Finance

What Is The Minimum Payment On A Citi Prefered Credit Card

Modified: March 3, 2024

Learn about the minimum payment on a Citi Preferred credit card and manage your finances wisely. Find out how to handle your credit card payments effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Understanding the Importance of Minimum Payments on a Citi Preferred Credit Card

- Exploring the Features and Benefits of the Citi Preferred Credit Card

- Demystifying the Formula for Calculating Minimum Payments on a Citi Preferred Credit Card

- Unveiling the Influential Elements that Shape the Minimum Payment Requirement on a Citi Preferred Credit Card

- Recognizing the Significance of Timely Minimum Payments for Citi Preferred Credit Cardholders

- Understanding the Ramifications of Failing to Meet Minimum Payment Obligations on a Citi Preferred Credit Card

- Practical Strategies for Effectively Handling Minimum Payment Obligations on a Citi Preferred Credit Card

- Empowering Citi Preferred Credit Cardholders Through Informed Financial Management

Introduction

Understanding the Importance of Minimum Payments on a Citi Preferred Credit Card

When it comes to managing a credit card, understanding the concept of minimum payments is crucial. This is especially true for individuals who hold a Citi Preferred credit card. The minimum payment on a credit card represents the lowest amount that a cardholder must pay by a specified due date to keep the account in good standing. Failing to make the minimum payment can result in late fees, increased interest rates, and negative impacts on one's credit score. In this article, we will delve into the specifics of minimum payments on a Citi Preferred credit card, including how they are calculated, the factors that influence them, and the consequences of not meeting them. Additionally, we will explore the significance of making minimum payments and provide practical tips for effectively managing them. Understanding these aspects is essential for responsible credit card management and financial well-being. Let's embark on a comprehensive journey to unravel the intricacies of minimum payments on a Citi Preferred credit card.

Understanding the Citi Preferred Credit Card

Exploring the Features and Benefits of the Citi Preferred Credit Card

The Citi Preferred credit card is a versatile financial tool that offers cardholders a range of benefits and rewards. This credit card is designed to cater to the diverse spending habits and lifestyle preferences of consumers, making it a popular choice for individuals seeking a reliable and rewarding payment solution. The card is known for its competitive rewards program, which often includes cash back, travel rewards, and other enticing perks.

One of the key attractions of the Citi Preferred credit card is its introductory offers, which may include a 0% APR period for balance transfers and purchases. This feature can be particularly appealing to individuals looking to consolidate existing credit card debt or make large purchases without incurring immediate interest charges. Additionally, the card may provide access to exclusive events, presale tickets, and other entertainment-related privileges, adding value beyond traditional spending rewards.

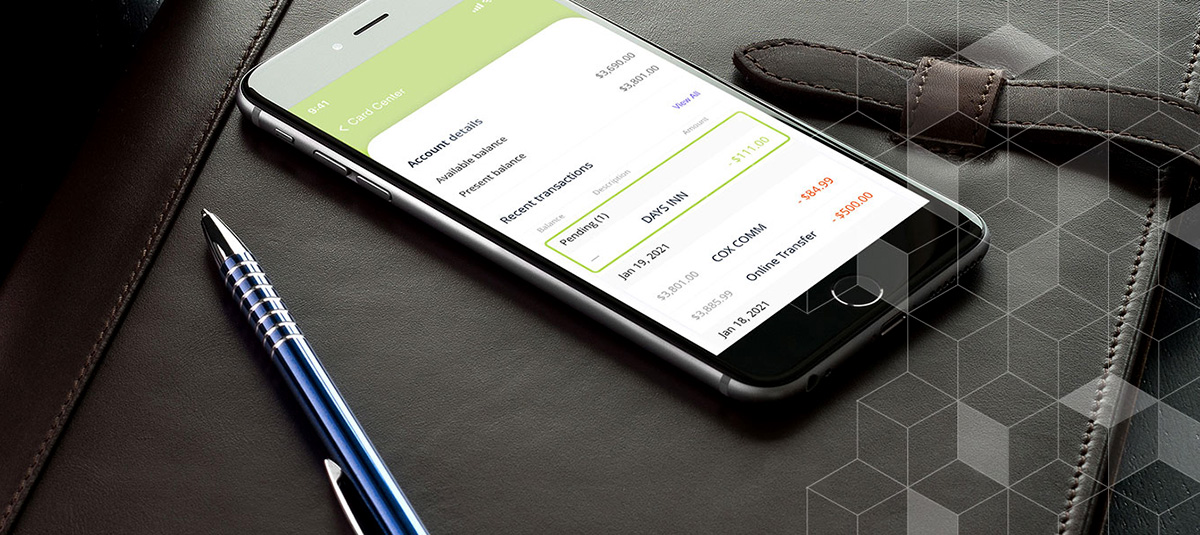

Furthermore, the Citi Preferred credit card typically incorporates robust security features, offering cardholders peace of mind when making transactions in-store, online, or while traveling. Many cardholders appreciate the convenience of managing their account through user-friendly online portals and mobile apps, streamlining the process of monitoring transactions, redeeming rewards, and making payments.

Understanding the features and benefits of the Citi Preferred credit card is essential for maximizing its potential and leveraging its offerings to support one’s financial goals. Whether it’s earning rewards on everyday purchases, taking advantage of promotional financing, or accessing exclusive perks, the Citi Preferred credit card can be a valuable asset in a cardholder’s financial toolkit.

Minimum Payment Calculation

Demystifying the Formula for Calculating Minimum Payments on a Citi Preferred Credit Card

Understanding how minimum payments are calculated on a Citi Preferred credit card is essential for responsible financial management. The minimum payment amount is typically determined based on various factors, including the cardholder’s outstanding balance, interest rates, and any fees accrued during the billing cycle. While the specific calculation method may vary slightly among different credit card issuers, including Citi, the fundamental components remain consistent.

The most common approach to calculating the minimum payment involves a percentage of the outstanding balance, often with a minimum dollar amount. For example, the minimum payment requirement may be set at 1%-3% of the total balance or a fixed amount, whichever is greater. This ensures that cardholders are obligated to make a reasonable contribution towards reducing their outstanding debt, even if their balance is relatively low.

It’s important to note that the minimum payment calculation also accounts for any interest charges and fees incurred during the billing cycle. This means that as the outstanding balance fluctuates and interest accrues, the minimum payment amount will adjust accordingly. As a result, cardholders should remain vigilant in monitoring their statements and understanding how their minimum payment is impacted by their spending and repayment behaviors.

For individuals holding a Citi Preferred credit card, the specifics of the minimum payment calculation can be found in the card’s terms and conditions or through direct communication with the issuer. By gaining clarity on the calculation methodology, cardholders can proactively manage their finances and make informed decisions regarding their payment strategy.

Ultimately, comprehending the formula for calculating minimum payments on a Citi Preferred credit card empowers cardholders to budget effectively, avoid unnecessary fees, and work towards reducing their overall credit card debt in a structured and sustainable manner.

Factors Affecting Minimum Payment

Unveiling the Influential Elements that Shape the Minimum Payment Requirement on a Citi Preferred Credit Card

Several key factors play a significant role in determining the minimum payment requirement on a Citi Preferred credit card. Understanding these factors is pivotal for cardholders seeking to manage their financial obligations effectively and make informed decisions regarding their credit card payments.

- Outstanding Balance: The outstanding balance on the credit card is a primary determinant of the minimum payment. Typically, the minimum payment is calculated as a percentage of the total balance, ensuring that cardholders contribute towards reducing their debt each month.

- Interest Rates: The annual percentage rate (APR) associated with the credit card directly impacts the minimum payment. Higher interest rates result in increased minimum payment requirements, reflecting the additional cost of carrying a balance from month to month.

- Fees and Charges: Any fees or charges incurred during the billing cycle, such as late fees or over-limit fees, contribute to the minimum payment amount. It’s essential for cardholders to be aware of potential fees and their implications on the minimum payment.

- Promotional Balances: If the card includes promotional balances, such as a 0% APR offer for a specified period, the minimum payment calculation may vary for these balances during the promotional period.

- Payment History: The cardholder’s payment history and behavior can influence the minimum payment requirement. Consistently late or missed payments may result in higher minimum payments and additional penalties.

For Citi Preferred credit cardholders, these factors collectively shape the minimum payment obligation each month. By recognizing the impact of these elements, cardholders can proactively manage their credit card usage, strive to reduce their outstanding balances, and mitigate the financial implications associated with minimum payments.

Moreover, staying informed about the specific terms and conditions outlined by Citi for the Preferred credit card empowers cardholders to navigate the nuances of minimum payment requirements and make strategic decisions aligned with their financial capabilities and goals.

Importance of Making Minimum Payments

Recognizing the Significance of Timely Minimum Payments for Citi Preferred Credit Cardholders

For individuals holding a Citi Preferred credit card, making timely minimum payments is not only a financial obligation but also a strategic move that can yield several critical benefits. Understanding the importance of meeting minimum payment requirements is essential for maintaining a healthy financial standing and optimizing the overall credit card experience.

Preservation of Credit Score: Consistently making at least the minimum payment on a Citi Preferred credit card is instrumental in preserving one’s credit score. Payment history is a significant factor in credit scoring models, and missed or late payments can have adverse effects on an individual’s creditworthiness. By meeting the minimum payment obligation, cardholders demonstrate responsible credit management, which can positively impact their credit score over time.

Prevention of Penalty Fees: Failing to make the minimum payment on a credit card, including the Citi Preferred card, can lead to the imposition of penalty fees. These fees not only add to the financial burden but also disrupt the cardholder’s budgeting and repayment plans. By making timely minimum payments, cardholders avoid incurring unnecessary fees, thereby maintaining better control over their financial resources.

Interest Mitigation: Meeting the minimum payment requirement helps mitigate the accumulation of excessive interest on the outstanding balance. While carrying a balance on a credit card incurs interest charges, making the minimum payment ensures that the interest accrual is managed within reasonable bounds. This can contribute to long-term savings and facilitate more efficient debt repayment strategies.

Positive Financial Habits: Cultivating the habit of consistently meeting minimum payment obligations fosters positive financial discipline. It encourages cardholders to stay mindful of their spending, budgeting, and repayment practices, laying a foundation for responsible financial behavior that extends beyond credit card management.

By recognizing the importance of making minimum payments on a Citi Preferred credit card, cardholders can proactively safeguard their credit standing, minimize financial costs, and cultivate enduring habits that support their overall financial well-being.

Consequences of Missing Minimum Payments

Understanding the Ramifications of Failing to Meet Minimum Payment Obligations on a Citi Preferred Credit Card

Missing the minimum payment on a credit card, including the Citi Preferred card, can trigger a cascade of adverse consequences that significantly impact a cardholder’s financial well-being. It is crucial for cardholders to comprehend the potential ramifications of failing to meet minimum payment obligations and the subsequent effects on their credit card account, overall finances, and credit standing.

Accrual of Late Fees: One of the immediate consequences of missing the minimum payment is the imposition of late fees. These fees not only add to the cardholder’s financial burden but also disrupt their budgeting and repayment plans, creating unnecessary financial strain.

Impact on Credit Score: Failing to make the minimum payment can result in negative reporting to credit bureaus, leading to a detrimental impact on the cardholder’s credit score. A lower credit score can hinder the individual’s ability to secure favorable terms for future credit products, such as loans and mortgages, and may lead to higher interest rates on credit cards and other financial instruments.

Increased Interest Charges: Missing minimum payments can lead to an escalation in interest charges on the outstanding balance. This not only adds to the overall cost of carrying a balance on the credit card but also prolongs the repayment period, impeding the cardholder’s journey towards financial freedom.

Loss of Rewards and Benefits: Some credit card issuers, including Citi, may suspend or revoke certain rewards and benefits for cardholders who consistently fail to meet minimum payment obligations. This can diminish the value proposition of the credit card and erode the potential advantages that come with responsible card usage.

Risk of Account Default: Persistent failure to make minimum payments can elevate the risk of the account being classified as delinquent or in default, potentially leading to more severe consequences, such as collection actions and legal recourse by the issuer.

By understanding the potential consequences of missing minimum payments on a Citi Preferred credit card, cardholders can appreciate the critical importance of meeting their payment obligations and take proactive measures to safeguard their financial stability and credit standing.

Tips for Managing Minimum Payments

Practical Strategies for Effectively Handling Minimum Payment Obligations on a Citi Preferred Credit Card

Managing minimum payments on a credit card, such as the Citi Preferred card, requires thoughtful planning and financial discipline. By implementing strategic approaches and cultivating responsible financial habits, cardholders can navigate their minimum payment obligations with confidence and optimize their credit card experience.

- Budget Wisely: Create a comprehensive budget that accounts for all financial obligations, including credit card payments. Allocating funds specifically for minimum payments ensures that this essential obligation is prioritized within the overall financial plan.

- Automate Payments: Take advantage of automatic payment options offered by the credit card issuer to ensure that the minimum payment is made on time each month. This minimizes the risk of overlooking the payment due date and incurring late fees.

- Monitor Spending: Stay vigilant about credit card usage and strive to keep spending within manageable limits. Responsible spending habits can contribute to a more manageable balance, facilitating the ability to meet minimum payment requirements without undue strain.

- Pay More When Possible: While meeting the minimum payment is crucial, whenever feasible, strive to pay more than the minimum to accelerate debt reduction and minimize interest charges. Even modest additional payments can make a meaningful impact over time.

- Utilize Alerts and Reminders: Leverage digital tools, such as mobile app notifications and email reminders, to stay informed about upcoming payment due dates and account activity. These alerts serve as valuable prompts for meeting minimum payment obligations promptly.

- Seek Financial Assistance if Needed: In cases of financial hardship or unexpected challenges, reach out to the credit card issuer to explore potential options for temporary relief, such as payment arrangements or hardship programs.

- Review Terms and Conditions: Familiarize yourself with the specific terms and conditions of the Citi Preferred credit card, particularly regarding minimum payments, to ensure a clear understanding of the requirements and implications.

By incorporating these practical tips into their financial management approach, Citi Preferred credit cardholders can navigate minimum payment obligations with greater ease and confidence, fostering a positive and sustainable credit card experience.

Conclusion

Empowering Citi Preferred Credit Cardholders Through Informed Financial Management

As we conclude our exploration of the intricacies surrounding minimum payments on a Citi Preferred credit card, it becomes evident that a comprehensive understanding of this fundamental aspect is pivotal for cardholders striving to maintain financial stability and maximize the benefits of their credit card usage. By delving into the nuances of minimum payment calculation, the factors influencing minimum payments, and the repercussions of missing these obligations, Citi Preferred credit cardholders can equip themselves with the knowledge and strategies necessary to navigate their credit card responsibilities effectively.

Recognizing the importance of making timely minimum payments and embracing practical tips for managing these obligations empowers cardholders to approach their credit card usage with confidence and prudence. By budgeting wisely, automating payments, monitoring spending, and seeking assistance when needed, cardholders can cultivate responsible financial habits that support their long-term financial well-being.

Moreover, understanding the potential consequences of missing minimum payments underscores the critical nature of meeting these obligations and underscores the significance of proactive financial management. By staying informed about the specific terms and conditions outlined by Citi for the Preferred credit card, cardholders can navigate the intricacies of minimum payment requirements and make informed decisions aligned with their financial capabilities and goals.

Ultimately, by embracing these insights and strategies, Citi Preferred credit cardholders can embark on a journey of empowered financial management, leveraging their credit card as a valuable tool for everyday transactions, financial flexibility, and rewarding benefits. With a proactive approach to minimum payments and a commitment to responsible credit card usage, cardholders can optimize their credit card experience and pave the way for sustained financial prosperity.