Home>Finance>Which Items Are On Both The Balance Sheet And The Statement Of Owner’s Equity?

Finance

Which Items Are On Both The Balance Sheet And The Statement Of Owner’s Equity?

Modified: March 1, 2024

Learn about the items in finance that are listed on both the balance sheet and the statement of owner's equity. Expand your knowledge of financial statements.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Balance Sheet

- Definition of Statement of Owner’s Equity

- Purpose of Balance Sheet and Statement of Owner’s Equity

- Items on Both the Balance Sheet and Statement of Owner’s Equity

- Common Assets on the Balance Sheet and Statement of Owner’s Equity

- Common Liabilities on the Balance Sheet and Statement of Owner’s Equity

- Common Owner’s Equity Items on the Balance Sheet and Statement of Owner’s Equity

- Examples of Items Found on Both the Balance Sheet and Statement of Owner’s Equity

- Importance of Analyzing Items on Both Statements

- Conclusion

Introduction

When it comes to understanding a company’s financial health, two key financial statements come into play: the balance sheet and the statement of owner’s equity. These two statements provide valuable insights into an organization’s assets, liabilities, and owner’s equity.

The balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It lists the company’s assets, liabilities, and owner’s equity, showing the equation of assets equaling liabilities plus owner’s equity. On the other hand, the statement of owner’s equity provides information about changes in the owner’s equity over a specific period of time.

Understanding the items that appear on both the balance sheet and the statement of owner’s equity is crucial for a comprehensive analysis of a company’s financial standing. These common items reflect the overlap between the company’s financial position at a specific point in time and the changes in the owner’s equity.

In this article, we will explore the items that are commonly found on both the balance sheet and the statement of owner’s equity. By gaining an understanding of these shared items, readers will be equipped with the necessary knowledge to evaluate a company’s financial health and make informed decisions.

Definition of Balance Sheet

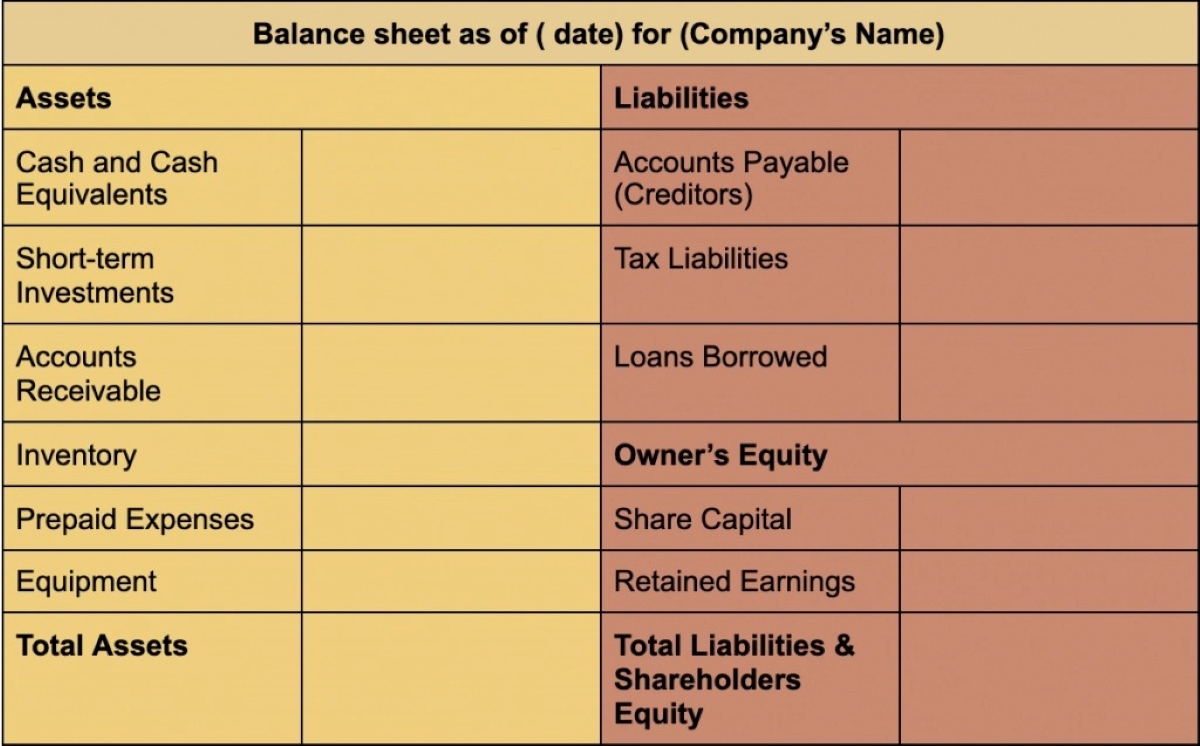

The balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It reflects the company’s assets, liabilities, and owner’s equity, and is structured based on the accounting equation: Assets = Liabilities + Owner’s Equity.

The purpose of the balance sheet is to provide a clear overview of what the company owns (assets), what it owes (liabilities), and the value of the owner’s investment in the business (owner’s equity). By presenting these details, the balance sheet illustrates the financial health and stability of the company.

Assets are resources owned by the company, such as cash, inventory, property, and equipment. Liabilities, on the other hand, represent the company’s debts and obligations, including loans, accounts payable, and other outstanding expenses. Lastly, owner’s equity reflects the residual interest in the company’s assets after deducting liabilities, representing the owner’s investment and retained earnings.

The balance sheet is typically divided into three main sections: assets, liabilities, and owner’s equity. Within each section, specific line items provide further breakdown and classification of the company’s financial position.

Overall, the balance sheet is a crucial document for both internal and external stakeholders. It helps management assess the company’s financial performance, identify trends, and make informed decisions. It also assists investors, creditors, and other external parties in evaluating the company’s financial health and potential for growth.

Definition of Statement of Owner’s Equity

The statement of owner’s equity, also known as the statement of retained earnings, is a financial statement that shows the changes in the owner’s equity over a specific period of time. It highlights how an owner’s investment in the business has changed due to various factors, such as net income, additional investments, or distributions.

The purpose of the statement of owner’s equity is to provide transparency and insight into the changes that have occurred in the owner’s equity section of the balance sheet. It demonstrates how the company’s retained earnings have grown or decreased over the designated period, thereby influencing the overall financial position of the business.

Owner’s equity represents the residual interest in the company’s assets after deducting liabilities. It encompasses the owner’s initial investment in the business, as well as any retained earnings generated from the company’s operations. Retained earnings are the accumulated profits that have not been distributed to owners or shareholders as dividends.

The statement of owner’s equity typically includes the following components:

- Owner’s initial investment: This represents the capital contributed by the owner or owners when the business was initially established.

- Net income or net loss: This section reflects the company’s profitability or losses for the period. Net income is calculated by deducting total expenses from total revenue.

- Additional investments or withdrawals: If the owner injects additional funds into the business or withdraws funds for personal use, these transactions are recorded in this section.

- Distributions or dividends: This component represents the distribution of profits to owners or shareholders. It reflects the amount of retained earnings being allocated as dividends.

- Ending balance of owner’s equity: This shows the final value of the owner’s equity at the end of the period and serves as the link between the statement of owner’s equity and the balance sheet.

The statement of owner’s equity provides valuable information for owners, investors, and creditors, enabling them to assess the financial performance and stability of the business. It helps stakeholders understand how the owner’s investment has grown or changed over time and provides insights into the distribution of profits within the company.

Purpose of Balance Sheet and Statement of Owner’s Equity

The balance sheet and the statement of owner’s equity play important roles in providing valuable financial information about a company. They serve specific purposes and aid stakeholders in assessing the financial health and performance of the business. Let’s explore the purposes of both statements:

Balance Sheet:

The main purpose of the balance sheet is to provide a snapshot of the company’s financial position at a specific point in time. It achieves the following objectives:

- Financial Analysis: The balance sheet assists in evaluating the financial strength and stability of the company by providing information on assets, liabilities, and owner’s equity. It helps stakeholders identify trends, assess liquidity, and analyze the company’s ability to meet its financial obligations.

- Creditworthiness: Lenders, suppliers, and creditors use the balance sheet to assess the company’s creditworthiness and determine the level of risk associated with extending credit or conducting business with the company.

- Investment Decision-making: Investors use the balance sheet to evaluate the company’s financial position and make informed investment decisions. It helps them assess the company’s potential for growth and profitability.

- Financial Reporting: The balance sheet is a crucial component of financial reporting, providing an accurate representation of the company’s financial position. It adheres to accounting standards and ensures transparency and accountability.

Statement of Owner’s Equity:

The statement of owner’s equity serves the following purposes:

- Understand Changes in Owner’s Investment: This statement provides insights into the changes in the owner’s equity over a specific period. It helps stakeholders understand how the owner’s investment in the business has grown or decreased due to factors such as net income, additional investments, or distributions.

- Evaluate Retained Earnings: The statement of owner’s equity allows stakeholders to assess the amount of retained earnings generated by the company and understand how these earnings are being allocated, whether for reinvestment in the business or distribution as dividends.

- Analyze Owner’s Financial Contribution: It provides a clear breakdown of the initial investment made by the owner and any subsequent contributions or withdrawals made during the reporting period.

- Assess Financial Performance: The statement of owner’s equity is instrumental in evaluating the financial performance of a company. By analyzing net income or net loss, stakeholders can gauge the profitability and overall success of the business.

In summary, the balance sheet and the statement of owner’s equity serve distinct purposes. While the balance sheet provides a snapshot of the company’s financial position, the statement of owner’s equity focuses on changes in the owner’s investment. Together, these statements provide stakeholders with a comprehensive understanding of a company’s financial health and performance.

Items on Both the Balance Sheet and Statement of Owner’s Equity

There are several items that can be found on both the balance sheet and the statement of owner’s equity. These items demonstrate the interconnection between the two statements and highlight the impact of various financial transactions on the company’s financial position and the owner’s equity. Let’s explore some of these common items:

- Retained Earnings: Retained earnings represent the accumulated profits of the company that have not been distributed to the owners or shareholders as dividends. This figure is listed in the owner’s equity section of the balance sheet and is also a central component of the statement of owner’s equity, showcasing the changes in retained earnings over time.

- Net Income or Net Loss: Net income or net loss, which reflects the company’s profitability over a specific period, appears on both the income statement and the statement of owner’s equity. Net income increases the retained earnings, resulting in growth in the owner’s equity, while net loss decreases retained earnings, leading to a decline in owner’s equity.

- Additional Investments: When the owner or owners make additional investments in the business, these transactions affect both the balance sheet and the statement of owner’s equity. The cash or other assets contributed by the owner are recorded as an increase in both the assets and the owner’s equity.

- Drawings or Distributions: If the owner withdraws funds from the business for personal use, these transactions are reflected on both the balance sheet and the statement of owner’s equity. The drawings or distributions decrease the owner’s equity, as the funds are taken out of the company and no longer contribute to the financial position.

These common items illustrate the dynamic relationship between the balance sheet and the statement of owner’s equity. They demonstrate how various financial transactions impact both the company’s financial position and the owner’s equity. By examining these shared items, stakeholders can gain a comprehensive understanding of the company’s financial health and the changes in the owner’s investment over time.

Common Assets on the Balance Sheet and Statement of Owner’s Equity

Assets are an essential component of both the balance sheet and the statement of owner’s equity. They represent the resources owned by the company that have monetary value. While the balance sheet focuses on presenting a comprehensive list of assets, the statement of owner’s equity highlights the impact of these assets on the owner’s equity. Let’s explore some common assets that appear on both statements:

- Cash: Cash is a vital asset that is listed on both the balance sheet and the statement of owner’s equity. It represents the amount of money held by the company and reflects its ability to meet short-term financial obligations.

- Accounts Receivable: Accounts receivable refers to the amounts owed to the company by its customers for goods or services provided on credit. This asset appears on the balance sheet as it represents the company’s right to receive payment, and it may impact the owner’s equity if any bad debts or uncollectible amounts are recognized.

- Inventory: Inventory represents the goods or products that a company holds for sale or use in its operations. It is listed as an asset on the balance sheet and can impact the owner’s equity through cost of goods sold, which affects the company’s profitability.

- Property, Plant, and Equipment (PP&E): PP&E includes tangible assets such as land, buildings, machinery, and vehicles that are used in the company’s operations. These assets are recorded on the balance sheet and their depreciation, amortization, or disposal can affect the owner’s equity.

- Investments: Investments can include various types, such as stocks, bonds, or equity investments in other companies. These assets are recorded on the balance sheet and can impact the owner’s equity through valuation changes or dividends received.

These common assets reflect the company’s financial resources and their impact on the owner’s equity. By analyzing these assets on both the balance sheet and the statement of owner’s equity, stakeholders can evaluate the liquidity, profitability, and long-term sustainability of the business.

Common Liabilities on the Balance Sheet and Statement of Owner’s Equity

Liabilities are vital obligations that a company owes to external parties, and they play a significant role in both the balance sheet and the statement of owner’s equity. Liabilities represent the company’s debts or obligations that need to be settled in the future. While the balance sheet provides a detailed overview of the company’s liabilities, the statement of owner’s equity showcases how these liabilities impact the owner’s equity. Let’s explore some common liabilities that appear on both statements:

- Accounts Payable: Accounts payable represent the amounts owed by the company to its suppliers or vendors for goods or services received on credit. This liability is listed on the balance sheet and may impact the owner’s equity if any discounts or disputes arise regarding the payment terms.

- Loans and Borrowings: Loans and borrowings are liabilities that arise from obtaining funds from external sources, such as financial institutions or lenders. These liabilities appear on the balance sheet and can affect the owner’s equity through interest expenses and repayments.

- Accrued Expenses: Accrued expenses are liabilities that arise when the company has incurred expenses but has not yet made the payment. Examples include salaries, interest, or utilities. These liabilities impact both the balance sheet and the owner’s equity, as they represent obligations yet to be settled.

- Deferred Revenue: Deferred revenue represents payments received by the company in advance for goods or services that have not been delivered or rendered. This liability is recorded on the balance sheet and can affect the owner’s equity as the company recognizes revenue over time.

- Income Taxes Payable: Income taxes payable represent the company’s tax obligations to the government. This liability is listed on the balance sheet and can impact the owner’s equity through tax expenses and payments.

These common liabilities reflect the company’s financial obligations and their impact on the owner’s equity. By examining these liabilities on both the balance sheet and the statement of owner’s equity, stakeholders can assess the company’s financial health, cash flow management, and ability to meet its financial commitments.

Common Owner’s Equity Items on the Balance Sheet and Statement of Owner’s Equity

Owner’s equity represents the residual interest in the company’s assets after deducting liabilities, and it encompasses the owner’s initial investment and any accumulated earnings. It is a key component of both the balance sheet and the statement of owner’s equity. These statements provide insights into the owner’s equity and how it changes over time. Let’s explore some common owner’s equity items that appear on both statements:

- Owner’s Initial Investment: The owner’s initial investment represents the capital contributed by the owner or owners when the business was first established. This amount reflects the owner’s equity and is listed on the balance sheet. It serves as the starting point for the owner’s equity calculations on the statement of owner’s equity.

- Retained Earnings: Retained earnings represent the accumulated profits that have not been distributed to the owners or shareholders as dividends. It is a crucial owner’s equity item that appears on both the balance sheet and the statement of owner’s equity. Retained earnings increase when the company generates net income and decrease when the company incurs net losses.

- Additional Investments: When the owner injects additional funds into the business, these transactions impact both the balance sheet and the statement of owner’s equity. The additional investments increase the owner’s equity, as they represent the owner’s increased stake in the business.

- Drawings or Distributions: If the owner withdraws funds from the business for personal use, these transactions are recorded on both the balance sheet and the statement of owner’s equity. The drawings or distributions decrease the owner’s equity, as the funds are taken out of the company.

- Net Income or Net Loss: Net income or net loss affects both the balance sheet and the statement of owner’s equity. Net income increases the owner’s equity, reflecting the profitability of the business, while net loss decreases the owner’s equity, indicating a decrease in the company’s overall financial position.

These common owner’s equity items demonstrate the relationship between the balance sheet and the statement of owner’s equity. They reflect the owner’s investment in the business, the impact of profitability and losses, and any additional capital contributions or withdrawals made by the owner. Analyzing these items provides stakeholders with insights into the owner’s equity and its fluctuations over time.

Examples of Items Found on Both the Balance Sheet and Statement of Owner’s Equity

There are various specific examples of items that can be found on both the balance sheet and the statement of owner’s equity. These examples highlight the relationship between the two financial statements and the impact of certain transactions on the company’s financial position and the owner’s equity. Let’s explore some common examples:

- Retained Earnings: Retained earnings are a key example that appears on both the balance sheet and the statement of owner’s equity. They represent the accumulated profits that have been retained within the company rather than distributed as dividends to owners or shareholders.

- Additional Investments: When the owner injects additional funds into the business, these transactions impact both the balance sheet and the statement of owner’s equity. Examples of additional investments can include cash contributions, additional capital, or assets transferred to the company.

- Drawings or Distributions: Drawings or distributions made by the owner, such as when the owner withdraws funds from the business for personal use, are examples of items that affect both the balance sheet and the statement of owner’s equity. These transactions reduce the owner’s equity as the funds are taken out of the company.

- Net Income or Net Loss: Net income or net loss is another example of an item that appears on both the balance sheet and the statement of owner’s equity. Net income reflects the excess of revenues over expenses, resulting in an increase in the owner’s equity. Conversely, a net loss represents the excess of expenses over revenues and decreases the owner’s equity.

- Owner’s Initial Investment: The owner’s initial investment, which represents the capital contributed by the owner or owners when the business was first established, is an example of an item that impacts both the balance sheet and the statement of owner’s equity. This investment serves as the foundation for the owner’s equity in the business.

These examples illustrate the connection between the balance sheet and the statement of owner’s equity, presenting how specific items influence both statements. They provide insights into the financial position of the company and how the owner’s equity is affected by various transactions and activities.

Importance of Analyzing Items on Both Statements

Analyzing the items that appear on both the balance sheet and the statement of owner’s equity is essential for gaining a comprehensive understanding of a company’s financial health and performance. This analysis provides valuable insights into the relationship between the company’s financial position and the changes in the owner’s equity. Here are some key reasons why analyzing these items is crucial:

- Evaluating Financial Stability: By examining the shared items on both statements, stakeholders can assess the financial stability of the company. This analysis allows for a deeper understanding of how the company’s assets, liabilities, and owner’s equity interact and influence each other. It helps identify potential risks and vulnerabilities that may impact the long-term viability of the business.

- Assessing Profitability and Growth: Analyzing the common items on both statements helps assess the company’s profitability and growth potential. Net income or net loss, as well as retained earnings, provide insights into the company’s profitability over time. By tracking these figures, stakeholders can evaluate the effectiveness of the company’s operations and its ability to generate sustainable profits.

- Understanding Capital Contributions and Distributions: The analysis of additional investments and drawings or distributions on both statements helps stakeholders understand the capital flows within the company. Examining these items allows for a clear understanding of how the owner’s equity is impacted by the owner’s contributions and withdrawals. It also provides insights into the financial decisions made by the owner and their potential implications for the company’s financial well-being.

- Identifying Trends and Patterns: Analyzing the shared items on the balance sheet and the statement of owner’s equity helps identify trends and patterns in the company’s financial performance. By comparing changes in items such as retained earnings, net income, or additional investments over different periods, stakeholders can gain insights into the company’s growth trajectory, financial priorities, and potential areas of concern.

- Supporting Decision-Making: The analysis of common items on both statements provides stakeholders with valuable information for decision-making. Whether it’s assessing the company’s creditworthiness, evaluating potential investments, or making strategic business decisions, having a comprehensive understanding of the interplay between the company’s financial position and owner’s equity is crucial for making informed choices.

Overall, analyzing the items on both the balance sheet and the statement of owner’s equity allows stakeholders to gain a holistic view of the company’s financial health, profitability, and growth prospects. It provides a deeper understanding of the relationship between the company’s financial position and the impacts on the owner’s equity, leading to more informed decision-making and better management of resources and finances.

Conclusion

The balance sheet and the statement of owner’s equity are two vital financial statements that provide critical insights into a company’s financial health, positioning, and the impact on the owner’s equity. Understanding the items that appear on both statements is crucial for a comprehensive analysis of a company’s financial standing.

The balance sheet provides a snapshot of a company’s financial position, showcasing its assets, liabilities, and owner’s equity at a specific point in time. On the other hand, the statement of owner’s equity illustrates the changes in the owner’s equity over a specific period, considering factors such as net income, additional investments, and distributions.

By analyzing common items on both the balance sheet and the statement of owner’s equity, stakeholders gain valuable insights into the company’s financial stability, profitability, and growth trends. These items include retained earnings, net income or net loss, additional investments, drawings or distributions, and the owner’s initial investment.

Examining these shared items allows for a deeper understanding of the relationship between the company’s financial position and the owner’s equity. It provides insights into the impact of financial transactions and activities, helping stakeholders evaluate capital flows, assess profitability, track trends, and support decision-making processes.

Ultimately, by analyzing the items on both the balance sheet and the statement of owner’s equity, stakeholders can make informed assessments of a company’s financial health, assess its creditworthiness, and identify opportunities for growth and improvement. This comprehensive understanding empowers stakeholders to make sound financial decisions and contribute to the long-term success of the business.