Finance

What Does The Acronym APR Stand For?

Published: March 3, 2024

Learn what the acronym APR stands for in finance and how it impacts your loans and credit. Understand the importance of APR in managing your finances.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Understanding the Significance of APR in Finance

- Unveiling the Essence of Annual Percentage Rate (APR)

- Unveiling the Significance of Annual Percentage Rate (APR) in Financial Transactions

- Unraveling the Mechanics of Annual Percentage Rate (APR) Calculation

- Illustrating the Impact of Annual Percentage Rate (APR) Through Real-World Scenarios

- Navigating the Financial Landscape with APR Insight

Introduction

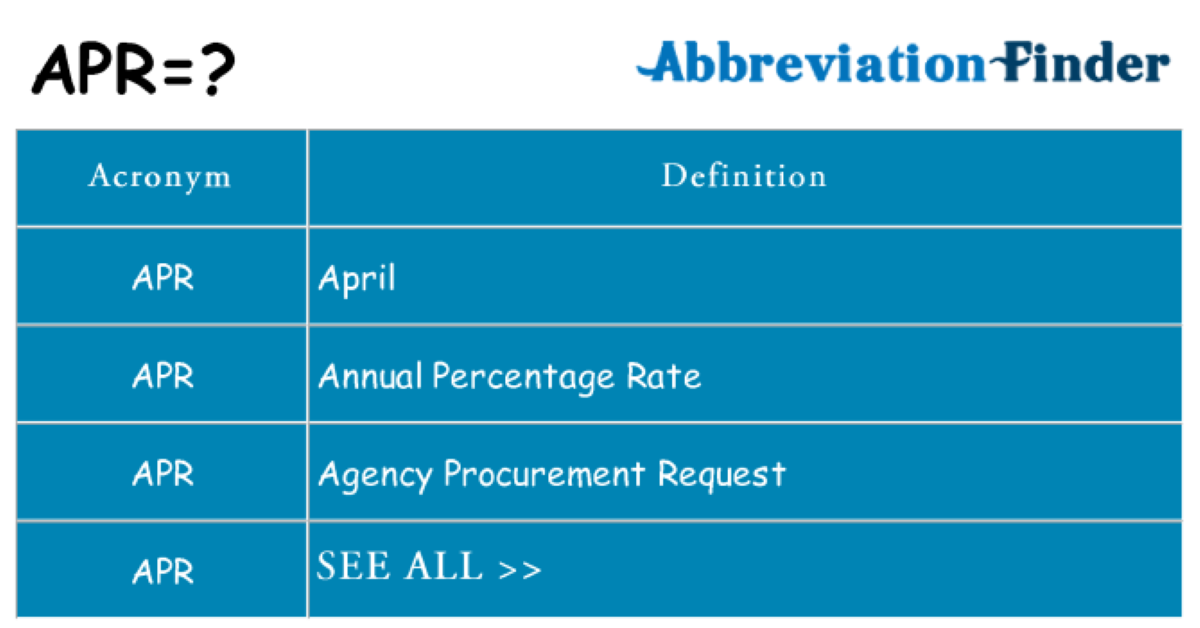

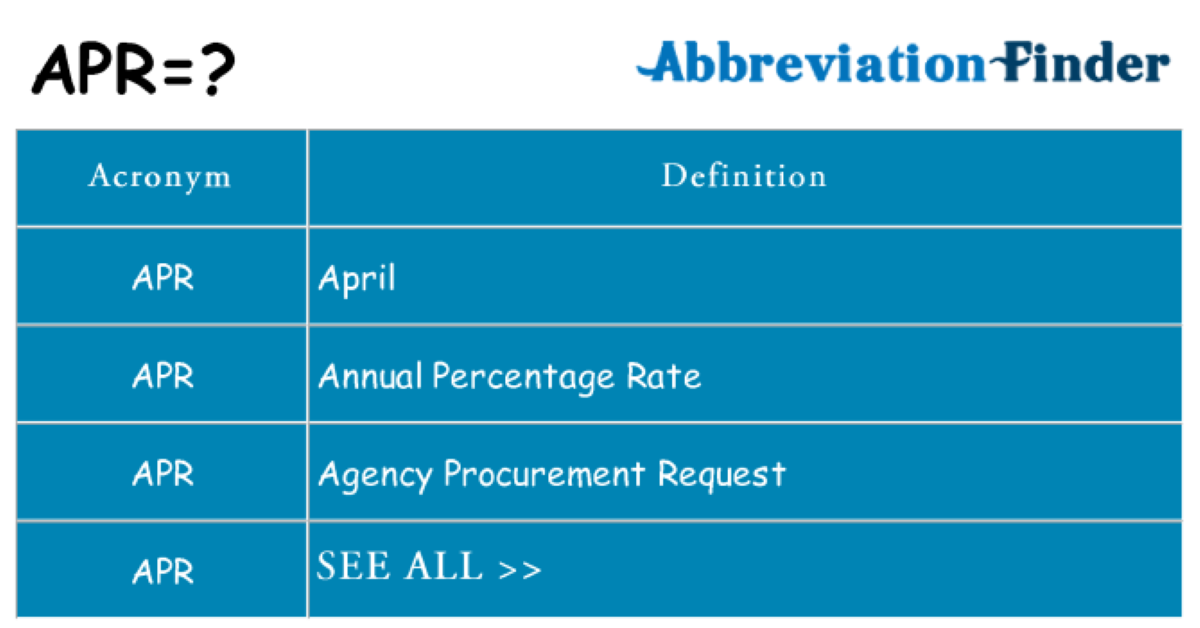

Understanding the Significance of APR in Finance

When delving into the realm of personal finance, one often encounters a myriad of acronyms and jargon that can be perplexing to the uninitiated. Among these, the acronym APR holds a pivotal role in the financial landscape, wielding significant influence over borrowing and lending transactions. APR, which stands for Annual Percentage Rate, serves as a crucial metric for assessing the true cost of borrowing and is a cornerstone of financial literacy.

As consumers, we encounter APR in various financial products, including credit cards, mortgages, personal loans, and car loans. It is an omnipresent factor that shapes our financial decisions, yet its essence and implications are not always comprehensively understood. In this article, we will embark on a journey to demystify the concept of APR, unraveling its significance, calculation methods, and real-world applications.

By gaining a deeper understanding of APR, readers will be empowered to make informed financial choices, navigate lending options with confidence, and comprehend the impact of interest rates on their financial well-being. Join us as we unravel the layers of APR, shedding light on its intricacies and unveiling its relevance in the realm of personal finance.

Definition of APR

Unveiling the Essence of Annual Percentage Rate (APR)

At its core, the Annual Percentage Rate (APR) serves as a comprehensive measure of the cost of borrowing, encompassing not only the interest rate but also additional fees and charges incurred in securing a loan or utilizing a credit facility. Unlike the nominal interest rate, which solely reflects the percentage of interest charged on the principal amount, the APR offers a holistic view of the borrowing expense, providing a more accurate representation of the financial obligation imposed on the borrower.

When a financial institution extends a loan or credit, the APR encapsulates not only the interest accrued over a defined period but also takes into account origination fees, points, mortgage insurance, and other costs associated with the borrowing arrangement. By incorporating these ancillary expenses, the APR enables borrowers to gauge the true expense of obtaining financing, facilitating transparent comparisons between different loan offers and credit products.

It is imperative to recognize that the APR is not solely confined to the realm of borrowing; it also manifests in savings and investment instruments. In the context of savings accounts or investment vehicles, the APR denotes the annualized rate of return, providing insight into the growth of funds over time. This duality underscores the pervasive influence of APR across diverse financial domains, underscoring its status as a fundamental metric in the financial landscape.

As consumers navigate the labyrinth of financial products and lending options, understanding the nuances of APR empowers them to make well-informed decisions, discern the genuine cost of credit, and sidestep potential pitfalls associated with opaque borrowing terms. By delving into the intricacies of APR, individuals can cultivate a heightened financial acumen, enabling them to navigate the borrowing and lending terrain with confidence and clarity.

Importance of APR

Unveiling the Significance of Annual Percentage Rate (APR) in Financial Transactions

The Annual Percentage Rate (APR) wields profound significance in the realm of financial transactions, permeating various facets of borrowing, lending, and investment activities. Its importance transcends mere numerical representation, as it holds the key to informed decision-making, financial transparency, and consumer protection.

One of the paramount contributions of APR lies in its role as a unifying yardstick for comparing the cost of credit across diverse lending products. Whether evaluating mortgage offers, credit card terms, or personal loan options, the APR serves as a standardized metric that encapsulates the total cost of borrowing, enabling consumers to discern the most cost-effective and favorable financing arrangements. By fostering transparent comparisons, the APR empowers individuals to make astute financial choices, steering clear of predatory lending practices and exorbitant borrowing costs.

Moreover, the disclosure of APR in financial agreements and promotional materials serves as a safeguard for consumers, fostering transparency and ensuring that borrowers are fully apprised of the financial implications entailed in their credit transactions. This transparency is instrumental in promoting fair lending practices, mitigating the risk of deceptive advertising, and empowering consumers to make well-informed decisions without falling prey to obscured borrowing terms.

Furthermore, the significance of APR extends to regulatory compliance and consumer protection initiatives. Regulatory bodies and financial authorities mandate the comprehensive disclosure of APR in loan documentation and credit disclosures, aiming to fortify consumer rights, enhance financial literacy, and curtail exploitative lending practices. By mandating the transparent disclosure of APR, regulatory frameworks strive to foster a level playing field, where consumers are equipped with the requisite information to navigate the financial landscape prudently and judiciously.

Ultimately, the importance of APR reverberates in its capacity to engender financial empowerment, bolster consumer confidence, and instill a sense of fiscal responsibility. By comprehending the implications of APR, individuals are poised to make well-informed financial decisions, optimize their borrowing costs, and navigate the labyrinth of credit options with acumen and discernment. The pervasive influence of APR underscores its status as a cornerstone of financial literacy, illuminating the path towards prudent financial management and informed decision-making.

How APR is Calculated

Unraveling the Mechanics of Annual Percentage Rate (APR) Calculation

The calculation of the Annual Percentage Rate (APR) entails a nuanced process that amalgamates various financial components to yield a comprehensive representation of the borrowing cost. At its essence, the APR calculation encompasses not only the nominal interest rate but also incorporates ancillary fees, charges, and expenses associated with the credit facility. This holistic approach aims to furnish borrowers with a transparent assessment of the true cost of borrowing, fostering informed decision-making and facilitating comparisons across diverse lending options.

When computing the APR for a loan or credit product, the lender considers the nominal interest rate, origination fees, points, mortgage insurance, and other charges incurred by the borrower. These elements are amalgamated to derive the total finance charges over the loan’s term, subsequently factoring in the repayment schedule and frequency of compounding to ascertain the annualized cost of credit. By assimilating these multifaceted components, the APR encapsulates the full spectrum of borrowing expenses, transcending the singular focus on interest rates to furnish a holistic depiction of the financial obligation.

It is imperative to highlight that the methodology for calculating APR may vary across different lending products and financial instruments. For instance, in the context of a mortgage, the APR computation incorporates not only the interest rate and lender fees but also accounts for mortgage insurance premiums and other pertinent expenses, reflecting the comprehensive cost of homeownership. Conversely, in the realm of credit cards, the APR calculation encompasses the annualized interest rate, annual fees, and other charges, furnishing a consolidated metric for evaluating the cost of credit card utilization.

Furthermore, the frequency of compounding, repayment terms, and the presence of variable interest rates can exert a notable impact on the APR calculation, necessitating a meticulous assessment of the borrowing terms and conditions. By comprehending the mechanics of APR calculation, consumers are empowered to decipher the true cost of credit, discern the impact of borrowing expenses on their financial well-being, and make judicious financial choices that align with their long-term objectives.

Ultimately, the calculation of APR embodies a concerted effort to furnish borrowers with a transparent and comprehensive assessment of the cost of credit, transcending the superficial allure of nominal interest rates to unveil the underlying financial implications. By delving into the intricacies of APR computation, individuals can navigate the borrowing landscape with acumen and discernment, harnessing the power of financial transparency to optimize their borrowing costs and make informed financial decisions.

Examples of APR

Illustrating the Impact of Annual Percentage Rate (APR) Through Real-World Scenarios

To elucidate the tangible impact of Annual Percentage Rate (APR) on borrowing costs, let us delve into illustrative examples that underscore the significance of this pivotal metric in the realm of personal finance.

Example 1: Mortgage Financing

Consider a scenario where an individual is evaluating mortgage offers from different lenders. Lender A extends a mortgage with a nominal interest rate of 4.5% and additional fees amounting to $3,000, while Lender B offers a mortgage with a nominal interest rate of 4.7% and ancillary charges totaling $2,500. Despite the lower nominal interest rate offered by Lender A, the inclusion of higher fees renders the APR higher than that of Lender B. By scrutinizing the APR, the borrower can discern the comprehensive cost of each mortgage offer, facilitating an informed decision based on the true expense of borrowing.

Example 2: Credit Card Utilization

Imagine an individual exploring credit card options, where Card X features an annual fee of $100 and a nominal interest rate of 18%, while Card Y imposes no annual fee but carries a nominal interest rate of 21%. By computing the APR for each card, factoring in the annual fee and interest charges, the borrower can gain a holistic understanding of the cost of credit card utilization. This empowers the individual to select the card that aligns with their financial preferences and minimizes the long-term cost of credit.

These examples underscore the pivotal role of APR in enabling consumers to discern the true cost of borrowing, navigate lending options with clarity, and make informed financial decisions that align with their long-term financial well-being. By leveraging the insights gleaned from these scenarios, individuals can harness the power of APR to optimize their borrowing costs, mitigate financial risks, and cultivate a heightened sense of financial acumen.

Conclusion

Navigating the Financial Landscape with APR Insight

As we conclude our exploration of the Annual Percentage Rate (APR), it becomes evident that this metric transcends mere numerical representation, embodying a profound impact on borrowing, lending, and financial decision-making. The essence of APR lies in its capacity to illuminate the true cost of credit, fostering transparency, and empowering consumers to make well-informed financial choices that align with their objectives and preferences.

Through our journey, we have unveiled the multifaceted nature of APR, delving into its calculation methodologies, real-world implications, and pivotal role in financial transactions. From mortgage financing to credit card utilization, the influence of APR permeates diverse facets of personal finance, underscoring its status as a fundamental metric for assessing borrowing costs and promoting financial transparency.

By comprehending the nuances of APR, individuals are poised to navigate the borrowing landscape with acumen and discernment, leveraging the insights gleaned to optimize their borrowing costs, mitigate financial risks, and cultivate a heightened sense of financial literacy. The transparency engendered by APR empowers consumers to sidestep predatory lending practices, discern the genuine cost of credit, and make judicious financial decisions that resonate with their long-term financial well-being.

Ultimately, the journey through the realm of APR serves as a testament to the pivotal role of financial literacy in fostering informed decision-making and empowering individuals to navigate the financial landscape with confidence. By embracing the insights garnered from our exploration, readers are poised to harness the power of APR, unravel the complexities of borrowing costs, and embark on a journey towards prudent financial management and astute financial decision-making.

As we part ways, let us carry forth the enlightenment gleaned from our foray into the realm of APR, leveraging this knowledge to embark on a trajectory of informed financial choices, empowered by the clarity and transparency afforded by this quintessential metric. With APR as our compass, we chart a course towards financial empowerment, equipped with the acumen and discernment to navigate the borrowing terrain with confidence and sagacity.